Professional Documents

Culture Documents

1 - Property Rental-Income WHT Rates Card 2023-24

Uploaded by

Ghulam MustafaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

1 - Property Rental-Income WHT Rates Card 2023-24

Uploaded by

Ghulam MustafaCopyright:

Available Formats

GIZ PAKISTAN

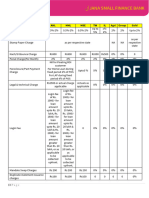

WITHHOLDING TAX RATES CARD 2023-24

(Effective 01.07.2023 - 30.06.2024)

TAX ON PROPERTY RENTAL INCOME:

IN CASE OF COMPANY 15%

Sr # IN CASE OF INDIVIDUAL & AOP Rate

1 WHERE THE GROSS AMOUNT OF RENT DOES NOT EXCEED RS. 300,000- NIL

WHERE THE GROSS AMOUNT OF RENT EXCEEDS RS. 300,000- BUT DOES

2 5% OF THE GROSS AMOUNT EXCEEDING RS. 300,000

NOT EXCEED RS. 600,000-

WHERE THE GROSS AMOUNT OF RENT EXCEEDS RS. 600,000- BUT DOES Rs. 15,000 PLUS 10% OF THE GROSS AMOUNT EXCEEDING RS.

3

NOT EXCEED RS. 2,000,000 600,000

Rs. 155,000 PLUS 25% OF THE GROSS AMOUNT EXCEEDING RS.

4 WHERE THE GROSS AMOUNT OF RENT EXCEEDS RS. 2,000,000

2,000,000

QUERIES: Contact: 111 489 725, Cell: 0301-8450819

aniq.qureshi@giz.de

DISCLAIMER: This rate card is only for the information purpose and is subject to updates. The official version of FBR will always prevail

over the information provided in this rate card.

www.fbr.gov.pk

GIZ Pakistan Property Rental Income Tax Rate 7/5/2023

You might also like

- Tax Rates For Non-Salaried Individuals and AopsDocument4 pagesTax Rates For Non-Salaried Individuals and AopsAdeel QaiserNo ratings yet

- Freedom Unleashed: How to Make Malaysia a Tax Free CountryFrom EverandFreedom Unleashed: How to Make Malaysia a Tax Free CountryRating: 5 out of 5 stars5/5 (1)

- 3 - Salary Income WHT Rates Card 2023-24Document1 page3 - Salary Income WHT Rates Card 2023-24Ghulam MustafaNo ratings yet

- BakerTilly Tax Rates CardDocument15 pagesBakerTilly Tax Rates Cardydy9mwfqchNo ratings yet

- Income Tax Card 2023-24 (Finance Act 2023)Document1 pageIncome Tax Card 2023-24 (Finance Act 2023)shahidNo ratings yet

- ISCO Tax Card TY 2017 PDFDocument15 pagesISCO Tax Card TY 2017 PDFRehan FarhatNo ratings yet

- Brochure-2020 Reviewed Final 29-08-2020Document4 pagesBrochure-2020 Reviewed Final 29-08-2020hk sunNo ratings yet

- Salary Tax Rates (2022 & 2023 Comparison)Document2 pagesSalary Tax Rates (2022 & 2023 Comparison)by kirmaniNo ratings yet

- Rental Income Tax SlabsDocument1 pageRental Income Tax SlabsabababababNo ratings yet

- Revision of Interest Rate On Domestic, NRO and NRE Term DepositsDocument2 pagesRevision of Interest Rate On Domestic, NRO and NRE Term DepositsTnaharNo ratings yet

- Tax CardDocument18 pagesTax CardQamar AbbasNo ratings yet

- Dexter Consultants: Updated Through Finance Act 2022Document1 pageDexter Consultants: Updated Through Finance Act 2022fahid aslamNo ratings yet

- Agriculture Term Loan - 795/860/891: NF-546 NF-983Document3 pagesAgriculture Term Loan - 795/860/891: NF-546 NF-983Santosh KumarNo ratings yet

