Professional Documents

Culture Documents

Accounts Assignment Class 11 CandE 20220111131012374

Uploaded by

Jithu EmmanuelCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Accounts Assignment Class 11 CandE 20220111131012374

Uploaded by

Jithu EmmanuelCopyright:

Available Formats

Assignment

Acountancy

Class 11 C/E

1. What is primary objective of financial statements?

2. What is the operating profit?

3. What is meant by marshalling of assets and liabilities?

4. What do we come to know by preparing a trading account?

5. Calculate gross profit when total purchases during the year are Rs. 8,00,000; returns outward Rs. 20,000; direct

expenses Rs. 60,000 and 2/3rd of the goods are sold for Rs. 6,10,000.

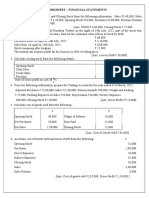

6. Calculate Closing Stock from the following details:

Rs. Rs.

Opening Stock 20,000 Purchases 70,000

Cash Sales 60,000 Credit sales 40,000

Rate of Gross Profit on cost 3313%.3313%.

7. From the following information, prepare trading account for the year ended 31st March, 2013 Cash purchases Rs.

4,50,000; credit purchases Rs. 27,00,000; returns inward Rs. 60,000; cash sales Rs. 4,80,000; credit sales Rs. 33,00,000;

returns outward Rs. 30,000; freight inwards Rs. 9,000; carriage inwards Rs. 9,000; wages and salaries Rs. 12,000;

opening stock Rs. 4,50,000; closing stock Rs. 2,64,000 but its market value is Rs.2,52,000.

8. From the following information, prepare the trading account for the year ended 31st March, 2013

Amt (Rs.) Amt (Rs.)

Opening Stock 3,00,000 Wages 6,000

Purchases 8,40,000 Freight 10,800

Closing stock 2,40,000 Carriage inwards 3,000

9. The percentage of gross profit on sales is 20%.

10. From the following information, prepare the Profit and Loss A/c for the year ended 31st March 2018

Rs.

Gross Profit 1,20,000

Rent 5,000

Salary 35,000

Commission paid 19,000

Interest on Loan 5,000

Advertisement 8,000

Interest received 8,000

Discount received 6,000

Printing and stationery 4,000

Legal charges 10,000

Bad debts 2,000

Loss by fire 6,000

Depreciation 4,000

11. Following is the trial balance of Kartik Makkar as on 31st March, 2013

Debit Credit

Name of Account Amount Name of Account Amount

(Rs.) (Rs.)

Stock on 1 st April, 2009 20,000 Discount Received 1,500

Purchases 1,16,000 Return outwards 5,200

Wages 4,000 Sales 1,97,300

Returns inwards 7,040 Bills payable 6,000

Carriage on purchases 4,720 Sundry creditors 11,200

Carriage on sales 1,420 Creditors for rent 1,000

Office salaries 9,600 Capital 80,000

Duty on imported goods 5,400 Loan from Raj 20,000

Rent and taxes 4,800 Commission 2,400

Cash 2,200

Bank balance 15,640

Bad debts 1,200

Discount allowed 1,280

Land and building 40,000

Scooter 13,200

Scooter repairs 1,700

Bills receivable 7,000

Commission 3,600

Sundry Debtors 50,800

Interest on Raj’s Loan 3,000

Drawings 12,000

3,24,600 3,24,600

====== ======

Prepare a trading and profit and loss account for the year ended on 31st March, 2013 and the balance sheet as at that

date. The stock on 31st March, 2010 was Rs. 44,000.

