Professional Documents

Culture Documents

V.S. Industry 20230620 HLIB

Uploaded by

kim heeOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

V.S. Industry 20230620 HLIB

Uploaded by

kim heeCopyright:

Available Formats

20 June 2023

Briefing Takeaways

HLIB Research

PP 9484/12/2012 (031413) V.S. Industry

Syifaa’ Mahsuri Ismail

syifaa@hlib.hongleong.com.my Expecting uptick from festive orders

(603) 2083 1710

Overall order outlook is still in cautious territory. However, management

HOLD (Maintain)

fore sees demand uptick from the preparation for shipments in the upcoming

holiday and festive season s by end of CY23. This will also be boosted by the

Target Price: RM0.84 new product launche s by brand owners after the wait and see approach. On a

Previously: RM0.88 brighter note, VSI is in advance stage with one of its prospective new

customers with contribution to kick in as early as 2QFY24. De spite the

Current Price: RM0.835

expectations from the upti ck in sales, we reckon that margin would still be

Capital upside 0.6% challenged especially from the increase in electricity cost coupled with the

Dividend yield 2.7% underutilisation of Customer Y in i-Park facility. We cut our FY23/24/ 25

Expected total return 3.3% forecasts by -18%/ -13%/ -6%, re spectively to bake in softer margin. After

earnings adjustment and rolling forward our valuation year to CY23 (from FY23)

Sector coverage: EMS our TP decreases slightly to RM0.84 (previously RM0.88). Reiterate HOLD.

Company description: VSI is one of the top 5

EMS players in Asean, providing vertically Recap. VSI results saw 3QFY23 core PATAMI of RM27.8m (-44% QoQ; -36% YoY),

integrated manufacturing solutions to MNC across which brought 9MFY23’s sum to RM142.1m (+20% YoY ). This missed our and

the globe. consensus full year forecasts. Despite better sales YoY, bottom-line slipped while

margin showed sign of easing mainly due to higher opex.

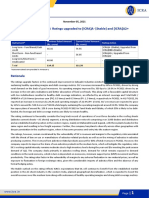

Share price

RM Pts Customer X. The order outlook is still crawling with the deceleration in demand for

VSI (LHS) KLCI (RHS)

1.60 one of its home products. However, this is supported partially by the strong order from

1700

1.40 the beauty care segment. In order to clinch better margins, VSI is working to improve

1.20 1600 Customer X’s value chain by creating a better vertical integration from the production

1.00 1500 of hair care components in house which simultaneously contributes to better plant

0.80 utilisation.

1400

0.60

1300

0.40 The bottom i s likely over. For the time being order forecast is still charting soft er

0.20 1200

numbers, despit e that it is expected to pick up from here especially for the preparation

0.00 1100

Jun-22 Aug-22 Nov-22 Jan-23 Mar-23 Jun-23

for the upcoming holiday and festive seasons by end of CY23. Despit e the softness

Historical return (%) 1M 3M 12M from US, coffee brewer and pool cleaning customers due to the recessionary fears,

Absolute 6.4 1.2 -17.3 the group expects to benefit from the new product launches ahead of the festive

Relative 10.4 4.1 -11.7 season which would be able to lift up the momentum of sales orders. Recall that most

brand owners delayed their product releas es this year due to the inflationary pressure

Stock information and softer consumer sentiment. As for Customer Y, management shared that there

Bloomberg ticker VSI MK are signs of gradual increase in orders albeit at a slower pace. Despite t he

Bursa code 6963 expectations from the uptick in sales, we reckon that margin would still be challenged

Issued shares (m) 3,858

Market capitalisation (RM m) 3,221 especially from t he inc reas ed in electricity cost coupled with t he underutilisation of

3-mth average volume (‘000) 3,990 Customer Y in i-Park facility.

SC Shariah compliant Yes

F4GBM Index member Yes New customer. VSI is currently in advance stage of discussion with one of its new

ESG rating customers and ex pects to start production for the supply parts and components in t he

consumer electronic product. According to the projected timeline, orders should come

Major shareholders in soon with contribution to kick in as early as 2QFY 24. This new customer will occupy

KWAP 9.0% the existing facility and capex is expected to be minimal for the set-up of machinery.

