Professional Documents

Culture Documents

Midterm Exam - Rafael Luis Pamonag

Midterm Exam - Rafael Luis Pamonag

Uploaded by

Rafael Luis PamonagOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Midterm Exam - Rafael Luis Pamonag

Midterm Exam - Rafael Luis Pamonag

Uploaded by

Rafael Luis PamonagCopyright:

Available Formats

Rafael Luis C.

Pamonag May 15, 2021

BSBA-2B MWF (4PM-5PM)

FM121: Financial Analysis and Reporting Prof: Mr. Francisco A. Baraquel

Midterm Examination

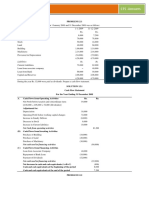

1. Cash Forecasting

HELEN BOWERS

Cash Budget Forecasting

From July-December 2018

July 2018 August 2018 September 2018 October 2018 November 2018 December 2018

Beginning cash 132,000 201,300 387,600 (65,100) 67,200 208,500

Add: cash collection

From current month sales (10%) 36,000 54,000 72,000 36,000 36,000 9,000

From last month sales (75%) 135,000 270,000 405,000 540,000 270,000 270,000

From second last month sales (15%) 27,000 27,000 54,000 81,000 108,000 54,000

Total cash available 330,000 552,300 918,600 591,900 481,200 541,500

Less: cash payments

For labour & raw payments 90,000 126,000 882,000 306,000 234,000 162,000

General & Admin expenses 27,000 27,000 27,000 27,000 27,000 27,000

Lease payments 9,000 9,000 9,000 9,000 9,000 9,000

Misc Expenses 2,700 2,700 2,700 2,700 2,700 2,500

Income tax payments ------- -------- 63,000 ------ ----- 63,000

Progress payments for design studio ------- ------ -------- 180,000 ------- -------

Total payments 128,700 164,700 983,700 524,700 272,700 263,700

Ending cash balance 201,300 387,600 (65,100) 67,200 208,500 277,800

Minimum required balance 90,000 90,000 90,000 90,000 90,000 90,000

Excess cash or Need to borrow 111,300 297,600 (155,100) (22,800) 118,500 187,800

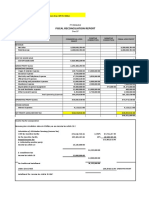

2. Cash Flow Statements

GYWNETT CORPORATION

Statement of Cash Flow (Indirect Method)

For the year ended December 31, 2017

Cash flows from Operating Activities

Net income 186,000

Add: Depreciation 246,000

Less:Gain on sale of Machinery (4,000)

Less:Increase in Account receivables (111,000)

Less: increase in inventories (218,000)

Add:increase in accounts payable 103,000

Less:decrease in taxes payable (25,000)

Add: increase in other short term payable 92,000

Total operating activities 269,000

Cash flows from investing activities

Sale of machinery 34,000

Purchase of land (12,000)

Purchase of machine (200,000)

Total investing activities (178,000)

Cash flow from financing activities

Issue of common stock 17,000

Payment of bonds payable (17,000)

Dividend paid (74,000)

Total financing activities (74,000)

Total cash generated 17,000

Add: beginning cash balance 175,000

Ending cash balance 192,000

3. Inventory Valuation

Given,

Ending inventory units is 60,000

Cost of units available is ₱1,452,100

Cost of goods sold is ₱1,164,100

Gross profit is ₱935,900

#1.

Computing sales value as:

Particulars Amount (₱)

Cost of goods sold during the month July 1,164,100

Add: Gross profit 935,900

Sales value 2,100,000

Computing ending inventory value as:

Particulars Amount (₱)

Cost of units 1,452,100

Less: Cost of goods sold during July 1,164,100

Ending inventory value 288,000

Computing opening inventory value as:

Particulars Amount (₱)

Cost of units 1,452,100

Less: Total purchases 1,042,100

Opening inventory value 410,000

Working:

Purchases Amount (₱)

July 5 280,500

July 11 265,000

July 15 247,500

July 16 249,100

Total purchases 1,042,100

Computing the number of units as:

Opening inventory (A) 410,000

Beginning inventory cost (B) 4.00 per unit

Units (A/B) 102,500

#2.

