Professional Documents

Culture Documents

Fabm 1 - CL Module Week 8

Fabm 1 - CL Module Week 8

Uploaded by

Pamela Diane Varilla AndalOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Fabm 1 - CL Module Week 8

Fabm 1 - CL Module Week 8

Uploaded by

Pamela Diane Varilla AndalCopyright:

Available Formats

Midterm – Second Semester Week 8: March 15-18, 2021

I. INTRODUCTION

Good Day! Welcome to the 8th week of our Correspondence Learning Modality for the

midterm. This week, you shall be given another lesson to study and another learning task/s to

submit.

Attached to this 8th week module is the weekly Study and Assessment Guide.

DATE TOPIC ACTIVITIES OR TASKS

Read the lessons about assets.

March 15- Types of Major Read the lessons about the liabilities.

18, 2021 Accounts Read the lessons about equity, income, and expenses.

Review for the midterm exam.

For this week, March 15-18, 2021 of this term, the following shall be your guide for the

different lessons and tasks that you need to accomplish. Be patient, read it carefully before

proceeding to the tasks expected of you. GOOD LUCK!

Content VIII. Types of Major Accounts

Assets

Liabilities

Equity

Income

Expenses

Learning Competencies At the end of the lesson, you should be able to:

discuss the five major accounts;

cite examples of each type of account; and

prepare a chart of accounts.

Activity Simple Recall Activity (Learning Content)

Essential Questions What are the classifications of assets and liabilities?

What are the items that increase/decrease equity?

In the different forms of business, what are the items included

under the equity account?

Fundamentals of Accountancy, Business, & Management 1 P a g e 1 | 10

This document is a property of University of Saint Louis Tuguegarao. It must not be reproduced or transmitted in any form, in whole or in part, without expressed written permission.

Value Statement “Our brains are either our greatest assets or our greatest

liabilities.”

--Robert Kiyosaki

“Our birth is the opening balance, death the closing balance,

prejudiced views are liabilities, and creative ideas are our

assets.”

--SMSQuotesimage.com

References Textbooks:

Florendo, J. 2016, Fundamentals of Accountancy, Business, and

Management 1, Rex Book Store

Paraan, M. et al. 2018, Fundamentals of Accountancy, Business,

and Management 1 For Senior High School, Books Atbp. Publishing

Corp.

Pineda, A. 2018, Fundamentals of Accounting, Business &

Management 1, Principles and Application, Mindshapers Co., Inc.

Books:

Ballada, W. 2017, Fundamentals of Accountancy Business &

Management 1, Made Easy

Aduana, N. 2016, Fundamentals of Accountancy, Business, and

Management 1 for Senior High School, Procedural Approach, C &

E Publishing, Inc.

Manalaysay, B. 2017, Fundamentals of Accountancy, Business,

and Management 1, Anvil Publishing, Inc.

Fundamentals of Accountancy, Business, & Management 1 P a g e 2 | 10

This document is a property of University of Saint Louis Tuguegarao. It must not be reproduced or transmitted in any form, in whole or in part, without expressed written permission.

II. LEARNING CONTENT

URC: Snacks Galore!

Every sari-sari store has its colorful line-up of snacks, candies, beverages, and noodles

ready for sale. From the long-time favorite snack Piattos, to the Maxx candy, to the C2 drink and

Payless Pancit Canton, a sari-sari store always has something to offer for the craving stomach. But

dis you know that all these brands, despite being diverse from each other, are produced by a

single company?

Universal Robina Corporation (URC), the “first Philippine multinational”, is one of the

largest branded food companies in the Philippines. While most locally known for the snack foods

it manufactures, especially Jack n’ Jill products, it is engaged in an even wider range of food-

related businesses, including the manufacture and distribution of branded consumer foods, hog

farming, manufacture of animal feeds, glucose, soya products and veterinary compounds, flour

milling and pasta manufacturing, sugar milling and refining, and in renewable energy via the bio-

ethanol and biomass cogeneration businesses. The list is almost endless – you name it.

Despite this wide range of products, the company still manages to operate in many

countries outside the Philippines, including China, Malaysia, Indonesia, Vietnam, Australia, and

New Zealand. How, then, can the company manage to keep up with such a fast-growing and wide-

ranging industry?

