Professional Documents

Culture Documents

A31 Cash and Receivables

Uploaded by

dre thegreatOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

A31 Cash and Receivables

Uploaded by

dre thegreatCopyright:

Available Formats

Cash and Receivables

March 7, 2023 8:46 PM

Cash

Definition:

- Under PAS 1, an entity shall classify an asset as current when the asset is cash or a cash

equivalent unless it is restricted to settle a liability for more than 12 months after the

reporting period.

- Under PAS 7, cash comprises cash on hand and demand deposits.

- Cash equivalent are short-term, highly liquid investments that are readily convertible to known

amounts of cash and which are subject to an insignificant risk of changes in value.

- Under PAS 7, an investment normally qualifies as a cash equivalent only when it has a short

maturity of, say, three months or less from the date of acquisition.

- Unrestricted in use, must be readily available in the payment of current obligation

3 items are included in cash account:

1. Cash on hand – examples: customer’s checks, cashier’s or manager’s checks, traveler’s checks,

bank drafts, money orders

2. Cash in bank – examples: demand deposit, savings deposit (all should be unrestricted as to

withdrawal)

3. Cash fund – examples: petty cash fund, payroll fund, dividend fund, travel fund, interest fund,

tax fund (fund for short term purposes)

Cash equivalents:

- Are short term and highly liquid investments that are readily convertible into cash and so near

their maturity that they present insignificant risk of changes in value because of interest rate

changes.

- Examples of CE are:

○ BSP treasury bill

○ Time deposit

○ Money market fund/instrument or commercial paper

○ Preference shares specified with redemption date

- Note:

○ All of these investments must be purchased three months (or 90 days) before maturity

date.

○ Equity securities cannot qualify as cash equivalents because it does not have maturity

value

○ PS with Specified Redemption - must be acquired three months before redemption date

Measurement of cash

- Cash is measured at face value.

- Cash in foreign currency is measured at current exchange rate.

- Cash is measured at lower of estimated realizable value and face value if the bank that holds

the funds of an entity is in bankruptcy or financial difficulty.

Presentation of Cash and Cash Equivalents

- Aggregated amount of cash and cash equivalents is reported as the first line item under

current assets of the statement of financial position.

- Disaggregated amount of cash and cash equivalents should be disclosed in the notes to

financial statements.

Classification of Investment in Time Deposit, Money Market Instrument and Treasury Bills

a. If purchase three months or less before its maturity, it's a cash equivalent

New Section 11 Page 1

a. If purchase three months or less before its maturity, it's a cash equivalent

b. If more than three months but within one year, a short term investment and current asset

c. More than one year, classified as long term investment

Cash fund for a certain purpose

- Cash fund set aside for use in current operations is a current asset

○ Thus included in cash and cash equivalents

• Cash fund for current operations – current asset (cash)

○ Examples: petty cash fund, payroll fund, dividend fund, travel fund, interest fund, tax

fund

• Cash fund set aside to acquire long term asset or to pay noncurrent obligations – noncurrent

asset (long term investment)

○ Examples: bond sinking fund, preference share redemption fund, contingency fund,

insurance fund, fund set aside to purchase/construct PPE.

• NOTE: Classification of the bond is parallel to the classification of its relate liability

Bank Overdraft

- There is an overdraft when the cash in bank account has a credit balance.

- Classified as current liability

- Shall not be offset against other bank accounts with debit balances, except, when an entity

maintains two or more account in one bank (an account with credit balance can be offset

against other account/s with positive balance) or when the amount is immaterial.

- In Philippines, bank overdrafts are, generally, not allowed.

Compensating Balance

- In relation to borrowing arrangement with a bank, compensating balance is the minimum

checking or demand deposit account balance that must be maintained.

- Not Legally Restricted

○ Cash

- Legally Restricted

○ Related to Current Liability - Current Asset

○ Related to Non-current Liability - Noncurrent Asset

Accounting for Issues about checks

• Undelivered/unreleased checks – drawn and recorded by the maker but not given to the

payee before the end of reporting period.

