Professional Documents

Culture Documents

Consolidated Receipt

Uploaded by

Khushbu GuptaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Consolidated Receipt

Uploaded by

Khushbu GuptaCopyright:

Available Formats

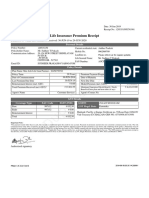

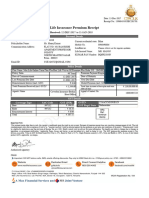

Date: 31-MAR-2023

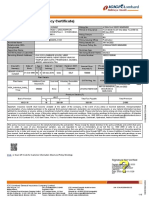

Premium Paid Certificate

Duration For Which the Premium is Received: 01/04/2022 to 31/03/2023

Personal Details

Policy Number: 337805535 Current residential state: Uttar Pradesh

Policyholder Name: Ms. Kriti Gupta Mobile No. 9999242035

Commuinication Address: A 49 ANIL VIHAR Landline no. Please inform us for regular updates

KHODA COLONY Life Insured Name: Ms. Kriti Gupta

SAHIL PUBLIC SCHOOL PAN Number: BGXPG3548K

Ghaziabad - 201001

Email ID: kitixiti@gmail.com

Policy Details

Plan Name: Max Life Online Term Plan Plus - 104N092V04

Policy Term 50 Years Premium Payment Frequency Annual

Date of Commencement 23-APR-2020 Date of Maturity 23-APR-2070

Last Premium Due Date 23-APR-2022 Next Due Date 23-APR-2023

Reinstatement Interest (incl. ` 0.00 Model Premium (incl. GST) ` 13,599.50

GST/S.Tax)

Total Premium Received (incl. ` 13,599.50 Total Sum Assured of base plan and term ` 50,00,000.00

GST/S.Tax)* rider (if any)

Agent's Name Mr. Rohit Kapoor Agent's Contact No. 9953899505

GST Details

Coverage Type SAC Code IGST/S.Tax GSTIN 06AACCM3201E1Z7

(INR) GST Regd. State Haryana

Base 997132 ` 1,431.00

Rider 997132 ` 643.50

Reinstatement Interest ` 0.00

Total ` 2,074.50

Important Note:

*For payment mode other than in cash, this receipt is conditional upon the credit in our account. Payment of premium amount does not constitute commencement of risk. The risk

commencement starts after acceptance of risk by us. *Amount received would be adjusted against the due premium as per terms and conditions of the policy. *Premiums may be

eligible for tax benefits under section 80C/80CCC/80D/37(1) of the Income Tax Act 1961. Kindly consult your tax advisor for more information. Tax benefits are liable to change due

to changes in legislation or government notification. GST shall comprise of CGST, SGST/UTGST or IGST (whichever is applicable) including cesses and levies, if any. All applicable

taxes, cesses and levies, as per prevailing laws, shall be borne by you. *For GST purposes ,this premium receipt is Tax Invoice. Assessable Value in GST for Endowment First Year

is 25%, Renewal Year is 12.5%; Single Premium Annuity is 10%; Term and Health is 100%.

Authorised signatory

PRM23 V2.9 01082019

You might also like

- Personal Details: Duration For Which The Premium Is Received: 01/04/2023Document1 pagePersonal Details: Duration For Which The Premium Is Received: 01/04/2023bbarle69No ratings yet

- Life Insurance InvoiceDocument1 pageLife Insurance InvoiceAkash DesaiNo ratings yet

- Consolidated ReceiptDocument1 pageConsolidated ReceiptSaket TiwariNo ratings yet

- Consolidated Premium ReceiptDocument1 pageConsolidated Premium ReceiptBhavik ThakerNo ratings yet

- Max Life Total Premium ReceiptDocument1 pageMax Life Total Premium ReceiptBhavik Thaker100% (1)

- Max Life Term PlanDocument1 pageMax Life Term PlanShreya JadhavNo ratings yet

- Premium Paid Certificate: Personal DetailsDocument1 pagePremium Paid Certificate: Personal Detailsravikumar281287No ratings yet

- Max Term Insurance - TejkumarDocument1 pageMax Term Insurance - Tejkumarkokkanti tejkumarNo ratings yet

- Maxlife SRMDocument1 pageMaxlife SRMnrcagroNo ratings yet

- Premium ReceiptsDocument1 pagePremium Receiptssudheer prakashNo ratings yet

- Consolidatedreceipt PDFDocument1 pageConsolidatedreceipt PDFSuyash MishraNo ratings yet

- Consolidated Life Insurence Premium Receipt FY-2022-2023-SujanDocument1 pageConsolidated Life Insurence Premium Receipt FY-2022-2023-SujanSujanNo ratings yet

- Consolidated ReceiptDocument2 pagesConsolidated Receiptdigital.arun999No ratings yet

- Insurance 1premiumDocument1 pageInsurance 1premiumBharathNo ratings yet

- Premium ReceiptsDocument1 pagePremium Receiptsmanojsh88870% (1)

