Professional Documents

Culture Documents

Woods Corporation

Uploaded by

Felix FelixCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Woods Corporation

Uploaded by

Felix FelixCopyright:

Available Formats

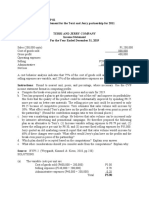

WOODS CORPORATION

INCOME STATEMENT

For The Year Ended December 31, 2015

Sales

Sales Revenue $ 4,175,000

Less : Sales Discount $ (34,000)

Sales Return and Allowance $ (79,000) $ (113,000)

Net Sales $ 4,062,000

Cost of Goods Sold

Inventory (Beginning) $ 535,000

Purchase $ 2,786,000

Less : Purchase Return $ (15,000)

Purchase Discount $ (27,000)

Ending Inventory $ 686,000

Freight In $ 72,000

Cost of Goods Sold $ 2,665,000

Gross Profit $ 1,397,000

Selling Expense

Selling Expense $ 69,000

Advertising Expense $ 54,000

Delivery Expense $ 93,000

Depreciation Expense (sales Equipment) $ 36,000

Salaries and Wages Expense (Sales) $ 284,000

Sales Commission $ 83,000

Telephone and Internet Expense (Sales) $ 17,000 $ 636,000

Administrative Expense

Accounting and Legal Service $ 33,000

Insurance Expense (Office) $ 24,000

Depreciation Expense (Office Equpment) $ 48,000

Salaries and Wages Expense (Office) $ 346,000

Utilities Expense $ 32,000

Miscellaneous Office Expense $ 8,000 $ 491,000

Total Operating Expense $ 1,127,000

Other Income and Expense

Rent Revenue $ 240,000

Loss on Sale of Division $ (60,000) $ 180,000

Income From Operations $ 450,000

Interest Expense $ (176,000)

Income Before Income Tax $ 274,000

Income Tax $ (82,200)

Net Income for The Year $ 191,800

Attribtable to :

Shareholders of Woods (900.000/10) $ 90,000

Earnings per Share $ 2.13

You might also like

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Income From Operation $ 144,000 Net Income $ 132,000 Earnings Per Share $ 92,000Document3 pagesIncome From Operation $ 144,000 Net Income $ 132,000 Earnings Per Share $ 92,000Ndwii PanduNo ratings yet

- Latihan Ch. 4 SelineDocument1 pageLatihan Ch. 4 SelinefaldyNo ratings yet

- Akuntansi Pengatar Ke 11Document2 pagesAkuntansi Pengatar Ke 11WiwitvlogNo ratings yet

- Hallstead Jewelers PDFDocument9 pagesHallstead Jewelers PDFRaghav JainNo ratings yet

- David A Carrucini Assignment Chapter 22Document8 pagesDavid A Carrucini Assignment Chapter 22dcarruciniNo ratings yet

- Mashmglons Print PostDocument9 pagesMashmglons Print Postankush diwanNo ratings yet

- P6Document3 pagesP6Jessica HutabaratNo ratings yet

- Fa2 TutorialDocument59 pagesFa2 TutorialNam PhươngNo ratings yet

- 2208 ch22Document7 pages2208 ch22Clyde Ian Brett PeñaNo ratings yet

- JEAA Instamart Income StatementDocument1 pageJEAA Instamart Income StatementJEAA InstamartNo ratings yet

- Income Statement: Sales Gross ProfitDocument1 pageIncome Statement: Sales Gross ProfitNiki CuaNo ratings yet

- Movida CashtoaccrualDocument5 pagesMovida CashtoaccrualVivienne Rozenn LaytoNo ratings yet

- Devie Helen S1 Akuntansi T12 C PADocument5 pagesDevie Helen S1 Akuntansi T12 C PAShigit PebriantoNo ratings yet

- Financial Accounting End TermDocument6 pagesFinancial Accounting End TermJohnny ProNo ratings yet

- Statement of IncomeDocument10 pagesStatement of IncomeScribdTranslationsNo ratings yet

- Solutions To ProblemsDocument22 pagesSolutions To ProblemsSyeed AhmedNo ratings yet

- Sneakers 2013Document5 pagesSneakers 2013priyaa0367% (12)

- 23-NURFC 2002 Projections vs. ActualDocument4 pages23-NURFC 2002 Projections vs. ActualCOASTNo ratings yet

- Profit and Loss Account TemplatesDocument2 pagesProfit and Loss Account TemplatesSpam JunkNo ratings yet

- Week 13 - SoalDocument3 pagesWeek 13 - SoalHeidi ParamitaNo ratings yet

- Peanut FinancialsDocument4 pagesPeanut FinancialsTertius Du ToitNo ratings yet

- Dian Sari (A031171703) Tugas Akl IiDocument3 pagesDian Sari (A031171703) Tugas Akl Iidian sariNo ratings yet

