Professional Documents

Culture Documents

7-3-24...4110 both...int-5010...audit...que

Uploaded by

nikulgauswami90330 ratings0% found this document useful (0 votes)

19 views5 pagesAudit ans

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentAudit ans

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

19 views5 pages7-3-24...4110 both...int-5010...audit...que

Uploaded by

nikulgauswami9033Audit ans

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 5

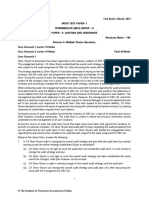

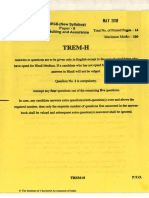

DATE:7-3-24 CODE:INT-5010 MARKS:100

BATCH:INTERMEDIATE MAY.24 BOTH

CA INTERMEDIATE

AUDITING AND ETHICS

SYLLABUS:MODULE - I

DIVISION A (MCQ)

* FOR 1 TO 3

Me and You Private Limited has been newly incorporated. The plant of the company has recently started production

with the help of funds provided by a bank for purchase and installation of machinery. Further, the company is also

utilizing working capital credit facilities from the same bank for meeting its day to day working capital requirements

like for purchase of raw materials, labour payment etc. However, just within six months of its operations, the

management feels that working capital funds are inadequate and situation is creating liquidity issues in the company.

The management of the company has approached its bankers and requested for enhancement in working capital

credit facilities. The bank manager is insisting upon financial statements of the company for half year along with

report providing assurance in this respect duly signed by Chartered Accountant as audit is far away. It also requires

projected financial statements for coming years along with a report from CA providing assurance regarding these

projections to consider request of management.

The management approaches CA P, who has qualified recently and started practising. Reports providing assurance

for half yearly results and projected financial statements are sought from CA P. The Management provides necessary

information and records to him in this regard.

Assume, in above case, the company only provides trial balance, financial statements in draft/preliminary form

along with accompanying records for the relevant half year to CA P and requests him to provide duly signed financial

statements with a report for mutually agreed professional fees.

1. The management of company has engaged CA P to issue a duly signed report for half year. Which of the following

standards, if any, issued by ICAI are relevant for CA P?

(a) Standards on Review Engagements

(b) Standards on Auditing

(c) Standards on Related Services

(d) There are no standards for issuing report in such situation.

2. Which of the following statements is MOST APRROPRIATE in given case situation?

(a) CA P can assist management in preparation of financial statements of the company. However, issue of a report

in such a case is outside the scope of work.

(b) CA P can assist management in preparation of financial statements of the company and he can issue an audit

report.

(c) CA P can assist management in preparation of financial statements of the company and he can issue a compilation

report in this respect.

(d) The responsibility of preparation of financial statement is of company’s management. CA P cannot assist

management in preparation of financial statements of the company. However, he can issue a review report.

3. In the above said scenario for issuance of signed financial statements for half year by CA P, as discussed in last para

of Case Study, identify the MOST APPROPRIATE statement: -

(a) Standard on Quality control (SQC 1) is not applicable as CA P cannot issue audit report.

(b) Standard on Quality Control (SQC 1) is not applicable as CA P cannot issue review report.

(c) Standard on Quality Control (SQC 1) is applicable in such type of engagement.

(d) Standard on Quality Control (SQC 1) is not applicable as CA P is barred from issuing any report in such type of

engagement.

(3*2=6 MARKS)

* FOR 4 TO 6

Kaur & Associates, a sole proprietor firm of Simran Kaur, is offered appointment as auditor of a company engaged in

manufacturing of automobile components for the first time. She is fact checking about the integrity of promoters of

the company and key managerial persons. Matters such as competence of staff to perform the engagement are also

considered by her. The appointment is subsequently accepted by her.

AAGAM PUBLISHERS -1-

She is also taking into account number and location of branches of the company, requirements of Schedule III of

Companies Act, 2013 and expected time by which audit has to be completed keeping in view statutory requirements.

