Professional Documents

Culture Documents

CH # 17 (Budget)

Uploaded by

Rooh Ullah KhanOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CH # 17 (Budget)

Uploaded by

Rooh Ullah KhanCopyright:

Available Formats

1

Chapter # 17 Budgeting

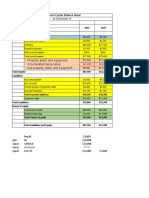

Ex # 2

(1)

Expected cash collection during February

Collection from Dec. Sales ( $11,310

Collection from Jan. Sales ($65,000 × 30%) 19,500

Collection from Feb. Sale ($54,000 × 55%) 29,700

Total collection during February $60,510

(2)

Cash Balance February 1

Cash balance – Jan. 1 $5,000

Expected collection during January

Collection from Nov. Sales ( $11,700

Collection from Dec. Sales ( 26,100

Collection from Jan. Sales ($65,000 × 55%) 35,750 73,550

Cash available during January $78,550

Expected cash disbursement

December Purchases $10,000

Other expenses 41,000 51,000

Expected cash balance Feb. 1 $27,550

(3)

Expected Cash balance Feb. 28

Expected cash balance Feb. 1 $27,550

Expected collection during Feb. 60,510

Cash available during Feb. $88,060

Expected cash disbursement during Feb.

Jan. purchases $12,500

Other expenses 41,000 53,500

Expected cash balance Feb. 28 $34,560

2

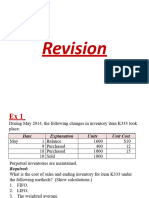

Ex # 3

(1) Expected cash collection in 19B

Trade A/R – Dec. 31 19B $84,000

Budgeted 19B cash sales ($1,200,000 × 0.20) 240,000

Remaining Sales Collection

Budgeted 19B Remaining stales

($1,200,000 × 0.80) $960,000

Trade A/R Dec. 31 19A (78,000)

Uncollectible Accounts (5,000) 877,000

Cash collection in 19B $1,201,000

(2) Cash disbursement in 19B for Purchase of Material

Cost of goods sold $840,000

Less: Inventory Dec. 31 19B 140,000

Cost of goods available for sale 980,000

Less: Inventory Dec. 31 19A 150,000

Purchases 19B 830,000

Less: Credit Purchases (98,000 – 95,000) 3,000

Cash disbursement of material purchased $827,000

(3) Cash Disbursement for Variable & Fixed General & Admin expenses 19B

Variable General & Admin expenses

19A Expenses ($1,100,000 × 0.10) × 0.50 $55,000

19B Expenses ($120,000 × 0.50) 60,000

$115,000

Fixed General & Admin expense

19A Expenses (100,000 – 40,000) × 0.20 $12,000

19B Expenses (100,000 – 40,000) × 0.80 48,000 60,000

Total cash disbursement $175,000

3

Ex # 4

Schmid Company

Income Statement

Rs. Rs. Rs. Rs.

Sales 360,000 720000 1080000 1440000

Less: Cost goods sold 252,000 504000 756000 1008000

Gross Profit (Sale × 30%) 108000 216000 324000 432000

Less: Commercial Expenses

Uncollectible Account (Sale × 1%) 3600 7200 10800 14400

Depreciation 10000 10000 10000 10000

Marketing expenses

Variable (sale × 12%) 43200 86400 129600 172800

Fixed 48000 48000 48000 48000

Admin expenses

Variable (Sale × 3%) 10800 21600 32400 43200

Fixed 34,200 34,200 34,200 34,200

Total Commercial expenses 149,800 207,400 265,000 322,600

Net Income (loss) (41,800) 8,600 59,000 109,400

Depreciation on Warehouse, office, and delivery facilities and Equipments

Annual Depreciation =

Cost Price = Rs. 800,000

Residual Value = Scrap Value = Break Up Value = 0

Useful life = Total life = Estimated life = 20 years

Annual Depreciation =

Quarterly Depreciation =

Note:

Commercial expenses means operating expenses

4

Ex # 5

(1)

Hardware Manufacturing Company

Forecasted Income Statement (000 omitted)

1st 2nd 3rd 4th

Quarter Quarter Quarter Quarter Total

Sales

Commercial $250 $266 $275 $300 $1,091

Government 100 120 110 115 445

Total Sales $350 $386 $385 $415 $1,536

Less: Cost of goods sold (sale × 46%) 161 178 177 191 707

Gross Profit $189 $208 $208 $224 $829

Commercial expenses

advertising $4 $4 $4 $4 $16

selling expenses (Sale × 10%) 35 39 39 42 155

Amin expenses (Gross profit × 16.8%) 32 35 35 $38 $140

General office expenses (Gross Profit × 12%) 23 25 25 27 100

Total 94 103 103 $111 $411

Operating income 95 105 105 113 418

Add: Other income 8 8 8 $8 $32

Income before tax 103 113 113 121 450

Less: Tax (Income before tax × 40%) 41 45 45 $48 $179

Net Income $62 $68 $68 $73 $271

5

Ex # 5

(2)