Classification is the main key for the orderly operations of the company. Back in 1954, it

only had a single product – cornstarch, popularly known as “gewgaw” – produced in Pasig City.

Of course, through the years, new brands were introduced, and new factories were opened. URC

products soon thereafter became prominent in groceries, convenience store chains, and sari-sari

stores. If it were not for its proper inventory handling, fixed assets maintenance, and strong cash

and receivables management, all of the company’s operations would have fallen into a complete

mess.

Source: 2014 URC Annual Report

INTRODUCTION

As we learned from the previous chapter, accounting concepts start from the basic equation:

Assets = Liabilities + Equity. But what actually makes up assets? What compose liabilities and

equity? Things such as cash, plant and equipment, long-term debts would now enter into the

picture. All of these are components of one of the three parts of the accounting equation, called

accounts. In this chapter, we will discuss the major accounts that are contained in the accounting

equation. Later in this chapter, we will also explore revenues and expenses, which are accounts

representing some of the changes in equity.

Fundamentals of Accountancy, Business, & Management 1 P a g e 3 | 10

This document is a property of University of Saint Louis Tuguegarao. It must not be reproduced or transmitted in any form, in whole or in part, without expressed written permission.

Types of Accounts

1. Assets

a. Current Assets

b. Noncurrent Assets

2. Liabilities

a. Current Liabilities

b. Noncurrent Liabilities.

3. Owner’s Equity

4. Income

5. Expenses

What are the classifications of assets and liabilities?

ASSETS

Assets are resources controlled by the enterprise as a result of past events and from which future

economic benefits are expected to flow to the enterprise (per IFRS Framework). In simple terms,

assets are valuable resources owned by the entity. Assets should be classified only into two:

current assets and noncurrent assets.

What are current assets and its examples?

Current assets are all assets which are expected to be realized within the ordinary course of

business, or a span of 12 months, whichever is longer. Realization here only means that these

assets are expected to be converted into cash, sold, or disposed after a certain time, or through

the passage of time.

a. Cash Cash is any medium of exchange that a bank will accept for deposit at face

value, perhaps the most basic, liquid, and familiar of all assets.

This includes bills, coins, checks, bank accounts.

Examples:

1. Petty Cash Fund – cash used to pay petty or small amounts.

2. Cash on Hand – cash in the possession and custody of the business.

3. Cash in Bank – cash that are deposited in the banks.

b. Accounts These are claims against customers arising from sale of services or goods

Receivable on credit.

This type of receivable offers less security than a promissory note.

c. Notes A written pledge that the customer will pay the business a fixed amount

Receivable of money on a certain date.

Fundamentals of Accountancy, Business, & Management 1 P a g e 4 | 10

This document is a property of University of Saint Louis Tuguegarao. It must not be reproduced or transmitted in any form, in whole or in part, without expressed written permission.

Represented by a promissory note which ensures that in the case of

default by the borrower, the company can seek additional legal remedies

to recover what has been lent.

d. Inventories These are assets which are:

1. held for sale in the ordinary course of business;

2. in the process of production for sale; or

3. in the form of materials or supplies to be consumed in the production

process or in the rendering of services.

e. Prepaid These are expenses paid for by the business in advance.

Expenses It is an asset because the business avoids having to pay cash in the future

for a specific expense.

These represent future economic benefits – assets – until the time these

start to contribute to the earning process; these, then, become expenses.

Examples:

1. Prepaid Advertising – advance payment of advertising in all media types

and promotional campaigns.

2. Prepaid Insurance – advance payment of insurance whether it is life

insurance or non-life insurance.

3. Prepaid Rent – advance payment of rent by the tenant or lessee.

4. Prepaid Supplies – advance payment of office supplies and/or store

supplies.

What are noncurrent assets and its examples?

All other assets which are not current, basically fall into the definition of noncurrent assets. Take

note that they do not need to have at least 12 months remaining before their expected

realization; as long as they do not meet current asset classification, they are classified here.

a. Property, These are tangible assets that are held by an enterprise for use in the

Plant, and production or supply of goods or services, or for rental to others, or for

Equipment administrative purposes and which are expected to be used during more

(PPE) than one period/year.

Examples:

1. Land – refers to the surface of the earth that is not covered by a body of

water.

