Professional Documents

Culture Documents

Download

Uploaded by

Sruthi RenganathCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Download

Uploaded by

Sruthi RenganathCopyright:

Available Formats

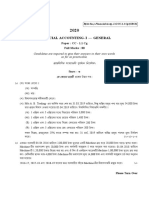

Semester III Financial Accounting-III Unit V – Dissolution of Partnership Firm

Dissolution of a Partnership Firm

Session – 55

Accounting for Dissolution- Ledger Accounts

Illustration 3

The Balance Sheet of Ram, Rahim and Robert as on 31st March, 2020 was as under:

Liabilities Amount Assets Amount

[Rs.] [Rs.]

Creditors 17,800 Machinery 30,000

Loan from Brown 6.200 Fixtures 2,000

Ram's Loan 15,000 Stock 10,400

Joint Life Policy Reserve 12,400 Debtors 18,400

Capitals: Less: R.B.D 400 18,000

Ram 30,000 Joint Life Policy 15,000

Rahim 10,000 Patents 10,000

Robert 2,000 Cash 8,000

93,400 93,400

The partners shared profits and losses in the ratio of 4:2:3. The firm was dissolved on

31.3.2020 and you are given the following information:

1. Robert had taken a loan from insurers for Rs. 5,000 on the security of the Joint life policy.

The policy was surrendered and insurers paid a sum of Rs.10,200 after deducting Rs.5,000

for Robert's loan and Rs.300 interest

2. One of the creditor took some of patents whose book value was Rs. 6,000 at a valuation

of Rs. 4,500. The balance to that creditor was paid in cash.

3. Shares worth Rs. 3,000 not shown in the Balance Sheet were given to Brown at this value.

4. The remaining assets realised as follows:

Machinery Rs. 17.000, Fixtures Rs.1,000, Stock Rs.9,000, Debtors Rs.16,500.

Digital Learning –DCE Mangalore University

Semester III Financial Accounting-III Unit V – Dissolution of Partnership Firm

5. All liabilities were paid and a total discount of Rs. 500 was allowed by the creditors.

6. The expenses of realisation amounted to Rs. 2,300

7. The remaining patents realised 50% of their book value.

Prepare Realisation Account, Partners’ Capital Accounts, Ram's Loan A/c and Bank Alc. to

close the books of the firm.

Books of Ram, Rahim and Robert

Realisation Account

Amount Amount

[Rs.] [Rs.]

To Machinery 30,000 By R.B.D 400

To Fixtures 2,000 By Creditors 17,800

To Stock 10,400 By Loan from Brown 6,200

To Debtors 18,400 By Joint Life Policy Reserve 12,400

To Joint Life Policy 15,000 By Roberts Capital [Note.1] 5,300

To Patents 10,000 By Bank A/c

To Bank Account: Joint Life Policy [Note 1] 10,200

Creditors (Note 2) 12,800 Machinery 17,000

Brown's loan 3,200 Fixtures 1,000

[6,200 - 3,000] Stock 9,000

To Realisation Debtors 16,500

Expenses 2,300 18,300 Patents [50% of Rs.4,000] 2000 55,700

By Capitals:

Ram 2,800

Rahim 1,400

Robert 2,100 6,300

1,04,100 1,04,100

Digital Learning –DCE Mangalore University

Semester III Financial Accounting-III Unit V – Dissolution of Partnership Firm

Partners' Capital Accounts

Ram Rahim Rober Ram Rahim Robert

t

To Realisation A/c - - 5,300 By Balance B/d 30,000 10,000 2000

To Realisation A/c. 2,800 1,400 2,100 By Bank Account - - 5,400

To Bank A/c. 27,200 8,600 -

30,000 10,000 7,400 30,000 10,000 7,400

Ram's Loan A/c

Amount Amount

[Rs.] [Rs.]

To Bank Account 15,000 By Balance B/d 15,000

15,000 15,000

Bank Account

Amount Amount

[Rs.] [Rs.]

To Balance B/d 8,000 By Realisation Account 18,300

To Realisation Account 55,700 By Ram's Loan Account 15,000

To Roberts Capital Account 5,400 By Capitals:

Ram 27,200

Rahim 8,600

69,100 69,100

Note: 1. Amount realised from Joint Life Policy:

Amount received from insurers 10,200

Robert's loan and interest 5,300

Total amount duo 15,500

Entry for that:

Digital Learning –DCE Mangalore University

Semester III Financial Accounting-III Unit V – Dissolution of Partnership Firm

Bank A/c. Dr. 10,200

Robert's Capital A/c. Dr. 5,300

To Realisation Ac 15,000

2. Amount paid to creditors: Rs.

Creditor due 17,800

Less: Patents taken by creditors 4,500

13,300

Less Discount allowed by creditors 500

12,800

Reference:

Karunakar Nayak, (2019), Financial Accounting III, Mangalore, United Agencies.

