Professional Documents

Culture Documents

Reliance Nippon Life IPO Note 091017-1509530730

Uploaded by

Krishna GoyalCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Reliance Nippon Life IPO Note 091017-1509530730

Uploaded by

Krishna GoyalCopyright:

Available Formats

Reliance Nippon Life Asset Management Information Note

Premia Research Issue Opens: October 25, 2017 Issue Closes: October 27, 2017 Price Band: ` 247-` 252

This document summarizes a few key points related to the issue and should not be treated as a comprehensive summary. Investors are

requested to refer the Red Herring Prospectus for further details regarding the issue, the issuer company and the risk factors before taking any

Recommendation investment decision. Please note that investment in securities is subject to risks including loss of principal amount and past performance is not

indicative of future performance. Nothing herein constitutes an offer of securities for sale in any jurisdiction where it is unlawful to do so.

Not Rated

This document is not intended to be an advertisement and does not constitute an invitation or form any part of any issue for sale or solicitation

of an offer to subscribe for or purchase any securities and neither this document nor anything contained herein shall form the basis for any

Issue Details contract or commitment whatsoever.

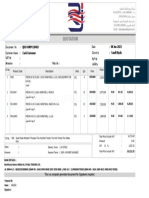

Face Value: `10 Company Overview

Public Issue 612 lakh Shares Reliance Nippon Life Asset Management (RNLAM) is one of the largest asset

Employee Reservation - management companies (AMC) in India, managing total AUM of `3.6 lakh crore as of

Price Band : `247-252 June 30, 2017.

Issue Size# ~`1,542 Cr The Company is involved in managing 1) mutual funds (MF, including ETFs); 2)

Bid lot 59 Equity shares

managed accounts, including portfolio management services, alternative investment

funds (AIFs) and pension funds; and 3) offshore funds and advisory mandates.

Issue Type: 100% Book building

Post Issue Market Cap#: ~` 15,422 Cr; Note: # - at upper band

According to ICRA RNLAM (is/was/has) –

o Ranked the third largest AMC, in terms of MF quarterly average AUM

% Shareholding Pre IPO (QAAUM) with a market share of 11.4%, as of June 30, 2017.

Promoter 96 o Ranked the second most profitable AMC in India in FY16.

o Highest total MF monthly average AUM (MAAUM) among all AMCs in India

Public 4

Source: RHP

from beyond top 15 (B-15) locations as of June 30, 2017.

o Second highest retail MAAUM in India as of June 30, 2017.

Share Reservation % of Issue o 18.6 Lakh SIP accounts with monthly inflows of ~`510 Cr (June 30, 2017).

QIB 50 Offer Details

NII 15 The offer consists of fresh issue of up to 244.8 lakh shares aggregating up to

Retail 35 `605/`617Cr at lower/upper end of the price band and Offer for Sale of up to 367.2 lakh

shares by selling shareholders Nippon Life Insurance Company and Reliance Capital

Company Management Limited.

Sundeep Sikka ED & CEO The proceeds from the issue will be utilized towards – Setting up new branches and

Prateek Jain CFO relocating certain existing branches (`38 Cr); Upgrading IT systems (`41 Cr); Advertising,

marketing and brand building activities (`72 Cr); Lending to company’s Subsidiary

(Reliance AIF) for investment of continuing interest in the new AIF schemes managed by

Issue Managers Reliance AIF (`125 Cr); Investing towards company’s continuing interest in new mutual

IIFL Holdings, Axis Capital, JM fund schemes managed by the company (`100 Cr); Funding inorganic growth and

Financial, CLSA India, Nomura

BRLMs

Financial, Edelweiss Financial, SBI

strategic initiatives (`165 Cr); and General corporate purposes.

Capital and Yes Securities Key Positives

Registrar Karvy Computershare Pvt Ltd. RNLAM has largest total MF MAAUM from smaller cities and towns, second most

profitable AMC in FY16 and third largest MF in terms of QAAUM. Its total revenues and

PAT has increased by a CAGR of 18.2% and 15.0%, respectively over FY13-17.