2. Building – a structure with roof and walls that is constructed on land.

3. Machinery – an equipment that has power to produce movements or

forces.

4. Furniture and Fixture – furniture refers to movable things that are result

of design (i.e., sofa, tables, chairs); fixture refers to something attached

to a property such as walls (i.e., lightnings, toilet fixtures).

Fundamentals of Accountancy, Business, & Management 1 P a g e 5 | 10

This document is a property of University of Saint Louis Tuguegarao. It must not be reproduced or transmitted in any form, in whole or in part, without expressed written permission.

5. Office Equipment – refers to business machines used in workplace (i.e.,

computer, copier machines).

6. Transportation Equipment – refers to vehicles whether land transport,

sea transport, or air transport.

b. Accumulated It is a contra account that contains the sum of the periodic depreciation

Depreciation charges.

The balance in this account is deducted from the cost of the related

asset – equipment and buildings – to obtain book value.

c. Intangible These are identifiable, nonmonetary assets without physical substance

Assets held for use in the production or supply of goods or services, for rental

to others, or for administrative purposes.

These include goodwill, patents, copyrights, licenses, franchises,

trademarks, brand names, secret processes, subscription lists and non-

competition agreements.

Take note:

Contra assets are those accounts that are presented in the asset portion of the

statement of financial position but are reductions to firm’s assets (i.e., allowance for

doubtful accounts, accumulated depreciation).

LIABILITIES

The present obligation of the enterprise arising from past events, the settlement of which is

expected to result in an outflow from the enterprise of resources embodying economic benefits

(per IFRS Framework). A plain definition would be – liabilities are obligations of the entity to

outside parties who have furnished resources.

What are current liabilities and its examples?

An entity shall classify a liability as current when:

1. It expects to settle the liability in its normal operating cycle.

2. It holds the liability primarily for the purpose of trading.

3. The liability is due to be settled within twelve (12) months after the end of the reporting

period.

4. The entity does not have an unconditional right to defer settlement of the liability for at

least twelve months after the end of the reporting period.

Paying out does not necessarily mean payment through cash, but it can also include conversion

and/or refinancing.

a. Accounts This account represents the reverse relationship of the accounts

Payable receivable.

By accepting the goods or services, the buyer agrees to pay for them in

the near future.

Fundamentals of Accountancy, Business, & Management 1 P a g e 6 | 10

This document is a property of University of Saint Louis Tuguegarao. It must not be reproduced or transmitted in any form, in whole or in part, without expressed written permission.

b. Notes Notes payable are written promises of the entity to pay a sum certain

Payable in future determinable time.

The business entity is the maker of the note; that is, the business entity

is the party who promises to pay the other party.

c. Accrued Amounts owed to others for unpaid expenses.

Liabilities These refers to the benefits received by the company but not yet paid.

Examples:

1. Salaries/Wages Payable – unpaid salaries and wages of the employees.

2. Utilities Payable – unpaid communication, electricity, and water bills

3. Interest payable – unpaid interest in a loan transaction.

4. Rent Payable – unpaid rent.

5. Taxes Payable – unpaid property and business taxes to be paid in the

government.

d. Unearned This refers to cash received in advance but not yet earned.

Revenues When the business entity receives payment before providing its

customers with goods or services, the amounts received are recorded

in the unearned revenue account (liability method).

When the goods or services are provided to the customer, the unearned

revenue is reduced and income is recognized.

What are noncurrent liabilities and its examples?

These are liabilities which the entity expects to settle after more than a year, or have the legal or

contractual capacity to defer payment accordingly.

a. Mortgage This account records long-term debt of the business entity for which

Payable the business entity has pledged certain assets as security to the

creditor.

In the event that the debt payments are not made, the creditor can

foreclose or cause the mortgaged asset to be sold to enable the entity

t settle the claim.

b. Bonds The bond is a contract between the issuer and the lender specifying

Payable the terms of repayment and the interest to be charged.

Business organizations often obtain substantial sums of money from

lenders to finance the acquisition of equipment and other needed

assets, they obtain these funds by issuing bonds.

Fundamentals of Accountancy, Business, & Management 1 P a g e 7 | 10

This document is a property of University of Saint Louis Tuguegarao. It must not be reproduced or transmitted in any form, in whole or in part, without expressed written permission.