Initially, she has thought it proper to inquire key employees of the company in procurement and marketing

departments and planned for the same. She has also planned to visit three plants of the company. The purpose of

planned inquiry and visit is to identify and assess risk of material misstatements.

A detailed set of instructions has been prepared by her office and it has been handed over to assistants in engagement

team. These set of instructions include details of extent of checking and nature of audit procedures to be performed

regarding purchases, sales, items of income, items of expenditure etc. During the course of execution of above set

of instructions, it has been brought to her notice that company is also producing substantial quantities of scrap

generated during manufacturing process. However, no instructions have been given to engagement team in this

regard.

4. Auditor is fact checking about promoters and key managerial persons. She is also considering competence of staff to

perform engagement. What is she trying to do?

(a) She is establishing audit strategy.

(b) She is conducting preliminary engagement activities.

(c) She is designing audit plan.

(d) She is checking her compliance of ethical requirements.

5. Consideration of number and location of branches, requirements of financial reporting framework and expected

time of completion are relevant factors primarily for which of the following -

(a) Developing audit plan (b) Establishing overall audit strategy

(c) Designing audit programme (d) Designing risk assessment procedures

6. Taking into account description of planned inquiry and visit, which of the following statements is TRUE?

(a) Planned inquiry and visit fall in area of audit strategy.

(b) Planned inquiry and visit are planned risk assessment procedures and fall in field of audit plan.

(c) The said description is not related to audit planning.

(d) Planned inquiry and visit fall in scope of audit programme.

(3*2=6 MARKS)

7. The operations of a company are automated substantially. Which of the following statements is most appropriate in

this respect?

(a) It results in complex business environment.

(b) It results in simple business environment and easier audit.

(c) Automation has no relationship with complexity of business environment.

(d) It results in simple business environment. However, it increases complexity of audit.

8. Who is responsible for maintaining effective internal financial controls?

(a) Statutory auditor (b) Audit Committee (c) Management (d) Shareholders

9. Which of the following is not a risk to a company’s internal control due to its IT environment?

(a) Potential loss of data (b) Inability to access data when required

(c) Unauthorized access to data (d) Processing of large volumes of data

(3*1=3 MARKS)

* FOR 10 TO 14

CA Drishti Khandelwal is conducting audit of a company engaged in manufacturing of towels and bedspreads. The

company is having its own manufacturing set-up. However, it also gets some manufacturing processes outsourced

from third parties. The company has three locations having substantial quantities of inventories in the same city.

Besides, due to outsourcing of some processes, inventories are also held in premises of third parties in the same

city. As part of audit procedures, she is performing many audit procedures required by different Standards on

Auditing.

In particular, she is attending physical inventory count process of the company at year end in accordance with

requirements of SA 501.The inventory of the company includes raw materials consisting mainly of natural and dyed

yarns, work in process in different stages of manufacturing and finished stocks of towels and bedspreads.

She is also planning sending confirmations to parties to whom the company has sold goods. On reviewing trade

receivables list, she finds that the list also contains large number of parties having small balances. She further finds

AAGAM PUBLISHERS -2-

that these receivables have arisen due to sale of bedspreads to small time retailers and possibility of difference in

balances as per company’s records and as per records of these small-time retailers is low. Risk of misstatements in

relation to trade receivables has been assessed as low. Besides, there is nothing to suggest that small-time retailers

would disregard such requests.

While conducting audit, she is testing controls operating in the company. She is also conducting tests of various

items of income and expenditure as well as balances appearing in balance sheet. She intends to rely upon sampling

extensively.

10. Which of the following statements is most appropriate regarding inventory count by auditor in accordance with SA

501?

(a) She should inspect the inventory to ascertain its existence and condition at all locations, observe how company

personnel are carrying out count procedures and perform test counting.

(b) She should inspect the inventory to ascertain its existence at all locations, observe how company personnel

are carrying out count procedures and perform test counting. The matter of condition of inventories falls in

domain of expert.

