Professional Documents

Culture Documents

CA Inter Audit Q MTP 1 May 23

Uploaded by

Drake DD0 ratings0% found this document useful (0 votes)

24 views7 pages(1) Mr. S briefed the audit staff of XYZ Ltd. on various audit procedures and standards. This included audit documentation, evidence, and risks of material misstatements.

(2) The engagement team discussed audit procedures for XYZ Ltd., including risk assessment procedures and evaluating risks related to financial statements and the audit work.

(3) A completion memorandum is prepared that summarizes significant matters identified during the audit and how they were addressed.

Original Description:

Original Title

CA-Inter-Audit-Q-MTP-1-May-23

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document(1) Mr. S briefed the audit staff of XYZ Ltd. on various audit procedures and standards. This included audit documentation, evidence, and risks of material misstatements.

(2) The engagement team discussed audit procedures for XYZ Ltd., including risk assessment procedures and evaluating risks related to financial statements and the audit work.

(3) A completion memorandum is prepared that summarizes significant matters identified during the audit and how they were addressed.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

24 views7 pagesCA Inter Audit Q MTP 1 May 23

Uploaded by

Drake DD(1) Mr. S briefed the audit staff of XYZ Ltd. on various audit procedures and standards. This included audit documentation, evidence, and risks of material misstatements.

(2) The engagement team discussed audit procedures for XYZ Ltd., including risk assessment procedures and evaluating risks related to financial statements and the audit work.

(3) A completion memorandum is prepared that summarizes significant matters identified during the audit and how they were addressed.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 7

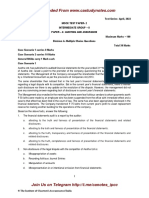

Downloaded From www.castudynotes.

com

Test Series: March, 2023

MOCK TEST PAPER- 1

INTERMEDIATE GROUP – II

PAPER – 6: AUDITING AND ASSURANCE

Time Allowed – 3 Hours Maximum Marks – 100

Division A- Multiple Choice Questions

Total 30 Marks

Case Scenario 1 carries 10 Marks

Case Scenario 2 carries 10 Marks

General MCQs carry 1 Mark each

Case Scenario 1

M/s SPR & Associates are appointed as auditors of XYZ Ltd. for the Financial Year 2021-22.

• The team consisted of Mr. S, Mr. P, Mr. R all Chartered Accountants and three article assistants.

• Mr. S, the engagement partner, briefed the audit staff about various items of financial statement to be

checked in detail in case of XYZ Ltd and about various aspects to be covered in the audit of the company.

• Mr. S told the audit staff about audit documentation, audit evidence, audit file, completion memorandum

and many other things along with relevant Standards of Auditing applicable.

• Mr. S also told the staff about the risk of material misstatement that the financial statements are prone

to and how it affects the sufficiency and appropriateness of audit evidence.

• The audit staff was also apprised about the various audit procedures to be a dopted while conducting

the audit of XYZ Ltd.

• Further discussions were done about various types of risks related to financial statement and the audit

work, the related audit procedures, and the risk assessment procedures.

• The engagement team is also very particular about the application of various Standards on Auditing

applicable in case of XYZ Ltd.

Based on the above facts, answer the following:-

(1) …………. is the summary of significant matters identified during audit and way they are addressed :

(a) Audit File

(b) Audit Programme

(c) Completion memorandum

(d) Checklists

(2) The susceptibility of an assertion to a misstatement that could be material before consideration of any

related control is………………:

(a) Control Risk

(b) Inherent Risk

(c) Audit Risk

(d) Significant Risk

Join Us on Telegram http://t.me/canotes_ipcc

© The Institute of Chartered Accountants of India

Downloaded From www.castudynotes.com

(3) Statement 1: Audit procedures consist of Risk Assessments Procedures and other procedures.

Statement 2: Substantive procedures consist of test of details and analytical procedures.

