Professional Documents

Culture Documents

Tax Aggressiveness

Uploaded by

AREWAGIST TVCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tax Aggressiveness

Uploaded by

AREWAGIST TVCopyright:

Available Formats

IIARD International Journal of Economics and Business Management E-ISSN 2489-0065 P-ISSN 2695-186X

Vol 8. No. 2 2022 www.iiardjournals.org

Tax Aggressiveness and Sustainability of Listed Oil and Gas

Firms in Nigeria: Does Firm Size Matter?

Omaliko Emeka (Ph.D), FSASS

Department of Accountancy

Nnamdi Azikiwe University,

P.M.B 5025 Awka, Anambra State, Nigeria

Okpala Ngozi (Ph.D)

Department of Accountancy

Nnamdi Azikiwe University,

P.M.B 5025 Awka, Anambra State, Nigeria

DOI: 10.56201/ijebm.v8.no2.2022.pg48.60

Abstract

This study empirically investigated the relationship which exists between tax aggressiveness

moderated by firm size and sustainability of oil and gas firms in Nigeria. In order to determine

the relationship between tax aggressiveness and corporate sustainability, tax aggressiveness was

measured using effective tax rate while corporate sustainability on the other hand was proxy

using social-environmental performance. The formulated hypotheses to guide the investigation

and the statistical test of parameter estimates was conducted using OLS regression model

operated with STATA V.15. Ex Post Facto design was adopted and data for the study were

obtained from the published annual reports and accounts of listed oil & gas firms on Nigerian

Exchange Group (NGX) spanning from 2013-2021. The findings of the study generally indicate

that tax aggressiveness has significant and positive relationship with sustainability of quoted

firms in Nigeria at 1% significant level. In the same vein, it was noted that firm size moderates

the relationship between tax aggressiveness and corporate sustainability at 5% level of

significance. Thus, the study concludes that tax aggressiveness ensures sustainability of firms in

Nigeria. The study however suggests the need for corporate organizations to engage the services

of tax consultants to assist them to organize the firm’s financial dealings in such a way that the

firm suffers a minimum tax liability.

Keywords: Tax Aggressiveness, Sustainability, Firm Size

IIARD – International Institute of Academic Research and Development Page 48

IIARD International Journal of Economics and Business Management E-ISSN 2489-0065 P-ISSN 2695-186X

Vol 8. No. 2 2022 www.iiardjournals.org

1.0 Introduction

Sustainability is seen as a strategy used by business organizations to maximize profits, diversify,

product differentiation, as well as to globally evaluate the performance of companies in relation

to their environment. However, the development of strategic thinking underscores the need to

include activities aimed at integrating social and environmental concerns into the business

decision-making process. Thus, companies that adequately integrate their environment and

people are considered socially responsible (Nnamani, Onyekwelu & Ugwu, 2017).

Business development has social and environmental impacts leading to social problems, global

warming, actual disasters and environmental pollution. As a result, many corporate organizations

assume just as much responsibility for social and environmental concerns as for economic

concerns. One reason is that corporations reflect growing social expectations and concerns of

stakeholders. Taxes, on the other hand, are mandatory payments levied by the government on the

profits of individuals and corporations. According to Uniamikogbo, Bennee and Adeusi (2019),

tax aggressiveness is essential for management to minimize a company’s tax burden. Tax

aggressiveness is an attempt to use lawful barriers to avoid tax refunds or minimize tax

payments. It is an attempt to use lawful barriers to avoid tax refunds or minimize tax payments.

However, when tax breaks are obtained through illegal means, actions protect the interests of

investors and other stakeholders, and increase the credibility of financial reporting or procedures,

this is considered fraud and is therefore considered a criminal offense. According to Kiabel and

Nwikpasi (2001), tax aggressiveness is the planning and conduct of business activities within the

framework of existing legislation in such a way that the company realizes the optimal or best tax

position while achieving its stated goal. In other words, tax aggressiveness not only encompasses

the strategies aimed at minimizing a company’s tax liability, but also considers the cash flow

consequences for the company when it is most beneficial for a corporation to pay its tax liability

and avoid being surcharged. It is an act of transferring values from the state to corporations to

promote corporate governance and increase shareholder wealth.

Hence, tax aggressiveness plays a very significant role in business organizations. From the a

priori expectations, most studies on tax aggressiveness were limited to firm performance so also

the studies on sustainability reporting were limited to financial performance in both developed

and developing countries. Also, no empirical literature in developed and developing countries

associated tax aggressiveness with corporate sustainability based on the available literature. The

present study therefore examined the connection that exists between tax aggressiveness and

sustainability of firms quoted under oil and gas sector of Nigerian Exchange Group (NGX). To

achieve this purpose, the following hypotheses were formulated:

H01 : Tax aggressiveness has no significant relationship with sustainability of Oil and Gas Firms

in Nigeria

IIARD – International Institute of Academic Research and Development Page 49

IIARD International Journal of Economics and Business Management E-ISSN 2489-0065 P-ISSN 2695-186X

Vol 8. No. 2 2022 www.iiardjournals.org

H02 : Firm Size does not moderate the relationship between Tax Aggressiveness and

Sustainability of Oil and Gas Firms in Nigeria

2 . 0 R e v ie w o f R e la t e d Lit e ra t ure

2.1 Conceptual Frame work

2.1.1 Tax Aggressiveness

According to Aliani and Zarai (2013), business organizations identify the types of tax

expenditures that are favorable when they minimize them within the framework of tax laws and

use them to avoid paying excessive taxes for a period with the intention of increasing net profit.

Reducing tax expense is commonly referred to as tax aggressiveness. Tax aggressiveness, also

known as tax protection or tax planning, has been defined differently by scholars. Hoffman

(1961) viewed it as the taxpayer’s ability to organize his financial dealings in such a way that he

suffers a minimum tax liability. Tax protection is generally defined as the process of managing

one’s affairs in order to defer, reduce or even eliminate the amount of taxes payable to the

government (Pniowsky, 2010).