- Tax Rates 2021Document6 pagesTax Rates 2021Muazam memonNo ratings yet

- Test 5 (QP)Document4 pagesTest 5 (QP)iamneonkingNo ratings yet

- Educative Series Green Housing LoanDocument2 pagesEducative Series Green Housing LoanRohith RaoNo ratings yet

- BakerTilly Tax Rates Card - TY 2024Document35 pagesBakerTilly Tax Rates Card - TY 2024sajjjadali7996No ratings yet

- 2 Tax RatesDocument15 pages2 Tax RatesragerahulNo ratings yet

- Fair Value of Land May Rise 20% As Goa Eyes Revenue Growth - Times of India PDFDocument4 pagesFair Value of Land May Rise 20% As Goa Eyes Revenue Growth - Times of India PDFParvaz CaziNo ratings yet

- Tax Card 2017 - LatestDocument9 pagesTax Card 2017 - LatestWaqas ShujaNo ratings yet

- Income Tax Card 2019-20: Suite 021, Block B Abu Dhabi Towers, F-11 Markaz Islamabad-PakistanDocument18 pagesIncome Tax Card 2019-20: Suite 021, Block B Abu Dhabi Towers, F-11 Markaz Islamabad-PakistanZain RehmanNo ratings yet

- GST On Hotel & Tourism Industry - FinancePostDocument5 pagesGST On Hotel & Tourism Industry - FinancePostkjsdfjjsfdjkNo ratings yet

- SOC AssetsDocument2 pagesSOC AssetsptsmithrafoundationNo ratings yet

- Tax Slab 2019Document3 pagesTax Slab 2019Ahmed RazaNo ratings yet

- DRDDDDocument12 pagesDRDDDWaqar HussainNo ratings yet

- Income Tax Slabs For FY 2019Document2 pagesIncome Tax Slabs For FY 2019Kamran KhanNo ratings yet

- Tax Year 2012 Rates of Tax For Individual Except A Salaried TaxpayerDocument5 pagesTax Year 2012 Rates of Tax For Individual Except A Salaried TaxpayerStyliXh MariamNo ratings yet

- Rates of Income TaxDocument9 pagesRates of Income TaxAiza KhanNo ratings yet

- Test 6 (QP)Document4 pagesTest 6 (QP)iamneonkingNo ratings yet

- Tax On Mutual Funds and SharesDocument6 pagesTax On Mutual Funds and SharesGiri SukumarNo ratings yet

- Wa0004.Document7 pagesWa0004.manoranjanthakur1979No ratings yet

- Slab RatesDocument1 pageSlab RatesjayNo ratings yet

- Test 2Document3 pagesTest 2Awais ShahidNo ratings yet

- ASC Salary Brochure TY 2017 For Website PDFDocument7 pagesASC Salary Brochure TY 2017 For Website PDFFaizanNo ratings yet

- Test 7Document4 pagesTest 7lalshahbaz57No ratings yet

- Section:C-1/B-1 Subject: CAF-06 Teacher: Mr. Sir Adnan Rauf Total Marks: 33 Time Allowed: 55 Mints. Assessment-1 Date: 28oct, 2019Document5 pagesSection:C-1/B-1 Subject: CAF-06 Teacher: Mr. Sir Adnan Rauf Total Marks: 33 Time Allowed: 55 Mints. Assessment-1 Date: 28oct, 2019Shaheer MalikNo ratings yet

- Stater Ki FinalDocument22 pagesStater Ki FinalsquarebuildinfratechNo ratings yet

- Normal Tax Rates For Individual & HUFDocument14 pagesNormal Tax Rates For Individual & HUFAdarsh PandeyNo ratings yet

- Updated One Pager SPL - Dsa-1Document1 pageUpdated One Pager SPL - Dsa-1Vishal BawaneNo ratings yet

- Income Tax Slab - Income Tax Slab For FY 2023-24 and AY 2024-25Document19 pagesIncome Tax Slab - Income Tax Slab For FY 2023-24 and AY 2024-25leelathecaNo ratings yet

- PD Interest RateDocument2 pagesPD Interest RatecraftylandofficialNo ratings yet