(a) Only Statement 1 is correct

(b) Only Statement 2 is correct

(c) Both 1 & 2 are correct

(d) Both 1 & 2 are incorrect

(4) …………….. refers to the audit procedures performed to obtain an understanding of the entity and its

environment, including the entity’s internal control, to identify and assess th e risks of material

misstatement, whether due to fraud or error at the financial statement and assertion levels: -

(a) Analytical Procedures

(b) Risk Assessment Procedures

(c) Audit Procedures

(d) Substantive Analytical Procedures

(5) Statement 1:- Substantive Procedures alone can provide sufficient and appropriate audit evidence at

the assertion level.

Statement 2:-Test of Control is audit procedure designed to evaluate the operating effectiveness of

controls in prevention, detection and correcting material misstatement at the assertion level.

(a) Only Statement 1 is correct

(b) Only Statement 2 is correct

(c) Both 1 & 2 are correct

(d) Both 1 & 2 are incorrect (5 x 2 = 10 Marks)

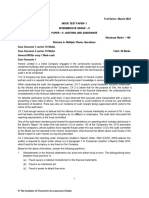

Case Scenario 2

M/s ABC & Associates have been appointed as auditors of Venus Ltd. for the Financial Year 2020-21.

• During the course of audit, the auditors notice that certain legal expenses been charged to revenue

during the financial year by Venus Ltd.

• These legal expenses are related to litigations going against the company regarding its Corporate Social

Responsibility expenses incurred near its factory area.

• Further, M/s ABC & Associates noticed that there is a major change in the debtors and creditors account

of Venus Ltd. during the financial year under audit. The auditors have decided to send balance

confirmation requests to the debtors and creditors of Venus Ltd. Also, the auditors decide to take

management representation letters wherever required.

• The auditors have noticed certain related party transactions reflected in the financial statements of

Venus Ltd. during the financial year under audit. The transaction is between Venus Ltd. and a Company

owned by wife of one of the directors of Venus Ltd.

• The auditors have become aware of certain subsequent events occurring in case of Venus Ltd. These

are related to the outcomes of the litigations going against Venus Ltd.

• The auditors are also concerned whether the litigations going against Venus Ltd. and their outcomes

have any impact on the going concern of the company.

Based on the above facts, answer the following:-

(1) Statement 1: Although Written Representations provide necessary audit evidence, they do not provide

sufficient and appropriate audit evidence on their own about the matters with which they deal.

2

Join Us on Telegram http://t.me/canotes_ipcc

© The Institute of Chartered Accountants of India

Downloaded From www.castudynotes.com

Statement 2: Written Representations do not include financial statements, the assertions within, or

supporting books and records.

(a) Only Statement 1 is correct

(b) Only Statement 2 is correct

(c) Both Statement 1 & 2 are correct

(d) None of Statement 1 & 2 is correct

(2) The auditor can perform the following procedures to identify litigation and claims of Venus Ltd.:-

(i) Inquiry of management including in house legal counsel.

(ii) Reviewing legal expenses account.

(iii) Reviewing of minutes of meetings of those charged to governance and correspondence between

entity and external legal counsel.

(a) (i) & (i) are correct

(b) (i), (ii) & (iii) are correct

(c) (ii) & (iii) are correct

(d) only (i) is correct

(3) Negative confirmation requests require the third party to respond in the following cases : -

(a) If there is agreement

(b) If there is disagreement

(c) In both cases of agreement as well as disagreement

(d) None of the above.

(4) Statement 1:- A failure of the confirming party to respond, or fully respond to a positive confirmation

request or a confirmation request returned undelivered is a case of Non Response.

Statement 2:- A response that indicates difference between information requested to be confirm ed and

contained in entity’s records and information provided by the confirming part is a case of Exception.

(a) Only Statement 1 is correct

(b) Only Statement 2 is correct

(c) Both Statement 1 & 2 are correct

(d) None of Statement 1 & 2 is correct

(5) Which of the following is correct so far as the related party transactions are concerned: -

(i) Many related party transactions are in the normal course of business.

(ii) Related party transactions may not be conducted under normal market term and conditions.