In the different forms of business, what are the items included under the equity account?

EQUITY

The residual interest in the assets of the enterprise after deducting all its liabilities (per IFRS

Framework). Equity may pertain to any of the following depending on the form of business

organization:

In a sole proprietorship, there is only one owner’s equity account because there is only

one owner.

In a partnership, an owner’s equity account exists for each partner.

In a corporation, owners’ equity, or shareholders’ or stockholders’ equity, consists of share

capital or capital stock, retained earnings and reserves representing appropriations of

retained earnings among others.

a. Capital This account is used to record the original and additional investments

of the owner of the business entity.

It is increased by the amount of profit earned during the year or is

decreased by a loss.

Cash or other assets that the owner may withdraw from the business

ultimately reduce it.

This account bears the name of the owner.

b. Withdrawals When the owner of a business entity withdraws cash or other assets,

such are recorded in the drawing or withdrawal account rather than

directly reducing the owner’s equity account.

What are the items that increase/decrease equity?

INCOME – Increases in Equity

Income is increases in economic benefits during the accounting period in the form of inflows or

enhancements of assets or decreases of liabilities that result in increase in equity, other than

those relating to contributions from equity participants (per IFRS Framework).

Service Income – the income derived from rendering or performing services for a customer

or client and is the primary income for a service business.

Sales – revenues earned as a result of sale of tangible products.

Other type of income includes the following:

1. Interest Income – income earned as a result of investment in debt securities or receivables

from other entities.

2. Rent Income – income from the use of the land or unit space.

Fundamentals of Accountancy, Business, & Management 1 P a g e 8 | 10

This document is a property of University of Saint Louis Tuguegarao. It must not be reproduced or transmitted in any form, in whole or in part, without expressed written permission.

3. Dividend Income – income from share investments as a result of dividend declaration of a

company.

EXPENSES – Decreases in Equity

Expenses are decreases in economic benefits during the accounting period in the form of outflows

or depletions of assets o incurrences of liabilities that result in decreases in equity, other than

those relating to distributions to equity participants (per IFRS Framework). Expenses include the

costs of any material, labor, supplies, and services used in an effort to produce revenue.

Examples of expenses are the following:

1. Cost of Sales (Cost of Goods Sold) – the cost incurred to purchase or to produce the products

sold to customers during the period.

2. Salaries or Wages Expense – includes all payments as a result of an employer-employee

relationship such as salaries or wages, 13th month pay, cost of living allowances and other

related benefits.

3. Utilities Expense – expenses related to use of telecommunications facilities, consumption of

electricity, fuel and water.

4. Supplies Expense – expense of using supplies in the conduct of daily business.

5. Rent Expense – expense for space, equipment or other asset rentals.

6. Insurance Expense – portion of premiums paid on insurance coverage (e.g., on motor vehicle,

health, life, fire, typhoon or flood) which has expired.

7. Interest Expense – an expense related to use of borrowed funds.

8. Bad Debt Expense – the amount of receivables estimated to be doubtful of collection and

charged as expense during an accounting period.

9. Depreciation Expense – the portion of the cost of a tangible asset (e.g., buildings and

equipment) allotted or charged as expense during an accounting period.

Other expenses may also include the following:

1. Advertising Expense

2. Tax Expense

3. Repair and Maintenance Expense

4. Miscellaneous Expense

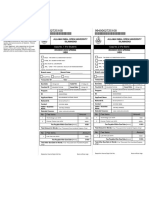

SIMPLE ACTIVITY

Classify each of the following either as asset (A), liability (L), equity (E), income (I), or expense

(Ex).

1. Accounts Payable 6. Cost of Goods Sold

2. Accounts Receivable 7. Furniture

Fundamentals of Accountancy, Business, & Management 1 P a g e 9 | 10

This document is a property of University of Saint Louis Tuguegarao. It must not be reproduced or transmitted in any form, in whole or in part, without expressed written permission.

3. Additional Paid-in Capital 8. Inventories

4. Cash 9. Notes Payable

5. Common Stock 10. Sales

GENERALIZATION

In accounting, there are five major accounts: assets, liabilities, equity, income, and expenses.

