Professional Documents

Culture Documents

Cash Flow Analysis Problems

Uploaded by

Kristine Mungcal0 ratings0% found this document useful (0 votes)

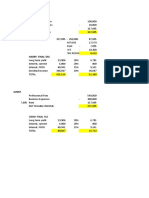

3 views5 pagesThis document contains financial information for two companies, including income statements, cash flow statements, and balance sheet figures. It calculates operating cash flow, cash flow from operations, cash flow from financing, and cash flow from investing for each company. Key figures include Company A generating $948,000 operating cash flow and $474,000 cash flow from operations, and Company B generating $17,091,000 operating cash flow and $13,473,000 cash flow from operations.

Original Description:

Original Title

cash-flow-analysis-problems

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document contains financial information for two companies, including income statements, cash flow statements, and balance sheet figures. It calculates operating cash flow, cash flow from operations, cash flow from financing, and cash flow from investing for each company. Key figures include Company A generating $948,000 operating cash flow and $474,000 cash flow from operations, and Company B generating $17,091,000 operating cash flow and $13,473,000 cash flow from operations.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

3 views5 pagesCash Flow Analysis Problems

Uploaded by

Kristine MungcalThis document contains financial information for two companies, including income statements, cash flow statements, and balance sheet figures. It calculates operating cash flow, cash flow from operations, cash flow from financing, and cash flow from investing for each company. Key figures include Company A generating $948,000 operating cash flow and $474,000 cash flow from operations, and Company B generating $17,091,000 operating cash flow and $13,473,000 cash flow from operations.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You are on page 1of 5

Sales 2,980,000.

00

Cost of goods sold 1,295,000.00

Administrative 530,000.00

Depreciation 420,000.00

EBIT 735,000.00

Less: Interest 45,000.00

Taxable income 690,000.00

Less: Tax (30%) 207,000.00

Net income 483,000.00

OCF = EBIT + Depreciation - Taxes

OCF = 735,000 + 420,000 - 207,000

OCF = 948,000

Sales 28,476.00

Less COGS and admin 20,136.00

Depreciation 3,408.00

EBIT 4,932.00

Less Interest 497.00

Taxable income 4,435.00

Less Tax (20%) 887.00

Net income 3,548.00 A

OCF = EBIT + Depreciation - Taxes

OCF = 4,932 + 3,408 - 887

OCF = 7,453 B

CFA = OCF - Net capital spending - Change in net working capital

CFA = 7,453 - 6,144 - 835

CFA = P474 C Change in net working capital

CFA = CFC +CFS Ending balance

Beginning Balance

CFC = Interest paid - Net new borrowings Change in net working capital

CFC = 497 - 0

CFC = 497 D Net capital spending ( Net fixed assets)

CFA = CFC + CFS

474 = 497 - 23

CFS = -23 E

Net new equity

CFS = Dividends paid - Net new equity

-23 = 739 - X Ending balance + Depreciation - Beginning bala

X = 739 + 23

X = 762

n net working capital

Current Assets Current Liab Net work cap

4,234.00 2,981.00 1,253.00

3,528.00 3,110.00 418.00

n net working capital 835.00

al spending ( Net fixed assets)

Net Fixed Assets

19,872.00 3,408.00

6,144.00

22,608.00

alance + Depreciation - Beginning balance = Net capital spending

Sales 40,664.00

Less COS and admin 20,393.00

Depreciation 3,434.00

EBIT 16,837.00

Less Interest 937.00

Taxable income 15,900.00

Less Tax (20%) 3,180.00

Net income 12,720.00

OCF = EBIT + Depreciation - Tax

OCF = 16,837 + 3,434 - 3,180 CA CL

OCF = P17,091 A 2020 2,881.00 1,726.00

2019 2,718.00 1,174.00

CFA = OCF - NCS - CNWC Change

CFA = 17,091 - 4,007 + 389

CFA = 13,473 B

Net Fixed Assets

CFC = Interest paid - Net new borrowings 12,602.00 3,434.00

CFC = 937 - 5,810 4,007.00

CFC = -4,873 C

13,175.00

Long term debt 2019; P6,873 and 2020; P12,683

Common stock 2019; P8,590 and 2020; P18,190

CFS = Dividends paid - Net new equity Net new borrowings = 12,683- 6,873

CFS = 1000 - 9600 5,810.00

CFS = -8,600

Net new equity = 18,190 - 8,590

9,600.00

CFA = CFC + CFS

13,473 = 4,873 + 8,600

13,473 = 13,473

NWC

1,155.00

1,544.00

- 389.00

You might also like

- LOMA 280 Test PDFDocument75 pagesLOMA 280 Test PDFAbhijit80% (10)

