Professional Documents

Culture Documents

New Incentive PLI RPLI Structure 07.04.23

Uploaded by

duvaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

New Incentive PLI RPLI Structure 07.04.23

Uploaded by

duvaCopyright:

Available Formats

Postal Life Insurance –Incentive Structure भारतीय डाक

India Post

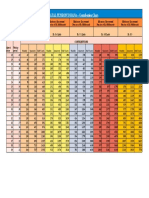

RATE OF INCENTIVE STRUCTURE

For first Year Incentive (i.e, for first 12 Months)

FOR EA, WLA,CWLA,YS AND CHILDREAN POLICY

POLICY PAYING TERM INCENTIVE STRUCTURE

Up to and equal to 15 years 4 % of first year premium

10 % of first year premium

More than 15 years but less than or equal to 25 years

20 % of first year premium

More than 25 years

FOR AEA (MONEY BACK) POLICY

POLICY PAYING TERM INCENTIVE STRUCTURE

less than or equal to 15 years 5 % of first year premium

7 % of first year premium

More than 25 years

* Incentive payable for regular policy. 1

Postal Life Insurance –Incentive Structure भारतीय डाक

India Post

RATE OF INCENTIVE STRUCTURE

For Renewal Year Incentive (i.e, after 12 Months)

•Premium received from 13th month Onwards in a PLI policy is renewal Premium. The

Incentive payable on renewal premium will be renewal Incentive.

•Incentive @ 1% on Premium received from 13 th month Onwards is payable .

* Incentive payable for regular policy. 2

Postal Life Insurance - Incentive भारतीय डाक

India Post

Sum Assured Rs. 10,00,000/-

Maturity Monthly Annual

Age at Entry

Age Premium Premium

29 55 2,950 35,400

Incentive Income

Premium Incentive

Year % of Incentive

Deposited Amount

1st Year 35,400/- 20% 7,080/-

Rest of every

year

35,400/- 1% 354/-

Total Incentive of 26 Years = 15,930/-

* Policy Term more than 25 year

* Incentive payable for regular policy. 3

Strategy - PLI भारतीय डाक

India Post

Monthly Average 1 Policy procured in 3 Days,

Sum Assured Age at Entry Maturity Age 10 Policies in a Month,

Premium

Rs. 10,00,000/- 120 Policies in a Year

29 55 2,950

Average

No. of Yearly Next Year

Monthly No. of 1st Year Total Renewal

Month Proposa Premium No. of

Premium to Deposit Incentive Premium to Incentive

& Year l in a to be Deposit to

be collected in a Year (20%) be Deposit (1%)

month collect be done

Per Month

Apr-20 10 29,500 12 3,54,000 70,800 120 3,54,000 3,540

May-20 10 29,500 11 3,24,500 64,900 120 3,54,000 3,540

Jun-20 10 29,500 10 2,95,000 59,000 120 3,54,000 3,540

Jul-20 10 29,500 9 2,65,500 53,100 120 3,54,000 3,540

Aug-20 10 29,500 8 2,36,000 47,200 120 3,54,000 3,540

Sep-20 10 29,500 7 2,06,500 41,300 120 3,54,000 3,540

Oct-20 10 29,500 6 1,77,000 35,400 120 3,54,000 3,540

Nov-20 10 29,500 5 1,47,500 29,500 120 3,54,000 3,540

Dec-20 10 29,500 4 1,18,000 23,600 120 3,54,000 3,540

Jan-21 10 29,500 3 88,500 17,700 120 3,54,000 3,540

Feb-21 10 29,500 2 59,000 11,800 120 3,54,000 3,540

Mar-21 10 29,500 1 29,500 5,900 120 3,54,000 3540

Total 120 23,01,000 4,60,200 1440 42,48,000 42,480

Total Incentive (26 Yr.) 15,22,200

4

Rural Postal Life Insurance –Incentive Structure भारतीय डाक

India Post

RATE OF INCENTIVE STRUCTURE

For first Year Incentive (i.e, for first 12 Months)

FOR REA, RWLA, RCWA, RAEA AND RURAL CHILDREAN POLICY

•Premium received from first 12 month in a RPLI policy is renewal Premium. The

Incentive payable on First Year premium will be First Year Incentive.