Digital Learning –DCE Mangalore University

You might also like

- Accounts Dissolution Test 3rd SemesterDocument6 pagesAccounts Dissolution Test 3rd SemesterNeha agarwalNo ratings yet

- Bos 28432 CP 14Document53 pagesBos 28432 CP 14Basant Ojha100% (1)

- Partner Ship - IIDocument6 pagesPartner Ship - IIM JEEVARATHNAM NAIDUNo ratings yet

- Amalgamation - Example 1 to 4Document4 pagesAmalgamation - Example 1 to 4Zhong HanNo ratings yet

- FND Partnership QuestionDocument3 pagesFND Partnership QuestionShweta BhadauriaNo ratings yet

- Partnership - I: Change in Profit Sharing RatioDocument33 pagesPartnership - I: Change in Profit Sharing RatioUjjwal BeriwalNo ratings yet

- Additional Illustrations-8Document9 pagesAdditional Illustrations-8Thulsi JayadevNo ratings yet

- Balance Sheet 1st Year 2nd Year Rs. RsDocument1 pageBalance Sheet 1st Year 2nd Year Rs. Rsjayesh janiNo ratings yet

- Faculty of Commerce & Business Management 6234/11Document28 pagesFaculty of Commerce & Business Management 6234/11Vishu DcpNo ratings yet

- Corporate Accounting Ii-1Document4 pagesCorporate Accounting Ii-1ARAVIND V KNo ratings yet

- Corporate Accounting - I Semester ExaminationDocument7 pagesCorporate Accounting - I Semester ExaminationVijay KumarNo ratings yet

- Cbse Questions Adm RetirementDocument19 pagesCbse Questions Adm RetirementDeepanshu kaushikNo ratings yet

- Unit 3 Admission of A Partner QuestionsDocument4 pagesUnit 3 Admission of A Partner QuestionsMitesh SethiNo ratings yet

- II Puc Accountancy Mock Paper IIDocument5 pagesII Puc Accountancy Mock Paper IISAI KISHORENo ratings yet

- Unit 4 & 5 Partnership - SuggestedDocument5 pagesUnit 4 & 5 Partnership - Suggestedomkolhe0007No ratings yet

- Partnership Final AccountDocument1 pagePartnership Final Accountsujan Bhandari100% (1)

- 12 2006 Accountancy 1Document5 pages12 2006 Accountancy 1Akash TamuliNo ratings yet

- Retirment of PartnerDocument30 pagesRetirment of PartnerRoozbeh ElaviaNo ratings yet

- Admission of PartnerDocument3 pagesAdmission of PartnerPraWin KharateNo ratings yet

- 11 - Final Accounts Assessment 4 PDFDocument7 pages11 - Final Accounts Assessment 4 PDFShreyas ParekhNo ratings yet

- XDocument5 pagesXSAI KISHORENo ratings yet

- Partnership Accounting SolutionsDocument21 pagesPartnership Accounting SolutionsAkmal MalikNo ratings yet

- Test DissolutionDocument1 pageTest DissolutionGauri SinglaNo ratings yet

- Register No. H 1972 - Principles of Accounting Exam QuestionsDocument7 pagesRegister No. H 1972 - Principles of Accounting Exam QuestionsAswinBhimaNo ratings yet

- Retirement and Dissolution of Firm Class TestDocument2 pagesRetirement and Dissolution of Firm Class TestHarish RajputNo ratings yet

- Accounts Parntership TestDocument6 pagesAccounts Parntership TestdhruvNo ratings yet

- PT 06 (Partnership) (5 Dec)Document8 pagesPT 06 (Partnership) (5 Dec)Rajesh Kumar100% (1)

- Dissolution of FirmDocument4 pagesDissolution of FirmAMIN BUHARI ABDUL KHADERNo ratings yet

- Financial Accounting IvDocument10 pagesFinancial Accounting Ivprajaktashete372No ratings yet

- Partner Ship Accounts - I: Balance Sheet Dr. Cr. Particulars Amount Rs. Particulars Amount RsDocument17 pagesPartner Ship Accounts - I: Balance Sheet Dr. Cr. Particulars Amount Rs. Particulars Amount RsM JEEVARATHNAM NAIDUNo ratings yet