Hardware Manufacturing Company

Forecasted Income Statement (000 omitted)

1st 2nd 3rd 4th

Quarter Quarter Quarter Quarter Total

Sales

Commercial $263 $279 $289 $315 $1,146

Government 100 120 110 115 445

Total Sales $363 $399 $399 $430 $1,591

Less: Cost of goods sold(sale × 46%) 167 184 184 198 733

Gross Profit $196 $215 $215 $232 $858

Commercial expenses

advertising $4 $4 $4 $4 $16

Selling expenses (Sale × 10%) 36 40 40 43 159

Amin expenses (Gross profit × 16.8%) 33 36 36 $39 $144

General office expenses (Gross Profit × 12%) 24 26 26 28 104

Total 97 106 106 $114 $423

Operating income 99 109 109 118 435

Add: Other income 8 8 8 $8 $32

Income before tax 107 117 117 126 467

Less: Tax (Income before tax × 40%) 43 47 47 $50 $187

Net Income $64 $70 $70 $76 $280

You might also like

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Fundamental Managerial Accounting Concepts 9th Edition Edmonds Solutions ManualDocument16 pagesFundamental Managerial Accounting Concepts 9th Edition Edmonds Solutions Manualeffigiesbuffoonmwve9100% (20)

- 1 - Accounting Information Systems Problems With SolutionsDocument22 pages1 - Accounting Information Systems Problems With Solutionsbusiness docNo ratings yet

- Solutions To ProblemsDocument22 pagesSolutions To ProblemsSyeed AhmedNo ratings yet

- David A Carrucini Assignment Chapter 22Document8 pagesDavid A Carrucini Assignment Chapter 22dcarruciniNo ratings yet

- Perbaikan SoalDocument3 pagesPerbaikan SoalChandraptrrNo ratings yet

- AHM13e Chapter - 01 - Solution To Problems and Key To CasesDocument19 pagesAHM13e Chapter - 01 - Solution To Problems and Key To CasesGaurav ManiyarNo ratings yet

- Devie Helen S1 Akuntansi T12 C PADocument5 pagesDevie Helen S1 Akuntansi T12 C PAShigit PebriantoNo ratings yet

- Property, Plant, and Equipment Accumulated Depreciation Net Property, Plant, and EquipmentDocument6 pagesProperty, Plant, and Equipment Accumulated Depreciation Net Property, Plant, and EquipmentEman KhalilNo ratings yet

- AKL 2 - Tugas 5 Marselinus A H T (A31113316)Document4 pagesAKL 2 - Tugas 5 Marselinus A H T (A31113316)Marselinus Aditya Hartanto TjungadiNo ratings yet

- ACCT 203 (Assignment 3)Document4 pagesACCT 203 (Assignment 3)koftaNo ratings yet

- P6-18 Unrealized Profit On Upstream SalesDocument4 pagesP6-18 Unrealized Profit On Upstream Salesw3n123No ratings yet

- Intermediate Accounting Exam 3 SolutionsDocument7 pagesIntermediate Accounting Exam 3 SolutionsAlex SchuldinerNo ratings yet

- Bài tập chương 13Document10 pagesBài tập chương 132021agl12.phamhoangdieumyNo ratings yet

- Week 13 - SoalDocument3 pagesWeek 13 - SoalHeidi ParamitaNo ratings yet

- Woods CorporationDocument1 pageWoods CorporationFelix FelixNo ratings yet

- Balucan InAcc 3 Week2 Part 2Document2 pagesBalucan InAcc 3 Week2 Part 2Luigi Enderez BalucanNo ratings yet

- Case 3 4Document7 pagesCase 3 4Jude Español JorsaNo ratings yet

- Task Performance 1Document1 pageTask Performance 1JanixxxNo ratings yet

- SCI WeiLong TradingDocument4 pagesSCI WeiLong TradingJoyce CalmaNo ratings yet

- FM-Cash Budget)Document9 pagesFM-Cash Budget)Aviona GregorioNo ratings yet

- Financial Plan:: The Following Sections Will Outline Important Financial InformationDocument17 pagesFinancial Plan:: The Following Sections Will Outline Important Financial InformationpalwashaNo ratings yet

- Problem SolvingDocument10 pagesProblem SolvingRegina De LunaNo ratings yet

- Budgeting ExerciseDocument2 pagesBudgeting Exercisekristel bulalacaoNo ratings yet

