Professional Documents

Culture Documents

Inprinciple Letter

Uploaded by

SIYARAM JHACopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Inprinciple Letter

Uploaded by

SIYARAM JHACopyright:

Available Formats

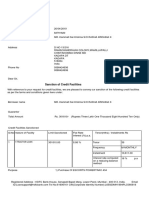

Congratulations

Hira Devi

Digital Approval for your application : ANS-PMMY-2021741-1124768

Date : 30 June 2023

Pradhan Mantri MUDRA Yojna for Business Activity

You have received a digital approval from Punjab National Bank

We are pleased to inform you that we are in-principally agreeable to your eligibility for the Pradhan Mantri MUDRA Yojna for Business Activity for Rs. 70,000 -. This will be

subject to satisfactory submission and verification of various documents and other details as may be required by Punjab National Bank and upon successful clearance of Due

Diligence and Other procedures as may be undertaken at Punjab National Bank’s discretion and internal risk/credit process requirements. Following are tentative terms

Loan Details Bank Branch Details

Product Mudra Kishore up to 2.00 Lakh - Branch Name ANDHRA THARHI

Working Capital

Bank Code 098800

Loan Amount ₹ 70,000

IFSC Code PUNB0098800

Interest Rate (Floating) 10.65 %

Branch Address DIST. - MADHUBANI

Loan Tenure 5.0 Years

Contact Details

Processing Fees 0.0 %

The Lender’s representative will contact you soon for further requirements. Now, all you need to do is to keep the attached list of documents ready in original along with a

copy of this letter for swift actions and processing. These documents/papers/enclosures (copies and originals) will be required for appraisal and processing of loan

Note

1. The Banker will have the option to request shifting of existing facilities / limits to their Bank OR ask for pari passu charges

2. Applicant will also be liable to bear the actual expenses pertaining to Stamp duty, Registration Charges, Government & Other charges and taxes as and when applicable. In

addition to this, Legal fee, Valuation fee, Guarantee Trust’s premium and other costs, as may be finalized by lender from time to time, pertaining to the processing of loan will

be solely borne by the applicant

The document requirements attached herewith are indicative and Bank reserves the right to call upon additional documents at its discretion based on credit, risk, compliance,

loan and other applicable policies/ guidelines of the Bank

Disclaimer

This digital approval letter is subject to the accuracy and correctness of information and data provided by you, its successful verification and satisfactory completion of

comprehensive due diligence as per Banks standards and regulations. This letter shall stand unilaterally revoked and cancelled by i issuing authority/ies and shall be

absolutely null and void, if any discrepancies are found in the information and data you have provided based on which the said loan is in - principally approved by the Bank.

Please note that availability / issuance / final sanction of Loan/ Finance shall be at the sole discretion of the Bank. The Bank reserves the right to approve /reject any loan

application without assigning any reason whatsoever.

JanSamarth merely acts as an online facilitator for availing Loan and further benefits, if any, from the Lender / Concerned Authorities & does not make any offer or does not

guarantee any loan and/or any other benefits on its own behalf as well as on the behalf of the Bank/ Concerned Authorities. There will be no liability of the platform with

respect to the Products rolled out by any Bank on the Platform

Display of any trademarks, tradenames, logos and other subject matters of intellectual property belong to the respective intellectual property owners. Display of such IP along

with the related products information does not imply the Platform's partnership with the owner of the Intellectual Property or issuer of such products

Regards

Team JanSamarth

In case of any query you can call us at 07969076111 or mail at Customer.support@jansamarth.in

You might also like

- Agent Banking Uganda Handbook: A simple guide to starting and running a profitable agent banking business in UgandaFrom EverandAgent Banking Uganda Handbook: A simple guide to starting and running a profitable agent banking business in UgandaNo ratings yet

- DigitalApproval LetterDocument1 pageDigitalApproval LetteraashishkulpaharNo ratings yet

- Purchase and Refinance Mortgage Process: A Handbook and Guide for Real Estate Mortgage!From EverandPurchase and Refinance Mortgage Process: A Handbook and Guide for Real Estate Mortgage!No ratings yet