(iii) In some circumstances, related party transactions may give rise to higher risks of material

misstatement.

(a) only (i) is correct

(b) (i) & (iii) are correct

(c) (i), (ii) & (iii) are correct

(d) (i) and (ii) are correct (5 x 2 = 10 Marks)

Join Us on Telegram http://t.me/canotes_ipcc

© The Institute of Chartered Accountants of India

Downloaded From www.castudynotes.com

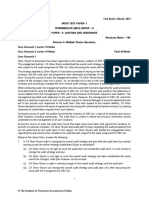

General MCQs

(1) The overall audit strategy and the audit plan remain the _______ responsibility

(a) auditor’s

(b) management’s

(c) those charged with governance.

(d) both management and those charged with governance.

(2) CA Amar is the statutory auditor of XYZ Ltd. for the FY 2020-21. During the process of assembling the

audit file, CA Amar briefed his team as to what all changes can be made to the audit documentation at

that stage. Which of the following changes cannot be made to the audit documentatio n during the final

assembly process?

(a) Sorting, collating & cross referencing of working papers.

(b) Signing off completion checklists relating to the file assembly process.

(c) Deleting or discarding superseded documents.

(d) Recalculation of Depreciation.

(3) The auditor has no obligation to perform any audit procedures regarding the financial statements after

the date of the auditor’s report. However, when, after the date of the auditor’s report but before the date

the financial statements are issued, a fact becomes known to the auditor that, had it been known to the

auditor at the date of the auditor’s report, may have caused the auditor to amend the auditor’s report,

the auditor shall:

(a) Discuss the matter with management and, where appropriate, those charged with governance.

(b) Determine whether the financial statements need amendment.

(c) Inquire how management intends to address the matter in the financial statements.

(d) All of the above

(4) Which of the following is incorrect-

For the purpose of Identifying and assessing the risks of material misstatement, the auditor shall :

(a) Identify risks throughout the process of obtaining an understanding of the entity and its

environment, including relevant controls that relate to the risks, and by considering the classes of

transactions, account balances, and disclosures in the financial statements;

(b) Assess the identified risks, and evaluate whether they relate more pervasively to the financial

statements as a whole and potentially affect many assertions;

(c) Relate the identified risks to what can go wrong at the assertion level, taking account of relevant

controls that the auditor intends to test; and

(d) Not consider the likelihood of misstatement, including the possibility of multiple misstatements, and

whether the potential misstatement is of a magnitude that could result in a material misstatement.

(5) Which of the following is Incorrect:

(a) An auditor conducting an audit in accordance with SAs is responsible for obtaining absolute

assurance that the financial statements taken as a whole are free from material misstatement,

whether caused by fraud or error.

Join Us on Telegram http://t.me/canotes_ipcc

© The Institute of Chartered Accountants of India

Downloaded From www.castudynotes.com

(b) As described in SA 200, owing to the inherent limitations of an audit, there is an unavoidable risk

that some material misstatements of the financial statements will not be detected, even though the

audit is properly planned and performed in accordance with the SAs.

(c) The risk of not detecting a material misstatement resulting from fraud is higher than the risk of not

detecting one resulting from error.

(d) The risk of the auditor not detecting a material misstatement resulting from management fraud is

greater than for employee fraud.

(6) Any casual vacancy in the office of a Cost Auditor, whether due to resignation, death or removal, shall

be filled by the Board of Directors within ______ days of occurrence of such vacancy and the company

shall inform the central government in Form CRA-2 within 30 days of such appointment of cost auditor.

(a) 30 Days

(b) 45 Days

(c) 60 Days

(d) 90 Days

(7) ______________refers to the record of audit procedures performed, relevant audit evidence obtained,

and conclusions the auditor reached.