- Allessandro Scarlatti CompanyDocument6 pagesAllessandro Scarlatti Companylaale dijaanNo ratings yet

- Excel Budget ProjectDocument7 pagesExcel Budget Projectapi-341205347No ratings yet

- Tayaban Lancer Company 1Document4 pagesTayaban Lancer Company 1Tayaban Van GihNo ratings yet

- Analisis Rasio P14-2Document4 pagesAnalisis Rasio P14-2Yoga Arif PratamaNo ratings yet

- Chapter 8 CostDocument5 pagesChapter 8 CostDogmanNo ratings yet

- P10-1B & P10-7BDocument4 pagesP10-1B & P10-7BmeifangNo ratings yet

- Financial Plan:: The Following Sections Will Outline Important Financial InformationDocument17 pagesFinancial Plan:: The Following Sections Will Outline Important Financial InformationAyesha KanwalNo ratings yet

- Examination Question and Answers, Set C (Problem Solving), Chapter 15 - Statement of Cash FlowDocument2 pagesExamination Question and Answers, Set C (Problem Solving), Chapter 15 - Statement of Cash Flowjohn carlos doringoNo ratings yet

- Bud GettingDocument8 pagesBud GettingLorena Mae LasquiteNo ratings yet

- Fa2 TutorialDocument59 pagesFa2 TutorialNam PhươngNo ratings yet

- Incomplete RecordDocument30 pagesIncomplete RecordMuhammad TahaNo ratings yet

- Pa12 Trần Khánh Vy Hw Ch5Document5 pagesPa12 Trần Khánh Vy Hw Ch5Vy Tran KhanhNo ratings yet

- HL Business Management 12 Exam 4Document6 pagesHL Business Management 12 Exam 4Micah M100% (1)

- Ma - Bep01 - LucioDocument4 pagesMa - Bep01 - LucioGrace SimonNo ratings yet

- Practice Questions and Answers: Financial AccountingDocument18 pagesPractice Questions and Answers: Financial AccountingFarah NazNo ratings yet

- FALL Class 7 - Cash Budgeting - Ch9 - GDBA - Note # 7 - TEACHERDocument7 pagesFALL Class 7 - Cash Budgeting - Ch9 - GDBA - Note # 7 - TEACHERAkankshaNo ratings yet

- Ma Bep01Document4 pagesMa Bep01Grace SimonNo ratings yet

- Tutorial 7Document3 pagesTutorial 7Steven CHONGNo ratings yet

- Acc Tut 12 Final JTDocument21 pagesAcc Tut 12 Final JTxhayyyzNo ratings yet

- Statement of Cash Flows 4Document6 pagesStatement of Cash Flows 4Rashid W QureshiNo ratings yet

- Examination Question and Answers, Set D (Problem Solving), Chapter 15 - Statement of Cash FlowDocument2 pagesExamination Question and Answers, Set D (Problem Solving), Chapter 15 - Statement of Cash Flowjohn carlos doringoNo ratings yet

- ST ND RD THDocument5 pagesST ND RD THNOVIDANo ratings yet

- CH - 04 SolutionDocument3 pagesCH - 04 SolutionSaifur R. SabbirNo ratings yet

- SCI (Function of Expense Method) Tiger CompanyDocument2 pagesSCI (Function of Expense Method) Tiger Companypatricia0% (1)

- QuestionsDocument13 pagesQuestionsAriaNo ratings yet

- Warner Company Statement of Cash FlowsDocument2 pagesWarner Company Statement of Cash FlowsKailash KumarNo ratings yet

- Peanut FinancialsDocument4 pagesPeanut FinancialsTertius Du ToitNo ratings yet

- % July August September Forecasted Sales Gross ProfitDocument8 pages% July August September Forecasted Sales Gross ProfitГанбаяр АнударьNo ratings yet

- B291 Revision - File 1Document15 pagesB291 Revision - File 1adel.dahbour97No ratings yet

- Sample Functional Form of Statement of Comprehensive IncomeDocument2 pagesSample Functional Form of Statement of Comprehensive IncomeHazel Joy DemaganteNo ratings yet

- Acct 2020 Excel Budget ProblemDocument6 pagesAcct 2020 Excel Budget Problemapi-307661249No ratings yet

- Practice Exam Chapters 9-12 Solutions: Problem IDocument5 pagesPractice Exam Chapters 9-12 Solutions: Problem IAtif RehmanNo ratings yet

- Prelim Exam-Boticario D. (AST)Document4 pagesPrelim Exam-Boticario D. (AST)Dominic E. BoticarioNo ratings yet

- JEAA Instamart Income StatementDocument1 pageJEAA Instamart Income StatementJEAA InstamartNo ratings yet