○ Treatment: Maker (debtor) – added back as part of cash

• Postdated checks – drawn, recorded and delivered to payee but has a date subsequent to end

of reporting period.

○ Treatment: Maker (debtor) – added back as part of cash

• Stale check/check long outstanding – check not converted to actual cash by payee within a

long period of time.

○ Treatment: Maker (debtor) – added back to cash

Imprest System

- This system requires that all cash receipts should be deposited intact and all cash

disbursements should be made by means of check.

- An internal cash control device

Two Systems of Handling Petty Cash Fund

1. Imprest Fund System

- Petty cash expense is recorded at the date of replenishment

- The amount of replenishment is normally equal to the petty cash disbursement

2. Fluctuating Fund System

- Petty cash expense are expensed immediately

- Replenishment may or may not be equal to the petty cash disbursement

New Section 11 Page 2

- Replenishment may or may not be equal to the petty cash disbursement

Receivables

Trade and Nontrade Receivables

1. Trade Receivables

- Claims arising from sale of merchandise or services in the ordinary course of business

- Includes

Accounts Receivables - customer's account, trade debtors and trade account

receivables

2. Non-trade Receivables

- Represents claims other than from sale of merchandise or service

- Examples

a. Advances to or receivables from shareholders, directors, officers, or employees

b. Advance to affiliates - noncurrent asset

c. Advance to supplier - current asset

d. Subscription Receivable

- More than 1 year - deduction in SHE (if silent treatment)

- Within 1 year - current

e. Creditors account with debit balance

f. Special Deposits - normally classified as noncurrent asset

g. Accruals - current

h. Claims receivable - current asset

Initial Measurement:

- Short term Receivables: Face Value

- 5Long Term Receivables:

- Noninterest bearing - Present Value

- Interest bearing: Face Value, but Present Value if market rate is unrealistic

Subsequent Measurement

- Net Realizable Value/Amortized Cost

NRV of Accounts Receivables:

New Section 11 Page 3

You might also like

- 1040 Exam Prep Module III: Items Excluded from Gross IncomeFrom Everand1040 Exam Prep Module III: Items Excluded from Gross IncomeRating: 1 out of 5 stars1/5 (1)

- Lecture No.1 Cash Cash Equiv TheoriesDocument3 pagesLecture No.1 Cash Cash Equiv TheoriesbsasociondaisyremarieNo ratings yet

- Understanding Cash and Cash EquivalentsDocument43 pagesUnderstanding Cash and Cash EquivalentsMarriel Fate CullanoNo ratings yet

- Financial Accounting and Reporting Study Guide NotesFrom EverandFinancial Accounting and Reporting Study Guide NotesRating: 1 out of 5 stars1/5 (1)

- IA1 Cash and Cash EquivalentsDocument20 pagesIA1 Cash and Cash EquivalentsJohn Rainier QuijadaNo ratings yet

- Cashandcashequivalent 150620153356 Lva1 App6892 PDFDocument27 pagesCashandcashequivalent 150620153356 Lva1 App6892 PDFMary Ann BaguioNo ratings yet

- Assets - Syn 101Document35 pagesAssets - Syn 101Marianne SironNo ratings yet

- Cash and Cash EquivalentsDocument3 pagesCash and Cash EquivalentsHufana, ShelleyNo ratings yet

- White PaperDocument5 pagesWhite PaperZara Jane DinhayanNo ratings yet

- Cash and Cash EquivalentsDocument31 pagesCash and Cash EquivalentsMark LouieNo ratings yet

- Module 1 - Cash and Cash EquivalentsDocument16 pagesModule 1 - Cash and Cash EquivalentsJehPoy0% (1)

- Understand Cash & Cash EquivalentsDocument37 pagesUnderstand Cash & Cash EquivalentsReiner Jan AlcantaraNo ratings yet

- Cash and Cash EquivalentsDocument33 pagesCash and Cash EquivalentsMerry Julianne DaymielNo ratings yet