- DigitalApproval LetterDocument1 pageDigitalApproval Lettershubhamkumarrajput92No ratings yet

- DigitalApproval LetterDocument2 pagesDigitalApproval LetterPUNALE MICHEL REDDYNo ratings yet

- DigitalApproval Letter PDFDocument1 pageDigitalApproval Letter PDFreddynagiNo ratings yet

- Inprinciple LetterDocument1 pageInprinciple Lettergautambarbhuiya29905gNo ratings yet

- Digital approval SBI education loanDocument1 pageDigital approval SBI education loanAyush PatilNo ratings yet

- Digital approval for Rs. 2,08,000 PMMY loanDocument1 pageDigital approval for Rs. 2,08,000 PMMY loanBIKRAM KUMAR BEHERANo ratings yet

- Inprinciple LetterDocument1 pageInprinciple LettershivaNo ratings yet

- Inprinciple LetterDocument1 pageInprinciple LetterDeep PratyakshNo ratings yet

- Digital approval SBI education loan Rs. 946kDocument1 pageDigital approval SBI education loan Rs. 946kKANNADIGA ANIL KERURKARNo ratings yet

- DigitalApproval LetterDocument1 pageDigitalApproval LetterThe Cool Telly UpdateNo ratings yet

- DigitalApproval_LetterDocument1 pageDigitalApproval_LetterSM GamingNo ratings yet

- Congratulations!: Your In-Principle Approval LetterDocument2 pagesCongratulations!: Your In-Principle Approval LetterLokanath ChoudhuryNo ratings yet

- Congratulations on Mudra Loan ApprovalDocument2 pagesCongratulations on Mudra Loan Approvalvedant bodkheNo ratings yet

- Inprinciple LetterDocument1 pageInprinciple LetterChiranjeet PANDITNo ratings yet

- Inprinciple LetterDocument1 pageInprinciple LetterMoin RashidNo ratings yet

- Congratulations!: Your In-Principle Approval LetterDocument2 pagesCongratulations!: Your In-Principle Approval LetterAquib ShaikhNo ratings yet

- Bajaj Finance LTD: Ganesh So UdaymalDocument4 pagesBajaj Finance LTD: Ganesh So UdaymalYASH PATNINo ratings yet

- True Credits loan approval letter summarizedDocument17 pagesTrue Credits loan approval letter summarizedSrinivasu Chintala100% (1)

- True Credits loan agreement detailsDocument18 pagesTrue Credits loan agreement detailsvadapalli aravindkumarNo ratings yet

- Agreement 4Document16 pagesAgreement 4karthik keyanNo ratings yet

- Vamsi Krishna Loan Sanction Letter 456Document7 pagesVamsi Krishna Loan Sanction Letter 456Venkatesh DoodamNo ratings yet

- ForeclosureDocument3 pagesForeclosuremohammadafreed223No ratings yet

- Sanction LetterDocument17 pagesSanction LetterAbhishek gautamNo ratings yet

- 408DPFJK048583 Foreclosure LetterDocument3 pages408DPFJK048583 Foreclosure Lettergmcpdbyv5fNo ratings yet

- Sanctioned: Tractor Loan for Rs. 309400Document3 pagesSanctioned: Tractor Loan for Rs. 309400Shaik Chand BashaNo ratings yet

- Bajaj Finance loan termsDocument8 pagesBajaj Finance loan termsKamal SharmaNo ratings yet

- LXS-H09023-242564415 - Terms & ConditionsDocument23 pagesLXS-H09023-242564415 - Terms & Conditionsdewic29037No ratings yet

- Foreclosure Letter 23-41-25Document3 pagesForeclosure Letter 23-41-25आम्हीं मालवणीNo ratings yet

- 4080CDJL956903 Foreclosure LetterDocument3 pages4080CDJL956903 Foreclosure LetterJanakiram TammineniNo ratings yet