(a) Audit Techniques

(b) Audit evidence

(c) Audit Documentation

(d) Audit Procedures record

(8) In case of Frauds involving amount less than INR 1 crores , the auditor should report to the :-

(a) Central Government

(b) Reserve Bank of India

(c) Bank’s Board/Audit Committee

(d) Comptroller & Audit General

(9) Mrs. Reema has availed a Personal Loan for her Boutique of INR 5 lakhs and a Vehicle Loan to purchase

an Activa Scooter for INR 60,000. She is regular in depositing EMI of the Activa Loan but has not made

any payments towards the Personal Loan due to low business during the year. In this case, which of the

following facilities should be categorized as NPA ?

(a) Activa Loan

(b) Personal Loan

(c) Higher of the two

(d) Both the Activa Loan & the Personal Loan

(10) After a Government expenditure has been incurred and the accounts are closed, the Appropriation

Accounts are prepared which are scrutinised by the

(a) CAG

(b) President

(c) Public Accounts Committee

(d) Parliament (10 x 1 = 10 Marks)

Join Us on Telegram http://t.me/canotes_ipcc

© The Institute of Chartered Accountants of India

Downloaded From www.castudynotes.com

Division B- Descriptive Questions

Question No. 1 is compulsory.

Attempt any four questions from the Rest.

Total 70 Marks

1. Examine with reasons (in short) whether the following statements are correct or incorrect : (Attempt any

7 out of 8)

(i) Advocacy threat, is the threat which occur when an auditing firm, its partner or associate could

benefit from a financial interest in an audit client.

(ii) According to ‘Audit of sanctions’, the auditors try to bring out cases of improper, avoidable, or

infructuous expenditure even though the expenditure has been incurred in conformity with the

existing rules and regulations.

(iii) Understanding the Internal Control of a company will not help the auditor in developing an Audit

Programme.

(iv) Assertions refer to the representations by the auditor to consider the different types of the potential

misstatements that may occur.

(v) Low acceptable sampling risk requires larger sample size.

(vi) The purpose of an audit is to enhance the degree of confidence of intended users in the financial

statements.

(vii) Narrative record is a series of instructions and/or questions which a member of the auditing sta ff

must follow and/or answer.

(viii) Planning is a discrete phase of an audit. (7 x 2 = 14 Marks)

2. Discuss the following:

(a) The firm should establish policies and procedures designed to provide it with reasonable

assurance that engagements are performed in accordance with professional standards and

regulatory and legal requirements, and that the firm or the engagement partner issues reports that

are appropriate in the circumstances. Explain. (4 Marks)

(b) Planning an audit involves establishing the overall audit strategy for the engagement and

developing an audit plan. Adequate planning benefits the audit of financial statements in several

ways. Explain such benefits of planning in the audit of financial statements. (4 Marks)

(c) The division of internal control into five components provides a useful framework for auditors to

consider how different aspects of an entity's internal control may affect the audit. Mention those

components of internal control. (3 Marks)

(d) With respect to audit in an automated environment, explain the following:

(i) General (IT) Controls

(ii) Material Weakness

(iii) Data Processing (3 Marks)

3. (a) When auditor identifies deficiencies and report on internal controls, he determines the significant

financial statement assertions that are affected by the ineffective controls in order to evaluate the

effect on control risk assessments and strategy for the audit of the financial statements. Explain.

(4 Marks)

(b) The auditor shall make a report to the members of the company on the accounts examined by him.

Explain with reference to relevant provisions of the Companies Act, 2013. (3 Marks)

Join Us on Telegram http://t.me/canotes_ipcc

© The Institute of Chartered Accountants of India

Downloaded From www.castudynotes.com

(c) Describe how risks in IT systems, if not mitigated, could have an impact on audit. (3 Marks)

(d) “The role of audit committee in corporate governance is not limited to making recommendation fo r

appointment of auditors only.” Discuss. (4 Marks)

4. (a) Discuss the reporting requirements as per CARO, 2020, regarding:

(i) disputed and undisputed statutory dues and

(ii) internal audit system of the company (4 Marks)

(b) What are the required disclosures for cash & Cash equivalents to be made by the company as per

Schedule III (Part I) to Companies Act, 2013? (4 Marks)

