Professional Documents

Culture Documents

Valuation and Common Sense

Valuation and Common Sense

Uploaded by

Haritika Chhatwal0 ratings0% found this document useful (0 votes)

3 views4 pagesThe document is an email from Professor Pablo Fernandez sharing a free book on valuation and common sense with 48 chapters available for download. It contains over 500 tables and 400 figures with calculations in an Excel file. The book has been used with MBAs and executives and any part of it can be freely used, distributed or copied. The professor welcomes any suggestions to improve the book.

Original Description:

valuation

Original Title

Valuation_and_Common_Sense

Copyright

© © All Rights Reserved

Available Formats

RTF, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document is an email from Professor Pablo Fernandez sharing a free book on valuation and common sense with 48 chapters available for download. It contains over 500 tables and 400 figures with calculations in an Excel file. The book has been used with MBAs and executives and any part of it can be freely used, distributed or copied. The professor welcomes any suggestions to improve the book.

Copyright:

© All Rights Reserved

Available Formats

Download as RTF, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

3 views4 pagesValuation and Common Sense

Valuation and Common Sense

Uploaded by

Haritika ChhatwalThe document is an email from Professor Pablo Fernandez sharing a free book on valuation and common sense with 48 chapters available for download. It contains over 500 tables and 400 figures with calculations in an Excel file. The book has been used with MBAs and executives and any part of it can be freely used, distributed or copied. The professor welcomes any suggestions to improve the book.

Copyright:

© All Rights Reserved

Available Formats

Download as RTF, PDF, TXT or read online from Scribd

You are on page 1of 4

Dear David:

This free book (6th edition, updated until September 2017) has 514 tables and

414 figures that are available (with all calculations) in Figures and Tables in Excel

Format

It also has more than 1,000 readers comments of previous editions. I use the book with

MBAs and Executives.You may use (resend, distribute, copy, photocopy…) the book

and any chapter as you wish. I would very much appreciate any of your suggestions for

improving the book.

Best regards,Pablo Fernandez. Professor of Finance. IESEwebPage

IESE Business School

The 48 chapters may be downloaded for free at the following links:

Valuation and Common Sense Chapters Downloadable

Table of contents, acknowledgments,

glossary http://ssrn.com/abstract=22

1 Company valuation methods http://ssrn.com/abstract=27

Cash flow is a fact. Net income is

2 http://ssrn.com/abstract=33

just an opinion

Ten badly explained topics in most

3 http://ssrn.com/abstract=20

corporate finance books

Cash flow valuation methods:

4 perpetuities, constant growth and http://ssrn.com/abstract=74

general case

Valuation using multiples: how do

5 http://ssrn.com/abstract=27

analysts reach their conclusions?

Valuing companies by cash flow

6 discounting: ten methods and nine http://ssrn.com/abstract=25

theories

Three residual income valuation

7 methods and discounted cash flow http://ssrn.com/abstract=29

valuation

WACC: definition, misconceptions

8 http://ssrn.com/abstract=16

and errors

Cash flow discounting:

9 fundamental relationships and http://ssrn.com/abstract=21

unnecessary complications

How to value a seasonal company

10 http://ssrn.com/abstract=40

discounting cash flows

Optimal capital structure: problems

11 with the Harvard and Damodaran http://ssrn.com/abstract=27

approaches

Equity premium: historical,

12 http://ssrn.com/abstract=93

expected, required and implied

The equity premium in 150

13 http://ssrn.com/abstract=14

textbooks

Market risk premium used in 82

14 countries in 2012: a survey with http://ssrn.com/abstract=20

7,192 answers

Are calculated betas good for

15 http://ssrn.com/abstract=50

anything?