- Sanction of Credit Facilities: 1/tractor Agri LoanDocument3 pagesSanction of Credit Facilities: 1/tractor Agri LoanShaik Chand BashaNo ratings yet

- Kammati Sai Krishna D.O.Document3 pagesKammati Sai Krishna D.O.Shaik Chand BashaNo ratings yet

- Sanctional Letter 3908838977 2020-01-15 PDFDocument1 pageSanctional Letter 3908838977 2020-01-15 PDFSurendra TagleNo ratings yet

- True Credits Private Limited: Loan Sanction LetterDocument17 pagesTrue Credits Private Limited: Loan Sanction LetterTECH SOUL100% (1)

- Loan Foreclosure LetterDocument3 pagesLoan Foreclosure LetterBabu BNo ratings yet

- Preview AgreementDocument11 pagesPreview Agreementasoukot84No ratings yet

- Foreclosure LetterDocument3 pagesForeclosure LetterSyed ShahbazNo ratings yet

- LXS C09023 242379575 - Terms & ConditionsDocument22 pagesLXS C09023 242379575 - Terms & ConditionsnehainverterbatteryNo ratings yet

- Long Term SheetDocument8 pagesLong Term SheetZabid khanNo ratings yet

- Sudheer Loan Letter PDFDocument7 pagesSudheer Loan Letter PDFmr copy xeroxNo ratings yet

- Foreclosure 4040CDIP003887Document3 pagesForeclosure 4040CDIP003887Manish JaiswalNo ratings yet

- Sanction of Credit Facilities: 1/tractor LoanDocument3 pagesSanction of Credit Facilities: 1/tractor LoanShaik Chand BashaNo ratings yet

- Foreclosure Letter - 15 - 57 - 44Document3 pagesForeclosure Letter - 15 - 57 - 44amirshahi2019No ratings yet

- Signature-1Document6 pagesSignature-1Phumi PhumiNo ratings yet

- Sanction of Credit Facilities: 1/tractor LoanDocument3 pagesSanction of Credit Facilities: 1/tractor LoanShaik Chand BashaNo ratings yet

- Foreclosure Letter - 20 - 26 - 19Document3 pagesForeclosure Letter - 20 - 26 - 19Santhosh AnantharamanNo ratings yet

- Loan Term Sheet - 09 - 50 - 35Document13 pagesLoan Term Sheet - 09 - 50 - 35Kumar SaurabhNo ratings yet

- Foreclosure Letter - 13 - 43 - 16Document3 pagesForeclosure Letter - 13 - 43 - 16srivastavadipanshu950No ratings yet

- MOD00005448 APPLICATIONFORMFinalDocument19 pagesMOD00005448 APPLICATIONFORMFinalgunjan.solanki90No ratings yet

- Foreclosure 16-17-18Document3 pagesForeclosure 16-17-18Mizzba NisarNo ratings yet

- Application Form for Loan of Rs. 10,500Document11 pagesApplication Form for Loan of Rs. 10,500Piyush PiyushNo ratings yet

- Foreclosure Letter - 16 - 49 - 26Document3 pagesForeclosure Letter - 16 - 49 - 26Goutham shetty MNo ratings yet

- Kothapalle Anjaneyulu-SONALIKA DODocument3 pagesKothapalle Anjaneyulu-SONALIKA DOShaik Chand BashaNo ratings yet

- Foreclosure 22 29 16Document3 pagesForeclosure 22 29 16Santosh KumarNo ratings yet

- Foreclosure Letter - 20 - 49 - 45Document3 pagesForeclosure Letter - 20 - 49 - 45Suman KumarNo ratings yet

- CORPORATE - FORM Internet BankingDocument2 pagesCORPORATE - FORM Internet BankingMohit SinghNo ratings yet

- Application Form for Consumer LoanDocument22 pagesApplication Form for Consumer LoanRamkumarNo ratings yet

- Loan Sanction_LetterDocument2 pagesLoan Sanction_LetterDaMoN0% (1)

- Confidentiality Agreement With Undertaking and WaiverDocument1 pageConfidentiality Agreement With Undertaking and WaiverreddNo ratings yet