Financial Summary

Analysts: Milan Desai Consolidated `Cr. FY15 FY16 FY17 Q1FY18*

E-mail: research@iifl.com Revenue from operations 847 1,200 1,307 364

YoY growth (%) 25.4 41.6 9.0 --

October 13, 2017

Profit Before Tax 464 522 581 130

Reported PAT 354 396 403 88

EPS‐ Diluted (`) 6.3 6.8 6.9 1.5

RoE (%) 23.1 22.1 21.3 --

Source: Company, IIFL Research; * Q1FY18 figures are not annualized

*For additional information and risk factors please refer to the Red Herring Prospectus. Please note that this document is for information purpose only.

Reliance Nippon Life Asset Management

Premia Research

Key Points

Leading Asset Management Company with Strong Credentials to Drive Growth

RNLAM is the third largest AMC in India, in terms of MF QAAUM, as of June 30, 2017,

according to ICRA report. It has strong relationships with distributors and investors,

consisting of individual (retail and HNIs) and institutional investors. Report further states,

RNLAM has a diversified investor base wherein it manages asset for 70.1 lakh investor

folios, which comprised 67.2 lakh retail folios. The MAAUM of retail investors managed by

it was the 2nd largest (with a total market share of 13.6%) among asset management

companies in India, according to ICRA. Furthermore, its branches are spread across 145

districts in India.

77 of the S&P BSE 100 companies have invested with RNLAM as of June 30, 2017 and the

company also managed assets for other small, medium and large corporates in India.

QAAUM, total revenues and profit after tax have increased by a compound annual growth

rate of 22.2%, 18.2% and 15.0%, respectively over FY13-17. According to ICRA, the

company had the highest net worth among the top five AMCs based on AAUM in India, as

of March 31, 2016.

Multi Channel Distribution Network

RNLAM has strong presence across India, has set up subsidiaries in Singapore and

Mauritius and a representative office in Dubai. In India, the company has a pan-India

network of 171 branches, of which 132 branches are located in B-15 locations and

approximately 58,000 distributors as of June 30, 2017. Its distributors comprise IFAs,

foreign banks, Indian private and public sector banks, broking companies, national

distributors and digital platforms. The company intends to continue to strengthen its

relationships with IFAs which allows it to reach investors in remote areas. The company’s

access to large and diversified distributor base has enabled it to build long-term retail

assets and none of its distributors account for over 4% of AUM, as of June 30, 2017.

The MAAUM of retail investors managed by it was ~` 58,400cr, which was the 2nd largest

among AMCs in India according to ICRA. Further, it had the highest total MF MAAUM

among all AMCs in India from beyond top 15 locations, as of June 30, 2017.

Key Risks

Macroeconomic Conditions in India

Macroeconomic conditions in India are likely to affect the performance of funds managed

by the company, which may in-turn affect AUM managed by it, its management fees and

revenue.

Increase in competition

Competition from existing and new market participants offering investment products

could reduce the company’s market share or put downward pressure on its fees.

Premia Research

Disclaimer

Recommendation Parameters for Fundamental/Technical Reports:

Buy – Absolute return of over +10%

Accumulate – Absolute return between 0% to +10%

Reduce – Absolute return between 0% to -10%

Sell – Absolute return below -10%

IIFL Holdings Limited and India Infoline Limited (part of the India Infoline Group) are involved in the initial public offering of Reliance Nippon Life Asset Management Limited,

in the capacity of a Book Running Lead Manager and a Syndicate Member to the Issue. However IIFL Holdings Limited and India Infoline Limited shall not be in any way

responsible for the contents hereof, any omission therefrom or shall be liable for any loss whatsoever arising from use of this document or otherwise arising in connection

therewith, including with respect to forward looking statements, if any. Neither IIFL Holdings Limited nor India Infoline Limited or any of its affiliates, group companies,

directors, employees, agents or representatives shall be liable for any damages whether direct, indirect, special or consequential including lost revenue or lost profits that may

arise from or in connection with the use of the information.

Please refer to http://www.indiainfoline.com/research/disclaimer for recommendation parameter, analyst disclaimer and other disclosures.