Beta = 1 does a better job than

16 http://ssrn.com/abstract=14

calculated betas

Betas used by professors: a survey

17 http://ssrn.com/abstract=14

with 2,500 answers

On the instability of betas: the case

18 http://ssrn.com/abstract=51

of Spain

Valuation of the shares after an

19 expropriation: the case of http://ssrn.com/abstract=21

ElectraBul

A solution to Valuation of the

20 shares after an expropriation: the http://ssrn.com/abstract=22

case of ElectraBul

Valuation of an expropriated

21 company: the case of YPF and http://ssrn.com/abstract=21

Repsol in Argentina

1,959 valuations of the YPF shares

22 http://ssrn.com/abstract=22

expropriated to Repsol

Internet valuations: the case of

23 http://ssrn.com/abstract=26

Terra-Lycos

24 Valuation of Internet-related http://ssrn.com/abstract=26

companies

Valuation of brands and intellectual

25 http://ssrn.com/abstract=27

capital

Interest rates and company

26 http://ssrn.com/abstract=22

valuation

Price to earnings ratio, value to

27 http://ssrn.com/abstract=22

book ratio and growth

28 Dividends and share repurchases http://ssrn.com/abstract=22

29 How inflation destroys value http://ssrn.com/abstract=22

Valuing real options: frequently

30 http://ssrn.com/abstract=27

made errors

119 common errors in company

31 http://ssrn.com/abstract=10

valuations

Shareholder value creation: a

32 http://ssrn.com/abstract=26

definition

Shareholder value creators in the

33 http://ssrn.com/abstract=17

S&P 500: 1991 – 2010

EVA and ‘cash value added’ do

34 NOT measure shareholder value http://ssrn.com/abstract=27

creation

All-shareholder return, all-period

35 http://ssrn.com/abstract=23

returns and total index return

339 questions on valuation and

36 http://ssrn.com/abstract=23

finance

37 CAPM: an absurd model http://ssrn.com/abstract=25

CAPM: the model and 307

38 http://ssrn.com/abstract=25

comments about it

Value of tax shields (VTS): 3

39 theories with “some” common http://ssrn.com/abstract=25

sense

Expected and Required returns:

40 http://ssrn.com/abstract=25

very different concepts

RF and Market Risk Premium

41 Used for 41 Countries in 2015: A http://ssrn.com/abstract=25

Survey

RF and MRP used by analysts in

42 http://ssrn.com/abstract=26

USA and Europe in 2015

Meaning of the P&L and of the

43 http://ssrn.com/abstract=26

Balance Sheet: Madera Inc

Net Income, cash flows, reduced

44 http://ssrn.com/abstract=26

balance sheet and WCR

Meaning of Net Income and

45 http://ssrn.com/abstract=26

Shareholders’ Equity

The Market Portfolio is NOT

46 http://ssrn.com/abstract=27

efficient

Is it Ethical to Teach that Beta and

47 https://ssrn.com/abstract=2

CAPM Explain Something?

Finance and Financial Economics:

48 https://ssrn.com/abstract=2

A debate

You might also like

- Financial Planning & Analysis and Performance ManagementFrom EverandFinancial Planning & Analysis and Performance ManagementRating: 3 out of 5 stars3/5 (1)

- Chapter 13Document61 pagesChapter 13frq qqr70% (20)

- Valuation: Measuring and Managing the Value of CompaniesFrom EverandValuation: Measuring and Managing the Value of CompaniesRating: 3 out of 5 stars3/5 (1)

- Chapman & Hall CRC Data Mining & PDFDocument295 pagesChapman & Hall CRC Data Mining & PDFASP MusicNo ratings yet

- Investment Performance Measurement: Evaluating and Presenting ResultsFrom EverandInvestment Performance Measurement: Evaluating and Presenting ResultsPhilip Lawton, CIPMRating: 1 out of 5 stars1/5 (1)

- The Business of Venture Capital: The Art of Raising a Fund, Structuring Investments, Portfolio Management, and ExitsFrom EverandThe Business of Venture Capital: The Art of Raising a Fund, Structuring Investments, Portfolio Management, and ExitsNo ratings yet

- Salomon Smith Barney Principles of Principal Components A Fresh Look at Risk Hedging and Relative ValueDocument45 pagesSalomon Smith Barney Principles of Principal Components A Fresh Look at Risk Hedging and Relative ValueRodrigoNo ratings yet

- The Chaos Report: January 1994Document9 pagesThe Chaos Report: January 1994Navarro Tito Menian Mijares Navarro Tito Menian MijaresNo ratings yet

- Role of Financial Statement in Investment Decision Making PDFDocument69 pagesRole of Financial Statement in Investment Decision Making PDFOluwaseun Olarewaju Olatunji38% (8)

- Client On Boarding. A Best Practice GuideDocument6 pagesClient On Boarding. A Best Practice GuideIan ArmourNo ratings yet