Kindly, send your assignment to the following mail id

deborahsamson@sjdelhi.com

You might also like

- Final Accounts Without Adj Day 1 CW-1Document2 pagesFinal Accounts Without Adj Day 1 CW-1ROHIT PAREEKNo ratings yet

- Frq-Acc-Grade 11-Set 05Document3 pagesFrq-Acc-Grade 11-Set 05itzmellowteaNo ratings yet

- Home Assignment - Financial Accounting PGPM 2019-20Document3 pagesHome Assignment - Financial Accounting PGPM 2019-20SidharthNo ratings yet

- The Following Trial Balance Have Been Taken Out From The Books of XYZ As On 31st DecemberDocument3 pagesThe Following Trial Balance Have Been Taken Out From The Books of XYZ As On 31st DecemberyogeshNo ratings yet

- 11th AccountsDocument8 pages11th AccountsShubham sumbriaNo ratings yet

- Additional Questions AcctsDocument3 pagesAdditional Questions AcctsDEV NANKANINo ratings yet

- Final Account WorksheetDocument4 pagesFinal Account Worksheetravikumarbadass0No ratings yet

- Balance SheetDocument2 pagesBalance SheetShubham TiwariNo ratings yet

- Numerical On Final AccountDocument7 pagesNumerical On Final AccountVikas giri100% (1)

- Debit Balances Rs. Credit Balances RS.: Vijayam Junior College I Year Final Accounts Additional ProblemsDocument4 pagesDebit Balances Rs. Credit Balances RS.: Vijayam Junior College I Year Final Accounts Additional ProblemsM JEEVARATHNAM NAIDUNo ratings yet

- 11 - Final Accounts Assessment 2 PDFDocument6 pages11 - Final Accounts Assessment 2 PDFShreyas ParekhNo ratings yet

- Problems on Final Accounts- Sole Proprietorship and Company Final AccountsDocument12 pagesProblems on Final Accounts- Sole Proprietorship and Company Final AccountsRishiShuklaNo ratings yet

- Financial Statement Assignment 1Document3 pagesFinancial Statement Assignment 1tahasafdari772No ratings yet

- And Profit and Loss Account and Balance Sheet On 31st December, 2019Document2 pagesAnd Profit and Loss Account and Balance Sheet On 31st December, 2019Prabhleen KaurNo ratings yet

- Assignment 1 ACCOUNTANCYDocument3 pagesAssignment 1 ACCOUNTANCYCHINMAY AGRAWALNo ratings yet

- Sole Proprietorship Final AccountDocument4 pagesSole Proprietorship Final Accountsujan BhandariNo ratings yet

- 11 - Final Accounts Assessment 4 PDFDocument7 pages11 - Final Accounts Assessment 4 PDFShreyas ParekhNo ratings yet

- Assignment Final AccountsDocument9 pagesAssignment Final Accountsjasmine chowdhary50% (2)

- Jayalakshmi Institute of Technology Accounting For Management Unit - Ii QuestionsDocument2 pagesJayalakshmi Institute of Technology Accounting For Management Unit - Ii QuestionsJayalakshmi Institute of TechnologyNo ratings yet

- Financial Reporting, Statement & Analysis - Assignment1Document5 pagesFinancial Reporting, Statement & Analysis - Assignment1sumanNo ratings yet

- Question Bank 1Document5 pagesQuestion Bank 1lavarocks23100% (1)

- RK Chopra Accounting Classes Trial Balance & Financial StatementsDocument1 pageRK Chopra Accounting Classes Trial Balance & Financial StatementsVansh SethiNo ratings yet

- Prepare Trading and P&L Accounts from given balancesDocument3 pagesPrepare Trading and P&L Accounts from given balancesKUNAL SHARMANo ratings yet

- 11-Accountancy WEEKLY-WORK 01.02.2022 Ch-22 Financial Statement - With AdjustmentDocument4 pages11-Accountancy WEEKLY-WORK 01.02.2022 Ch-22 Financial Statement - With AdjustmentSandeep NehraNo ratings yet

- Assignment Bballb BDocument4 pagesAssignment Bballb BTavnish SinghNo ratings yet