- Ventura, Mary Mickaella R Chapter 4 - MinicaseDocument5 pagesVentura, Mary Mickaella R Chapter 4 - MinicaseMary Ventura100% (1)

- CPA Review Notes 2019 - FAR (Financial Accounting and Reporting)From EverandCPA Review Notes 2019 - FAR (Financial Accounting and Reporting)Rating: 3.5 out of 5 stars3.5/5 (17)

- Sweet Dreams Inc. Case AnalysisDocument13 pagesSweet Dreams Inc. Case Analysisdontcare3267% (3)

- Answers: Operating Income Changes in Net Operating AssetsDocument6 pagesAnswers: Operating Income Changes in Net Operating AssetsNawarathna KumariNo ratings yet

- FI 3300 - Corporation Finance Spring 2015: THPS-1 Solution KeyDocument10 pagesFI 3300 - Corporation Finance Spring 2015: THPS-1 Solution KeySer Ronell0% (1)

- Chapter 13Document5 pagesChapter 13Kirsten FernandoNo ratings yet

- Bandhan BankDocument37 pagesBandhan BankBandaru NarendrababuNo ratings yet

- CTA Case Phil Am Life V CTA and CommissionerDocument4 pagesCTA Case Phil Am Life V CTA and Commissionersaintkarri100% (3)

- Case Study Accounting Oart2Document5 pagesCase Study Accounting Oart2Vero MinaNo ratings yet

- CH4 MinicaseDocument4 pagesCH4 Minicasemervin coquillaNo ratings yet

- CH4 Seminar SolutionsDocument3 pagesCH4 Seminar SolutionsrisitsavaniNo ratings yet

- Financial Statements, Taxes, and Cash Flow: Solutions To Questions and ProblemsDocument9 pagesFinancial Statements, Taxes, and Cash Flow: Solutions To Questions and ProblemsJulyMoon RMNo ratings yet

- Sweet Beginnings Company Balance Sheet For The Year Ended December 31, 2021Document3 pagesSweet Beginnings Company Balance Sheet For The Year Ended December 31, 2021Frylle Kanz Harani PocsonNo ratings yet

- Jawaban UTS Manajemen KeuanganDocument16 pagesJawaban UTS Manajemen KeuanganMikhail BarenovNo ratings yet

- Tugas 2, ANALISIS LAPORAN KEUANGANDocument9 pagesTugas 2, ANALISIS LAPORAN KEUANGANlessyNo ratings yet

- Example of Deferred Tax LiabilityDocument1 pageExample of Deferred Tax Liabilityarjun-chopra-4887No ratings yet

- FINMANDocument11 pagesFINMANJenny Shane UmaliNo ratings yet

- Answers (مبادئ مالية) Ch.2and3Document11 pagesAnswers (مبادئ مالية) Ch.2and3moon lightNo ratings yet

- RWJJ Chapter 2: Solutions To Assigned Questions and ProblemsDocument9 pagesRWJJ Chapter 2: Solutions To Assigned Questions and ProblemsvzzrNo ratings yet

- Tax ProblemsDocument14 pagesTax Problemsrav dano100% (1)

- Direct Tax Solution PDFDocument8 pagesDirect Tax Solution PDFGaurav SoniNo ratings yet

- Chapter No. 2 Financial Statements, Taxes and Cash Flow Solutions To Questions and ProblemsDocument9 pagesChapter No. 2 Financial Statements, Taxes and Cash Flow Solutions To Questions and ProblemsNuman Rox0% (1)

- Solutions Chapter 2Document8 pagesSolutions Chapter 2Vân Anh Đỗ LêNo ratings yet

- Afs 20240126 140330 0000Document2 pagesAfs 20240126 140330 0000jaysongo0635No ratings yet

- ParDocument4 pagesParLeiann MagnayeNo ratings yet

- CH 2 SolutionDocument4 pagesCH 2 SolutionHoang MinhNo ratings yet

- Chapter 2 12 Edi. Modf.Document8 pagesChapter 2 12 Edi. Modf.Maruf AhmedNo ratings yet