•Incentive @ 10% on Premium received for first 12 month is payable .

For Renewal Year Incentive (i.e, after 12 Months)

•Premium received from 13th month Onwards in a RPLI policy is renewal Premium. The

Incentive payable on renewal premium will be renewal Incentive.

•Incentive @ 2.5% on Premium received from 13 th month Onwards is payable .

* Incentive payable for regular policy. 5

Rural Postal Life Insurance - Incentive भारतीय डाक

India Post

Sum Assured Rs. 10,00,000/-

Maturity Monthly Annual

Age at Entry

Age Premium Premium

29 55 2,950 35,400

Incentive Income

Premium Incentive

Year % of Incentive

Deposited Amount

1st Year 35,400/- 10% 3,540/-

Rest of every

year

35,400/- 2.5% 885/-

Total Incentive of 26 Years = 25,665/-

* Policy Term more than 25 year

* Incentive payable for regular policy. 6

Strategy - RPLI भारतीय डाक

India Post

Monthly Average 1 Policy procured in 3 Days,

Sum Assured Age at Entry Maturity Age 10 Policies in a Month,

Premium

Rs. 10,00,000/- 120 Policies in a Year

29 55 2,950

Average

No. of Yearly Next Year

Monthly No. of 1st Year Total Renewal

Month Proposa Premium No. of

Premium to Deposit Incentive Premium to Incentive

& Year l in a to be Deposit to

be collected in a Year (10%) be Deposit (2.5%)

month collect be done

Per Month

Apr-20 10 29,500 12 3,54,000 35,400 120 3,54,000 8,850

May-20 10 29,500 11 3,24,500 32,450 120 3,54,000 8,850

Jun-20 10 29,500 10 2,95,000 29,500 120 3,54,000 8,850

Jul-20 10 29,500 9 2,65,500 26,550 120 3,54,000 8,850

Aug-20 10 29,500 8 2,36,000 23,600 120 3,54,000 8,850

Sep-20 10 29,500 7 2,06,500 20,650 120 3,54,000 8,850

Oct-20 10 29,500 6 1,77,000 17,700 120 3,54,000 8,850

Nov-20 10 29,500 5 1,47,500 14,750 120 3,54,000 8,850

Dec-20 10 29,500 4 1,18,000 11,800 120 3,54,000 8,850

Jan-21 10 29,500 3 88,500 8,850 120 3,54,000 8,850

Feb-21 10 29,500 2 59,000 5,900 120 3,54,000 8,850

Mar-21 10 29,500 1 29,500 2,950 120 3,54,000 8,850

Total 120 23,01,000 2,30,100 1440 42,48,000 1,06,200

Total Incentive (26 Yr.) 31,15,200

7

You might also like

- Mnop 220412Document22 pagesMnop 220412ajoy2barNo ratings yet

- MCQ On General Rules As To PostingDocument7 pagesMCQ On General Rules As To PostingSameer AhmedNo ratings yet

- Ccs (Conduct) RulesDocument3 pagesCcs (Conduct) RulesKawaljeetNo ratings yet

- Modified Assured Career Progression Scheme (Macps) Effective DateDocument5 pagesModified Assured Career Progression Scheme (Macps) Effective DateSystem Group MHANo ratings yet

- Foreign Service and Deputation PDF - 910771Document7 pagesForeign Service and Deputation PDF - 910771System Group MHANo ratings yet

- KSR 3Document9 pagesKSR 3abhivnairNo ratings yet

- Goods and Service Contracts Through Government E-Marketplace (Gem)Document24 pagesGoods and Service Contracts Through Government E-Marketplace (Gem)Ranjeet SinghNo ratings yet

- EPFO - Interactive Sesssion With Employers 26:09:2019Document25 pagesEPFO - Interactive Sesssion With Employers 26:09:2019Manish ShahNo ratings yet

- EPF & ESI Acts FAQsDocument13 pagesEPF & ESI Acts FAQsRatnesh RajanyaNo ratings yet

