Professional Documents

Culture Documents

Financial Mathematics June Exam Memo 2023

Uploaded by

KGOTHATSO VALENTINE MALATJI0 ratings0% found this document useful (0 votes)

5 views1 pageCopyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

5 views1 pageFinancial Mathematics June Exam Memo 2023

Uploaded by

KGOTHATSO VALENTINE MALATJICopyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You are on page 1of 1

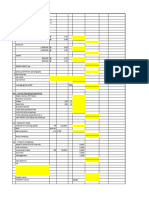

ANSWER FOR QUESTION 4.

Workings for net present value calculations Marks

Tax Values Machine

R' 000

Cost 7,500

Wear and Tear - Yr 1 -1,500

Value at end of year 6,000

Wear and Tear - Yr 2 -1,500

Value at end of year 4,500

Wear and Tear - Yr 3 -1,500

Value at end of year 3,000

Wear and Tear - Yr 4 -1,500

Value at end of year 1,500

Residual Value 1,000

Recoupment / (Scrapping Allowance) -500

Tax Calculation

R' 000 0 1 2 3 4

Net Cash Inflows 3,000 3,000 3,000 3,000 0.5

Wear and Tear -1,500 -1,500 -1,500 -1,500 1

Scrapping Allowance -500 1

- 1,500 1,500 1,500 1,000

Tax at 28% - -420 -420 -420 -280 0.5

Cash Flows

R' 000 0 1 2 3 4

Initial Cost -7,500 0.5

Feasibility Study - 0.5

Working Capital -500 - - - 450 1

Net Cash Inflows (Above) 3,000 3,000 3,000 3,000

Residual Value 1,000 1

Tax (from above) - -420 -420 -420 -280

-8,000 2,580 2,580 2,580 4,170

Discount Rate 12% 1

NPV @ 12% R 846.84 R 846.84 R 846,835 1

(Using a Calculator) (Using Excel)

TOTAL 8

MAX 7

You might also like

- Lahore School of Economics Financial Management II Cash Flow Estimation and Risk Analysis - 2 Assignment 9Document3 pagesLahore School of Economics Financial Management II Cash Flow Estimation and Risk Analysis - 2 Assignment 9Daniyal AliNo ratings yet

- GMA Correcting EntriesDocument6 pagesGMA Correcting EntriesRaff LesiaaNo ratings yet

- Balance Sheet: Assets Value Liabilities ValueDocument32 pagesBalance Sheet: Assets Value Liabilities ValueomernoumanNo ratings yet

- Hola-Kola: Section: E05 Group Number: G04 Name of ParticipantsDocument7 pagesHola-Kola: Section: E05 Group Number: G04 Name of ParticipantsSuvinay SethNo ratings yet

- Sloved Questions Financial AnalysisDocument12 pagesSloved Questions Financial AnalysisMurad KhanNo ratings yet

- Refat Mukmin - Asy 23Document7 pagesRefat Mukmin - Asy 232310102052.refatNo ratings yet

- Appendix-11B-Replacement Project Analysis-A Lathe For Trimming Molded Plastics Was Purchased.Document1 pageAppendix-11B-Replacement Project Analysis-A Lathe For Trimming Molded Plastics Was Purchased.Rajib Dahal100% (2)

- Hola Kola Solution Base AbhinavDocument17 pagesHola Kola Solution Base Abhinavnisha0% (2)

- Chiles Cagas Assignment Replacement Cost DecisionDocument3 pagesChiles Cagas Assignment Replacement Cost DecisionJohn Peter EgnaligNo ratings yet

- Excel Karna Krishna1Document37 pagesExcel Karna Krishna1Krishna KumarNo ratings yet

- FLORES - Working PapersDocument2 pagesFLORES - Working PapersMaureen FloresNo ratings yet

- JamilAhmed - 2355 - 19750 - 1 - Lecture003-Cash Flow EstimationDocument29 pagesJamilAhmed - 2355 - 19750 - 1 - Lecture003-Cash Flow Estimationmuskan.j.talrejaNo ratings yet

- Latihan UTS AKUNDocument32 pagesLatihan UTS AKUNchittamahayantiNo ratings yet

- 2015 Year-End Financial Report for Beauty SalonDocument2 pages2015 Year-End Financial Report for Beauty SalonDjaloe Arief PradibtyaNo ratings yet

- Preliminary Balance Sheet AssetsDocument3 pagesPreliminary Balance Sheet AssetsleuleuNo ratings yet

- CF Assignment 1 Group 9Document51 pagesCF Assignment 1 Group 9rishabh tyagiNo ratings yet

- Weekly Assignment Chapter 1Document4 pagesWeekly Assignment Chapter 1Ombati StephenNo ratings yet

- FormulasDocument9 pagesFormulasYajZaragozaNo ratings yet

- Topic 1 SolutionsDocument14 pagesTopic 1 SolutionsPhan Phúc NguyênNo ratings yet

- KKTiwari - 18214263 - Worldwide Paper Company-2016Document5 pagesKKTiwari - 18214263 - Worldwide Paper Company-2016KritikaPandeyNo ratings yet

