Professional Documents

Culture Documents

Sworn Statement 2022

Sworn Statement 2022

Uploaded by

vivianOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Sworn Statement 2022

Sworn Statement 2022

Uploaded by

vivianCopyright:

Available Formats

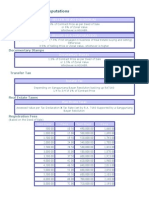

ANNEX “B-2”

INCOME PAYEE’S SWORN DECLARATION OF GROSS RECEIPTS/SALES

(For Self-Employed and/or Engaged in the Practice of Profession with Lone Income Payor)

FILIPINO

I, ________________________________________, ___________________________, of legal age, single/ married to

(Name) (Citizenship)

_____________________________________________________ permanently residing at _________________________________

(Name of Spouse)

_______________________________________________ with

(Address)

Taxpayer Identification Number (TIN) _________________________, after having been duly sworn in accordance with law hereby

depose and state:

1. That I derived my ____________________ income only from _DOH-CENTRAL LUZON CENTER FOR HEALTH

(business/professional) (Name of Lone Payor)

with Taxpayer Identification Number __000-791-464-006 __ and business address at _GOVERNMENT CENTER_

MAIMPIS, CITY OF SAN FERNANDO , PAMPANGA________________________________________________;

2. That for the current year ________, my gross receipts will not exceed Two Hundred Fifty Thousand Pesos (₱250,000.00) and

that I am registered as a non-VAT taxpayer; that whatever is the amount of income received, I will comply with the

requirement to file my Income Tax Return on the prescribed due date. For this purpose, I opt to avail of either one of the

following:

Graduated Income Tax Rates under Section 24(A)(2)(a) of the Tax Code, as amended, based on the taxable

income. With this selection, I acknowledge that I am subject to 0% income tax, thus, not subject to

creditable withholding tax; subject to percentage tax, if applicable, and will file the required percentage tax

returns or subject to withholding percentage tax, in case of government money payments.

Eight Percent (8%) income tax rate under Section 24(A)(2)(b) of the Tax Code, as amended, based on

gross receipts/sales and other non-operating income - with this selection, I understand that this is in lieu of

the graduated income tax rates and the Percentage Tax under Section 116 of the Tax Code, as amended;

thus, no withholding tax shall be made;

3. That based on my selection above, if my gross sales/receipts and other non-operating income exceeds ₱250,000.00 but not

over ₱3,000,000.00, my afore-stated lone income payor shall automatically withhold the prescribed rate of withholding tax:

a. In case of Graduated Income Tax Rates, I acknowledge that aside from income tax, I am subject to

business tax (Percentage Tax, if applicable) and creditable withholding of income in excess of

P250,000.00, and business tax withholding, if any, are applicable on the entire income payment; OR

b. In case of Eight Percent (8%) income tax rate, I acknowledge that I am only subject to income tax and

thus, to the creditable withholding income tax in excess of P250,000.00;

4. That I duly execute this SWORN DECLARATION in compliance with the requirement prescribed under Section ____ of

Revenue Regulations No. ________;

5. That I declare, under the penalties of perjury, that this declaration has been made in good faith, and to the best of my

knowledge and belief to be true and correct.

_____________________________________________

Signature over Printed Name of Individual Taxpayer

SUBSCRIBED AND SWORN to before me this _____ day of ____________, 20___ in _______________________________.

Applicant exhibited to me his/her ___________________________issued at _______________________ on

_________________________.

(Government Issued ID and No.)

NOTARY PUBLIC

Doc. No.: __________

Page No.: __________

Book No.: __________

Series of ___________

Affix ₱30.00

Documentary

Stamp Tax

(To be filled-out by the withholding agent/lone payor)

Date Received: __________________ Received by:

(MM-DD-YYYY-00001)

_____________________________________________________________

Signature over Printed Name of the Withholding Agent/Payor or Authorized Officer

_____________________________________________________________

Designation/Position of Authorized Officer

_____________________________________________________________

Name of Withholding Agent/Lone Payor

You might also like

- Request For ReinvestigationDocument9 pagesRequest For Reinvestigationjoel raz94% (17)

- Transfer Commitment FormDocument1 pageTransfer Commitment Formromarcambri100% (7)

- Annex F RR 11-2018Document1 pageAnnex F RR 11-2018Joeanna100% (13)

- Affidavit of Correctness of EntriesDocument1 pageAffidavit of Correctness of EntriesPatrick Penachos100% (1)