- LTC RulesDocument30 pagesLTC RulesmeetsatyajeeNo ratings yet

- Apy Chart PDFDocument1 pageApy Chart PDFsabarishgandavarapuNo ratings yet

- Simple Rules (Civil & Mechanical) 2019 CurrentDocument18 pagesSimple Rules (Civil & Mechanical) 2019 CurrentAnish DebnathNo ratings yet

- Nps Note and MCQDocument37 pagesNps Note and MCQRSMENNo ratings yet

- D A RuleDocument30 pagesD A RuleAbhishek Kumar TiwariNo ratings yet

- LTC RulesDocument34 pagesLTC Rulessunilhanda33_4382901No ratings yet

- Pay and AllowancesDocument23 pagesPay and AllowancesRavi KumarNo ratings yet

- F.R. Without Pay Fixations PDFDocument18 pagesF.R. Without Pay Fixations PDFAPSEBAEANo ratings yet

- CAG Manual of Standing Orders Audit DutiesDocument53 pagesCAG Manual of Standing Orders Audit DutiesAshutosh Anil Vishnoi100% (1)

- GST MCQs - Comprehensive Guide to Key Concepts & Questions on India's Goods and Services TaxDocument15 pagesGST MCQs - Comprehensive Guide to Key Concepts & Questions on India's Goods and Services Taxalgoscale techNo ratings yet

- P & T Financial Handbook Volume - IDocument8 pagesP & T Financial Handbook Volume - IvipinNo ratings yet

- CCS Rules guideDocument21 pagesCCS Rules guideVish indianNo ratings yet

- 2000 MCQ On Postal ExamDocument134 pages2000 MCQ On Postal Examv51061462No ratings yet

- Delegation of Financial Powers RulesDocument35 pagesDelegation of Financial Powers Ruleskaus9199No ratings yet

- 1 - CAG DPC ActDocument42 pages1 - CAG DPC ActkunalNo ratings yet

- Conduct RulesDocument47 pagesConduct RulesPuneet VasdevNo ratings yet

- Sanjeev Khugshal's resume highlights 19 years of experience in administration and 11 years in accountsDocument204 pagesSanjeev Khugshal's resume highlights 19 years of experience in administration and 11 years in accountsSanjeev KhugshalNo ratings yet

- Casual Labourers Scheme Provides Temporary StatusDocument3 pagesCasual Labourers Scheme Provides Temporary Statusnew besesdNo ratings yet

- MACP SchemeDocument15 pagesMACP SchemevkjajoriaNo ratings yet

- LTC PDFDocument11 pagesLTC PDFMagesssNo ratings yet

- Conduct Rule-1Document43 pagesConduct Rule-1Vishal ThakurNo ratings yet

- CCS (Conduct) Rules, 1964 - From Website of DoPT As On 07.01.2019Document185 pagesCCS (Conduct) Rules, 1964 - From Website of DoPT As On 07.01.2019अजय चौधरी100% (1)

- Central Civil Services Temporary Service RulesDocument33 pagesCentral Civil Services Temporary Service RulesAbhishek KumarNo ratings yet

- EPFO's Latest Initiatives for Employers and EmployeesDocument40 pagesEPFO's Latest Initiatives for Employers and Employeestusharujadhav5655No ratings yet

- Kvs Accounts Code LatestDocument299 pagesKvs Accounts Code LatestManju ChahalNo ratings yet

- Ccs (Cca) RulesDocument53 pagesCcs (Cca) RulesRakesh GuptaNo ratings yet

- Frequently Asked Questions on MACP Career Progression SchemeDocument8 pagesFrequently Asked Questions on MACP Career Progression SchemeGanesan sNo ratings yet

- 5-Leave Rules-HbDocument5 pages5-Leave Rules-HbBusyBoy PriyamNo ratings yet

- GPF (General Provident Fund) Rules, 1960 and Contributory Provident FundDocument9 pagesGPF (General Provident Fund) Rules, 1960 and Contributory Provident FundFinance AdministrationNo ratings yet