- Sections:All Subject: CAF-06 Teacher: Sir Adnan/Salman Total Marks: 36 Time Allowed: 1 Hour 10 Minutes Assessment-1 Date: 17 May, 2021Document6 pagesSections:All Subject: CAF-06 Teacher: Sir Adnan/Salman Total Marks: 36 Time Allowed: 1 Hour 10 Minutes Assessment-1 Date: 17 May, 2021BablooNo ratings yet

- Audit Fee by IcapDocument2 pagesAudit Fee by IcapwaqaswaNo ratings yet

- Final BU POT Fall 2023Document4 pagesFinal BU POT Fall 2023sohail199aliNo ratings yet

- Msme Loan - Upto 2lakhs: NF-546 NF-998 NF-588 NF-855 NF-803 NF-482 NF-373 NF-368Document4 pagesMsme Loan - Upto 2lakhs: NF-546 NF-998 NF-588 NF-855 NF-803 NF-482 NF-373 NF-368Santosh KumarNo ratings yet

- Tax Year 2013-14 (As Per Finance Act 2013) : Tax Card For Staff and Clients OnlyDocument1 pageTax Year 2013-14 (As Per Finance Act 2013) : Tax Card For Staff and Clients OnlyMuhammad sarfrazNo ratings yet

- Budget 2019 Analysis: Economics, Politics and Social Sciences Interest Group IIM KozhikodeDocument7 pagesBudget 2019 Analysis: Economics, Politics and Social Sciences Interest Group IIM KozhikodeB V S VAIBHAV 22No ratings yet

- Mutual Fund Screener: For The Quarter Ended Jun - 18Document27 pagesMutual Fund Screener: For The Quarter Ended Jun - 18BHAVESH KHOMNENo ratings yet

- Hadiser Name JaliatiDocument1 pageHadiser Name JaliatiSahidulla MollaNo ratings yet

- Sanchay Public Deposit FormDocument6 pagesSanchay Public Deposit Formmanoj barokaNo ratings yet

- 2 Tax RatesDocument15 pages2 Tax Rates1407345No ratings yet

- Final Spotlight February 2019Document98 pagesFinal Spotlight February 2019RanjanNo ratings yet

- Applicable For Pcc/Ipcc May-2010/Nov-2010Document17 pagesApplicable For Pcc/Ipcc May-2010/Nov-2010Anshul AgarwalNo ratings yet

- Week 4Document22 pagesWeek 4Lawprep TutorialgovNo ratings yet

- Tax Card 2022Document2 pagesTax Card 2022abdullahsaleem91100% (1)

- Loan Application Form Occupation Details Borrowers PhotographDocument14 pagesLoan Application Form Occupation Details Borrowers Photographrishika7014No ratings yet

- Union Budget - 2023-24 - Direct Tax Proposals (K&Co)Document54 pagesUnion Budget - 2023-24 - Direct Tax Proposals (K&Co)Charul ChhajerNo ratings yet

- Consumer CirDocument7 pagesConsumer CirNitish PandeyNo ratings yet

- Receivable MGTDocument12 pagesReceivable MGTDarshan JoshiNo ratings yet

- Asia Small and Medium-Sized Enterprise Monitor 2021 Volume III: Digitalizing Microfinance in Bangladesh: Findings from the Baseline SurveyFrom EverandAsia Small and Medium-Sized Enterprise Monitor 2021 Volume III: Digitalizing Microfinance in Bangladesh: Findings from the Baseline SurveyNo ratings yet

- Strategic Management at Lever Brothers Pakistan Limited: Corporate Level StrategyDocument1 pageStrategic Management at Lever Brothers Pakistan Limited: Corporate Level StrategyGhulam MustafaNo ratings yet

- Understanding Market Opportunities: Mcgraw-Hill/IrwinDocument26 pagesUnderstanding Market Opportunities: Mcgraw-Hill/IrwinGhulam MustafaNo ratings yet

- Advanced NegotiatingDocument112 pagesAdvanced NegotiatingNiren PatelNo ratings yet

- Interactive PlanningDocument5 pagesInteractive PlanningGhulam MustafaNo ratings yet