Professional Documents

Culture Documents

Aryadhan New CAM Format For NBFC Clean Version CAM & Annexures

Uploaded by

Swarna SinghOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Aryadhan New CAM Format For NBFC Clean Version CAM & Annexures

Uploaded by

Swarna SinghCopyright:

Available Formats

M/s.

Aryadhan Financial Solutions Private Limited (AFSPL)

Proposal for Sanction of Additional Term Loan of Rs. 16.25 Crore for a period of 12

Months

Executive Summary

1) Customer Name – Aryadhan Financial Solutions Private Limited

Proposal Type Additional Term Month & Year Jan-2017

Loan Established

Commencement of 2017 Line of Business WAREHOUSE

Business RECEIPT FINANCE

(WRF) ON POST-

HARVEST SIDE

Bank Relation ~10 Months (Since Corporate Office/ Noida, Uttar

Vintage (in Months) May-2022) Registerd Office Pradesh/ Noida,

Uttar Pradesh

Auditor / since M/s Dass Gupta & Last Client visit 4th March, 2023

when Associates/ FY 2022 Date

Net worth as on Rs. 233.93 Crore CRAR (%) – As on 64.89%

31.12.2022 31.12.2022

Net NPA (%) – As on Nil TOL / ATNW – As 1.00x

31.12.2022 on 31.12.2022

Share of Banking 43.90% Our Exposure / 1.60% (Existing)

Exposure in Overall Tangible Net 8.55% (Proposed)

Resource Profile Worth of

(%)- Dec-22 Borrower

Company (%)

Top two states for Madhya Pradesh- ALM Mismatch No Negative

portfolio 20.92% (Within 1 Year Cumulative

Rajasthan- 17.49% Bucket) – Yes/ No mismatch

External Rating / CRISIL BBB- Internal Rating USFB 4

Date of rating (Reaffirmed: Revised

from Stable to

Positive)/

19.10.2022

Refer Annexure-9

Past External CRISIL BBB- Cash & Bank Rs. 94.57 Crore

Ratings (last 3 (Reaffirmed: Balance (Unencumbered)

ratings) Stable)/ 25.05.2022 (31.12.2022)

CRISIL BBB-

(Reaffirmed:

AUM (31.12.2022) Rs. 334.60 Crores

Stable)/ 21.04.2022

(Total Own)

CRISIL BBB-

(Reaffirmed:

Stable)/ 03.09.2021

Aryadhan Financial Solutions Private Limited - CAM & Annexures Page 1 of 67

2) Proposed Proposal & Terms / Existing Exposure: If existing NIL, NA to be

mentioned

Existing Proposed

Particulars

Term Loan – I Term Loan – IV

Facility Term Loan Term Loan

Sanction Date 26.05.2022 NA

Sanctioned Amount ₹15.00 Crore ₹16.25 Crore

Total exposure on AFSPL shall not

O/s. Feb 28, 2023 ₹3.75 Crore

be more than ₹20.00 Crore

Tenor 12 months 12 months

11.25% floating linked 11.25% floating linked with last 12

with last 12 weeks weeks average 364 days T-Bill ~

Interest Rate @

average 364 days T-Bill ~ Quarterly Reset (Spread of 4.28%)

onboarding

Quarterly Reset (Spread

of 6.59%)

Current Interest Rate 12.51% NA

0.25% plus applicable 0.25% plus applicable taxes

Processing Fee

taxes

Primary: Book Debts of Primary: Book Debts of 110%

Security 110%

Cash Collateral: 5% Cash Collateral: 5%

12 Equal Monthly 12 Equal Monthly instalments

Repayment

instalments

PG Nil Nil

Arya Collateral Arya Collateral Warehousing

CG Warehousing Services Services Private Limited

Private Limited

Asset Classification Standard NA

Pending Compliance Nil NA

Peak Exposure: Our Peak exposure to the company shall be Rs. 20 Crore on disbursement

of proposed additional term loan of Rs. 16.25 Crores.

3) Exposure details under NBFC Industry:

Industry wise limit & exposure:

Amount

Particulars

(Rs. Crore)

NBFC Industry exposure Limit at Bank level 1250.00

Aryadhan Financial Solutions Private Limited - CAM & Annexures Page 2 of 67

Total NBFC Industry exposure at Bank level, including

1202.12

undisbursed. Excluding the repayment in the month of Mar-2023

Obligor wise Exposure, including undisbursed:

Obligor Limit Exposure

Single Obligor Limit 75.00 20.00*

Group Obligor Limit 100.00

Note: Existing exposure to Aryadhan Financial Services Private Limited is Rs. 3.75 Crores

which is proposed to be enhanced to Rs. 20 Crores with sanction of proposed additional

term loan of Rs. 16.25 Crores.

