Professional Documents

Culture Documents

Question No. 2 Forecast For Bottled Water

Uploaded by

Muhammad Shoaib0 ratings0% found this document useful (0 votes)

4 views3 pagesThis document discusses different forecasting techniques including moving averages and exponential smoothing. It provides information on:

1) How moving averages work to smooth price data by calculating an average price over a period of time, which helps reduce the effects of short term fluctuations. They are widely used in technical analysis to identify changes in momentum.

2) Exponential smoothing assumes the future will be similar to the recent past, and learns the typical or level demand based on historical data. It provides a smoothed representation of demand.

3) To forecast with exponential smoothing when data is not available for some periods, assumptions and baselines may need to be used, such as applying the demand from an earlier period. References are also provided on

Original Description:

Operations management assignment

Original Title

2

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document discusses different forecasting techniques including moving averages and exponential smoothing. It provides information on:

1) How moving averages work to smooth price data by calculating an average price over a period of time, which helps reduce the effects of short term fluctuations. They are widely used in technical analysis to identify changes in momentum.

2) Exponential smoothing assumes the future will be similar to the recent past, and learns the typical or level demand based on historical data. It provides a smoothed representation of demand.

3) To forecast with exponential smoothing when data is not available for some periods, assumptions and baselines may need to be used, such as applying the demand from an earlier period. References are also provided on

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

4 views3 pagesQuestion No. 2 Forecast For Bottled Water

Uploaded by

Muhammad ShoaibThis document discusses different forecasting techniques including moving averages and exponential smoothing. It provides information on:

1) How moving averages work to smooth price data by calculating an average price over a period of time, which helps reduce the effects of short term fluctuations. They are widely used in technical analysis to identify changes in momentum.

2) Exponential smoothing assumes the future will be similar to the recent past, and learns the typical or level demand based on historical data. It provides a smoothed representation of demand.

3) To forecast with exponential smoothing when data is not available for some periods, assumptions and baselines may need to be used, such as applying the demand from an earlier period. References are also provided on

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 3

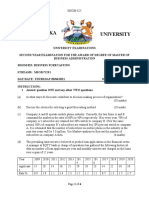

Question No.

Forecast for Bottled Water

Volume Exponential Exponential Exponential

(Million Soothing Soothing Soothing

Year litre) Moving Average 0.1 0.2 0.3

201

8 445106.0 445106.0 445106.0 445106.0

201

9 458139.8 445106.0417 445106.0417 445106.0417

202

0 443924.3 446409.4183 447712.7948 449016.1714

202

1 467740.5 449056.7171 446160.9067 446955.0964 447488.6107

202

2 456601.5372 448318.8662 451112.1774 453564.178

Forecast for Juice

Volume Exponential Exponential Exponential

(Million Soothing Soothing Soothing

Year litre) Moving Average 0.1 0.2 0.3

2018 34631.4 34631.4 34631.4 34631.4

2019 35130.8 34631.44647 34631.44647 34631.44647

2020 33889.2 34681.38439 34731.32231 34781.26023

2021 35543.0 34550.48828 34602.16522 34562.89639 34513.63997

2022 34854.35341 34696.25289 34758.92548 34822.46054

Forecast for Soft Drink

Volume Exponential Exponential Exponential

(Million Soothing Soothing Soothing

Year litre) Moving Average 0.1 0.2 0.3

2018 346124.8 346124.8 346124.8 346124.8

2019 352475.6 346124.8068 346124.8068 346124.8068

2020 339805.5 346759.8897 347394.9727 348030.0557

2021 358778.2 346135.3128 346064.4503 345877.0772 345562.6875

2022 350353.1034 347335.8231 348457.2975 349527.3349

a) A moving average, sometimes known as an MA, is a common instrument used in

technical analysis of stock prices. (Raudys, 2003) Calculating a stock's moving

average helps to smooth out the price data by providing a constantly updated average

price. This is one of the reasons why this calculation is done. When price movements

are unpredictable and occur over a short period of time, calculating a stock's moving

average can assist smooth out the effects of these fluctuations. (Karasu, 2020)

Moving averages are a common technique that are widely used in the discipline of

technical analysis. Technical analysis is a subfield of investing that seeks to

understand and profit from the price movement patterns of securities and indexes.