(c) She should inspect the inventory to ascertain its existence at selected location, observe how company personnel

are carrying out count procedures and perform test counting. The matter of condition of inventories falls in

domain of expert.

(d) She should inspect the inventory to ascertain its existence and condition at all locations and perform counting

of each and every item.

11. As regards inventories lying with third parties, which of following statements meets requirements of SA 501?

(a) She should request confirmation from third parties regarding quantity and condition of inventories held on

behalf of the company as well as request third parties to allow her to inspect inventories held by them. Both

requirements are necessary to be complied with.

(b) She should request confirmation from third parties regarding quantity and condition of inventories held on

behalf of the company or request third parties to allow her to inspect inventories held by them. Compliance of

any one of these or both is required for purposes of SA 501.

(c) There is no obligation cast upon an auditor in respect of inventories lying with third parties.

(d) She should request confirmation from third parties regarding quantity, condition and value of inventories held

on behalf of the company or request third parties to allow her to inspect inventories held by them. Compliance

of any one of these is sufficient for purposes of SA 501.

12. Keeping in view description regarding trade receivables, identify the most appropriate statement in context of SA

505?

(a) She should not plan and design confirmation requests for large number of parties having small balances.

(b) She should plan and design positive confirmation requests for large number of parties having small balances.

(c) She should plan and design positive confirmation requests for large number of parties having small balances

and meticulously analyse exception rate

(d) She should plan and design negative confirmation requests for large number of parties having small balances.

13. As regards sampling, which of the following statements is most appropriate in terms of requirements of SA 530?

(a) Sampling is used in tests of transactions as well as tests of controls.

(b) Sampling is used in tests of balances as well as tests of controls.

(c) Sampling is used in tests of details.

(d) Sampling is used in tests of details as well as tests of controls.

14. Since she intends to rely upon sampling extensively, which of the following statements is true about sampling risk?

(a) Sampling risk can be eliminated.

(b) Increase in sampling risk would lead to decrease in detection risk.

(c) Decrease in sampling risk would lead to increase in detection risk.

(d) Sampling risk will always be in existence.

(5*2=10 MARKS)

15. An auditor is verifying purchases to ensure their genuineness. Consequently, he is also trying to verify that no fake

“trade payables” are present in financial statements. Which assertions concerning purchase transactions and trade

payables respectively are being verified by auditor?

(a) Occurrence; Existence (b) Occurrence; Completeness

AAGAM PUBLISHERS -3-

(c) Existence; Occurrence (d) Completeness; Occurrence

16. Which of the following statement is most appropriate as regards to disclosure of goods in transit in financial

statements of a company?

(a) No separate disclosure of goods in transit is required.

(b) Disclosure of total goods in transit under head of inventories is required.

(c) Disclosure of goods in transit under each sub-head of inventories is required.

(d) Disclosure of goods in transit for raw material and finished goods is required.

17. Sweat Equity shares are issued by a company at a discount or for consideration other than cash to its:-

(a) Directors only (b) Clients only

(c) Directors or employees (d) Auditors only

18. Which of the following is not an element of cost of an item of machinery included under head “Property, Plant and

Equipment”?

(a) Installation costs

(b) Freight cost of bringing the item to its location

(c) Inaugural costs

(d) Employee benefit cost for making such an item suitable for production

19. Which of the classification is not required by a company in respect of its “Cash and cash equivalents?”

(a) Balance with Banks (b) Balance with scheduled banks

(c) Cash on hand (d) Cheques on hand

(5*1=5 MARKS)

(30 MARKS)

DIVISION B (DESCRIPTIVE)

Q-1.(a) State with reasons (in short) whether the following statements are correct or incorrect:

(i) There is direct relationship between materiality and the degree of audit risk.

(ii) Control risk is the susceptibility of an account balance or class of transactions to misstatement that could be material

either individually or, when aggregated with misstatements in other balances or classes, assuming that there were

no related internal controls.

(iii) Tests of control are performed to obtain audit evidence about the effectiveness of Internal Controls Systems.

