Professional Documents

Culture Documents

Rupee 160911

Rupee 160911

Uploaded by

vikas.dhanesha7256Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Rupee 160911

Rupee 160911

Uploaded by

vikas.dhanesha7256Copyright:

Available Formats

Rupee 160911 Rupee extends gains The rupee rose 0.6% to 47.27 against the dollar as against 47.55.

The unit was choppy in first half with slight gains and no knee jerk movement in reaction to RBI rate hike. The central bank hiked the LAF rate by 25 bps and raised concerns over high inflation and over downside risk to growth. RBI also persisted with its anti-inflationary stance. Notably, the unit edged up in post-noon despite choppy stocks and modest gains in USD against majors and some Asian peers. It breached the intraday resistance near 47.40 and edged up to a 3-day high of 47.22. Traders cited some banks cutting long dollar positions ahead of weekend. Forward premia edged up tracking lower USDINR quotes and higher OIS rates. Rate futures segment was barren. OIS rates edged up tracking higher local bond yield and broadly improved global risk appetite. Futures September USDINR contract slipped 0.65% to 47.3500 as against 47.6575. The contract mirrored movement in USDINR through most part of the day. It moved in a wide range holding 47.3000-47.6625 through the day. Meanwhile, RBI hiked the LAF rate by 25 bps and raised concerns over high inflation and over downside risk to growth. It also persisted with its anti-inflationary stance. Open interest increased by around half-apercent whereas volume slipped 15.22% over the day. September EURINR contract snapped a 3-day streak of gains and slipped 0.59% over the day. The contract had edged up in early deals as concerns over European banking crisis eased. However, the contract slipped in post-noon tracking slide in spot EURUSD on the back of profit booking. Investors awaited news from a meeting of EU finance ministers in Poland. Open interest ended flat while volume in the EURINR contract rose after declining for the previous three sessions. September GBPINR contract snapped a 6-day wining streak while September JPYINR contract erased gains of the previous two sessions to hit a 3-day low. GBPINR and JPYINR contract saw a slide in open interest and rise in volume over the day. Options The total traded volume in the most active calls and puts was 1,085,376 contracts (19.09%) while the total market open interest was 1,674,562 contracts (-15.18%). September 46.75, 47, 47.25, 47.5 and 47.75 strike calls and puts were among the most active contracts. Premia of 46.75 and 47 strike calls fell 29.5 paise and 29.25 paise, respectively. The 47.5 and 47.75 strike put rose 9 paise and 13 paise over the day.

The 47.25 and 47.75 strike calls saw a rise in open interest and decline in volume. Further, the 47 and 47.5 strike puts saw a surge in open interest and volume. Put/Call ratio of September 46.75, 47, 47.25, 47.5 and 47.75 strike calls and puts stood at 1.81. Volatility of calls and puts off all the above strikes slipped.

You might also like

- Accounting For Construction ContractsDocument8 pagesAccounting For Construction ContractsSantu DuttaNo ratings yet

- Sahara India (Fraud) Case: Business Ethics Assignment-2Document4 pagesSahara India (Fraud) Case: Business Ethics Assignment-2Sasmit PatilNo ratings yet

- Stock Market ReportDocument43 pagesStock Market ReportPatelDMNo ratings yet

- Treasury Daily 01 19 16Document4 pagesTreasury Daily 01 19 16patrick-lee ellaNo ratings yet

- Treasury Daily 01 15 16Document5 pagesTreasury Daily 01 15 16patrick-lee ellaNo ratings yet

- Treasury Daily 01 14 16Document5 pagesTreasury Daily 01 14 16patrick-lee ellaNo ratings yet

- Treasury Daily 01 13 16Document4 pagesTreasury Daily 01 13 16patrick-lee ellaNo ratings yet

- Rupee 270511Document1 pageRupee 270511vikas.dhanesha7256No ratings yet

- Treasury Daily 01 18 16Document4 pagesTreasury Daily 01 18 16patrick-lee ellaNo ratings yet