As noted in the study by Ogbeide and Obaretin (2018), aggressive tax management

practices/behaviour reduces the tax revenue accruing to government. Fiscal aggressive activities

are very important to achieve optimal financial performance of the company if all things being

equal. Tax aggressiveness is often implemented through effective strategies. These strategies

become effective when they allow companies to reduce tax costs and increase profits. Public

company tax aggressiveness strategies take the form of allowable items that are deductible under

tax laws. These are tax deductions that managers can use to reduce tax costs. The lower the tax

expense, the higher the return on investment, expressed as profit for the period. Tax

aggressiveness has its adverse effects. One of the adverse effects of tax aggressiveness is tax

avoidance. This not only affects the company’s image, but can also affect the investment

resources of shareholders. The favorable economic effect of tax aggressiveness is the reduction

in tax costs.

2.1.2 Organizational Sustainability

Sustainability report is a report that contains financial performance information and non-

financial information that includes social and environmental activities that enable companies to

grow sustainably (Clarissa & Rasmini, 2018). For company’s sustainability to be continual,

adequate attention should be paid to “3Ps” which are; profit, people and planet

According to Omaliko and Onyeogubalu (2021), to be sustainable, organizations must concede:

Accountability for their environmental, social and economic impacts.

Being transparent in its decisions and activities that affect its responsibilities.

Responding to the interests of its stakeholders.

Accepting that fact that rule of law is mandatory

IIARD – International Institute of Academic Research and Development Page 50

IIARD International Journal of Economics and Business Management E-ISSN 2489-0065 P-ISSN 2695-186X

Vol 8. No. 2 2022 www.iiardjournals.org

As cited in Obiora, Omaliko and Okeke (2022), Omaliko, Nwadialor and Nweze (2020),

Nigerian Code of Corporate Governance (2018) reports that proper attention to sustainability

issues, including environmental, social, occupational and community health and safety ensures

successful long-term business development and the company as this is what a responsible

corporate citizen does towards contributing to economic development.

The following guidelines are recommended by NCCG 2018 in relation to organizational

sustainability;

report on the company’s business principles, practices and efforts to achieve

sustainability;

report on the most environmentally friendly options, especially for companies operating

in disadvantaged regions or in regions with sensitive ecology, to minimize the

environmental impact of the company’s operations;

report on the nature and extent of employment equity and diversity (gender and other

issues);

report on the opportunities created for the physically disabled or disadvantaged;

report on the company’s environmental, social and governance policies and practices; etc.

The position of the Global Reporting Initiative (G4-LA1, LA9, G4-HR4, HR8 and G4-SO1) on

social sustainability disclosure is as follows;

report the total number and rate of employee hires during the reporting period, by age

group, gender, and region.

report education, training, counseling, prevention, and risk control programs that support

employees, their families, or community members related to critical illness.

report operations and suppliers where employees' rights to freedom of association or

collective bargaining may be violated or may be subject to significant risk.

report the total number of identified incidents of violations of indigenous peoples' rights

during the reporting period.

report the percentage of operations with implemented local community engagement ,

impact assessments and development programs.

2.2 Theoretical Framework

2.2.1 Agency Theory

Agency theory was proposed by Jensen and Meckling in 1976. Agency theory has been widely

used by empirical researchers to explain the relationship between environmental practices and

firm performance. According to Jensen and Murphy (1990), the principal-agent theory can be

used to justify the positive correlation between corporate tax aggressiveness and corporate

sustainability. The link between sustainability practices and tax sheltering should provide an

attractive incentive for companies to thrive, as tax breaks give the taxpayer the opportunity to

organize their financial dealings in such a way that they suffer a minimum tax liability.

IIARD – International Institute of Academic Research and Development Page 51

IIARD International Journal of Economics and Business Management E-ISSN 2489-0065 P-ISSN 2695-186X

Vol 8. No. 2 2022 www.iiardjournals.org

According to Desai and Dharmapala (2009), tax sheltering is a form of tax avoidance that

integrates more aspects of agency conflicts between managers and investors. From the agency’s

tax point of view, management skirting is the main problem to be solved by investors.

Management opportunism, or resource diversion, is another form of agency issues considered

under avoidance. According to Jensen and Meckling (1976), managers who are agents of clients

(shareholders) are hired to work to maximize returns for shareholders. Managers of organizations

are agents of the shareholders. Therefore, to maximize shareholder wealth, they would need to

reduce their operating expenses. One of these ways to reduce operating expenses is to use tax

protection measures (aggressiveness) to reduce their tax liability. However, in order to reduce the

tax burden on companies, tax sheltering must take place within the legal framework. The main

reason managers of organizations engage in tax sheltering is because of the benefits they derive

from an increase in after-tax income.

Similarly, agency theory and definitions of tax sheltering have clearly demonstrated that after-tax

returns could be uninterestingly affected by tax minimization, while tax minimization could be

viewed as tax-aggressive. Therefore, the study is anchored on this theory.

2.3 Empirical Review

Ogbeide and Obaretin (2018) examined corporate governance mechanisms and tax

aggressiveness of listed firms in Nigeria. Eighty- five (85) quoted non- financial firms were

selected and data were collected over the period 2012 to 2016. Inferential statistics consisting of

General Method of Moment was used for the data analysis. This was after carrying out unit root

test and other diagnostic tests respectively. The results obtained reveal that corporate governance

mechanisms exert significant impact on tax aggressiveness in Nigeria. Specifically, ownership

concentration and managerial ownership were positive and significantly impacts tax

aggressiveness of listed non- financial firms in Nigeria whereas board size negatively and

significantly impact tax aggressiveness over the reference period. Board gender diversity and

board independence were significant and exert negative influence on tax aggressiveness of firms

in Nigeria. The study recommended that there has to be a designed framework to efficiently and

effectively monitor the interaction between corporate governance mechanisms and managers’

rent extraction due to tax aggressive behaviour. This will drastically minimize the tendency for

them to engage in rent seeking behaviour. Firms should create a tax department that should be

regarded as profit centers that should be manned by tax experts / auditors who are deemed to be

imbued with wide experience on tax strategies to minimize tax expense payment.