- BIR - Affidavit of Preservation of Working PapersDocument1 pageBIR - Affidavit of Preservation of Working PapersLimuel Balestramon RazonalesNo ratings yet

- Quality Accreditation Checklist Form 4Document1 pageQuality Accreditation Checklist Form 4Joy Dimaano0% (1)

- eAccReg Sworn Statement - TaxpayerDocument1 pageeAccReg Sworn Statement - TaxpayerJayson Flaviano Panganiban100% (2)

- EAccreg and ESales Enrollment FormDocument1 pageEAccreg and ESales Enrollment FormFrancis Chris100% (2)

- Loose LeafDocument1 pageLoose LeafMaricel Valerio Canlas67% (6)

- Fee InvoiceDocument2 pagesFee InvoiceBaljit SinghNo ratings yet

- Letter of Request For DeactivationDocument1 pageLetter of Request For DeactivationRonald LeabresNo ratings yet

- RevReg 13-77Document12 pagesRevReg 13-77dppascua100% (1)

- Lessee Information StatementDocument4 pagesLessee Information StatementDarryl Jay Medina75% (4)

- BIR Sample Letter of Intent For Efps (Individual)Document1 pageBIR Sample Letter of Intent For Efps (Individual)GraceKayCee50% (10)

- Notice of Death To Bir Estate SampleDocument2 pagesNotice of Death To Bir Estate SampleGlenda May100% (2)

- Sworn Declaration (Bir)Document1 pageSworn Declaration (Bir)Katherine Olidan75% (4)

- ANNEX A Notarial Letter For EsalesDocument1 pageANNEX A Notarial Letter For EsalesBryan Co100% (5)

- Inventory of Unused ReceiptsDocument1 pageInventory of Unused ReceiptsAnna Sun100% (6)

- Illustration PlanDocument3 pagesIllustration Plansohail0% (1)

- Watchtower: 1928 Convention Report - Detroit, MichiganDocument80 pagesWatchtower: 1928 Convention Report - Detroit, MichigansirjsslutNo ratings yet

- Annex B-2 RR 11-2018Document1 pageAnnex B-2 RR 11-2018Alo Rio100% (3)

- Income Payee'S Sworn Declaration of Gross Receipts/SalesDocument1 pageIncome Payee'S Sworn Declaration of Gross Receipts/SalesTacloban Rebs100% (4)

- Closure of Business With BirDocument2 pagesClosure of Business With Birjohn allen MarillaNo ratings yet

- BIR Sworn StatementDocument1 pageBIR Sworn StatementPFMPC Secretary100% (1)

- Philhealth Online Access Form (Poaf)Document5 pagesPhilhealth Online Access Form (Poaf)pogirtNo ratings yet

- New Pagibig STLRF FormatDocument6 pagesNew Pagibig STLRF FormatNen Mar0% (2)

- PESO RequirementsDocument2 pagesPESO RequirementsVher Christopher DucayNo ratings yet

- Sworn Declaration-2307 - 2020Document1 pageSworn Declaration-2307 - 2020JOHN JERALD P. MIRANDANo ratings yet

- BIR Ruling On How To Compute Book Value If There Is Unpaid SubscriptionDocument3 pagesBIR Ruling On How To Compute Book Value If There Is Unpaid SubscriptionBobby LockNo ratings yet

- A. Gross Monthly Salary: Certificate of Employment and CompensationDocument1 pageA. Gross Monthly Salary: Certificate of Employment and CompensationMary Rose LlameraNo ratings yet

- Credit Risk AnalysisDocument1 pageCredit Risk AnalysisPhilip JosephNo ratings yet

- COR and Income Payee's Sworn Declaration of Gross Receipts - Sales - Lone Income PayorDocument2 pagesCOR and Income Payee's Sworn Declaration of Gross Receipts - Sales - Lone Income PayorKw1kS0T1kNo ratings yet

- DEED of SALE (Portion of Real Estate)Document1 pageDEED of SALE (Portion of Real Estate)Eliza Corpuz Gadon100% (7)

- Ohio Complaint Against GoogleDocument17 pagesOhio Complaint Against GoogleCincinnatiEnquirerNo ratings yet

- Letter of Intent BIR-eFPSDocument1 pageLetter of Intent BIR-eFPSsheNo ratings yet

- Annex B-1 Guide, Instructions and Blank Copy: (Several Income Payors)Document4 pagesAnnex B-1 Guide, Instructions and Blank Copy: (Several Income Payors)Kristel Anne LiwagNo ratings yet