(iv) Maintenance of Internal Control System is the responsibility of the Statutory Auditor.

(8 MARKS)

Q-1.(b) Discuss limitations of internal contol.

(6 MARKS)

Q-2.(a) Explain relationship between audit strategy and audit plan.

(5 MARKS)

Q-2.(b) While applying the Substantive Analytical Procedures what techniques can be used by the statutory auditor of a

company to obtain sufficient and appropriate audit evidence?

(5 MARKS)

Q-2.(c) Explain difference between reasonable assurance engagement and limited assurance engagement.

(4 MARKS)

Q-3.(a) Explain elements of an assurance engagement.

(5 MARKS)

Q-3.(b) How will you vouch and/or verify payment of taxes?

(5 MARKS)

Q-3.(c) The statutory auditor of MNO Ltd., CA Kishore identifies certain inconsistencies while applying analytical procedures

to the financial and non financial data of MNO Ltd. What should CA Kishore do in this case with reference to SA 520

on “Analytical Procedures”?

(4 MARKS)

Q-4.(a) M/s Pankaj & Associates, Chartered Accountants, have been appointed as an auditor of ABC Limited. CA Pankaj did

AAGAM PUBLISHERS -4-

not apply any audit procedures regarding opening balances. He argued that since financial statements were audited

by the predecessor auditor therefore he is not required to verify them. Is CA Pankaj correct in his approach?

(5 MARKS)

Q-4.(b) You are the statutory auditor of Jupiter Ltd. for the FY 2022-23. During the course of audit, you noticed that the

company has PPE under construction i.e. Capital Work in Progress. What disclosures should the company give with

respect to the ageing schedule of such capital work in progress as required by Schedule III to the Companies Act,

2013?

(5 MARKS)

Q-4.(c) Planning supervision and review of work of engagement team members depends on which factors or may vary upon

which factors?

(4 MARKS)

Q-5.(a) For construction of audit programme which following points should be kept in mind?

(5 MARKS)

Q-5.(b) The auditor of Saturn Ltd. wants to verify whether the company has valid legal ownership rights over the inventories

recorded in the balance sheet as on 31.03.2023. What audit procedures should the statutory auditor of the company

perform?

(5 MARKS)

Q-5.(c) While planning the audit of S Ltd. you want to apply sampling techniques. What are the risk factors you should keep

in mind?

(4 MARKS)

-0-0-0-0-0-0-0-0-

AAGAM PUBLISHERS -5-

You might also like

- MTP 12 21 Questions 1696771411Document8 pagesMTP 12 21 Questions 1696771411harshallahotNo ratings yet

- 1554382617CA Final Audit MCQ Booklet PDFDocument25 pages1554382617CA Final Audit MCQ Booklet PDFLakshay SinghNo ratings yet

- MTP m21 A Q 2Document6 pagesMTP m21 A Q 2sakshiNo ratings yet

- Mock Dec Part 2 QDocument7 pagesMock Dec Part 2 QheikNo ratings yet

- Audit Mtp2 DoneDocument11 pagesAudit Mtp2 Donegaurav gargNo ratings yet

- Paper 3 - Audit - TP-8Document6 pagesPaper 3 - Audit - TP-8Suprava MishraNo ratings yet

- Rrpa 9Document8 pagesRrpa 9mr rahulNo ratings yet

- All Mcqs Are Compulsory Question No. 1 Is Compulsory. Attempt Any Four Questions From The RestDocument12 pagesAll Mcqs Are Compulsory Question No. 1 Is Compulsory. Attempt Any Four Questions From The RestGJ ELASHREEVALLINo ratings yet

- Audit Test Solution by CA Harshad Jaju SirDocument13 pagesAudit Test Solution by CA Harshad Jaju SirHetal BeraNo ratings yet

- Paper - 3: Advanced Auditing and Professional Ethics: (5 Marks)Document16 pagesPaper - 3: Advanced Auditing and Professional Ethics: (5 Marks)RashmiNo ratings yet