(c) Studymate Limited is a company engaged in the manufacture of stationery items. The company

sells its goods on credit. The debtors as on 31.03.2022, amounted to ` 10 crores. What is the

disclosure requirement for the company with respect to the ageing schedule of th e trade

receivables in terms of Schedule III (Part I) to the Companies Act, 2013? (6 Marks)

5. (a) Akash & Associates are the statutory auditors of Deluxe Ltd. for the FY 2020-21. During the course

of audit, CA Akash, the engagement partner requested the management of the company to provide

written representation with respect to valuation of a transaction. The management, however does

not provide the same to CA Akash. What course of action should CA Akash follow in such situation?

(3 Marks)

(b) "An auditor is required to make specific evaluations while forming an opinion in an audit report."

State those evaluations. (4 Marks)

(c) Explain and also state the role of auditor with respect to the following in case of a hotel:

(i) Inventories (4 Marks)

(ii) Travel agents & shops (3 Marks)

6. (a) When are following considered as non performing as per the RBI guidelines?

(i) Government guaranteed advances

(ii) Advances to staff (4 Marks)

(b) Explain pledge and set off as the modes of creation of security with respect to advance granted by

a bank. (4 Marks)

OR

(c) State the points which merit consideration in the audit of a CLUB w.r.t its members. (4 Marks)

(d) While verifying the legal and professional expenses of the client company, what audit procedures

should the auditor perform? (3 Marks)

(e) Name the assertion that the auditor will check by performing the following audit procedures.

(a) Employees benefit expense in respect of all personnel have been fully accounted for.

(b) Discounts on sales has been properly adjusted/ accounted for.

(c) Employee benefit expense recorded during the period relates to the current accounting period

only. (3 Marks)

Join Us on Telegram http://t.me/canotes_ipcc

© The Institute of Chartered Accountants of India

You might also like

- Senate Finds Massive Fraud Washington Mutual: Special Delivery For Wamu Victims!Document666 pagesSenate Finds Massive Fraud Washington Mutual: Special Delivery For Wamu Victims!DinSFLA100% (9)

- Audi24 FeDocument5 pagesAudi24 FeFrancineNo ratings yet

- Project Cost Estimating Manual Third Edition PDFDocument83 pagesProject Cost Estimating Manual Third Edition PDFYanning LiNo ratings yet

- Tenancy Agreement (Kamal Carwash)Document3 pagesTenancy Agreement (Kamal Carwash)Syed Isamil75% (8)

- Global Housing Indicators: Evidence For ActionDocument64 pagesGlobal Housing Indicators: Evidence For ActionGlobal Housing Policy IndicatorsNo ratings yet

- © The Institute of Chartered Accountants of IndiaDocument7 pages© The Institute of Chartered Accountants of IndiaAlok TiwariNo ratings yet

- MTP m21 A Q 2Document6 pagesMTP m21 A Q 2sakshiNo ratings yet

- Audit Test Solution by CA Harshad Jaju SirDocument13 pagesAudit Test Solution by CA Harshad Jaju SirHetal BeraNo ratings yet

- Audit Mtp2 DoneDocument11 pagesAudit Mtp2 Donegaurav gargNo ratings yet

- AUDIT 2 New Question PaperDocument9 pagesAUDIT 2 New Question Paperneha manglaniNo ratings yet

- Audit MTP2 QP M24 @CAInterLegendsDocument17 pagesAudit MTP2 QP M24 @CAInterLegendssharmaansshumanNo ratings yet

- CA Inter Audit Q MTP 2 May 23Document8 pagesCA Inter Audit Q MTP 2 May 23Sam KukrejaNo ratings yet

- MTP 19 52 Questions 1712750749Document13 pagesMTP 19 52 Questions 1712750749shivamshttNo ratings yet

- Rrpa 9Document8 pagesRrpa 9mr rahulNo ratings yet

- All Mcqs Are Compulsory Question No. 1 Is Compulsory. Attempt Any Four Questions From The RestDocument10 pagesAll Mcqs Are Compulsory Question No. 1 Is Compulsory. Attempt Any Four Questions From The Restritz meshNo ratings yet