Nwaobia, Kwarbai, and Ogundajo (2016) examined the consequences of tax planning on the

value of firms in Nigeria, using 50 firm-year observations for the period 2010-2014. They

sourced data from the financials of the sampled companies and analyses involved both

descriptive and inferential statistics within a specified panel regression framework. A significant

joint effect on the firm value was observed for all tax planning variables considered. A positive

and significant effect was observed for Effective tax rate (ETR), Firm age (FAG) and Dividend

(DIV) while capital intensity and leverage were seen to have significant negative effect of firm

value. They recommend an all-inclusive approach to tax planning to improve on firm value.

IIARD – International Institute of Academic Research and Development Page 52

IIARD International Journal of Economics and Business Management E-ISSN 2489-0065 P-ISSN 2695-186X

Vol 8. No. 2 2022 www.iiardjournals.org

Uniamkogbo, Bennee and Adeusi (2019). investigated the effect of corporate governance on tax

aggressiveness in Nigeria. Specifically, four variables; gender diversity, board size, CEO duality,

and ownership structure were used as proxy for Corporate Governance while Effective Tax Rate

was used to represent Tax aggressiveness in the Oil & Gas marketing firms in Nigeria. The

population of study consists of all Oil & Gas marketing firms listed on the Nigerian Stock

Exchange as at 31st December 2017.The entire population was adopted as the study sample

using the census sampling approach. The secondary source of data collection method was used in

generating data from the annual reports and accounts of the selected firms for the period 2013-

2017. Data generated were analysed using descriptive statistics and Ordinary Least Square

(OLS) regression. Findings from the study showed that a positive and significant relationship

exists between gender diversity, board size and tax aggressiveness while a negative but

significant relationship subsists between CEO duality and tax aggressiveness. Negative and

insignificant relationship exists between ownership structure and tax aggressiveness in the

Nigerian Oil & Gas marketing firms. We therefore recommend that audit committee of firms

should be backed up with the obligation of appraising tax assessment and returns in order to

avoid any form of illicit strategic tax behaviour by management. Also, Board of directors should

clarify their responsibilities and provide recommendations to strengthen the control on the

significant variables identified in this study analysis.

Lanis, McClure and Zirnsak (2017) analyse the tax aggressiveness of major alcohol and bottling

companies operating in Australia. Included in the analysis are both Australian and foreign owned

businesses. In total 13 companies were analysed and sample was broken up between profit or

loss firms in consistency with the academic literature. Five companies were classified as loss,

seven as profit and one as neither. Effective tax rates and book tax gaps were analysed with

respect to the sample. Using the Australian Taxation Office (ATO) tax data, six corporations

paid tax at, or near, the statutory rate of 30 per cent in the financial years 2013-2014 and 2014-

2015, two paid at a rate lower than 20 per cent (Asahi Holdings and Lion), and the other five

paid nothing. Taken together, the large alcohol companies in Australia are paying much less tax

than would be expected if the 30 per cent corporate income tax rate applied. The analysis found

that the wine industry made only small tax contributions to the Australian community over the

two years.

Usman, Okaiwele and Asuquo (2020) examined the relationship between corporate tax planning,

board compensation and firm value and moderating capacity on any association between tax

planning and firm value. Consequently, the study used a sample of 71 profitable non-financial

and non-oil and gas firms publicly listed on the Nigerian Stock Exchange (NSE) for financial

years covering 2008 to 2015. Using the Generalised Least Square (GLS) regression, the result

shows that there is a positive relationship between tax planning, board compensations and firm

value, while board compensations failed to moderate the relationship between tax planning and

firm value. Further, as regards the control variables, firm size showed a positive and significant

impact on the firm value, while there was a significant negative relationship between leverage

and firm value.

Nnamani, Onyekwelu and Ugwu (2017) evaluated the effect of sustainability accounting on the

financial performance of listed manufacturing firms in Nigeria. Firms used for the study were

IIARD – International Institute of Academic Research and Development Page 53

IIARD International Journal of Economics and Business Management E-ISSN 2489-0065 P-ISSN 2695-186X

Vol 8. No. 2 2022 www.iiardjournals.org

chosen from the Nigerian brewery sector. Data were sourced from the financial statements of

three sampled firms. Data were analysed using the ordinary linear regression. The study reveals

that sustainability reporting has positive and significant effect on financial performance of firms

studied. Following the findings, the study recommends that firms in Nigeria should invest

reasonable amount of their earnings on sustainability activities while specific accounting

templates be articulated by professional accounting regulating bodies to guide firms’ reportage

on sustainability activities. The Financial Reporting Council of Nigeria (FRC) and others alike

should make sustainability reporting compulsory while adequate sanctions are spelt out and

enforced on defaulting organizations to serve as a deterrent.

Richardson, Wang and Zhang (2016) examine the influence exerted by ownership structure on

corporate tax avoidance in selected listed Chinese private firms. Analyses using regression

model reveal a significant non-linear relationship between ownership concentration and tax

avoidance. At the base, increased ownership concentration was seen to exert a positive effect on

tax planning as a result of entrenchment. Though voting right induced concentrated ownership

beyond the minimum level needed for effective control exert negative influence on tax planning

due to the alignment effect. Another notable finding was the significantly positive association

observed between pyramidal ownership structure and tax planning as a result of the

entrenchment effect.

3.0 Methodology

The present study adopted ex-post facto design. The use of ex-post facto design was based on the

fact that our data is secondary in nature which has existed and cannot be manipulated. The

population of the study consists of the entire 10 firms quoted under oil and gas sector of Nigerian

Exchange Limited spanning from 2013-2021 according to their financial statements. Out of 10

firms that formed the population of the study, 6 firms were tax aggressive firms while the

remaining 4 firms were tax conservative firms (Mrs Oil Plc, Total Nig Plc, Rak Unity Pet Plc

and Eterna Plc) which were removed. Based on this, a total of 6 tax aggressive firms formed our

sample size with 54 observations. These firms include (Ardova Plc, Capital Oil Plc, Japaul Gold

and Ventures Plc, Conoil Plc, Oando Plc and Seplat Oil Plc).