- Investment Valuation: Tools and Techniques for Determining the Value of any Asset, University EditionFrom EverandInvestment Valuation: Tools and Techniques for Determining the Value of any Asset, University EditionRating: 5 out of 5 stars5/5 (1)

- Online Portfolio SelectionDocument227 pagesOnline Portfolio SelectionChua Yong Sheng DarrenNo ratings yet

- SMC Corporate Notes - Final Info Memo 5.21 .18 FINAlDocument68 pagesSMC Corporate Notes - Final Info Memo 5.21 .18 FINAlCristan Bap EspinaNo ratings yet

- Financial Management: Partner in Driving Performance and ValueFrom EverandFinancial Management: Partner in Driving Performance and ValueNo ratings yet

- Capital Budgeting Valuation: Financial Analysis for Today's Investment ProjectsFrom EverandCapital Budgeting Valuation: Financial Analysis for Today's Investment ProjectsNo ratings yet

- Value and Capital Management: A Handbook for the Finance and Risk Functions of Financial InstitutionsFrom EverandValue and Capital Management: A Handbook for the Finance and Risk Functions of Financial InstitutionsRating: 5 out of 5 stars5/5 (1)

- F5 LSBF Study NotesDocument206 pagesF5 LSBF Study NotesIzhar MumtazNo ratings yet

- Best Practices and Advances in Program ManagementDocument304 pagesBest Practices and Advances in Program ManagementUljan ThaçiNo ratings yet

- 11 Architecture Review Board CharterDocument9 pages11 Architecture Review Board CharterMuhammad Ammad100% (2)

- Investment Valuation: Tools and Techniques for Determining the Value of Any AssetFrom EverandInvestment Valuation: Tools and Techniques for Determining the Value of Any AssetRating: 5 out of 5 stars5/5 (1)

- The Chief Information Officer's Body of Knowledge: People, Process, and TechnologyFrom EverandThe Chief Information Officer's Body of Knowledge: People, Process, and TechnologyNo ratings yet

- Python Machine Learning Case Studies PDFDocument216 pagesPython Machine Learning Case Studies PDFKaique MouraNo ratings yet

- Corporate Explorer Fieldbook: How to Build New Ventures In Established CompaniesFrom EverandCorporate Explorer Fieldbook: How to Build New Ventures In Established CompaniesNo ratings yet

- Table of Contents Valuation and Common Sense (6th Edition)Document17 pagesTable of Contents Valuation and Common Sense (6th Edition)Hugo Bobadilla100% (1)

- Valuation and Common SenseDocument438 pagesValuation and Common SenseJENNIFFER ALEJANDRA ALDANA TOLEDONo ratings yet

- Table of Contents - Valuation and Common Sense (8th Edition)Document13 pagesTable of Contents - Valuation and Common Sense (8th Edition)meditationinstitute.netNo ratings yet

- CAFC M21 CHP Wise Test Paper+hintsDocument2 pagesCAFC M21 CHP Wise Test Paper+hintsAkshay r GowdaNo ratings yet

- Outline EprintDocument7 pagesOutline EprintAngelieV.RemediosNo ratings yet

- Contents May 2019Document17 pagesContents May 2019Kicki AnderssonNo ratings yet

- Coleag06 Act2Document4 pagesColeag06 Act2jhonny moralesNo ratings yet

- CFA LEVEL 1 Preparation BOOK 4Document50 pagesCFA LEVEL 1 Preparation BOOK 4Focus HartNo ratings yet

- Cdo Modeling OverviewDocument37 pagesCdo Modeling OverviewtwinbedtxNo ratings yet

- A Case Study On Profit Planning of Laxmi Bank Limited, KathmanduDocument9 pagesA Case Study On Profit Planning of Laxmi Bank Limited, KathmanduSocialist GopalNo ratings yet

- Cash Flow Analysis and The Funds Statement Accounting Research Study No. 02Document115 pagesCash Flow Analysis and The Funds Statement Accounting Research Study No. 02AGNES CASTILLONo ratings yet

- Applied Probabilistic Calculus For Financial Engineering An Introduction Using R 1st Edition Bertram K. C. ChanDocument42 pagesApplied Probabilistic Calculus For Financial Engineering An Introduction Using R 1st Edition Bertram K. C. Chanscott.ackley492100% (6)