- © The Institute of Chartered Accountants of IndiaDocument8 pages© The Institute of Chartered Accountants of Indiadeepika devsaniNo ratings yet

- Question No. 1 Is Compulsory. Attempt Any Five Questions From The RestDocument8 pagesQuestion No. 1 Is Compulsory. Attempt Any Five Questions From The RestNithyashree RajagopalanNo ratings yet

- Audit MTP 2 PDFDocument8 pagesAudit MTP 2 PDFAkshay JainNo ratings yet

- MTP 12 21 Questions 1696771411Document8 pagesMTP 12 21 Questions 1696771411harshallahotNo ratings yet

- Advanced Auditing and Professional Ethics - QDocument16 pagesAdvanced Auditing and Professional Ethics - QCAtestseriesNo ratings yet

- All Mcqs Are Compulsory Question No. 1 Is Compulsory. Attempt Any Four Questions From The RestDocument12 pagesAll Mcqs Are Compulsory Question No. 1 Is Compulsory. Attempt Any Four Questions From The RestGJ ELASHREEVALLINo ratings yet

- Audit Case StudiesDocument18 pagesAudit Case StudiesAanand ALNo ratings yet

- Auditing and Assurance - Mock Test Paper - Questions - Oct 2022 - CA Inter (New)Document9 pagesAuditing and Assurance - Mock Test Paper - Questions - Oct 2022 - CA Inter (New)KM ASSOCIATESNo ratings yet

- Audit QP - 1Document18 pagesAudit QP - 1sanket karwaNo ratings yet

- MTP1 May2022 - Paper 6 AuditingDocument20 pagesMTP1 May2022 - Paper 6 AuditingYash YashwantNo ratings yet

- © The Institute of Chartered Accountants of IndiaDocument8 pages© The Institute of Chartered Accountants of IndiaShrwan SinghNo ratings yet

- Tutorial 2Document7 pagesTutorial 2Esther LaiNo ratings yet

- Acc 03Document10 pagesAcc 03ShijjNo ratings yet

- Audit 1Document6 pagesAudit 1Yumna SalvatiraNo ratings yet

- 71746bos071022 Inter P6aDocument10 pages71746bos071022 Inter P6aTutulNo ratings yet

- Auditing Theory 1st PBDocument6 pagesAuditing Theory 1st PBRalph Adian TolentinoNo ratings yet

- MTP 10 21 Answers 1694676341Document9 pagesMTP 10 21 Answers 1694676341shoaibinamdar1454No ratings yet

- AUDITINGDocument11 pagesAUDITINGMaud Julie May FagyanNo ratings yet

- ACCT3000 - Marking Guide - Mock Final Exam Paper - Semester 2 - 2020Document16 pagesACCT3000 - Marking Guide - Mock Final Exam Paper - Semester 2 - 2020Yovna SarayeNo ratings yet

- Acctg 16a - Midterm ExamDocument6 pagesAcctg 16a - Midterm ExamChriestal SorianoNo ratings yet

- Audit Sample Paper and Suggested AnswerDocument60 pagesAudit Sample Paper and Suggested AnswerAyush GargNo ratings yet

- MTP m21 A Ans 2Document8 pagesMTP m21 A Ans 2sakshiNo ratings yet

- Commerce - ObjectivesDocument28 pagesCommerce - ObjectivesAsim JavedNo ratings yet

- October 2008Document17 pagesOctober 2008Deex AgueronNo ratings yet

- Mittal Commerce Classes Intermediate - Mock Test (GI-1, GI-2, VI-VDI-SI-1,2)Document7 pagesMittal Commerce Classes Intermediate - Mock Test (GI-1, GI-2, VI-VDI-SI-1,2)Planet ZoomNo ratings yet

- AUDIT Mock 1 Solution May 24Document4 pagesAUDIT Mock 1 Solution May 24vansh bhandariNo ratings yet