Computing units sold as:

Particulars Quantities

Beginning inventory 102,500

Add: Purchases 200,000

Aggregate availability 302,500

Less: Ending inventory 60,000

Cost of goods sold 242,500

#3.

Computing unit cost of inventory as:

Particulars Amount

Value of ending inventory (A) 288,000

Ending inventory (B) 60,000

Unit cost 4.8

You might also like

- Schaum's Outline of Principles of Accounting I, Fifth EditionFrom EverandSchaum's Outline of Principles of Accounting I, Fifth EditionRating: 5 out of 5 stars5/5 (3)

- The Legalized Crime of Banking and A Constitutional Remedy (1958)Document265 pagesThe Legalized Crime of Banking and A Constitutional Remedy (1958)johnrose521No ratings yet

- Managerial Accounting - Hallstead Jewelers CaseDocument2 pagesManagerial Accounting - Hallstead Jewelers Casesxzhou23100% (1)

- Equity Valuation: Models from Leading Investment BanksFrom EverandEquity Valuation: Models from Leading Investment BanksJan ViebigNo ratings yet

- Cash Flow Statement Problems PDFDocument32 pagesCash Flow Statement Problems PDFnsrivastav180% (30)

- Schaum's Outline of Bookkeeping and Accounting, Fourth EditionFrom EverandSchaum's Outline of Bookkeeping and Accounting, Fourth EditionRating: 5 out of 5 stars5/5 (1)

- Business Finance Week 7 Basic Long-Term Financial ConceptsDocument16 pagesBusiness Finance Week 7 Basic Long-Term Financial ConceptsJessa Gallardo0% (1)

- Issue of DebenturesDocument28 pagesIssue of DebenturesFalguni Mathews100% (1)

- Cash Flow Statement and Financial Ratio AssignDocument4 pagesCash Flow Statement and Financial Ratio AssignChristian TanNo ratings yet

- Investment and Portfolio Chapter 1Document24 pagesInvestment and Portfolio Chapter 1MarjonNo ratings yet

- Performance Evaluation Form: Employee Name: Department: Location: Title: Performance Period: ManagerDocument4 pagesPerformance Evaluation Form: Employee Name: Department: Location: Title: Performance Period: ManagerMarjonNo ratings yet

- Human Resource Management PPT Lesson 1Document10 pagesHuman Resource Management PPT Lesson 1MarjonNo ratings yet

- Acc117 Sem Oct Feb 2022Document10 pagesAcc117 Sem Oct Feb 20222022846282No ratings yet

- Chegg SolutionsDocument4 pagesChegg SolutionsZenika PetersNo ratings yet

- Acc117 - Assessment - Project 2 (Q)Document5 pagesAcc117 - Assessment - Project 2 (Q)SHARIFAH NOORAZREEN WAN JAMURINo ratings yet

- Financial Reporting, Statement and Analysis Assignment For 2 Semester Name: Dishant Tibrewal SUBMISSION DATE - 16/07/21Document3 pagesFinancial Reporting, Statement and Analysis Assignment For 2 Semester Name: Dishant Tibrewal SUBMISSION DATE - 16/07/21Dishant TibrewalNo ratings yet

- The Hong Kong Polytechnic University Hong Kong Community CollegeDocument6 pagesThe Hong Kong Polytechnic University Hong Kong Community CollegeFung Yat Kit KeithNo ratings yet

- Cash FlowsDocument4 pagesCash FlowsAira Dane VillegasNo ratings yet

- Bheverlynn Corporation Data SetDocument2 pagesBheverlynn Corporation Data SetDaisy Macuroy PurcaNo ratings yet

- Jullie-Ann Ybañez - ACC000-TLA7-2 Financial Statements - Sheet1Document5 pagesJullie-Ann Ybañez - ACC000-TLA7-2 Financial Statements - Sheet1Jullie-Ann YbañezNo ratings yet

- Quiz 2. Midterm (Cash Out Statement) : Cash Flow From Operating ActivitiesDocument4 pagesQuiz 2. Midterm (Cash Out Statement) : Cash Flow From Operating ActivitiesGila AbrazaldoNo ratings yet

- The Institute of Chartered Accountants of Bangladesh: Sample Question Paper Certificate Level-AccountingDocument8 pagesThe Institute of Chartered Accountants of Bangladesh: Sample Question Paper Certificate Level-AccountingArif UddinNo ratings yet

