Professional Documents

Culture Documents

SK Budget Message For 2022

Uploaded by

genesis tolibasOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

SK Budget Message For 2022

Uploaded by

genesis tolibasCopyright:

Available Formats

Republic of the Philippines

PROVINCE OF SOUTHERN LEYTE

Municipality of Sogod

-o0o-

October 12, 2021

BUDGET MESSAGE

The Honorable Members

Sangguniang Panlalawigan

Maasin City

Thru: The Honorable Members

Sangguniang Bayan

Sogod, Southern Leyte

Gentlemen and Ladies :

May I submit the proposed Annual Budget for FY 2022 of the Municipal Government of

Sogod pursuant to Section 318 of RA 7160.

This Executive Budget was prepared after a thorough deliberation with all concerned

offices/departments and interested citizens to make it an effective tool for equitably allocating

the limited resources of government to the different sectors, thus making the budget an

instrument for the economic and social upliftment of our people. We have substantially

committed funds for the programs, projects and activities needed for an efficient and effective

delivery of the basic services enumerated in the Local Government Code. These programs,

projects and activities are harmonized with President Duterte’s priority areas for development,

such as;

1. Anti - Corruption /transparent, Accountable and Participatory Governance.

2. Poverty Reduction and empowerment of the poor and vulnerable.

3. Rapid, Inclusive and Sustained Economic Growth.

4. Just and lasting Peace and the Rules of Law.

5. Integrated of the Environment and Climate change adaptation and mitigation.

This Budget integrates the Municipal Development Plan into the expenditures program by

proposing only those projects which have been ranked as top priority in the Annual Investment

Program (AIP).

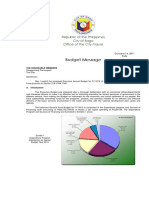

The Annual Budget for CY 2022 is composed of the expenditures program amounting to

P 272,206,524.00. This Expenditure Program is illustrated in Exhibit 1 and 2.

Exhibit 1

EXPENDITURE PROGRAM

Budget Year 202

20%

General Public Services - 136,603,763.00

Social Services - 30,772,122.00

15%

Economic Services - 42,890,905.00

65%

1

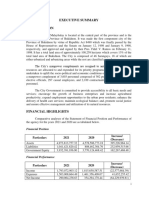

Exhibit 2

DISTRIBUTION BY TYPE OF REVENUE

11.40% External Revenue

9.25% IRA - 166,816,790.00

TAX REVENUE - 19,465,000.00

79.34%

NON-TAX REVENUE - 23,985,000.00

GOALS AND OBJECTIVES

- Agricultural /Rural Areas Productivity & Livelihood Program

- Comprehensive and Responsive Health Services

- Increased Agricultural Productivity and Commercial Activities

- Enhanced Revenue Generation and Prudent Fiscal Administration

- Maintenance of Peace and Order and Public Safety

FISCAL POLICIES

To ensure the sustainability of our collection efficiency in achieving our fiscal targets, the

following measures are to be implemented.

1. Enhancing Tax Collection Efficiency through administrative support and applicable judicial

remedies, if warranted.

2. Updating of Local Tax Ordinance and its strict implementation.

3. Financing construction of an integrated Public Market.

4. Updating scale of fees.

DISTRIBUTION OF LGU BUDGET BY FUNCTIONAL ACTIVITIES

Insert exhibit The Total Budget of the Municipality for Budget Year 2022 will reach P

272,206,524.00 and 79% of these will be derived from the IRA - Internal Revenue Allotment as

shown in Exhibit 2. Revenue from Local taxes for the budget year is estimated at P

43,450,000.00

A summary of the total General Fund Budget and allocation by sector, as follows:

SECTOR AMOUNT % TOTAL

General Public Services 129,090,423.00 61.39

Social Services 23,272,122.00 11.06

Economic Services 14,057,547.00 6.68

20% Local Development Fund 33,333,358.00 15.85

5% Calamity Fund 10,513,340.00 5.00

============ ===========

272,206,524.00 99.98 or 100%

DISTRIBUTION BY MAJOR EXPENSE CLASS

PERSONAL SERVICES

The Total Expenditures for Personal Services for Budget Year is P 93,579,059.00

2

The Municipality implements the 1st tranche of monthly salary increase under President

Duterte’s (LBC No. 121 dated January 24, 2020).

MAINTENANCE AND OTHER OPERATING EXPENSES

This expense class serves as the basic needs of various offices in the Municipal Government

in the operation and performance of their mandates and responsibilities which will ultimately

gear then to effective performance of office targets.

An amount of P 103,360,834.00 or 38.51% of the total Budget has been provided.