4) Key Shareholders / Partners

Type of No. of

Name % SH

Shareholder Shares

Promoter & 3056817 100.00%

Arya Collateral Warehousing Private Limited Promoter

Group

Promoter & 1 0.00%

Margapuri Prasanna Rao Promoter

Group

Total Promoter 3056818 100.00%

In addition to equity shares mentioned above, the parent company “Arya Collateral

Warehousing Private Limited” is holding 138028 numbers of Compulsory convertible non-

cumulative preference shares (CCPS) with face value of Rs. 100 each.

Shareholding of Promoter Group companies and its description are given in Annexure-

2

5) Board Members & Management Details

Board Members

Key management

Date

Yrs of

of Type of Designation / Since

Name Name associ

Appn Director when with Arya Group

ation

t

Chattanathan Mana 27.06.201

Devarajan ging 9 Chattanathan ~4

Managing Director/ Jul-19

Direc Devrajan Years

tor

Anand Direc 27.01.201 Anand ~9.5

Director/ Oct-12

Chandra tor 7 Chandra Years

Margapuri Direc 27.01.201 Margapuri ~9.5

Director/Sep-12

Prasanna Rao tor 7 Prasanna Rao Years

Aryadhan Financial Solutions Private Limited - CAM & Annexures Page 3 of 67

Kushal Nomi 03.04.201

Agrawal nee 8 Inderjeet ~4 Chief Business Officer/

Direc Singh Years Jan-19

tor

Joginder ~9 General Manager - Farm

Ralhan Years Vertica/ Dec-14

~8

Ritesh Raman Head Business/ Jul-13

Years

~2

Karthik KS Head Strategy/ Jun-21

Years

~5

Ankita Jain Credit Manager/ May-18

Years

Nisha ~3

Legal/ Sep-20

Choudhary Years

Daya Shankar ~2

Internal Audit/ Dec-21

Tapaswi Years

Currently company has 4 members board with Mr. Chattanathan Devarajan as Managing

Director and Mr. Kushal Agrawal as Independent Director.

There is no change in board of directors of Aryadhan Financial Solutions Private Limited

(AFSPL) since July-2019.

There is no director on board of Aryadhan Financial Solutions Private Limited (AFSPL)

which is on any bank board. Thus, there is no connected lending currentlyThere is no

change in board of directors of Aryadhan Financial Solutions Private Limited (AFSPL) since

July-2019.

Mr. Sandeep Katiyar moved out from the of Aryadhan Financial Services Private Limited

in October 2022 in search of better career opportunity. He was General Manager Finance

with AFSPL. Other than this, there is no major change in senior management in recent

past.

Detailed management background given at Annexure-3.

6) Company Brief profile

Pointers Details

Background of the Company Aryadhan Financial Solutions Private Limited (AFSPL)

was incorporated in Jan 2017.

AFSPL is a Non Deposit Taking NBFC (other than

Systemically important NBFC) registered with RBI as

an asset finance company and has and has its

registered office in Noida, Uttar Pradesh.

It is engaged in the business as a wholly-owned Non-

Banking Financial Company (NBFC) subsidiary of Arya

Collateral Warehousing Services Private Limited

(ACWSPL).

Aryadhan Financial Solutions Private Limited - CAM & Annexures Page 4 of 67

The company provides post-harvest commodity

financing in association with its parent which manages

more than 10,252 warehouses across the country.

AFSPL provides loans to farmers against the

commodities kept and managed at the parent’s

warehouses

Promoters Profile, Arya Collateral Warehousing Service Private Limited

Background and Past Track (ARYA) was incorporated 1982. In 2002, it forayed into

Collateral Management for management of stocks of

primarily agricultural produce. ARYA was promoted by

the J.M. Baxi Group that was established in the year

1916. M/s. J.M. Baxi & Company is India's largest and

most professional shipping and integrated end-to-end

logistics Agency offering an array of services that are

niche driven and unique in terms of customer focus,

quality, safety, technology, innovation and

professional competence.

Arya Collateral Warehousing Services Private Limited

(ACWSPL) is engaged in providing warehousing and

management of stocks primarily agricultural products.

The company offers warehousing and collateral

management, audits and surveillance, financial

inclusion and priority sector assistance, quality

certification, and assaying services. ACWSPL works

with farmers, farmer organizations, financial

institutions, agriculture corporations, development

actors, commodity exchanges, and international

players. The company’s clientele includes ADM,

Britannia, ITC Limited, Axis Bank, HDFC Bank, ICICI

Bank, Yes Bank, and RBL Bank.

