Professional Documents

Culture Documents

Admission 1

Uploaded by

Ravi Agrawal0 ratings0% found this document useful (0 votes)

5 views1 pageOm, Ram, and Shanti were partners in a firm sharing profits in a 3:2:1 ratio. On April 1, 2014, their balance sheet showed total assets of Rs. 12,18,000 equal to total liabilities, which included capital accounts for each partner. Hanuman joined the firm with Rs. 1,00,000 capital and 1/10 share of profits, and paid his share of goodwill valued at Rs. 3,00,000. The balance sheet was adjusted by creating a Rs. 18,000 liability for discounted bills, reducing stock and furniture values by 20%, and increasing land and building value by 10%.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentOm, Ram, and Shanti were partners in a firm sharing profits in a 3:2:1 ratio. On April 1, 2014, their balance sheet showed total assets of Rs. 12,18,000 equal to total liabilities, which included capital accounts for each partner. Hanuman joined the firm with Rs. 1,00,000 capital and 1/10 share of profits, and paid his share of goodwill valued at Rs. 3,00,000. The balance sheet was adjusted by creating a Rs. 18,000 liability for discounted bills, reducing stock and furniture values by 20%, and increasing land and building value by 10%.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

5 views1 pageAdmission 1

Uploaded by

Ravi AgrawalOm, Ram, and Shanti were partners in a firm sharing profits in a 3:2:1 ratio. On April 1, 2014, their balance sheet showed total assets of Rs. 12,18,000 equal to total liabilities, which included capital accounts for each partner. Hanuman joined the firm with Rs. 1,00,000 capital and 1/10 share of profits, and paid his share of goodwill valued at Rs. 3,00,000. The balance sheet was adjusted by creating a Rs. 18,000 liability for discounted bills, reducing stock and furniture values by 20%, and increasing land and building value by 10%.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

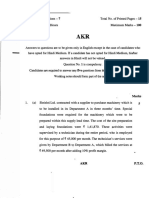

Q. 1.

Om, Ram and Shanti were partners in a firm sharing profits in the ratio

of 3 : 2 : 1. On 1st April, 2014 their Balance Sheet was as follows :

Liabilities Amount Assets Amount

(₹) (₹)

Capital Accounts : 9,20,000 Land and Building 3,64,000

Om 3,58,000 Ram 48,000 Plant and 2,95,000

3,00,000 1,60,000 Machinery 2,33,000

Shanti 2,62,000 90,000 Furniture 38,000

General Reserve Bills Receivables 90,000

Creditors Sundry Debtors 1,11,000

Bills Payable Stock 87,000

Bank

12,18,000 12,18,000

On the above date Hanuman was admi ed on the following terms :

(i) He will bring ₹ 1,00,000 for his capital and will get 1/10th share in

the profits.

(ii) He will bring necessary cash for his share of goodwill premium.

The goodwill of the firm was valued at ₹ 3,00,000.

(iii) A liability of ₹ 18,000 will be created against bills receivables discounted.

(iv) The value of stock and furniture will be reduced by 20%.

(v) The value of land and building will be increased by 10%.

(vi) Capital accounts of the partners will be adjusted on the basis of

Hanuman’s capital in their profit sharing ra o by opening current accounts.

Prepare Revalua on Account ,Partners Capital Accounts and New Balance

sheet.

You might also like

- Accounting Problems With SolutionsDocument63 pagesAccounting Problems With Solutionssumit_sagar69% (13)

- Accountancy Assignment Grade 12Document4 pagesAccountancy Assignment Grade 12sharu SKNo ratings yet

- BBA II Chapter 2 Sale of Partnership ProblemsDocument14 pagesBBA II Chapter 2 Sale of Partnership ProblemsSiddharth SalgaonkarNo ratings yet

- QuestionDocument2 pagesQuestionRavi AgrawalNo ratings yet

- 12th Marking AccountancyDocument52 pages12th Marking AccountancyManoj GiriNo ratings yet