- Case 3 BudgetingDocument13 pagesCase 3 BudgetingPatrick SalvadorNo ratings yet

- 01 Quiz On Topic 02 With Answer KeyDocument7 pages01 Quiz On Topic 02 With Answer KeyNye NyeNo ratings yet

- Ultimate Book of Accountancy: Brilliant ProblemsDocument9 pagesUltimate Book of Accountancy: Brilliant ProblemsPramod VasudevNo ratings yet

- 01 ELMS Activity 3Document2 pages01 ELMS Activity 3Gonzaga FamNo ratings yet

- Assign #03 FNNDocument11 pagesAssign #03 FNNUsman GhaniNo ratings yet

- TK4 AkuntasniDocument7 pagesTK4 AkuntasniSarah NurfadilahNo ratings yet

- Ratios QDocument1 pageRatios Qkashif.ali60001No ratings yet

- Ultimate Book of Accountancy: Class - XII Accountancy Chapter - 05 (Part - B) : Cash Flow Statement Part-4Document11 pagesUltimate Book of Accountancy: Class - XII Accountancy Chapter - 05 (Part - B) : Cash Flow Statement Part-4Pramod VasudevNo ratings yet

- Unit VI CashFlowStatementDocument32 pagesUnit VI CashFlowStatementSmiti RupaNo ratings yet

- Advanced Accounting 3Document1 pageAdvanced Accounting 3Tax TrainingNo ratings yet

- The Institute of Finance Management: AnswersDocument6 pagesThe Institute of Finance Management: AnswersAli SalehNo ratings yet

- ACC12 - Statement of Cash FlowsDocument1 pageACC12 - Statement of Cash FlowsVimal KvNo ratings yet

- Overall TemplateDocument5 pagesOverall TemplateUsman GhaniNo ratings yet

- B2 2021 Nov AnsDocument13 pagesB2 2021 Nov AnsRashid AbeidNo ratings yet

- FFS - Numericals 2Document3 pagesFFS - Numericals 2Funny ManNo ratings yet

- Net Cash Flow From Operating Activities 1,222,000Document1 pageNet Cash Flow From Operating Activities 1,222,000Jen DeloyNo ratings yet

- Jawaban Chapter 23 - Soal DikerjakanDocument2 pagesJawaban Chapter 23 - Soal Dikerjakanabd storeNo ratings yet

- Ma AssigmentDocument32 pagesMa AssigmentAashayNo ratings yet

- CH23 - Transactional Approach and CFExercises and SolutionsDocument6 pagesCH23 - Transactional Approach and CFExercises and SolutionsHossein ParvardehNo ratings yet

- Ultimate Book of Accountancy: Dr. Vinod Kumar Vishvas PublicationsDocument4 pagesUltimate Book of Accountancy: Dr. Vinod Kumar Vishvas PublicationsPramod VasudevNo ratings yet

- CFAS 16 and 18Document2 pagesCFAS 16 and 18Cath OquialdaNo ratings yet

- Financial Accounting Class Activity Fall 6 2021 Statement of Cash FlowsDocument4 pagesFinancial Accounting Class Activity Fall 6 2021 Statement of Cash FlowsRajay BramwellNo ratings yet

- Latihan Intercompany Profit Transactions-Plant Assets WS 2Document5 pagesLatihan Intercompany Profit Transactions-Plant Assets WS 2Raihan SalehNo ratings yet

- Cashflow Solutions Q2Document7 pagesCashflow Solutions Q2calliemozartNo ratings yet

- ASSIGNMENT 2.1 CASH FLOWS StudentDocument4 pagesASSIGNMENT 2.1 CASH FLOWS StudentMichael Angelo CatubigNo ratings yet

- Villena Stephanie A12-02 QA2 Attempt2Document8 pagesVillena Stephanie A12-02 QA2 Attempt2Stephanie VillenaNo ratings yet

- CHATTO - Finals - Summer 2022 - Cash Flows & Cap. BudgDocument6 pagesCHATTO - Finals - Summer 2022 - Cash Flows & Cap. BudgJULLIE CARMELLE H. CHATTONo ratings yet

