Professional Documents

Culture Documents

Account Opening Process in PSX

Uploaded by

shani 0070 ratings0% found this document useful (0 votes)

23 views19 pagesAccount Opening Process in PSX

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentAccount Opening Process in PSX

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

23 views19 pagesAccount Opening Process in PSX

Uploaded by

shani 007Account Opening Process in PSX

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 19

ACCOUNT OPENING PROCESS IN

PAKISTAN STOCK EXCHANGE

Complete Guide

The account opening process in PSX is an

easy process a customer can do by

themselves or by broker’s representative.

The steps for opening an account are:

The customer has to go to the

official website of the securities

broker with which they want to

open the account. Firstly, they

have to register themselves on

the website by entering their

email and password.

After signing up they will be

directed to the account opening

form.

Now open ‘Form for new customer’ option. In this

form the customer has to provide their basic

information which includes:

o Name o Registered Mobile Number

o E-mail ID o IBAN

o CNIC Number o Residential status

After submitting the above information open the

‘Account holder details’ option.

In this step the customer has to provide all the

detailed information along with documents

prescribed by the form.

o CNIC Front/Back

o Proof of address

o Proof of source of income

o Signature proof

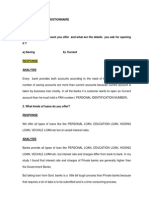

DOCUMENTS

Now open ‘Terms and conditions’ option. The customer

will have to provide digital/online approval and

acceptance of the terms & conditions for the account.

This information will be forwarded to National

Clearing Company of Pakistan Limited (NCCPL),

which will start verification of the information.

This means CNIC, IBAN and mobile verification.

Upon successful verification, NCCPL will send a

One Time Password (OTP) on the customer’s

registered mobile number. If the customer is non

resident Pakistani then they will get the OTP on

their E-mail.

To verify the OTP the customer has to send their

OTP to the broker/representative or they can also

verify their OTP by the link that will be provided to

them by the broker.

The broker will then start the process to open

an account after having done their

verification.

Manually Signature or physical documents

will not be required.

TIME REQUIRED TO OPEN AN ACCOUNT

If the client submits all the right

information to the broker then the

account (CDC sub account) will be open in

3 to 5 working days.

The client will get the UIN(unique identity

number) in the same time.

UKN NUMBER

Unique Know Your Customer Number (UKN) will be

issued by NCCPL after account opening process.

The customer can get this number in 17 to 20 working

days.

UKN is required when the customer wants to change

any of their information like E-mail, Address, IBAN etc.

It is also used when the customer already has an

account in PSX and they want to open more accounts.

ACCOUNT OPENING CHARGES

There are several charges applicable on account opening.

All the brokerage firms have different charges .The basic

ones are listed as follows:

Brokerage Fees

(Varies amongst brokerage firms)

CDC sub account maintenance charges

(Rs 252 annually)

NCCPL Fees

(Rs 452 annually)

ELIGIBILITY CRITERIA

The minors (below 18) are not eligible to

open the account because only CNIC holders

are allowed to open the account.

ACCOUNT OPENING PROCESS MANUALLY

In PSX, the customer can also open their account

manually by submitting the documents on hand

and by filling the form physically. The process will

be same as online account opening.

In this fast moving digital world PSX is trying to

setup online account opening system and to finish

the account opening process manually.

Every brokerage house has different requirements. The basic requirements are as follows:

THANK YOU!

You might also like

- How to get US Bank Account for Non US ResidentFrom EverandHow to get US Bank Account for Non US ResidentRating: 5 out of 5 stars5/5 (1)

- Payment MethodDocument19 pagesPayment MethodOliviaDuchess100% (1)

- Getting Started with Your New Career at ConcentrixDocument4 pagesGetting Started with Your New Career at ConcentrixRose Marie Secretaria BerdosNo ratings yet

- Angel Broking Demat Account OpeningDocument7 pagesAngel Broking Demat Account OpeningmNo ratings yet

- Module Name Test Case # Req Id Scenario Description Pre-RequisiteDocument8 pagesModule Name Test Case # Req Id Scenario Description Pre-RequisitesathvikNo ratings yet

- Digital Account Opening Solution - GuidelinesDocument4 pagesDigital Account Opening Solution - GuidelinesMujeeb MaqboolNo ratings yet

- Frequently Asked Questions (Faqs) : E Filing and CPCDocument22 pagesFrequently Asked Questions (Faqs) : E Filing and CPCPriya GoyalNo ratings yet

- eSTAMPS User GuideDocument16 pageseSTAMPS User GuideSatish NookalaNo ratings yet

- User Guide-Estamps: S T A M P SDocument16 pagesUser Guide-Estamps: S T A M P SSaahiel SharrmaNo ratings yet

- Assignment III Security Trading and Applied Finance - Kamran Rauf - F20MBA304Document6 pagesAssignment III Security Trading and Applied Finance - Kamran Rauf - F20MBA304Kamran RaufNo ratings yet

- GuideDocument5 pagesGuidejanclaudinefloresNo ratings yet

- VCB-ib@nking User Guide PDFDocument34 pagesVCB-ib@nking User Guide PDFThông Hà ThúcNo ratings yet

- Chap-4 Departmentalization of NBPDocument25 pagesChap-4 Departmentalization of NBP✬ SHANZA MALIK ✬No ratings yet

- Cleartax Guide To e VerificationDocument2 pagesCleartax Guide To e VerificationRohit GuptaNo ratings yet

- User Init RegistrationDocument10 pagesUser Init RegistrationMashfiq SohrabNo ratings yet

- Kokan BankDocument20 pagesKokan BankramshaNo ratings yet

- 88643200593Document2 pages88643200593infoNo ratings yet

- Requirement For Digital Account Opening, RDADocument2 pagesRequirement For Digital Account Opening, RDAhassanpc574No ratings yet