- Accounts Theory Bank by Anand BhangariaDocument137 pagesAccounts Theory Bank by Anand BhangariaAshitosh VeenNo ratings yet

- Spssmissingvalueanalysis 160Document49 pagesSpssmissingvalueanalysis 160Rina BakhtianiNo ratings yet

- Deboer Ma BmsDocument68 pagesDeboer Ma Bmsdavid smithNo ratings yet

- BBS ReportDocument49 pagesBBS ReportRaz BinadiNo ratings yet

- PDF The Economics of Money Banking Financial Markets Massimo Giuliodori Ebook Full ChapterDocument53 pagesPDF The Economics of Money Banking Financial Markets Massimo Giuliodori Ebook Full Chapterchristopher.zodrow386No ratings yet

- Luận văn tốt nghiệpDocument45 pagesLuận văn tốt nghiệpHào HoàngNo ratings yet

- PBA Projections Practice NoteDocument67 pagesPBA Projections Practice NotejwidodocourseNo ratings yet

- E MetricsDocument67 pagesE Metricsedmaisonbarros3No ratings yet

- Master of Business Administration: Assignment Mark SheetDocument32 pagesMaster of Business Administration: Assignment Mark SheetZedNo ratings yet

- Resources Training Cash ManagementDocument30 pagesResources Training Cash ManagementAbhishek JhaNo ratings yet

- Keep Rubric and Question Weights in Mind When Preparing Report 100 Points - 40% of Grade Done As A Group Due: at 23:59, 12-01-22 Wednesday of Week 5Document59 pagesKeep Rubric and Question Weights in Mind When Preparing Report 100 Points - 40% of Grade Done As A Group Due: at 23:59, 12-01-22 Wednesday of Week 5Minh TongNo ratings yet

- Analysis of Some Incremental Variants of Policy IterationDocument49 pagesAnalysis of Some Incremental Variants of Policy IterationasdNo ratings yet

- Tut - Fi ThesisDocument8 pagesTut - Fi Thesiskimstephenswashington100% (2)

- SBR Exam TipDocument3 pagesSBR Exam TipmeghabhansaliclassesNo ratings yet

- 40 Kamal Garg Audit ImpDocument3 pages40 Kamal Garg Audit ImpRadhesh BhootNo ratings yet

- Container Port Performance - Index WB 2021Document114 pagesContainer Port Performance - Index WB 2021Amin Ama DuwilaNo ratings yet

- IAS 36 NokulungaDocument54 pagesIAS 36 NokulungaWebster GobvuNo ratings yet

- Fundamental Analysis and Relative Valuation Multiples Pg80Document411 pagesFundamental Analysis and Relative Valuation Multiples Pg80krisNo ratings yet

- Cryptocurrency Plan SampleDocument33 pagesCryptocurrency Plan SampleReem SaddamNo ratings yet

- Qudratullah WafaDocument61 pagesQudratullah Wafahamedi1No ratings yet

- Project 4th SemDocument92 pagesProject 4th Semप्रशांत कौशिकNo ratings yet

- Buss and Vilkov - Option-Implied Correlation and Factor Betas RevisitedDocument48 pagesBuss and Vilkov - Option-Implied Correlation and Factor Betas RevisitedSeanHoNo ratings yet

- 29 07 18 00 29 24 RegressionDocument4 pages29 07 18 00 29 24 Regressionyagya aroraNo ratings yet

- Responding To The Eurozone Crisis - Applying The Shadow Rating Approach To Determine Economic Capital For Sovereign ExposuresDocument70 pagesResponding To The Eurozone Crisis - Applying The Shadow Rating Approach To Determine Economic Capital For Sovereign ExposuresMark FesencoNo ratings yet

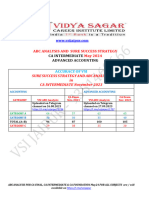

- CA Inter Adv Accounting ABC Analysis & Sure Success Strategy MayDocument4 pagesCA Inter Adv Accounting ABC Analysis & Sure Success Strategy Maybrooklaser0007No ratings yet