- Cash Part1Document7 pagesCash Part1cuaresmamonicaNo ratings yet

- Intacc 1Document6 pagesIntacc 1imsana minatozakiNo ratings yet

- Iac1 C1 DalidaDocument6 pagesIac1 C1 DalidaEdith DalidaNo ratings yet

- It Is A Current Asset. It Is Part of Cash and Cash EquivalentsDocument2 pagesIt Is A Current Asset. It Is Part of Cash and Cash EquivalentsBts Army ForeverNo ratings yet

- Cash and Cash Equivalents GuideDocument6 pagesCash and Cash Equivalents GuideKairo ZeviusNo ratings yet

- Cash and Cash EquivalentsDocument5 pagesCash and Cash EquivalentsCamille Joyce Corpuz Dela CruzNo ratings yet

- Cash and Equivalents GuideDocument52 pagesCash and Equivalents GuideDeryl GalveNo ratings yet

- Cash Cash - Money and Other Negotiable Instrument That Is Payable in Money and Acceptable by TheDocument4 pagesCash Cash - Money and Other Negotiable Instrument That Is Payable in Money and Acceptable by TheannyeongNo ratings yet

- Xfar ReviewerDocument6 pagesXfar ReviewerAliyah Ishi UcagNo ratings yet

- Module 16 - Cash and Cash EquivalentsDocument7 pagesModule 16 - Cash and Cash EquivalentsLuiNo ratings yet

- Afar NotesDocument24 pagesAfar NotesCoreen ElizaldeNo ratings yet

- Cash and Cash EquivalentsDocument31 pagesCash and Cash EquivalentsMaynard van LascuñaNo ratings yet

- 01 Intermediate Accounting 1 Cash and Cash EquivalentsDocument9 pages01 Intermediate Accounting 1 Cash and Cash EquivalentsRoyu BreakerNo ratings yet

- Cash Cash EquivalentDocument92 pagesCash Cash EquivalentInzaghi CruiseNo ratings yet

- Reviewer Accounting - CrisaDocument12 pagesReviewer Accounting - Crisamiracle123No ratings yet

- A101 Financial Accounting and Reporting XFARDocument61 pagesA101 Financial Accounting and Reporting XFARCristina TayagNo ratings yet

- Module 3 Cash and Cash EquivalentsDocument32 pagesModule 3 Cash and Cash Equivalentschuchu tv100% (1)

- CFAS Chapter 4 - Cash and Cash EquivalentsDocument3 pagesCFAS Chapter 4 - Cash and Cash EquivalentsAngelaMariePeñarandaNo ratings yet

- Cash and Cash Equivalents (Chapter 1)Document171 pagesCash and Cash Equivalents (Chapter 1)chingNo ratings yet

- Topic 5 - Cash and Cash Equivalent - Rev (Students)Document31 pagesTopic 5 - Cash and Cash Equivalent - Rev (Students)Novian Dwi Ramadana0% (1)

- FS Overview: Cash and Cash EquivalentsDocument14 pagesFS Overview: Cash and Cash EquivalentsRommel estrellado100% (1)

- Cash and Cash EquivalentsDocument5 pagesCash and Cash EquivalentsJladySilhoutte100% (3)

- ReviewerDocument67 pagesReviewerKyungsoo DohNo ratings yet

- CCE NotesDocument7 pagesCCE NotesHavanah Erika Dela CruzNo ratings yet

- Cash and Cash EquivalentsDocument27 pagesCash and Cash EquivalentsPatOcampoNo ratings yet

- Cash and Cash EquivalentsDocument20 pagesCash and Cash EquivalentsKing TaguibaoNo ratings yet

- IA For Prelims FinalDocument438 pagesIA For Prelims FinalCeline Therese BuNo ratings yet

- Intermediate Accounting ReviewerDocument5 pagesIntermediate Accounting ReviewerBroniNo ratings yet

- Finacco Module 3Document42 pagesFinacco Module 3obtuse anggelNo ratings yet

- Chapter-2-cash-and-Cash-equivalentsDocument12 pagesChapter-2-cash-and-Cash-equivalentslorieferpaloganNo ratings yet