- XII Test (Death, Ret - Diss)Document4 pagesXII Test (Death, Ret - Diss)MLastTryNo ratings yet

- Assignment - Dissolution and Death ChapterDocument2 pagesAssignment - Dissolution and Death ChapterDevan KocharNo ratings yet

- Retire Death Dissolution SheetDocument6 pagesRetire Death Dissolution SheetTanvi SisodiaNo ratings yet

- Isc-Xii Debk Model Test PapersDocument160 pagesIsc-Xii Debk Model Test PapersRahul PareekNo ratings yet

- Partner Ship Accounts - I: Balance Sheet Dr. Cr. Particulars Amount Rs. Particulars Amount RsDocument17 pagesPartner Ship Accounts - I: Balance Sheet Dr. Cr. Particulars Amount Rs. Particulars Amount RsM JEEVARATHNAM NAIDUNo ratings yet

- Syjc - B. K. - Prelim Exam No. 7Document4 pagesSyjc - B. K. - Prelim Exam No. 7karkeraadiyaNo ratings yet

- Vineet FileDocument8 pagesVineet FileVineet KumarNo ratings yet

- Sample Question Paper-Ii Accountancy Class Xii Maximum Marks: 80 Time Allowed: 3 Hrs. General InstructionsDocument38 pagesSample Question Paper-Ii Accountancy Class Xii Maximum Marks: 80 Time Allowed: 3 Hrs. General Instructionsmohit pandeyNo ratings yet

- Questions Isc AccDocument52 pagesQuestions Isc Accrajc080805No ratings yet

- Liabilities Amount Rs. Assets Amount RsDocument2 pagesLiabilities Amount Rs. Assets Amount RsM JEEVARATHNAM NAIDUNo ratings yet

- Paper 5Document4 pagesPaper 5hbyhNo ratings yet

- 1Document5 pages1firoozdasmanNo ratings yet

- Retirement and Dissolution of Firm Class TestDocument2 pagesRetirement and Dissolution of Firm Class TestHarish RajputNo ratings yet

- Screenshot 2023-01-07 at 7.33.02 AMDocument5 pagesScreenshot 2023-01-07 at 7.33.02 AMhchandiramani3No ratings yet

- Accountancy - XII - QPDocument5 pagesAccountancy - XII - QPKulvirkuljitharmeet singhNo ratings yet

- 12 Accountancy Lyp 2014 Delhi Set2Document11 pages12 Accountancy Lyp 2014 Delhi Set2Ashish GangwalNo ratings yet

- 4 Retirement and Death of A PartnerDocument9 pages4 Retirement and Death of A PartnerAman Kakkar0% (1)

- 3 AdmissionDocument14 pages3 AdmissionAman KakkarNo ratings yet

- Financial Accounting IvDocument10 pagesFinancial Accounting Ivprajaktashete372No ratings yet

- Worksheet 2Document4 pagesWorksheet 2singhharshu3222No ratings yet

- Accounts Worksheet Ch-1 To 3Document3 pagesAccounts Worksheet Ch-1 To 3Preetsahib SinghNo ratings yet

- Arihant Class12 Accountancy - Sample-Paper01.pdf&token 34451b25&source StandardsDocument19 pagesArihant Class12 Accountancy - Sample-Paper01.pdf&token 34451b25&source Standardsnishi25wadhwaniNo ratings yet

- Sale of PartnershipDocument11 pagesSale of PartnershipJoel VargheseNo ratings yet

- Test Series: March, 2019 Mock Test Paper - 1 Intermediate (Ipc) : Group - Ii Paper - 5: Advanced AccountingDocument7 pagesTest Series: March, 2019 Mock Test Paper - 1 Intermediate (Ipc) : Group - Ii Paper - 5: Advanced AccountingPiyush AmbastaNo ratings yet

- Nov - 19 - Question and AnswersDocument15 pagesNov - 19 - Question and AnswersVidhi AgrawalNo ratings yet

- Dissolution Practice Questions PDFDocument8 pagesDissolution Practice Questions PDFUmesh JaiswalNo ratings yet