3.1 Operationalization and Measurement of Variables

3.1.1 Dependent Variable

Organizational sustainability (OS) was measured using Kinder Lydenberg Domini (KLD) social-

environmental performance (SEP) rating system and the content analysis method of data

collection as used by Uwuigbe (2011), Omaliko and Okpala (2020), Omaliko, Nwadialor and

Nweze (2020). For this purpose, a score of (1) was awarded if an item was reported; otherwise a

score of (0) was awarded. Consequently, a firm could score a maximum of 20 points and a

minimum of 0. The formula for calculating the reporting scores by using these 20 attributes is

expressed in a functional form below:

20

IIARD – International Institute of Academic Research and Development Page 54

IIARD International Journal of Economics and Business Management E-ISSN 2489-0065 P-ISSN 2695-186X

Vol 8. No. 2 2022 www.iiardjournals.org

RS = Σdi

i= 1

Where:

RS = Reporting Score

di = 1 if the item is reported and 0 if the item is not reported

i = 1, 2, 3.... 20.

3.1.1 Independent Variable

The independent variable in this study is tax aggressiveness and it was proxy and measured using

effective tax rate. This is in harmony with the works of Ogbeide and Obaretin (2018).

3.2 Model Specification and Justification

In order to examine the relationship which exists between tax aggressiveness and corporate

sustainability in Nigeria, the following models were designed for the study. This is shown below

as thus:

SEP = β0 + β1 ETR + ε

Hence, the above model is re-designed as thus;

SEP = β0 + β1 ETR + β2 FS+ β3 ETR*FS + ε

This study estimates the following equation to analyse the moderating role of firm size. In this

study, firm size is taken as moderator. The researcher multiplies tax aggressiveness (ETR) and

firm size (proxy of Total Assets) which is the multiplier and moderator for the study.

Where:

ETR = Effective Tax Rate

SEP = Social and Environmental Performance

FS = Firm Size

ε = error term

Decision Rule: accept Ho if P-value > 5% significant level otherwise reject Ho

4.0: Data Analysis and Results

Table 1: Descriptive Statistics

STATS ETR FS SEP

Mean 3.25 2.65 2.45

Std. Dev. .6697649 .6488634 5.57105

Maximum 29 3.4 6.01

Minimum 8 1.4 1.12

Observations 54 54 54

Source: Researcher’s Computation (2022).

IIARD – International Institute of Academic Research and Development Page 55

IIARD International Journal of Economics and Business Management E-ISSN 2489-0065 P-ISSN 2695-186X

Vol 8. No. 2 2022 www.iiardjournals.org

Table 1 shows that on the average, in a 9-year period (2013-2021), the listed oil and gas firms in

Nigeria were characterized by positive social and environmental performance (SEP) value of

2.45. This is an indication that the selected firms in Nigeria have positive sustainability value

with a standard deviation value of 5.57105.

The average effective tax rate (ETR) value for the sampled firms was 3.25 with a standard

deviation value of .6697649. This means that firms with ETR values of 3.25 and above are more

sustainable. There is also a high variation in maximum and minimum values of ETR which stood

at 29 and 8 respectively. This wide variation in ETR values among the sampled firms justifies

the need for this study as the researcher assumes that firms with higher ETR values are more

sustainable than those firms with low ETR values.

Also an average value of 2.65 was recorded for firm size (moderator) with a standard deviation

of .6488634. Thus implies that firms with FS value of 2.65 and above are more sustainable.

There is also a high variation in maximum and minimum values of FS which stood at 3.4 and 1.4

respectively. This wide variation in FS values among the sampled firms justifies the need for this

study as the researcher assumes that firms with higher FS values are more sustainable than those

firms with low FS values.

4.1 Test of Hypotheses

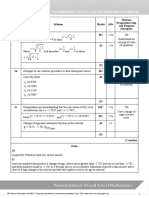

Table 2: Result on the relationship between Tax Aggressivene ss Moderated by Firm Size

and Sustainability of Listed Oil and Gas Firms in Nigeria.

Source | SS df MS Number of obs = 54

-------------+------------------------------ F (3, 50) = 2.125

Model | 206.360322 3 68.7867740 Prob > F = 0.0100

Residual | 1618.57911 50 32.3715822 R-squared = 0.5643

-------------+------------------------------ Adj R-squared = 0.5132

Total | 1824.93943 53 34.4328194 Root MSE = 1.0653

------------------------------------------------------------------------------------------

SEP | Coef. Std. Err. t P>|t| [95% Conf. Interval]

-------------+----------------------------------------------------------------------------

ETR | 1.115653 .5189300 2.15 0.000 1.935208 4.166513

FS | .1744744 .0629040 2.77 0.005 3.112804 2.763855

ETR*FS | .6354262 .0968100 6.56 0.042 2.579913 1.309061

_cons | .3962235 .1942833 2.04 0.035 8.820688 8.028241

Source: Result output from STATA 15.

4.2: Discussion of Findings

The result of the analysis of the study using OLS Model is expressed as follows:

H01 : Tax aggressiveness has no significant relationship with sustainability of Oil and Gas firms

in Nigeria

IIARD – International Institute of Academic Research and Development Page 56

IIARD International Journal of Economics and Business Management E-ISSN 2489-0065 P-ISSN 2695-186X

Vol 8. No. 2 2022 www.iiardjournals.org

This hypothesis was tested and the result of the regression model as exposited on table 2

indicates that the relationship between tax aggressiveness and firms’ sustainability is positive and

significant with a P-value (significance) of 0.000 for the model which is less than the 1% level of

significance adopted. Likewise the result of the positive coefficient shows that an increase in

firms’tax aggressiveness while other variables are held constant increases firms sustainability

1.11%. We consequently rejected the null hypothesis and accepted the alternate hypothesis

which contends that tax aggressiveness has significant relationship with sustainability of oil and

gas firms in Nigeria.