Beh Kim Ling 7.7% Despite the initial small order sales forecast, we understand that the margin

Beh Hwee Sze 7.3%

contribution should be on the higher range when compared to its existing customers.

Earnings summary

FYE (Jul) FY22 FY23f FY24f Forecast. We slashed our FY23/24/25 forecasts by -18%/-13%/-6%, respectively to

PATMI – core (RM m) 202.3 174.5 239.0 bake in softer margin.

EPS – core (sen) 5.2 4.5 6.2

P/E (x) 15.9 18.5 13.5 Maintain HOLD. After earnings adjustment and rolling forward our valuation year to

CY23 (from FY23) our TP decreases slightly to RM0.84 (previously RM0.88) based on

unchanged 16x PE multiple. We reiterate our HOLD call in view of the volatile market

climate and cautious demand. We remain wary as demand from major brand owners

could still be subdued given the recessionary fears and subdued consumer sentiment.

1 HLIB Research l www.hlebroking.com

V.S. Industry l Briefing Takeaways

Financial Forecast

All items in (RM m) unless otherwise stated

Income statement Quarterly financial summary

FYE Jul FY21 FY22 FY23f FY24f FY25f FYE Jul 3QFY22 4QFY22 1QFY23 2QFY23 3QFY23

Revenue 4,002.3 3,914.1 4,310.5 4,757.8 5,326.0 Revenue 927.6 1,004.4 1,294.3 1,147.0 996.8

COGS (3,475.0) (3,509.3) (3,970.0) (4,346.3) (4,825.3) COGS (831.0) (936.3) (1,175) (1,067) (927.5)

EBITDA 527.2 404.8 340.5 411.5 500.6 EBITDA 96.6 68.0 119.3 79.1 69.326

D&A (cum) (101.5) (121.4) (101.8) (101.7) (101.5) D&A (30.8) (31.2) (31.8) (30.9) (30.6)

EBIT 425.8 303.3 238.7 309.9 399.1 EBIT 65.7 36.9 87.5 48.2 38.7

Net Interest Income ( (7.3) (9.7) (15.8) (5.1) (5.0) Net Interest Income (2.4) (3.5) (6.7) (9.5) (7.9)

Associates (0.7) (0.7) (0.7) (0.7) (0.7) Associates (0.4) 0.8 0.0 0.1 0.7

PBT 329.1 200.7 222.3 304.1 393.4 PBT 62.9 34.2 80.9 38.8 31.5

Tax (87.5) (53.7) (55.6) (73.0) (94.4) Tax (14.8) (12.4) (21.6) (11.1) (8.7)

Net Profit 241.6 147.0 166.7 231.2 299.0 Net Profit 48.1 21.7 59.3 27.7 22.8

MI 3.7 19.8 7.8 7.8 7.8 MI 3.2 12.8 1.4 2.6 4.0

PATAMI 245.4 166.8 174.5 239.0 306.8 PATAMI 51.3 34.6 60.7 30.4 26.8

Exceptionals (cum 24.3 35.5 - - - Exceptionals (8.2) 47.3 3.6 19.6 1.027

Core PATAMI 269.69 202.3 174.5 239.0 306.8 Core PATAMI 43.1 81.9 64.3 50.0 27.8

HLIB/Consensus 91% 96% 107%

Balance sheet Valuation Ratios

FYE Jul FY21 FY22 FY23f FY24f FY25f FYE Jul FY21 FY22 FY23f FY24f FY25f

Cash 402.4 278.6 431.3 432.1 436.2 Core EPS (sen) 7.0 5.2 4.5 6.2 8.0

Receivables 992.1 1,092.3 1,074.7 1,186.2 1,327.8 P/E (x) 11.9 15.9 18.5 13.5 10.5