Assets are grouped into two: current and noncurrent assets. Liabilities are also grouped into two:

current and noncurrent liabilities. Equity is the residual interest of the owners in the assets of the

business after considering all liabilities. Furthermore, equity increases as a result of revenues,

gains, or capital distributions, and equity decreases as a result of expenses, losses, and

distribution to owners.

Fundamentals of Accountancy, Business, & Management 1 P a g e 10 | 10

This document is a property of University of Saint Louis Tuguegarao. It must not be reproduced or transmitted in any form, in whole or in part, without expressed written permission.

You might also like

- WorldcomDocument5 pagesWorldcomHAN NGUYEN KIM100% (1)

- Fidp in Business FinanceDocument19 pagesFidp in Business FinanceRowena Barcarse100% (1)

- Fundamentals of ABM 1Document164 pagesFundamentals of ABM 1Marissa Dulay - Sitanos67% (15)

- Accounting Made Easy by Rajesh Agrawal, R SrinivasanDocument192 pagesAccounting Made Easy by Rajesh Agrawal, R Srinivasangaurav newatiaNo ratings yet

- Financial Accounting Volume 1 Chapter 1 Kieso PDFDocument46 pagesFinancial Accounting Volume 1 Chapter 1 Kieso PDFCitra Riansyah100% (1)

- Cube of Expected Returns - Antti-Ilmanen-AQR PDFDocument23 pagesCube of Expected Returns - Antti-Ilmanen-AQR PDFJoshua BayNo ratings yet

- Term Sheet WhiteDocument3 pagesTerm Sheet WhiteholtfoxNo ratings yet

- Fabm 1 - CL Module Week 7Document15 pagesFabm 1 - CL Module Week 7Pamela Diane Varilla AndalNo ratings yet

- Fabm 1 - CL Module Week 6Document17 pagesFabm 1 - CL Module Week 6Pamela Diane Varilla AndalNo ratings yet

- Fabm 1 - CL Module Week 2Document8 pagesFabm 1 - CL Module Week 2Pamela Diane Varilla AndalNo ratings yet

- Fabm 1 - CL Module Week 5Document8 pagesFabm 1 - CL Module Week 5Pamela Diane Varilla AndalNo ratings yet

- Fabm 1 - CL Module Week 4Document12 pagesFabm 1 - CL Module Week 4Pamela Diane Varilla AndalNo ratings yet

- Daily Lesson Log - Tusara, Stephen Kim R.Document4 pagesDaily Lesson Log - Tusara, Stephen Kim R.Stephen TusaraNo ratings yet

- Fabm 1 - CL Module Week 3Document15 pagesFabm 1 - CL Module Week 3Pamela Diane Varilla AndalNo ratings yet

- Fundamentals of Accountancy, Business and Management 1: Second QuarterDocument26 pagesFundamentals of Accountancy, Business and Management 1: Second QuarterELIANNE VY100% (1)

- Course Syllabus in FABM2 PDFDocument7 pagesCourse Syllabus in FABM2 PDFAbigail InaoNo ratings yet

- MODULE 1-Accounting and Its EnvironmentDocument25 pagesMODULE 1-Accounting and Its EnvironmentMaureen BalagbaganNo ratings yet

- Instructional Plan Fundamentals of Accountancy, Business and Management 1Document2 pagesInstructional Plan Fundamentals of Accountancy, Business and Management 1SHENo ratings yet

- Module2 Lecture TranscriptDocument63 pagesModule2 Lecture TranscriptlauraNo ratings yet

- F A, B & M 2: Undamentals of Ccountancy Usiness AnagementDocument14 pagesF A, B & M 2: Undamentals of Ccountancy Usiness AnagementDories AndalNo ratings yet

- Acctg Module 5Document3 pagesAcctg Module 5pearlyNo ratings yet

- Fundamentals of Accounting and Business MNGMNT 2 and Business Math FinalDocument77 pagesFundamentals of Accounting and Business MNGMNT 2 and Business Math FinalCelina LimNo ratings yet

- Financial&Mngmnt AccountingDocument286 pagesFinancial&Mngmnt Accountingritesh_aladdin100% (1)

- BTLE 30043 Bookkeeping For Service BusinessDocument135 pagesBTLE 30043 Bookkeeping For Service Businessnicoleshi100% (1)

