Professional Documents

Culture Documents

Stafford Press Question

Uploaded by

Vishal Shukla0 ratings0% found this document useful (0 votes)

17 views4 pagesStafford Press Case Study

Original Title

stafford press question

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentStafford Press Case Study

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

17 views4 pagesStafford Press Question

Uploaded by

Vishal ShuklaStafford Press Case Study

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 4

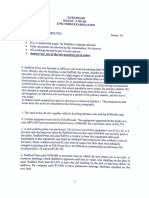

STAFFORD PRESS

1. The land at the old site, together with

the building thereon, was sold for

$149,860 cash.

2. Certain equipment was sold for

$35,200 cash. This equipment appeared

on the books at a cost of $73,645 less

accumulated depreciation of $40,890 for

a net book value of $32,755.

3. A new printing press was purchased. The invoice cost

of this equipment was $112,110. A 2 percent cash

discount was taken by Stafford Press so that only

$109,868 was actually paid to the seller. Stafford

Press also paid $450 to a trucker to have this

equipment delivered. Installation of this equipment

was made by Stafford Press employees who worked a

total of 60 hours. These workers received $15 per

hour in wages, but their time was ordinarily charged

to printing jobs at $ 30.50 per hour, the difference

representing a allowance for overhead ($12.15) and

profit ($3.35).

4. Stafford Press paid $140,000 to purchase land on

which the new plant was to be built. A rundown

building, which Stafford’s appraiser said had no value,

was standing on the plot of land. Stafford Press paid

$21,235 to have the old building on the plot of land

torn down. In addition, the company paid $13,950 to

have permanent drainage facilities installed on the

new land.

5. A new composing machine was an invoice cost of $

28,030 was purchased. The company paid $20,830

cash and received a trade in allowances of $7,200 on

a used piece of equipment. The used equipment

could have been sold outright for not more than

$6,050. It had cost $12,000 new, and accumulated

depreciation on it was $5,200, making the net book

value $6,800.

6. The company erected a building at the new site for

$561,000. Of this amount, $136,000 was paid in cash

and $425,000 was borrowed on a mortgage.

7. Trucking and other costs associated with moving equipment from the old location to the new

location and installing it were $8,440. In addition, Stafford press employees worked an estimated

125 hours on that part of the move that related to equipment.

8. During the moving operation, a piece of equipment costing $10,000 was dropped and damaged;

$3,220 was spent to repair it. Management believed, however, that the salvage value of this

equipment had been reduced by $660 from the original estimate of $1,950 to $1,290. Up until

that time, the equipment was being depreciated at $805 per year, representing a 10 percent rate

after deduction of estimated salvage of $1,950. Accumulated depreciation was $3,220.

STAFFORD PRESS

Condensed Balance Sheet

(Prior to Move)

ASSETS LAIBILTIES AND OWNER’S EQUITY

Current Assets: Current Liabilities $160,223

Cash $395,868 Common Stock $400,000

Other current Assets $251,790 Retained Earnings $358,648

Total Current Assets $647,658

Property and Equipment:

Land $34,034

Buildings $350,064

Less: Accu. Depreciation $199,056 $151,008

Equipment $265,093

Less: Accu. Depreciation $178,922 $86,171

$918,871 $918,871

You might also like

- Accounting Practice 4 First Partial 2021-3Document13 pagesAccounting Practice 4 First Partial 2021-3ScribdTranslationsNo ratings yet

- Wa0007.Document4 pagesWa0007.Anushka Chhabra H22067No ratings yet

- Case 7 3 StaffordDocument5 pagesCase 7 3 StaffordArjun Khosla0% (2)

- Homework ch2Document35 pagesHomework ch2KristineTwo CorporalNo ratings yet

- Tania Maharani - C1C019071 - Tugas AKL 3Document5 pagesTania Maharani - C1C019071 - Tugas AKL 3Tania MaharaniNo ratings yet

- Gianrie Gwyneth Cabigon - Assign - BusCom ExercisesDocument10 pagesGianrie Gwyneth Cabigon - Assign - BusCom ExercisesRie CabigonNo ratings yet

- (Quiz Uas Take Home) Akl-1 PDFDocument7 pages(Quiz Uas Take Home) Akl-1 PDFStephani ElvinaNo ratings yet

- Abc Recit 1Document3 pagesAbc Recit 1reiNo ratings yet

- Yohannes Sinaga - 023001801165 - AKL - Bab4 2Document6 pagesYohannes Sinaga - 023001801165 - AKL - Bab4 2Yohannes SinagaNo ratings yet

- Exhibit 17. Goodwill Calculation and The Consolidated Balance SheetDocument4 pagesExhibit 17. Goodwill Calculation and The Consolidated Balance SheetЭниЭ.No ratings yet

- Accounting For Property, Plant and Equipment and Intangible AssetsDocument19 pagesAccounting For Property, Plant and Equipment and Intangible AssetsMichael Linard SamileyNo ratings yet