Inventories 636.5 925.0 978.9 1,071.7 1,189.8 EV/EBITDA (x) 6.1 8.8 10.0 8.2 6.8

PPE 989.5 1,214.5 1,042.4 1,040.8 1,039.2 DPS (sen) 4.2 4.2 2.3 3.1 4.0

Other 577.8 469.8 640.0 640.0 640.0 Dividend yield (% ) 5.0 5.0 2.7 3.7 4.8

Assets 3,598.4 3,980.2 4,167.4 4,370.8 4,633.2 BVPS (RM) 0.5 0.6 0.6 0.6 0.7

Payables 847.0 860.3 968.0 1,059.8 1,176.6 P/B (x) 1.6 1.5 1.4 1.3 1.3

Total debt 404.6 600.1 600.1 600.1 600.1 EBITDA margin 13.2 10.3 7.9 8.6 9.4

Other 129.3 158.9 158.9 158.9 158.9 EBIT margin 10.6 7.7 5.5 6.5 7.5

Liabilities 1,380.9 1,619.2 1,727.0 1,818.7 1,935.5 PBT margin 8.2 5.1 5.2 6.4 7.4

Shareholders' Funds 2,040.5 2,190.3 2,277.6 2,397.1 2,550.5 Net margin 6.7 5.2 4.0 5.0 5.8

MI (BS) 177.0 170.7 162.8 155.0 147.1 ROE (% ) 13.2 9.2 7.7 10.0 12.0

Equity 2,217.5 2,361.0 2,440.4 2,552.1 2,697.6 ROA (% ) 7.5 5.1 4.2 5.5 6.6

Net gearing 0.0 0.1 0.1 0.1 0.1

Cash Flow Analysis

FYE Jul FY21 FY22 FY23f FY24f FY25f

PBT 329.1 329.1 222.3 304.1 393.4

D&A 101.5 101.5 101.8 101.7 101.5

Working capital (272.9) (272.9) 71.4 (112.5) (143.0)

Taxation (100.7) (100.7) (55.6) (73.0) (94.4)

Others 66.9 66.9 - - -

CFO 123.9 123.9 340.0 220.3 257.6

Capex (230.5) (230.5) (100.0) (100.0) (100.0)

Others 13.6 13.6 - - -

CFI (217.0) (217.0) (100.0) (100.0) (100.0)

Dividends (105.7) (105.7) (87.3) (119.5) (153.4)

Others 189.9 189.9 - - -

CFF 84.1 84.1 (87.3) (119.5) (153.4)

Net CF 2.6 2.6 152.7 0.8 4.1

Beginning cash 361.2 361.2 278.6 431.3 432.1

Ending cash 402.4 402.4 431.3 432.1 436.2

2 HLIB Research l www.hlebroking.com

Hong Leong Investment Bank Berhad (10209-W) l Briefing Takeaways

Disclaimer

The information contained in this report is based on data obtained from sources believed to be reliable. However, the data and/ or sources have not been independently

verified and as such, no representation, express or implied, are made as to the accuracy, adequacy, completeness or reliability of the info or opinions in the report.

Accordingly, neither Hong Leong Investment Bank Berhad nor any of its related companies and associates nor person connected to it accept any liability whatsoever for any

direct, indirect or consequential losses (including loss of profits) or damages that may arise from the use or reliance on the info or opinions in this publication.

Any information, opinions or recommendations contained herein are subject to change at any time without prior notice. Hong Leong Investment Bank Berhad has no

obligation to update its opinion or the information in this report.

Investors are advised to make their own independent evaluation of the info contained in this report and seek independent fina ncial, legal or other advice regarding the

appropriateness of investing in any securities or the investment strategies discussed or recommended in this report. Nothing in this report constitutes investment, legal,

accounting or tax advice or a representation that any investment or strategy is suitable or appropriate to your individual circumstances or otherwise represents a personal

recommendation to you.

Under no circumstances should this report be considered as an offer to sell or a solicitation of any offer to buy any securities referred to herein.

Hong Leong Investment Bank Berhad and its related companies, their associates, directors, connected parties and/or employees may, from time to time, own, have positions

or be materially interested in any securities mentioned herein or any securities related thereto, and may further act as market maker or have assumed underwriting

commitment or deal with such securities and provide advisory, investment or other services for or do business with any companies or entities mentioned in this report. In

reviewing the report, investors should be aware that any or all of the foregoing among other things, may give rise to real or potential conflict of interests.