- Fabm 1 - CL Module Week 1Document15 pagesFabm 1 - CL Module Week 1Pamela Diane Varilla AndalNo ratings yet

- SHS Lesson PlanDocument6 pagesSHS Lesson PlanEaganNo ratings yet

- DLL AbmDocument3 pagesDLL AbmMichelle Vinoray PascualNo ratings yet

- SDO Imus City LeaP ABM FABM1 3RD QTR WEEK3Document4 pagesSDO Imus City LeaP ABM FABM1 3RD QTR WEEK3Cassandra UmaliNo ratings yet

- Republic of The Philippines Department of Education Region II Schools Division Office - Cagayan Semi Detailed Lesson Plan - Senior High School ABM 11Document7 pagesRepublic of The Philippines Department of Education Region II Schools Division Office - Cagayan Semi Detailed Lesson Plan - Senior High School ABM 11EaganNo ratings yet

- QA SIPACKS in Business Finance Q3 W1 7Document91 pagesQA SIPACKS in Business Finance Q3 W1 7Roan DiracoNo ratings yet

- Financial Accounting Ii (Hec Roadmap Page # 59) : Earning UtcomesDocument6 pagesFinancial Accounting Ii (Hec Roadmap Page # 59) : Earning UtcomesMeer communicatorNo ratings yet

- Accounting and Finance FoundationsDocument534 pagesAccounting and Finance Foundationssoewai naungNo ratings yet

- Accounting Slides II Key ConceptsDocument30 pagesAccounting Slides II Key ConceptsEdouard Rivet-BonjeanNo ratings yet

- Abm 6 3rd Quarter Mod FileDocument56 pagesAbm 6 3rd Quarter Mod FiledulanaryzalynNo ratings yet

- MK I-01 Financial ManagementDocument22 pagesMK I-01 Financial ManagementSiti Paras UbuddiyahNo ratings yet

- DBA 5036 - Entrepreniual FinanceDocument287 pagesDBA 5036 - Entrepreniual FinanceShrividhyaNo ratings yet

- Fundamentals of Accountancy Business and Management 1 11 3 QuarterDocument4 pagesFundamentals of Accountancy Business and Management 1 11 3 QuarterPaulo Amposta CarpioNo ratings yet

- Guiding Principles of Accounting: Get Ready!Document2 pagesGuiding Principles of Accounting: Get Ready!Yanet0% (1)

- Accounting For ManagersDocument286 pagesAccounting For Managersritesh_aladdinNo ratings yet

- FMA - Non-Specific - MBA ZC415 COURSE HANDOUTDocument13 pagesFMA - Non-Specific - MBA ZC415 COURSE HANDOUTRavi KaviNo ratings yet

- Financial Accounting UpdatedDocument87 pagesFinancial Accounting UpdatedGuru vamsi100% (1)

- Abm111 - Introduction To AccountingDocument31 pagesAbm111 - Introduction To AccountingAlexandra TabarNo ratings yet

- Table of ContentDocument6 pagesTable of ContentMohammad C. DatuganNo ratings yet

- Masbate Polytechnic and Development College, Inc.: VisionDocument7 pagesMasbate Polytechnic and Development College, Inc.: VisionRobelyn Fababier VeranoNo ratings yet

- Entrepreneurship Quarter 2: Module 8Document19 pagesEntrepreneurship Quarter 2: Module 8Adiel Seraphim100% (1)

- Fundamentals of Accountancy, Business and Management 1: Quarter 3 - Module 2: Accounting Concepts and PrinciplesDocument17 pagesFundamentals of Accountancy, Business and Management 1: Quarter 3 - Module 2: Accounting Concepts and PrinciplesMary Gwyneth PerezNo ratings yet

- DLL Tle6 Entrep Amp Ict WK 1 10Document50 pagesDLL Tle6 Entrep Amp Ict WK 1 10Saira Agencia-AvenidoNo ratings yet

- Cip Financial Literacy by Kamal Bhatia Erkan Carpan Andrea MarieDocument18 pagesCip Financial Literacy by Kamal Bhatia Erkan Carpan Andrea Marieapi-659802423No ratings yet

- Accounting Gr10 - September 4, 2021Document4 pagesAccounting Gr10 - September 4, 2021wandeerNo ratings yet