- Karnataka II PUC Accountancy Sample Question Paper 16Document5 pagesKarnataka II PUC Accountancy Sample Question Paper 16Kishu KishoreNo ratings yet

- Aditya Degree College::Bhimavaram: Accounting For ManagersDocument3 pagesAditya Degree College::Bhimavaram: Accounting For Managersrealguy556789No ratings yet

- Bcoc-131: Financial Accounting Tutor Marked AssignmentDocument17 pagesBcoc-131: Financial Accounting Tutor Marked AssignmentRajni KumariNo ratings yet

- Paper 5Document4 pagesPaper 5hbyhNo ratings yet

- Financial Accounting Problems and SolutionsDocument11 pagesFinancial Accounting Problems and SolutionsJude VascoNo ratings yet

- BKA MODEL ANSWER OF BOARD EXAMINATION MARCH 2024Document8 pagesBKA MODEL ANSWER OF BOARD EXAMINATION MARCH 2024azozzod03No ratings yet

- Ts Grewal Class 12 Accountancy Chapter 7 PDFDocument11 pagesTs Grewal Class 12 Accountancy Chapter 7 PDFmonikaNo ratings yet

- Test Series: March, 2021 Mock Test Paper - 1 Intermediate (New) : Group - Ii Paper - 5: Advanced AccountingDocument7 pagesTest Series: March, 2021 Mock Test Paper - 1 Intermediate (New) : Group - Ii Paper - 5: Advanced AccountingOcto ManNo ratings yet

- PartnershipDocument28 pagesPartnershipVasu JainNo ratings yet

- 1st Semi Prelium Chp. 1, 3, 4, 5, 6 (40 Marks) Dt. 07.12.2020 (All Branch)Document3 pages1st Semi Prelium Chp. 1, 3, 4, 5, 6 (40 Marks) Dt. 07.12.2020 (All Branch)Arthur ShelbyNo ratings yet

- REVISION TEST Admission of A PartnerDocument2 pagesREVISION TEST Admission of A PartnerOshvi ShrivastavaNo ratings yet

- MB0025 Financial and Management AccountingDocument7 pagesMB0025 Financial and Management Accountingvarsha100% (1)

- 11 Com Pre-ExamDocument4 pages11 Com Pre-ExamObaid Khan50% (2)

- 12 2006 Accountancy 2Document5 pages12 2006 Accountancy 2Akash TamuliNo ratings yet

- Accounts DPP Retirement of A PartnerDocument15 pagesAccounts DPP Retirement of A PartnerPreeti SharmaNo ratings yet

- Accounts Assignment Class 11 CandE 20220111131012374Document5 pagesAccounts Assignment Class 11 CandE 20220111131012374Jithu EmmanuelNo ratings yet

- Untitled FgapqDocument5 pagesUntitled FgapqSusovan SirNo ratings yet

- 12 Comm QP AccountDocument2 pages12 Comm QP Accountvishal rahaneNo ratings yet

- Accountancy - XII - QPDocument5 pagesAccountancy - XII - QPKulvirkuljitharmeet singhNo ratings yet

- Mid term exam questions on Accountancy for II PUCDocument4 pagesMid term exam questions on Accountancy for II PUCManju PNo ratings yet

- Revision Test - I STD - Xii (Accountancy) : Seventh Day Adventist Higher Secondary SchoolDocument3 pagesRevision Test - I STD - Xii (Accountancy) : Seventh Day Adventist Higher Secondary SchoolStudy HelpNo ratings yet

- Internal Reconstruction P-1 Liabilities Rs Assets RsDocument8 pagesInternal Reconstruction P-1 Liabilities Rs Assets RsPaulomi LahaNo ratings yet

- Financial Accounting ProblemsDocument3 pagesFinancial Accounting ProblemsAnonymous NSNpGa3T93No ratings yet

- Admitting New PartnersDocument8 pagesAdmitting New PartnersVineet KumarNo ratings yet

- Unit III Amalgamation With Respect To A.S - 14 Purchase ConsiderationDocument17 pagesUnit III Amalgamation With Respect To A.S - 14 Purchase ConsiderationPaulomi LahaNo ratings yet

- XI AccountancyDocument5 pagesXI Accountancytechnical hackerNo ratings yet

- Test 3 QPDocument7 pagesTest 3 QPDharmateja ChakriNo ratings yet

- Accounts Solution Mock 2 12-11Document21 pagesAccounts Solution Mock 2 12-11Foundation Group tuitionNo ratings yet

