Professional Documents

Culture Documents

Fin 101 Apurado

Fin 101 Apurado

Uploaded by

CARMEL APURADOCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Fin 101 Apurado

Fin 101 Apurado

Uploaded by

CARMEL APURADOCopyright:

Available Formats

Carmel E.

Apurado FIN 101

BSA 1_4 3016

Insights about the Seven Principles of Investing by Warren Buffet

The Seven Principles of Investing are:

Managers must have integrity and talent

Invest by facts not emotions

Buy wonderful businesses not ‘cigar butts’

Only buy stocks that you understand

When you see great opportunity, take it!

Don’t sell unless the business fundamentally changes

Buy at a price below intrinsic value

My understanding about the first principle of Warren Buffet is that it emphasizes the importance of

investing in companies led by trustworthy and skilled managers. Integrity ensures ethical decision-

making, while talent enables effective execution of business strategies. The second principle is advises

investors to base their investment decisions on objective information and analysis rather than being

swayed by emotional factors such as fear or greed. Relying on facts and data helps reduce the impact of

biases. Next principle suggests investing in high-quality companies with strong fundamentals and

competitive advantages, rather than settling for distressed or undervalued businesses that may have

limited long-term potential. The fourth principle is about encourages investors to focus on businesses and

industries they have a good understanding of. By investing in companies they comprehend, investors can

make more informed decisions and assess risks effectively. Fifth principle is highlights the importance of

recognizing and acting upon attractive investment opportunities. It encourages investors to seize favorable

moments when they arise, as timing can be crucial in achieving investment success. Then the sixth

principle suggests holding onto investments unless there is a significant change in the underlying

fundamentals of the business. It promotes a long-term perspective and discourages making impulsive

selling decisions based on short-term fluctuations. Lastly, this principle advocates for purchasing stocks at

a price that is lower than their estimated intrinsic value. It involves conducting thorough analysis to

determine the underlying value of a business and seeking opportunities where the market price offers a

margin of safety.

These principles emphasize the importance of ethical leadership, rational decision-making,

investing in quality companies, understanding investments, seizing opportunities, taking a long-term

perspective, and seeking value in the market. Following these principles can help investors make

informed decisions and increase their chances of long-term investment success.

You might also like

- Common Stocks and Uncommon Profits Philip A FisherDocument14 pagesCommon Stocks and Uncommon Profits Philip A FisherAsherjoy Tech100% (1)

- Entrepreneurship Theory Process and Practice 9th Edition Kuratko Solutions Manual Full Chapter PDFDocument34 pagesEntrepreneurship Theory Process and Practice 9th Edition Kuratko Solutions Manual Full Chapter PDFnancyfranklinrmnbpioadt100% (15)

- Auto BuySell+Trend and Targets V4Document10 pagesAuto BuySell+Trend and Targets V4Jeniffer RayenNo ratings yet

- Portfolio Optimization Techniques in Mutual Funds - Trends and IssuesDocument66 pagesPortfolio Optimization Techniques in Mutual Funds - Trends and Issuesjitendra jaushik83% (6)

- Common Stocks and Uncommon Profits NEW PDFDocument7 pagesCommon Stocks and Uncommon Profits NEW PDFUIIC Shahada100% (1)

- Value Investing: The Buffett Techniques Of Accumulating Wealth With Practical Strategies To Always Choose The Intelligent InvestmentFrom EverandValue Investing: The Buffett Techniques Of Accumulating Wealth With Practical Strategies To Always Choose The Intelligent InvestmentRating: 4.5 out of 5 stars4.5/5 (39)

- WEEK 12-13 - Buying An Existing BusinessDocument21 pagesWEEK 12-13 - Buying An Existing BusinessKarl Alvin Reyes HipolitoNo ratings yet

- Dissertation On Debt Securities Market in IndiaDocument103 pagesDissertation On Debt Securities Market in Indiaumesh kumar sahu0% (2)

- 34 Investment Strategies and Rules To Make You A Better Investor - Arbor Asset Allocation Model Portfolio (AAAMP) Value BlogDocument8 pages34 Investment Strategies and Rules To Make You A Better Investor - Arbor Asset Allocation Model Portfolio (AAAMP) Value BlogValamunis DomingoNo ratings yet