- Letter of Intent To BIR For eFPS EnrolmentDocument1 pageLetter of Intent To BIR For eFPS EnrolmentFreann Sharisse Austria100% (2)

- Special Power of Attorney BIRDocument1 pageSpecial Power of Attorney BIRJomielyn GaleraNo ratings yet

- Letter of EFPS For BIRDocument2 pagesLetter of EFPS For BIRLetty Tamayo100% (1)

- SEC Form Annex D Submission of Email Address and Mobile Numbers For CorporationDocument1 pageSEC Form Annex D Submission of Email Address and Mobile Numbers For CorporationJoy Nisolada100% (3)

- Secretary's CertificateDocument1 pageSecretary's CertificateJil MacasaetNo ratings yet

- Philhealth ER1-Employer FormDocument1 pagePhilhealth ER1-Employer FormAimee F67% (3)

- RMO 12 2013 List of Unused Expired ORsSIsCIs Annex DDocument2 pagesRMO 12 2013 List of Unused Expired ORsSIsCIs Annex DMIS MijerssNo ratings yet

- Application-for-Business-Retirement in MuntinlupaDocument1 pageApplication-for-Business-Retirement in MuntinlupajoycegNo ratings yet

- Business Tax Protest Letter SampleDocument1 pageBusiness Tax Protest Letter SampleMaristela Regidor100% (1)

- 1906 January 2018 ENCS FinalDocument1 page1906 January 2018 ENCS FinalShane Shane100% (4)

- BIR Form No. 1900Document2 pagesBIR Form No. 1900Aldrin Laloma100% (1)

- Sworn Declaration Annex B-2Document4 pagesSworn Declaration Annex B-2Theresa Redler100% (1)

- No Rent Affidavit TemplateDocument2 pagesNo Rent Affidavit TemplateRyan Jude Lim100% (1)

- Sworn DeclarationDocument1 pageSworn DeclarationGilden Joy CequenaNo ratings yet

- Annex B-1 RR 11-2018Document1 pageAnnex B-1 RR 11-2018Vincent AmomonponNo ratings yet

- Income Payee'S Sworn Declaration of Gross Receipts/SalesDocument1 pageIncome Payee'S Sworn Declaration of Gross Receipts/SalesJan DoeNo ratings yet

- Annex B 2 RR 11 2018 PDFDocument1 pageAnnex B 2 RR 11 2018 PDFDnrxsNo ratings yet

- AnnexDocument1 pageAnnexAHOUR PANGILAYANNo ratings yet

- Annex B-2 RR 11-2018Document1 pageAnnex B-2 RR 11-2018Kristine JoyceNo ratings yet

- Annex B-2 RR 11-2018Document1 pageAnnex B-2 RR 11-2018Petrovich100% (1)

- Annex B-2 RR 11-2018Document1 pageAnnex B-2 RR 11-2018Princess RegalaNo ratings yet

- Annex B-2 RR 11-2018Document1 pageAnnex B-2 RR 11-2018JadeNo ratings yet

- Annex B 1 RR 11 20181 2023Document1 pageAnnex B 1 RR 11 20181 2023danilotinio2No ratings yet

- Sworn Statement 1Document1 pageSworn Statement 1Eloisa MoniqueNo ratings yet

- Sworn Declaration - INCOME PAYEEDocument1 pageSworn Declaration - INCOME PAYEEkforteza.jtoNo ratings yet

- Annex B-1 RR 11-2018Document1 pageAnnex B-1 RR 11-2018Jose Marie De LeonNo ratings yet

- Please Attach Your COR On Page 1: (Trainer Name) (Trainer ID)Document2 pagesPlease Attach Your COR On Page 1: (Trainer Name) (Trainer ID)Jaymart de VillaNo ratings yet

- Joborder - Annex - A1 Lone Income PayorDocument1 pageJoborder - Annex - A1 Lone Income PayorNDP InfantaNo ratings yet

- Gen Bir Annex B2Document2 pagesGen Bir Annex B2ArgielJedTabalBorras100% (2)

- Agrarian Land Reform (RA 6657)Document13 pagesAgrarian Land Reform (RA 6657)Eliza Corpuz GadonNo ratings yet

- Basic Real Estate ComputationsDocument4 pagesBasic Real Estate ComputationsEliza Corpuz GadonNo ratings yet

- Agrarian Land Reform (RA 6657)Document13 pagesAgrarian Land Reform (RA 6657)Eliza Corpuz GadonNo ratings yet