Published in 2017. © India Infoline Ltd 2017, India Infoline Limited (Formerly “India Infoline Distribution Company Limited”), CIN No.: U99999MH1996PLC132983, Corporate

Office – IIFL Centre, Kamala City, Senapati Bapat Marg, Lower Parel, Mumbai – 400013 Tel: (91-22) 4249 9000 .Fax: (91-22) 40609049, Regd. Office – IIFL House, Sun Infotech

Park, Road No. 16V, Plot No. B-23, MIDC, Thane Industrial Area, Wagle Estate, Thane – 400604 Tel: (91-22) 25806650. Fax: (91-22) 25806654 E-mail: mail@iifl.com Website:

www.indiainfoline.com, Refer www.indiainfoline.com for detail of Associates.

National Stock Exchange of India Ltd. SEBI Regn. No.: INB231097537/ INF231097537/ INE231097537, Bombay Stock Exchange Ltd. SEBI Regn. No.: INB011097533/

INF011097533/ BSE-Currency, MCX Stock Exchange Ltd. SEBI Regn. No.: INB261097530/ INF261097530/ INE261097537, United Stock Exchange Ltd. SEBI Regn. No.:

INE271097532, PMS SEBI Regn. No. INP000002213, IA SEBI Regn. No. INA000000623, SEBI RA Regn.:- INH000000248.

For Research related queries, write at research@iifl.com

For Sales and Account related information, write to customer care: cs@iifl.com or call on 91-22 4007 1000

You might also like

- HDFC Asset Management Company LimitedDocument3 pagesHDFC Asset Management Company LimitedmadhpanNo ratings yet

- Piramal Enterprises - MOStDocument8 pagesPiramal Enterprises - MOStdarshanmadeNo ratings yet

- Jstreet 344Document10 pagesJstreet 344JhaveritradeNo ratings yet

- VIB - Section2 - Group5 - Final Project - ReportDocument13 pagesVIB - Section2 - Group5 - Final Project - ReportShrishti GoyalNo ratings yet

- Nirmal Bang 26th July 2018 IPO NoteDocument13 pagesNirmal Bang 26th July 2018 IPO NoteNiruNo ratings yet

- Comparative Analysis of Mutual Fund Schemes and Major Investment AvenuesDocument52 pagesComparative Analysis of Mutual Fund Schemes and Major Investment AvenuesPrithvi Raj SinghNo ratings yet

- JSTREET Volume 330Document10 pagesJSTREET Volume 330JhaveritradeNo ratings yet

- Latent View Analytics Limited Ipo: All You Need To Know AboutDocument7 pagesLatent View Analytics Limited Ipo: All You Need To Know AboutPeterNo ratings yet

- Welspun Enterprises LTD - Investor Presentation - 2Document36 pagesWelspun Enterprises LTD - Investor Presentation - 2Dwijendra ChanumoluNo ratings yet

- ICICI Securities IPO NoteDocument7 pagesICICI Securities IPO NoteKrishna GoyalNo ratings yet

- Reliance Capital: Reliance Home Finance: A Deep Dive Into Business ModelDocument15 pagesReliance Capital: Reliance Home Finance: A Deep Dive Into Business Modelsharkl123No ratings yet

- Equity Research (Titan Biotech Limited)Document9 pagesEquity Research (Titan Biotech Limited)Dhruv ThakkarNo ratings yet

- J-STREET Volume 349Document10 pagesJ-STREET Volume 349JhaveritradeNo ratings yet

- Icici Securities RudraDocument7 pagesIcici Securities RudraSachinShingoteNo ratings yet

- Spandana Sphoorty Financial Limited IPO Note-201908050934443167041Document13 pagesSpandana Sphoorty Financial Limited IPO Note-201908050934443167041tanmayNo ratings yet

- 7 Undervalued Stocks With High Growth Potential Over Next One YearDocument6 pages7 Undervalued Stocks With High Growth Potential Over Next One Yearhoney1002No ratings yet

- June 2019 Investor LetterDocument7 pagesJune 2019 Investor LetterMohit AgarwalNo ratings yet