- Common Stocks and Uncommon ProfitsDocument7 pagesCommon Stocks and Uncommon ProfitsPrasanna Bhattacharya100% (1)

- EdelweissMF BookSummary TheEducationofaValueInvestor IDocument4 pagesEdelweissMF BookSummary TheEducationofaValueInvestor IVaishnaviRavipatiNo ratings yet

- EdelweissMF CommonStocksDocument3 pagesEdelweissMF CommonStocksAlex DavidNo ratings yet

- What Is Value Investing?Document10 pagesWhat Is Value Investing?Navaraj BaniyaNo ratings yet

- Wealth Creation GuideDocument12 pagesWealth Creation GuideRenju ReghuNo ratings yet

- Value Investing Cheat SheetDocument9 pagesValue Investing Cheat Sheetapi-529717141No ratings yet

- of Behavioral Corporate FinanceDocument19 pagesof Behavioral Corporate Financejanak0609No ratings yet

- Behavioral Corporate FinanceDocument14 pagesBehavioral Corporate Financejanak0609No ratings yet

- Common Stocks and Uncommon Profits: Philip FisherDocument7 pagesCommon Stocks and Uncommon Profits: Philip FisherRaja RamanathanNo ratings yet

- The Keys To Successful InvestingDocument4 pagesThe Keys To Successful InvestingArnaldoBritoAraújoNo ratings yet

- The Value Investor HandbookDocument11 pagesThe Value Investor Handbookfadlan chNo ratings yet

- 4.0 Advice and Suggestion To The InvestorDocument1 page4.0 Advice and Suggestion To The Investorpskhor89No ratings yet

- 7 Mistakes People Make Hiring Financial AdvisorsDocument2 pages7 Mistakes People Make Hiring Financial AdvisorsJimKNo ratings yet

- Selling DecisionDocument13 pagesSelling DecisionNalini baskaranNo ratings yet

- Rules of InvestingDocument3 pagesRules of InvestingkailasNo ratings yet

- The Manual of Ideas by John Mihaljevic - Book SummaryDocument4 pagesThe Manual of Ideas by John Mihaljevic - Book SummaryBanderlei SilvaNo ratings yet

- What You Should Retain From GrahamDocument5 pagesWhat You Should Retain From GrahamjmNo ratings yet

- Paytm Masterclass ITI AMCDocument11 pagesPaytm Masterclass ITI AMCDaniel JamesNo ratings yet

- Why Passive Investing Is An Excellent Default ChoiceDocument6 pagesWhy Passive Investing Is An Excellent Default ChoiceRajeev GargNo ratings yet

- Entrepreneurship Theory Process and Practice 9th Edition Kuratko Solutions ManualDocument13 pagesEntrepreneurship Theory Process and Practice 9th Edition Kuratko Solutions Manualscarletba4cc100% (25)

- The Warren Buffet Portfolio - SUMMARY NOTESDocument33 pagesThe Warren Buffet Portfolio - SUMMARY NOTESMMMMM99999100% (1)

- Personal Entrepreneurial CompetenciesDocument48 pagesPersonal Entrepreneurial CompetenciesJonabelle Leviste IbarbiaNo ratings yet

- EdelweissMF BookSummary TheManualIdeas-29Jan2021Document3 pagesEdelweissMF BookSummary TheManualIdeas-29Jan2021VaishnaviRavipatiNo ratings yet

- 10 Characteristics of Successful EntrepreneursDocument14 pages10 Characteristics of Successful EntrepreneursKusrianto KurniawanNo ratings yet

- Lesson 3 Value Investing For Smart People Safal NiveshakDocument3 pagesLesson 3 Value Investing For Smart People Safal NiveshakKohinoor RoyNo ratings yet

- I. Executive Summary Virtual Stock Trading Allows Investors To Practice Buying and Selling SecuritiesDocument18 pagesI. Executive Summary Virtual Stock Trading Allows Investors To Practice Buying and Selling SecuritiesMarnelli LagumbayNo ratings yet