- AUDITING - CUAC 202 ASSIGNMENT 1-12Document18 pagesAUDITING - CUAC 202 ASSIGNMENT 1-12Joseph SimudzirayiNo ratings yet

- Inter Audit - SubjectiveDocument4 pagesInter Audit - SubjectiveYogesh BansalNo ratings yet

- Audit QP - 1Document18 pagesAudit QP - 1sanket karwaNo ratings yet

- Compulsory MCQS: (Just Select The Correct Answer, No Need For Reasoning)Document17 pagesCompulsory MCQS: (Just Select The Correct Answer, No Need For Reasoning)shivam wadhwaNo ratings yet

- Audit Fundamentals Level Skills Module MalaysiaDocument6 pagesAudit Fundamentals Level Skills Module MalaysiaTang Swee ChanNo ratings yet

- Final Set A SolutionsDocument8 pagesFinal Set A SolutionsAARCHI JAINNo ratings yet

- Audit 1 QDocument24 pagesAudit 1 QG INo ratings yet

- FAUINT 2012 Jun A PDFDocument9 pagesFAUINT 2012 Jun A PDFMessi GenaroNo ratings yet

- Auditing Set 2Document7 pagesAuditing Set 2cleophacerevivalNo ratings yet

- Dec 2021Document16 pagesDec 2021DiyaNo ratings yet

- All Year RTP AuditDocument564 pagesAll Year RTP AuditShivam ChaudharyNo ratings yet

- AL Audit Assurance May Jun 2014Document3 pagesAL Audit Assurance May Jun 2014Bizness Zenius HantNo ratings yet

- Auditing exam questionsDocument16 pagesAuditing exam questionsIssa BoyNo ratings yet

- ICMAP ASSIGNMENT QUESTIONS ON RISK MANAGEMENT AND AUDITDocument10 pagesICMAP ASSIGNMENT QUESTIONS ON RISK MANAGEMENT AND AUDITAreeb BaqaiNo ratings yet

- ASSURANCE & AUDIT PRACTICE SOLUTIONSDocument9 pagesASSURANCE & AUDIT PRACTICE SOLUTIONSsamuel_dwumfourNo ratings yet

- CA Final Audit A MTP 2 Nov23 Castudynotes ComDocument10 pagesCA Final Audit A MTP 2 Nov23 Castudynotes ComRajdeep GuptaNo ratings yet

- AuditNew Suggested Ans CA Inter Jan 21Document14 pagesAuditNew Suggested Ans CA Inter Jan 21Priyansh KhatriNo ratings yet

- Audit Dec 21 Suggested Answer @mission - CA - InterDocument19 pagesAudit Dec 21 Suggested Answer @mission - CA - Intersantosh pandeyNo ratings yet

- MTP 10 21 Answers 1694676341Document9 pagesMTP 10 21 Answers 1694676341shoaibinamdar1454No ratings yet

- Audit and Assurance (International) : Thursday 6 June 2013Document6 pagesAudit and Assurance (International) : Thursday 6 June 2013Asim NazirNo ratings yet

- 69779bos55738 p6Document16 pages69779bos55738 p6OPULENCENo ratings yet

- Sample For Auditing Mantras For CA IPCCDocument110 pagesSample For Auditing Mantras For CA IPCCAnurag Singal75% (4)

- © The Institute of Chartered Accountants of IndiaDocument8 pages© The Institute of Chartered Accountants of IndiasakshiNo ratings yet

- f8 DEC 2010 QuestionsDocument7 pagesf8 DEC 2010 QuestionsPakistan DramasNo ratings yet

- PRTC Aud 1st PB 05 Audit Problem and Solution - CompressDocument14 pagesPRTC Aud 1st PB 05 Audit Problem and Solution - CompressNovemae CollamatNo ratings yet

- CA Inter Paper 6 All Question PapersDocument116 pagesCA Inter Paper 6 All Question PapersNivedita SharmaNo ratings yet

- AUDIT Mock 1 Solution May 24Document4 pagesAUDIT Mock 1 Solution May 24vansh bhandariNo ratings yet

