Professional Documents

Culture Documents

Absorption Costing

Uploaded by

Bình Nguyen0 ratings0% found this document useful (0 votes)

3 views4 pagesThe document provides financial information for two years including actual production, sales, costs of goods sold, gross margin, selling and administrative costs, and earnings before interest and taxes. Key details are actual production was 4,400 units in year 1 and 3,800 units in year 2, cost of goods sold included direct materials, direct labor, variable overhead, and fixed overhead which was absorbed at a rate of $2 per unit, and earnings before interest and taxes were $2,500 in year 1 and $1,100 in year 2.

Original Description:

Original Title

absorption costing

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document provides financial information for two years including actual production, sales, costs of goods sold, gross margin, selling and administrative costs, and earnings before interest and taxes. Key details are actual production was 4,400 units in year 1 and 3,800 units in year 2, cost of goods sold included direct materials, direct labor, variable overhead, and fixed overhead which was absorbed at a rate of $2 per unit, and earnings before interest and taxes were $2,500 in year 1 and $1,100 in year 2.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

3 views4 pagesAbsorption Costing

Uploaded by

Bình NguyenThe document provides financial information for two years including actual production, sales, costs of goods sold, gross margin, selling and administrative costs, and earnings before interest and taxes. Key details are actual production was 4,400 units in year 1 and 3,800 units in year 2, cost of goods sold included direct materials, direct labor, variable overhead, and fixed overhead which was absorbed at a rate of $2 per unit, and earnings before interest and taxes were $2,500 in year 1 and $1,100 in year 2.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You are on page 1of 4

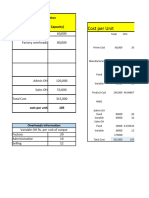

PU Y1 Y2

Actual production 4400 3800

Actual sales 4200 4000

sales rev 42000 40000

Less: COGS

opening inventory 0 1600

Add: production

DM 2 8800 7600

DL 3 13200 11400

Variable OH 1 4400 3800

FOH*absorped 2 8800 7600

Less: closing inventory -1600 0

less (over)/add (under) absorped -300 900

total COGS 33300 32900

gross margin 8700 7100

Less selling, admin cost

Variable 1 4200 4000

fixed 2000 2000

Total S&A 6200 6000

EBIT 2500 1100

OH cost= FOAR=budgeted fixed oh cost/budgeted production 2

FOH p.u 2

variable production cost 6

unit cost 8

FOH absorped 8800

actual FOH 8500

(absorp>actual)=> over absorped 300

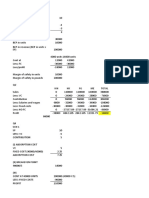

Contribution income statement

Year 1 Year 2

4200 4000

Sales rev 42000 40000

Less: variable exp -29400 -28000

CM 12600 12000

Less: fixed exp -10500 -10500

Net income 2100 1500

Fixed production cost 8000

Budgeted production 4000

FPC/unit 2 200 units deferred in inventory

You might also like

- PS Set 1 - 2Document61 pagesPS Set 1 - 2Rithesh KNo ratings yet

- Worksheet Campar IndustriesDocument11 pagesWorksheet Campar IndustriesRUPIKA R GNo ratings yet

- Assignment 2 - CMADocument9 pagesAssignment 2 - CMAVivek SharanNo ratings yet

- Day 4 (My)Document11 pagesDay 4 (My)Jhilmil JeswaniNo ratings yet

- COST MANAGEMENT AND CONTROL CIA - Sheet1Document6 pagesCOST MANAGEMENT AND CONTROL CIA - Sheet1neha konarNo ratings yet

- Miller Toy Company Manufactures A Plastic Swimming PoolDocument10 pagesMiller Toy Company Manufactures A Plastic Swimming Poollaale dijaanNo ratings yet

- MANAC Pre MidDocument9 pagesMANAC Pre MidAbhay KaseraNo ratings yet

- Exacting SpecificationsDocument7 pagesExacting SpecificationsGNYNETH JASMIN LINGANNo ratings yet

- Retain/drop A Segment E12-2Document6 pagesRetain/drop A Segment E12-2Khanh NgocNo ratings yet

- Problem 1: Solution Guide - Requirement 1Document4 pagesProblem 1: Solution Guide - Requirement 1Lerma MarianoNo ratings yet

- CostingDocument56 pagesCostingKartNo ratings yet

- C305 - Matthew (Midterm Excel Templates)Document11 pagesC305 - Matthew (Midterm Excel Templates)Rachel KantersNo ratings yet

- Prime Cost 2940000 Conversion Cost Work Cost (Gross) 4140000Document4 pagesPrime Cost 2940000 Conversion Cost Work Cost (Gross) 4140000Shachin ShibiNo ratings yet

- 30 Dec COST SHEET - PGDMDocument15 pages30 Dec COST SHEET - PGDMPoonamNo ratings yet

- Cma Budget ExcelDocument6 pagesCma Budget ExcelDristi SinghNo ratings yet

- Mas - Chapter 4 LessonsDocument5 pagesMas - Chapter 4 Lessonsalida17No ratings yet

- P56 P57.5 P6.5375 P6.625: All Production Specific Job Specific Job All ProductionDocument2 pagesP56 P57.5 P6.5375 P6.625: All Production Specific Job Specific Job All ProductionGeraldine Mae DamoslogNo ratings yet