- Prepared By:: Aloysois Ken O. Asilo Rodjie D. Ortiguerra Junell B.Macapulay Allen BuensucesoDocument15 pagesPrepared By:: Aloysois Ken O. Asilo Rodjie D. Ortiguerra Junell B.Macapulay Allen BuensucesoJayson G. GunioNo ratings yet

- Unit 21: Asset Management: Lead in (P97)Document3 pagesUnit 21: Asset Management: Lead in (P97)Minh Châu Tạ ThịNo ratings yet

- Essays of Warren Buffett - Lessons For Corporate America by Lawrence Cunningham - The Rabbit HoleDocument3 pagesEssays of Warren Buffett - Lessons For Corporate America by Lawrence Cunningham - The Rabbit Holebrijsing0% (1)

- Choosing The Stock Picking Approach Suitable To YouDocument18 pagesChoosing The Stock Picking Approach Suitable To YouSudhanshuNo ratings yet

- Investment Wisdom From The Super AnalystsDocument6 pagesInvestment Wisdom From The Super Analystsautostrada.scmhrdNo ratings yet

- Nucrk Geent01x Module6 2Document22 pagesNucrk Geent01x Module6 2Shiene SalamidaNo ratings yet

- Lecture No-2Document5 pagesLecture No-2Pratiksha UghadeNo ratings yet

- Ten Lessons For Investors: Lesson 1: The More Things Change, The More They Stay The SameDocument5 pagesTen Lessons For Investors: Lesson 1: The More Things Change, The More They Stay The Samejann_nittNo ratings yet

- Ten Lessons For Investors: Lesson 1: The More Things Change, The More They Stay The SameDocument5 pagesTen Lessons For Investors: Lesson 1: The More Things Change, The More They Stay The Samejann_nittNo ratings yet

- Top Tips For Choosing InvestmentsDocument6 pagesTop Tips For Choosing InvestmentsBey Bi NingNo ratings yet

- Module IIIDocument30 pagesModule IIIabhishek guptaNo ratings yet

- Fundamental Analysis: Capital MarketsDocument19 pagesFundamental Analysis: Capital MarketsIT GAMINGNo ratings yet

- 10 Estrategia para InvertirDocument13 pages10 Estrategia para InvertirMauricio Herrera DiazNo ratings yet

- ENTREP 9 Mod.1 WK 2Document25 pagesENTREP 9 Mod.1 WK 2Tyra Joy V. BartolomeNo ratings yet

- FAQ - CR Value FundDocument4 pagesFAQ - CR Value FundArun KumarNo ratings yet

- Start UpDocument4 pagesStart UpTanishq GurnaniNo ratings yet

- Chapter 1: Introduction To Entrepreneurship What Is An Entrepreneur?Document4 pagesChapter 1: Introduction To Entrepreneurship What Is An Entrepreneur?Alyssa GailleNo ratings yet

- Entrepreneurship StrategiesDocument14 pagesEntrepreneurship StrategiesshwetaozaNo ratings yet

- Chapter 5: Financial Plan and Resource GenerationDocument19 pagesChapter 5: Financial Plan and Resource GenerationKap DemonNo ratings yet

- Tips of InvestmentDocument6 pagesTips of InvestmentR.v. NaveenanNo ratings yet

- Universidad Iberoamericana Unibe: Define The Following TermsDocument3 pagesUniversidad Iberoamericana Unibe: Define The Following TermsjoseluisNo ratings yet

- Common Stocks and Uncommon Profits and Other WritingsDocument13 pagesCommon Stocks and Uncommon Profits and Other WritingsAnirbanDeshmukhNo ratings yet

- Summary of The Warren Buffett WayDocument7 pagesSummary of The Warren Buffett WayV.ChandrasekranNo ratings yet

- Better Value Investing: A simple guide to improving your results as a value investorFrom EverandBetter Value Investing: A simple guide to improving your results as a value investorRating: 4.5 out of 5 stars4.5/5 (2)