- Aplication Level Audit Assurance Nov Dec 2013Document2 pagesAplication Level Audit Assurance Nov Dec 2013Noman_TufailNo ratings yet

- Qld FITS Audit Planning ReportDocument10 pagesQld FITS Audit Planning ReportAdeel AhmedNo ratings yet

- © The Institute of Chartered Accountants of IndiaDocument8 pages© The Institute of Chartered Accountants of Indiadeepika devsaniNo ratings yet

- 2018 Prelim EQPDocument6 pages2018 Prelim EQPhn tNo ratings yet

- Audit Software BenefitsDocument12 pagesAudit Software BenefitsMehedi Hasan TouhidNo ratings yet

- RMA-MP-ICMA-Model-PaperDocument2 pagesRMA-MP-ICMA-Model-Papersohail merchantNo ratings yet

- All Mcqs Are Compulsory Question No. 1 Is Compulsory. Attempt Any Four Questions From The RestDocument10 pagesAll Mcqs Are Compulsory Question No. 1 Is Compulsory. Attempt Any Four Questions From The Restritz meshNo ratings yet

- November 2021 Professional Examinations Advanced Audit & Assurance (Paper 3.2) Chief Examiner'S Report, Questions and Marking SchemeDocument22 pagesNovember 2021 Professional Examinations Advanced Audit & Assurance (Paper 3.2) Chief Examiner'S Report, Questions and Marking SchemeVonnieNo ratings yet

- Auditing Ethics Full Test 1 May 2024 Test Paper 1703329935Document22 pagesAuditing Ethics Full Test 1 May 2024 Test Paper 1703329935hersheyys4No ratings yet

- AUDIT 2 New Question PaperDocument9 pagesAUDIT 2 New Question Paperneha manglaniNo ratings yet

- All Bookish Knowledge Parts in ONE FILE- AADocument30 pagesAll Bookish Knowledge Parts in ONE FILE- AAtuitiontutoraNo ratings yet

- CASE STUDY BASED (WITHOUT ANSWERS)Document14 pagesCASE STUDY BASED (WITHOUT ANSWERS)mshivam617No ratings yet

- 03 MCQ and True or False statements bookletDocument58 pages03 MCQ and True or False statements bookletVijaya LaxmiNo ratings yet

- Section C This Scenario Relates To Four RequirementsDocument6 pagesSection C This Scenario Relates To Four Requirementshakunguyn646No ratings yet

- Audit and Assurance (International) : Wednesday 9 June 2010Document6 pagesAudit and Assurance (International) : Wednesday 9 June 2010Tapiwa K NgungunyaniNo ratings yet

- Question No. 1 Is Compulsory. Attempt Any Five Questions From The RestDocument8 pagesQuestion No. 1 Is Compulsory. Attempt Any Five Questions From The RestNithyashree RajagopalanNo ratings yet

- Auditing Terminal Exam - SP2020Document2 pagesAuditing Terminal Exam - SP2020Daim AslamNo ratings yet

- CAF 8 AUD Spring 2023Document3 pagesCAF 8 AUD Spring 2023saad.office101No ratings yet

- Audit Top 70 Questions by CA VIDHI CHHEDADocument64 pagesAudit Top 70 Questions by CA VIDHI CHHEDAManoj VenkatNo ratings yet

- Department of Accountancy: Page - 1Document17 pagesDepartment of Accountancy: Page - 1NoroNo ratings yet

- Acca f8 JUNE 2010 QuestionsDocument6 pagesAcca f8 JUNE 2010 QuestionsPakistan DramasNo ratings yet

- A Study of the Supply Chain and Financial Parameters of a Small BusinessFrom EverandA Study of the Supply Chain and Financial Parameters of a Small BusinessNo ratings yet

- Lipid ChemistryDocument93 pagesLipid ChemistrySanreet RandhawaNo ratings yet

- Food Safety Culture Webinar SLIDESDocument46 pagesFood Safety Culture Webinar SLIDESAto Kwamena PaintsilNo ratings yet