- National Taxation (Income & Business Tax) OCTOBER 1, 2014Document39 pagesNational Taxation (Income & Business Tax) OCTOBER 1, 2014Eliza Corpuz GadonNo ratings yet

- Additional Notes For CARL R.A 6657Document2 pagesAdditional Notes For CARL R.A 6657Eliza Corpuz GadonNo ratings yet

- Philippine Anti CyberbullyingDocument4 pagesPhilippine Anti CyberbullyingCalimlim Kim100% (2)

- GSTR1 Excel Workbook Template V2.0Document63 pagesGSTR1 Excel Workbook Template V2.0ShyamPrasadNo ratings yet

- Module 2B. Debt RestructuringDocument17 pagesModule 2B. Debt RestructuringAaron MañacapNo ratings yet

- San Diego Municipal Code CHapter 15Document106 pagesSan Diego Municipal Code CHapter 15Chris SchulteNo ratings yet

- Disclosure of Security Vulnerabilities Legal and Ethical IssuesDocument127 pagesDisclosure of Security Vulnerabilities Legal and Ethical IssuesChemaPitolNo ratings yet

- Format of Revised Schedule Vi To The Companies Act 1956 in ExcelDocument11 pagesFormat of Revised Schedule Vi To The Companies Act 1956 in Excelanshulagarwal62No ratings yet

- School Form 1 (SF 1) School RegisterDocument3 pagesSchool Form 1 (SF 1) School RegisterFlorinda UrbiNo ratings yet

- CSPL INTERNAL DOC-AUDIT 20.jan - 21jan 21Document6 pagesCSPL INTERNAL DOC-AUDIT 20.jan - 21jan 21sukhNo ratings yet

- Password Protection PolicyDocument3 pagesPassword Protection PolicyRahul GargNo ratings yet

- Gauteng Provincial Government Places Senior Health Officials On Precautionary Suspension As The Siu Begins An Investigation Into Procurement at Tembisa HospitalDocument2 pagesGauteng Provincial Government Places Senior Health Officials On Precautionary Suspension As The Siu Begins An Investigation Into Procurement at Tembisa HospitaleNCA.comNo ratings yet

- Judiciary SystemDocument3 pagesJudiciary Systemrustam1rioNo ratings yet

- Liberation TheologyDocument19 pagesLiberation Theologyapi-3699641100% (1)

- Land Conversion (New) - GO MS No 98 - Application Form PDFDocument1 pageLand Conversion (New) - GO MS No 98 - Application Form PDFKajal IndurkhyaNo ratings yet

- Mining Investemet 2016Document12 pagesMining Investemet 2016eduardoleonsNo ratings yet

- Cambridge International AS & A Level: PHYSICS 9702/33Document8 pagesCambridge International AS & A Level: PHYSICS 9702/33Jean-Michel RatnaNo ratings yet

- Market Trend and Forecast 22 - 30 - IBED ReportDocument33 pagesMarket Trend and Forecast 22 - 30 - IBED Report7 cloudNo ratings yet

- PHOEVIE Civil Service Exam 2016 Free Answer KeyDocument9 pagesPHOEVIE Civil Service Exam 2016 Free Answer KeyPhoevie Yongao Toyhorada100% (1)

- Garasi Drift Rate CardDocument17 pagesGarasi Drift Rate CardDesi Rahmi DianaNo ratings yet

- Mahindra Finance Project PDFDocument60 pagesMahindra Finance Project PDFIMAM JAVOORNo ratings yet

- Corporate Finance, Global Edition - (Part 7 Options)Document33 pagesCorporate Finance, Global Edition - (Part 7 Options)OCNo ratings yet

- Gurpal Singh Ahluwalia, J.: Equiv Alent Citation: 2019 (3) MPLJ62Document13 pagesGurpal Singh Ahluwalia, J.: Equiv Alent Citation: 2019 (3) MPLJ62TSA LEGALNo ratings yet

- IBM Offer Letter - P. JayachandraDocument17 pagesIBM Offer Letter - P. JayachandraGuru PrasadNo ratings yet

- Askari Bank Internship ReportDocument76 pagesAskari Bank Internship Reportmalik omerNo ratings yet

- Test Bank For Advanced Accounting, 1st Edition HamlenDocument43 pagesTest Bank For Advanced Accounting, 1st Edition HamlenJanine NazNo ratings yet

- Should The General Manager Be FiredDocument10 pagesShould The General Manager Be FiredAbdul MohidNo ratings yet

- Ethical Issues in The Health Care of OlderDocument14 pagesEthical Issues in The Health Care of Olderedward osae-oppongNo ratings yet