H02 : Firm Size does not moderate the relationship between Tax Aggressiveness and

Sustainability of Oil and Gas Firms in Nigeria

This hypothesis was tested and the result of the regression model as exposited on table 2

indicates that firm size moderates the relationship between tax aggressiveness and firms’

sustainability. With a P-value (significance) of 0.042 for the model, the test was considered

statistically significant. Also the result of the positive coefficient shows that an increase in

firms’size while other variables are held constant ensures corporate tax aggressiveness which in-

turn, increases firms sustainability by 63%. We consequently rejected null hypothesis and

accepted alternate hypothesis which contends that firm size moderates the relationship between

tax aggressiveness and sustainability of oil and gas firms in Nigeria.

Also, firm size when tested independently as a control variable indicates a positive and

significant relationship with corporate sustainability. With a p-value of 0.005, the test is

considered statistically significant at 1% level.

5.1 Conclusion and Recommendation

Based on the findings of the study, it was concluded that corporate tax aggressiveness moderated

by firm size has significant and positive relationship with sustainability of listed oil and gas firms

in Nigeria. The implication of this is that tax aggressive firms are more sustainable. Based on

this, the study suggests the need for corporate organizations to engage the services of tax

consultants to organize the firm’s financial dealings in such a way that the firm suffers a

minimum tax liability.

IIARD – International Institute of Academic Research and Development Page 57

IIARD International Journal of Economics and Business Management E-ISSN 2489-0065 P-ISSN 2695-186X

Vol 8. No. 2 2022 www.iiardjournals.org

References

Aliani, K. (2013). Does corporate governance affect tax planning? Evidence from American

companies. International Journal of Advanced Research 1(10), 864-879.

Clarissa, V., Rasmini, K. (2018). Effect of sustainability reporting on financial performance with

good corporate governance quality as moderating variable. International Journal of

science; Basic and Applied Research, 40(2), 139-149

Desai, M. A., & Dharmapala, D. (2018). Tax and corporate governance: An economic approach.

MPI Studies on Intellectual Property, Competition and Tax Law, 3, 13-30.

Jensen, M., & Meckling, W. (1976). Theory of the Firm: Managerial Behavior, Agency Costs

and Ownership Structure’, Journal of Financial Economics, 3, 305-360.

Kiabel, B. D., & Nwikpas, N. N. (2001). Selected aspects of Nigerian taxes, Owerri: Springfield

Publication ltd

Nnamani, J., Onyekwelu, U., & Ugwu, K. (2017). Effect of sustainability accounting and

reporting on financial performance of firms on Nigeria brewery sector. European Journal

of Business and Innovative Research, 5(1), 1-15

Nwaobia, A, Kwarbai, J, & Ogundajo, G. (2016). Tax planning and firm value: empirical

evidence from Nigerian consumer goods industrial sector’, Research Journal of Finance

and Accounting, 7(2), 172-184

Obiora, F., Omaliko, E., & Okeke, C. (2022). Effect of E-naira digital currency on financial

performance of listed deposit money banks in Nigeria. International Journal of Trend in

Scientific Research and Development, 6(2), 222-229

Ogbeide, O., Obaretin, O. (2018). Corporate governance mechanism and tax aggressiveness of

listed firms in Nigeria. Amity Journal of Corporate Governance, 3(1), 1-12

Omaliko, E., & Nwadialor, E., & Nweze, A. (2020). Effect of non-financial disclosures on

performance of non-financial firms in Nigeria. Journal of Accounting and Financial

Management, 6(1), 16-39

Omaliko, E., & Nweze, A., & Nwadialor, E. (2020). Effect of social and environmental

disclosures on performance of non-financial firms in Nigeria. Journal of Accounting and

Financial Management, 6(1), 40-58

Omaliko, E., & Okpala, A. (2020). Effect of environmental disclosures on dividend payout of

firms in Nigeria. International Journal of Banking and Finance Research, 6(3), 14-28

Omaliko, E., & Onyeogubalu, O. (2021). Voluntary risk management disclosures and

organizational sustainability; Nigerian experience. Attaining Sustainable Development

Goals in Families, Companies and Communities, Nnamdi Azikiwe University Book Series

on Sustainable Development

IIARD – International Institute of Academic Research and Development Page 58

IIARD International Journal of Economics and Business Management E-ISSN 2489-0065 P-ISSN 2695-186X

Vol 8. No. 2 2022 www.iiardjournals.org

Pniowsky, J. (2010). Aggressive tax planning-How aggressive is too aggressive? Thompson

Dorfman Sweatman LLP, 3, 1-3.

Richardson, G., Wang, C., Zhang, E. (2016). The effect of board of director composition on

corporate tax aggressiveness. Journal of Accounting and Public Policy, 30, 50-70.

Uniamkogbo, E., Bennee, E., & Adeusi, S. (2019). Corporate governance and tax aggressiveness

in Nigeria. AE-Funai Journal of Accounting, 4(1), 20-33

Usman, O., & Okaiwele, M., & Asuquo, B. (2020). Corporate tax planning, board compensation

and firm value in Nigeria. International Accounting and Taxation Research Group 1(1),

11-28

Uwuigbe, O. R. (2011). Corporate Governance and Financial Performance of Banks: A Study of

Listed Banks in Nigeria. A Doctoral Thesis Submitted to the School of Postgraduate

Studies, Covenant University, Ota, Ogun State

IIARD – International Institute of Academic Research and Development Page 59

IIARD International Journal of Economics and Business Management E-ISSN 2489-0065 P-ISSN 2695-186X

Vol 8. No. 2 2022 www.iiardjournals.org

S/N SECTORS QUOTED FIRMS IN NIGERIA TOTAL % SAMPLE OF TOTAL % SAMPLE OF EFFECTIVE REMARK

COYS USED POPULATION COYS POPULATION TAX RATE

(6) EXCLUDED EXCLUDED (4)

OIL AND GAS

1 Ardova Pl c 1 26 ETR ≤ 30%

2 Ca pi ta l Oi l Pl c 1 15 ETR ≤ 30%

3 Ja pa ul Gold a nd Ventures Plc 1 8 ETR ≤ 30%

4 Conoi l Pl c 1 24 ETR ≤ 30%

5 Oa ndo Pl c 1 27 ETR ≤ 30%

6 Sepl a t Oi l Pl c 1 29 ETR ≤ 30%

7 Mrs Oi l 1 56 ETR > 30%

8 Tota l Ni g Pl c 1 45 ETR > 30%

9 Ra k Uni ty Pet Pl c 1 31 ETR > 30%

10 Eterna l Pl c 1 35 ETR > 30%

TOTAL NO OF COYS UNDER 6 60% 4 40%

OIL & GAS SECTOR

Appendix 1

The List of Companies Quoted under Oil and Gas Sectors of Nigerian Exchange Group (NGX)

Source: Extract from NGX Factbook & Author’s Conception (2022).