- Ebook Introducing Financial Mathematics Theory Binomial Models and Applications Chapman and Hall CRC Financial Mathematics Series 1St Edition Mladen Victor Wickerhauser Online PDF All ChapterDocument70 pagesEbook Introducing Financial Mathematics Theory Binomial Models and Applications Chapman and Hall CRC Financial Mathematics Series 1St Edition Mladen Victor Wickerhauser Online PDF All Chapterjames.hackworth412100% (4)

- Final Project Format For Banking Sector of Bank A, Bank B and Bank C in Same Industry For FY 20X1 20X2 20X3Document15 pagesFinal Project Format For Banking Sector of Bank A, Bank B and Bank C in Same Industry For FY 20X1 20X2 20X3Waqar BaigNo ratings yet

- Banner Finance Reference ManualDocument38 pagesBanner Finance Reference ManualMarcus Skookumchuck VanniniNo ratings yet

- Textbook Wiley Gaap 2016 Interpretation and Application of Generally Accepted Accounting Principles 1St Edition Joanne M Flood Ebook All Chapter PDFDocument54 pagesTextbook Wiley Gaap 2016 Interpretation and Application of Generally Accepted Accounting Principles 1St Edition Joanne M Flood Ebook All Chapter PDFmarie.rodriguez715100% (1)

- Coding of Data SetDocument105 pagesCoding of Data SetHaritika ChhatwalNo ratings yet

- Financial Statement AnalysisDocument7 pagesFinancial Statement AnalysisHaritika ChhatwalNo ratings yet

- WS 9igcse Business April May 2018-19Document6 pagesWS 9igcse Business April May 2018-19Haritika ChhatwalNo ratings yet

- Solution Set For Mergers and Acquisitions MBA IIIDocument20 pagesSolution Set For Mergers and Acquisitions MBA IIIHaritika ChhatwalNo ratings yet

- Research Design Quantitative Analysis For DataDocument50 pagesResearch Design Quantitative Analysis For DataHaritika ChhatwalNo ratings yet

- Hargreaves Et Al (2002) Perspectives - On - Alternative - Assessment - ReformDocument29 pagesHargreaves Et Al (2002) Perspectives - On - Alternative - Assessment - ReformHaritika ChhatwalNo ratings yet

- Ws 9igcse Business October 2018-19Document3 pagesWs 9igcse Business October 2018-19Haritika ChhatwalNo ratings yet

- Syllabus OrientationDocument3 pagesSyllabus OrientationHaritika ChhatwalNo ratings yet

- Good Questions On As-14Document97 pagesGood Questions On As-14Haritika ChhatwalNo ratings yet

- Ws 9igcse Business July 2018-19Document5 pagesWs 9igcse Business July 2018-19Haritika ChhatwalNo ratings yet

- Giisacp Igcse10 BS 2018 19Document6 pagesGiisacp Igcse10 BS 2018 19Haritika ChhatwalNo ratings yet

- Giisacp Igcse10 BS 2018 19Document2 pagesGiisacp Igcse10 BS 2018 19Haritika ChhatwalNo ratings yet

- Session 1 - Fmi - 17 NovDocument10 pagesSession 1 - Fmi - 17 NovHaritika ChhatwalNo ratings yet

- Prob Dist PracticeDocument2 pagesProb Dist PracticeHaritika ChhatwalNo ratings yet

- Ch-18 Cross Border Merger DealsDocument35 pagesCh-18 Cross Border Merger DealsHaritika ChhatwalNo ratings yet

- Session 17-18 Consumer and Wholesale Banking (Autosaved)Document61 pagesSession 17-18 Consumer and Wholesale Banking (Autosaved)Haritika ChhatwalNo ratings yet

- CH 5 - Legal DimensionsDocument49 pagesCH 5 - Legal DimensionsHaritika ChhatwalNo ratings yet

- SESSION 1-2 (Autosaved) (Autosaved)Document79 pagesSESSION 1-2 (Autosaved) (Autosaved)Haritika ChhatwalNo ratings yet

- Session - 1 FmiDocument17 pagesSession - 1 FmiHaritika ChhatwalNo ratings yet

- Assignment Food Nutrition 2019Document10 pagesAssignment Food Nutrition 2019Haritika ChhatwalNo ratings yet

- Amara Raja BatteriesDocument13 pagesAmara Raja BatteriesHaritika ChhatwalNo ratings yet

- Unit 1 RDM: February 2018Document16 pagesUnit 1 RDM: February 2018Haritika ChhatwalNo ratings yet