- Financial Accounts Assingnment 3Document5 pagesFinancial Accounts Assingnment 3Zakarya KhanNo ratings yet

- Better Mousetraps ExerciseDocument11 pagesBetter Mousetraps ExerciseBrl Gnsn0% (1)

- CHPTR 7 Worksheet DemoDocument1 pageCHPTR 7 Worksheet DemoParamorfsNo ratings yet

- Bosmtpfinaloldp 5 AnsDocument13 pagesBosmtpfinaloldp 5 AnsharoldpsbNo ratings yet

- Income Statment of RideyaDocument4 pagesIncome Statment of Rideyafaizan mughalNo ratings yet

- Questions Chapter 3 No.11: PEROT CORPORATION - Patay2 Chip ProjectDocument6 pagesQuestions Chapter 3 No.11: PEROT CORPORATION - Patay2 Chip ProjectddNo ratings yet

- Class 1 7th Feb OxygenDocument17 pagesClass 1 7th Feb OxygenAmit JainNo ratings yet

- Chapter 6 WorksheetDocument46 pagesChapter 6 WorksheetHardeep SinghNo ratings yet

- JD Sdn. BHD Study CaseDocument5 pagesJD Sdn. BHD Study CaseSuperFlyFlyers100% (2)

- Calculate Salary Loan Interest RatesDocument9 pagesCalculate Salary Loan Interest RatesAssejerNo ratings yet

- Demonstration Problem - Chapter 4 - Internet Consulting ServicesDocument9 pagesDemonstration Problem - Chapter 4 - Internet Consulting ServicesTooba HashmiNo ratings yet

- CuppaMania NPV AnalysisDocument2 pagesCuppaMania NPV AnalysisdeepaksikriNo ratings yet

- Excel Solution - Extruder Capital Budgeting Case StudyDocument15 pagesExcel Solution - Extruder Capital Budgeting Case Studyalka murarkaNo ratings yet

- Tarafarma Worksheet Januari 2017Document2 pagesTarafarma Worksheet Januari 2017Nazla HanifaNo ratings yet

- 2017 SPS SuZhou ISC MOSDocument9 pages2017 SPS SuZhou ISC MOSMazen FakhfakhNo ratings yet

- PETR 3310 Homework 02 SolutionDocument6 pagesPETR 3310 Homework 02 SolutionBrian AndersonNo ratings yet

- JamilAhmed - 2355 - 19750 - 1 - Lecture 3 Demo ProblemsDocument20 pagesJamilAhmed - 2355 - 19750 - 1 - Lecture 3 Demo Problemsmuskan.j.talrejaNo ratings yet

- Quicky Profit and LossDocument1 pageQuicky Profit and LossBea GarciaNo ratings yet

- ACC Individual AssignmentDocument6 pagesACC Individual AssignmentRuddyMartiniNo ratings yet

- fm_eco_answerDocument12 pagesfm_eco_answersriramakrishnajayamNo ratings yet

- 2020 Sem 1 ACC10007 Discussion Questions (And Solutions) - Topic 2 (Part 2)Document5 pages2020 Sem 1 ACC10007 Discussion Questions (And Solutions) - Topic 2 (Part 2)Renee WongNo ratings yet

- Fare Transportations Ltd 5-Year Financial Forecast TitleDocument2 pagesFare Transportations Ltd 5-Year Financial Forecast TitleTahsin Al MuntaquimNo ratings yet

- Canyon Transport: Perform Financial CalculationsDocument7 pagesCanyon Transport: Perform Financial CalculationsManoj TeliNo ratings yet

- Assignment Business FinanceDocument104 pagesAssignment Business FinanceShanmathi ArumugamNo ratings yet

- Aminah Quiz Answer Done by Abdullah Narejo-The Great.Document10 pagesAminah Quiz Answer Done by Abdullah Narejo-The Great.Abdullah NarejoNo ratings yet

- Tugas 1 JournalDocument6 pagesTugas 1 Journalaldika ferroNo ratings yet

- Dec2016 ProfitDocument1 pageDec2016 ProfitadmfrdsNo ratings yet

- Cost Analysis and Cash Flow Projection for New Product DevelopmentDocument3 pagesCost Analysis and Cash Flow Projection for New Product DevelopmentAbdul KodirNo ratings yet

- Vertical Income Statement and Balance Sheet for Jyoti LtdDocument6 pagesVertical Income Statement and Balance Sheet for Jyoti LtdAravind ShekharNo ratings yet

- ExcerciseDocument10 pagesExcercisehafizulNo ratings yet

- Cash Flow Estimations /how To Project Cash FlowsDocument18 pagesCash Flow Estimations /how To Project Cash FlowsShafqat RabbaniNo ratings yet

- Client: PT Jambi Prima Coal Closing Date: 31 Desember 2018Document7 pagesClient: PT Jambi Prima Coal Closing Date: 31 Desember 2018Umar MukhtarNo ratings yet

- Eva ProblemsDocument10 pagesEva ProblemsROSHNY DAVIS100% (1)

- Q9-Q1 NPV and EAB AnalysisDocument9 pagesQ9-Q1 NPV and EAB AnalysisDivyam GargNo ratings yet