- Quiz 2 Receivables - Solution GuideDocument8 pagesQuiz 2 Receivables - Solution GuideMaricar PinedaNo ratings yet

- The Institute of Finance Management: AnswersDocument6 pagesThe Institute of Finance Management: AnswersAli SalehNo ratings yet

- Deferred TaxDocument14 pagesDeferred Taxiftekharul alamNo ratings yet

- fOMRULAS hw1Document7 pagesfOMRULAS hw1Giovanna Uragano BarbatoNo ratings yet

- AFAR8719 - Foreign-Currency-Transaction-and-Translation Solutions PDFDocument2 pagesAFAR8719 - Foreign-Currency-Transaction-and-Translation Solutions PDFSid TuazonNo ratings yet

- FinManSemis2 UmaliDocument7 pagesFinManSemis2 UmaliJenny Shane UmaliNo ratings yet

- AFAR ANSWER KeyDocument6 pagesAFAR ANSWER KeyCheska JaplosNo ratings yet

- Answers To Concepts Review and Critical Thinking QuestionsDocument6 pagesAnswers To Concepts Review and Critical Thinking QuestionsHimanshu KatheriaNo ratings yet

- Chapter 4 - FINANCIAL STUDYDocument14 pagesChapter 4 - FINANCIAL STUDYRed SecretarioNo ratings yet

- YowDocument35 pagesYowJane Michelle Eman100% (1)

- CHAPTER 14 - ExercisesDocument6 pagesCHAPTER 14 - ExercisesDeviane CalabriaNo ratings yet

- AfarDocument4 pagesAfaroxennnnNo ratings yet

- Afar by Dr. FerrerDocument4 pagesAfar by Dr. FerrerFrans HechanovaNo ratings yet

- Afar by Dr. Ferrer First Preboard Review 85Document4 pagesAfar by Dr. Ferrer First Preboard Review 85Julie Neay AfableNo ratings yet

- FormatsDocument15 pagesFormatsMohamed ShaminNo ratings yet

- Solution To Capital Investment ExercisesDocument7 pagesSolution To Capital Investment ExercisesMaria ClaraNo ratings yet

- Semi FinalDocument17 pagesSemi FinalJane TuazonNo ratings yet

- Afar by Dr. FerrerDocument4 pagesAfar by Dr. FerrerJade GomezNo ratings yet

- AACA2 AssignmentsDocument20 pagesAACA2 AssignmentsadieNo ratings yet

- Capital BudgetingDocument3 pagesCapital BudgetingMichael angelo TugasNo ratings yet

- Corporate Finance Canadian 7th Edition Jaffe Solutions ManualDocument16 pagesCorporate Finance Canadian 7th Edition Jaffe Solutions Manualtaylorhughesrfnaebgxyk100% (27)

- Corporate Finance Solution Chapter 6Document9 pagesCorporate Finance Solution Chapter 6Kunal KumarNo ratings yet

- Tutanes, Ma. Angelita 3BAM5ADocument2 pagesTutanes, Ma. Angelita 3BAM5AMaxGel De VeraNo ratings yet

- Jawaban Mojakoe-UTS Akuntansi Keuangan 1 Ganjil 2020-2021Document22 pagesJawaban Mojakoe-UTS Akuntansi Keuangan 1 Ganjil 2020-2021Vincenttio le CloudNo ratings yet

- Corporate Finance: Capital BudgetingDocument29 pagesCorporate Finance: Capital BudgetingPigeons LoftNo ratings yet

- Acc 3013 - Fwa Revision AnswersDocument15 pagesAcc 3013 - Fwa Revision Answersfalnuaimi001No ratings yet

- Profitability Ratio 2Document18 pagesProfitability Ratio 2Wynphap podiotanNo ratings yet

- Net Income 17,000: Account Receivable - 45,000Document3 pagesNet Income 17,000: Account Receivable - 45,000Rock RoseNo ratings yet

- SBM Errata Sheet 2020 - 080920Document11 pagesSBM Errata Sheet 2020 - 080920Hamza AliNo ratings yet

- Tugas Personal 1 FINC6193Document9 pagesTugas Personal 1 FINC6193alif syahputra11No ratings yet