Technical analysts will use moving averages, for instance, to determine whether or

not a security is experiencing a change in momentum when the price of the asset

suddenly declines. Moving averages function in this manner to determine whether or

not a particular security is going through a change in its momentum. On other cases,

they will rely on moving averages to support their beliefs that a change is on the

horizon to back up their assumptions.

A simple arithmetic moving average (SMA) can be computed by adding up the prices

at the necessary time intervals, then dividing the amount obtained by the total number

of time intervals included in the calculation. To calculate the value of a security, for

example, one could add up its closing price for a predetermined number of time

periods, then divide that total by the same predetermined number of times. This would

give one an estimate of the security's value. (Muangprathub, 2020) The moving

average over a shorter time period responds more quickly to changes in the price of

the underlying securities, whereas the moving average over a longer time period

requires more time to react. Because one trade for the short term, the moving average

that one utilize needs to have a fast response time to price changes. For this reason, a

moving average with three periods is utilized.

b) A straightforward exponential smoothing is one of the most straightforward

methods for predicting the outcome of a time series. The fundamental presumption

behind this paradigm is that the future will present itself as being extremely analogous

to the recent past. Because of this, the only demand pattern that this model could learn

is the level of demand based on historical data. The level can be thought of as a

typical value that the fluctuating demand tends to bounce around. The graphic that

follows shows that the level is a smoothed picture of the demand. (Dev, 2018)

In this particular scenario, a projection for the fifth quarter is required. One will need

the forecast from the previous period for that (i.e., period 4). (It’s now in the fourth

and final period). Nevertheless, there are no estimates provided for Period 4. As a

result, it is essential to estimate the prognosis for period 4 before anything else.

Because there is no forecast provided for Period 3, a situation that is quite similar to

the previous one occurs in Period 4. Because of this, in order to construct our

projection for the period 3, it need to look back two more times. It is self-evident that

this will result in our having to reset the clock to the first minute that it was set to. As

there was no period that came before this one, it is necessary to make assumptions

while attempting to make a prognosis for period 1. When developing forecasts, it is

fairly common practice to base them on the demand from the period before, which

might be referred to as Period 1. In other words, this will provide a baseline estimate

that may be used as a basis for developing a forecast for Year 2. As a result, it might

apply this strategy to the process of making forecasts for the years 2023–2025.

References

Dev, S. A. T. H. M. G. R. L. A. a. V. S. W., 2018. Solar irradiance forecasting using triple

exponential smoothing.. n 2018 International Conference on Smart Energy Systems and

Technologies.

Karasu, S. A. A. B. S. a. A. W., 2020. A new forecasting model with wrapper-based feature

selection approach using multi-objective optimization technique for chaotic crude oil time

series.. Energy.

Muangprathub, J. I. A. B. L. a. P. N., 2020. Portfolio risk and return with a new simple

moving average of price change ratio.. Wireless Personal Communications.

Raudys, A. L. V. a. M. E., 2003. Moving averages for financial data smoothing.. In

International conference on information and software technologi.

You might also like

- Quadratic Equations Advanced AssignmentDocument3 pagesQuadratic Equations Advanced AssignmentNeeravNo ratings yet

- Nature of Abstract ArtDocument15 pagesNature of Abstract ArtHamed KhosraviNo ratings yet

- Group Ariel StudentsDocument8 pagesGroup Ariel Studentsbaashii4No ratings yet

- NSTP Cwts Chapter 5 LeadershipDocument20 pagesNSTP Cwts Chapter 5 LeadershipRezzella Ann Cinto71% (7)

- First Quarter (Media and Information Lit) (AutoRecovered)Document4 pagesFirst Quarter (Media and Information Lit) (AutoRecovered)Nover Keithley Sicay MenteNo ratings yet

- Bicycling WorldDocument15 pagesBicycling WorldKarl Angelo ArrietaNo ratings yet

- Query PerformanceDocument6 pagesQuery PerformancemngtrajeshNo ratings yet

- Applied Predictive Analytics: Principles and Techniques for the Professional Data AnalystFrom EverandApplied Predictive Analytics: Principles and Techniques for the Professional Data AnalystNo ratings yet