ARYA was one of the first Collateral Management

Companies that was incorporated in India. ARYA was

incorporated with a Mission to deliver quality

warehousing solutions with an effective blend of

technology & business systems. The Company today

extends its expertise at various levels of the Agri

supply chain. It works extensively with Financial

Institutions and Commodity Exchanges to provide

efficient linkages to farmers and producer companies.

Target Customers for the Arya are Farmers, Farmer

Producer Organisations (FPO), Processors, Financial

Institutions, Agri Corporations, International Buyers

Aryadhan Financial Solutions Private Limited - CAM & Annexures Page 5 of 67

and Development Actors

Main products and geography It is involved in financing to Farmers, Farmer Producer

Organizations (FPO), Aggregators and Small Traders

Through Warehouse Receipt Finance (WRF) on Post-

Harvest Side.

The company is majorly into Warehouse Receipt

Financing contributing to ~95% to total AUM.

Top 6 commodities stored by Aryadhan are Paddy,

Soyabean, Maize, Wheat, Rice and Chana-Bengal Gram

Contributing to More Than 79% To AUM.

Aryadhan has operations in 14 States. ~30% of the

States Contributes to ~70% of the AUM. Top 4

contributors being Madhya Pradesh (~21%), Rajasthan

(~17%), Uttar Pradesh (16.13%) and Haryana (~12%).

Key changes if any Mr. Sandeep Katiyar moved out from the of Aryadhan

Financial Services Private Limited in October 2022 in

search of better career opportunity. He was General

Manager Finance with AFSPL.

Presently, Mr. Muktesh Pareek, Head - Finance &

Structured Product is managing his role.

Further, to strengthen the management at group

level, Ms Aprajita Saigal is appointed as group CFO in

Dec-22. She has 22+ years of work experience

including Airtel, Clix Capital, GE India, Aon Hewitt and

Deloitte Haskins and Sells. Her last role was Senior

Vice President Finance - CFO for Central Functions at

Airtel where she was responsible for driving Network

& IT strategy, performance management, cost

optimization & governance. Ms Saigal is a graduate

from Shriram College of Commerce and is a Chartered

Accountant.

Any other important update In FY23, Arya has planned to have another equity

round within and expecting infusion of $100 million in

Q1 of FY24. Out of this $50 million is planned to be

invested in Aryadhan Financial Solution Private

Limited.

Dedupe Checks No adverse comments

Detailed dedupe checks done including remarks at

Annexure-1.

Aryadhan Financial Solutions Private Limited - CAM & Annexures Page 6 of 67

7) Details of product offered by the company

Average

Average % of AUM

Name of the Average Tenor Ticket Size

Interest contribution

product (Months) (Rs. in

rate (Dec-22)

Crores)

Warehouse ~9 Months ~0.63 ~12.50% 95.08%

Receipt

Funding

FPO Funding ~4 months ~0.10 ~14.80% 0.79%

(Non

Commodity)

Bill Discounting ~9 Months ~2.25 ~10.50% 0.67%

linked with Lock in ~0.22 ~12.43% 0.33%

period that Arya

Lease Rental Collateral has with

Discounting warehouse owner

Top Up loan ~9 Months ~0.29 ~13.50% 0.09%

Note: Aryadhan Financial Solutions Private Limited has sanctioned loan of Rs. 34 cr to

Aryatech Platforms Private Limited and Loan outstanding as on 31st Dec, 2022 was

Rs.10.19 crores. (Contributing 3.05% to AUM,not included above). Aryatech Platforms

Private Limited is group company of AFSPL. Source of income of Aryatech Platform is

Collaboration fee, Storage & Handing Fee and Deferred Charges.

Detailed Products and Processes are given in Annexure-8

Exposure to TOP-20 Borrower is Rs. 121.16 Crores which is 36.21%% of total AUM of

Rs. 334.60 Crores at end of Dec-22. Details are given in Annexure-10

8) Details of equity infusion in the past:

Year Amount (Crore) Type of investor

FY 2018-19 11.48 Promoter and Promoter Group

FY 2019-20 42.00 Promoter and Promoter Group

FY 2020-21 75.01 Promoter and Promoter Group

FY 2021-22 100.00 Promoter and Promoter Group

9) Borrowing Profile:

The borrowing profile of the company is indicated in Annexure-4

Aryadhan Financial Solutions Private Limited - CAM & Annexures Page 7 of 67

9 a) A brief summary is presented as under:

Number O/S as on

%

Lender Type of December 31, 2022 ROI Range

Contribution

Lenders (Rs. in Crore)

NBFC/FI 9 141.99 10.20% to 12.55% 64.52%

Universal Bank 5 43.99 8.58% to 10.83% 19.99%

Group

1 22.00 11.53% to 11.63% 10.00%

Company

SFB 2 8.47 12.18% to 13.15% 3.85%

Multiple retail

subscribers to 3.60 11% 1.64%

NCD

Grand Total 17 220.05 100.00%

Comments: Share of Banks in the total resource profile is 43.90% including unutilised

working capital limits of Rs. 70 Crores from HSBC Bank and unutilised ODFD Limit from

Yes Bank. At outstanding level share of Banks (Universal Banks + SFB) is 23.84%.