Note: Firms with ETR > 30% are considered as Tax Conservative Firms while firms with ETR

≤ 30% are considered as Tax Aggressive Firms which the present study concentrated on. Hence

Tax Conservative Firms were excluded from the study.

IIARD – International Institute of Academic Research and Development Page 60

You might also like

- Mark Scheme: Q Scheme Marks Aos Pearson Progression Step and Progress Descriptor 1A M1Document7 pagesMark Scheme: Q Scheme Marks Aos Pearson Progression Step and Progress Descriptor 1A M1Arthur LongwardNo ratings yet

- Automatic Bus Suspension PID Controller DesignDocument50 pagesAutomatic Bus Suspension PID Controller Designchuhuynh100% (1)

- Avian 48 Guide PDFDocument8 pagesAvian 48 Guide PDFEng-Mohamed Zakria ElbadryNo ratings yet

- Environmental AccountingDocument18 pagesEnvironmental AccountingNada KhaledNo ratings yet

- Ado, Rashid, Mustapha and Lateef 2021Document25 pagesAdo, Rashid, Mustapha and Lateef 2021Saheed Lateef AdemolaNo ratings yet

- SSRN Id3697494Document14 pagesSSRN Id3697494Laura StefaniaNo ratings yet

- 02 Cost ControlDocument12 pages02 Cost Controldhanielagonzales525No ratings yet

- GRI EnvironmentalDocument14 pagesGRI EnvironmentalNada KhaledNo ratings yet

- Corporate Board Attributes and Tax AggressivenessDocument28 pagesCorporate Board Attributes and Tax AggressivenessDivine ugboduNo ratings yet

- Do Characteristic of Firm Related To Corporate Tax Avoidance?Document12 pagesDo Characteristic of Firm Related To Corporate Tax Avoidance?aijbmNo ratings yet

- The Impact of Thin Capitalization and Profitability On Tax Avoidance With Institutional Ownership As A Moderation VariableDocument9 pagesThe Impact of Thin Capitalization and Profitability On Tax Avoidance With Institutional Ownership As A Moderation VariableInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Corporate Social Responsibility Performance and Tax Aggressiveness of Listed Industrial and Consumer Goods Manufacturing Firms in NigeriaDocument10 pagesCorporate Social Responsibility Performance and Tax Aggressiveness of Listed Industrial and Consumer Goods Manufacturing Firms in NigeriaMichelle WrightNo ratings yet

- The Effect of Corporate Income Tax On Financial Performance of Listed Manufacturing Firms in GhanaDocument8 pagesThe Effect of Corporate Income Tax On Financial Performance of Listed Manufacturing Firms in GhanaAlexander DeckerNo ratings yet

- Tax Planning Strategies Impact on Firm Value in Nigerian Consumer Goods SectorDocument12 pagesTax Planning Strategies Impact on Firm Value in Nigerian Consumer Goods SectorIlham FajarNo ratings yet

- Tax Cooperative Compliance and Federally Collected Tax Revenue in NigeriaDocument22 pagesTax Cooperative Compliance and Federally Collected Tax Revenue in NigeriaPriandhita AsmoroNo ratings yet

- Effect of Sales and Firm Size On SustainDocument8 pagesEffect of Sales and Firm Size On SustainBrianNo ratings yet

- 24 Articulos - Cost Control and Profitability of Selected Manufacturing Companies in NigeriaDocument20 pages24 Articulos - Cost Control and Profitability of Selected Manufacturing Companies in NigeriaCristian Santivañez MillaNo ratings yet

- The Influence of Transfer Pricing, Corporate Governance, CSR, and Earnings Management On Tax AggressivenessDocument11 pagesThe Influence of Transfer Pricing, Corporate Governance, CSR, and Earnings Management On Tax AggressivenessRiono abu fahriNo ratings yet

- Effect of Corporate Tax Aggressiveness On Firm Growth in Nigeria An Empirical AnalysisDocument12 pagesEffect of Corporate Tax Aggressiveness On Firm Growth in Nigeria An Empirical AnalysisEditor IJTSRDNo ratings yet

- IJRPR13483Document8 pagesIJRPR13483Lakshmi vanahalliNo ratings yet

- The Moderating Effect of Profitability On The Relationship Between Ownership Structure and Corporate Tax Avoidance in Nigeria ListDocument16 pagesThe Moderating Effect of Profitability On The Relationship Between Ownership Structure and Corporate Tax Avoidance in Nigeria ListDivine ugboduNo ratings yet

- Equity Ownership Structure and Corporate Tax AggreDocument11 pagesEquity Ownership Structure and Corporate Tax AggreMardianaNo ratings yet

- The Effect of Return On Assets, Auditor Reputation, and Company Size On Tax Avoidance (Consumer Goods Industry Sector Companies Listed On The Indonesia Stock Exchange For The 2018-2021 Period)Document10 pagesThe Effect of Return On Assets, Auditor Reputation, and Company Size On Tax Avoidance (Consumer Goods Industry Sector Companies Listed On The Indonesia Stock Exchange For The 2018-2021 Period)International Journal of Innovative Science and Research TechnologyNo ratings yet

- The Influence of CEO Demography Characteristics, Profitability and The Quality of External Auditors On Tax Aggressiveness of Family Firm'sDocument11 pagesThe Influence of CEO Demography Characteristics, Profitability and The Quality of External Auditors On Tax Aggressiveness of Family Firm'sInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Mulyati (2019)Document10 pagesMulyati (2019)Devi asih retno WulanNo ratings yet