- Beyond Smart Beta: Index Investment Strategies for Active Portfolio ManagementFrom EverandBeyond Smart Beta: Index Investment Strategies for Active Portfolio ManagementNo ratings yet

- Practice ForecastingDocument4 pagesPractice ForecastingDexter KhooNo ratings yet

- QTF PROJECT MSC Samkit Shah Roll No.20Document12 pagesQTF PROJECT MSC Samkit Shah Roll No.20shahsamkit08No ratings yet

- Financial Performance HDFC 2023Document8 pagesFinancial Performance HDFC 2023udaya kumarNo ratings yet

- Economy of PakistanDocument17 pagesEconomy of PakistanNameNo ratings yet

- Central Bank of India Result UpdatedDocument10 pagesCentral Bank of India Result UpdatedAngel BrokingNo ratings yet

- 562 Ijar-16777Document5 pages562 Ijar-16777Utkarsh BajpaiNo ratings yet

- Comparative Study of Nonperforming Assets of Public Sector and Private Sector BanksDocument11 pagesComparative Study of Nonperforming Assets of Public Sector and Private Sector Banksvenkat thejNo ratings yet

- Given The P&L and Balance Sheet Assumptions, Calculate The FollowingDocument37 pagesGiven The P&L and Balance Sheet Assumptions, Calculate The FollowingSuvid0% (1)

- Project Report On KKKKKKDocument16 pagesProject Report On KKKKKKAnupam GhoshNo ratings yet

- Money & Banking Project (Best)Document10 pagesMoney & Banking Project (Best)jamilkhannNo ratings yet

- Token ModelDocument16 pagesToken ModelPopa CiprianNo ratings yet

- XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX: ECO 204 (Statistics For Business and Economics II) Section: 07Document16 pagesXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX: ECO 204 (Statistics For Business and Economics II) Section: 07Hasib HasanNo ratings yet

- Research PaperDocument5 pagesResearch PapervvpatelNo ratings yet

- Green Book - Appraisal Summary TablesDocument34 pagesGreen Book - Appraisal Summary TablesTrisha CarlisleNo ratings yet

- IJRHS 2016 Vol04 Issue 04 10Document8 pagesIJRHS 2016 Vol04 Issue 04 10subhaseduNo ratings yet

- BUS 660 New Business PlanningDocument13 pagesBUS 660 New Business PlanningLori DoctorNo ratings yet

- Risk Analysis of Rivertype Hydropower PlantDocument7 pagesRisk Analysis of Rivertype Hydropower PlantJhoni SitompulNo ratings yet

- United Bank of India Result UpdatedDocument12 pagesUnited Bank of India Result UpdatedAngel BrokingNo ratings yet

- Corporation Bank Result UpdatedDocument11 pagesCorporation Bank Result UpdatedAngel BrokingNo ratings yet

- Bank of India Result UpdatedDocument12 pagesBank of India Result UpdatedAngel BrokingNo ratings yet

- Water Needs Analysis - WS - Sungai Selan - Bima Fabiyandi - 19251174Document9 pagesWater Needs Analysis - WS - Sungai Selan - Bima Fabiyandi - 19251174La Ode. MunajadNo ratings yet

- TSA Final Report HaroonDocument39 pagesTSA Final Report HaroonHaroon ZahidNo ratings yet

- South Indian Bank Result UpdatedDocument13 pagesSouth Indian Bank Result UpdatedAngel BrokingNo ratings yet

- EC203 Tutorial 12 Time Series 16Document4 pagesEC203 Tutorial 12 Time Series 16R and R wweNo ratings yet

- Group 1 Written Assignment V FIN C FIN304Document15 pagesGroup 1 Written Assignment V FIN C FIN304Rajesh MongerNo ratings yet

- Tugas Apg4Document9 pagesTugas Apg4Windi Wilda NingsiNo ratings yet

- SACM Exhibits TemplateDocument11 pagesSACM Exhibits TemplateJustin RuffingNo ratings yet