- D&A RulesDocument20 pagesD&A RulesSrinivas TummaNo ratings yet

- Uniform Format of Accounts For Central Automnomous Bodies PDFDocument46 pagesUniform Format of Accounts For Central Automnomous Bodies PDFsgirishri4044No ratings yet

- Circular Cghs Referal Expostfacto Approval Delegation 7-4-99Document4 pagesCircular Cghs Referal Expostfacto Approval Delegation 7-4-99Prakash Kapoor100% (1)

- SR - No Form Name of Form RemarksDocument4 pagesSR - No Form Name of Form RemarksDEVI SINGH MEENANo ratings yet

- Verification of Service Bokk-Rule 32 of CCS (Pension) RulesDocument54 pagesVerification of Service Bokk-Rule 32 of CCS (Pension) RulesRajula Gurva ReddyNo ratings yet

- GST Mcq'sDocument43 pagesGST Mcq'sSuraj PawarNo ratings yet

- FRBM ActDocument6 pagesFRBM ActGGUULLSSHHAANNNo ratings yet

- Leave RulesDocument12 pagesLeave RulesVish indianNo ratings yet

- Important Points Service Rules PDF - 900524Document45 pagesImportant Points Service Rules PDF - 900524System Group MHANo ratings yet

- GPRA RulesDocument15 pagesGPRA Rulesvarunendra pandeyNo ratings yet

- PF ActDocument4 pagesPF Actsimranjeets_22No ratings yet

- Budget FormulationDocument54 pagesBudget FormulationShravani PalandeNo ratings yet

- Financial Delegation Rules GuideDocument42 pagesFinancial Delegation Rules GuideManoj Kumar SainiNo ratings yet

- Consolidated Casual Labour InstructionsDocument8 pagesConsolidated Casual Labour InstructionsKundan Singh100% (1)

- Dar 1968Document17 pagesDar 1968arun kumarNo ratings yet

- N Fee StrucDocument3 pagesN Fee StrucAnonymous BuAlxgBaNo ratings yet

- Com Par Is IonDocument9 pagesCom Par Is Ionnikunj_shahNo ratings yet

- b464b3f8-a02f-4f47-8e63-821b81be0bb2Document7 pagesb464b3f8-a02f-4f47-8e63-821b81be0bb2vonamal985No ratings yet

- Screenshot 2023-11-09 at 10.10.20 AMDocument20 pagesScreenshot 2023-11-09 at 10.10.20 AMdikshadurgude23798No ratings yet

- c549992e-cba1-4e32-9e08-7f8ff2a6d613Document7 pagesc549992e-cba1-4e32-9e08-7f8ff2a6d613vonamal985No ratings yet

- Get annual cashback and income with ICICI Pru Lakshya GoldDocument2 pagesGet annual cashback and income with ICICI Pru Lakshya GoldMehul Bajaj100% (1)

- Non-State Institutions ExplainedDocument4 pagesNon-State Institutions Explainedjaishalyn melecioNo ratings yet

- Heirs of Candelaria V RomeroDocument2 pagesHeirs of Candelaria V Romeromoniquehadjirul100% (1)

- The Gazette: of IndiaDocument4 pagesThe Gazette: of Indiagurpreet06No ratings yet

- Law Clinic and Mooting DR DapaahDocument19 pagesLaw Clinic and Mooting DR DapaahGlennNo ratings yet

- Pay Slip Mar 2023 PDFDocument1 pagePay Slip Mar 2023 PDFDipendra TomarNo ratings yet

- State Capture and Corruption in Transition EconomiesDocument8 pagesState Capture and Corruption in Transition EconomiesAkbiyeva BagdatNo ratings yet

- Practice Direction 14.3 Appendix ADocument2 pagesPractice Direction 14.3 Appendix AFrannis AnnyNo ratings yet

- Nestle vs. FY SonsDocument2 pagesNestle vs. FY SonsD Del SalNo ratings yet

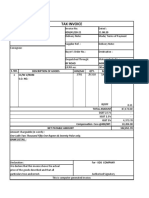

- Invoice PBT2723A00184059Document1 pageInvoice PBT2723A00184059WORK MODENo ratings yet