- Free CashflowDocument4 pagesFree CashflowMainali GautamNo ratings yet

- Potato Twister Annexes Edited JoemDocument10 pagesPotato Twister Annexes Edited JoemJoem NemenzoNo ratings yet

- Ilustration 2Document5 pagesIlustration 2KiranNo ratings yet

- IFRS Inventory Valuation and Lease Accounting RevisionDocument16 pagesIFRS Inventory Valuation and Lease Accounting RevisionMalaika QaziNo ratings yet

- Bethesda & GoodweekDocument8 pagesBethesda & GoodweekDian Pratiwi RusdyNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- 1ST Quarter Exam Mapeh 8Document7 pages1ST Quarter Exam Mapeh 8John Rey Manolo BaylosisNo ratings yet

- Compact NSX - Micrologic 5-6-7 - User Guide 11Document1 pageCompact NSX - Micrologic 5-6-7 - User Guide 11amnd amorNo ratings yet

- Ginger by NcipmDocument53 pagesGinger by NcipmAbhishekNo ratings yet

- Types of Air Conditioning UnitsDocument10 pagesTypes of Air Conditioning Unitssnowgalvez44No ratings yet

- Listening and Speaking 3 Q: Skills For Success Unit 4 Student Book Answer KeyDocument4 pagesListening and Speaking 3 Q: Skills For Success Unit 4 Student Book Answer KeyAhmed MohammedNo ratings yet

- 1 An Overview of Physical and Phase ChangeDocument5 pages1 An Overview of Physical and Phase ChangeGede KrishnaNo ratings yet

- 5.1 Quadratic Functions: 344 Learning ObjectivesDocument15 pages5.1 Quadratic Functions: 344 Learning ObjectiveskhadijaNo ratings yet

- Ratio - Proportion - PercentDocument31 pagesRatio - Proportion - PercentRiyadh HaiderNo ratings yet

- W 2HotlineContacts2019 - 0 2 PDFDocument3 pagesW 2HotlineContacts2019 - 0 2 PDFNathan Townsend Levy100% (1)

- 342 Mechanical and Fluid Drive Maintenance Course DescriptionDocument2 pages342 Mechanical and Fluid Drive Maintenance Course Descriptionaa256850No ratings yet

- Section 08500 - Windows: Whole Building Design Guide Federal Green Construction Guide For SpecifiersDocument7 pagesSection 08500 - Windows: Whole Building Design Guide Federal Green Construction Guide For SpecifiersAnonymous NMytbMiDNo ratings yet

- Logix 5000 CIP Sync ConfigurationDocument180 pagesLogix 5000 CIP Sync Configurationاحتشام چوہدریNo ratings yet

- Spread footing design calculationDocument6 pagesSpread footing design calculationFrancklinMeunierM'ondoNo ratings yet

- Oil and Gas FieldDocument5 pagesOil and Gas FieldMuhammad SyafiieNo ratings yet

- 21st Century Literature Quarter 2 Week 7Document5 pages21st Century Literature Quarter 2 Week 7SHERRY MAE MINGONo ratings yet

- Dayton Audio Classic Series Subwoofers and Series II Woofer SpecificationsDocument1 pageDayton Audio Classic Series Subwoofers and Series II Woofer Specificationssales diyaudiocart.comNo ratings yet

- S7SDocument336 pagesS7S217469492100% (1)

- Myopia, Myth and Mindset 1 PDFDocument9 pagesMyopia, Myth and Mindset 1 PDFHassaan AhmadNo ratings yet

- Graphics Hardware Terminology, Displays and ArchitectureDocument35 pagesGraphics Hardware Terminology, Displays and ArchitectureBinoNo ratings yet

- Eastern Shipping Lines, Inc. v. IAC, G.R. No. L-69044 and L-71478, May 29, 1987, 150 SCRA 463Document11 pagesEastern Shipping Lines, Inc. v. IAC, G.R. No. L-69044 and L-71478, May 29, 1987, 150 SCRA 463Melle EscaroNo ratings yet

- Effecta WoodyDocument21 pagesEffecta WoodyMR XNo ratings yet

- Nouveau Document TexteDocument6 pagesNouveau Document Texteamal mallouliNo ratings yet

- Env203Geo205 Map - ElementsDocument14 pagesEnv203Geo205 Map - ElementsFarhana SuptiNo ratings yet

- Gas Turbine Flow MeterDocument33 pagesGas Turbine Flow MeterKhabbab Hussain K-hNo ratings yet

- Process Payments & ReceiptsDocument12 pagesProcess Payments & ReceiptsAnne FrondaNo ratings yet

- Report On MinesDocument7 pagesReport On MinesYhaneNo ratings yet

- Ansi C 136.20Document16 pagesAnsi C 136.20Amit Kumar Mishra100% (1)

- Training ReportDocument56 pagesTraining ReportRavimini100% (2)

- ZEOLITEDocument13 pagesZEOLITEShubham Yele100% (1)

- TENSION PNEUMOTHORAX (Malav Shah)Document66 pagesTENSION PNEUMOTHORAX (Malav Shah)Sharath PsNo ratings yet