Professional Documents

Culture Documents

Mock Test 2 Case Study

Uploaded by

Surah RahOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Mock Test 2 Case Study

Uploaded by

Surah RahCopyright:

Available Formats

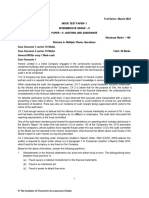

CA INTERMEDIATE (AUDITING)

CHAPTER-6 :- MOCK TEST (2)

CASE STUDY

M/s KTR & Associates , with its Partners CA Kumar , CA Tina & CA Rohan have been

appointed as auditors of Vigyaan Ltd. for the financial year 2021-22. Hema , Rekha &

Jaya are respectively the Managing , Part time & Independent directors of Vigyaan

Ltd. , while Mr. Sushil Sharma is the Secretary to the CIO. Vigyaan Ltd. is an e-

commerce company and almost all the processes, operations, accounting and

decisions are carried out by using computers in the Company. The auditors

understand that there are several aspects that they should consider to determine the

level of automation and complexity in the business environment of Vigyaan Ltd.

While planning the audit work, the engagement partners discussed with the audit

staff about the various types of controls in the automated environment. The

seniormost Article Ravi is given the task of understanding , observing & documenting

how the IT department is organized in the company , the IT activities, the IT

dependencies, relevant risks and controls . CA Tina tells her Article Vidya about using

the IDEA software in Audit operations. The different types of audit tests that can be

used in audit of an automated business environment were also discussed within the

engagement team. The responsibility regarding the Internal Financial Controls was

also discussed in detail. Further the tools and techniques that can be used to deal

with the enormous data and information of Vigyaan Ltd. were briefed to the audit

staff by the engagement partners. CA Rohan observes that the IT risks have not been

considered for and not mitigated to an acceptable level thereby impacting the

business environment such that more substantive audit work is needed to be done

by them as auditors. CA Kumar finds that the Secretary to the CIO has been given

access to the information systems that enforces less or no limits on using that

system. He requests Mr. Sunil Sharma to tell him about the Company’s documented

policy with respect to the Business Continuity Plan and Disaster Recovery Plan to

recover from failure in case any unfortunate event occurs. He further tells Article

Raman to prepare a Risk & Control Matrix as per the risks identified relating to the

Company’s Automated Environment. The team carries out the audit and while

assessing their findings to be included in the Audit Report , they find a significant

deficiency in the Internal controls and discuss among themselves as to how it should

be reported.

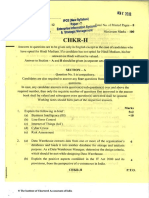

Based on the above facts, answer the following:-

1. The powers given to Mr. Sunil Sharma by the CIO falls under the category of

(a) Data breach

(b) Segregation of Duties

(c) Super/Privileged access

(d) Centralised System Control

© The Institute of Chartered Accountants of India

2. Statement 1: Section 149(8) of the Companies Act , 2013 applies to the Company and

the director Jaya specifically.

Statement 2: Section 143(3)(i) of the Companies Act , 2013 applies to Hema , Rekha ,

Jaya & Sushil altogether.

(a) Only Statement 1 is correct

(b) Only Statement 2 is correct

(c) Both Statements 1 & 2 are correct

(d) Both Statements 1 & 2 are incorrect

3. The

work allocated to article Raman is of the nature of ________ as per the Guidance note

on Internal Financial Controls issued by the ICAI.

(a) Risk Assessment

(b) Understand & Evaluate

(c) Test for Operating effectiveness

(d) Reporting

4. The work being performed by the article Divya is an example of using _____ in Audit.

(a) Audit Tests

(b) Walkthrough

(c) Written representations

(d) Data Analytics

5. As per the Audit findings of the team , they should

(a) Communicate in writing to those charged with governance.

(b) Report the matter directly to the Central Government.

(c) Test the Compensating controls in the Company.

(d) Reperform the Audit Trail.

6. Raman and his team are working in compliance with

(a) SA 315.

