Professional Documents

Culture Documents

Matematik Tg5 - Bab 3

Uploaded by

LoveableCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Matematik Tg5 - Bab 3

Uploaded by

LoveableCopyright:

Available Formats

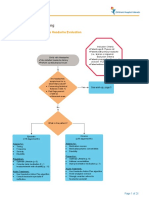

BAB 3 Matematik Pengguna: Insurans

Consumer Mathematics: Insurance

3.1 Risiko dan Perlindungan Insurans Buku Teks: m.s. 74 – 80

NOTA

• Jenis insurans:

Video

Types of insurances:

Jenis insurans

Type of insurance

Insurans hayat Insurans am

Life insurance General insurance

Insurans motor Insurans perubatan dan kesihatan Insurans perjalanan

Motor insurance Medical and health insurance Travel insurance

Insurans kebakaran Insurans kemalangan diri

Fire insurance Personal accident insurance

• Insurans berkelompok ialah insurans yang memberikan perlindungan kepada sekumpulan individu seperti pekerja syarikat atau

murid sekolah.

Group insurance is an insurance that covers a group of individuals such as employees in a company or pupils in schools.

Jawab setiap soalan berikut.

Answer each of the following questions. SP3.1.1 TP1 TP2

1. Khairul membeli sebuah kereta. Dia menginsuranskan keretanya di bawah polisi komprehensif. Khairul

memandu kereta itu pada hari hujan. Keretanya hilang kawalan dan melanggar sebuah motosikal. Khairul

dan penunggang motosikal itu telah mengalami kecederaan dan kedua-dua kenderaan mengalami

kerosakan. Bolehkah Khairul membuat

Khairul bought a car. He insured his car under the comprehensive policy. Khairul drove the car on a rainy day. His car

lost control and crashed into a motorcycle. Khairul and the motorcyclist were injured and both vehicles were damaged.

Can Khairul make

(a) tuntutan kerosakan bagi kedua-dua kenderaan?

a claim for the damages for both the vehicles?

(b) tuntutan perbelanjaan perubatan penunggang motosikal itu?

a claim for the medical expenses for the motorcyclist?

(c) tuntutan perbelanjaan perubatan diri sendiri?

a claim for the medical expenses for himself?

(a) Boleh/Can

(b) Boleh/Can

(c) Tidak boleh/Cannot

39

© Sasbadi Sdn. Bhd.

03 MAID 2022 MATHS TG5-BAB 03(NM)_Madi 2P.indd 39 11/11/2021 3:33 PM

2. Puan Lisa memiliki sebuah rumah teras. Dia telah membeli insurans kebakaran yang memberikan

perlindungan kerugian akibat kebakaran, kilat dan letupan untuk rumahnya. Nyatakan tiga perlindungan

tambahan yang boleh dimasukkan dalam polisi kebakarannya.

Puan Lisa owns a terrace house. She has purchased fire insurance that provides coverage for losses caused by fire, lightning

and explosions for her house. State three additional coverages that can be included in her fire policy.

Taufan, banjir, rusuhan/Hurricance, flood, riot

3. Devika menjalani pembedahan jantung di sebuah hospital swasta. Kos rawatannya sebanyak RM320 000

ditanggung oleh syarikat insurans. Selain itu, Devika diberi elaun hospital RM250 per hari.

Devika underwent heart surgery at a private hospital. The treatment cost of RM320 000 was borne by the insurance

company. Apart from that, Devika is given a hospital allowance of RM250 per day.

(a) Tentukan jenis insurans yang dibeli oleh Devika.

Determine the type of insurance purchased by Devika.

(b) Seterusnya, nyatakan dua polisi yang terlibat.

Hence, state two policies involved.

(a) Insurans perubatan dan kesihatan

Medical and health insurance

(b) Insurans hospital dan pembedahan/Hospitalisation and surgical insurance

Insurans pendapatan hospital/Hospital income insurance

4. Encik Chong membeli suatu insurans. Insurans itu memberikan perlindungan kepada pemegang polisi

yang mengalami kecederaan, hilang upaya dan kematian akibat kemalangan sahaja. Nyatakan jenis

insurans yang dibeli oleh Encik Chong.

Mr Chong buys an insurance. The insurance provides coverage to the policyholder who suffers an injury, disability and

death cause by accident only. State the type of insurance purchased by Mr Chong.

Insurans kemalangan diri

Personal accident insurance

5. Suraya melancong ke Jerman. Dia kehilangan bagasi ketika tiba Lapangan Terbang Frankfurt. Suraya

mendapat pampasan daripada insurans yang dibelinya.

Suraya travels to Germany. She lost her luggage when arriving at Frankfurt Airport. Suraya gets compensation from the

insurance she bought.

(a) Nyatakan jenis insurans yang dibeli oleh Suraya.

State the type of insurance purchased by Suraya.

(b) Seterunya, nyatakan dua risiko lain yang dilindungi oleh insurans itu.

Hence, state other two risks covered by the insurance.

(a) Insurans perjalanan/Travel insurance

(b) Kehilangan pasport/Loss of passport

Belanja perubatan/Medical expenses

40 SP 3.1.1 TP 1 2 3 4 5 6

© Sasbadi Sdn. Bhd.

03 MAID 2022 MATHS TG5-BAB 03(NM)_Madi 2P.indd 40 11/11/2021 3:33 PM

3.1 Risiko dan Perlindungan Insurans Buku Teks: m.s. 80

Jawab setiap soalan berikut.

Answer each of the following questions. SP3.1.2 TP3

1. Helen dan kawan-kawannya merancang untuk melancong ke Australia. Jadual di bawah menunjukkan

harga premium bagi insurans perjalanan yang ditawarkan oleh Syarikat Insurans Selamat Bhd.

Helen and her friends plan to travel to Australia. The table shows the premiums for travel insurance offered by Syarikat

Insurans Selamat Bhd.

Kadar/Rate (RM)

Bilangan hari

Number of days Dewasa Warga emas Kanak-kanak Keluarga

Adult Senior citizen Child Family

1–5 30 30 20 70

6 – 10 45 45 30 110

11 – 15 60 60 42 160

16 – 22 80 80 56 210

Nyatakan dua faktor yang menentukan jumlah premium bagi insurans itu.

State two factors that determine the total premium for the insurance.

Tempoh perjalanan/Duration of travel

Bilangan orang yang diinsuranskan/Number of people insured

2. Jadual di bawah menunjukkan harga premium bagi insurans perjalanan yang ditawarkan oleh Syarikat

Insurans Selamat Bhd.