- JM Financial - Initiating CoverageDocument11 pagesJM Financial - Initiating Coveragerchawdhry123No ratings yet

- HSL PCG Investment Idea - CITY UNION BANK LTD.Document14 pagesHSL PCG Investment Idea - CITY UNION BANK LTD.kishore13No ratings yet

- Capital FirstDocument34 pagesCapital FirstgreyistariNo ratings yet

- GIC Housing Finance LTD: Retail ResearchDocument14 pagesGIC Housing Finance LTD: Retail ResearchumaganNo ratings yet

- Divedend Stks 15 102018Document2 pagesDivedend Stks 15 102018ShanmugamNo ratings yet

- HDFC Standard Life - BUY (Differentiated Franchise) 20180101 PDFDocument68 pagesHDFC Standard Life - BUY (Differentiated Franchise) 20180101 PDFAmit Kumar AgrawalNo ratings yet

- For Those Who Play To Win.: Midcap Fund Midcap FundDocument4 pagesFor Those Who Play To Win.: Midcap Fund Midcap FundABCNo ratings yet

- Spandana Sphoorty Financial Limited - Company Profile, Issue Details, Balance Sheet & Key Ratios - Angel BrokingDocument7 pagesSpandana Sphoorty Financial Limited - Company Profile, Issue Details, Balance Sheet & Key Ratios - Angel Brokingmoisha sharmaNo ratings yet

- AngelBrokingResearch SpandanaSpoorty LTD IPO 03082019Document7 pagesAngelBrokingResearch SpandanaSpoorty LTD IPO 03082019durgasainathNo ratings yet

- Reliance Capital - Initiating Coverage - Centrum 06122012Document19 pagesReliance Capital - Initiating Coverage - Centrum 06122012nit111No ratings yet

- Jstreet 343Document10 pagesJstreet 343JhaveritradeNo ratings yet

- Jstreet 345Document10 pagesJstreet 345JhaveritradeNo ratings yet

- Managing Director's Message: BriefingDocument126 pagesManaging Director's Message: Briefingsid2007goelNo ratings yet

- Research Report On LKP SecDocument9 pagesResearch Report On LKP SecVipin PatilNo ratings yet

- Geojit Financial AmbitInsights - 29may2017Document8 pagesGeojit Financial AmbitInsights - 29may2017Ganesh Cv0% (1)

- Edelweiss Crossover Opportunities Fund - Series II - December 2018Document2 pagesEdelweiss Crossover Opportunities Fund - Series II - December 2018Ashish Agrawal100% (1)

- Mosl Hdfclife-Nov 2017Document62 pagesMosl Hdfclife-Nov 2017rchawdhry123No ratings yet

- Medreich LimitedDocument7 pagesMedreich LimitedAnishNo ratings yet

- Can Fin Homes - IC Oct, 2017Document11 pagesCan Fin Homes - IC Oct, 2017milandeepNo ratings yet

- JSTREET Volume 347Document10 pagesJSTREET Volume 347Jhaveritrade100% (1)

- Quess CorpDocument22 pagesQuess CorpdcoolsamNo ratings yet

- Kiri Industries - 2017 - HdfcsecDocument16 pagesKiri Industries - 2017 - HdfcsecHiteshNo ratings yet

- Axis SmallcapDocument79 pagesAxis SmallcapJatin SoniNo ratings yet

- PNB Metlife Annual Report 2017-18 - tcm47-67181Document211 pagesPNB Metlife Annual Report 2017-18 - tcm47-67181Ishita YadavNo ratings yet

- The Megatrend in Financialization of Savings in India-Explained in Three ChartsDocument5 pagesThe Megatrend in Financialization of Savings in India-Explained in Three ChartsSumangalNo ratings yet

- Management Integrity: 24 Annual Wealth Creation Study (2014-2019)Document56 pagesManagement Integrity: 24 Annual Wealth Creation Study (2014-2019)Sudhir ShastriNo ratings yet

- Sharekhan's Top SIP Fund PicksDocument4 pagesSharekhan's Top SIP Fund PicksemailamiyaNo ratings yet