- UntitledDocument13 pagesUntitledTejasree SaiNo ratings yet

- 16 B 3 Supplemental - Problems - and - Solutions - CH - 1Document6 pages16 B 3 Supplemental - Problems - and - Solutions - CH - 1minajovanovicNo ratings yet

- Activity For Chapter 3 (Financial Statements, Cash Flow and Taxes)Document2 pagesActivity For Chapter 3 (Financial Statements, Cash Flow and Taxes)pamela dequillamorteNo ratings yet

- Appendix C End-Of-Period Spreadsheet (Work Sheet) For A Merchandising BusinessDocument14 pagesAppendix C End-Of-Period Spreadsheet (Work Sheet) For A Merchandising BusinessLan Hương Trần ThịNo ratings yet

- Midterm 1217Document7 pagesMidterm 1217Iphegenia DipoNo ratings yet

- For The Year Ended December 31, 2020: Rcs Consultancy CorporationDocument11 pagesFor The Year Ended December 31, 2020: Rcs Consultancy CorporationYzzabel Denise L. TolentinoNo ratings yet

- MGAC2 ForecastingDocument22 pagesMGAC2 ForecastingJoana TrinidadNo ratings yet

- CashFlowStatement AssignmentDocument15 pagesCashFlowStatement AssignmentAnanta Vishain0% (1)

- Ws CmaDocument11 pagesWs CmaVRNo ratings yet

- Activity - Financial StatementsDocument5 pagesActivity - Financial StatementsPhilip Jhon BayoNo ratings yet

- Hasil Abnormal ReturnDocument1 pageHasil Abnormal ReturnSurya KeceNo ratings yet

- Tôi Đang Chia Sẻ 'Financial Plan - Sample' Với BạnDocument12 pagesTôi Đang Chia Sẻ 'Financial Plan - Sample' Với BạnThùy Linh DươngNo ratings yet

- Pricilla AssignmentDocument3 pagesPricilla AssignmentjasonnumahnalkelNo ratings yet

- Description Income Expenses Assets LiabilitiesDocument12 pagesDescription Income Expenses Assets LiabilitiesNipuna Perera100% (1)

- Poa Mock Exam 2020Document13 pagesPoa Mock Exam 2020DanNo ratings yet

- Cash Flows HXDocument2 pagesCash Flows HXDevin AvilaNo ratings yet

- FAR 05 Task PerformanceDocument2 pagesFAR 05 Task PerformanceCla JoyceNo ratings yet

- Jomar Box Company: Sales 7000x$60 $420,000Document1 pageJomar Box Company: Sales 7000x$60 $420,000MarjonNo ratings yet

- Fin. Anal RafaelDocument6 pagesFin. Anal RafaelMarjonNo ratings yet

- Fin. Anal Rafael 3Document4 pagesFin. Anal Rafael 3MarjonNo ratings yet

- Davao Oriental State College of Science and TechnologyDocument3 pagesDavao Oriental State College of Science and TechnologyMarjonNo ratings yet

- CRM ProposalDocument4 pagesCRM ProposalMarjonNo ratings yet

- BSP - Final Exam LUCHAVEZDocument16 pagesBSP - Final Exam LUCHAVEZMarjonNo ratings yet

- Case Study No.1Document2 pagesCase Study No.1MarjonNo ratings yet

- CBM130 Quiz No.3Document2 pagesCBM130 Quiz No.3MarjonNo ratings yet

- Case StudyDocument7 pagesCase StudyMarjonNo ratings yet

- Marjon Limot & Jose Araneta Jr. December 09, 2020 Bsba-3B MWF (6:00PM-7:00PM) CBM130: Strategic Management Prof: Maam Teoxon Paired ActivityDocument3 pagesMarjon Limot & Jose Araneta Jr. December 09, 2020 Bsba-3B MWF (6:00PM-7:00PM) CBM130: Strategic Management Prof: Maam Teoxon Paired ActivityMarjonNo ratings yet

- Personal Finance Quiz No.2Document3 pagesPersonal Finance Quiz No.2MarjonNo ratings yet

- FM131 AssignmentDocument1 pageFM131 AssignmentMarjonNo ratings yet

- Ba132: International Business and Trade: (A Foreign Market Opportunity Assessment)Document5 pagesBa132: International Business and Trade: (A Foreign Market Opportunity Assessment)MarjonNo ratings yet