Details about largest Lender: - Largest lender to the company is HSBC Bank with share

of 23.43% in total exposure including unutilised working capital limits. At Dec-22,

WCDL/Overdraft limit of Rs. 70 Crores sanctioned by HSBC remained un-availed. The limit

was sanctioned on 27.12.2022 at ROI of 8.58% for a tenor of 84 months. Aryadhan is in

relationship with HSBC Bank since May-2022.

At outstanding level as on Dec 31, 2022, WintWealth has highest exposure of Rs. 33.50

Crores (15.22% of total outstanding). any

The borrowing profile of the company is indicated in Annexure-4.

Aryadhan Financial Solutions Private Limited - CAM & Annexures Page 8 of 67

9 b) Details of any recent borrowings: -

Boo

Lend Sanctio ROI @ Tenor Cash

Facility Sanctio k

er n Sanctio PF (Month Collater

Type n Debt

Name Date n s) al

Rs Crs s

HSBC 27.12.20

Overdraft+WC 70.00 8.58% 84 110% Nil

Bank 22

DL

State

Bank 30.11.20 0.20

WCDL 28.00 9.65% 12 125% 5%

of 22 %

India

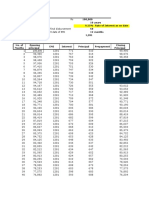

10) Financial & Operational Snapshot [Rs. crore]

FY20 FY21 FY 22 Dec-22 FY23 FY24

Particulars

(A) (A) (A) (Prov) (Proj) (Proj)

No. of States 10 13 15 14 14 14

Total staff 54 51 66 98

Disbursements 97.56 280.86 450.50 689.11

Gross Loan Portfolio 64.87 168.56 241.20 334.60 515.00 1055.01

On Balance Sheet 64.87 168.56 235.45 334.60 500.00 947.51

Managed Portfolio 0.00 0.00 5.75 0.00 15.00 107.50

Total Income 6.50 16.20 31.90 43.92 57.59 95.66

PAT -2.81 -2.24 3.95 5.61 6.61 11.68

Tangible NW 50.48 122.56 226.81 233.93 234.80 245.90

TOL 43.00 102.21 103.85 233.64 365.08 953.35

Total Assets 94.50 226.47 332.20 467.59 600.00 1200.00

Current Ratio

TOL / TNW 0.85 0.83 0.46 1.00 1.55 3.88

CRAR (%) 76.44% 65.80% 89.93% 64.89%

ROA (%) -4.44% -1.40% 1.41% 1.87% 1.42% 1.30%

GNPA In ₹ Cr 0.20 3.67 0.95 0.95

NNPA in ₹ Cr 0.18 0.35 0.00 0.00

GNPA (%) 0.31% 2.18% 0.41% 0.28%

NNPA (%) 0.28% 0.21% 0.00% 0.00%

Note: Projections are dated.

Aryadhan Financial Solutions Private Limited - CAM & Annexures Page 9 of 67

Comments:

Branch/geography expansion: - At present Aryadhan Financial Solutions Pvt Ltd is

financing only against the commodities stored in the warehouses which are under control

of Arya Collateral Warehousing Services Private Limited. These warehouses are business

point for Arya Group. Presently, the group has warehouses at 864+ locations in 14 States.

Arya Group has presence at more than 10895 warehouses to provide Storage & Logistics

Solutions, Audits & Surveillance, Procurement Facilitation, Consultation and Financing.

Portfolio growth: - Portfolio has grown by 38.72% by the end of Dec-22 when compared

with Mar-22. The company is looking for total AUM of Rs. 500 Crores to Rs. 550 Crores by

end of FY23 and 25% to 30% growth in FY24 with total AUM of around Rs. 1050 Crores to

Rs. 1100 Crores.

Profitability: The company has achieved positive PAT for the first time in FY22. PAT for

the FY 22 is at ₹3.95 Crores. The company was in losses till FY 21 due to initial years of

operation.

There was a single case of fraud/ theft against the company in Q1 of FY 22 amounting to

Rs.95 lakhs where Stock was moved out with connivance of an employee and a borrower

from the State of Gujarat (provisioned @100%). The matter is under investigation by

Police. Based on the outcome of the investigation, insurance claim shall be filed.