CAPITAL OUTLAY

This expense class represent 4.13% of the Annual Budget or an amount equivalent to

P 16,175,000.00 which has been purposely allocated for the Purchase of Lot for New Cemetery

and additional Lot for Dumpsite Area used for Solid Waste Management Program and other

office equipment and facilities to enhanced delivery of goods and services.

SPECIAL PURPOSE APPROPRIATION

The amount of P 56,091,631.00 has been allocated for Special Purpose Appropriation

representing 20.85% of the Annual Budget for FY 2021. It covers the provisions of the following:

20% - Economic Development Fund

5% - Local Disaster Risk Reduction Management fund or Calamity Fund

CONCLUSION

Honorable Members of the Sanggunian, this budget proposal manifests our determination

to lay a Strong foundation for a greater and progressive municipality. Let us join our hands

together as we go about our mission of providing a brighter future of our constituents.

Very truly yours,

IMELDA U. TAN

Local Chief Executive

You might also like

- Strengthening Fiscal Decentralization in Nepal’s Transition to FederalismFrom EverandStrengthening Fiscal Decentralization in Nepal’s Transition to FederalismNo ratings yet

- Office of The Municipal MayorDocument6 pagesOffice of The Municipal MayorVIRGILIO OCOY III100% (1)

- Abr Balingoan 0000000018 5208Document82 pagesAbr Balingoan 0000000018 5208gerlie22No ratings yet

- Bago City 2012 Budget MessageDocument3 pagesBago City 2012 Budget MessageAl SimbajonNo ratings yet

- Naguilian Executive Summary 2021Document5 pagesNaguilian Executive Summary 2021Willie FabroaNo ratings yet

- Budget Message Cy 2021Document5 pagesBudget Message Cy 2021Amelia BersamiraNo ratings yet

- Tigbauan Executive Summary 2020Document8 pagesTigbauan Executive Summary 2020cpa126235No ratings yet

- Annual Report 2022Document33 pagesAnnual Report 2022JAMIL ASUMNo ratings yet

- Maydolong Executive Summary 2022Document4 pagesMaydolong Executive Summary 2022Floydlizamarie PatualNo ratings yet

- San Nicolas Executive Summary 2021Document5 pagesSan Nicolas Executive Summary 2021Jenny Orallo GarletNo ratings yet

- Proposed Budget for Municipality of Pilar, Sorsogon for FY 2013Document32 pagesProposed Budget for Municipality of Pilar, Sorsogon for FY 2013Genevieve AlcalaNo ratings yet

- Draft AIP 2018 PDFDocument30 pagesDraft AIP 2018 PDFYajar ZehcnasNo ratings yet

- Abia State Q1 BPR Report 2022Document45 pagesAbia State Q1 BPR Report 2022Okechukwu LovedayNo ratings yet

- Carmen Executive Summary 2020Document8 pagesCarmen Executive Summary 2020Johanna Mae AutidaNo ratings yet

- Executive Summary: A. IntroductionDocument5 pagesExecutive Summary: A. IntroductionChiara Melanie ButawanNo ratings yet

- 2019-2020 - VoteBFP - 755 - Jinja Municipal Council - Budget Framework PaperDocument18 pages2019-2020 - VoteBFP - 755 - Jinja Municipal Council - Budget Framework PaperJohn KimutaiNo ratings yet

- Samar Executive Summary 2021Document132 pagesSamar Executive Summary 2021Charlie Maine TorresNo ratings yet

- July 20 Grand Forks Bochenski Budget PowerpointDocument68 pagesJuly 20 Grand Forks Bochenski Budget PowerpointJoe BowenNo ratings yet

- Bayambang Water District Executive Summary 2020Document5 pagesBayambang Water District Executive Summary 2020Paul De LeonNo ratings yet

- Apalit Executive Summary 2020Document6 pagesApalit Executive Summary 2020Terry AceNo ratings yet

- Dalaguete Executive Summary 2021Document5 pagesDalaguete Executive Summary 2021AUDREY MARIEL CANDORNo ratings yet

- Budget 2021 22 Highlights CommentsDocument135 pagesBudget 2021 22 Highlights CommentsArsal GujjarNo ratings yet

- Barangay Budget: Republic of The PhilippinesDocument5 pagesBarangay Budget: Republic of The PhilippinesAlbert JoseNo ratings yet

- 2021 Budget Speech.Document24 pages2021 Budget Speech.Ashley KnowledgeNo ratings yet

- Guimbal Executive Summary 2019Document5 pagesGuimbal Executive Summary 2019AllynMae TurijaNo ratings yet

- Barangay Budget Message Outlines FY 2022 PlansDocument9 pagesBarangay Budget Message Outlines FY 2022 Plansruelan carnajeNo ratings yet

- Alaminos Executive Summary 2012Document3 pagesAlaminos Executive Summary 2012Maureen ToledoNo ratings yet