The table shows the premiums for travel insurance offered by Syarikat Insurans Selamat Bhd.

Asia Seluruh dunia/Worldwide

Kadar/Rate (RM) Kadar/Rate (RM)

Bilangan hari Warga Kanak- Warga Kanak-

Number of days Dewasa Keluarga Dewasa Keluarga

emas emas

kanak kanak

Adult Senior Family Adult Senior Family

Child Child

citizen citizen

1–5 46 85 20 112 55 95 35 140

6 – 10 55 105 30 140 72 118 53 185

11 – 15 73 135 42 192 104 158 76 265

16 – 22 94 176 55 248 136 208 100 355

Plan tahunan 260 – 131 – 320 – 200 –

Annual plan

Encik Wong akan melawat ke Jepun selama 12 hari. Encik Suresh pula perlu menghadiri suatu seminar

di Jerman selama 12 hari.

Mr Wong will visit Japan for 12 days. Mr Suresh have to attend a seminar in Germany for 12 days.

(a) Apakah faktor yang mempengaruhi perbezaan harga premium bagi insurans perjalanan Encik Wong

dan Encik Suresh?

What are the factors that influence the difference in premiums for the travel insurance of Mr Wong and Mr Suresh?

(b) Encik Suresh kerap menghadiri seminar antarabangsa dan persidangan antarabangsa. Insurans yang

manakah sesuai untuk Encik Suresh?

Mr Suresh regularly attends international seminars and international conferences. Which insurance is suitable

for Mr Suresh?

(a) Destinasi berbeza/Different destinations

(b) Insurans perjalanan premium tahunan/Annual premium travel insurance

41 SP 3.1.2 TP 1 2 3 4 5 6

© Sasbadi Sdn. Bhd.

03 MAID 2022 MATHS TG5-BAB 03(NM)_Madi 2P.indd 41 11/11/2021 3:33 PM

3.1 Risiko dan Perlindungan Insurans Buku Teks: m.s. 81 – 85

NOTA

Nilai muka polisi Face value of policy

• Premium = × Kadar premium per RMx Premium = × Premium rate per RMx

RMx RMx

Jawab soalan berikut.

Answer the following questions. SP3.1.2 TP3

Jadual di bawah menunjukkan kadar premium tahunan bagi setiap RM1 000 nilai muka insurans sementara

boleh baharu tahunan yang ditawarkan oleh Syarikat Insurans MM.

The table shows the annual premium rate per RM1 000 face value of a yearly renewable term insurance offered by Syarikat

Insurans MM.

Lelaki/Male (RM) Perempuan/Female (RM)

Umur

Age Bukan perokok Perokok Bukan perokok Perokok

Non-smoker Smoker Non-smoker Smoker

34 2.09 2.68 1.42 1.75

35 2.13 2.73 1.46 1.79

36 2.19 2.81 1.51 1.85

1. Nyatakan dua faktor yang menyebabkan kenaikan kadar premium berdasarkan jadual itu. Terangkan.

State two factors that cause the increase in premium rate based on the table. Explain.

Umur – Jangka hayat setiap individu semakin pendek dengan pertambahan umur

Age – Life expectancy of each individual decreases with increasing age

Perokok – Kebarangkalian perokok mempunyai masalah kesihatan adalah lebih tinggi

Smoker – The probability of a smoker to have health concerns is higher

2. Encik Ravi berumur 36 tahun dan merokok. Dia ingin membeli polisi insurans yang bernilai RM160 000.

Hitung premium tahunannya.

Mr Ravi is 36 years old and a smoker. He wants to buy an insurance policy worth RM160 000. Calculate his annual premium.

RM160 000

× 2.81 = RM449.60

RM1 000

3. Puan Lee berusia 34 tahun, seorang yang sihat dan tidak merokok. Dia telah membeli polisi insurans

itu bernilai RM300 000 dan polisi penyakit kritikal. Polisi penyakit kritikal itu memberi perlindungan

sebanyak 40% nilai muka asas dan kadar premium bagi setiap RM1 000 ialah RM1.74. Hitung premium

tahunan Puan Lee.

Mrs Lee is 34 years old, healthy and a non-smoker. She bought the insurance policy worth RM300 000 and a critical

illness policy. The critical illness policy provides protection of 40% of basic face value and the premium rate is RM1.74 per

RM1 000. Calculate Mrs Lee’s annual premium.

Jumlah perlindungan untuk penyakit kritikal/Total coverage for critical illness = 40% × RM300 000

= RM120 000

RM300 000 RM120 000

Premium tahunan/Annual premium = × 1.42 + × 1.74

RM1 000 RM1 000

= RM634.80

42 SP 3.1.2 TP 1 2 3 4 5 6

© Sasbadi Sdn. Bhd.

03 MAID 2022 MATHS TG5-BAB 03(NM)_Madi 2P.indd 42 11/11/2021 3:33 PM

3.1 Risiko dan Perlindungan Insurans Buku Teks: m.s. 82 – 85

Jawab soalan berikut.

Answer following questions. SP3.1.2 TP3

1. Encik Faizal ingin memperbaharui insurans keretanya. Maklumat keretanya dan kadar premium di bawah

Tarif Motor bagi polisi motor yang dikeluarkan di Semenanjung Malaysia adalah seperti berikut:

Encik Faizal wants to renew his car insurance. The information of his car and the premium rates under the Motor Tariff for

motor policies issued in Peninsular Malaysia are as follows:

Jumlah yang ingin Kapasiti enjin Polisi Polisi pihak

diinsuranskan RM80 000 tidak melebihi komprehensif

ketiga

Sum insured Engine capacity Comprehensive

Third party policy

not exceeding policy

Kapasiti enjin (RM)

1 500 cc (cc) (RM)

Engine capacity

1 400 273.80 120.60

Lokasi/Location Pahang

NCD 30% 1 650 305.50 135.00

Hitung premium kasar bagi kereta Encik Faizal jika dia mahu menginsuranskan keretanya bawah

Calculate the gross premium for Encik Faizal’s car if he wants to insures his car under

(a) polisi komprehensif,

the comprehensive policy,

(i) RM1 000 yang pertama/The first RM1 000 RM305.50

(ii) RM26 × 79 (Setiap RM1 000 baki/Each RM1 000 balance) RM2 054.00

(iii) Premium asas/Basic premium = (i) + (ii) RM2 359.50

(iv) NCD 30% 0.3 × RM2 359.50 = RM707.85

(v) Premium kasar/Gross premium = (iii) – (iv) RM1 651.65

(b) polisi pihak ketiga, kebakaran dan kecurian,

the third party, fire and theft policy,

(i) Premium asas/Basic premium = 0.75 × RM2 359.50 RM1 769.63

(ii) NCD 30% 0.3 × RM1 769.63 = RM530.89

(iii) Premium kasar/Gross premium = (i) – (ii) RM1 238.74

(c) polisi pihak ketiga.

the third party policy.