Aryadhan is duly covered by insurance coverage on account of theft, burglary and

employee fraud (fidelity insurance). At present, this is the only case under NPA. Whole

outstanding of Rs.0.95 Crores is provisioned for. To control and document, Arya Collateral

has started installing Cameras with Artificial Intelligence (Presently, installed at more

than 450 warehouses). These Surveillance Camera’s with AI sends alerts on Warehouse

Activities (open alert, closer alert, shutter down alert, utilization alert, etc.), Vehicle

Movement (Truck seen at site, Truck Doc in time, Truck Doc out time, etc.) and People

Movement (when warehouse is closed, inside warehouse, outside warehouse, etc.)

There was an incident of Fire in FY22 where stock worth Rs. 0.62 Crores was burnt where

recovery on sale was around Rs. 0.08 Crores and remaining Rs. 0.52 Crores is written off.

The company has filed a claim with the insurance company and on settlement of the same

income shall be booked accordingly. The claim settlement is pending since quantity and

value of commodity lost due to fire could not be finalized between the insurance company

and Aryadhan Financial Solution Pvt Ltd. Presently, Aryadhan Financial Solution Pvt Ltd

is not expecting any substantial receipt from the claim settlement.

Cost of Borrowing/ Lending Rates: At Dec-22, average borrowing rate is ~11.25% and

average processing fee paid is ~0.50% whereas average lending rate is ~12.60% and

average processing fee charged ranges between 0.80% to 1%. Profitability is on account

of adequate level of capital invested in the company.

PAR number: - The increase in PAR numbers is cyclic in Dec/Jan. Borrowers wait for

increase in prices for selling the stored commodities. Disbursements against Commodities

stored in March/ April falls due towards December/January.

AUM Reconciliation: There is mismatch of Rs. 334.84- Rs. 334.60 = Rs. 0.24 Crore in

portfolio cuts and financials. Some customer’s repayment was there in Company’s pool

balance and adjusted subsequently. This led to difference in Portfolio cuts and financials.

Aryadhan Financial Solutions Private Limited - CAM & Annexures Page 10 of 67

Projection: - The company is Targeting AUM of Rs.500-550 Crores in FY23 and Rs. 1050-

1100 Crore in FY24.

The company has projected Leverage within 4x, NNPA within 3.00% and CRAR above 20%

for at the end of FY 23 & FY 24.

In FY23, Arya has planned to have another equity round within and expecting infusion of

$100 million in Q1 of FY24. Out of this $50 million is planned to be invested in Aryadhan

Financial Solution Private Limited.

Details about group companies is given in Annexure-11

11) Disbursement Trend

Month Amount in ₹ Crores Month Amount in ₹ Crores

Oct-21 30.61 Apr-22 137.06

Nov-21 29.45 May-22 147.60

Dec-21 44.58 Jun-22 92.03

Jan-22 33.93 Jul-22 19.16

Feb-22 44.62 Aug-22 10.90

Mar-22 104.78 Sep-22 28.37

Oct-22 35.39

Nov-22 126.05

Dec-22 92.55

Jan-23 91.09

Comment: From Apr-22 to Dec-22, the company has disbursed loans amounting to Rs.

689.11 Crores. Disbursement in Jan’23 was Rs. 91.09 Crores.

Overall targeted disbursement for FY23 is of ~Rs. 850 Crores.

12) Analysis of Delinquencies

Mar- Dec- Mar- Dec- Mar- Dec-

20 20 21 21 22 22

Portfolio

64.83 98.50 168.56 142.74 241.20 334.60

O/s

PAR>0 7.36% 2.98% 3.90% 8.98% 1.07% 5.98%

PAR>30 7.24% 2.14% 1.27% 2.23% 0.95% 1.69%

PAR>90 1.02% 0.39% 0.02% 0.56% 0.02% 0.43%

PAR>180 0.94% 0.00% 0.00% 0.21% 0.00% 0.28%

Aryadhan Financial Solutions Private Limited - CAM & Annexures Page 11 of 67

Comments-

Reason for increase in delinquency: As understood, the increase in PAR numbers

is cyclic. Borrowers wait for increase in prices for selling the stored commodities.

Disbursements against Commodities stored in March/ April falls due towards

December/January.

At Jan-23, PAR>0 has come down to 5.18%.