- 1-F8 Selective MCQs OnlyDocument10 pages1-F8 Selective MCQs OnlyAtka FahimNo ratings yet

- © The Institute of Chartered Accountants of IndiaDocument8 pages© The Institute of Chartered Accountants of IndiasakshiNo ratings yet

- MTP 3 21 Answers 1681446073Document10 pagesMTP 3 21 Answers 1681446073shoaibinamdar1454No ratings yet

- Audit ExamDocument13 pagesAudit Examvyom rajNo ratings yet

- Case Study Based (Without Answers)Document14 pagesCase Study Based (Without Answers)mshivam617No ratings yet

- HHHHDocument6 pagesHHHHLester Jude Del RosarioNo ratings yet

- Paper 3: Advanced Auditing and Professional Ethics (Old Course) Note: Answer of Question No. 42 Has Been RevisedDocument19 pagesPaper 3: Advanced Auditing and Professional Ethics (Old Course) Note: Answer of Question No. 42 Has Been RevisedRiyaz ShaikNo ratings yet

- Mid Term Test Sem 2 20182019Document8 pagesMid Term Test Sem 2 20182019KaraokeNo ratings yet

- Paper 3: Advanced Auditing and Professional Ethics (New Course) Note: Answer of Question No. 42 Has Been RevisedDocument18 pagesPaper 3: Advanced Auditing and Professional Ethics (New Course) Note: Answer of Question No. 42 Has Been RevisedPrincyNo ratings yet

- Lebanese Association of Certified Public Accountants - Audit February Exam 2020 Extra SessionDocument8 pagesLebanese Association of Certified Public Accountants - Audit February Exam 2020 Extra Sessionjifri syamNo ratings yet

- 8int 2010 Dec QDocument6 pages8int 2010 Dec QDawn CaldeiraNo ratings yet

- Econ 132A Spring 2008 Mt#2: Version 1 Page 1Document16 pagesEcon 132A Spring 2008 Mt#2: Version 1 Page 1MoanaNo ratings yet

- 2-F8 MCQ's Questions and AnswersDocument19 pages2-F8 MCQ's Questions and AnswersMansoor SharifNo ratings yet

- ACCT5908 2015题目Document21 pagesACCT5908 2015题目a45247788989No ratings yet

- CA Final Audit Q MTP 1 May 2024 Castudynotes ComDocument16 pagesCA Final Audit Q MTP 1 May 2024 Castudynotes Comsonytvhome112233No ratings yet

- Audit Ch. 1 3 FlashcardsDocument20 pagesAudit Ch. 1 3 Flashcardst5nhakhobauNo ratings yet

- Navkar Institute DATE:3-3-19 CODE:NI-6027 Batch:Inter Rev May 19 GR Ii & Both MARKS:100 Ca Intermediate Audit and Assurance syllabus:FULL Q-1. MCQ: 1Document12 pagesNavkar Institute DATE:3-3-19 CODE:NI-6027 Batch:Inter Rev May 19 GR Ii & Both MARKS:100 Ca Intermediate Audit and Assurance syllabus:FULL Q-1. MCQ: 1Sravani BysaniNo ratings yet

- AUDIT Finalold p3Document6 pagesAUDIT Finalold p3VIHARI DNo ratings yet

- Intermediate May 2019 B3Document22 pagesIntermediate May 2019 B3PASTORYNo ratings yet

- BUSN7054 Take Home Final Exam S1 2020Document14 pagesBUSN7054 Take Home Final Exam S1 2020Li XiangNo ratings yet

- F8 RM December 2015 QuestionsDocument14 pagesF8 RM December 2015 QuestionsatleuzhanovaNo ratings yet

- 7-3-24... 4110 Both... Int-5010... Audit... QueDocument5 pages7-3-24... 4110 Both... Int-5010... Audit... Quenikulgauswami9033No ratings yet

