Professional Documents

Culture Documents

Case Study Whitney Narrative - Jarina and Sanap

Uploaded by

Jefferson JarinaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Case Study Whitney Narrative - Jarina and Sanap

Uploaded by

Jefferson JarinaCopyright:

Available Formats

Submitted by: Jefferson Jarina and Chestine Jenn Sanap

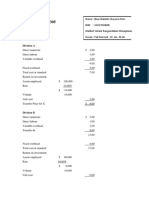

WHITNEY COMPANY

Income Statement

For the Year Ended December 31

Total Per Unit (USD) Per Unit (USD) Per Unit (USD)

CF 2A 2B CF 2A 2B

Sales $ 450,000.00 $ 600,000.00 $ 720,000.00 $ 10.00 $ 8.00 $ 12.00

Less: Variable Costs

Direct Materials $ 90,000.00 $ 150,000.00 $ 120,000.00 $ 2.00 $ 2.00 $ 2.00

Direct Labor $ 78,300.00 $ 130,500.00 $ 104,400.00 $ 1.74 $ 1.74 $ 1.74

Variable Manufacturing Over Head $ 13,500.00 $ 22,500.00 $ 18,000.00 $ 0.30 $ 0.30 $ 0.30

Variable Shipping $ 5,400.00 $ 9,000.00 $ 7,200.00 $ 0.12 $ 0.12 $ 0.12

Variable Sales Commision $ 27,000.00 $ 45,000.00 $ 64,800.00 $ 0.60 $ 0.60 $ 1.08

Variable Administration $ 1,800.00 $ 3,000.00 $ 2,400.00 $ 0.04 $ 0.04 $ 0.04

Contribution Margin $ 234,000.00 $ 240,000.00 $ 403,200.00 $ 5.20 $ 3.20 $ 6.72

Less: Fixed Costs

Fixed Manufacturing Over Head $ 85,000.00 $ 85,000.00 $ 85,000.00 $ 1.89 $ 1.13 $ 1.42

Fixed Advertising $ 120,000.00 $ 120,000.00 $ 220,000.00 $ 2.67 $ 1.60 $ 3.67

Fixed Administrative $ 48,000.00 $ 48,000.00 $ 48,000.00 $ 1.07 $ 0.64 $ 0.80

Net Income Loss/Profit $ -19,000.00 $ -13,000.00 $ 50,200.00 $ -0.42 $ -0.17 $ 0.84

1: Whitney's Income Statement (Contribution Format)

Total Per Unit (USD)

Sales $ 450,000.00 $ 10.00 $ 10.00

Less: Variable Costs $ -

Direct Materials $ 90,000.00 $ 2.00

Direct Labor $ 78,300.00 $ 1.74

Variable Manufacturing Over Head $ 13,500.00 $ 0.30

Variable Shipping $ 5,400.00 $ 0.12

Variable Sales Commision $ 27,000.00 $ 0.60

Variable Administration $ 1,800.00 $ 0.04 $ 4.10

Contribution Margin $ 234,000.00 $ 5.20

Less: Fixed Costs $ -

Fixed Manufacturing Over Head $ 85,000.00 $ 1.89

Fixed Advertising $ 120,000.00 $ 2.67

Fixed Administrative $ 48,000.00 $ 1.07 $ 253,000.00

Net Income Loss $ -19,000.00 $ -0.42

2A : Vice President Income Statement (Contribution Format)

Total Per Unit (USD)

Sales $ 600,000.00 $ 8.00

Less: Variable Costs

Direct Materials $ 150,000.00 $ 2.00

Direct Labor $ 130,500.00 $ 1.74

Variable Manufacturing Over Head $ 22,500.00 $ 0.30

Variable Shipping $ 9,000.00 $ 0.12

Variable Sales Commision $ 45,000.00 $ 0.60

Variable Administration $ 3,000.00 $ 0.04

Contribution Margin $ 240,000.00 $ 3.20

Less: Fixed Costs

Fixed Manufacturing Over Head $ 85,000.00 $ 1.13

Fixed Advertising $ 120,000.00 $ 1.60

Fixed Administrative $ 48,000.00 $ 0.64

Net Income Loss $ -13,000.00 $ -0.17

2B : Sales Manager Income Statement (Contribution Format)