This research report is being supplied to you on a strictly confidential basis solely for your information and is made strictly on the basis that it will remain confidential. All

materials presented in this report, unless specifically indicated otherwise, are under copyright to Hong Leong I nvestment Bank Berhad. This research report and its contents

may not be reproduced, stored in a retrieval system, redistributed, transmitted or passed on, directly or indirectly, to any person or published in whole or in part, or altered in

any way, for any purpose.

This report may provide the addresses of, or contain hyperlinks to websites. Hong Leong Investment Bank Berhad takes no responsibility for the content contained therein.

Such addresses or hyperlinks (including addresses or hyperlinks to Hong Leong Investment Bank Berhad own website material) are provided solely for your convenience.

The information and the content of the linked site do not in any way form part of this report. Accessing such website or following such link through the report or Hong Leong

Investment Bank Berhad website shall be at your own risk.

1. As of 20 June 2023, Hong Leong Investment Bank Berhad has proprietary interest in the following securities covered in this report:

(a) -.

2. As of 20 June 2023, the analyst(s) whose name(s) appears on the front page, who prepared this report, has interest in the following securities covered in this report:

(a) -.

Published & printed by:

Hong Leong Investment Bank Berhad (10209-W)

Level 28, Menara Hong Leong,

No. 6, Jalan Damanlela,

Bukit Damansara,

50490 Kuala Lumpur

Tel: (603) 2083 1800

Fax: (603) 2083 1766

Stock rating guidelines

BUY Expected absolute return of +10% or more over the next 12 months.

HOLD Expected absolute return of -10% to +10% over the next 12 months.

SELL Expected absolute return of -10% or less over the next 12 months.

UNDER REVIEW Rating on the stock is temporarily under review which may or may not result to a change from the previous rating.

NOT RATED Stock is not or no longer within regular coverage.

Sector rating guidelines

OVERWEIGHT Sector expected to outperform the market over the next 12 months.

NEUTRAL Sector expected to perform in-line with the market over the next 12 months.

UNDERWEIGHT Sector expected to underperform the market over the next 12 months.

The stock rating guidelines as stipulated above serves as a guiding principle to stock ratings. However, apart from the abovementioned quantitative definitions, other

qualitative measures and situational aspects will also be considered when arriving at the final stock rating. Stock rating may also be affected by the market capitalisation of

the individual stock under review.

3 HLIB Research l www.hlebroking.com

You might also like

- Credit Union Revenues World Summary: Market Values & Financials by CountryFrom EverandCredit Union Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- BLSTR Q4FY20 ResultsDocument6 pagesBLSTR Q4FY20 ResultsAnkush AgrawalNo ratings yet

- Scientific and Medical Equipment House - Al Rajhi CapitalDocument18 pagesScientific and Medical Equipment House - Al Rajhi Capitalikhan809No ratings yet

- TP: IDR6,700: Astra International PX: IDR6,325Document20 pagesTP: IDR6,700: Astra International PX: IDR6,325michael gorbyNo ratings yet

- CapitalGoods SectorUpdate2Mar23 ResearchDocument6 pagesCapitalGoods SectorUpdate2Mar23 Researchavinashpathak777No ratings yet

- Aarti Industries Limited: Positional CallDocument10 pagesAarti Industries Limited: Positional CallNANDIKANTI SRINIVASNo ratings yet

- Avenue Supermarts Ltd. - GeojitDocument4 pagesAvenue Supermarts Ltd. - GeojitdarshanmadeNo ratings yet

- Voltas PL PDFDocument5 pagesVoltas PL PDFADNo ratings yet

- Voltas: Building On StrengthsDocument5 pagesVoltas: Building On StrengthsADNo ratings yet

- Hti Nvidia 0401Document10 pagesHti Nvidia 0401gradeeagleNo ratings yet

- Consumer Sector - Best in ClassDocument30 pagesConsumer Sector - Best in ClassEry IrmansyahNo ratings yet

- Axis Bank - 03 - 03 - 2023 - Khan030323Document7 pagesAxis Bank - 03 - 03 - 2023 - Khan030323Ranjan SharmaNo ratings yet