- Cash and Cash EquivalentsDocument10 pagesCash and Cash Equivalentssoyoung kimNo ratings yet

- BedhewbdjkewDocument16 pagesBedhewbdjkewMaica A.No ratings yet

- Audit ProblemsDocument32 pagesAudit ProblemsShane TabunggaoNo ratings yet

- Financial Accounting and ReportingDocument31 pagesFinancial Accounting and ReportingBer SchoolNo ratings yet

- Audit ProblemsDocument47 pagesAudit ProblemsShane TabunggaoNo ratings yet

- Cash-and-Cash-Equivalents IADocument7 pagesCash-and-Cash-Equivalents IAJehannahBaratNo ratings yet

- Cash and Cash EquivalentsDocument11 pagesCash and Cash EquivalentsJoana Marie SajolNo ratings yet

- Cash and Cash EquivalentDocument54 pagesCash and Cash EquivalentHello Kitty100% (1)

- 2020 Int Acc 1 - ReceivablesDocument45 pages2020 Int Acc 1 - ReceivablesNICOLE HIPOLITONo ratings yet

- Analyzing Financing LiabilitiesDocument13 pagesAnalyzing Financing LiabilitiesJarida La UongoNo ratings yet

- Audit Problems FinalDocument48 pagesAudit Problems FinalShane TabunggaoNo ratings yet

- Cashand Cash Equivalents101Document38 pagesCashand Cash Equivalents101Wynphap podiotanNo ratings yet

- Topic 5 - Cash and Cash Equivalent - Rev (Students)Document31 pagesTopic 5 - Cash and Cash Equivalent - Rev (Students)RomziNo ratings yet

- Ca5105 Intermediate Accounting I CHAPTER 1 - Cash and Cash Equivalents Financial AssetsDocument28 pagesCa5105 Intermediate Accounting I CHAPTER 1 - Cash and Cash Equivalents Financial AssetsRaina OsorioNo ratings yet

- 3 Cash and Cash EquivalentsDocument4 pages3 Cash and Cash EquivalentsJamie MarizNo ratings yet

- Cash and Cash EquivalentDocument50 pagesCash and Cash EquivalentAurcus JumskieNo ratings yet

- Business ManagemeneeettdsdfsfDocument2 pagesBusiness Managemeneeettdsdfsfdre thegreatNo ratings yet

- Businness ManagemeneeeetDocument2 pagesBusinness Managemeneeeetdre thegreatNo ratings yet

- Business ManagementDocument2 pagesBusiness Managementdre thegreatNo ratings yet

- Business Management 17Document1 pageBusiness Management 17dre thegreatNo ratings yet

- Business ManagemeeeeentDocument1 pageBusiness Managemeeeeentdre thegreatNo ratings yet

- Bme CH 12Document2 pagesBme CH 12dre thegreatNo ratings yet

- Bme CH 13Document2 pagesBme CH 13dre thegreatNo ratings yet

- September 19, 2022 8:10 AM: New Section 1 Page 1Document9 pagesSeptember 19, 2022 8:10 AM: New Section 1 Page 1dre thegreatNo ratings yet

- Bme CH 6Document1 pageBme CH 6dre thegreatNo ratings yet

- Bme CH 8 - 9Document5 pagesBme CH 8 - 9dre thegreatNo ratings yet

- December 5, 2022 8:23 AM: New Section 8 Page 1Document3 pagesDecember 5, 2022 8:23 AM: New Section 8 Page 1dre thegreatNo ratings yet

- Fabm 1 ReviewDocument29 pagesFabm 1 ReviewMelanie Cruz ConventoNo ratings yet

- RHB BG Application FormDocument4 pagesRHB BG Application Formken limNo ratings yet

- Shell liable for damages due to bad faith attachment of debtor's planeDocument1 pageShell liable for damages due to bad faith attachment of debtor's planeNathalie Jean Yap100% (3)

- Bear Stearns Collapse Due to Risky CDO BetsDocument15 pagesBear Stearns Collapse Due to Risky CDO BetsJaja JANo ratings yet