(i) Premium asas/Basic premium RM135.00

(ii) NCD 30% 0.3 × RM135.00 = RM40.50

(iii) Premium kasar/Gross premium = (i) – (ii) RM94.50

43

© Sasbadi Sdn. Bhd.

03 MAID 2022 MATHS TG5-BAB 03(NM)_Madi 2P.indd 43 11/11/2021 3:33 PM

2. Encik Shamsul membeli insurans kemalangan diri daripada sebuah syarikat insurans. Jadual di bawah

menunjukkan sebahagian faedah insurans kemalangan diri itu.

Encik Shamsul bought a personal accident insurance from an insurance company. The table shows some of the benefits

of the personal accident insurance.

Premium tahunan

Jumlah Annual premium

Faedah

Benefit

perlindungan

Total coverage Kelas 1 & 2 Kelas 3

Class 1 & 2 Class 3

Kematian dan hilang upaya kekal akibat

kemalangan RM300 000

Accidental death and permanent disability

Kematian akibat penyakit berjangkit RM80 000

Death due to infectious disease

Rawatan perubatan (bagi setiap kemalangan) Sehingga RM50 000 RM561.62 RM1 038.82

Medical treatment (per accident) Up to RM50 000

Elaun hospital harian

(sehingga 365 hari bagi setiap kemalangan) RM150

Daily hospital allowance

(up to 365 days per accident)

• Kelas 1 – Pekerjaan dalam industri tidak berbahaya dan bekerja di dalam pejabat.

Class 1 – Occupation in low risk industries and in office.

• Kelas 2 – Pekerjaan yang melibatkan tugas-tugas bukan manual dalam industri separa bahaya.

Class 2 – Occupation involving non-manual works with semi-hazardous industry.

• Kelas 3 – Pekerjaan yang melibatkan tugas-tugas manual dan penggunaan peralatan atau mesin.

Class 3 – Occupation involving manual works and use of tools or machinery.

(a) Mengapakah premium bagi pekerjaan kelas 1 dan 2 lebih rendah daripada kelas 3?

Why is the premium for class 1 and 2 occupation lower than class 3?

Risiko mengalami kemalangan bagi pekerjaan kelas 1 dan 2 adalah lebih kecil daripada kelas 3.

The risk of getting into an accident for class 1 and 2 occupation is lower than class 3.

(b) Encik Shamsul mengalami kemalangan jalan raya dan dimasukkan ke hospital selama 12 hari. Dia

mengalami hilang upaya kekal. Jumlah kos rawatannya ialah RM56 380. Hitung jumlah pampasan yang

dibayar oleh syarikat insurans kepada Encik Shamsul.

Encik Shamsul had a road accident and was hospitalised for 12 days. He was permanently disabled. The total cost

of treatment was RM56 380. Calculate the total compensation paid by the insurance company to Encik Shamsul.

Jumlah faedah yang dibayar/Total benefit paid

= RM300 000 + RM50 000 + 12 × RM150

= RM351 800

44 SP 3.1.2 TP 1 2 3 4 5 6

© Sasbadi Sdn. Bhd.

03 MAID 2022 MATHS TG5-BAB 03(NM)_Madi 2P.indd 44 11/11/2021 3:33 PM

3.1 Risiko dan Perlindungan Insurans Buku Teks: m.s. 85 – 87

Jawab setiap soalan berikut.

Answer each of the following questions. SP3.1.3 TP4 TP5

1. Puan Hui menginsuranskan keretanya bawah polisi komprehensif dengan peruntukan deduktibel sebanyak

RM300. Puan Hui mengalami tiga kali kemalangan dalam tempoh insurans tersebut. Kerugian dalam

kemalangan pertama, kedua dan ketiga masing-masing ialah RM2 350, RM800 dan RM200. Tentukan

sama ada Puan Hui boleh membuat tuntutan terhadap kerugian dalam setiap kemalangan itu. Nyatakan

bayaran pampasan yang boleh dituntut bagi setiap kemalangan itu.

Mrs Hui insured her car under the comprehensive policy with a deductible provision of RM300. Mrs Hui suffered three

accidents during the insurance coverage period. The losses in the first, second and third accidents were RM2 350, RM800

and RM200 respectively. Determine whether Mrs Hui can make a claim for the losses in each of those accidents. State the

compensation amount that can be claimed for each accident.

Boleh buat tuntutan?

Kemalangan Kerugian Can make a claim?

Bayaran pampasan

Accident Loss Amount of compensation

(Ya/Yes, Tidak/No)

Pertama RM2 350 Ya/Yes RM2 350 – RM300 = RM2 050

First

Kedua RM800 Ya/Yes RM800 – RM300 = RM500

Second

Ketiga RM200 Tidak/No RM0

Third

2. Encik Zainul telah membeli insurans motor untuk keretanya tanpa peruntukan deduktibel. Dia menamakan

isterinya, Puan Norish sebagai pemandu tambahan. Keretanya mengalami kerosakan dalam dua kemalangan.

Dalam kemalangan pertama, kereta Encik Zainul dipandu oleh isterinya dan kerugian yang dialami ialah

RM7 000. Dalam kemalangan kedua, kereta Encik Zainul dipandu oleh kawannya dan kerugian yang

dialami ialah RM4 500. Tentukan sama ada Encik Zainul boleh membuat tuntutan terhadap kerugian

dalam setiap kemalangan itu. Nyatakan bayaran pampasan yang boleh dituntut bagi setiap kemalangan itu.

Encik Zainul has purchased motor insurance for his car without a deductible provision. He named his wife, Puan Norish

as the additional driver. His car was damaged in two accidents. In the first accident, Encik Zainul’s car was driven by

his wife and the loss suffered was RM7 000. In the second accident, Encik Zainul’s car was driven by his friend and the

loss suffered was RM4 500. Determine whether Encik Zainul can make a claim for the losses in each of those accidents.

State the amount of compensation that can be claimed for each accident.

Boleh buat tuntutan?

Kemalangan Kerugian Can make a claim?

Bayaran pampasan

Accident Loss Amount of compensation

(Ya/Yes, Tidak/No)

Pertama RM7 000 Ya/Yes RM7 000

First

Kedua RM4 500 Ya/Yes RM4 500 – RM400 = RM4 100

Second

45 SP 3.1.3 TP 1 2 3 4 5 6

© Sasbadi Sdn. Bhd.