- Effectiveness of Prefabricated MyofunctionalDocument10 pagesEffectiveness of Prefabricated MyofunctionalAdina SerbanNo ratings yet

- Awards and Honors 2018Document79 pagesAwards and Honors 2018rajinder345No ratings yet

- CFLM-1 Chapter 5Document17 pagesCFLM-1 Chapter 5Rico T. MusongNo ratings yet

- 1 Vkip 113Document595 pages1 Vkip 113flopo72No ratings yet

- Three Days To SeeDocument2 pagesThree Days To SeeMae MejaresNo ratings yet

- Research On Evolution Equations Compendium Volume 1Document437 pagesResearch On Evolution Equations Compendium Volume 1Jean Paul Maidana GonzálezNo ratings yet

- Firebird Developer Guide Beta Delphi FiredacDocument162 pagesFirebird Developer Guide Beta Delphi FiredacDanilo CristianoNo ratings yet

- Wireless Local LoopDocument8 pagesWireless Local Loopapi-3827000100% (1)

- REVISED 2023-2025 LIPH Appraisal Checklist Rating Scale v5 9.12Document11 pagesREVISED 2023-2025 LIPH Appraisal Checklist Rating Scale v5 9.12Joshua AssinNo ratings yet

- A Complete Note of English For All Competitive ExamsDocument136 pagesA Complete Note of English For All Competitive ExamsRaja PosupoNo ratings yet

- TELENGANA BUSINESS DIRECTORY PENEL D-PanelDocument65 pagesTELENGANA BUSINESS DIRECTORY PENEL D-Panelamandeep100% (4)

- BBL CVDocument13 pagesBBL CVkuashask2No ratings yet

- Sensory Evaluation of FoodDocument38 pagesSensory Evaluation of FoodKHOZA SBUSISIWENo ratings yet

- Song Activity by Christina AguileraDocument1 pageSong Activity by Christina AguileraRossita BasharovaNo ratings yet

- News TIA Portal V15 and V15 1 enDocument43 pagesNews TIA Portal V15 and V15 1 enjohanNo ratings yet

- The Carb Cycling Codex ThibaudeuDocument30 pagesThe Carb Cycling Codex ThibaudeuOrlando Paez Cortazar100% (1)

- Language Learning Enhanced by Music and SongDocument7 pagesLanguage Learning Enhanced by Music and SongNina Hudson100% (2)

- Final Order in The Matter of M/s Alchemist Capital LTDDocument61 pagesFinal Order in The Matter of M/s Alchemist Capital LTDShyam SunderNo ratings yet

- HC - Come Home To Yourself PDFDocument133 pagesHC - Come Home To Yourself PDFOtilia100% (1)

- KZN OUTER WEST Development ProjectsDocument25 pagesKZN OUTER WEST Development ProjectsDurban Chamber of Commerce and IndustryNo ratings yet

- CPSC5125 - Assignment 3 - Fall 2014 Drawing Polygons: DescriptionDocument2 pagesCPSC5125 - Assignment 3 - Fall 2014 Drawing Polygons: DescriptionJo KingNo ratings yet

- Press Release-HandoverDocument2 pagesPress Release-HandovermoblogNo ratings yet

- Fatima! Through The Eyes of A ChildDocument32 pagesFatima! Through The Eyes of A ChildThe Fatima Center100% (1)

- Letter To Editor NDocument5 pagesLetter To Editor NNavya AgarwalNo ratings yet

- Led PowerpointDocument35 pagesLed PowerpointArunkumarNo ratings yet

- Chapter 4 Designing Your SolutionDocument22 pagesChapter 4 Designing Your SolutionRamona Isabel UrsaisNo ratings yet

- Summative Test 1 English 9 Q1Document2 pagesSummative Test 1 English 9 Q1Katherine Anne Munar0% (1)

- Ken Scott - Metal BoatsDocument208 pagesKen Scott - Metal BoatsMaxi Sie100% (3)