- Reviewer Acctg 7Document6 pagesReviewer Acctg 7ezraelydanNo ratings yet

- Uswatur Rizkiyah - 180422623171 - JJ - Tugas AKL II - P1-3Document4 pagesUswatur Rizkiyah - 180422623171 - JJ - Tugas AKL II - P1-3Kiki amaliaNo ratings yet

- Exercise 1. Classification of Cash Flow 2Document8 pagesExercise 1. Classification of Cash Flow 2Linh LinhNo ratings yet

- Sherlin - 198110790 - Tugas 1 Akuntansi Keuangan LanjutanDocument6 pagesSherlin - 198110790 - Tugas 1 Akuntansi Keuangan LanjutanSherlin KhuNo ratings yet

- Firda Arfianti - LC53 - CONSOLIDATION BALANCE SHEET Exercise 3-3Document2 pagesFirda Arfianti - LC53 - CONSOLIDATION BALANCE SHEET Exercise 3-3FirdaNo ratings yet

- Chapter 3 ExaminationDocument4 pagesChapter 3 ExaminationSurameto HariyadiNo ratings yet

- Modul Lab Akuntansi Lanjutan Ii - P 21.22Document34 pagesModul Lab Akuntansi Lanjutan Ii - P 21.22christin melinaNo ratings yet

- Ex. 10-135-Nonmonetary ExchangeDocument4 pagesEx. 10-135-Nonmonetary ExchangeCarlo ParasNo ratings yet

- Latihan Arus KasDocument8 pagesLatihan Arus KasEka Junita HartonoNo ratings yet

- Chapter 9 Question Review PDFDocument12 pagesChapter 9 Question Review PDFAbdul AkberNo ratings yet

- Advanced ACCT PROJECT II FINAL DRAFTDocument3 pagesAdvanced ACCT PROJECT II FINAL DRAFTnoureen sohailNo ratings yet

- Chegg India Pvt. Ltd. MNE Test Paper - Accountancy: Answer Any 5 QuestionsDocument7 pagesChegg India Pvt. Ltd. MNE Test Paper - Accountancy: Answer Any 5 QuestionsJoel Christian MascariñaNo ratings yet

- Ppe - WorksheetDocument7 pagesPpe - Worksheetbereket nigussieNo ratings yet

- Final Exam - Fall 2007Document9 pagesFinal Exam - Fall 2007jhouvanNo ratings yet

- Tugas Asdos AklDocument6 pagesTugas Asdos AklNicholas AlexanderNo ratings yet

- HARD ROCK COMPANY Statement of Financial PositionDocument3 pagesHARD ROCK COMPANY Statement of Financial PositionJade Lykarose Ochavillo GalendoNo ratings yet

- Ch1 HW SolutionsDocument6 pagesCh1 HW SolutionsNuzul Hafidz Yaslin0% (1)

- Chapter 10 - SolutionsDocument25 pagesChapter 10 - SolutionsGerald SusanteoNo ratings yet

- Initial Cost of EquipmentDocument10 pagesInitial Cost of EquipmentRamin AminNo ratings yet

- Altria Numbers and ValuationDocument66 pagesAltria Numbers and ValuationJosé Manuel EstebanNo ratings yet

- Mokoagouw, Angie Lisy (Advance Problem Chapter 1)Document14 pagesMokoagouw, Angie Lisy (Advance Problem Chapter 1)AngieNo ratings yet

- Crystal Meadows: Statement of Cash Flows Grigorios KrousiarlisDocument14 pagesCrystal Meadows: Statement of Cash Flows Grigorios KrousiarlisevdokiaaakNo ratings yet

- ACCO 420 Midterm Fall 2017Document6 pagesACCO 420 Midterm Fall 2017conu studentNo ratings yet

- Makalah Farrer Manufacturing CoDocument16 pagesMakalah Farrer Manufacturing CoM RahmanNo ratings yet

- Sherlyne Balqist Setyo Afrilin 008201800085 Exercises Intermediate AccountingDocument7 pagesSherlyne Balqist Setyo Afrilin 008201800085 Exercises Intermediate AccountingSTEFANI NUGRAHANo ratings yet

- Advance AccountingDocument7 pagesAdvance AccountingPutri anjjarwatiNo ratings yet

- Tax Homework Chapter 6Document4 pagesTax Homework Chapter 6RosShanique ColebyNo ratings yet

- Soal Jawaban AKL CHP 1Document5 pagesSoal Jawaban AKL CHP 1Allpacino DesellaNo ratings yet

- TeDocument8 pagesTeRaja JulianNo ratings yet

- Working 1Document2 pagesWorking 1Hà Lê DuyNo ratings yet

- Homework 1 Week2Document12 pagesHomework 1 Week2Nicholas Giovanna ChongNo ratings yet