- Partner Ship - IIDocument6 pagesPartner Ship - IIM JEEVARATHNAM NAIDUNo ratings yet

- REVISION 2022 Part A - CH. 4Document4 pagesREVISION 2022 Part A - CH. 4ADAM ABDUL RAZACKNo ratings yet

- CBSE Class 12 Accountancy Sample Papers 2014 - 15Document7 pagesCBSE Class 12 Accountancy Sample Papers 2014 - 15Karthick KarthickNo ratings yet

- Admission of PartnerDocument3 pagesAdmission of PartnerPraWin KharateNo ratings yet

- 12 Com....Document5 pages12 Com....Advanced AcademyNo ratings yet

- Class 12 Accountancy Sample Paper Term 2Document3 pagesClass 12 Accountancy Sample Paper Term 2Ayaan KhanNo ratings yet

- Corporate Accounting - I Semester ExaminationDocument7 pagesCorporate Accounting - I Semester ExaminationVijay KumarNo ratings yet

- CA IPCC Old Accounts Question Paper Nov 2018 StudycafeDocument15 pagesCA IPCC Old Accounts Question Paper Nov 2018 Studycafeadityatiwari122006No ratings yet

- AccountsDocument5 pagesAccountssunil kumar100% (2)

- Adobe Scan 09 Nov 2023Document6 pagesAdobe Scan 09 Nov 2023iamadrish17No ratings yet

- FND Partnership QuestionDocument3 pagesFND Partnership QuestionShweta BhadauriaNo ratings yet

- Ca QP ModelDocument3 pagesCa QP Modelmahabalu123456789No ratings yet

- 12 C BK Mock Board PraveenaDocument4 pages12 C BK Mock Board PraveenaAdvanced AcademyNo ratings yet

- Topic Wise Test Accounting From Incomplete RecordsDocument4 pagesTopic Wise Test Accounting From Incomplete RecordsChinmay GokhaleNo ratings yet

- BK Prelims ComDocument6 pagesBK Prelims ComAafreen QureshiNo ratings yet

- Admission of A Partner AssignmentDocument3 pagesAdmission of A Partner AssignmentAishwarya NaikNo ratings yet

- Accounts DPP Retirement of A PartnerDocument15 pagesAccounts DPP Retirement of A PartnerPreeti SharmaNo ratings yet

- Amalgamation, Absorption Etc PDFDocument21 pagesAmalgamation, Absorption Etc PDFYashodhan MithareNo ratings yet

- Cbse Questions Adm RetirementDocument19 pagesCbse Questions Adm RetirementDeepanshu kaushikNo ratings yet

- ABPM Weekly Test 06.02.2020Document3 pagesABPM Weekly Test 06.02.2020Veera SwamyNo ratings yet

- Dissolution of FirmDocument4 pagesDissolution of FirmAMIN BUHARI ABDUL KHADERNo ratings yet

- Admission of A Partner PDFDocument8 pagesAdmission of A Partner PDFSpandan DasNo ratings yet

- Day 2 Accounts (1)Document1 pageDay 2 Accounts (1)kawaljeetsingh121666No ratings yet

- Fundamental & Dissolution of Partnership: Time Allowed: 3/2 Hrs. M.M. 50Document4 pagesFundamental & Dissolution of Partnership: Time Allowed: 3/2 Hrs. M.M. 50ashok jaiswalNo ratings yet

- Tales of Peasants, Traders, and Officials: Contracting in Rural Andhra Pradesh, 1980-82From EverandTales of Peasants, Traders, and Officials: Contracting in Rural Andhra Pradesh, 1980-82No ratings yet

- Credit Derivatives and Structured Credit: A Guide for InvestorsFrom EverandCredit Derivatives and Structured Credit: A Guide for InvestorsNo ratings yet

- Handbook of Asset and Liability Management: From Models to Optimal Return StrategiesFrom EverandHandbook of Asset and Liability Management: From Models to Optimal Return StrategiesNo ratings yet