- Bank Copy CandidateDocument1 pageBank Copy CandidateVijayBabuNo ratings yet

- Takween - Main ENDocument340 pagesTakween - Main ENAyaOmarNo ratings yet

- Finals Exercise 1 - WC Management Receivables and InventoryDocument4 pagesFinals Exercise 1 - WC Management Receivables and InventoryMarielle SidayonNo ratings yet

- HelpAge India and Nicholas Piramal CSR Connect..Document42 pagesHelpAge India and Nicholas Piramal CSR Connect..ajinkyadeNo ratings yet

- Mphasis An HP Company: ERP / SAP OverviewDocument74 pagesMphasis An HP Company: ERP / SAP OverviewmeddebyounesNo ratings yet

- Module 3 Chapter 7Document8 pagesModule 3 Chapter 7Angelie Bocala CatalanNo ratings yet

- Losing The News The Decimation of Local Journalism and The Search For SolutionsDocument114 pagesLosing The News The Decimation of Local Journalism and The Search For SolutionsReading_EagleNo ratings yet

- Cem 801 - CONTRACT-QBDocument13 pagesCem 801 - CONTRACT-QBRaNo ratings yet

- Proforma Invoice For Solar LED Street Light From Zhongshan Alltop Lighting Co., LTD-20230215-C15.1878Document1 pageProforma Invoice For Solar LED Street Light From Zhongshan Alltop Lighting Co., LTD-20230215-C15.1878Reveco FermilioNo ratings yet

- Eastern Livestock, Creditor List Dkt107-1Document2 pagesEastern Livestock, Creditor List Dkt107-1Lee ThomasonNo ratings yet

- ExampleDocument12 pagesExampleIbtehaj KayaniNo ratings yet

- Axis Securities Sees 8% UPSIDE in DCB Bank LTD Another Couple ofDocument8 pagesAxis Securities Sees 8% UPSIDE in DCB Bank LTD Another Couple ofDhaval MailNo ratings yet

- CH 9 Company Accounts - Issue of Debentures QueDocument1 pageCH 9 Company Accounts - Issue of Debentures QueYashvi ShahNo ratings yet

- All Journal IJM Edit3Document255 pagesAll Journal IJM Edit3lingeshNo ratings yet

- Indian Income Tax Return Acknowledgement: Acknowledgement Number: Date of FilingDocument1 pageIndian Income Tax Return Acknowledgement: Acknowledgement Number: Date of FilingKrishna KalyanNo ratings yet

- Industry Reports OverviewDocument43 pagesIndustry Reports OverviewAkshay ChunodkarNo ratings yet

- BufflowDocument4 pagesBufflowDeepadharsanNo ratings yet

- Bba ProjectDocument45 pagesBba Projectharsh chouhanNo ratings yet

- Abc-Case Study-Part 2 1Document26 pagesAbc-Case Study-Part 2 1Danny ClintonNo ratings yet

- Janine Mae Serpa Msme Engr. John N. Celeste, Msme, DpaDocument2 pagesJanine Mae Serpa Msme Engr. John N. Celeste, Msme, Dpajaninemaeserpa14No ratings yet

- Jadual Ketiga 04012019 EngDocument92 pagesJadual Ketiga 04012019 EngAlexander HoNo ratings yet

- Responsive Document - CREW: Department of Education: Regarding For-Profit Education: 8/16/201111-00026-F (Ginns Redactions2) (PART 3)Document500 pagesResponsive Document - CREW: Department of Education: Regarding For-Profit Education: 8/16/201111-00026-F (Ginns Redactions2) (PART 3)CREWNo ratings yet

- Sales and Leases OutlineDocument4 pagesSales and Leases OutlinerusselldanielNo ratings yet

- Ica-Ja 1Document27 pagesIca-Ja 1TarikTaliHidungNo ratings yet

- Proceedings To Annul Transaction: Suspect PeriodDocument19 pagesProceedings To Annul Transaction: Suspect PeriodGigiRuizTicarNo ratings yet

- PTX - Past Year Set BDocument9 pagesPTX - Past Year Set BNUR ALEEYA MAISARAH BINTI MOHD NASIR (AS)No ratings yet