- Summary of The Intelligent Investor: by Benjamin Graham and Jason Zweig | Includes AnalysisFrom EverandSummary of The Intelligent Investor: by Benjamin Graham and Jason Zweig | Includes AnalysisRating: 5 out of 5 stars5/5 (1)

- Crompton GreavesDocument12 pagesCrompton GreavesAngel BrokingNo ratings yet

- Lululemon CaseDocument17 pagesLululemon CasetotnoemiNo ratings yet

- SD 05684602Document13 pagesSD 05684602Miguel gagoNo ratings yet

- RA CertificationDocument10 pagesRA CertificationBidhinNo ratings yet

- Chapter 4 BKM Investments 9e SolutionsDocument6 pagesChapter 4 BKM Investments 9e Solutionsnpiper2950% (2)

- Interest Payments and Project Evaluation: CEGE0016 - Financial Aspects of Project EngineeringDocument47 pagesInterest Payments and Project Evaluation: CEGE0016 - Financial Aspects of Project EngineeringRiccardo PappalardoNo ratings yet

- Contemporary Financial Management Moyer 12th Edition Solutions ManualDocument16 pagesContemporary Financial Management Moyer 12th Edition Solutions ManualSteveJacobsafjg100% (38)

- Ichimoku Components and Trading StrategiesDocument28 pagesIchimoku Components and Trading StrategiesGeorge JR Bagsao100% (1)

- Small Saving SchemeDocument30 pagesSmall Saving SchemePallaviNo ratings yet

- What To Evaluate in A Mutual Fund Factsheet - Investor EducationDocument3 pagesWhat To Evaluate in A Mutual Fund Factsheet - Investor EducationAnkit SharmaNo ratings yet

- Alphaex Capital Candlestick Pattern Cheat Sheet InfographDocument1 pageAlphaex Capital Candlestick Pattern Cheat Sheet InfographEchaNo ratings yet

- 4D. Arithmetic Number Misc & Complex WorkbookDocument21 pages4D. Arithmetic Number Misc & Complex WorkbookAnvesha SarafNo ratings yet

- FRM一级百题 风险管理基础Document67 pagesFRM一级百题 风险管理基础bertie RNo ratings yet

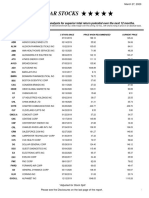

- Five Star StocksDocument5 pagesFive Star StocksJeff SturgeonNo ratings yet

- Purging of Impure IncomeDocument3 pagesPurging of Impure IncomeshariqnisarNo ratings yet

- Equity Markets in India1Document86 pagesEquity Markets in India1anand_jobsNo ratings yet

- 'DFI, MUTUAL FUNDS, RRB' With YouDocument5 pages'DFI, MUTUAL FUNDS, RRB' With YouSuccess ForumNo ratings yet

- Risk & Profile QuestionnaireDocument7 pagesRisk & Profile QuestionnairePrerana JajuNo ratings yet

- IAS16 - PPE - ExercisesDocument5 pagesIAS16 - PPE - Exercises21125244No ratings yet

- Unlocking Success in ICT 2022 Mentorship - LumitraderDocument435 pagesUnlocking Success in ICT 2022 Mentorship - LumitraderLouis AndéNo ratings yet

- (Aman Pathak) RESEARCH METHODOLOGYDocument4 pages(Aman Pathak) RESEARCH METHODOLOGYAman PathakNo ratings yet

- Case Study PresentationDocument13 pagesCase Study PresentationOmkar PawarNo ratings yet

- Byron Wein - Blackstone - Time For A PauseDocument4 pagesByron Wein - Blackstone - Time For A PausewaterhousebNo ratings yet

- Shipinvest4004 Introduction - Executive VersionDocument30 pagesShipinvest4004 Introduction - Executive VersionDPR007No ratings yet

- CFS Subsequent To Date of AcquisitionDocument2 pagesCFS Subsequent To Date of AcquisitionGorden Kafare Bino0% (1)

- AcctgDocument11 pagesAcctgsarahbee100% (2)

- Chapter 9 - Answers To All ProblemsDocument19 pagesChapter 9 - Answers To All ProblemsRamyAlyonesNo ratings yet