- Acca110 Adorable Ac21 As03Document6 pagesAcca110 Adorable Ac21 As03Shaneen AdorableNo ratings yet

- CH23 - Transactional Approach and CFExercises and SolutionsDocument6 pagesCH23 - Transactional Approach and CFExercises and SolutionsHossein ParvardehNo ratings yet

- Act - Skills Development LeviesDocument13 pagesAct - Skills Development LeviesJason Fourie100% (1)

- Extreme Networks Consolidated XOS Hardware Installation GuideDocument162 pagesExtreme Networks Consolidated XOS Hardware Installation GuidejoseNo ratings yet

- Mobilization and Empowerment of Marginalized Women in South AsiaDocument32 pagesMobilization and Empowerment of Marginalized Women in South AsiaaalsNo ratings yet

- Agenda European Economic Congress Katowice 2010Document25 pagesAgenda European Economic Congress Katowice 2010BelongToTheCityNo ratings yet

- CoteDocument736 pagesCoteJohn AndersonNo ratings yet

- Introduction To Cyber Law: Jitender VigDocument54 pagesIntroduction To Cyber Law: Jitender VigVipul PartapNo ratings yet

- Transaction Details Report PDFDocument25 pagesTransaction Details Report PDFShakhir MohunNo ratings yet

- Revision Notes Chapter-1 Introduction To AccountingDocument8 pagesRevision Notes Chapter-1 Introduction To Accountingyash siwachNo ratings yet

- Final Examination (Final)Document10 pagesFinal Examination (Final)Michelle Vinoray Pascual0% (2)

- 3.0 CONCEPT OF AL-MILKIYAH-isb542-oktDocument27 pages3.0 CONCEPT OF AL-MILKIYAH-isb542-oktummieulfahNo ratings yet

- LTC RulesDocument30 pagesLTC RulesmeetsatyajeeNo ratings yet

- Xaar 128 OpGuide OptDocument70 pagesXaar 128 OpGuide OptmehoNo ratings yet

- Chapter 1 - Accounting For Business CombinationsDocument6 pagesChapter 1 - Accounting For Business CombinationsLyaNo ratings yet

- TPA ProjectDocument13 pagesTPA ProjectAsmit WadhwaNo ratings yet

- Informative Speech, DISS. by Tine.Document2 pagesInformative Speech, DISS. by Tine.Tine DeguzmanNo ratings yet

- Present Simple Vs Present Continuous Free Online ExerciseDocument1 pagePresent Simple Vs Present Continuous Free Online ExerciseCapugiu RebeccaNo ratings yet

- IRDocument18 pagesIRMALAVIKA JAYAKRISHNAN P T 1827039No ratings yet

- Business Income 4Document35 pagesBusiness Income 4Nyakuni NobertNo ratings yet

- Isp National - Zonal - Isp - Application - Form - 2Document4 pagesIsp National - Zonal - Isp - Application - Form - 2api-25988294100% (1)

- School Safety ReportDocument180 pagesSchool Safety ReportBreitbart NewsNo ratings yet

- Summer Training Report 12 PDF FreeDocument111 pagesSummer Training Report 12 PDF FreeAKKY JAINNo ratings yet

- Polycarbonate Sheet Rate AnalysisDocument2 pagesPolycarbonate Sheet Rate AnalysisVenkataramanaiah Puli0% (1)

- E1.12 Percentages 2A Topic Booklet 1 - 1Document7 pagesE1.12 Percentages 2A Topic Booklet 1 - 1M MADANINo ratings yet

- Vda Vs ReyesDocument3 pagesVda Vs ReyesJohn AbellanidaNo ratings yet

- 15-Legarda v. CA G.R. No. 94457 March 18, 1991Document6 pages15-Legarda v. CA G.R. No. 94457 March 18, 1991Jopan SJNo ratings yet

- Marcos Vs Heirs of NavarroDocument4 pagesMarcos Vs Heirs of NavarroSachuzen23No ratings yet

- Carrier Must Get PaidFact or Fiction TauscherDocument11 pagesCarrier Must Get PaidFact or Fiction Tauscherstavros panagoulopoulosNo ratings yet

- Burton Junior Post v. Otto C. Boles, Warden of The West Virginia State Penitentiary, 332 F.2d 738, 4th Cir. (1964)Document11 pagesBurton Junior Post v. Otto C. Boles, Warden of The West Virginia State Penitentiary, 332 F.2d 738, 4th Cir. (1964)Scribd Government DocsNo ratings yet

- Affidavit of Self AdjudicationDocument2 pagesAffidavit of Self AdjudicationAldrinNo ratings yet

- Irf 5302Document6 pagesIrf 5302Yessenia PerezNo ratings yet