03 MAID 2022 MATHS TG5-BAB 03(NM)_Madi 2P.indd 45 11/11/2021 3:33 PM

3.1 Risiko dan Perlindungan Insurans Buku Teks: m.s. 85 – 87

Jawab setiap soalan berikut.

Answer each of the following questions. SP3.1.3 TP4 TP5

1. Eric telah membeli polisi insurans perubatan dengan peruntukan deduktibel sebanyak RM10 000 setahun

dan had tahunan sebanyak RM200 000. Dia menjalani dua kali pembedahan pada tahun yang sama dalam

tempoh insurans tersebut. Kos pembedahan kali pertama dan kali kedua masing-masing ialah RM9 000

dan RM148 000. Nyatakan jumlah wang yang ditanggung oleh Eric dan jumlah wang yang dibayar oleh

syarikat insurans bagi pembedahan kali pertama dan pembedahan kali kedua.

Eric has purchased a medical insurance policy with a deductible provision of RM10 000 per year and annual limit of

RM200 000. Eric underwent two surgeries in the same year during the insurance coverage. The first and second surgery

costs are RM9 000 and RM148 000 respectively. State the amount borne by Eric and the amount paid by the insurance

company for the first and the second surgery.

Jumlah wang yang Jumlah wang yang dibayar

Pembedahan Kos

Surgery Cost

ditanggung oleh Eric oleh syarikat insurans

Amount borne by Eric Amount paid by the insurance company

Pertama RM9 000 RM9 000 RM0

First

Kedua RM148 000 RM1 000 RM148 000 – RM1 000 = RM147 000

Second

2. Puan Lina telah membeli polisi insurans perubatan dengan peruntukan deduktibel sebanyak RM15 000

setahun dan had tahunan sebanyak RM300 000. Dia disahkan menghidap barah payudara dan menjalani

pembedahan pada hujung tahun 2019. Kemudian, dia meneruskan rawatan dengan kimoterapi pada tahun

2020 selepas pembedahan itu. Kos pembedahan pada tahun 2019 ialah RM300 000 dan kos rawatan untuk

kimoterapi pada tahun 2020 ialah RM35 000. Nyatakan jumlah wang yang dibayar oleh Puan Lina dan

jumlah wang yang dibayar oleh syarikat insurans dalam dua tahun itu.

Puan Lina has purchased a medical insurance policy with a deductible provision of RM15 000 per year and annual limit of

RM300 000. She was diagnosed with breast cancer and underwent surgery at the end of 2019. She then continues her

treatment with chemotherapy in 2020 after the surgery. The surgery cost in 2019 is RM300 000 and the treatment cost

for the chemotherapy in 2020 is RM35 000. State the total amount paid by Puan Lina and the total amount paid by the

insurance company in the two years.

Jumlah wang yang dibayar

Jumlah wang yang dibayar

Pembedahan Kos oleh syarikat insurans

Surgery Cost

oleh Puan Lina

Amount paid by the

Amount paid by Puan Lina

insurance company

Pertama/First RM300 000 – RM15 000

RM300 000 RM15 000

(Tahun/Year 2019) = RM285 000

Kedua/Second RM35 000 – RM15 000

RM35 000 RM15 000

(Tahun/Year 2020) = RM20 000

Jumlah/Total RM30 000 RM305 000

46 SP 3.1.3 TP 1 2 3 4 5 6

© Sasbadi Sdn. Bhd.

03 MAID 2022 MATHS TG5-BAB 03(NM)_Madi 2P.indd 46 11/11/2021 3:33 PM

3.1 Risiko dan Perlindungan Insurans Buku Teks: m.s. 87 – 90

NOTA

• Jumlah insurans yang harus dibeli = Peratusan ko-insurans × Nilai boleh insurans harta

Amount of required insurance = Percentage of co-insurance × Insurable value of property

Jawab soalan berikut.

Answer the following questions. SP3.1.3 TP4 TP5

1. Asmadi, Nazim, David dan Rajan telah membeli insurans kebakaran daripada syarikat insurans yang

sama. Nilai boleh insurans rumah mereka adalah sama, iaitu RM500 000. Polisi insurans kebakaran

yang ditawarkan mempunyai peruntukan ko-insurans untuk menginsuranskan 90% daripada nilai boleh

insurans harta dan deduktibel sebanyak RM3 000.

Asmadi, Nazim, David and Rajan bought fire insurances from the same insurance company. The insurable value of their

houses is the same, which is RM500 000. The fire insurance policy offered has a co-insurance provision to insure 90% of

its insurable value and a deductible of RM3 000.

(a) Hitung jumlah insurans yang harus dibeli untuk setiap rumah.

Calculate the amount of insurance required for each house.

(b) Keempat-empat rumah itu telah mengalami kebakaran. Jadual di bawah menunjukkan amaun insurans

yang dibeli dan kerugian yang dialami oleh empat buah rumah itu.

All the four houses caught on fire. The table shows the amount of insurances purchased and the losses suffered

by the four houses.

Pemegang polisi Asmadi Nazim David Rajan

Policyholder

Jumlah insurans Jumlah insurans

yang dibeli yang harus dibeli RM300 000 RM400 000 RMp

Amount of insurance Amount of insurance

purchased required

Kerugian Kerugian menyeluruh

RM200 000 RM60 000 RM120 000

Loss Total loss

(i) Hitung bayaran pampasan yang diterima oleh Asmadi, Nazim dan David.

Calculate the amount of compensation received by Asmadi, Nazim and David.

(ii) Hitung penalti ko-insurans Nazim.

Calculate the co-insurance penalty of Nazim.

(iii) Rajan menerima bayaran pampasan sebanyak RM93 000. Hitung nilai p.

Rajan received a compensation of RM93 000. Calculate the value of p.

90

(a) × RM500 000 = RM450 000

100

(b) (i) Asmadi : RM200 000 – RM3 000 = RM197 000

RM300 000

Nazim : × RM60 000 – RM3 000 = RM37 000

RM450 000

David : RM400 000 – RM3 000 = RM397 000

RM300 000

(ii) RM60 000 – × RM60 000 = RM20 000

RM450 000

p

(iii) × 120 000 – 3 000 = 93 000

450 000

p

× 120 000 = 96 000

450 000

p = 360 000

47

© Sasbadi Sdn. Bhd.