Collection Efficiency

Curren

Curren t and Over All

Openi Mont Monthl Over Prepay

t OD collectio

ng hly y Due ment

Collect collect n

Overd Dema Collect collect Collecti

Month ion ion Efficienc

ues nd ion ion on

Efficie Efficie y

ncy C ncy

(₹ in (₹ in (₹ In /B (%) (₹ in F=(C+E H=(C+E+

(₹ in Cr)

Cr) Cr) Cr) Cr) )/B G)/B

A B C D=C/B E F G H

Apr-22 2.48 6.16 1.15 18.67% 0.61 28.57% 30.33 520.94%

198.96

May-22 6.87 3.86 2.49 64.51% 5.19 34.30 1087.56%

%

100.00

Jun-22 3.05 4.05 2.45 60.49% 1.60 53.01 1408.89%

%

Jul-22 3.04 7.44 2.24 30.11% 0.85 41.53% 42.23 609.14%

Aug-22 7.40 9.14 1.95 21.33% 3.48 59.41% 64.52 765.32%

137.54

Sep-22 11.11 8.47 3.47 40.97% 8.18 58.96 833.65%

%

Oct-22 7.93 7.97 1.76 22.13% 3.92 71.35% 74.31 1003.80%

Nov-22 10.22 11.24 4.83 42.98% 5.80 94.60% 101.06 993.29%

Dec-22 10.82 25.91 10.67 41.16% 6.07 64.58% 59.28 293.36%

118.66

Jan-23 20.00 22.77 12.72 55.84% 14.30 93.64 529.89%

%

Comments-

Overall collection efficiency is more than 100% due to high prepayments and Bullet

Repayments.

Aryadhan Financial Solutions Private Limited - CAM & Annexures Page 12 of 67

12 b) Comments on Write-offs, Restructuring and Provisioning: Rs. in Crore

31.3.20 31.03.20 31.03.20 31.03.20 30.06.20 30.09.20 31.12.20

19 20 21 22 22 22 22

Audited Audited Audited Audited Prov. Prov. Prov.

Gross

0.15 0.20 3.67 0.95 0.95 0.95 0.95

NPAs

Provisio

n for 0.01 0.02 3.32 0.95 0.95 0.95 0.95

NPAs

Net

0.13 0.18 0.35 0.00 0.00 0.00 0.00

NPAs

Gross

Advanc 27.25 64.83 168.55 230.22 477.78 357.38 334.84

es

Gross

NPAs /

Gross 0.55% 0.31% 2.18% 0.41% 0.20% 0.27% 0.28%

Advanc

es

Net

Advanc 27.24 64.81 165.23 229.27 476.83 356.43 333.89

es

Net

NPAs /

Net 0.48% 0.28% 0.21% 0.00% 0.00% 0.00% 0.00%

Advanc

es

Loan

Write 0.00 0.00 3.67 0.52 0.00 0.00 0.00

off

Comments:

There was a single case of fraud/ theft against the company in Q1 of FY 22 amounting to

Rs.95 lakhs where Stock was moved out with connivance of an employee and a borrower

from the State of Gujarat (provisioned @100%). The matter is under investigation by

Police. Based on the outcome of the investigation, insurance claim shall be filed.

Aryadhan is duly covered by insurance coverage on account of theft, burglary and

employee fraud (fidelity insurance). At present, this is the only case under NPA. Whole

outstanding of Rs.0.95 Crores is provisioned for.

There was an incident of Fire in FY22 where stock worth Rs. 0.62 Crores was burnt where

recovery on sale was around Rs. 0.08 Crores and remaining Rs. 0.52 Crores is written off

as mentioned in the table above. The company has filed a claim with the insurance

company and on settlement of the same income shall be booked accordingly.

Portfolio cuts, and PAR analysis details (Statewise, Tenorwise, etc) are annexed in

Annexure-5.

Aryadhan Financial Solutions Private Limited - CAM & Annexures Page 13 of 67

13) Comments on Overall Liquidity:

ALM: There is no negative cumulative mismatch in any of the bucket.

Cash Position: Rs. In Crore

Apr May Jun Jul Aug Sep Oct Nov Dec Jan

Particulars

-22 -22 -22 -22 -22 -22 -22 -22 -22 -23

Opening Free Cash 86. 102 74. 61. 68. 106 100 140 130 94.

in Hand/Bank (a) 22 .52 53 46 61 .44 .69 .78 .20 57

176. 131. 103 45. 70. 76. 93. 141 83. 126

Add: Inflows (b)

02 46 .49 06 75 42 19 .96 74 .44

159. 159. 116 37. 32. 82. 53. 152 119 107

Less: Outflows (c)

72 44 .56 91 93 17 10 .53 .38 .52

Closing cash in 102 74. 61. 68. 106 100 140 130 94. 113

hand/bank (a+b-c) .52 53 46 61 .44 .69 .78 .20 57 .49

The company has cash & bank balance of Rs. 113.49 Crores at the end of Jan-23 (Rs. 94.57

Crores at Dec-22). Lien marked FDs are excluded for drawing cash flow.

The company generally keeps 3-4 months of liquidity to meet Repayment (Principle +

Interest) and Opex obligations.

Presently, company has proposals of ~Rs. 100 Crores including Utkarsh Small Finance

Bank.