- Ata Ims (Aib MK) : Regional Morning NotesDocument5 pagesAta Ims (Aib MK) : Regional Morning NotesFong Kah YanNo ratings yet

- INDIAN HOTELS - Initiating CoverageDocument30 pagesINDIAN HOTELS - Initiating CoverageTejesh GoudNo ratings yet

- Ashok Leyland: Tough Times Ahead Downgrade To ReduceDocument5 pagesAshok Leyland: Tough Times Ahead Downgrade To ReduceYogesh KumarNo ratings yet

- Cap Goods Comparison Spark - Dec 19Document29 pagesCap Goods Comparison Spark - Dec 19Sn SubramanyaNo ratings yet

- Big Bags International PVT LTDDocument7 pagesBig Bags International PVT LTDnayabrasul208No ratings yet

- R R Kabel 20 09 2023 PrabhuDocument40 pagesR R Kabel 20 09 2023 PrabhusamraatjadhavNo ratings yet

- 2023 PicksDocument14 pages2023 PicksDurgaprasanna BeheraNo ratings yet

- AU SFB - Centrum - 190324 - EBRDocument11 pagesAU SFB - Centrum - 190324 - EBRDivy JainNo ratings yet

- HSIE Results Daily - 15 Feb 24-202402150648003692167Document8 pagesHSIE Results Daily - 15 Feb 24-202402150648003692167Sanjeedeep Mishra , 315No ratings yet

- RITES LTD - Management Meeting Note June 2023 - 19!06!2023 - 09Document7 pagesRITES LTD - Management Meeting Note June 2023 - 19!06!2023 - 09Sanjeedeep Mishra , 315No ratings yet

- Diwalipicks 2020Document4 pagesDiwalipicks 2020Vimal SharmaNo ratings yet

- Automobiles SectorDocument45 pagesAutomobiles SectorTejesh GoudNo ratings yet

- V-Guard Industries: Operationally Strong QuarterDocument5 pagesV-Guard Industries: Operationally Strong QuarterUmesh ThawareNo ratings yet

- AKR Industries 19mar2020Document8 pagesAKR Industries 19mar2020Karthikeyan RK SwamyNo ratings yet

- Sahyadri Industries LimitedDocument7 pagesSahyadri Industries LimitedficiveNo ratings yet

- Kitex Garments Limited - R - 11112020Document8 pagesKitex Garments Limited - R - 11112020Positive ThinkerNo ratings yet

- Zetwerk Manufacturing Businesses PVT LTDDocument8 pagesZetwerk Manufacturing Businesses PVT LTDrahulappikatlaNo ratings yet

- Supreme Industries LTD: ESG Disclosure ScoreDocument7 pagesSupreme Industries LTD: ESG Disclosure ScoreGrim ReaperNo ratings yet

- KEI Q1 Result UpdateDocument7 pagesKEI Q1 Result UpdateAryan SharmaNo ratings yet

- Aarti Industries Equity Research ReportDocument30 pagesAarti Industries Equity Research ReportSaravana ElectricNo ratings yet

- Roha Dyechem Private Limited: Rating RationaleDocument8 pagesRoha Dyechem Private Limited: Rating RationaleForall PainNo ratings yet

- VMART Retail IC Sep20Document28 pagesVMART Retail IC Sep20Khush GosraniNo ratings yet

- Automobiles: Lockdown, RM Inflation Dent EarningsDocument8 pagesAutomobiles: Lockdown, RM Inflation Dent EarningsPrahladNo ratings yet

- Saudi Consumer 2020Document9 pagesSaudi Consumer 2020ikhan809No ratings yet

- 6971 KOBAY HLG 2021-08-27 BUY 7.00 KobayTechnologyAnEngineeringParadigmfortheTechSector - 436954370Document17 pages6971 KOBAY HLG 2021-08-27 BUY 7.00 KobayTechnologyAnEngineeringParadigmfortheTechSector - 436954370Nicholas ChehNo ratings yet

- Ashok Leyland LTD: ESG Disclosure ScoreDocument8 pagesAshok Leyland LTD: ESG Disclosure ScoreRomelu MartialNo ratings yet