- The Following Account Balances Were Included in Bromley Company S BalanceDocument1 pageThe Following Account Balances Were Included in Bromley Company S BalanceTaimur TechnologistNo ratings yet

- 6 Advanced Accounting 2DDocument3 pages6 Advanced Accounting 2DRizky Nugroho SantosoNo ratings yet

- Statement of Change in Working Capital & Inflows/Outflows of Working CapitalDocument5 pagesStatement of Change in Working Capital & Inflows/Outflows of Working CapitalChandani DesaiNo ratings yet

- Problem 2-2: J.L. Gregory CompanyDocument5 pagesProblem 2-2: J.L. Gregory CompanyKAPIL MBA 2021-23 (Delhi)No ratings yet

- Tugas AKM1 Pertemuan 10Document3 pagesTugas AKM1 Pertemuan 10Siti rahmahNo ratings yet

- Chapter - 1Document23 pagesChapter - 1Kumar AmitNo ratings yet

- QuestionsDocument1 pageQuestionsjesicaNo ratings yet

- Chapter 1 Book Questions With AnswersDocument5 pagesChapter 1 Book Questions With AnswersZeinab MohamadNo ratings yet

- Advanced Accounting Part 2 Take Home Activity: - Total Present Value)Document3 pagesAdvanced Accounting Part 2 Take Home Activity: - Total Present Value)Airille CarlosNo ratings yet

- Task 4 - Consolidation: Patricia HarringtonDocument9 pagesTask 4 - Consolidation: Patricia HarringtonDewi Agus SukowatiNo ratings yet

- AFA Tut 2Document16 pagesAFA Tut 2Đỗ Kim ChiNo ratings yet

- Ch1 Handout QuestionsDocument2 pagesCh1 Handout QuestionsSin TungNo ratings yet

- LabQuiz1Document5 pagesLabQuiz1DE LUNA, John Michael T.No ratings yet

- HOMEWORK-Chapter 2: Full Name: Trần Thị Thu Hiền Id: Ds150054 Class: Ib1503Document6 pagesHOMEWORK-Chapter 2: Full Name: Trần Thị Thu Hiền Id: Ds150054 Class: Ib1503Thạch TrâmNo ratings yet

- Form6 Mock ExamDocument7 pagesForm6 Mock Examkya.pNo ratings yet

- MizisufotivilaveDocument3 pagesMizisufotivilaveVishal ShuklaNo ratings yet

- Lets Make The World A Better PlaceDocument15 pagesLets Make The World A Better PlaceVishal ShuklaNo ratings yet

- The Role and Impact of Industry 4.0 and The Internet of Things On The Business Strategy of The Value Chain-The Case of HungaryDocument25 pagesThe Role and Impact of Industry 4.0 and The Internet of Things On The Business Strategy of The Value Chain-The Case of HungaryYvada SiissyNo ratings yet

- Mollier Chart WaterDocument1 pageMollier Chart Waterchouchou575% (8)

- Chapter 7. Ferrous and Non-Ferrous AlloysDocument14 pagesChapter 7. Ferrous and Non-Ferrous AlloysVishal ShuklaNo ratings yet

- Krishna Perfect FriendDocument1 pageKrishna Perfect FriendVishal ShuklaNo ratings yet

- Chapter 3. Failure of MaterialsDocument20 pagesChapter 3. Failure of MaterialsVishal ShuklaNo ratings yet

- RRB JE CBT1 - 2 Mechanical PDFDocument865 pagesRRB JE CBT1 - 2 Mechanical PDFshankarNo ratings yet

- Practice Problems For Engineering Thermodynamics: August 2019Document23 pagesPractice Problems For Engineering Thermodynamics: August 2019Sofia Diane AbrahanNo ratings yet

- Internet of Things in The Context of Industry 4.0: An OverviewDocument16 pagesInternet of Things in The Context of Industry 4.0: An OverviewNur Dini LeeNo ratings yet

- German Language CourseDocument210 pagesGerman Language Course42099% (71)

- Steam NozzleDocument19 pagesSteam NozzleVishal ShuklaNo ratings yet

- Engg MechanicsDocument37 pagesEngg MechanicsMITTAPALLI PAVAN KUMAR REDDYNo ratings yet

- PUZZLE 1 by A.K. Nandan.Document11 pagesPUZZLE 1 by A.K. Nandan.Vishal ShuklaNo ratings yet

- Humanvaluesandprofessionalethicsnotesunit1 140909033811 Phpapp02Document13 pagesHumanvaluesandprofessionalethicsnotesunit1 140909033811 Phpapp02Silky GaurNo ratings yet

- Energy Lecture 10 SolarPowerDocument44 pagesEnergy Lecture 10 SolarPowerSabareeswaran MurugesanNo ratings yet

- Steam Table For EngineersDocument103 pagesSteam Table For EngineersVizay KumarNo ratings yet