- Ratio Analysis of Co-Operative Bank of Surat: Manisha D. PatelDocument11 pagesRatio Analysis of Co-Operative Bank of Surat: Manisha D. Patels.muthuNo ratings yet

- ForecastingDocument56 pagesForecastingSumeet GaikwadNo ratings yet

- Prospective Analysis - ForecastingDocument17 pagesProspective Analysis - ForecastingqueenbeeastNo ratings yet

- Group8 IBRM Assin09 Data 20221205 (ENG)Document23 pagesGroup8 IBRM Assin09 Data 20221205 (ENG)jinklad47No ratings yet

- Gross Advances and Gross Npas of Public Sector BanksDocument7 pagesGross Advances and Gross Npas of Public Sector BankssweetyashishNo ratings yet

- Allahabad Bank Result UpdatedDocument11 pagesAllahabad Bank Result UpdatedAngel BrokingNo ratings yet

- IDBI Bank: Performance HighlightsDocument13 pagesIDBI Bank: Performance HighlightsAngel BrokingNo ratings yet

- Business Plan For Establishment of Liquid Detergent PlantDocument22 pagesBusiness Plan For Establishment of Liquid Detergent PlantĐạt Diệp0% (1)

- SIRIDocument24 pagesSIRISri Lalitha YanamandraNo ratings yet

- Knowledge Management Processes 5: Silvia Martelo-Landroguez and Gabriel Cepeda-CarriónDocument2 pagesKnowledge Management Processes 5: Silvia Martelo-Landroguez and Gabriel Cepeda-CarriónDani JaramilloNo ratings yet

- Final Presentation BKH1810036F - Tama DharDocument19 pagesFinal Presentation BKH1810036F - Tama DharArpita Dhar TamaNo ratings yet

- Msom 825Document4 pagesMsom 825Cheruiyot EmmanuelNo ratings yet

- FINANCIAL ANALYSIS of AMUL - 122742796 PDFDocument7 pagesFINANCIAL ANALYSIS of AMUL - 122742796 PDFbhavin rathodNo ratings yet

- CHAPTER 4-5 Cashless Policy Data AnalysisDocument22 pagesCHAPTER 4-5 Cashless Policy Data AnalysisDiiyor LawsonNo ratings yet

- 2020 - Class 10 - Revision - Q - For StudentsDocument4 pages2020 - Class 10 - Revision - Q - For StudentsCartieNo ratings yet

- Anushka Chauhan 80012100054Document6 pagesAnushka Chauhan 80012100054TANYA AGGARWALNo ratings yet

- AFM 273 F2021 Midterm W AnswersDocument31 pagesAFM 273 F2021 Midterm W AnswersAustin BijuNo ratings yet

- American Eagle Outfitters TemplateDocument16 pagesAmerican Eagle Outfitters TemplateVitor Minoru OkadaNo ratings yet

- Assignment For Week #7 - FA17 - 9572Document4 pagesAssignment For Week #7 - FA17 - 9572Nicolas BattyNo ratings yet

- Assignment Briefing (Level 7) : 'S Cost of FinancingDocument4 pagesAssignment Briefing (Level 7) : 'S Cost of FinancingHimani DiwanNo ratings yet

- Fundamental Analysis: Sunday - March 7, 2021Document44 pagesFundamental Analysis: Sunday - March 7, 2021purtamadre RonNo ratings yet

- BdaDocument24 pagesBdaAbinNo ratings yet

- 22nd Japan Country-ReportDocument16 pages22nd Japan Country-ReportDavid MarlisNo ratings yet

- 3.22 Drought AnalysisDocument3 pages3.22 Drought Analysiszenabhi31_916626204No ratings yet

- An Analysis of The Unemployment and Inflation Rate of Japan Utilizing The Box-Jenkins MethodologyDocument17 pagesAn Analysis of The Unemployment and Inflation Rate of Japan Utilizing The Box-Jenkins MethodologyArya KodeNo ratings yet

- 17AIC BaylonDocument12 pages17AIC Baylonskdelacruz.djdengrNo ratings yet

- Final Exam 2017Document10 pagesFinal Exam 2017Ahtisham KhawajaNo ratings yet

- Bank of India Result UpdatedDocument12 pagesBank of India Result UpdatedAngel BrokingNo ratings yet