- ISGEC 3R Nov17 - 2021Document7 pagesISGEC 3R Nov17 - 2021Aayushman GuptaNo ratings yet

- Greenpanel Industries: IndiaDocument4 pagesGreenpanel Industries: IndiaMichelangelo BortolinNo ratings yet

- 7204 - D&O - PUBLIC BANK - 2023-08-24 - BUY - 4.37 - DOGreenTechnologiesExpectingaVShapeRecovery - 1840691060Document5 pages7204 - D&O - PUBLIC BANK - 2023-08-24 - BUY - 4.37 - DOGreenTechnologiesExpectingaVShapeRecovery - 1840691060Nicholas ChehNo ratings yet

- Havells India: Added Aspirational PortfolioDocument10 pagesHavells India: Added Aspirational PortfolioDinesh ChoudharyNo ratings yet

- 354466122018909bharat Forge LTD Q4FY18 Result Updates - SignedDocument5 pages354466122018909bharat Forge LTD Q4FY18 Result Updates - Signedakshara pradeepNo ratings yet

- Reliance Industries: Re-Rating Triggers Playing OutDocument5 pagesReliance Industries: Re-Rating Triggers Playing OutdarshanmadeNo ratings yet

- Century Textiles & Industries Limited 1433 QuarterUpdateDocument3 pagesCentury Textiles & Industries Limited 1433 QuarterUpdatedivya mNo ratings yet

- FY22 Q4 - Update Note - Citi AcquisitionDocument8 pagesFY22 Q4 - Update Note - Citi Acquisitioncerohad333No ratings yet

- Waaree Energies LimitedDocument6 pagesWaaree Energies LimitedHasik JainNo ratings yet

- Alpha and Omega Semiconductor Ltd. (AOSL)Document7 pagesAlpha and Omega Semiconductor Ltd. (AOSL)Shreelalitha KarthikNo ratings yet

- Maxis BHD Market Perform : 1HFY20 Within ExpectationsDocument4 pagesMaxis BHD Market Perform : 1HFY20 Within ExpectationsSarah AriffNo ratings yet

- Greatec UOBDocument5 pagesGreatec UOBNicholas ChehNo ratings yet

- Greatec PUBLIC RESEARCHDocument4 pagesGreatec PUBLIC RESEARCHNicholas ChehNo ratings yet

- AxisCap - Craftsman Automation - IC - 23 Feb 2022Document61 pagesAxisCap - Craftsman Automation - IC - 23 Feb 2022vandit dharamshi100% (1)

- ISGEC Heavy Engineering - Feb 2020 ICRADocument9 pagesISGEC Heavy Engineering - Feb 2020 ICRAPuneet367No ratings yet

- UOB Company Update AKRA 12 Jul 2023Document5 pagesUOB Company Update AKRA 12 Jul 2023botoy26No ratings yet

- RHB Equity 360° - 20 May 2010 (Notion Vtec, Kencana, Media Prima, Amway Technical: IOI, FBM KLCI)Document4 pagesRHB Equity 360° - 20 May 2010 (Notion Vtec, Kencana, Media Prima, Amway Technical: IOI, FBM KLCI)Rhb InvestNo ratings yet

- Research On CAMS by HDFC Securities - Nov 2020Document22 pagesResearch On CAMS by HDFC Securities - Nov 2020Sanjeet SahooNo ratings yet

- Natgate 230515 Cu (Kenanga)Document4 pagesNatgate 230515 Cu (Kenanga)Muhammad SyafiqNo ratings yet

- RHB Report My HPP Holdings Ipo Note 20201230 55456608300173055feb4c180905fDocument10 pagesRHB Report My HPP Holdings Ipo Note 20201230 55456608300173055feb4c180905fiqadinNo ratings yet

- SJS Enterprises LimitedDocument7 pagesSJS Enterprises LimitedCA Ankur BariaNo ratings yet

- Ashok Leyland Q3FY19 Result UpdateDocument4 pagesAshok Leyland Q3FY19 Result Updatekapil bahetiNo ratings yet

- Top 52 Financial Analyst Interview Questions and AnswersDocument24 pagesTop 52 Financial Analyst Interview Questions and AnswersJerry TurtleNo ratings yet