- Day 06Document15 pagesDay 062nd julieNo ratings yet

- Financial Accounting I Revised Fourth Edition Mohammed Hanif Full ChapterDocument55 pagesFinancial Accounting I Revised Fourth Edition Mohammed Hanif Full Chaptercarol.germann781100% (18)

- Balance SheetDocument5 pagesBalance SheetVanessaNicole14391No ratings yet

- PDF Abm 11 Famb1 q1 w4 Mod5 DDDocument18 pagesPDF Abm 11 Famb1 q1 w4 Mod5 DDMargie Sorquiano Abad QuitonNo ratings yet

- Table of ContentDocument6 pagesTable of ContentHalimanessa AlontoNo ratings yet

- Best FM Outline COurseDocument4 pagesBest FM Outline COurseBiswa Mohan PatiNo ratings yet

- Parika Salem Secondary School Term 2 (Easter) Scheme 2020 Grade 09 (Csec) Business Studies - Principles of AccountsDocument10 pagesParika Salem Secondary School Term 2 (Easter) Scheme 2020 Grade 09 (Csec) Business Studies - Principles of AccountsDeon LatchmanNo ratings yet

- School Grade Level Teacher Learning Area Teaching Date Quarter Teaching Time No. of DaysDocument3 pagesSchool Grade Level Teacher Learning Area Teaching Date Quarter Teaching Time No. of DaysDearla Bitoon100% (1)

- Accounting For Fun and Profit. A Guide To Understanding Financial Statements - Lawrence A. WeissDocument209 pagesAccounting For Fun and Profit. A Guide To Understanding Financial Statements - Lawrence A. Weisshernan covarrubiasNo ratings yet

- CSE Commerce and Accountancy Syllabus - 2015-2016 - UPSCsyllabusDocument4 pagesCSE Commerce and Accountancy Syllabus - 2015-2016 - UPSCsyllabusankit sinhaNo ratings yet

- DLL Tle6-Entrep & Ict WK 1-10Document49 pagesDLL Tle6-Entrep & Ict WK 1-10Ma Carmel Jaque100% (3)

- Learning Module In: Grade 11Document14 pagesLearning Module In: Grade 11Esvee TyNo ratings yet

- Accounts Lesson PlanningDocument28 pagesAccounts Lesson PlanningEdu TainmentNo ratings yet

- Rational Investing with Ratios: Implementing Ratios with Enterprise Value and Behavioral FinanceFrom EverandRational Investing with Ratios: Implementing Ratios with Enterprise Value and Behavioral FinanceNo ratings yet

- Essential Elements of The Definition of AccountingDocument9 pagesEssential Elements of The Definition of AccountingPamela Diane Varilla AndalNo ratings yet

- Fabm 1 - CL Module Week 6Document17 pagesFabm 1 - CL Module Week 6Pamela Diane Varilla AndalNo ratings yet

- Pdev (F) Week 6Document5 pagesPdev (F) Week 6Pamela Diane Varilla AndalNo ratings yet

- Finals Theology 4 Module Week 6Document4 pagesFinals Theology 4 Module Week 6Pamela Diane Varilla AndalNo ratings yet

- Business Ethics Week 6 Final TermDocument2 pagesBusiness Ethics Week 6 Final TermPamela Diane Varilla AndalNo ratings yet

- Ucsp Week 4 Learning TaskDocument3 pagesUcsp Week 4 Learning TaskPamela Diane Varilla AndalNo ratings yet

- Physcie Finals Week 6Document3 pagesPhyscie Finals Week 6Pamela Diane Varilla AndalNo ratings yet

- PrinciplesDocument6 pagesPrinciplesPamela Diane Varilla AndalNo ratings yet

- Far QuizDocument20 pagesFar QuizPamela Diane Varilla AndalNo ratings yet

- New Syllabus FAR LDocument19 pagesNew Syllabus FAR LPamela Diane Varilla AndalNo ratings yet

- Tos FarDocument3 pagesTos FarPamela Diane Varilla AndalNo ratings yet

- Template ResearchDocument14 pagesTemplate ResearchPamela Diane Varilla AndalNo ratings yet

- Arts MidtermsDocument5 pagesArts MidtermsPamela Diane Varilla AndalNo ratings yet