- Trial BalanceDocument14 pagesTrial Balanceswetha_makulaNo ratings yet

- Practical Question Accountancy MainDocument22 pagesPractical Question Accountancy MainDubai SheikhNo ratings yet

- AnswerDocument3 pagesAnswerRE GHANo ratings yet

- Financial Statements of NonDocument3 pagesFinancial Statements of NonYashi GuptaNo ratings yet

- Unit 2Document15 pagesUnit 2neharajt06061No ratings yet

- Unit-5 Final AccountsDocument7 pagesUnit-5 Final AccountsSanthosh Santhu0% (1)

- P&LAC Exercises PracticeDocument5 pagesP&LAC Exercises PracticeDilfaraz KalawatNo ratings yet

- Intro To Final Acc. ProblemsDocument11 pagesIntro To Final Acc. ProblemsDheer BhanushaliNo ratings yet

- Financial Analysis ProblemDocument16 pagesFinancial Analysis ProblemShreyashi DasNo ratings yet

- Faculty Business and Management Bbf211: Financial Reporting AnanlsisDocument7 pagesFaculty Business and Management Bbf211: Financial Reporting AnanlsisMichael AronNo ratings yet

- Ac 11 ProjectsDocument8 pagesAc 11 ProjectsJagdish sanjotNo ratings yet

- XI AccountancyDocument5 pagesXI Accountancytechnical hackerNo ratings yet

- AFH Important questionDocument6 pagesAFH Important questionmanassadashiv013No ratings yet

- Accounting Questions PracticesDocument2 pagesAccounting Questions PracticesSusanna Ng50% (2)

- Accounts Test (Class Xi) (Set - 1) : Particular Rs. RsDocument2 pagesAccounts Test (Class Xi) (Set - 1) : Particular Rs. RsDiya KumariNo ratings yet

- Manan Aggarwal - FINAL ACCOUNT-questionsDocument10 pagesManan Aggarwal - FINAL ACCOUNT-questionsManan AggarwalNo ratings yet

- FINANCIALREPORTINGand Analysis ExamDocument7 pagesFINANCIALREPORTINGand Analysis ExamKizito KizitoNo ratings yet

- MS Shubham Traders Trading and Profit Loss AccountsDocument6 pagesMS Shubham Traders Trading and Profit Loss AccountsSidhant KothriwalNo ratings yet

- Worksheet Financial StatementsDocument11 pagesWorksheet Financial StatementsTanishkNo ratings yet

- MBA I Semester Supplementary Examinations December/January 2018/19Document2 pagesMBA I Semester Supplementary Examinations December/January 2018/19Chandra SekharNo ratings yet

- Ratio Analysis-1Document3 pagesRatio Analysis-1Ramakrishna J RNo ratings yet

- Cash Flow StatementDocument3 pagesCash Flow StatementanupsuchakNo ratings yet

- Final Ac P2Document5 pagesFinal Ac P2SudeepNo ratings yet

- Adobe Scan 07-Jul-2022Document2 pagesAdobe Scan 07-Jul-2022Accounting HelpNo ratings yet

- Accounting Fundamentals - Practice Worksheet SolutionsDocument11 pagesAccounting Fundamentals - Practice Worksheet SolutionsMeet PatelNo ratings yet

- Worksheet AccountingDocument5 pagesWorksheet AccountingDorinNo ratings yet

- Accountancy Practice Paper - 1Document2 pagesAccountancy Practice Paper - 1Rinshi GuptaNo ratings yet

- Class Test – Financial Statements with AdjustmentsDocument2 pagesClass Test – Financial Statements with Adjustmentssara VermaNo ratings yet

- Buad 803 Ahmad Jibrilindv. AssignmentDocument3 pagesBuad 803 Ahmad Jibrilindv. AssignmentAhmad JibrilNo ratings yet

- Particulars Rs. Particulars RsDocument2 pagesParticulars Rs. Particulars RsAman RajNo ratings yet