- Market Equity IntroDocument4 pagesMarket Equity Introemmanuel oduNo ratings yet

- Financial Lending - Bajaj FinDocument53 pagesFinancial Lending - Bajaj Finarvindkumar.yNo ratings yet

- CFA一级百题预测 财务Document90 pagesCFA一级百题预测 财务Evelyn YangNo ratings yet

- The Statement of Financial Position of Ninety LTD For The Last Two Years AreDocument2 pagesThe Statement of Financial Position of Ninety LTD For The Last Two Years Arenjoroge mwangiNo ratings yet

- Iraqi Companies at WOC 2011Document30 pagesIraqi Companies at WOC 2011Hanasa Ahmed Kirkuki100% (1)

- Effect of Age On Financial Decisions: Shruti MaheshwariDocument10 pagesEffect of Age On Financial Decisions: Shruti MaheshwariCristinaCrissNo ratings yet

- Interest Rates Fortitude and ConfigurationDocument11 pagesInterest Rates Fortitude and ConfigurationEugene AlipioNo ratings yet

- Business PlanDocument7 pagesBusiness Planapi-535920590No ratings yet

- Dissertation On Stock Market in IndiaDocument5 pagesDissertation On Stock Market in IndiaBuyPsychologyPapersUK100% (1)

- Ifrs For Smes Basis For Conclusions and Ifs Part BDocument166 pagesIfrs For Smes Basis For Conclusions and Ifs Part BKatrina LeonardoNo ratings yet

- Case Analysis Casa DisenoDocument7 pagesCase Analysis Casa DisenoLexNo ratings yet

- Solved The Financial Statements For Nike Inc Are Presented in AppendixDocument1 pageSolved The Financial Statements For Nike Inc Are Presented in AppendixDoreenNo ratings yet

- 2023 Euromoney Market Leaders Guidelines FinalDocument9 pages2023 Euromoney Market Leaders Guidelines Finalfareha abidNo ratings yet

- Article 5 - Advancing Financial Reporting in The Age of Technology An Interview With Robert H. HerzDocument9 pagesArticle 5 - Advancing Financial Reporting in The Age of Technology An Interview With Robert H. HerzFakhmol RisepdoNo ratings yet

- General Income Statement Format and Types of LeverageDocument8 pagesGeneral Income Statement Format and Types of LeverageNawazish KhanNo ratings yet

- FM09-CH 03 PDFDocument14 pagesFM09-CH 03 PDFGregNo ratings yet

- Long-Term Social Impacts and Financial Costs of Foreclosure On Families and Communities of ColorDocument49 pagesLong-Term Social Impacts and Financial Costs of Foreclosure On Families and Communities of ColorJH_CarrNo ratings yet

- QC LeipoDocument11 pagesQC Leipoanne fornolesNo ratings yet

- RamSync BriefDocument5 pagesRamSync Briefjoshua arnettNo ratings yet

- Fa 2 1Document8 pagesFa 2 1Quỳnh Anh NguyễnNo ratings yet

- Interim Order in The Matter of United Cosmetics Manufacturing (I) Ltd. and Its DirectorsDocument15 pagesInterim Order in The Matter of United Cosmetics Manufacturing (I) Ltd. and Its DirectorsShyam SunderNo ratings yet

- Insider Monkey HF Newsletter - May 2013Document92 pagesInsider Monkey HF Newsletter - May 2013rvignozzi1No ratings yet

- 273901jeff Brown Reviews - Jeff Brown Investor - Jeff Brown - Jeff Brown Best Biotech StockDocument5 pages273901jeff Brown Reviews - Jeff Brown Investor - Jeff Brown - Jeff Brown Best Biotech StockarwynevqhhNo ratings yet

- Managerial Accounting Financial RatioDocument20 pagesManagerial Accounting Financial RatioHij PaceteNo ratings yet

- Insolvency and Restructuring Procedures - Vietnam - YKVN Law PDFDocument13 pagesInsolvency and Restructuring Procedures - Vietnam - YKVN Law PDFThôngHoàngNo ratings yet