- Acyfar 3Document1 pageAcyfar 3Pamela Diane Varilla AndalNo ratings yet

- 1c ExamsDocument2 pages1c ExamsPamela Diane Varilla AndalNo ratings yet

- Mahesh MishraDocument2 pagesMahesh MishraMahesh MishraNo ratings yet

- Project Report of Banking & InsuranceDocument28 pagesProject Report of Banking & InsuranceMD Aziz91% (33)

- State Farm QuotesDocument2 pagesState Farm QuotesAnh NguyenNo ratings yet

- ACI Study TextDocument168 pagesACI Study TextHangoba ZuluNo ratings yet

- Important : Allama Iqbal Open University Islamabad Allama Iqbal Open University IslamabadDocument1 pageImportant : Allama Iqbal Open University Islamabad Allama Iqbal Open University IslamabadAfzAal GraphicNo ratings yet

- Assumptions - Assumptions - Financing: Year - 0 Year - 1 Year - 2 Year - 3 Year - 4Document2 pagesAssumptions - Assumptions - Financing: Year - 0 Year - 1 Year - 2 Year - 3 Year - 4PranshuNo ratings yet

- 6,00.000xoxrs: Financial AccountingDocument19 pages6,00.000xoxrs: Financial AccountingSharanpreet kaurNo ratings yet

- Mortgage Loan AgreementDocument80 pagesMortgage Loan AgreementRohit WankhedeNo ratings yet

- 8 As 21 Consolidated Financial StatementsDocument26 pages8 As 21 Consolidated Financial StatementssmartshivenduNo ratings yet

- Cfa Program Level II Common AcronymsDocument2 pagesCfa Program Level II Common AcronymsRusdemè ZaleNo ratings yet

- Manny Koshbin - Real StateDocument11 pagesManny Koshbin - Real StateMichael A. Alonso RodriguezNo ratings yet

- Unit Vi: Receivables ManagementDocument18 pagesUnit Vi: Receivables ManagementDevyansh GuptaNo ratings yet

- Accounting For Merchandising OperationsDocument51 pagesAccounting For Merchandising OperationsNguyễn TúNo ratings yet

- Lect 11 - FM&I - CAPM EtcDocument6 pagesLect 11 - FM&I - CAPM EtcAnonymous utSFl8No ratings yet

- Fin Pension 95031336Document6 pagesFin Pension 95031336Manish DebnathNo ratings yet

- Mid AFA-II 2020Document2 pagesMid AFA-II 2020CRAZY SportsNo ratings yet

- Chapter 7 - International Arbitrage and IRPDocument30 pagesChapter 7 - International Arbitrage and IRPPháp NguyễnNo ratings yet

- MG Freesites LTD.: Za Kasarnou 1, 831 03 Bratislava, SlovakiaDocument1 pageMG Freesites LTD.: Za Kasarnou 1, 831 03 Bratislava, Slovakiakundan singhNo ratings yet

- Customer Inquiry ReportDocument4 pagesCustomer Inquiry ReportHartito HargiastoNo ratings yet

- Data Bayaran Bap 2018 SK & SBK Fasa 1 - PahangDocument14 pagesData Bayaran Bap 2018 SK & SBK Fasa 1 - Pahangsb ONo ratings yet

- Bankingsystem Structureinpakistan:: Prepared by & Syed Ali Abbas Zaidi MoinDocument12 pagesBankingsystem Structureinpakistan:: Prepared by & Syed Ali Abbas Zaidi MoinmoeenNo ratings yet

- Covid 19 and Digital BankDocument3 pagesCovid 19 and Digital BankYuvanesh KumarNo ratings yet

- AAP ReviewerDocument14 pagesAAP ReviewerJadon MejiaNo ratings yet

- AnalysisDocument10 pagesAnalysiselsiekhateshNo ratings yet

- Fire Chapter 1 MCQ PDFDocument7 pagesFire Chapter 1 MCQ PDFjds0% (1)

- NEFT/RTGS As A Payment Option For Governmental Transactions: General Egov Payments Leave A CommentDocument2 pagesNEFT/RTGS As A Payment Option For Governmental Transactions: General Egov Payments Leave A Commentchintanp_20No ratings yet

- Capital Reorganisation Year 2Document60 pagesCapital Reorganisation Year 2janeth pallangyoNo ratings yet