- Symbiosis Law School, Pune Project Backlog on Corporate AccountingDocument2 pagesSymbiosis Law School, Pune Project Backlog on Corporate AccountingARATFTAFTNo ratings yet

- Final Accounts Example - MBA WPDocument6 pagesFinal Accounts Example - MBA WPJIJONo ratings yet

- Worksheet Final AccountsDocument9 pagesWorksheet Final AccountsAa BbNo ratings yet

- AssignmentDocument3 pagesAssignmentER ABHISHEK MISHRANo ratings yet

- 11EcoAsgmtIndexNumbersassignment 20220112124653426Document2 pages11EcoAsgmtIndexNumbersassignment 20220112124653426Jithu EmmanuelNo ratings yet

- CLASS 11 CandD PED ASSIGNMENT 20220111123815493Document3 pagesCLASS 11 CandD PED ASSIGNMENT 20220111123815493Jithu EmmanuelNo ratings yet

- CLASS XI English Assignment 20220112124944841Document5 pagesCLASS XI English Assignment 20220112124944841Jithu EmmanuelNo ratings yet

- Class 11 Economics Assignment 20220112124718712Document2 pagesClass 11 Economics Assignment 20220112124718712Jithu EmmanuelNo ratings yet

- CLASS 11 Eco Revision Formula 20220114140334759Document2 pagesCLASS 11 Eco Revision Formula 20220114140334759Jithu EmmanuelNo ratings yet

- Calculating profits and losses from accounting recordsDocument3 pagesCalculating profits and losses from accounting recordsJithu EmmanuelNo ratings yet

- Xic D Applied Mathematics Assignment 20220210075956520Document1 pageXic D Applied Mathematics Assignment 20220210075956520Jithu EmmanuelNo ratings yet

- CLASS 11 CandD PED ASSIGNMENT 20220111123815493Document3 pagesCLASS 11 CandD PED ASSIGNMENT 20220111123815493Jithu EmmanuelNo ratings yet

- St. Joseph'S Academy Savita Vihar Delhi YEAR: 2021 - 2022 Class-Xi C&D Subject - Physical EducationDocument1 pageSt. Joseph'S Academy Savita Vihar Delhi YEAR: 2021 - 2022 Class-Xi C&D Subject - Physical EducationJithu EmmanuelNo ratings yet

- Understanding Economics FundamentalsDocument12 pagesUnderstanding Economics FundamentalsDev DarjiNo ratings yet

- St. Joseph'S Academy Savita Vihar Delhi YEAR: 2021 - 2022 Class-Xi C&D Subject - Physical EducationDocument1 pageSt. Joseph'S Academy Savita Vihar Delhi YEAR: 2021 - 2022 Class-Xi C&D Subject - Physical EducationJithu EmmanuelNo ratings yet

- St. Joseph'S Academy Savita Vihar Delhi YEAR: 2021 - 2022 Class-Xi C&D Subject - Physical EducationDocument1 pageSt. Joseph'S Academy Savita Vihar Delhi YEAR: 2021 - 2022 Class-Xi C&D Subject - Physical EducationJithu EmmanuelNo ratings yet

- Understanding Economics FundamentalsDocument12 pagesUnderstanding Economics FundamentalsDev DarjiNo ratings yet

- Subscription Agreement Form: Please Your SelectionDocument2 pagesSubscription Agreement Form: Please Your Selectionالدحي البارقيNo ratings yet

- IFRS IntroductionDocument44 pagesIFRS Introductionpadm0% (1)

- Case Study On BMW PDFDocument1 pageCase Study On BMW PDFZoe McKenzieNo ratings yet

- Public RelationDocument14 pagesPublic RelationWahyu RinaNo ratings yet

- Literature Review Main 1Document3 pagesLiterature Review Main 1Sangeeta GirishlalNo ratings yet

- Ariana Villanueva ResumeDocument1 pageAriana Villanueva Resumeariana villanuevaNo ratings yet