Total Per Unit (USD)

Sales $ 720,000.00 $ 12.00

Less: Variable Costs

Direct Materials $ 120,000.00 $ 2.00

Direct Labor $ 104,400.00 $ 1.74

Variable Manufacturing Over Head $ 18,000.00 $ 0.30

Variable Shipping $ 7,200.00 $ 0.12

Variable Sales Commision $ 64,800.00 $ 1.08

Variable Administration $ 2,400.00 $ 0.04

Contribution Margin $ 403,200.00 $ 6.72

Less: Fixed Costs

Fixed Manufacturing Over Head $ 85,000.00 $ 1.42

Fixed Advertising $ 220,000.00 $ 3.67

Fixed Administrative $ 48,000.00 $ 0.80

Net Income Profit $ 50,200.00 $ 0.84

3. Total(Units) = Fixed Cost + Desired profit / (selling price - Variable cost/unit)

= (USD 253,000 + USD 30,200) / (USD 10 - USD 4.10)

= 48,000 units needed to be sold in order to generate USD 30,200 profit next year

Total Per Unit (USD)

Sales $ 480,000.00 $ 10.00

Less: Variable Costs

Direct Materials $ 62,400.00 $ 1.30

Direct Labor $ 83,520.00 $ 1.74

Variable Manufacturing Over Head $ 14,400.00 $ 0.30

Variable Shipping $ 5,760.00 $ 0.12

Variable Sales Commision $ 28,800.00 $ 0.60

Variable Administration $ 1,920.00 $ 0.04

Contribution Margin $ 283,200.00 $ 3.20

Less: Fixed Costs

Fixed Manufacturing Over Head $ 85,000.00

Fixed Advertising $ 120,000.00

Fixed Administrative $ 48,000.00

Net Income Profit $ 30,200.00

4: To determine total increase in Advertising Cost to earn 4.5% of sales from 60,000 units

Total Per Unit (USD)

Sales $ 600,000.00 $ 10.00

Less: Variable Costs

Direct Materials $ 120,000.00 $ 2.00

Direct Labor $ 104,400.00 $ 1.74

Variable Manufacturing Over Head $ 18,000.00 $ 0.30

Variable Shipping $ 7,200.00 $ 0.12

Variable Sales Commision $ 36,000.00 $ 0.60

Variable Administration $ 2,400.00 $ 0.04

Contribution Margin $ 312,000.00 $ 5.20

Less: Fixed Costs

Fixed Manufacturing Over Head $ 85,000.00

Fixed Advertising $ 152,000.00

Fixed Administrative $ 48,000.00

Net Income Profit $ 27,000.00

No 3 Fixed Advertising $ 120,000.00

Less No 4 Fixed Advertising $ 152,000.00

Total Advertising Allowable Increase $ 32,000.00

5. To determine special Order of 9,500 units from an overseas distributor unit price:

Total Per Unit (USD)

Sales $ 88,445.00 $ 9.31

Less: Variable Costs

Direct Materials $ 19,000.00 $ 2.00

Direct Labor $ 16,530.00 $ 1.74

Variable Manufacturing Over Head $ 2,850.00 $ 0.30

Variable Shipping $ 1,710.00 $ 0.18

Variable Sales Commision $ - $ -

Variable Administration $ 285.00 $ 0.03 $ 40,375.00

Contribution Margin $ 48,070.00

Less: Fixed Costs

Fixed Insurance $ 5,700.00 $ -

Fixed Manufacturing Over Head $ 17,955.00 $ 1.89

Fixed Advertising $ - $ -

Fixed Administrative $ 10,165.00 $ 1.07 $ 33,820.00

Net Income Profit $ 14,250.00

You might also like

- Articles of Incorporation of One Person CorporationDocument3 pagesArticles of Incorporation of One Person CorporationJM EnguitoNo ratings yet

- Calculate Break-Even Point Using Accounting Profit FormulaDocument5 pagesCalculate Break-Even Point Using Accounting Profit FormulagiangphtNo ratings yet

- Compare Two Proposed Printing Presses InvestmentDocument5 pagesCompare Two Proposed Printing Presses InvestmentNadya Azzura100% (1)