- TeamLease Services Private LTD GR SDocument16 pagesTeamLease Services Private LTD GR SSk.Abdul NaveedNo ratings yet

- Angel One: IndiaDocument9 pagesAngel One: IndiaRam JaneNo ratings yet

- Dewan Housing Finance LTD: Retail ResearchDocument9 pagesDewan Housing Finance LTD: Retail ResearchSreenivasulu E NNo ratings yet

- Mirae Asset India Opportunities Fund (MAIOF) : Product Update December 2017Document2 pagesMirae Asset India Opportunities Fund (MAIOF) : Product Update December 2017pramodkrishnaNo ratings yet

- Team Members: Rahul Nandi Jiwan Ankit Raj Supratim DharDocument25 pagesTeam Members: Rahul Nandi Jiwan Ankit Raj Supratim DharVivaan WayneNo ratings yet

- Outlook Publishing (India) Private Limited: Summary of Rated InstrumentsDocument7 pagesOutlook Publishing (India) Private Limited: Summary of Rated InstrumentsKetan BhoiNo ratings yet

- SIP-Shape by AMFI PDFDocument60 pagesSIP-Shape by AMFI PDFBiresh SalujaNo ratings yet

- Latent View Analytics LTD.: Leading Data Analytics Company Within A Growing IndustryDocument21 pagesLatent View Analytics LTD.: Leading Data Analytics Company Within A Growing IndustryAJ WalkerNo ratings yet

- Practical Valuation Guide For InvestingDocument56 pagesPractical Valuation Guide For Investingsadaf hashmiNo ratings yet

- Script Code: 531179 ISIN: INE109C01017 Symbol: ARMANFIN Series: EQDocument42 pagesScript Code: 531179 ISIN: INE109C01017 Symbol: ARMANFIN Series: EQvermaanuradha823No ratings yet

- Sharekhan's Top SIP Fund PicksDocument4 pagesSharekhan's Top SIP Fund PicksSamir PatelNo ratings yet

- Summary of Saurabh Mukherjea, Rakshit Ranjan & Salil Desai's Diamonds in the DustFrom EverandSummary of Saurabh Mukherjea, Rakshit Ranjan & Salil Desai's Diamonds in the DustNo ratings yet

- Analytical Corporate Valuation: Fundamental Analysis, Asset Pricing, and Company ValuationFrom EverandAnalytical Corporate Valuation: Fundamental Analysis, Asset Pricing, and Company ValuationNo ratings yet

- Risk Premium & Management - an Asian Direct Real Estate (Dre) PerspectiveFrom EverandRisk Premium & Management - an Asian Direct Real Estate (Dre) PerspectiveNo ratings yet

- Summary of Michael J. Mauboussin & Alfred Rappaport's Expectations InvestingFrom EverandSummary of Michael J. Mauboussin & Alfred Rappaport's Expectations InvestingNo ratings yet

- Ipo Note Go FashionDocument7 pagesIpo Note Go FashionKrishna GoyalNo ratings yet

- IPO NOTE Concord Biotech Ltd.Document12 pagesIPO NOTE Concord Biotech Ltd.Krishna GoyalNo ratings yet

- IdeaForge Technology IPO Note Motilal OswalDocument9 pagesIdeaForge Technology IPO Note Motilal OswalKrishna GoyalNo ratings yet

- IPO Note - Sula Vineyards LTDDocument2 pagesIPO Note - Sula Vineyards LTDKrishna GoyalNo ratings yet

- IPO Note SBFC Finance LTDDocument14 pagesIPO Note SBFC Finance LTDKrishna GoyalNo ratings yet

- IPO NOTE Concord Biotech Ltd.Document12 pagesIPO NOTE Concord Biotech Ltd.Krishna GoyalNo ratings yet

- Imran Updated CVDocument4 pagesImran Updated CVimran qumarNo ratings yet

- 362-Project OverviewDocument9 pages362-Project OverviewMichael ImperatoNo ratings yet

- Big Data KPMGDocument4 pagesBig Data KPMGTim Van den WijngaertNo ratings yet

- ESIC Benefits at A GlanceDocument5 pagesESIC Benefits at A Glancevix8No ratings yet