- CALCULATING PURCHASE CONSIDERATIONDocument11 pagesCALCULATING PURCHASE CONSIDERATIONJoel VargheseNo ratings yet

- Sib PresentationDocument33 pagesSib PresentationA MaheshwariNo ratings yet

- Chapter 4. Time Value of MoneyDocument49 pagesChapter 4. Time Value of MoneySơn Đặng TháiNo ratings yet

- CANARA BANK Educationl LoanDocument1 pageCANARA BANK Educationl LoanRahulJotwaniNo ratings yet

- Student Budget WorksheetDocument12 pagesStudent Budget WorksheetEstela Marie BarreteNo ratings yet

- ENG 309 - NOI 3 - 2020S - Lecture Slides - 7.1Document29 pagesENG 309 - NOI 3 - 2020S - Lecture Slides - 7.1Hayate yameNo ratings yet

- Adjusting Entries Quiz PDFDocument13 pagesAdjusting Entries Quiz PDFnewonemade100% (1)

- AssignmentDocument1 pageAssignmentBilal MehmoodNo ratings yet

- Utkarsh CompetDocument4 pagesUtkarsh CompetshubhenduNo ratings yet

- Case Summary: Loans Between Friends and Unjust EnrichmentDocument6 pagesCase Summary: Loans Between Friends and Unjust EnrichmentElsha DamoloNo ratings yet

- Circular No. 449 - Modified Guidelines On The Pag-IBIG Fund Calamity Loan ProgramDocument8 pagesCircular No. 449 - Modified Guidelines On The Pag-IBIG Fund Calamity Loan ProgramJaybie SabadoNo ratings yet

- Dispute ResultsDocument24 pagesDispute Resultsrichard winfreyNo ratings yet

- Shravya - HOME LOAN - HDFCDocument13 pagesShravya - HOME LOAN - HDFCMOHAMMED KHAYYUMNo ratings yet

- Manoj Internship ReportDocument63 pagesManoj Internship ReportSurbhi SharmaNo ratings yet

- Tla 5.5 - Group 5Document6 pagesTla 5.5 - Group 5Alvin Dave MacaNo ratings yet

- Partnerships Liquidation: Advanced Accounting, Fifth EditionDocument33 pagesPartnerships Liquidation: Advanced Accounting, Fifth Editionhasan jabrNo ratings yet

- Chapter 1 Capacity To PayDocument15 pagesChapter 1 Capacity To Paymakemesway100% (1)

- Test Bank Ifa Part 3 2015 EditiondocxDocument287 pagesTest Bank Ifa Part 3 2015 EditiondocxRaca DesuNo ratings yet

- Annexture Loan OptionsDocument8 pagesAnnexture Loan OptionsAlbi GokulNo ratings yet

- Settlement LetterDocument1 pageSettlement LetterAmrish VenkatesanNo ratings yet

- Topic 4 Mathematics of FinanceDocument66 pagesTopic 4 Mathematics of FinanceAndrew PillayNo ratings yet

- Statistics CIA 3 - 2nd SemesterDocument23 pagesStatistics CIA 3 - 2nd SemesterHigi SNo ratings yet

- STK 8 Statement of AccountsDocument3 pagesSTK 8 Statement of Accountsdhananjay kulkarniNo ratings yet

- LKISSK 2021 Winners Tackle Financial Stability IssuesDocument2 pagesLKISSK 2021 Winners Tackle Financial Stability IssuesRezha Nursina YuniNo ratings yet

- Internship Report of ADBLDocument41 pagesInternship Report of ADBLconXn Communication & CyberNo ratings yet

- Chapter 2.1Document39 pagesChapter 2.1Jay BetaizarNo ratings yet

- Report PDF Response ServletDocument4 pagesReport PDF Response ServletRavi ChristoNo ratings yet

- Module - 2-Davis, - Michaels, - and - Co-Questions (2) UpdatesDocument5 pagesModule - 2-Davis, - Michaels, - and - Co-Questions (2) Updatesseth litchfieldNo ratings yet

- FINANCIAL Accounting:: Course Instructor Sehrish AbroDocument54 pagesFINANCIAL Accounting:: Course Instructor Sehrish AbroMohsin HassanNo ratings yet

- Preventing MSME Fraud with Due DiligenceDocument16 pagesPreventing MSME Fraud with Due Diligencesidh0987No ratings yet

- Richc Dad Financial Statement TemplateDocument10 pagesRichc Dad Financial Statement TemplatealwaysleadneverfollowNo ratings yet