- Sensitivity Analysis Excel TemplateDocument5 pagesSensitivity Analysis Excel TemplateCele MthokoNo ratings yet

- Start-up costs and break-even analysisDocument7 pagesStart-up costs and break-even analysisANo ratings yet

- Profit and Loss Summary: Budget Summary ReportDocument6 pagesProfit and Loss Summary: Budget Summary ReportIslam Ayman AbdelwahabNo ratings yet

- Accounting For Competitive Marketing A Case Study in Marketing Accounting Roxor Watch Company Pty LTDDocument7 pagesAccounting For Competitive Marketing A Case Study in Marketing Accounting Roxor Watch Company Pty LTDKrystel Joie Caraig ChangNo ratings yet

- Budget Summary Report1Document4 pagesBudget Summary Report1MarvvvNo ratings yet

- Financial Ratio Analysis TemplateDocument6 pagesFinancial Ratio Analysis Template✬ SHANZA MALIK ✬No ratings yet

- PR AKLII Bab 14 Dan 15 Sarah Puspita Anggraini (411796)Document15 pagesPR AKLII Bab 14 Dan 15 Sarah Puspita Anggraini (411796)Satrio Saja67% (3)

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Chapter 8: Leverage and EBIT–EPS AnalysisDocument51 pagesChapter 8: Leverage and EBIT–EPS AnalysisNikita AggarwalNo ratings yet

- Hec Wood Ratio Analysis Input Worksheet 2/13/2012Document6 pagesHec Wood Ratio Analysis Input Worksheet 2/13/2012Michael HakimNo ratings yet

- Group 2 - Answers To QuestionsDocument2 pagesGroup 2 - Answers To QuestionsJr Roque100% (4)

- EUR To USD - Convert EUR To USD - Exchange Euro To US Dollar - Currency ConverterDocument2 pagesEUR To USD - Convert EUR To USD - Exchange Euro To US Dollar - Currency ConverterBehroz KarimporNo ratings yet

- Dispensers of California, Inc.Document7 pagesDispensers of California, Inc.Prashuk SethiNo ratings yet

- Understanding Asian Kill Zone, London Manipulation, Optimum TradingDocument35 pagesUnderstanding Asian Kill Zone, London Manipulation, Optimum TradingKevin Mwaura100% (1)

- Exhibit 2 Product Class Cost Analysis (Normal Year) : Units UnitsDocument6 pagesExhibit 2 Product Class Cost Analysis (Normal Year) : Units UnitsSangtani PareshNo ratings yet

- Example Sensitivity AnalysisDocument4 pagesExample Sensitivity Analysismc lim100% (1)

- JD Sdn. BHD Study CaseDocument5 pagesJD Sdn. BHD Study CaseSuperFlyFlyers100% (2)

- Tugas SPM 6-1Document13 pagesTugas SPM 6-1Reza Afrisal33% (3)

- Class Case 4 - Whitney CompanyDocument3 pagesClass Case 4 - Whitney Company9ry5gsghybNo ratings yet

- Sales Price: Mark-Up On Total Variable Cost Per BatchDocument8 pagesSales Price: Mark-Up On Total Variable Cost Per BatchNikita SharmaNo ratings yet

- Chapter 2 MathDocument3 pagesChapter 2 Mathwowipev155No ratings yet

- Manufacturing Cost Savings vs Purchase Cost AnalysisDocument5 pagesManufacturing Cost Savings vs Purchase Cost AnalysisPunkruk McentNo ratings yet

- Setup and Financial Information for Current, Hi-Tech and Broker ScenariosDocument6 pagesSetup and Financial Information for Current, Hi-Tech and Broker ScenariosGabiNo ratings yet

- Initial Investment:: Solution A: 1) Particulars Press ADocument12 pagesInitial Investment:: Solution A: 1) Particulars Press AFernando Barreto GuzmanNo ratings yet

- Supds and Suds Income Statement AnalysisDocument8 pagesSupds and Suds Income Statement Analysisalvin kesumaNo ratings yet