- Binalonan Water District Pangasinan Executive Summary 2022Document5 pagesBinalonan Water District Pangasinan Executive Summary 2022Joseph CajoteNo ratings yet

- Executive Summary 2020Document5 pagesExecutive Summary 2020Marc CabreraNo ratings yet

- Apalit2022 CARDocument12 pagesApalit2022 CARTerry AceNo ratings yet

- Pleasanton City Council Report On Budget Revisions 4/15/2020Document7 pagesPleasanton City Council Report On Budget Revisions 4/15/2020Courtney TeagueNo ratings yet

- Padada Executive Summary 2021Document5 pagesPadada Executive Summary 2021Hanna RiNo ratings yet

- Budget CallDocument3 pagesBudget CallBacong SalugNo ratings yet

- Malaybalay City Executive Summary 2021Document5 pagesMalaybalay City Executive Summary 2021Bags OholicNo ratings yet

- Aborlan Executive Summary 2019Document6 pagesAborlan Executive Summary 2019Arly TolentinoNo ratings yet

- Catarman Municipality 2019 Executive SummaryDocument7 pagesCatarman Municipality 2019 Executive SummaryJeanine IlaganNo ratings yet

- Lakki MarwatDocument118 pagesLakki MarwatRizwanUllahKhanNo ratings yet

- Bayombong Executive Summary 2021Document8 pagesBayombong Executive Summary 2021Aika KimNo ratings yet

- Mombasa County CFSP 2020Document72 pagesMombasa County CFSP 2020Mombasa CountyNo ratings yet

- Office of The Sangguniang Barangay: Appropriation Ordinance No. 2018-001Document5 pagesOffice of The Sangguniang Barangay: Appropriation Ordinance No. 2018-001Hana Navalta SoberanoNo ratings yet

- July 13 Grand Forks Budget PreviewDocument25 pagesJuly 13 Grand Forks Budget PreviewJoe BowenNo ratings yet

- 03-Estancia2022 Executive SummaryDocument4 pages03-Estancia2022 Executive SummaryEi Mi SanNo ratings yet

- Catbalogan-City-Executive-Summary-2022Document12 pagesCatbalogan-City-Executive-Summary-2022Ely CabangunayNo ratings yet

- General MacArthur Executive Summary 2020Document6 pagesGeneral MacArthur Executive Summary 2020Ma. Danice Angela Balde-BarcomaNo ratings yet

- Executive Summary of Cabatuan Municipality's Financial OperationsDocument7 pagesExecutive Summary of Cabatuan Municipality's Financial OperationsSteve RodriguezNo ratings yet

- Dipaculao Aurora ES2017Document6 pagesDipaculao Aurora ES2017kim ann m. avenillaNo ratings yet

- Dolores Executive Summary 2020Document6 pagesDolores Executive Summary 2020Ma. Danice Angela Balde-BarcomaNo ratings yet

- Bagumbayan-Executive-Summary-2021Document3 pagesBagumbayan-Executive-Summary-2021jsophiaramos0221No ratings yet

- San Juan City Executive Summary 2022Document7 pagesSan Juan City Executive Summary 2022MAYON NAGANo ratings yet

- Executive Summary of New Bataan MunicipalityDocument5 pagesExecutive Summary of New Bataan MunicipalityJoergen Mae MicabaloNo ratings yet

- Asingan Executive Summary 2022Document5 pagesAsingan Executive Summary 2022Christopher RosarioNo ratings yet

- Agency Background: Executive Summary A. IntroductionDocument4 pagesAgency Background: Executive Summary A. IntroductionRObelyn Alwod BOta-angNo ratings yet

- Talisay City Executive Summary 2019Document6 pagesTalisay City Executive Summary 2019patatas e.No ratings yet

- EXECUTIVE SUMMARYDocument9 pagesEXECUTIVE SUMMARYJoergen Mae MicabaloNo ratings yet

- Surallah-Executive-Summary-2020Document5 pagesSurallah-Executive-Summary-2020Kynard PatrickNo ratings yet

- East Penn Long Range Fiscal and Capital Plan 03-13-2023Document54 pagesEast Penn Long Range Fiscal and Capital Plan 03-13-2023Jay BradleyNo ratings yet

- San Juan Executive Summary 2021Document7 pagesSan Juan Executive Summary 2021Louie CoNo ratings yet

- Pateros Executive Summary 2021Document9 pagesPateros Executive Summary 2021Ruffus TooqueroNo ratings yet

- Sta. Barbara Executive Summary 2021Document4 pagesSta. Barbara Executive Summary 2021Jose MacaNo ratings yet

- Municipal Finances in IndiaDocument31 pagesMunicipal Finances in IndiaSushma DakeyNo ratings yet