- Tem 2final PDFDocument9 pagesTem 2final PDFSkuukzky baeNo ratings yet

- Aptamers in HIV Research Diagnosis and TherapyDocument11 pagesAptamers in HIV Research Diagnosis and TherapymikiNo ratings yet

- Active and Passive Voice Chart PDFDocument1 pageActive and Passive Voice Chart PDFcastillo ceciliaNo ratings yet

- Enzyme KineticsDocument13 pagesEnzyme KineticsMohib100% (1)

- Key Differences Between Natural Sciences and Social SciencesDocument6 pagesKey Differences Between Natural Sciences and Social SciencesAshenPerera60% (5)

- Creatinine JaffeDocument2 pagesCreatinine JaffeOsinachi WilsonNo ratings yet

- Tepache Kulit Nanas Sebagai Bahan Campuran Minuman 28 37Document10 pagesTepache Kulit Nanas Sebagai Bahan Campuran Minuman 28 37nabila sukmaNo ratings yet

- Microsoft Security Product Roadmap Brief All Invitations-2023 AprilDocument5 pagesMicrosoft Security Product Roadmap Brief All Invitations-2023 Apriltsai wen yenNo ratings yet

- Enr PlanDocument40 pagesEnr PlanShelai LuceroNo ratings yet

- Programmer Competency Matrix - Sijin JosephDocument8 pagesProgrammer Competency Matrix - Sijin JosephkikiNo ratings yet

- Gec-Art Art Appreciation: Course Code: Course Title: Course DescriptionsDocument14 pagesGec-Art Art Appreciation: Course Code: Course Title: Course Descriptionspoleene de leonNo ratings yet

- Airbag Inflation: The Airbag and Inflation System Stored in The Steering Wheel. See MoreDocument5 pagesAirbag Inflation: The Airbag and Inflation System Stored in The Steering Wheel. See MoreShivankur HingeNo ratings yet

- Handwashing and Infection ControlDocument23 pagesHandwashing and Infection ControlLiane BartolomeNo ratings yet

- The History of Coins and Banknotes in Mexico: September 2012Document35 pagesThe History of Coins and Banknotes in Mexico: September 2012Mladen VidovicNo ratings yet

- Gas Mixtures: Seventh Edition in SI UnitsDocument13 pagesGas Mixtures: Seventh Edition in SI Unitshamed farzanehNo ratings yet

- Inventory Valiuation Raw QueryDocument4 pagesInventory Valiuation Raw Querysatyanarayana NVSNo ratings yet

- Online Student Enrollment SystemDocument29 pagesOnline Student Enrollment SystemajidonsonNo ratings yet

- Dimension ReductionDocument15 pagesDimension ReductionShreyas VaradkarNo ratings yet

- NJMC Lca FinalDocument47 pagesNJMC Lca Finalr_gelpiNo ratings yet

- ......... NCP CaseDocument34 pages......... NCP Casevipnikally80295% (19)

- Continuous Improvement Strategies in TQMDocument28 pagesContinuous Improvement Strategies in TQMSimantoPreeomNo ratings yet

- Applsci 13 13339Document25 pagesApplsci 13 13339ambroseoryem1No ratings yet

- Drainage Manual: State of Florida Department of TransportationDocument78 pagesDrainage Manual: State of Florida Department of TransportationghoyarbideNo ratings yet

- SAC SINGLAS Accreditation Schedule 15 Apr 10Document5 pagesSAC SINGLAS Accreditation Schedule 15 Apr 10clintjtuckerNo ratings yet

- Appendix A - Status Messages: Armed. Bad Snubber FuseDocument9 pagesAppendix A - Status Messages: Armed. Bad Snubber Fuse이민재No ratings yet

- Aruksha ResumeDocument2 pagesAruksha Resumeapi-304262732No ratings yet

- Q3 SolutionDocument5 pagesQ3 SolutionShaina0% (1)

- Lesson Plan in ESPDocument4 pagesLesson Plan in ESPkaren daculaNo ratings yet