(b) SA 240.

(c) SA 200.

(d) SA 299.

7. CA Rohan’s observations show the impact of risks in IT environment on

(a) Substantive Audit

(b) Controls

(c) Reporting

(d) No Risk impact.

© The Institute of Chartered Accountants of India

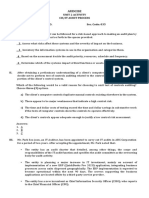

8. CA Kumar’s request to Mr. Sunil Sharma has following implications :-

Statement 1 :- It falls under the Program Change type of General Controls implemented in

the Company by the management.

Statement 2 :- His objective of the request is to ensure that access to programs and data is

authenticated and authorized to meet financial reporting objectives.

(a) Only Statement 1 is correct

(b) Only Statement 2 is correct

(c) Both Statements 1 & 2 are correct

(d) Both Statements 1 & 2 are incorrect

9. The

audit team finds a deficiency in internal control which means that control is designed,

implemented or operated in such a way that it is unable to ___________________

misstatements in the financial statements on a timely basis.

(a) prevent

(b) detect or correct

(c) prevent or correct

(d) prevent or detect and correct

10. Which of the following is a type of control deficiency or a combination of deficiencies in

internal controls that is important enough to merit the attention of those charged with

governance since there is a reasonable possibility that a material misstatement will not be

prevented or detected in a timely manner by management :-

(a) Significant Deficiency

(b) Material Weakness

(c) Significant Weakness

(d) Compensating Controls

ANSWERS

1. (c)

2. (a)

3. (b)

4. (d)

5. (a)

6. (a)

7. (b)

8. (d)

9. (d)

10. (b)

© The Institute of Chartered Accountants of India

You might also like

- Sample Internal Audit Charter For Credit UnionsDocument3 pagesSample Internal Audit Charter For Credit Unionsmary_cruz_9100% (1)

- Audit Cheat SheetDocument33 pagesAudit Cheat SheetSas Hasani100% (3)

- Wasender Bulk Whatsapp Sender Group Sender Wahtsapp Bot LicenseDocument1 pageWasender Bulk Whatsapp Sender Group Sender Wahtsapp Bot LicenseSurah Rah100% (1)

- Auditing The Art and Science of Assurance Engagements by Alvin Arens Z Liborgpdf PDF Free 264 289 DikonversiDocument37 pagesAuditing The Art and Science of Assurance Engagements by Alvin Arens Z Liborgpdf PDF Free 264 289 DikonversiLabora Dwi PutriNo ratings yet

- PRTC AUD-1stPB 05.22Document14 pagesPRTC AUD-1stPB 05.22Ciatto SpotifyNo ratings yet

- Hock CIA P2 - Mock ExamDocument50 pagesHock CIA P2 - Mock ExamFazlihaq Durrani75% (4)

- Chapter 10 FinalDocument19 pagesChapter 10 FinalMichael Hu0% (1)

- ACCA F8 Audit and Assurance Revision Notes 2017 PDFDocument84 pagesACCA F8 Audit and Assurance Revision Notes 2017 PDFJudithNo ratings yet

- THE AUDIT PROCESS - Accepting An Engagement: Financial Statement AssertionsDocument24 pagesTHE AUDIT PROCESS - Accepting An Engagement: Financial Statement AssertionsEliza Beth100% (3)

- Auditing and Assurance Services in Australia by Gay TEST BANKDocument15 pagesAuditing and Assurance Services in Australia by Gay TEST BANKEdward YangNo ratings yet

- Testbank Auditing An International ApproDocument334 pagesTestbank Auditing An International ApproHazel XuNo ratings yet

- Chapter 4 SalosagcolDocument3 pagesChapter 4 SalosagcolElvie Abulencia-BagsicNo ratings yet

- AUDIT 2 New Question PaperDocument9 pagesAUDIT 2 New Question Paperneha manglaniNo ratings yet