- 5-Year Financial Plan - Manufacturing 1Document8 pages5-Year Financial Plan - Manufacturing 1tulalit008No ratings yet

- Cash Flow Exam2Document1 pageCash Flow Exam2arafatNo ratings yet

- Property, Plant, and Equipment Accumulated Depreciation Net Property, Plant, and EquipmentDocument6 pagesProperty, Plant, and Equipment Accumulated Depreciation Net Property, Plant, and EquipmentEman KhalilNo ratings yet

- Dispensers of California, Inc.Document7 pagesDispensers of California, Inc.Prashuk SethiNo ratings yet

- Fundamental Managerial Accounting Concepts 9th Edition Edmonds Solutions ManualDocument16 pagesFundamental Managerial Accounting Concepts 9th Edition Edmonds Solutions Manualeffigiesbuffoonmwve9100% (20)

- Consolidated Statements of IncomeDocument52 pagesConsolidated Statements of IncomeTinatini BakashviliNo ratings yet

- Q22 SolutionDocument2 pagesQ22 Solutionneeldholakia27No ratings yet

- Visa Inc. - Income Statement: Recommended: S&P Capital IQ - Standard 2016 FQ3 2016 FQ4Document36 pagesVisa Inc. - Income Statement: Recommended: S&P Capital IQ - Standard 2016 FQ3 2016 FQ4石哲龍No ratings yet

- For Year Ending December 31, 2018: Lakeside Company Income StatementDocument8 pagesFor Year Ending December 31, 2018: Lakeside Company Income StatementMark Christian Cutanda VillapandoNo ratings yet

- Profit and Loss StatementDocument3 pagesProfit and Loss StatementAli TekinNo ratings yet

- 2 .Accounting Statements, Taxes, and Cash FlowDocument27 pages2 .Accounting Statements, Taxes, and Cash FlowBussines LearnNo ratings yet

- Income Statement For Livingarts Inc. For The Period Ending December 31St 2019 2017 2018 2019 RevenueDocument1 pageIncome Statement For Livingarts Inc. For The Period Ending December 31St 2019 2017 2018 2019 RevenueTom NobleNo ratings yet

- ACCCOB3Document10 pagesACCCOB3Jenine YamsonNo ratings yet

- Sensitivity Analysis Excel TemplateDocument5 pagesSensitivity Analysis Excel TemplateCele MthokoNo ratings yet

- Analisis Rasio P14-2Document4 pagesAnalisis Rasio P14-2Yoga Arif PratamaNo ratings yet

- Minicaso Bethesda Mining CompanyDocument8 pagesMinicaso Bethesda Mining CompanySebastián OrtizNo ratings yet

- Intermediate Accounting: Assignment 4: Exercise 4-6: Multiple-Step and Extraordinary ItemsDocument13 pagesIntermediate Accounting: Assignment 4: Exercise 4-6: Multiple-Step and Extraordinary ItemsMuhammad MalikNo ratings yet

- Ma - Bep01 - LucioDocument4 pagesMa - Bep01 - LucioGrace SimonNo ratings yet

- All SonsDocument14 pagesAll SonsMay BalangNo ratings yet

- Ma Bep01Document4 pagesMa Bep01Grace SimonNo ratings yet

- CFI FMVA Final Assessment Case Study 1ADocument12 pagesCFI FMVA Final Assessment Case Study 1Apadre pio kone100% (1)

- May 2019 #2 - Sheet1 PDFDocument2 pagesMay 2019 #2 - Sheet1 PDFStephano OlliviereNo ratings yet

- Chapter 15Document8 pagesChapter 15Mychie Lynne MayugaNo ratings yet

- Task 4 - Consolidation: Patricia HarringtonDocument9 pagesTask 4 - Consolidation: Patricia HarringtonDewi Agus SukowatiNo ratings yet

- FCF 12th Edition Chapter 02Document32 pagesFCF 12th Edition Chapter 02David ChungNo ratings yet

- Making Capital Investment DecisionsDocument42 pagesMaking Capital Investment Decisionsgabisan1087No ratings yet

- Tutorial 7Document3 pagesTutorial 7Steven CHONGNo ratings yet

- Financial Management (Problems)Document12 pagesFinancial Management (Problems)Prasad GowdNo ratings yet

- Hypercompuglobalmeganet Corporation Assumptions For Financial Projections Description Value Comment Revenue AssumptionsDocument4 pagesHypercompuglobalmeganet Corporation Assumptions For Financial Projections Description Value Comment Revenue AssumptionsKSXNo ratings yet