- Staples IncDocument4 pagesStaples IncNo nameNo ratings yet

- Advertising and Integrated Brand Promotion 6th Edition OGuinn Solution ManualDocument15 pagesAdvertising and Integrated Brand Promotion 6th Edition OGuinn Solution Manualzaraazahid_950888410No ratings yet

- One Million FollowersDocument3 pagesOne Million FollowersBeriNo ratings yet

- 080 Divya LSCM AssignmentDocument8 pages080 Divya LSCM AssignmentpraveenaNo ratings yet

- FADM Assignment SolvedDocument12 pagesFADM Assignment SolvedAnujain JainNo ratings yet

- Vertical and Horizantal Analysis of Ultratech CementDocument12 pagesVertical and Horizantal Analysis of Ultratech Cementthamil marpanNo ratings yet

- Strategies for Customer Relationship ManagementDocument26 pagesStrategies for Customer Relationship Managementprince100% (3)

- Micro Perspective of Tourism & Hospitaity ManagementDocument9 pagesMicro Perspective of Tourism & Hospitaity ManagementRikki Vergara FloresNo ratings yet

- 8.25.14 Stipulated Joint FInal Pretrial Order by City and Certain ObjectorsDocument393 pages8.25.14 Stipulated Joint FInal Pretrial Order by City and Certain ObjectorsWDET 101.9 FM100% (2)

- 2303 1 Minutes SignedDocument3 pages2303 1 Minutes Signedapi-320633238No ratings yet

- BASF - Rebranding Old Vs New Names - 2011-10-07 V5Document2 pagesBASF - Rebranding Old Vs New Names - 2011-10-07 V5Valentina PangayomanNo ratings yet

- 3 monthly gift subscriptions to add as a benefitDocument1 page3 monthly gift subscriptions to add as a benefitGangadhar BituNo ratings yet

- Dokumen - Tips - Consumer Behavior Analysis of Pest Control Brands in IndiaDocument23 pagesDokumen - Tips - Consumer Behavior Analysis of Pest Control Brands in IndiaRahul JainNo ratings yet

- Course Syllabus Outline OBLI 2nd SEM AY 2021 2022 For The ClassDocument8 pagesCourse Syllabus Outline OBLI 2nd SEM AY 2021 2022 For The ClassJULLIAN PAOLO UMALINo ratings yet

- Source: Auditing: A Risk Analysis Approach 5 Edition by Larry F. KonrathDocument19 pagesSource: Auditing: A Risk Analysis Approach 5 Edition by Larry F. KonrathMelanie SamsonaNo ratings yet

- Booklet - Business Immersion Program 2023Document34 pagesBooklet - Business Immersion Program 2023Kenneth ChandrawidjajaNo ratings yet

- Technical English For Engineers F2 S7 PDFDocument18 pagesTechnical English For Engineers F2 S7 PDFMichelle Cabello AstorgaNo ratings yet

- Online Shopping SatisfactionDocument11 pagesOnline Shopping SatisfactionKristel Mae OlivarNo ratings yet

- Introduction To Research Methods A Hands On Approach 1st Edition Pajo Test BankDocument12 pagesIntroduction To Research Methods A Hands On Approach 1st Edition Pajo Test Bankethelbertsangffz100% (30)

- Sunbeam Group AssignmentDocument9 pagesSunbeam Group Assignmentshubhangini SaindaneNo ratings yet

- Othm Report Unit 1.Document16 pagesOthm Report Unit 1.PRG ARMYNo ratings yet

- Amerant - Certificados de DepósitoDocument2 pagesAmerant - Certificados de Depósitoscribd01No ratings yet

- KFCDocument15 pagesKFCSubham ChakrabortyNo ratings yet

- Retail Sector in India A Case of Big BazaarDocument44 pagesRetail Sector in India A Case of Big Bazaaravinash1987100% (7)