- Rrpa 9Document8 pagesRrpa 9mr rahulNo ratings yet

- EIS Booster Practice Session Questions CH 1 - MCQs May 23Document25 pagesEIS Booster Practice Session Questions CH 1 - MCQs May 23hdelibrate2019No ratings yet

- PRTC Aud 1st PB 05 Audit Problem and Solution - CompressDocument14 pagesPRTC Aud 1st PB 05 Audit Problem and Solution - CompressNovemae CollamatNo ratings yet

- Test Acc 5102Document2 pagesTest Acc 5102michael choggaNo ratings yet

- 7-3-24... 4110 Both... Int-5010... Audit... QueDocument5 pages7-3-24... 4110 Both... Int-5010... Audit... Quenikulgauswami9033No ratings yet

- 7 Week AssessmentDocument6 pages7 Week Assessmentkarem mohamedNo ratings yet

- © The Institute of Chartered Accountants of IndiaDocument8 pages© The Institute of Chartered Accountants of IndiaHarish KoriNo ratings yet

- All Year RTP AuditDocument564 pagesAll Year RTP AuditShivam ChaudharyNo ratings yet

- Paper 3 - Audit - TP-8Document6 pagesPaper 3 - Audit - TP-8Suprava MishraNo ratings yet

- 1554382617CA Final Audit MCQ Booklet PDFDocument25 pages1554382617CA Final Audit MCQ Booklet PDFLakshay SinghNo ratings yet

- © The Institute of Chartered Accountants of IndiaDocument8 pages© The Institute of Chartered Accountants of IndiaShrwan SinghNo ratings yet

- MTP1 May2022 - Paper 6 AuditingDocument20 pagesMTP1 May2022 - Paper 6 AuditingYash YashwantNo ratings yet

- MTP 12 21 Questions 1696771411Document8 pagesMTP 12 21 Questions 1696771411harshallahotNo ratings yet

- 20181211005-Rizkania Arum - Tugas SIA II Pert 10Document7 pages20181211005-Rizkania Arum - Tugas SIA II Pert 1020181211005 RIZKANIA ARUM PUTRINo ratings yet

- CISA Chapter 1 PracticeDocument132 pagesCISA Chapter 1 Practicedaniel geevargheseNo ratings yet

- Eis PDFDocument28 pagesEis PDFRahul GuptaNo ratings yet

- 05 - Part 1-Control and Accounting Information SystemsDocument16 pages05 - Part 1-Control and Accounting Information SystemsQuỳnh NhưNo ratings yet

- Chap 4567 AAADocument16 pagesChap 4567 AAAHà Phương TrầnNo ratings yet

- Audit Test Solution by CA Harshad Jaju SirDocument13 pagesAudit Test Solution by CA Harshad Jaju SirHetal BeraNo ratings yet

- Section E. Internal ControlsDocument5 pagesSection E. Internal Controlsrmaha2452No ratings yet

- Cuac 202 AssignmentssDocument18 pagesCuac 202 AssignmentssJoseph SimudzirayiNo ratings yet

- Mock Dec Part 2 QDocument7 pagesMock Dec Part 2 QheikNo ratings yet

- Feedback On The Self-Test - Ais 5131 Chapter 1 Part ADocument3 pagesFeedback On The Self-Test - Ais 5131 Chapter 1 Part AClarissa MenceroNo ratings yet

- CIiiiiA Part 2 - Mock Exam 2Document54 pagesCIiiiiA Part 2 - Mock Exam 2aymen marzouki100% (1)

- CA Inter Audit Q MTP 1 May 23Document7 pagesCA Inter Audit Q MTP 1 May 23Drake DDNo ratings yet

- All Mcqs Are Compulsory Question No. 1 Is Compulsory. Attempt Any Four Questions From The RestDocument12 pagesAll Mcqs Are Compulsory Question No. 1 Is Compulsory. Attempt Any Four Questions From The RestGJ ELASHREEVALLINo ratings yet