- MBF14e Chap04 Governance PbmsDocument16 pagesMBF14e Chap04 Governance PbmsKarl60% (5)

- ANoteonthe Real Currency Exchange RateDocument12 pagesANoteonthe Real Currency Exchange Ratedziri NourNo ratings yet

- SSRN Id3766088Document21 pagesSSRN Id3766088Parthiv MistryNo ratings yet

- Asian Paints BsDocument2 pagesAsian Paints BsPriyalNo ratings yet

- Getting to Yes: How to Negotiate Agreement Without Giving InFrom EverandGetting to Yes: How to Negotiate Agreement Without Giving InRating: 4 out of 5 stars4/5 (652)

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)From EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Rating: 4.5 out of 5 stars4.5/5 (15)

- The Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindFrom EverandThe Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindRating: 5 out of 5 stars5/5 (231)

- How to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)From EverandHow to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Rating: 4.5 out of 5 stars4.5/5 (5)

- SAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsFrom EverandSAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsNo ratings yet

- The ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!From EverandThe ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!Rating: 4.5 out of 5 stars4.5/5 (14)

- A Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineFrom EverandA Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineNo ratings yet

- Overcoming Underearning(TM): A Simple Guide to a Richer LifeFrom EverandOvercoming Underearning(TM): A Simple Guide to a Richer LifeRating: 4 out of 5 stars4/5 (21)

- Purchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsFrom EverandPurchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsRating: 5 out of 5 stars5/5 (1)

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesFrom EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNo ratings yet

- The Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)From EverandThe Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)Rating: 4 out of 5 stars4/5 (33)

- Start, Study and Pass The CPA Exam FAST - Proven 8 Step CPA Exam Study PlaybookFrom EverandStart, Study and Pass The CPA Exam FAST - Proven 8 Step CPA Exam Study PlaybookRating: 5 out of 5 stars5/5 (4)

- Ratio Analysis Fundamentals: How 17 Financial Ratios Can Allow You to Analyse Any Business on the PlanetFrom EverandRatio Analysis Fundamentals: How 17 Financial Ratios Can Allow You to Analyse Any Business on the PlanetRating: 4.5 out of 5 stars4.5/5 (14)

- Financial Accounting For Dummies: 2nd EditionFrom EverandFinancial Accounting For Dummies: 2nd EditionRating: 5 out of 5 stars5/5 (10)

- Warren Buffett and the Interpretation of Financial Statements: The Search for the Company with a Durable Competitive AdvantageFrom EverandWarren Buffett and the Interpretation of Financial Statements: The Search for the Company with a Durable Competitive AdvantageRating: 4.5 out of 5 stars4.5/5 (109)

- Accounting For Small Businesses QuickStart Guide: Understanding Accounting For Your Sole Proprietorship, Startup, & LLCFrom EverandAccounting For Small Businesses QuickStart Guide: Understanding Accounting For Your Sole Proprietorship, Startup, & LLCRating: 5 out of 5 stars5/5 (1)

- Accounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsFrom EverandAccounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsRating: 4 out of 5 stars4/5 (7)

- The Big Four: The Curious Past and Perilous Future of the Global Accounting MonopolyFrom EverandThe Big Four: The Curious Past and Perilous Future of the Global Accounting MonopolyNo ratings yet

- Your Amazing Itty Bitty(R) Personal Bookkeeping BookFrom EverandYour Amazing Itty Bitty(R) Personal Bookkeeping BookNo ratings yet

- Attention Pays: How to Drive Profitability, Productivity, and AccountabilityFrom EverandAttention Pays: How to Drive Profitability, Productivity, and AccountabilityNo ratings yet

- Contract Negotiation Handbook: Getting the Most Out of Commercial DealsFrom EverandContract Negotiation Handbook: Getting the Most Out of Commercial DealsRating: 4.5 out of 5 stars4.5/5 (2)

- The E-Myth Chief Financial Officer: Why Most Small Businesses Run Out of Money and What to Do About ItFrom EverandThe E-Myth Chief Financial Officer: Why Most Small Businesses Run Out of Money and What to Do About ItRating: 4.5 out of 5 stars4.5/5 (14)