- Premium Receipt: ' 50,00,000.00 ' 853.78 13-DEC-2020 To 12-JAN-2021 13-JAN-2021Document1 pagePremium Receipt: ' 50,00,000.00 ' 853.78 13-DEC-2020 To 12-JAN-2021 13-JAN-2021ceogaursNo ratings yet

- Premium Receipts PDFDocument1 pagePremium Receipts PDFAJAY JAISWALNo ratings yet

- Policydownload 230207 000615-43Document1 pagePolicydownload 230207 000615-43Anindya SundarNo ratings yet

- Life Insurance Premium Receipt: Personal DetailsDocument1 pageLife Insurance Premium Receipt: Personal DetailsHarsh Gandhi0% (1)

- Life Insurance Premium Receipt: Personal DetailsDocument1 pageLife Insurance Premium Receipt: Personal Detailssatish varmaNo ratings yet

- Life Insurance Premium Receipt: Personal DetailsDocument1 pageLife Insurance Premium Receipt: Personal DetailsRanjith BNo ratings yet

- 80C Relience InsuranceDocument1 page80C Relience Insuranceshailesh.kumarNo ratings yet

- Life Insurance Premium Receipt: Duration For Which The Premium Is Received: 12-DEC-2017 To 11-JAN-2018 Personal DetailsDocument2 pagesLife Insurance Premium Receipt: Duration For Which The Premium Is Received: 12-DEC-2017 To 11-JAN-2018 Personal Detailsnitish rohiraNo ratings yet

- Medical InsuranceDocument1 pageMedical Insurancesunil dinodiyaNo ratings yet

- Max Life InsuranceDocument1 pageMax Life InsuranceLohith Labhala100% (1)

- Premium Receipt: Personal DetailsDocument1 pagePremium Receipt: Personal DetailssunnybisnoiNo ratings yet

- Zprmrnot 23345535 17208239Document1 pageZprmrnot 23345535 17208239bharat4u04No ratings yet

- Health Insurance Premium Receipt: Personal DetailsDocument1 pageHealth Insurance Premium Receipt: Personal DetailsRanjith BNo ratings yet

- Mh43av0575 Utkarsha SharmaDocument2 pagesMh43av0575 Utkarsha SharmaJainam AjmeraNo ratings yet

- Premium Receipts - LifeInsuranceDocument1 pagePremium Receipts - LifeInsuranceUttam kumar chintuNo ratings yet

- Premium ReceiptsDocument1 pagePremium ReceiptsNeeraj TyagiNo ratings yet

- Premium ReceiptsDocument1 pagePremium ReceiptsUttam kumar chintuNo ratings yet

- Life Insurance Premium ReceiptDocument1 pageLife Insurance Premium ReceiptChandPari AkulNo ratings yet

- Life Insurance Premium Receipt: Personal DetailsDocument1 pageLife Insurance Premium Receipt: Personal DetailsRITIKANo ratings yet

- Term Insurance Premium Receipt: Personal DetailsDocument1 pageTerm Insurance Premium Receipt: Personal DetailsRanjith BNo ratings yet

- Parents Policy Father PDFDocument1 pageParents Policy Father PDFshamsehrNo ratings yet

- (A) Policy Schedule (Policy Certificate) : Policyall 2 2 1 1Document3 pages(A) Policy Schedule (Policy Certificate) : Policyall 2 2 1 1Vijay VemuriNo ratings yet

- 297511794-OctDocument1 page297511794-OctVikash SinghNo ratings yet

- KTM rc200 Insurance - MA877865 - E - 1Document2 pagesKTM rc200 Insurance - MA877865 - E - 1smartguyxNo ratings yet

- Zprmrnot 23764103 16031216Document1 pageZprmrnot 23764103 16031216Kiran KumarNo ratings yet

- Policy NN012203163316 PrintNewDocument22 pagesPolicy NN012203163316 PrintNewPrabhakar bhaleraoNo ratings yet

- 2018032388Document1 page2018032388Vengal reddyNo ratings yet

- Official Receipt 1676234863Document1 pageOfficial Receipt 1676234863vasim hatwadkarNo ratings yet

- Premium ReceiptsDocument1 pagePremium ReceiptsVijay PendurthiNo ratings yet

- Ulip StatementDocument2 pagesUlip StatementShashwat DuggalNo ratings yet

- Circi: InsuranceDocument1 pageCirci: InsuranceapplerajivNo ratings yet

- Life Insurance Premium Receipt: Personal DetailsDocument1 pageLife Insurance Premium Receipt: Personal Detailsnitish rohiraNo ratings yet

- July 3Document1 pageJuly 3Vikash SinghNo ratings yet

- Premium Receipt: Personal DetailsDocument1 pagePremium Receipt: Personal Detailskathik MNo ratings yet

- Life Insurance Corporation of India Detailed Policy Status ReportDocument1 pageLife Insurance Corporation of India Detailed Policy Status ReportCHANDRA PRAKASHNo ratings yet

- Life Insurance 47KDocument1 pageLife Insurance 47KRaghupathi PaindlaNo ratings yet