- World Exchange Rates: Currency Report 29th July 2013Document2 pagesWorld Exchange Rates: Currency Report 29th July 2013nishantjain95No ratings yet

- Treasury Daily 01 29 16Document5 pagesTreasury Daily 01 29 16patrick-lee ellaNo ratings yet

- Rupee 010811Document2 pagesRupee 010811vikas.dhanesha7256No ratings yet

- Treasury Daily 01 20 16Document4 pagesTreasury Daily 01 20 16patrick-lee ellaNo ratings yet

- Treasury Daily 01 28 16Document5 pagesTreasury Daily 01 28 16patrick-lee ellaNo ratings yet

- DC 1Document1 pageDC 1hemanggorNo ratings yet

- BNP FX WeeklyDocument22 pagesBNP FX WeeklyPhillip HsiaNo ratings yet

- Quity Research AB: Erivative Report TH Pril: E L D 4 ADocument9 pagesQuity Research AB: Erivative Report TH Pril: E L D 4 AAru MehraNo ratings yet

- Equity Research Lab: Derivative Report 19Th FebDocument9 pagesEquity Research Lab: Derivative Report 19Th FebAru MehraNo ratings yet

- Urrency Forecast: $ Continued To Weaken Vs Other Major CurrenciesDocument4 pagesUrrency Forecast: $ Continued To Weaken Vs Other Major CurrenciesprinceasatiNo ratings yet

- Currency Daily Report September 24Document4 pagesCurrency Daily Report September 24Angel BrokingNo ratings yet

- CurrencyWeekly 220615Document5 pagesCurrencyWeekly 220615dineshganNo ratings yet

- Citi 14061Document1 pageCiti 14061roshanr009No ratings yet

- Currency Report: MF Global Daily ReportDocument5 pagesCurrency Report: MF Global Daily ReportTarique kamaalNo ratings yet

- MCB Market Update - 16th December 2016 - tcm12-13133Document2 pagesMCB Market Update - 16th December 2016 - tcm12-13133sharktale2828No ratings yet

- Forex Round Up 06.12.09Document11 pagesForex Round Up 06.12.09Neha DhuriNo ratings yet

- Rupee Drops To 1-Year Low On Importer $ Demand: 8 Sep, 2011, 06.32PM IST, ReutersDocument4 pagesRupee Drops To 1-Year Low On Importer $ Demand: 8 Sep, 2011, 06.32PM IST, ReutersPrajita MehtaNo ratings yet

- Fear of Hard Brexit' Led Sterling Below Thirty Year LevelDocument4 pagesFear of Hard Brexit' Led Sterling Below Thirty Year LevelDynamic LevelsNo ratings yet

- 01 July 2011 - FX Weekly CompleteDocument23 pages01 July 2011 - FX Weekly CompletetimurrsNo ratings yet

- DatacfDocument2 pagesDatacfhemanggorNo ratings yet

- HSL PCG "Currency Insight"-Weekly: 19 September, 2016Document16 pagesHSL PCG "Currency Insight"-Weekly: 19 September, 2016shobhaNo ratings yet

- Daily Currency Report 4th JanDocument3 pagesDaily Currency Report 4th JanvruaklNo ratings yet

- E L D 18 A: Quity Rese Arch AB: Eriva Tive R Eport TH PrilDocument9 pagesE L D 18 A: Quity Rese Arch AB: Eriva Tive R Eport TH PrilAru MehraNo ratings yet

- HSL PCG "Currency Insight"-Weekly: 13 June, 2016Document17 pagesHSL PCG "Currency Insight"-Weekly: 13 June, 2016Dinesh ChoudharyNo ratings yet

- Quity Research AB: Erivative TH Pril: E L D 8 ADocument9 pagesQuity Research AB: Erivative TH Pril: E L D 8 AAru MehraNo ratings yet

- Currency Daily Report, June 18 2013Document4 pagesCurrency Daily Report, June 18 2013Angel BrokingNo ratings yet

- VIP Analytics Global 181023Document9 pagesVIP Analytics Global 181023SufiNo ratings yet