- Atlas Co 000$ 000$ Statement of Profit & Loss For Year Ended 31 March Statement of Financial Position For The Year End 31 March 20X3Document3 pagesAtlas Co 000$ 000$ Statement of Profit & Loss For Year Ended 31 March Statement of Financial Position For The Year End 31 March 20X3Muhammad MahmoodNo ratings yet

- BALANCE SHEET (In Millions) INCOME STATEMENT (In Miliions)Document2 pagesBALANCE SHEET (In Millions) INCOME STATEMENT (In Miliions)ib tyNo ratings yet

- BALANCE SHEET (In Millions) INCOME STATEMENT (In Miliions)Document2 pagesBALANCE SHEET (In Millions) INCOME STATEMENT (In Miliions)ib tyNo ratings yet

- Gross ProfitDocument3 pagesGross ProfitADITHYA KOVILINo ratings yet

- Case Study On Master BudgetDocument8 pagesCase Study On Master BudgetMusaib Ansari100% (1)

- Day 4Document8 pagesDay 4um23328No ratings yet

- Q. 20Document3 pagesQ. 20Gayatri VaityNo ratings yet

- Harsh ElectricalsDocument7 pagesHarsh ElectricalsR GNo ratings yet

- Marginal Costing - As LevelDocument2 pagesMarginal Costing - As LevelMUSTHARI KHANNo ratings yet

- Accounting For Production LossesDocument6 pagesAccounting For Production LossesMary Ann NatividadNo ratings yet

- Intangile Asset - IFRS 15 25 - 03 - 2021Document8 pagesIntangile Asset - IFRS 15 25 - 03 - 2021Huệ LêNo ratings yet

- Excel Question 2Document12 pagesExcel Question 2Aleena AmirNo ratings yet

- Intercompany TransactionDocument3 pagesIntercompany TransactionErjohn PapaNo ratings yet

- Product Costing SCMDocument2 pagesProduct Costing SCMjeremy groundNo ratings yet

- Special Sales Pricing/ Special Order Pricing/Accept or Reject An Order/Distress PricingDocument7 pagesSpecial Sales Pricing/ Special Order Pricing/Accept or Reject An Order/Distress PricingJillian Dela CruzNo ratings yet

- FM 2Document4 pagesFM 2Adityansu SumanNo ratings yet

- Het Shukla FABMC202100207Document11 pagesHet Shukla FABMC202100207Yo shuk singhNo ratings yet

- Budet ExerciseDocument5 pagesBudet ExerciseVarun yashuNo ratings yet

- Revision Class Notes 6 Jun 21Document7 pagesRevision Class Notes 6 Jun 21Rania barabaNo ratings yet

- Book 3 ADocument2 pagesBook 3 ACece CastroNo ratings yet

- Day 6Document4 pagesDay 6um23328No ratings yet

- Day 5 - Class ExerciseDocument5 pagesDay 5 - Class Exerciseum23328No ratings yet

- Kieso Pa P51aDocument5 pagesKieso Pa P51aDerian WijayaNo ratings yet

- Chap3 - Hanh Vi Nha SXDocument28 pagesChap3 - Hanh Vi Nha SXThọ ĐỗNo ratings yet

- FC 21000 SP 8 VC 5 Cont. Per Unit 3 BEP FC/cont - Per Unit 7000 UnitsDocument15 pagesFC 21000 SP 8 VC 5 Cont. Per Unit 3 BEP FC/cont - Per Unit 7000 UnitsAfzal AhmedNo ratings yet

- Budgeting Example-Worked OutDocument27 pagesBudgeting Example-Worked Outgabriel mwendwaNo ratings yet

- Tutorial Class-1Document4 pagesTutorial Class-1RishabhJainNo ratings yet

- Costing Solution 12-12-2022Document7 pagesCosting Solution 12-12-2022Isha SinghNo ratings yet

- kế toán quản trị bt chap3Document18 pageskế toán quản trị bt chap3Tung DucNo ratings yet

- Answers For Short-Term Decisions Additional Practice QuestionsDocument2 pagesAnswers For Short-Term Decisions Additional Practice QuestionsTrần NghĩaNo ratings yet

- HOBA Notes 2Document4 pagesHOBA Notes 2Hana GNo ratings yet

- Variableabsorption CostingDocument77 pagesVariableabsorption Costingandrea arapocNo ratings yet

- ACCA PM Variance FormulaDocument3 pagesACCA PM Variance FormulaAmeliaNo ratings yet

- Moby CoDocument3 pagesMoby CoMuhammad MahmoodNo ratings yet

- Cost Sheet (M-I)Document17 pagesCost Sheet (M-I)Yolo GuyNo ratings yet

- CostingDocument46 pagesCostingRaghav KhakholiaNo ratings yet

- Variances Working Sheet CDocument12 pagesVariances Working Sheet CHitesh YadavNo ratings yet

- #L13 Txtbook Example Wessex Eng.Document30 pages#L13 Txtbook Example Wessex Eng.Ulugbek SayfiddinovNo ratings yet

- Daikin Ducable Unit 5 5tr To 16 7trDocument2 pagesDaikin Ducable Unit 5 5tr To 16 7trరాజా రావు చామర్తిNo ratings yet

- Narsee Monjee Institute of Management StudiesDocument8 pagesNarsee Monjee Institute of Management StudiesSHIVANGI AGRAWALNo ratings yet

- Ac417 Solution R174903ZDocument5 pagesAc417 Solution R174903ZPresident MusukiNo ratings yet

- British Commercial Computer Digest: Pergamon Computer Data SeriesFrom EverandBritish Commercial Computer Digest: Pergamon Computer Data SeriesNo ratings yet