- Determinants of Tax Revenue - A Case of Nigeria - Ishola & OthersDocument10 pagesDeterminants of Tax Revenue - A Case of Nigeria - Ishola & Otherspriyanthikadilrukshi05No ratings yet

- The Influence of Capital Intensity, Sales Growth,Document11 pagesThe Influence of Capital Intensity, Sales Growth,Amberly QueenNo ratings yet

- 250-Article Text-743-1-10-20230816Document23 pages250-Article Text-743-1-10-20230816TJ AyanfeNo ratings yet

- Keywords:-Corporate Income Tax, Profitability, LiquidityDocument12 pagesKeywords:-Corporate Income Tax, Profitability, LiquidityInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- The Effect of Tax Planning, Profitability and Company Growth On Firm Value With CorporateGovernance Quality As A Moderating Variable Study in Manufacturing Companies Listed On CSE 2017-2021Document8 pagesThe Effect of Tax Planning, Profitability and Company Growth On Firm Value With CorporateGovernance Quality As A Moderating Variable Study in Manufacturing Companies Listed On CSE 2017-2021International Journal of Innovative Science and Research TechnologyNo ratings yet

- 2019 - Jurnal Bahasa Inggris Ta - Herianti, ChairinaDocument20 pages2019 - Jurnal Bahasa Inggris Ta - Herianti, ChairinaKarenNo ratings yet

- Oladipo 2022Document10 pagesOladipo 2022yuliana jaengNo ratings yet

- The Impact of Ethical Tax Behaviour On TDocument10 pagesThe Impact of Ethical Tax Behaviour On Tgarba shuaibuNo ratings yet

- The Impact of Deferred Tax and Tax Planning on Earnings Management and ProfitabilityDocument22 pagesThe Impact of Deferred Tax and Tax Planning on Earnings Management and ProfitabilityNurlita Puji AnggraeniNo ratings yet

- The Effect of Profitability, Company Size, and Sales Growth On Tax Avoidance With Leverage As A Moderating VariableDocument8 pagesThe Effect of Profitability, Company Size, and Sales Growth On Tax Avoidance With Leverage As A Moderating VariableInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Impact Analysis of Tax Policy and The Performance of Small and MediumDocument25 pagesImpact Analysis of Tax Policy and The Performance of Small and Mediumkara albueraNo ratings yet

- Tax Planning Strategies and Financial Performance of Listed Deposit Money Banks in NigeriaDocument13 pagesTax Planning Strategies and Financial Performance of Listed Deposit Money Banks in NigeriaEditor IJTSRDNo ratings yet

- BSA - Balmes Paolo Gabriel Et - Al. 10 Page ResearchDocument9 pagesBSA - Balmes Paolo Gabriel Et - Al. 10 Page ResearchChryshelle LontokNo ratings yet

- 3-Value Added Tax Compliance, And Small andDocument26 pages3-Value Added Tax Compliance, And Small andymaladaNo ratings yet

- Green Accounting Reporting and Financial Performance of Manufacturing Firms in NigeriaDocument9 pagesGreen Accounting Reporting and Financial Performance of Manufacturing Firms in NigeriaAJHSSR JournalNo ratings yet

- The Effect of Tax Avoidance, Profit Management, Managerial Ownership On Tax DisclosureDocument9 pagesThe Effect of Tax Avoidance, Profit Management, Managerial Ownership On Tax DisclosureInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- 391 2259 1 PBDocument15 pages391 2259 1 PBASRIANIHASANNo ratings yet

- How The Effect of Deferred Tax Expenses and Tax Planning On Earning Management ?Document6 pagesHow The Effect of Deferred Tax Expenses and Tax Planning On Earning Management ?Nurlita Puji AnggraeniNo ratings yet

- How EffectDocument6 pagesHow Effecttutik sutikNo ratings yet

- Economies 10 00251 v3Document22 pagesEconomies 10 00251 v3shabeer khanNo ratings yet

- SaprudinDocument10 pagesSaprudinGracia Pulcheria ValentinaNo ratings yet

- Faktor-Faktor Yang Memengaruhi PPH Badan Terutang Pada Perusahaan Manufaktur Di Bursa Efek IndonesiaDocument10 pagesFaktor-Faktor Yang Memengaruhi PPH Badan Terutang Pada Perusahaan Manufaktur Di Bursa Efek IndonesiaEdy AkuntansiNo ratings yet

- Sri Lankan Journal of Business Economics SLJBE Vol. 08 2 2019 Nov Article 02Document12 pagesSri Lankan Journal of Business Economics SLJBE Vol. 08 2 2019 Nov Article 02demolaojaomoNo ratings yet

- Tax Planning and Firms' Value in NigeriaDocument13 pagesTax Planning and Firms' Value in NigeriaResearch ParkNo ratings yet

- Marchell Teja - FIXDocument10 pagesMarchell Teja - FIXsinomicsjournalNo ratings yet

- PPM 2022 01 OladipoDocument9 pagesPPM 2022 01 OladipoFrogie 68844No ratings yet

- Detection of Tax Avoidance Due To The COVID-19 Pandemic With The Tax Aggressiveness ModelDocument5 pagesDetection of Tax Avoidance Due To The COVID-19 Pandemic With The Tax Aggressiveness ModelHiền MỹNo ratings yet

- The Effect of Good Corporate Governance Principles Application, Corporate Social Responsibilitydisclosure, and L..Document8 pagesThe Effect of Good Corporate Governance Principles Application, Corporate Social Responsibilitydisclosure, and L..Nana AlhusnaNo ratings yet

- (The Effect of Deffered Tax Expense and Tax Avoidance On EarningDocument16 pages(The Effect of Deffered Tax Expense and Tax Avoidance On Earningwardi santosoNo ratings yet

- Green Accounting and Firm Performance in NigeriaDocument10 pagesGreen Accounting and Firm Performance in NigeriaEditor IJTSRDNo ratings yet