- Weekly Snippets - Karvy 12 Mar 2016Document7 pagesWeekly Snippets - Karvy 12 Mar 2016AdityaKumarNo ratings yet

- Daily Markets UpdateDocument35 pagesDaily Markets Updateapi-25889552No ratings yet

- Currency Daily Report November 7Document4 pagesCurrency Daily Report November 7Angel BrokingNo ratings yet

- Kotak Sec - Forex Insight 24 May 2021Document3 pagesKotak Sec - Forex Insight 24 May 2021Dhiren DesaiNo ratings yet

- Currency Daily Report July 25 2013Document4 pagesCurrency Daily Report July 25 2013Angel BrokingNo ratings yet

- Weekly Currency Tips Via Trifid ProfessionalsDocument5 pagesWeekly Currency Tips Via Trifid ProfessionalsRahul SolankiNo ratings yet

- Dates and CommentryDocument12 pagesDates and CommentryprinceasatiNo ratings yet

- Published By:-Equity Research LABDocument9 pagesPublished By:-Equity Research LABAru MehraNo ratings yet

- HSL PCG "Currency Insight"-Weekly: 04 February, 2017Document16 pagesHSL PCG "Currency Insight"-Weekly: 04 February, 2017Dinesh ChoudharyNo ratings yet

- FX Weekly Commentary - Sep 25 - Sep 30 2011 Elite Global TradingDocument5 pagesFX Weekly Commentary - Sep 25 - Sep 30 2011 Elite Global TradingJames PutraNo ratings yet

- Currency Market Weekly ReportDocument5 pagesCurrency Market Weekly ReportRahul SolankiNo ratings yet

- Currency Daily Report, June 26 2013Document4 pagesCurrency Daily Report, June 26 2013Angel BrokingNo ratings yet

- Stock MarketDocument7 pagesStock MarketdebashreepalNo ratings yet

- Weekly Mutual Fund and Debt Report: Retail ResearchDocument14 pagesWeekly Mutual Fund and Debt Report: Retail ResearchGauriGanNo ratings yet

- Daily FX Update: Europe Provides Offset To Worrisome China PmiDocument3 pagesDaily FX Update: Europe Provides Offset To Worrisome China PmiMohd Sofian YusoffNo ratings yet

- Daily Equity ReportDocument5 pagesDaily Equity ReportJijoy PillaiNo ratings yet

- HSL PCG "Currency Insight"-Weekly: 12 September, 2016Document17 pagesHSL PCG "Currency Insight"-Weekly: 12 September, 2016shobhaNo ratings yet

- Currency Daily Report, May 24 2013Document4 pagesCurrency Daily Report, May 24 2013Angel BrokingNo ratings yet

- Daily Trade Analyses 08.4.2023 Update 1Document4 pagesDaily Trade Analyses 08.4.2023 Update 1Nitish RoushanNo ratings yet

- 21MAYDocument3 pages21MAYritudahiya1389No ratings yet

- 6 - 6th October 2016 - tcm12-12785Document2 pages6 - 6th October 2016 - tcm12-12785sharktale2828No ratings yet

- Daily Technical Analysis Report 23/october/2015Document14 pagesDaily Technical Analysis Report 23/october/2015Seven Star FX LimitedNo ratings yet

- Weekly Mutual Fund and Debt Report: Retail ResearchDocument14 pagesWeekly Mutual Fund and Debt Report: Retail ResearchGauriGanNo ratings yet

- Currency Daily Report, June 05 2013Document4 pagesCurrency Daily Report, June 05 2013Angel BrokingNo ratings yet

- HSL PCG "Currency Insight"-Weekly: 21 January, 2017Document16 pagesHSL PCG "Currency Insight"-Weekly: 21 January, 2017arun_algoNo ratings yet

- Sponsored By:: Petroleum Conservation Research AssociationDocument22 pagesSponsored By:: Petroleum Conservation Research Associationvikas.dhanesha7256No ratings yet