- System Service Manual DRF CALDocument4 pagesSystem Service Manual DRF CALManuelNo ratings yet

- Instructions: Ashoka University Ma Economics Entrance ExaminationDocument10 pagesInstructions: Ashoka University Ma Economics Entrance ExaminationJayesh RaghuwanshiNo ratings yet

- Capítulo 3 Habituation and SensitizationDocument17 pagesCapítulo 3 Habituation and SensitizationAngela JordáNo ratings yet

- WEF GSC Annual Survey 2017Document68 pagesWEF GSC Annual Survey 2017mashablescribdNo ratings yet

- Automotive Painter Record Book EssentialsDocument21 pagesAutomotive Painter Record Book EssentialsCertified Rabbits LoverNo ratings yet

- Comprehensive Cellulose Chemistry - Vol. 1 - Fundamentals and Analytical MethodsDocument286 pagesComprehensive Cellulose Chemistry - Vol. 1 - Fundamentals and Analytical MethodsrodsNo ratings yet

- National Air Quality Index (IND-AQI) for IndiaDocument40 pagesNational Air Quality Index (IND-AQI) for IndiaRAHUL KUMARNo ratings yet

- Sociology Essay Nature Vs NurtureDocument1 pageSociology Essay Nature Vs NurtureFarhana JaidiNo ratings yet

- Navamsa - Visti LarsenDocument12 pagesNavamsa - Visti Larsendeshan basura100% (5)

- Concepts of Avortion PDFDocument13 pagesConcepts of Avortion PDFMadalinaSabauNo ratings yet

- Major Orientation Reflection PaperDocument2 pagesMajor Orientation Reflection PaperNessNo ratings yet

- SONDEX TRAINING MANUAL TWO PHASE PRODUCTION LOG ANALYSISDocument1 pageSONDEX TRAINING MANUAL TWO PHASE PRODUCTION LOG ANALYSISKader BakourNo ratings yet

- Chapel School: Home-Based Learning Package Week 2 Third TermDocument21 pagesChapel School: Home-Based Learning Package Week 2 Third TermZuri NoveloNo ratings yet

- The Vollmer Group World-Wide Top Products For Top PerformanceDocument5 pagesThe Vollmer Group World-Wide Top Products For Top PerformanceHarryNo ratings yet

- Levels of Work / Stratified Systems Thinking (SST)Document2 pagesLevels of Work / Stratified Systems Thinking (SST)Ingrid HurwitzNo ratings yet

- Lunar Mansions GuideDocument21 pagesLunar Mansions GuideAragaw Mulu100% (2)

- Stepan Formulation 1181Document2 pagesStepan Formulation 1181Panacea PharmaNo ratings yet

- An Investigation Into The Effects of Electric Field Uniformity On Electrospun TPU Fiber Nano-Scale MorphologyDocument14 pagesAn Investigation Into The Effects of Electric Field Uniformity On Electrospun TPU Fiber Nano-Scale MorphologyMuhammad Shafiz DanialNo ratings yet

- Document 29 - Larson v. Perry (Dorland) ("Bad Art Friend")Document41 pagesDocument 29 - Larson v. Perry (Dorland) ("Bad Art Friend")x2478No ratings yet

- Final Thesis on Inpatient Health and Wellness CenterDocument91 pagesFinal Thesis on Inpatient Health and Wellness CenterClarisse DoriaNo ratings yet

- Taking Off-ABCDocument3 pagesTaking Off-ABChello.testduluNo ratings yet

- Assignment 2Document5 pagesAssignment 2Inahkoni Alpheus Sky OiragasNo ratings yet

- Juvenile Delinquency NotesDocument26 pagesJuvenile Delinquency NotesBuddhaNo ratings yet

- Nimesulid SpectrofotometricDocument2 pagesNimesulid Spectrofotometricdanielafarmacie_1617No ratings yet

- CONTINGENCY PLAN FOR COVID 19 - A$ SizeDocument15 pagesCONTINGENCY PLAN FOR COVID 19 - A$ Sizemaribel bathanNo ratings yet

- Pile FoundationDocument38 pagesPile FoundationChowdhury PriodeepNo ratings yet

- k-350 k-355 Teknik DataDocument7 pagesk-350 k-355 Teknik DataRafael PerezNo ratings yet

- HAC-10143-MS-CIV-003-Method Statement For Concrete RepairDocument26 pagesHAC-10143-MS-CIV-003-Method Statement For Concrete RepairHema playsNo ratings yet

- STEADY EL. CURRENT AND CIRCUIT PROPERTIESDocument33 pagesSTEADY EL. CURRENT AND CIRCUIT PROPERTIESሀይደር ዶ.ርNo ratings yet

- 5e Lesson Plan 4Document3 pages5e Lesson Plan 4api-2601088160% (2)