- Isca Nov 17Document23 pagesIsca Nov 17Vedant BangNo ratings yet

- © The Institute of Chartered Accountants of IndiaDocument8 pages© The Institute of Chartered Accountants of IndiaAyushi SinhaNo ratings yet

- Audit Mtp2 DoneDocument11 pagesAudit Mtp2 Donegaurav gargNo ratings yet

- CA Inter Eis SM RTP May22Document26 pagesCA Inter Eis SM RTP May22Shubham KuberkarNo ratings yet

- RTP May2022 - Paper 7 EISSMDocument26 pagesRTP May2022 - Paper 7 EISSMYash YashwantNo ratings yet

- All Yr RTP Eis SMDocument225 pagesAll Yr RTP Eis SMShivam ChaudharyNo ratings yet

- Internal ControlDocument4 pagesInternal ControlShaira Mikaela CasiñoNo ratings yet

- Audit Sample Paper and Suggested AnswerDocument60 pagesAudit Sample Paper and Suggested AnswerAyush GargNo ratings yet

- MTP m21 A Q 2Document6 pagesMTP m21 A Q 2sakshiNo ratings yet

- 3 Business Finance12Document10 pages3 Business Finance12Abdullah al MahmudNo ratings yet

- Finals SourceDocument51 pagesFinals SourceMarielle GonzalvoNo ratings yet

- AAI 2 Part 6A PSA 315 & PSA 265 N Internal Control - Rev PDFDocument101 pagesAAI 2 Part 6A PSA 315 & PSA 265 N Internal Control - Rev PDFAbigailNo ratings yet

- Eis MCQ IcaiDocument105 pagesEis MCQ IcaiRitam chaturvediNo ratings yet

- © The Institute of Chartered Accountants of IndiaDocument25 pages© The Institute of Chartered Accountants of IndiaShrwan SinghNo ratings yet

- © The Institute of Chartered Accountants of IndiaDocument154 pages© The Institute of Chartered Accountants of IndiaJattu TatiNo ratings yet

- Enterprise Information Systems: Ntermediate OurseDocument136 pagesEnterprise Information Systems: Ntermediate OurseSandeep SinghNo ratings yet

- Chapter 13Document12 pagesChapter 13Andrew PhamNo ratings yet

- Acctg 16a - Midterm ExamDocument6 pagesAcctg 16a - Midterm ExamChriestal SorianoNo ratings yet

- Audit and Assurance: Certificate in Accounting and Finance Stage ExaminationDocument4 pagesAudit and Assurance: Certificate in Accounting and Finance Stage ExaminationHamid MahmoodNo ratings yet

- CAF 8 AUD Spring 2020Document5 pagesCAF 8 AUD Spring 2020Huma BashirNo ratings yet

- Exam57501 p3 NilDocument20 pagesExam57501 p3 NilBijay AgrawalNo ratings yet

- Internal Control and Accounting System of Chic Paints LTDDocument22 pagesInternal Control and Accounting System of Chic Paints LTDPhanieNo ratings yet

- © The Institute of Chartered Accountants of IndiaDocument15 pages© The Institute of Chartered Accountants of IndiaAlok TiwariNo ratings yet

- AUDCISE Unit 2 Worksheet - Agner, Jam Althea ODocument2 pagesAUDCISE Unit 2 Worksheet - Agner, Jam Althea OdfsdNo ratings yet

- 8int 2011 Jun ADocument9 pages8int 2011 Jun ADawn CaldeiraNo ratings yet

- Answers Chapter 1Document43 pagesAnswers Chapter 1Maricel Inoc FallerNo ratings yet

- (Chegg) Which of The Following Activities Are Assoclated With A Company's Financial Reporting Informnation System?Document143 pages(Chegg) Which of The Following Activities Are Assoclated With A Company's Financial Reporting Informnation System?Anh Đinh Hồ TuyếtNo ratings yet

- Test (Fia) TwoDocument9 pagesTest (Fia) TwotshepomoejanejrNo ratings yet

- A Study of the Supply Chain and Financial Parameters of a Small BusinessFrom EverandA Study of the Supply Chain and Financial Parameters of a Small BusinessNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionNo ratings yet