- BA132: International Business and Trade: (A Foreign Market Opportunity Assessment)Document2 pagesBA132: International Business and Trade: (A Foreign Market Opportunity Assessment)MarjonNo ratings yet

- GOOD-GOVERNANCE QuizDocument1 pageGOOD-GOVERNANCE QuizMarjonNo ratings yet

- Good Governance FormatDocument16 pagesGood Governance FormatMarjonNo ratings yet

- Investment and Portfolio Chapter 2Document32 pagesInvestment and Portfolio Chapter 2MarjonNo ratings yet

- Investment and Portfolio Chapter 4Document48 pagesInvestment and Portfolio Chapter 4MarjonNo ratings yet

- Ba132: International Business and Trade (Final Requirements)Document9 pagesBa132: International Business and Trade (Final Requirements)MarjonNo ratings yet

- Philippines Money ColorsDocument1 pagePhilippines Money ColorsMarjonNo ratings yet

- GST RegistationDocument5 pagesGST RegistationTarasankar BhattacharjeeNo ratings yet

- Topic 1-Unit 5-Accounting PrinciplesDocument51 pagesTopic 1-Unit 5-Accounting PrinciplesHoàng CúcNo ratings yet

- All PoclerksolvedpapersDocument264 pagesAll Poclerksolvedpaperssoumen4catNo ratings yet

- Messages 8B Brazilian LocalizationDocument20 pagesMessages 8B Brazilian LocalizationcmocattoNo ratings yet

- City Limits Magazine, March 1997 IssueDocument40 pagesCity Limits Magazine, March 1997 IssueCity Limits (New York)No ratings yet

- Alibaba Conversion and Penetration RatesDocument18 pagesAlibaba Conversion and Penetration RatesPedro Neira100% (1)

- EOH Stakeholder LetterDocument3 pagesEOH Stakeholder LetterBusinessTechNo ratings yet

- FCCB AccountingDocument20 pagesFCCB AccountingManoj NambiarNo ratings yet

- Igarashi PDFDocument95 pagesIgarashi PDFDipanshu NagarNo ratings yet

- Auditing Pak MCQSDocument27 pagesAuditing Pak MCQSAHADNo ratings yet

- Transaction Cycles Business ProcessesDocument5 pagesTransaction Cycles Business Processeslied27106No ratings yet

- PLDT Audited FsDocument161 pagesPLDT Audited FsRomelyn PagulayanNo ratings yet

- Swasti Sharma Research ReportDocument60 pagesSwasti Sharma Research Reportswasti sharmaNo ratings yet

- mgt211 Final Term 2009Document8 pagesmgt211 Final Term 2009Prince HiraNo ratings yet

- List of Creditors MotorsDocument28 pagesList of Creditors MotorsGuzila HuNo ratings yet

- 2020 - Yearly - Pabrik Kertas Tjiwikimia (Report-Billingual) Dec 31 2020 - FINALDocument107 pages2020 - Yearly - Pabrik Kertas Tjiwikimia (Report-Billingual) Dec 31 2020 - FINALLolly PollyNo ratings yet

- Mli SelectDocument3 pagesMli SelectCheryl SarnavkaNo ratings yet

- Adam Bataineh Ch5Document10 pagesAdam Bataineh Ch5Omar AssafNo ratings yet

- TLA 3mmwDocument3 pagesTLA 3mmwAngelica MaeNo ratings yet

- Peter Selis BankruptcyDocument55 pagesPeter Selis BankruptcyJessica McBrideNo ratings yet

- PDFDocument12 pagesPDFDyna JoseNo ratings yet

- 2011 Survey On Children (PSA)Document105 pages2011 Survey On Children (PSA)Chrissete AgustinNo ratings yet

- Cambridge International Advanced Subsidiary and Advanced LevelDocument4 pagesCambridge International Advanced Subsidiary and Advanced LevelVenonNo ratings yet

- The Cpa Licensure Examination Syllabus Advanced Financial Accounting and ReportingDocument4 pagesThe Cpa Licensure Examination Syllabus Advanced Financial Accounting and ReportingClaiver SorianoNo ratings yet

- Economics (National Income Analysis)Document7 pagesEconomics (National Income Analysis)Karissa Kate CamurunganNo ratings yet

- RK ProjectDocument82 pagesRK ProjectRitika KhuranaNo ratings yet