- 6.1 Chapter 24 Government Economic Objectives: and PoliciesDocument59 pages6.1 Chapter 24 Government Economic Objectives: and PoliciesHaritika ChhatwalNo ratings yet

- FPI FortnightlyDocument30 pagesFPI FortnightlyHaritika ChhatwalNo ratings yet

- Dias PresentationDocument12 pagesDias PresentationHaritika ChhatwalNo ratings yet

- Final Assignment Cardiogood FitnessDocument31 pagesFinal Assignment Cardiogood FitnessHaritika ChhatwalNo ratings yet

- Unit Three RDMDocument12 pagesUnit Three RDMHaritika ChhatwalNo ratings yet

- Unit Two RDMDocument14 pagesUnit Two RDMHaritika ChhatwalNo ratings yet

- BADocument1 pageBAHaritika ChhatwalNo ratings yet

- Unit Four RDMDocument7 pagesUnit Four RDMHaritika ChhatwalNo ratings yet

- MIT Job DescriptionDocument23 pagesMIT Job DescriptionPaolo Caviedes SaavedraNo ratings yet

- Annual Rep 2007 08Document228 pagesAnnual Rep 2007 08Pavithra MohanNo ratings yet

- Partnership DissolutionDocument13 pagesPartnership Dissolutionanshu kushwahNo ratings yet

- STRAMA Case StudyDocument62 pagesSTRAMA Case StudyKimberly Daryl CuNo ratings yet

- Consolidated Cash Flow Statement: For The Year Ended 31 March 2020Document3 pagesConsolidated Cash Flow Statement: For The Year Ended 31 March 2020Ashish GuptaNo ratings yet

- Eric ArroyoDocument2 pagesEric Arroyoeearroyo100% (1)

- Definition of E-CommerceDocument4 pagesDefinition of E-Commercehimanshu sanghaviNo ratings yet

- Read The Mind of AAA Marker WEB v2 PDFDocument17 pagesRead The Mind of AAA Marker WEB v2 PDFThuLe123No ratings yet

- Company Profile: Unit 2G. K-Pointe Commercial Center, Pilahan, Sabang, Lipa City E-MailDocument3 pagesCompany Profile: Unit 2G. K-Pointe Commercial Center, Pilahan, Sabang, Lipa City E-Mailamara corpNo ratings yet

- Stephen Murray Resume 2023 PHDocument4 pagesStephen Murray Resume 2023 PHAndrew AlemanaNo ratings yet

- Golden RulesDocument4 pagesGolden RulesCharlie True FriendNo ratings yet

- JD Naukri PDFDocument2 pagesJD Naukri PDFPreeti SinghNo ratings yet

- 1672494147Ch - 3 Accounting For Employee Stock Option Plans PDFDocument2 pages1672494147Ch - 3 Accounting For Employee Stock Option Plans PDFAnjali khanchandaniNo ratings yet

- Ac 2027Document394 pagesAc 2027PAT DUARTENo ratings yet

- Butte County Sheriffs Office Evacuation Procedures-3Document11 pagesButte County Sheriffs Office Evacuation Procedures-3api-568691686No ratings yet

- DHR International: ConfidentialDocument5 pagesDHR International: ConfidentialDisha Kansara ChawlaNo ratings yet

- Inside JobDocument46 pagesInside Jobbibekmishra8107No ratings yet

- PCC ConfigDocument345 pagesPCC ConfigVamsi SuriNo ratings yet

- Personal StatementDocument3 pagesPersonal StatementjulietNo ratings yet

- HanduotDocument20 pagesHanduotTegene TesfayeNo ratings yet

- Jackson Pettigrew Presentation 1221Document15 pagesJackson Pettigrew Presentation 1221SarahNo ratings yet

- GAM Financial StatementsDocument12 pagesGAM Financial StatementsNabelah OdalNo ratings yet

- Improvement: Aggregate FollowingDocument18 pagesImprovement: Aggregate FollowingGauravNo ratings yet

- Tutorial Letter 201/1/2019: Strategic SourcingDocument10 pagesTutorial Letter 201/1/2019: Strategic SourcingloshniNo ratings yet

- PADANG 0308 TestDocument122 pagesPADANG 0308 Testyosdi harmenNo ratings yet