03 MAID 2022 MATHS TG5-BAB 03(NM)_Madi 2P.indd 47 11/11/2021 3:33 PM

2. Encik Lim menjalani pembedahan. Jumlah kos pembedahan dan perawatannya ialah RM88 200. Dia

mempunyai polisi insurans perubatan utama dengan had tahunan RM100 000, deduktibel sebanyak RM300

dan fasal penyertaan peratusan ko-insurans 80/20 dalam polisinya. Hitung kos perubatan yang ditanggung

oleh syarikat insurans dan Encik Lim sendiri.

Mr Lim underwent a surgery. The total cost of his surgery and treatment was RM88 200. Mr Lim has a major medical insurance

policy with an annual limit of RM100 000, a deductible of RM300 and a 80/20 co-insurance percentage participation clause

in his policy. Calculate the medical cost borne by the insurance company and Mr Lim himself.

Kos perubatan selepas deduktibel RM88 200 – RM300 = RM87 900

Medical cost after deductible

Kos perubatan yang ditanggung oleh syarikat insurans 80

Medical cost borne by the insurance company

× RM87 900 = RM70 320

100

Kos perubatan yang ditanggung oleh Encik Lim RM88 200 – RM70 320 = RM17 880

Medical cost borne by Mr Lim

3. Yati mempunyai polisi insurans perubatan utama dengan deduktibel sebanyak RM200 dan fasal

penyertaan peratusan ko-insurans 75/25 dalam polisinya. Dia telah menjalani pembedahan apendiks.

Jumlah kos perubatannya tidak melebih had tahunan. Dia mendapat pampasan sebanyak RM6 330

daripada syarikat insurans. Hitung jumlah kos perubatan Yati dan seterusnya, hitung kos perubatan yang

ditanggung oleh Yati sendiri.

Yati has a major medical insurance policy with a deductible of RM200 and a 75/25 co-insurance percentage participation

clause in her policy. She underwent an appendix surgery. The total medical cost does not exceed the annual limit. She

received a compensation of RM6 330 from the insurance company. Calculate the total medical cost of Yati and hence,

calculate the medical cost borne by Yati herself.

Katakan jumlah kos perubatan Yati ialah RMp.

Let the total medical cost of Yati be RMp.

(p – 200) × 0.75 = 6 330

p – 200 = 8 440

p = 8 640

Kos perubatan yang ditanggung oleh Yati

Medical cost borne by Yati

= RM8 640 – RM6 330

= RM2 310

48 SP 3.1.3 TP 1 2 3 4 5 6

© Sasbadi Sdn. Bhd.

03 MAID 2022 MATHS TG5-BAB 03(NM)_Madi 2P.indd 48 11/11/2021 3:33 PM

PRAKTIS SPM KERTAS 1

1. Jadual di bawah menunjukkan kadar premium tahunan bagi setiap RM1 000 nilai muka insurans hayat boleh

baharu tahunan yang ditawarkan oleh sebuah syarikat insurans.

The table shows the annual premium rate per RM1 000 face value of a yearly renewable life insurance offered by

an insurance company.

Lelaki/Male Perempuan/Female

Umur

Age Bukan perokok Perokok Bukan perokok Perokok

Non-smoker Smoker Non-smoker Smoker

34 2.09 2.68 1.42 1.75

35 2.13 2.73 1.46 1.79

36 2.19 2.81 1.51 1.85

Encik Yong ialah seorang perokok berumur 35 tahun. Dia ingin membeli polisi insurans hayat bernilai RM350 000

dan menambah polisi penyakit kritikal. Butiran polisi penyakit kritikal yang ditawarkan oleh syarikat insurans adalah

seperti yang ditunjukkan dalam jadual di bawah.

Mr Yong is a 35-year-old smoker. He wants to buy the life policy worth RM350 000 and wants to add on a critical illness

policy. The detail of the critical illness policy offered by the insurance company is as shown in the table below.

Nilai polisi penyakit kritikal Kadar premium bagi setiap RM1 000

Value of critical illness policy Premium rate per RM1 000

60% nilai muka asas/60% of basic face value 3.15

Hitung premium tahunan Encik Yong.

Calculate Mr Yong’s annual premium.

A RM1 172 B RM1 617

C RM1 407 D RM1 729

2. Jadual 1 menunjukkan kadar premium bagi polisi motor yang dikeluarkan di Malaysia.

Table 1 shows the premium rates for motor policies issued in Malaysia.

Kapasiti enjin Semenanjung Malaysia Sabah dan Sarawak

tidak melebihi Peninsular Malaysia Sabah and Sarawak

Engine capacity Polisi komprehensif Polisi pihak ketiga Polisi komprehensif Polisi pihak ketiga

not exceeding Comprehensive policy Third party policy Comprehensive policy Third party policy

(cc) (RM) (RM) (RM) (RM)

1 400 273.80 120.60 196.20 67.50

1 650 305.50 135.00 220.00 75.60

2 200 339.10 151.20 243.90 85.20

Jadual 1/Table 1

Encik Gopal mempunyai sebuah kereta di Sibu. Butiran keretanya adalah seperti yang ditunjukkan dalam

Jadual 2.

Encik Gopal owns a car in Sibu. The details of his car are as shown in Table 2.

Jumlah yang ingin diinsuranskan/Sum insured Kapasiti enjin/Engine capacity NCD

RM24 000 1 496 cc 55%

Jadual 2/Table 2

Hitung beza antara premium kasar bagi kereta Encik Gopal di bawah polisi komprehensif dan polisi pihak ketiga.

Calculate the difference between the gross premium for Encik Gopal’s car under a comprehensive policy and

a third party policy.

A RM38.25 B RM79.42

C RM275.09 D RM345.282

49

© Sasbadi Sdn. Bhd.

03 MAID 2022 MATHS TG5-BAB 03(NM)_Madi 2P.indd 49 11/11/2021 3:33 PM

PRAKTIS SPM KERTAS 2

Bahagian A

1. Jadual di bawah menunjukkan kadar premium tahunan bagi setiap RM1 000 nilai muka insurans hayat sementara

boleh baharu yang ditawarkan oleh sebuah syarikat insurans.

The table shows the yearly premium rate per RM1 000 face value of a yearly renewable term insurance offred by an insurance

company.

Lelaki/Male Perempuan/Female

Umur

Age Bukan perokok Perokok Bukan perokok Perokok

Non-smoker Smoker Non-smoker Smoker

38 2.36 3.03 1.62 2.03

39 2.48 3.22 1.70 2.14

40 2.65 3.47 1.80 2.27

Jadual 1/Table 1

(a) Nyatakan satu kelebihan insurans sementara boleh baharu.

State one advantage of the yearly renewable term insurance.