- An Analysis of Tax Avoidance in Food Beverage Companies Registered in Indonesia Stock ExchangeDocument13 pagesAn Analysis of Tax Avoidance in Food Beverage Companies Registered in Indonesia Stock ExchangeDante Callo FuentesNo ratings yet

- 3.Man-Factors That Affect Tax Compliance Among Small and Medium Enterprises - Dr. Isaac IkporDocument12 pages3.Man-Factors That Affect Tax Compliance Among Small and Medium Enterprises - Dr. Isaac IkporImpact JournalsNo ratings yet

- Analysis On Effect of Tax Avoidance and Good Corporate Governance To Firm ValueDocument10 pagesAnalysis On Effect of Tax Avoidance and Good Corporate Governance To Firm ValueSELFIARLYNJFNo ratings yet

- 494-Article Text-814-1-10-20191014Document6 pages494-Article Text-814-1-10-20191014txkatamso.tiketing1No ratings yet

- The Effect of Corporate Tax On Dividend Policy of Listed Consumer Goods Companies in NigeriaDocument9 pagesThe Effect of Corporate Tax On Dividend Policy of Listed Consumer Goods Companies in NigeriaMayaz AhmedNo ratings yet

- The Role of Political Connection in The Influences of Transfer Pricing, Thin Capitalization, Return On Assets Toward Tax AvoidanceDocument9 pagesThe Role of Political Connection in The Influences of Transfer Pricing, Thin Capitalization, Return On Assets Toward Tax AvoidanceInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Capital Expenditure and The Impact of Taxation On Economic Growth in NigeriaDocument13 pagesCapital Expenditure and The Impact of Taxation On Economic Growth in NigeriaThe IjbmtNo ratings yet

- A Comprehensive Assessment of Tax Capacity in Southeast AsiaFrom EverandA Comprehensive Assessment of Tax Capacity in Southeast AsiaNo ratings yet

- Wellington Secondary College: All Orders To Be Completed Online atDocument3 pagesWellington Secondary College: All Orders To Be Completed Online atMathusan LakshmanNo ratings yet

- Demystifying Interventional Radiology A Guide For Medical StudentsDocument195 pagesDemystifying Interventional Radiology A Guide For Medical StudentsMo Haroon100% (1)

- ESE 601 Week 4 Assignment Universal Learning Characteristic1Document5 pagesESE 601 Week 4 Assignment Universal Learning Characteristic1Homeworkhelpbylance0% (1)

- Joints, Bones & Healthy SkeletonsDocument2 pagesJoints, Bones & Healthy Skeletonsسكمي نعمة الكرمهNo ratings yet

- Research in Educ 215 - LDM Group 7Document25 pagesResearch in Educ 215 - LDM Group 7J GATUSNo ratings yet

- Md. Sabbir Hossain Khan: Contact InformationDocument4 pagesMd. Sabbir Hossain Khan: Contact InformationHimelNo ratings yet

- Garlic As Mosquito RepellentDocument18 pagesGarlic As Mosquito Repellentagnes80% (5)

- NGS QC MetricsDocument7 pagesNGS QC MetricsAgustin BernacchiaNo ratings yet

- PGDM-IIPR Final Research Based ReportDocument9 pagesPGDM-IIPR Final Research Based Reportnavneet dubeyNo ratings yet

- DD Cen TS 14425-1-2003Document16 pagesDD Cen TS 14425-1-2003mossamorrisNo ratings yet

- Individual Assignment 2 - Article Review - Opm530Document2 pagesIndividual Assignment 2 - Article Review - Opm530Amir HafiyNo ratings yet

- Dual Nature of Radiation and Matter PDFDocument18 pagesDual Nature of Radiation and Matter PDFLakshit SharmaNo ratings yet

- Full Scale Tests of Heat Strengthened Glass With Ceramic FritDocument17 pagesFull Scale Tests of Heat Strengthened Glass With Ceramic FritKároly FurusNo ratings yet

- Concrete WorkDocument3 pagesConcrete WorkAbdul Ghaffar100% (1)

- Black Iron Amended PEA PDFDocument372 pagesBlack Iron Amended PEA PDFemerson sennaNo ratings yet

- ch1 2Document26 pagesch1 2Yeh Chul ShinNo ratings yet

- Pengaruh Promosi Kesehatan Metode Penyuluhan Tentang Hiv/Aids Terhadap Peningkatan Pengetahuan Remaja Di Sma N 5 Padang Sari Setiarini AbstrakDocument7 pagesPengaruh Promosi Kesehatan Metode Penyuluhan Tentang Hiv/Aids Terhadap Peningkatan Pengetahuan Remaja Di Sma N 5 Padang Sari Setiarini AbstrakRafi SalimNo ratings yet

- An Ecological Approach For Social Work PracticeDocument11 pagesAn Ecological Approach For Social Work PracticeJona MempinNo ratings yet

- Iso 4582 1980Document8 pagesIso 4582 1980Ruwan Sampath WickramathilakaNo ratings yet

- Process Costing: Cost Accounting Principles, 9eDocument17 pagesProcess Costing: Cost Accounting Principles, 9eoliver tzNo ratings yet

- Final Project: Compiled Chapter Test: Icaro, Joanne Bernadette GDocument18 pagesFinal Project: Compiled Chapter Test: Icaro, Joanne Bernadette GJoanne IcaroNo ratings yet

- INBO2020 Solutions 20200220Document11 pagesINBO2020 Solutions 20200220Abhik Kumar MajiNo ratings yet

- Renowned Professors in RussiaDocument5 pagesRenowned Professors in RussiaAfias Thomas MatheNo ratings yet

- Experiencias Cercanas A La Muerte PDFDocument18 pagesExperiencias Cercanas A La Muerte PDFGabriel MoraguesNo ratings yet

- RIYAGUPTA MidSemDocument14 pagesRIYAGUPTA MidSemanaya jianaNo ratings yet

- Mathematics Reference Books: No. Name Author PublisherDocument1 pageMathematics Reference Books: No. Name Author PublisherDelicateDogNo ratings yet

- Perret Mahindra SeminarDocument32 pagesPerret Mahindra SeminarBeowulf StarkNo ratings yet