Detailed Cash Flow and ALM analysis given at Annexure 6.

14a) Benchmark Ratios & Interest Rate Compliance

Company’s Actual as

S. No. Benchmark Ratios Criteria

on (Dec’22)

1 CRAR Minimum 18% 64.89%

2 TOL / ATNW Maximum 6x 1.00x

3% (Max), however given the

current pandemic impact the same

3 Net NPA Nil

can be relaxed for a reasonable

period on case-to-case basis.

No cumulative negative

4 ALM Mismatch Not within 1 year bucket

mismatch within 1 year

Share of Banking

Exposure in overall

5 Minimum 15% 43.90%

Resource Profile of

the NBFC

Our Exposure /

1.60% (Existing)

6 Tangible Net Worth of Maximum 20%

8.55% (Proposed)

borrower

Aryadhan Financial Solutions Private Limited - CAM & Annexures Page 14 of 67

Statutory compliance on Interest Rate:

1 Whether ROI offered is Fixed or Floating Floating

2 Rate of Interest proposed for current loan 11.25%

3 Fixed Rate of Interest No

3 Fixed Rate of Interest - One year MCLR NA

Whether ROI offered > One year MCLR

4 NA

[Fixed ROI offered cannot be below 1 yr MCLR]

5 Floating Rate of Interest Yes

6 Whether floating ROI Linked with External Benchmark Not Applicable

7 Reset frequency – Quarterly Yes

15) Regulatory checks & Prudential Exposure Norms:

15 a) Adherence done & Prudential Exposure Norms as below:

S. No. Defined Prudential Criteria Whether

Exposure Limit Complied

1 For Single Borrower within 5% of capital funds Yes

Exposure: (Tier I and Tier II capital) OR

20% of eligible Tier I capital

2 For Group Exposure: within 7.5% of capital funds Yes

(Tier I and Tier II capital) OR

25% of eligible Tier I Capital

3 Internal limit for aggregate 10% of the overall advances Yes

exposure to all NBFCs put as on the last completed

together quarter of the current

Financial Year.

4 Internal sub-limit (within 25% of the internal limit Yes

Internal Limit): defined for aggregate

Aggregate exposure to all exposure to all NBFCs put

NBFCs, having gold loans to together

the extent of 50 per cent or

more of their total financial

assets, taken together

15 b) Adherence done with regulatory and other checks: Detailed in Annexure-7

16) Any Other Matter of Material Importance- Nil

Aryadhan Financial Solutions Private Limited - CAM & Annexures Page 15 of 67

17) Key Risks and its Mitigants (From Risk Management Dept)

Key risks and it mitigates.

# Description of Key Risk Mitigants

1 AFSPL Top 20 Borrower Exposure share Nature of product of the company is not retail

increased from ~24% to ~36% of AUM in individual loan, these are primarily business

span of Seven Months loans. More than 95% of the loans carry LTV

within 80%. The Company follows strong credit

AFSPL Top 20 Borrower Exposure as per appraisal methodology where for ticket size

last sanction as on March 31, 2022 was ₹ above 1 Crore, they will assess the case basis

56.8cr and as on December 31, 2022 it Bank Statement and Financials with other due

jumped to ₹121.2cr. Such a sharp spike diligence including reference checks. Exposure

in high ticket exposures though backed of top 20 borrowers has increased however

by collateral & of short tenor exposure average ticket size as on December is 63 lakh

do proposes concentration risk & is a key only and delinquency of the portfolio and the

concern w.r.t Asset Quality in case of any collection efficiency are also well controlled.

of such exposure goes bad.

Arya Collateral has Price Monitoring System in

place with reference to which it issues Margin

Call Letters for reduction in coverage beyond

stipulation for the particular commodity. If

margin call is not responded by way of Payment

or providing additional acceptable commodity,

liquidation takes place as per process.

The company is focusing on warehouse receipt

funding being in sync with business of Parent

Company and financing on commodities stored

in professional warehouses under the control of

Arya Collateral only.

2 AFSPL resource profile comprises of Share of bank share increased from 14% in April

low share from Banking Channel 22 to 24% (At outstanding level share of Banks)

as of December 2022. Share of Banks in the

AFSPL over all borrowings as on total resource profile is 43.90% including

December 31, 2022, was ₹220.1cr and unutilized working capital limits of Rs. 70

Bank’s share in the total borrowings was Crores from HSBC Bank and unutilized ODFD

only 24% which is on a lower side and Limit from Yes Bank.

thus the cost of fund for AFSPL is

relatively higher. Latest sanction from HSBC in Dec-22 is at ROI of

8.58% and SBI in Nov-22 is at ROI of 9.65%.