- Online Counseling Fee Payment Guide <40Document3 pagesOnline Counseling Fee Payment Guide <40abhishekNo ratings yet

- Nra 0041964Document12 pagesNra 0041964Vikas RanaNo ratings yet

- M2N12500728Document1 pageM2N12500728nareshreddy_nare2987No ratings yet

- Andhra Bank Internet Banking Login, Accounts, Payments, Fund Transfers, Requests & Mail FeaturesDocument8 pagesAndhra Bank Internet Banking Login, Accounts, Payments, Fund Transfers, Requests & Mail FeaturesSrinivas RaoNo ratings yet

- Stay Connected Address Change FormDocument2 pagesStay Connected Address Change Formनित्यानंद पाटीलNo ratings yet

- PHL Metrobank Enrollment InstructionsDocument2 pagesPHL Metrobank Enrollment InstructionsJames Patrick MilanaNo ratings yet

- Multiple Form 26QB For Multiple Buyers, Sellers & Other FAQSDocument5 pagesMultiple Form 26QB For Multiple Buyers, Sellers & Other FAQSprashantgeminiNo ratings yet

- Guidelines For Payment On URA PortalDocument3 pagesGuidelines For Payment On URA Portalzhong qing MaNo ratings yet

- Procedure of TaxDocument16 pagesProcedure of Taxali hassanNo ratings yet

- Enroll for your Metrobank Payroll Account in 7 easy stepsDocument4 pagesEnroll for your Metrobank Payroll Account in 7 easy stepsKae SalvadorNo ratings yet

- Features of All Types of AccountsDocument113 pagesFeatures of All Types of AccountsNahid HossainNo ratings yet

- HDFC Bank's Instant Account FAQ - Open a Bank Account Online in MinutesDocument4 pagesHDFC Bank's Instant Account FAQ - Open a Bank Account Online in Minutessom ghoshNo ratings yet

- RequirementsDocument7 pagesRequirementspeteryoo12345No ratings yet

- Step 1:: CXO CXWDocument5 pagesStep 1:: CXO CXWRasheed Rick AmoresNo ratings yet

- Bank Account Opening GuideDocument24 pagesBank Account Opening GuideHammad AhmadNo ratings yet

- Joint bank account opening proceduresDocument3 pagesJoint bank account opening proceduresAnonymous fcqc0EsXHNo ratings yet

- Dividend Mandate FormDocument2 pagesDividend Mandate FormWaqas MurtazaNo ratings yet

- Ann 2Document2 pagesAnn 2Kedriner LabanNo ratings yet

- SKYBANKING Manual V 2Document55 pagesSKYBANKING Manual V 2Miraj GaziNo ratings yet

- Allied Bank: Internet Banking User Guide V2.0Document16 pagesAllied Bank: Internet Banking User Guide V2.0Muzna FaisalNo ratings yet

- Internet Banking, Mobile Banking, and Bill Payment AgreementDocument7 pagesInternet Banking, Mobile Banking, and Bill Payment AgreementJhomer ClaroNo ratings yet

- Module 10 (Abhishek)Document12 pagesModule 10 (Abhishek)abhishek gautamNo ratings yet

- NBP Internship ReportDocument29 pagesNBP Internship ReportKashif SheikhNo ratings yet

- Mfa CH-3Document22 pagesMfa CH-320BBA29 DUBEY ADITYA ManasNo ratings yet

- Pre PDFDocument2 pagesPre PDFJOHN DEERENo ratings yet

- Please Affix Stamp HereDocument4 pagesPlease Affix Stamp HereleomhorNo ratings yet

- Send Money Internationally With SCBDocument20 pagesSend Money Internationally With SCBHaroon AbidNo ratings yet

- Tax. 23Document18 pagesTax. 23RahulNo ratings yet

- HBL Current Accounts Guide - Basic, Conventional, Freedom & MoreDocument8 pagesHBL Current Accounts Guide - Basic, Conventional, Freedom & MoreAnonymous fcqc0EsXHNo ratings yet

- Current AccountsDocument8 pagesCurrent AccountsAnonymous fcqc0EsXHNo ratings yet

- Training Program:-: ClearingDocument7 pagesTraining Program:-: ClearingBahawal KhanNo ratings yet

- Faqs Regarding Account Opening/Updation in CDS: (After The Roll Out of Cko Regime)Document5 pagesFaqs Regarding Account Opening/Updation in CDS: (After The Roll Out of Cko Regime)Qurat Ul AinNo ratings yet

- Opening new accounts through Aadhaar authenticationDocument66 pagesOpening new accounts through Aadhaar authenticationDharmavir Singh GautamNo ratings yet

- Cukai Taksiran Online Payment dengan JomPAYDocument4 pagesCukai Taksiran Online Payment dengan JomPAYamzar amnaNo ratings yet

- Online Payment - Passport SevaDocument2 pagesOnline Payment - Passport SevaAbdul Hakeem Semar KamaluddinNo ratings yet

- 1) - What Kind of Account You Offer and What Are The Details You Ask For Opening It?Document14 pages1) - What Kind of Account You Offer and What Are The Details You Ask For Opening It?Pawan Jaju100% (1)

- Key Features and Confirmation Format 13-06-2022Document3 pagesKey Features and Confirmation Format 13-06-2022मेरा राम छोटू रामNo ratings yet

- MCB Internet Banking Faqs: View OnlyDocument19 pagesMCB Internet Banking Faqs: View OnlyMuhammad AsifNo ratings yet

- Sib Demat AcopDocument10 pagesSib Demat Acopsibabrata chatterjeeNo ratings yet

- Procedure of Account OpeningDocument11 pagesProcedure of Account OpeningSky WalkerNo ratings yet