(b) (i) Encik Amirul ialah seorang perokok yang berusia 40 tahun. Dia telah membeli polisi insurans hayat

sementara boleh baharu bernilai RM200 000. Hitung premium tahunan Encik Amirul.

Encik Amirul is a 40-year-old smoker. He bought a yearly renewable term life insurance policy worth RM200 000

from the company. Calculate Encik Amirul’s annual premium amount.

(ii) Kawan Encik Amirul, Encik Ho juga seorang perokok yang berusia 40 tahun. Premium tahunan Encik Ho

adalah berbeza daripada Encik Amirul. Nyatakan satu sebab yang mungkin.

Encik Amirul’s friend, Mr Ho is also a 40-year-old smoker. Mr Ho’s annual premium is different from Encik. Amirul.

State one possible reason.

[3 markah/3 marks]

Jawapan/Answer:

(a) Premium lebih murah pada tahun-tahun awal.

Cheaper premiums in the early years.

RM200 000

(b) (i) × 3.47 = RM694

RM1 000

(ii) Jumlah asas diinsuranskan yang dipilih oleh Encik Amirul dan Encik Ho adalah berbeza.

The basic sums insured chosen by Encik Amirul and Mr Ho are different.

2. Insurans kereta Encik Lim mempunyai peruntukan dedutibel sebanyak RM500. Dia telah mengalami tiga kali

kemalangan sepanjang tempoh insurans itu. Kerugian yang dialami dalam kemalangan kali pertama, kali kedua

dan kali ketiga masing-masing ialah RM400, RM1 500 dan RM2 600. Hitung jumlah pampasan yang boleh

dituntut oleh Encik Lim.

Mr Lim’s car insurance has a deductible provision of RM500. He suffered three accidents during the insurance coverage

period. The losses suffered in the first, second and third accident are RM400, RM1 500 and RM2 600 respectively. Calculate

the total amount of compensation that can be claimed by Mr Lim.

[3 markah/3 marks]

Tuntutan tidak boleh dibuat untuk kemalangan pertama kerana jumlah kerugian kurang daripada amaun deduktibel.

Claim cannot be made for the first accident because the amount of the loss is less than the deductible amount.

Jumlah bayaran pampasan /Total amount of compensation = (RM1 500 – RM500) + (RM 2 600 – RM500)

= RM3 100

50

© Sasbadi Sdn. Bhd.

03 MAID 2022 MATHS TG5-BAB 03(NM)_Madi 2P.indd 50 11/11/2021 3:33 PM

Bahagian B

3. Jadual di bawah menunjukkan sebahagian maklumat polisi insurans perubatan yang dibeli oleh Puan Nadya.

Deduktibel tahunan dalam polisi perubatan Puan Nadya tidak ditunjukkan.

The table shows part of the medical insurance policy information purchased by Puan Nadya. The annual deductible in Puan

Nadya’s insurance policy is not shown.

Deduktibel tahunan Fasal penyertaan peratusan ko-insurans Had tahunan

Annual deductible Co-insurance percentage participation clause Annual limit

85/15 RM250 000

(a) Pada tahun 2020, Puan Nadya telah menjalani suatu pembedahan dengan jumlah kos RM120 000. Bayaran

kos yang ditanggung oleh syarikat insurans ialah RM98 600. Hitung deduktibel dalam polisi insurans

perubatan Puan Nadya.

In the year 2020, Puan Nadya underwent a surgery with a total cost of RM120 000. The cost borne by the insurance company

is RM98 600. Calculate the deductible in Puan Nadya’s medical insurance policy.

(b) Pada tahun 2021, Puan Nadya menjalani satu lagi pembedahan dengan jumlah kos RM145 000. Hitung

kos yang ditanggung oleh Puan Nadya dan syarikat insurans.

In the year 2021, Puan Nadya underwent another surgery with a total cost of RM145 000. Calculate the cost borne by

Puan Nadya and the insurance company.

[8 markah/8 marks]

Jawapan/Answer:

(a) Kos yang ditanggung oleh syarikat insurans ialah 85% daripada jumlah kos selepas deduktibel.

Cost incurred by the insurance company is 85% of the total cost after deductible.

85% → RM98 600

RM98 600

15% → × 15 = RM17 400

85

Deduktibel/Deductible = RM120 000 – RM98 600 – RM17 400

= RM4 000

(b) Kos selepas deduktibel/Cost after deductible = RM145 000 – RM4 000

= RM141 000

Kos yang ditanggung oleh syarikat insurans/Cost incurred by the insurance company

85

= × RM141 000

100

= RM119 850

Kos yang ditanggung oleh Puan Nadya/Cost incurred by Puan Nadya

= RM145 000 – RM119 850

= RM25 150

51

© Sasbadi Sdn. Bhd.

03 MAID 2022 MATHS TG5-BAB 03(NM)_Madi 2P.indd 51 11/11/2021 3:33 PM

4. Pemilik rumah P, Q dan R di suatu kawasan perumahan telah membeli insurans kebakaran daripada sebuah

syarikat insurans yang sama. Syarikat insurans itu menawarkan insurans kebakaran dengan deduktibel sebanyak

RMx dan peruntukan ko-insurans untuk menginsuranskan 90% daripada nilai boleh insurans. Nilai boleh

insurans rumah P, Q dan R adalah sama, iaitu RMy. Kawasan perumahan itu telah mengalami kebakaran. Jadual

di bawah menunjukkan nilai yang diinsuranskan, kerugian yang dialami dan bayaran pampasan yang diterima.

Pampasan yang diterima oleh pemilik rumah R tidak ditunjukkan.

The owners of houses P, Q and R in a housing area have purchased fire insurance from the same insurance company. The

insurance company offers fire insurance with a deductible provision of RMx and a co-insurance provision to insure 90% of

the insurable value. The insurable values of houses P, Q and R are the same, which is RMy. The housing area caught on fire.

The table shows the value insured, losses incurred and the amount of compensation received. The amount of compensation

received by the owner of house R is not shown.

Rumah P Q R

House

Nilai yang diinsuranskan RM350 000 RM360 000 RM300 000

Amount insured

Kerugian Kerugian menyeluruh RM180 000 RM240 000

Loss Total loss

Pampasan RM347 000 RM141 000

Compensation

(a) Hitung nilai x dan nilai y.

Calculate the values of x and y.

(b) Hitung bayaran pampasan yang diterima oleh pemilik rumah R. Seterusnya, hitung nilai penalti ko-insurans.

Calculate the amount of compensation received by the owner of house R. Hence, calculate the co-insurance penalty.