- Tugas Chapter 8Document8 pagesTugas Chapter 8wiwit_karyantiNo ratings yet

- Problem CH 7 Hansen Mowen Cornerstone of Managerial AccountingDocument8 pagesProblem CH 7 Hansen Mowen Cornerstone of Managerial Accountingwiwit_karyantiNo ratings yet

- Kasus 6-1 - Jihan NabilahDocument21 pagesKasus 6-1 - Jihan Nabilahalesha nindyaNo ratings yet

- Q22 SolutionDocument2 pagesQ22 Solutionneeldholakia27No ratings yet

- New Fragrance Cash Flow AnalysisDocument4 pagesNew Fragrance Cash Flow AnalysisRyan CartaNo ratings yet

- 3 Bill FrenchDocument5 pages3 Bill FrenchShivam MishraNo ratings yet

- UTECH CVP Income Statement 2010Document8 pagesUTECH CVP Income Statement 2010dcarruciniNo ratings yet

- Tagpuno, Riki Jonas - Capital BudgetingDocument9 pagesTagpuno, Riki Jonas - Capital BudgetingrikitagpunoNo ratings yet

- Constructing A Downtown Parking Lot in DraperDocument7 pagesConstructing A Downtown Parking Lot in DraperWater MelonNo ratings yet

- Base CaseDocument9 pagesBase Casechanapa klongpobsukNo ratings yet

- AccountsDocument5 pagesAccountsHarshani DanpaulNo ratings yet

- 1.-MBA-Job-Order-Costing SolutionDocument5 pages1.-MBA-Job-Order-Costing Solutionumangsharma0494No ratings yet

- Managerial Accounting - Invidual Task 4Document7 pagesManagerial Accounting - Invidual Task 4Alexander CordovaNo ratings yet

- ACCT-312: Class Exercises (Chapter 2) : AnnualDocument35 pagesACCT-312: Class Exercises (Chapter 2) : AnnualAmir ContrerasNo ratings yet

- David JDocument18 pagesDavid JLucky LuckyNo ratings yet

- KASUS 6-1: Nomor. 1 PerhitunganDocument21 pagesKASUS 6-1: Nomor. 1 PerhitunganMeita PutriNo ratings yet

- Statement of IncomeDocument10 pagesStatement of IncomeScribdTranslationsNo ratings yet

- CH 14 CaseDocument7 pagesCH 14 CaseMcCoy BroughNo ratings yet

- Product Line Total Company WeedbanDocument13 pagesProduct Line Total Company WeedbanPiands FernandsNo ratings yet

- Chapter 13 ExcelDocument42 pagesChapter 13 ExcelMd Al Alif Hossain 2121155630No ratings yet

- KASUS 6-1 Hal 305: Nomor. 1 PerhitunganDocument21 pagesKASUS 6-1 Hal 305: Nomor. 1 PerhitunganjnNo ratings yet

- JEAA Instamart Income StatementDocument1 pageJEAA Instamart Income StatementJEAA InstamartNo ratings yet

- Lesson 2Document55 pagesLesson 2Anh MinhNo ratings yet

- Tugas Sistem Pengendalian Manajemen Transfer Pricing: Disusun Oleh: Reza Afrisal CB / 115020301111038Document13 pagesTugas Sistem Pengendalian Manajemen Transfer Pricing: Disusun Oleh: Reza Afrisal CB / 115020301111038Maulida insNo ratings yet

- Financial Ratio Analysis TemplateDocument6 pagesFinancial Ratio Analysis Templatekristina niaNo ratings yet

- Part 1 (Weight: 50%) : Show Your Calculations and Results Similar To Table 6.1 and 6.2 (Book Example)Document7 pagesPart 1 (Weight: 50%) : Show Your Calculations and Results Similar To Table 6.1 and 6.2 (Book Example)Arpi OrujyanNo ratings yet

- Anjani Risa Pratiwi - 1801035213 - SPM AK-A-dikonversiDocument14 pagesAnjani Risa Pratiwi - 1801035213 - SPM AK-A-dikonversiAnjani RisaNo ratings yet

- Rental Analysis and Projections for The Meridian Apartments in BaltimoreDocument64 pagesRental Analysis and Projections for The Meridian Apartments in BaltimoreWill MillerNo ratings yet