- Department of Agricultural and Plantation Engineering Faculty of Engineering Technology The Open University of Sri LankaDocument2 pagesDepartment of Agricultural and Plantation Engineering Faculty of Engineering Technology The Open University of Sri LankaDK White LionNo ratings yet

- Determinants of Successful Loan Repayment Performance of Private Borrowers in Development Bank of Ethiopia, North RegionDocument84 pagesDeterminants of Successful Loan Repayment Performance of Private Borrowers in Development Bank of Ethiopia, North Regionnega cheruNo ratings yet

- MarchDocument214 pagesMarchbhargavtangudu117No ratings yet

- Rice Price Crisis: Causes, Impacts, and Solutions: Sushil Pandey Mark W. RosegrantDocument15 pagesRice Price Crisis: Causes, Impacts, and Solutions: Sushil Pandey Mark W. RosegrantJohn Khiener AbendanNo ratings yet

- Molisteel - PowerPointDocument35 pagesMolisteel - PowerPointPatel Ki BahuNo ratings yet

- Allocative Efficiency Vs X EfficiencyDocument25 pagesAllocative Efficiency Vs X EfficiencyaasdNo ratings yet

- Partnership DissolutionDocument4 pagesPartnership DissolutionBianca IyiyiNo ratings yet

- Profile - Teledipity 2Document1 pageProfile - Teledipity 2Nayara TeodoroNo ratings yet

- 2020 Cerner Annual ReportDocument121 pages2020 Cerner Annual ReportmsanrxlNo ratings yet

- Computerised System Validation - Introduction To Risk Management - The GAMP® 5 ApproachDocument6 pagesComputerised System Validation - Introduction To Risk Management - The GAMP® 5 ApproachHuu TienNo ratings yet

- AirSial TICKET 1P547CDocument2 pagesAirSial TICKET 1P547CBASIT100% (2)

- BS en 10088-4-2009Document48 pagesBS en 10088-4-2009khanhNo ratings yet

- Bloomberg User Manual 2nd Edition 2018 Chapter 6 PDFDocument21 pagesBloomberg User Manual 2nd Edition 2018 Chapter 6 PDFRolandNo ratings yet

- QTN FreonDocument1 pageQTN Freonsanad alsoulimanNo ratings yet

- Problem 23-10 QuickBooks Guide PDFDocument2 pagesProblem 23-10 QuickBooks Guide PDFJoseph SalidoNo ratings yet

- Constitutional Law Primer Bernas-1-258-276Document19 pagesConstitutional Law Primer Bernas-1-258-276Shaira Jean SollanoNo ratings yet

- Azure Data Platform Overview PDFDocument30 pagesAzure Data Platform Overview PDFpraveenindayNo ratings yet

- Instruction Kit For Eform Sh-8Document11 pagesInstruction Kit For Eform Sh-8maddy14350No ratings yet

- Open Banking: Global State of PlayDocument16 pagesOpen Banking: Global State of PlayaldykurniawanNo ratings yet

- CIRIA Report PR62 - Fundamental Basis of Grout Injection For Ground TreatmentDocument58 pagesCIRIA Report PR62 - Fundamental Basis of Grout Injection For Ground TreatmentCJODoNo ratings yet

- Good Man Wave TheoryDocument20 pagesGood Man Wave TheorySantoso Adiputra Mulyadi100% (2)

- Free Work Method Statement QueenslandDocument10 pagesFree Work Method Statement QueenslandPaul RobertsNo ratings yet

- Substantive Test of Intangible Assets, Prepaid Expenses (Autosaved)Document38 pagesSubstantive Test of Intangible Assets, Prepaid Expenses (Autosaved)Mej AgaoNo ratings yet

- Essex College: Operation Management (British Aerospace)Document25 pagesEssex College: Operation Management (British Aerospace)Ahmed BilalNo ratings yet

- Final Chapter 6 Financial PlanDocument26 pagesFinal Chapter 6 Financial Planangelo felizardoNo ratings yet

- LS4. Products and Services Leah GDocument2 pagesLS4. Products and Services Leah GConnie LopicoNo ratings yet