- Ef in 440686Document1 pageEf in 440686Surah RahNo ratings yet

- OCR ThisDocument11 pagesOCR ThisSurah RahNo ratings yet

- Lotus Flexible Multipurpose Responsive WP Theme LicenseDocument1 pageLotus Flexible Multipurpose Responsive WP Theme LicenseSurah RahNo ratings yet

- T.Y. B. Com Auditing (MCQ'S) by Asst. Prof. Pravin Kad (M. Com., SET, NET) 8788167249 (Document13 pagesT.Y. B. Com Auditing (MCQ'S) by Asst. Prof. Pravin Kad (M. Com., SET, NET) 8788167249 (Kadam KartikeshNo ratings yet

- PRINCIPLES OF AUDITING Bharathiar University III B COM PADocument59 pagesPRINCIPLES OF AUDITING Bharathiar University III B COM PAkalpanaNo ratings yet

- Module 2 - Introduction To FS AuditDocument5 pagesModule 2 - Introduction To FS AuditLysss EpssssNo ratings yet

- Jurnal 1Document20 pagesJurnal 1NingratmartaNo ratings yet

- NGO Reference Model: Impact ContextDocument2 pagesNGO Reference Model: Impact ContextRai KharalNo ratings yet

- Grace Gural-Balaguer: Acctg 22 InstructorDocument59 pagesGrace Gural-Balaguer: Acctg 22 InstructorMary CuisonNo ratings yet

- Management Control SystemDocument159 pagesManagement Control SystemRishi Johnny Raina100% (2)

- ICAO Part 3 - A Guide For ExpertsDocument17 pagesICAO Part 3 - A Guide For ExpertsrofavamaNo ratings yet

- ICOFR Presentation 18 October 2021Document20 pagesICOFR Presentation 18 October 2021omar_geryesNo ratings yet

- THESES Corporate Governance Achille SIMO PDFDocument61 pagesTHESES Corporate Governance Achille SIMO PDFLouis Al BedouinNo ratings yet

- Auditing Theory Mcqs by Salosagcol With AnswersDocument31 pagesAuditing Theory Mcqs by Salosagcol With AnswersLeonard Cañamo100% (1)

- CH 10 - Understanding Entity and Its EnvironmentDocument8 pagesCH 10 - Understanding Entity and Its EnvironmentJwyneth Royce DenolanNo ratings yet

- Reporting ScriptDocument3 pagesReporting ScriptMitch Tokong MinglanaNo ratings yet

- Kpmg-Entrance-Test 21.22Document13 pagesKpmg-Entrance-Test 21.22Vũ Tăng ThếNo ratings yet

- Cis FinalsDocument19 pagesCis FinalsVillena Divina VictoriaNo ratings yet

- Lecture Notes: Manila Cavite Laguna Cebu Cagayan de Oro DavaoDocument5 pagesLecture Notes: Manila Cavite Laguna Cebu Cagayan de Oro DavaoDenny June CraususNo ratings yet

- Revenue and Collection CycleDocument12 pagesRevenue and Collection CycleLydelle Mae CabaltejaNo ratings yet

- Manalastas, Jimbo P. Activity Module 6Document4 pagesManalastas, Jimbo P. Activity Module 6Jimbo ManalastasNo ratings yet

- Substantive Testing New N CompleteDocument3 pagesSubstantive Testing New N CompleteRaja Ghufran ArifNo ratings yet

- Checklist - SOX ComplianceDocument6 pagesChecklist - SOX ComplianceAnantha Raman100% (1)

- Answers3600 QuizDocument156 pagesAnswers3600 QuizDuc Anh DoanNo ratings yet

- Auditing Theory: (Test Bank) Gerardo S. RoqueDocument82 pagesAuditing Theory: (Test Bank) Gerardo S. RoqueYukiNo ratings yet