- Statistical Methods for Six Sigma: In R&D and ManufacturingFrom EverandStatistical Methods for Six Sigma: In R&D and ManufacturingNo ratings yet

- The Evolution of Palliative Care - Cicily Saunders Journal ArticleDocument3 pagesThe Evolution of Palliative Care - Cicily Saunders Journal ArticleTorgo ThompsonNo ratings yet

- Characteristics of Life UpdatedDocument12 pagesCharacteristics of Life UpdatedGarcia Gino MikoNo ratings yet

- Secondary and Higher Education DivisionDocument6 pagesSecondary and Higher Education DivisionShohel RanaNo ratings yet

- About ADWEADocument1 pageAbout ADWEAranasherdilNo ratings yet

- 9780521392938Document276 pages9780521392938SrramNo ratings yet

- OS8 Gap AnalysisDocument3 pagesOS8 Gap AnalysisMihaela MikaNo ratings yet

- PTE Test Describe Image Is A Very Important Part in The Speaking Section of PTE Academic. What Is All AboutDocument2 pagesPTE Test Describe Image Is A Very Important Part in The Speaking Section of PTE Academic. What Is All Aboutpoonam_goyal26No ratings yet

- Fresh Foods Ordering ProcessDocument5 pagesFresh Foods Ordering ProcessSagarPatelNo ratings yet

- ApolloDocument12 pagesApolloRishabh KumarNo ratings yet

- 7 - Statistical Inference PDFDocument17 pages7 - Statistical Inference PDFdepressed potatoNo ratings yet

- JECRCDocument8 pagesJECRCShivani Ekant YadavNo ratings yet

- Cloud Kono MieDocument355 pagesCloud Kono MieandypressNo ratings yet

- Arduino Library For The AM2302 Humidity and Temperature SensorDocument2 pagesArduino Library For The AM2302 Humidity and Temperature SensorMallickarjunaNo ratings yet

- Cement Production at Deva Cement Factory FromDocument4 pagesCement Production at Deva Cement Factory Fromdbnurse2010No ratings yet

- Payrevision Order Medical CollegesDocument59 pagesPayrevision Order Medical CollegesDr-Renjith RajanNo ratings yet

- Alif Sheikh I'D-18192107032 Assignment-1 TXE-206Document6 pagesAlif Sheikh I'D-18192107032 Assignment-1 TXE-206Alif SheikhNo ratings yet

- Philippine Laws On Housing and Human SettlementsDocument8 pagesPhilippine Laws On Housing and Human SettlementsJoJONo ratings yet

- Impact of Diversity Challenges On Organisational Cynicism - An Egyptian StudyDocument7 pagesImpact of Diversity Challenges On Organisational Cynicism - An Egyptian Studyleepsaiit@gmailcomNo ratings yet

- Entrepreneurship - MGT602 Power Point Slides Lecture 43Document10 pagesEntrepreneurship - MGT602 Power Point Slides Lecture 43Sourav SharmaNo ratings yet

- A Compilation of ParentingDocument101 pagesA Compilation of ParentingTumuluru Krishna MurtyNo ratings yet

- Machinery and Equipment Industry Application PaperDocument26 pagesMachinery and Equipment Industry Application PapermetroroadNo ratings yet

- A Comparative Study On The Accounting Procedures by Flash Sales Market Regarding Their Revenue Recognition (Revision)Document10 pagesA Comparative Study On The Accounting Procedures by Flash Sales Market Regarding Their Revenue Recognition (Revision)Jeff Tan JonsonNo ratings yet

- Quiz 2Document2 pagesQuiz 2Nathaniel Malabay100% (1)

- Using The Gsutil Tool To Copy Files and Folders To Cloud Bucket v3Document11 pagesUsing The Gsutil Tool To Copy Files and Folders To Cloud Bucket v3Caroline MourãoNo ratings yet

- Economics Project: Effect of Extra-Curricular Activities On Quality of Human Resource Developed Within The CollegeDocument64 pagesEconomics Project: Effect of Extra-Curricular Activities On Quality of Human Resource Developed Within The CollegeShaifaliSaxenaNo ratings yet