- Premium ReceiptsDocument1 pagePremium ReceiptsAmit KumarNo ratings yet

- Reliance Premium Receipt y M D GDocument1 pageReliance Premium Receipt y M D Gyadavravindranath57No ratings yet

- Official Receipt 1676234862Document1 pageOfficial Receipt 1676234862vasim hatwadkarNo ratings yet

- Life Insurance Premium ReceiptDocument1 pageLife Insurance Premium ReceiptVijayNo ratings yet

- Zprmrnot 22868079 21565386Document1 pageZprmrnot 22868079 21565386krishandeeptiNo ratings yet

- Parents Policy Mother PDFDocument1 pageParents Policy Mother PDFshamsehrNo ratings yet

- Goods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesFrom EverandGoods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesNo ratings yet

- Understanding Named, Automatic and Additional Insureds in the CGL PolicyFrom EverandUnderstanding Named, Automatic and Additional Insureds in the CGL PolicyNo ratings yet

- New Syllabus: Open Book ExaminationDocument7 pagesNew Syllabus: Open Book Examinationsheena2saNo ratings yet

- Answer For Assigment Chapter 5-IBT-UIBEDocument8 pagesAnswer For Assigment Chapter 5-IBT-UIBEValdimiro BelezaNo ratings yet

- Reforms of BhuttoDocument11 pagesReforms of BhuttoBilal Hussain63% (19)

- Expense PolicyDocument20 pagesExpense PolicyJustinFinneranNo ratings yet

- Charging For Civil Engineering ServicesDocument3 pagesCharging For Civil Engineering Servicesbaniiknik100% (2)

- FRANSABANKDocument7 pagesFRANSABANKJn90No ratings yet

- FABM ReviewerDocument17 pagesFABM ReviewerKyle Kyle67% (3)

- Research Paper Word - Banking Sector FraudDocument13 pagesResearch Paper Word - Banking Sector FraudMeena BhagatNo ratings yet

- Group Assignment ReportDocument35 pagesGroup Assignment ReportTrọng MinhNo ratings yet

- The Birth of The Internet Bubble: Netscape IPODocument12 pagesThe Birth of The Internet Bubble: Netscape IPOMridul GreenwoldNo ratings yet

- Mixed Use Mall: Project Proposal ForDocument36 pagesMixed Use Mall: Project Proposal ForSemir100% (1)

- Global Strategy and SustainabilityDocument12 pagesGlobal Strategy and Sustainabilityrabia basriNo ratings yet

- Applied Auditing Report (Audit of Receivables)Document7 pagesApplied Auditing Report (Audit of Receivables)mary louise magana100% (1)

- Rich Blitz Boat Rental and ToursDocument9 pagesRich Blitz Boat Rental and ToursLeah MandinNo ratings yet

- Schiller Micro 16e Chap005Document30 pagesSchiller Micro 16e Chap005Esha 1277-FBAS/BSBT/F19No ratings yet

- Corporate Strategy of Vodafone and IdeaDocument12 pagesCorporate Strategy of Vodafone and Ideaaryanrajvk75% (4)

- Role of Tourism in Economic Development of Rajasthan: AbstractDocument8 pagesRole of Tourism in Economic Development of Rajasthan: AbstractPringal SoniNo ratings yet

- (FS11) Mergers and AcquisitionsDocument30 pages(FS11) Mergers and AcquisitionsRicha GuptaNo ratings yet

- Outlook Money - October 2023Document84 pagesOutlook Money - October 2023HUGAL75No ratings yet

- Present Value - Extra Topic Chapt 9 12 AdvDocument5 pagesPresent Value - Extra Topic Chapt 9 12 AdvlokNo ratings yet

- Impact of Private Sector Banks On Public Sector BanksDocument248 pagesImpact of Private Sector Banks On Public Sector Banksjalender7No ratings yet

- New Venture Financing: Dr. Richard Michelfelder, Ph.D. Spring 2013Document25 pagesNew Venture Financing: Dr. Richard Michelfelder, Ph.D. Spring 2013Zewdie BekaluNo ratings yet

- UNIT 13 Background InformationDocument15 pagesUNIT 13 Background Informationnguyen16023No ratings yet

- Etsy Investor-Presentation-1Q20 - Final-VersionDocument47 pagesEtsy Investor-Presentation-1Q20 - Final-VersionOleksandr YaroshenkoNo ratings yet

- Yocket Loan Assistance Documents RequiredDocument1 pageYocket Loan Assistance Documents RequiredMaulik SolankiNo ratings yet

- ESOP Under FEMA RegulationDocument8 pagesESOP Under FEMA RegulationDeeksha NCNo ratings yet

- Commodity PrimerDocument6 pagesCommodity PrimerSammus LeeNo ratings yet

- Chapters 7 10 Complete IhrmDocument8 pagesChapters 7 10 Complete IhrmNada AlhenyNo ratings yet

- Government Service Insurance System (GSIS) Social Security System (SSS)Document8 pagesGovernment Service Insurance System (GSIS) Social Security System (SSS)pompomNo ratings yet

- DPWH Special-Provision 2019Document205 pagesDPWH Special-Provision 2019Pearl AndreaNo ratings yet