[9 markah/9 marks]

Jawapan/Answer:

(a) x = 350 000 – 347 000 = 3 000

Katakan RMz ialah jumlah insurans yang harus dibeli.

Let RMz be the amount of required insurance.

360 600

× 180 000 = 144 000

z

z = 450 000

90% × y = 450 000

0.9y = 450 000

y = 500 000

RM300 000

(b) Bayaran pampasan/Amount of compensation = × RM240 000 – RM3 000

RM450 000

= RM157 000

RM300 000

Penalti ko-insurans/Co-insurance penalty = RM240 000 – × RM240 000

RM450 000

= RM80 000

52

© Sasbadi Sdn. Bhd.

03 MAID 2022 MATHS TG5-BAB 03(NM)_Madi 2P.indd 52 11/11/2021 3:33 PM

You might also like

- FaisalDocument6 pagesFaisalAiman Aslam KhanNo ratings yet

- Life Insurance vs. General Insurance - Max Life InsuranceDocument7 pagesLife Insurance vs. General Insurance - Max Life InsuranceAMOL KENENo ratings yet

- Assignment 3 of FEBDocument21 pagesAssignment 3 of FEBshikha singhNo ratings yet

- Principles of Insurance BBA 3226: Date: 25-09-2010, Day: SaturdayDocument7 pagesPrinciples of Insurance BBA 3226: Date: 25-09-2010, Day: SaturdayMasiur RahmanNo ratings yet

- IRM (Unit - 1)Document89 pagesIRM (Unit - 1)9415507292No ratings yet

- EditedDocument30 pagesEditedAadi SachdevaNo ratings yet

- Insurance Industry in IndiaDocument25 pagesInsurance Industry in IndiaPriyanshi SharmaNo ratings yet

- What Is Insurance - Meaning, Types, Importance & BenefitsDocument7 pagesWhat Is Insurance - Meaning, Types, Importance & BenefitsAyush VermaNo ratings yet

- Current Jss 2 Business Studies 2nd TermDocument24 pagesCurrent Jss 2 Business Studies 2nd Termpalmer okiemuteNo ratings yet

- InsuranceDocument18 pagesInsuranceYash SinglaNo ratings yet

- Types of Insurance NewDocument9 pagesTypes of Insurance NewTanzeemNo ratings yet

- ICICI Prudential Life Insurance Company Project ReportDocument118 pagesICICI Prudential Life Insurance Company Project ReportsknagarNo ratings yet

- ppt4Document64 pagesppt4EdenNo ratings yet

- Consumers' Perceptions of Reliance Life Insurance Health PlansDocument105 pagesConsumers' Perceptions of Reliance Life Insurance Health Plans2014rajpointNo ratings yet

- Unit 7Document40 pagesUnit 7Prabhat JainNo ratings yet

- Banking, Insurance Topics ExplainedDocument20 pagesBanking, Insurance Topics ExplainedSriram rathNo ratings yet

- Life and General InsuranceDocument28 pagesLife and General InsuranceAravinda ShettyNo ratings yet

- Types of General Insurance ExplainedDocument4 pagesTypes of General Insurance ExplainedNipun DhingraNo ratings yet

- M008-Consumer Mathematics (Insurance)Document8 pagesM008-Consumer Mathematics (Insurance)Tan Jun YouNo ratings yet

- Insurance Companies, Insurance Agent, Insurance Policies & More .Document7 pagesInsurance Companies, Insurance Agent, Insurance Policies & More .Pritish PatnaikNo ratings yet

- BBAE 0401 Principles & Practices Of Life InsuranceDocument82 pagesBBAE 0401 Principles & Practices Of Life InsuranceEkansh MaheshwariNo ratings yet

- Endowment: Knds InsuranceDocument4 pagesEndowment: Knds InsuranceShivam shivhareNo ratings yet

- INSURANCE (Updated)Document50 pagesINSURANCE (Updated)annafray7No ratings yet

- Insurence 02Document2 pagesInsurence 02Teja MariduNo ratings yet

- Assignment: Name-Vishlesh Hukmani ENROLLMENT NO.-03014901819 Course-Bba (B&I) Subject-Principles of Insurance 2 SemsterDocument4 pagesAssignment: Name-Vishlesh Hukmani ENROLLMENT NO.-03014901819 Course-Bba (B&I) Subject-Principles of Insurance 2 SemsterVishlesh 03014901819No ratings yet

- Chapter.1. Introduction To Insurance IndustryDocument64 pagesChapter.1. Introduction To Insurance IndustryKunal KaduNo ratings yet

- Basics of Business Insurance - NotesDocument41 pagesBasics of Business Insurance - Notesjeganrajraj100% (1)

- Kuch BhiDocument13 pagesKuch BhiSAUMYANo ratings yet

- History and Types of Insurance in IndiaDocument72 pagesHistory and Types of Insurance in India6338250% (4)

- Insurance manual (Student) (2)Document87 pagesInsurance manual (Student) (2)Ana Rey RuizNo ratings yet

- Basics of Insurance HandoutDocument10 pagesBasics of Insurance HandoutPradeep NadarNo ratings yet

- Chapter FiveDocument27 pagesChapter FiveMeklit TenaNo ratings yet

- Principles of Insurance - Pham HaDocument157 pagesPrinciples of Insurance - Pham HaanonymousninjatNo ratings yet

- Fire vs Life Insurance: Key Differences and My PreferenceDocument4 pagesFire vs Life Insurance: Key Differences and My PreferenceMd Arifin ArifNo ratings yet

- Types of Insurance ExplainedDocument14 pagesTypes of Insurance ExplainedHS AspuipluNo ratings yet

- Wealth Management - Insurance - C58 - C59 - C60 - C62 - C63 - C64 - C65 - C66Document18 pagesWealth Management - Insurance - C58 - C59 - C60 - C62 - C63 - C64 - C65 - C66Prince JoshiNo ratings yet

- Report On Motor Insurence of Phoenix Insurance Company LTDDocument22 pagesReport On Motor Insurence of Phoenix Insurance Company LTDvvv NainaNo ratings yet

- Child Insurance PlanDocument72 pagesChild Insurance PlanAnvesh Pulishetty -BNo ratings yet

- Insurance SectorDocument12 pagesInsurance Sector20BBA137No ratings yet

- ASSIGNMENTDocument4 pagesASSIGNMENTVishlesh 03014901819No ratings yet

- Assignment PDFDocument4 pagesAssignment PDFVishlesh 03014901819No ratings yet

- Class Notes Part 3Document5 pagesClass Notes Part 3greatsali70No ratings yet

- Final DraftDocument71 pagesFinal DraftPayal RaghorteNo ratings yet

- Insurance in NigeriaDocument3 pagesInsurance in NigeriapresidonsiNo ratings yet