- Accounting Past MCQDocument108 pagesAccounting Past MCQbinalamitNo ratings yet

- Paper - 1: Principles & Practice of Accounting Questions True and FalseDocument28 pagesPaper - 1: Principles & Practice of Accounting Questions True and FalseSaurabh JainNo ratings yet

- Chapter 4 - Completing The Accounting CycleDocument74 pagesChapter 4 - Completing The Accounting CycleNgân TrươngNo ratings yet

- Expressed, Resulting, Constructive TrustsDocument15 pagesExpressed, Resulting, Constructive TrustsHiruni Pqbqsqrq100% (1)

- Ratio Analysis Insights for Investors and ManagersDocument7 pagesRatio Analysis Insights for Investors and ManagersAhmad vlogsNo ratings yet

- Problems Chapter 7-1: RequiredDocument16 pagesProblems Chapter 7-1: RequiredTanyelle Louv0% (1)

- Financial Statement AnalysisDocument2 pagesFinancial Statement AnalysisJalees ur RehmanNo ratings yet

- Instructions To Students: Annual Examinations For Schools 2019Document8 pagesInstructions To Students: Annual Examinations For Schools 2019parapara11No ratings yet

- Bba 301Document10 pagesBba 301rohanNo ratings yet

- Chapter 1 Accounting Equation - Double Entry BookkeepingDocument5 pagesChapter 1 Accounting Equation - Double Entry BookkeepingKate BlossomNo ratings yet

- Law On Obligation Contracts REVIEWERDocument8 pagesLaw On Obligation Contracts REVIEWERroselyn cortezNo ratings yet

- Unclaimed BalancesDocument1 pageUnclaimed BalancesCarmencita TabundaNo ratings yet

- INTACC Reviewer Cash and EquivalentsDocument9 pagesINTACC Reviewer Cash and EquivalentsCzarhiena SantiagoNo ratings yet

- Balance SheetDocument2 pagesBalance SheetKeight NuevaNo ratings yet

- Theories For Accounts Receivable and Allowance For Doubtful AccountsDocument5 pagesTheories For Accounts Receivable and Allowance For Doubtful AccountsIrish D. CudalNo ratings yet

- Chapter 16 - Accounts From Incomplete Records-Single Entry SystemDocument27 pagesChapter 16 - Accounts From Incomplete Records-Single Entry SystemTru eduzoneNo ratings yet

- Hellene Panhard LoresheetDocument2 pagesHellene Panhard LoresheetFlavio Bergantini DiasNo ratings yet

- College Financial Plan TemplateDocument4 pagesCollege Financial Plan TemplateSanduni WeerakoonNo ratings yet

- Installment Sales-: Loss On Repossession XXX Gain On Repossession XXXDocument5 pagesInstallment Sales-: Loss On Repossession XXX Gain On Repossession XXXJoyce Ann Agdippa BarcelonaNo ratings yet

- ABC Audit Representation LetterDocument3 pagesABC Audit Representation LetterMatthew TsangNo ratings yet

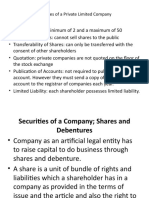

- Features of A Private Limited CompanyDocument102 pagesFeatures of A Private Limited CompanyDavid ONo ratings yet

- Project Report: and Finance Under The University of Calcutta)Document15 pagesProject Report: and Finance Under The University of Calcutta)Amit SinghNo ratings yet

- Module 1: Introduction To Accounting: 1 Semester, SY 2020-2021Document25 pagesModule 1: Introduction To Accounting: 1 Semester, SY 2020-2021Rasmey MarcosNo ratings yet

- Department of commerce 1st semester examDocument9 pagesDepartment of commerce 1st semester examEshal KhanNo ratings yet

- Model Answers - 116342Document6 pagesModel Answers - 116342Marius BuysNo ratings yet

- Complete Guide to Business Loans in the PhilippinesDocument3 pagesComplete Guide to Business Loans in the PhilippinesRai RaiNo ratings yet