- IIPDocument3 pagesIIPvikas.dhanesha7256No ratings yet

- Intra 230811Document1 pageIntra 230811vikas.dhanesha7256No ratings yet

- Rupee 010811Document2 pagesRupee 010811vikas.dhanesha7256No ratings yet

- FandI CT7 200504 ExampaperDocument11 pagesFandI CT7 200504 ExampaperClerry SamuelNo ratings yet

- Chapter 2 - Financial Markets: Learning OutcomesDocument9 pagesChapter 2 - Financial Markets: Learning OutcomesIanna Kyla BatomalaqueNo ratings yet

- 2010 TRS 051811Document3 pages2010 TRS 051811jspectorNo ratings yet

- PaySlip July 2022Document1 pagePaySlip July 2022Kaushal YadavNo ratings yet

- GRP I - Law (N) - Suggested Ans - Nov 2018Document22 pagesGRP I - Law (N) - Suggested Ans - Nov 2018ABC LtdNo ratings yet

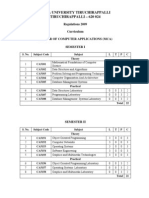

- Anna University Tiruchirappalli Tiruchirappalli - 620 024Document64 pagesAnna University Tiruchirappalli Tiruchirappalli - 620 024haiitskarthickNo ratings yet

- Credit Insurance MarketDocument107 pagesCredit Insurance MarketManjunath Reddy100% (2)

- Accounting Equation QuestionsDocument4 pagesAccounting Equation QuestionsJatin PhiraniNo ratings yet

- Fa2prob3 1Document3 pagesFa2prob3 1jayNo ratings yet

- Alan Krauss - Sr. Vice President - First American BankDocument2 pagesAlan Krauss - Sr. Vice President - First American Banklarry-612445No ratings yet

- CorpusDocument162 pagesCorpussiewyukNo ratings yet

- CCM HomeBuyerGuideDocument20 pagesCCM HomeBuyerGuideCleveracciNo ratings yet

- Georgia Laws Rules Regulations Pertinent To All AdjustersDocument5 pagesGeorgia Laws Rules Regulations Pertinent To All AdjustersEUGENE DEXTER NONESNo ratings yet

- ITR DocumentDocument6 pagesITR DocumentRamesh BabuNo ratings yet

- Igcse May 2023 1R MSDocument16 pagesIgcse May 2023 1R MSdaimon6407100% (1)

- Profit and LossDocument22 pagesProfit and LossShrimant H. NikamNo ratings yet

- Business TodayDocument104 pagesBusiness TodayBrunoNo ratings yet

- Krishna SugarsDocument53 pagesKrishna SugarsSammed DarurNo ratings yet

- Dissertation On Risk Management in Banking SectorDocument9 pagesDissertation On Risk Management in Banking SectorWhereCanIBuyResumePaperAkronNo ratings yet

- Box All and P Urcel Chapter 10Document6 pagesBox All and P Urcel Chapter 10Christine HarditNo ratings yet

- Dupire Functional ItoDocument43 pagesDupire Functional ItoRayan RayanNo ratings yet

- Activity2. MidtermDocument2 pagesActivity2. MidtermGirlynne TerenNo ratings yet

- Unaudited 3m Condensed Combined Financial StatementsDocument40 pagesUnaudited 3m Condensed Combined Financial StatementsValtteri ItärantaNo ratings yet

- The Contemporary World Module 2Document27 pagesThe Contemporary World Module 2Dan Christian VillacoNo ratings yet

- PUPUN00342240000080825 NewDocument12 pagesPUPUN00342240000080825 Newsachin kambojNo ratings yet

- Danish Iqbal: ObjectiveDocument3 pagesDanish Iqbal: ObjectiveLearning PointNo ratings yet

- Toaz - Info Quiz 6 With Solutiondocx PRDocument15 pagesToaz - Info Quiz 6 With Solutiondocx PRReland CastroNo ratings yet

- Income From EmploymentDocument40 pagesIncome From Employmenttran thanhNo ratings yet