- Case 1 Group1 7A1Document6 pagesCase 1 Group1 7A1ruruNo ratings yet

- Value Drivers (Assumptions)Document6 pagesValue Drivers (Assumptions)Phuong ThaoNo ratings yet

- HD - SCF HD - SCFDocument3 pagesHD - SCF HD - SCFsyedatiqrocketmailcomNo ratings yet

- Cash Flow Estimation: Given DataDocument4 pagesCash Flow Estimation: Given DataMd. Din Islam Asif100% (2)

- Guillermo UpdateddataDocument6 pagesGuillermo UpdateddataGabiNo ratings yet

- 72 - Pertemuan 4 DocumentDocument7 pages72 - Pertemuan 4 DocumentWahyu JanokoNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Unit 2Document8 pagesUnit 2Ale JandroNo ratings yet

- Types of Business ModelsDocument12 pagesTypes of Business ModelsSaid AdanNo ratings yet

- ICICI Bank Letter of OfferDocument5 pagesICICI Bank Letter of OfferHighline Hotel100% (2)

- Inventrory 85Document24 pagesInventrory 85api-515904890No ratings yet

- TOMS Case Study Aishath Shanasa 1191402196Document8 pagesTOMS Case Study Aishath Shanasa 1191402196BushraNo ratings yet

- A Study On DerivativesDocument70 pagesA Study On DerivativesDivya Kakran100% (2)

- 6 The Sixth Meeting Is Organization Part 2 PDFDocument4 pages6 The Sixth Meeting Is Organization Part 2 PDFRiko AryantoNo ratings yet

- Singapore AirlinesDocument25 pagesSingapore AirlinesVivek KotakNo ratings yet

- Statement of The Problem and QuestionnaireDocument5 pagesStatement of The Problem and QuestionnaireRusselNo ratings yet

- COSMY - Perfume & Cosmetic TemplateDocument43 pagesCOSMY - Perfume & Cosmetic Templaterosylia tchitemboNo ratings yet

- K - GRP 7 - Report On Aviation SectorDocument47 pagesK - GRP 7 - Report On Aviation SectorApoorva PattnaikNo ratings yet

- SmithCompXM Sample Questions1Document13 pagesSmithCompXM Sample Questions1FrankNo ratings yet

- Form 18 Sdi 4 - Recourse Liabilities - Risk of Material Misstatement (Romm) WorksheetDocument17 pagesForm 18 Sdi 4 - Recourse Liabilities - Risk of Material Misstatement (Romm) WorksheetwellawalalasithNo ratings yet

- QC RT AA TC35bDocument1 pageQC RT AA TC35bAizuddin RosliNo ratings yet

- Top 10 Roles of A Manager in OrganizationDocument5 pagesTop 10 Roles of A Manager in OrganizationANUPAM KAPTINo ratings yet

- Miranda Lambert InfoDocument4 pagesMiranda Lambert InfoMurry LeeNo ratings yet

- Classroom Exercises On Receivables AnswersDocument4 pagesClassroom Exercises On Receivables AnswersJohn Cedfrey Narne100% (1)

- Confirmation Your Receipt: Payment Was Successful - Your Money Has Been SentDocument2 pagesConfirmation Your Receipt: Payment Was Successful - Your Money Has Been SentAhmed KassemNo ratings yet

- Vita ReporttDocument84 pagesVita ReporttTamanna GoyalNo ratings yet

- Cambridge Ordinary LevelDocument12 pagesCambridge Ordinary LevelAdeenaNo ratings yet

- CHAPTER5Document16 pagesCHAPTER5Bisag Asa88% (8)

- Future Fit Toolkit S CombinedDocument79 pagesFuture Fit Toolkit S CombinedtapanborahNo ratings yet

- Well PermitDocument5 pagesWell PermitGDSMCEONo ratings yet

- Sponsorship Details For Icetsbp 23Document3 pagesSponsorship Details For Icetsbp 23prakash28shankerNo ratings yet

- Procure-Mentally SpeakingDocument10 pagesProcure-Mentally Speakingvidiv vidivNo ratings yet

- M-14 Conduct On Site Supervision of BEIDocument172 pagesM-14 Conduct On Site Supervision of BEIkassamammukaNo ratings yet

- Unit1: BrandDocument6 pagesUnit1: BrandMAI HUỲNH THỊ TRÚCNo ratings yet

- Invoice: New Charges New TaxesDocument8 pagesInvoice: New Charges New TaxesmeNo ratings yet

- Analisis Kasus Just in TimeDocument2 pagesAnalisis Kasus Just in Timediah permata sariNo ratings yet

- Mean, Median, Mode and Range - Gaming AveragesDocument3 pagesMean, Median, Mode and Range - Gaming AveragesAnnie AliNo ratings yet