- FM II Assignment 5 Solution 19Document6 pagesFM II Assignment 5 Solution 19Sheryar NaeemNo ratings yet

- Chapter 13 A-C PDFDocument13 pagesChapter 13 A-C PDFKim Arvin DalisayNo ratings yet

- Multiple Choice Answers and Solutions: Franchise Accounting 177Document11 pagesMultiple Choice Answers and Solutions: Franchise Accounting 177Mazikeen DeckerNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Ifrs Inr Press ReleaseDocument7 pagesIfrs Inr Press ReleaseV KeshavdevNo ratings yet

- Vice Presidents/ V: Sr. No. Name of The Person TenureDocument7 pagesVice Presidents/ V: Sr. No. Name of The Person TenurePREET10No ratings yet

- Application of JhimpirDocument194 pagesApplication of Jhimpirjaved765No ratings yet

- Forex College Report (Final)Document67 pagesForex College Report (Final)Neha jain100% (1)

- Cma Inter - Corporate Accounts Marathon NotesDocument50 pagesCma Inter - Corporate Accounts Marathon NotesCreation of MoneyNo ratings yet

- Some New Evidence On Why Companies Use Convertible BondsDocument12 pagesSome New Evidence On Why Companies Use Convertible BondsferinadNo ratings yet

- Week 2 - Fabm 1 - Accounting Cycle of A Merchandising BusinessDocument19 pagesWeek 2 - Fabm 1 - Accounting Cycle of A Merchandising BusinessSheila Marie Ann Magcalas-GaluraNo ratings yet

- LP Elements of Statement of Financial PositionDocument3 pagesLP Elements of Statement of Financial PositionAld Rich NuñezNo ratings yet

- Amortizing Bond and Accreting Bond ValuationDocument9 pagesAmortizing Bond and Accreting Bond ValuationDavid LeeNo ratings yet

- TT1 Bahasa Inggris Niaga Adbi4201Document1 pageTT1 Bahasa Inggris Niaga Adbi4201lutfiNo ratings yet

- Taxation Chapter 2Document17 pagesTaxation Chapter 2KathleenAlfaroDelosoNo ratings yet

- Explanation of The RCCP For BUSLAW IIDocument3 pagesExplanation of The RCCP For BUSLAW IINarvaez, Angel BethNo ratings yet

- Liquidity Concepts by Victorious 5Document17 pagesLiquidity Concepts by Victorious 5MUDRICK ACCOUNTSNo ratings yet

- Nism Depository Operations Study Notes PDFDocument29 pagesNism Depository Operations Study Notes PDFPooja PandeyNo ratings yet

- Ea2 TaxationDocument3 pagesEa2 TaxationBlythe teckNo ratings yet

- Contract Costing PPT FinalDocument15 pagesContract Costing PPT FinalShivamNo ratings yet

- Topic 5 - Dividend PolicyDocument5 pagesTopic 5 - Dividend PolicyZURINA ABDUL KADIRNo ratings yet

- Reverand Father Layog Case StudyDocument2 pagesReverand Father Layog Case StudyJomsNo ratings yet

- Financial Statement AnalysisDocument19 pagesFinancial Statement AnalysisNickNo ratings yet

- Chapter 11Document75 pagesChapter 11Maged AboelmagdNo ratings yet

- Acon PtyDocument13 pagesAcon PtyTuba MirzaNo ratings yet

- CFO ProgrammeDocument7 pagesCFO ProgrammeAnish ShahNo ratings yet

- 1-4e Income Taxes: Formula For Federal Income Tax On IndividualsDocument3 pages1-4e Income Taxes: Formula For Federal Income Tax On IndividualsMeriton KrivcaNo ratings yet

- London School Ofbusiness and Finance: Lecture Nine Corporate FinanceDocument44 pagesLondon School Ofbusiness and Finance: Lecture Nine Corporate FinanceAayaz TuriNo ratings yet

- Treasury Yield Curve: FUQINTRD 683W: Global Markets and InstitutionsDocument23 pagesTreasury Yield Curve: FUQINTRD 683W: Global Markets and InstitutionsNaresh KumarNo ratings yet

- U.S. Hegemony Today - Peter GowanDocument12 pagesU.S. Hegemony Today - Peter GowanpeterVoterNo ratings yet