- Chapter-I: Meaning of InsuranceDocument49 pagesChapter-I: Meaning of InsuranceTy GravesNo ratings yet

- Career in InsuranceDocument74 pagesCareer in InsuranceVijay AttemNo ratings yet

- Insurance CompanyDocument10 pagesInsurance CompanyShoaib AslamNo ratings yet

- Ty - Bcom (Banking and Insurance)Document36 pagesTy - Bcom (Banking and Insurance)BHAVESHNo ratings yet

- Insurance - Concept, Principles, Functions of Insurance Company, Q&ADocument11 pagesInsurance - Concept, Principles, Functions of Insurance Company, Q&AShajana ShahulNo ratings yet

- Inmt 4Document25 pagesInmt 4shriyans varmaNo ratings yet

- United India Insurance IntroductionDocument81 pagesUnited India Insurance IntroductionvickychapterNo ratings yet

- Consumer Mathematics InsuranceDocument27 pagesConsumer Mathematics InsuranceSamsollNo ratings yet

- Question Paper - Fundamentals of Insurance 2021 - Question & AnswersDocument14 pagesQuestion Paper - Fundamentals of Insurance 2021 - Question & Answersjeganrajraj100% (4)

- Risk Management Group Assignments on Insurance TopicsDocument2 pagesRisk Management Group Assignments on Insurance TopicsEbsa AdemeNo ratings yet

- New Syllabus: Open Book ExaminationDocument4 pagesNew Syllabus: Open Book Examinationsheena2saNo ratings yet

- Types of Insurance Explained in DetailDocument8 pagesTypes of Insurance Explained in Detailmonikaa jangidNo ratings yet

- Insurance Sector in India: Trend & ChallengesDocument58 pagesInsurance Sector in India: Trend & Challengesshreeya salunkeNo ratings yet

- A Project Report On Consumer PerceptionDocument106 pagesA Project Report On Consumer PerceptionAKSHIT VERMANo ratings yet

- Insurance, regulations and loss prevention :Basic Rules for the industry Insurance: Business strategy books, #5From EverandInsurance, regulations and loss prevention :Basic Rules for the industry Insurance: Business strategy books, #5No ratings yet

- HVCODocument8 pagesHVCOAryan BlagganNo ratings yet

- Elementary Education Thesis Topic IdeasDocument8 pagesElementary Education Thesis Topic Ideasdnnvbpvh100% (1)

- Psychological TestDocument1 pagePsychological TestAniketShahNo ratings yet

- V.K Fitness gym equipment quotationDocument4 pagesV.K Fitness gym equipment quotationavik mukherjeeNo ratings yet

- CBTDocument2 pagesCBTTanvi ManjrekarNo ratings yet

- Lecture 5 Brachytherapy Implantation - 6-18 FinalDocument10 pagesLecture 5 Brachytherapy Implantation - 6-18 FinalArcrije JerezNo ratings yet

- V154 BSBLDR602 Assessment Task - 1Document3 pagesV154 BSBLDR602 Assessment Task - 1Briyidt Alejandra CaroNo ratings yet

- Films that bring the issue of waste to lightDocument7 pagesFilms that bring the issue of waste to lightLaudianeSant'AnnaNo ratings yet

- PDF097Document1 pagePDF097Hao LuoNo ratings yet

- Pub Family Practice Examination and Board ReviewDocument937 pagesPub Family Practice Examination and Board ReviewMohammad PharaonNo ratings yet

- ĐỀ 22Document6 pagesĐỀ 22Nguyễn Thị Bích NguyênNo ratings yet

- Calcium Oxide Safety Data SheetDocument5 pagesCalcium Oxide Safety Data SheetGİZEM DEMİRNo ratings yet

- Test English - Prepare For Your English Exam 2Document2 pagesTest English - Prepare For Your English Exam 2Josue GuerreroNo ratings yet

- Pelaksanaan Perawatan Luka Post Operasi Sectio Caesarea Sesuai Standar Operasional ProsedurDocument9 pagesPelaksanaan Perawatan Luka Post Operasi Sectio Caesarea Sesuai Standar Operasional Prosedural ghaisaniNo ratings yet

- Lesson 2 - BTVNDocument3 pagesLesson 2 - BTVNHoàng HiềnNo ratings yet

- Headache Clinical PathwayDocument25 pagesHeadache Clinical PathwayKoushik Mazumder ShuvoNo ratings yet

- Expat Insider 2019 - The InterNations Survey - 0Document116 pagesExpat Insider 2019 - The InterNations Survey - 0tarmiricmyNo ratings yet

- Dat e Physicians Order RationaleDocument4 pagesDat e Physicians Order Rationaleember parkNo ratings yet

- Shapiro (1992) A Preliminary Study of The Long Term MeditatorsDocument18 pagesShapiro (1992) A Preliminary Study of The Long Term MeditatorsMichel AngersNo ratings yet

- Health: Quarter 2 - Module 1Document37 pagesHealth: Quarter 2 - Module 1Mark Dexter Mejia80% (5)

- Reader's Digest India in English Magazine PDFDocument151 pagesReader's Digest India in English Magazine PDFSubha SriNo ratings yet

- 4.diagnosis of Facial AsymmetryDocument17 pages4.diagnosis of Facial AsymmetryKajal Panchal19951995No ratings yet

- Application LetterDocument1 pageApplication LetterWetzell PornelNo ratings yet

- Direct Examination of The Expert WitnessDocument43 pagesDirect Examination of The Expert WitnessJeryl Grace FortunaNo ratings yet

- ROLE OF SPIRITUALITY IN ATTAINING WELLBEING - Final Version After Changes PDFDocument24 pagesROLE OF SPIRITUALITY IN ATTAINING WELLBEING - Final Version After Changes PDFKiran Kumar SalagameNo ratings yet

- Material Safety Data Sheet (MSDS) : 1. Chemical & Company IdentificationDocument4 pagesMaterial Safety Data Sheet (MSDS) : 1. Chemical & Company Identificationชินวิช แสงสักNo ratings yet

- Breaking Free From AddictionsDocument9 pagesBreaking Free From AddictionslivromeoNo ratings yet

- 41Document15 pages41pangetkoNo ratings yet

- Practical Research OrigDocument37 pagesPractical Research OrigKillua ZoldyckNo ratings yet

- CSU Cannabis ConferenceDocument2 pagesCSU Cannabis ConferenceD Plump ConsultingNo ratings yet