- Friedman - The Social Responsibility of BusinessDocument6 pagesFriedman - The Social Responsibility of BusinessFran RojasNo ratings yet

- Profit or Loss From Business: Schedule C (Form 1040) 09Document2 pagesProfit or Loss From Business: Schedule C (Form 1040) 09JIMOH100% (1)

- Tax Invoice: Plot No.E1-E2, Riico Industr-Ial Ajmer Gstin/Uin: 08AACCT2953Q1ZQ State Name: Rajasthan, Code: 08Document1 pageTax Invoice: Plot No.E1-E2, Riico Industr-Ial Ajmer Gstin/Uin: 08AACCT2953Q1ZQ State Name: Rajasthan, Code: 08SHIV SHAKTI TRUCKSNo ratings yet

- Bujinkan RulesDocument2 pagesBujinkan RulesSeyyed ValiNo ratings yet

- ULO 2 - Let's Check Activity 1Document3 pagesULO 2 - Let's Check Activity 1Leon NobadNo ratings yet

- Annex B 07032023Document28 pagesAnnex B 07032023Hannah Mae DumpayanNo ratings yet

- Affidavits of lost IDsDocument15 pagesAffidavits of lost IDsQuel Castro AgustinNo ratings yet

- ABMA std11Document26 pagesABMA std11neno2405No ratings yet

- PA504 R1 - Understanding Public AdministrationDocument53 pagesPA504 R1 - Understanding Public AdministrationJethro VillasantaNo ratings yet

- Exchange Rates Annual Central Bank of Trinidad and TobagoDocument5 pagesExchange Rates Annual Central Bank of Trinidad and TobagoFayeed Ali RassulNo ratings yet

- Tax Invoice: One Lakh Two Thousand Fifty One Rupees & Seventy Paise Only. Bank DetailDocument3 pagesTax Invoice: One Lakh Two Thousand Fifty One Rupees & Seventy Paise Only. Bank DetailAnuj Kumar GiriNo ratings yet

- I Enterprises Ru/s: E-Way Bill NoDocument1 pageI Enterprises Ru/s: E-Way Bill NoMadhuram SharmaNo ratings yet

- Principles of Taxation Law 2021 Full ChapterDocument41 pagesPrinciples of Taxation Law 2021 Full Chapteralyssa.lalley545100% (26)

- 76, MA Dt.28!07!2021-Development of MIG Layouts-Jagananna Smart TownshipsDocument9 pages76, MA Dt.28!07!2021-Development of MIG Layouts-Jagananna Smart TownshipsRaghuNo ratings yet

- Himachal Pradesh E-Mail/ Regd. Public Works Department: NO - SRJ/AB/PMGSY/HP-08-39A/2018-19-Dated: - ToDocument4 pagesHimachal Pradesh E-Mail/ Regd. Public Works Department: NO - SRJ/AB/PMGSY/HP-08-39A/2018-19-Dated: - ToKULDEEP SINGH THAKURNo ratings yet

- EPIMB Granting of Financial Benefits To Host Communities Under ER 1 94 As AmendedDocument1 pageEPIMB Granting of Financial Benefits To Host Communities Under ER 1 94 As AmendedNethinimsBelieversNo ratings yet

- Ethics in TaxationDocument2 pagesEthics in TaxationFazal Rehman MandokhailNo ratings yet

- RTO RC Book RequestDocument4 pagesRTO RC Book RequestGanesh MaliNo ratings yet

- Affidavit of Accuracy of Contents of Submitted Registration DocumentsDocument6 pagesAffidavit of Accuracy of Contents of Submitted Registration DocumentsRudith ann QuiachonNo ratings yet

- Special Power of Attorney: Nenita B. AkiatanDocument2 pagesSpecial Power of Attorney: Nenita B. AkiatanJessiePatronNo ratings yet

- Advanced Fire Fighting Course (5 Day) STCW-95Document2 pagesAdvanced Fire Fighting Course (5 Day) STCW-95hope earlNo ratings yet