- 6306903Document4 pages6306903maudiNo ratings yet

- Computron Industries Ratio Analysis For ClassDocument8 pagesComputron Industries Ratio Analysis For ClassRishabh JainNo ratings yet

- Particulars Year 0 Year 1 Year 2 Year 3Document3 pagesParticulars Year 0 Year 1 Year 2 Year 3Nicholas AnthonyNo ratings yet

- Chapter12 AnalysisDocument25 pagesChapter12 AnalysisJan ryanNo ratings yet

- CaseStudy2-Dataset2 v2Document49 pagesCaseStudy2-Dataset2 v2Chip choiNo ratings yet

- DIRECTORS1Document28 pagesDIRECTORS1Ekta ChaudharyNo ratings yet

- 07 Segment Reporting 1Document4 pages07 Segment Reporting 1Irtiza AbbasNo ratings yet

- Quiz EiDocument3 pagesQuiz EiJOY LYN REFUGIONo ratings yet

- Hong Seng - AR 2021 (27.1.2022) - Final PDFDocument183 pagesHong Seng - AR 2021 (27.1.2022) - Final PDFseeme55runNo ratings yet

- Assignment 1 (Case Study)Document11 pagesAssignment 1 (Case Study)Mannat ShrivastavaNo ratings yet

- Annual Report 2022: UBS Group AGDocument390 pagesAnnual Report 2022: UBS Group AGMaula Nurul Subekti SubektiNo ratings yet

- BrochureDocument5 pagesBrochurevincent8295547No ratings yet

- 4.3 Insurance, Collars Other StrategiesDocument13 pages4.3 Insurance, Collars Other StrategiesTimy WongNo ratings yet

- SPREADSHEET APPLICATIONS - PEA 2021-2022 SESSION - Case StudiesDocument8 pagesSPREADSHEET APPLICATIONS - PEA 2021-2022 SESSION - Case StudiesOladapo Oluwakayode AbiodunNo ratings yet

- SOAReportDocument9 pagesSOAReportPrathamNo ratings yet

- Catchment Mapping BillaDocument12 pagesCatchment Mapping Billa28-RPavan raj. BNo ratings yet

- Guide To Securing Funds For SMBs (Small & Medium-Sized Businesses)Document3 pagesGuide To Securing Funds For SMBs (Small & Medium-Sized Businesses)nancy khannaNo ratings yet

- A Project Report On Portfolio Management by Deepak ChoubeyDocument48 pagesA Project Report On Portfolio Management by Deepak Choubeyjatin shettyNo ratings yet

- Entrepreneurship TQ SFNHSDocument9 pagesEntrepreneurship TQ SFNHSRUTH MIASCO100% (1)

- AMM - Midwest Aluminum PremiumDocument13 pagesAMM - Midwest Aluminum Premiumnerolf73No ratings yet

- Milestone 2 - Prompt 2Document12 pagesMilestone 2 - Prompt 2Peter PapelNo ratings yet

- Skyblue Aircraft BrokerageDocument2 pagesSkyblue Aircraft BrokerageAlexScribdNo ratings yet

- Indian Banking Industry by Ravi Ranjan SirDocument20 pagesIndian Banking Industry by Ravi Ranjan SirRavi RanjanNo ratings yet

- ESBM Notes Unit-4Document37 pagesESBM Notes Unit-4satyamtiwari44003No ratings yet

- Brookfield Asset Management Investor Day 2022 TranscriptDocument58 pagesBrookfield Asset Management Investor Day 2022 Transcriptchi.leNo ratings yet

- Profit Loss Discount Trainer-1Document2 pagesProfit Loss Discount Trainer-1Deepak SNo ratings yet

- 58 TQMDocument8 pages58 TQMWorld Of CreativityNo ratings yet

- Business Strategies & Value CreationDocument3 pagesBusiness Strategies & Value CreationDayan DudosNo ratings yet

- Broker ReviewDocument26 pagesBroker ReviewgghghgfhfghNo ratings yet

- Introducing Quant Quantamental FundDocument24 pagesIntroducing Quant Quantamental FundsamraatjadhavNo ratings yet

- Strategic Management A1Document5 pagesStrategic Management A1203370245No ratings yet