Going forward, with the increase in vintage of

the operations, the company’s funding from

banks is presumed to be increased with

reduction in rates (as can be seen from the

trend mentioned above).

Presently, the company has proposal of around

Rs. 100 crores from banks including our bank in

advanced stage of sanction process.

Aryadhan Financial Solutions Private Limited - CAM & Annexures Page 16 of 67

3 AFSPL profitability in higher interest There is regular improvement in bank

rate regime highly susceptible borrowing, recently company has got the

sanction of Rs. 70.00 Crores from HSBC @ 8.58%

AFSPL average borrowing rate is ~11.25% of ROI and SBI has sanctioned@ 9.65%. Going

and average processing fee paid is forward with the increase in vintage of the

~0.50% whereas average lending rate is company, cost of funds is presumed to be

~12.60% and average processing fee decreased by way of borrowing from banks as

charged ranges between 0.80% to 1%. well as NBFCs where company is planning to

Profitability is on account of adequate add more from banking channel.

level of capital invested in the company.

Parent Company’s support in liquidity

AFSPL operational profitability would be management by way of regular fund infusion

under pressure in case of rising cost of has also given lenders additional comfort in its

fund regime & AFSPL inability to pass on risk management.

higher cost to its clients.

In the increasing regime of interest rates, peers

will also increase the interest rates. Aryadhan

Financial Solution Pvt Ltd has additional

comfort of funds in places without any cost

(funds from Arya Collateral). Further, Arya

Group is providing multiple integrated services

which increases stickiness of its clients.

4 AFSPL operational track record AFSPL is a 100% subsidiary of Arya Collateral.

limited. Aryadhan financing on commodities stored in

warehouses under the control of Arya

AFSPL started operations in FY19 only Collateral. The business model is such to

thus the operational track record is of provide integrated services under the roof of

only three years. This limitation added Arya Collateral. Arya Group has diversified in

with 100% dependency on the holding

terms of range of services provided by it

company for business growth, is a key

(Storage, Logistics, Audits & Surveillance,

concern going forward as AFSPL needs to

diversify its operations with other Procurement Facilitation, Consultancy, Stock

Warehouse Business Owners and with Certification, Buyer/ Supplier Collaboration,

more seasoning the real operational Financing, etc.) As informed by the

effectiveness will be exhibited by AFSPL. management as of now company does not

intend to diversify its operations with other

warehouse business owners.

NBFC Compliance Checklist as per ALCO approval:

# Description Reverts

1 Bank may avoid financing to the NBFC As per the best of our knowledge and visits

where there is doubt on end use of funds done along with credit team, we could not

find any misuse of funds borrowed for on

lending. In addition, we also use to obtain

end use certificate within the specified

utilization time with tagged receivable list

of clients certified by an external

Chartered Accountant (as per the

sanctioned terms and conditions). Apart

Aryadhan Financial Solutions Private Limited - CAM & Annexures Page 17 of 67

from this we also take book debts

certificate from management/CA certified

by on quarterly basis.

2 Bank may avoid financing to any NBFC The Company uses the funds for the

where part of the investments are not purpose as specified in sanction letter.

related to their regular business area. It Hence, there is no diversion of funds known

provides some signal of diversion of fund to us as per our records checked through

balance sheet of the company.

3 Bank needs to be more careful where

structure of the NBFC is more complex in As per the best of our knowledge the

terms of group company or related Company has not a complex structure.

company

4 Bank needs to be more careful in The Company is in comfortable position.

financing to any NBFC with rating of ‘BBB- Current rating of the Company is BBB- from

‘ as further small stress in the CRISIL, however company has sufficient

company/sector may lead to rating capital base, experienced senior

downgrade to non-investment grade management and strong board to manage

rating. the growth.

5 Bank need to be more watchful if any No such case, as the Company is growing

NBFC is reporting abnormal growth as carefully without any process lapse and

same may result into lapse in processes, compromising in asset quality. During our

compromising in asset quality and other pre-sanctioning visit with Credit team no

audit related issues. such instances were found.

6 NBFCs with no Asset Liability mismatch or As per the data provided by the company,

positive Asset Liability mismatch for the the Company is in comfortable ALM position

various time buckets should be preferred with no negative cumulative mismatch in

from financing point of view. any of the buckets.

7 Bank should prefer NBFCs where share of As on 31st December 2022 the company has

Bank funding is higher than share of total borrowing outstanding of ₹220.05

financing from NBFCs. As in the current crore out of which borrowing from Bank is

liquidity crunch, many of the corporate Rs. 24% at outstanding level, however it is

lending NBFCs will significantly slow down 44% including unutilized working capital

their funding to relatively smaller NBFCs. limits.

Hence NBFCs dependent on other NBFCs

for financing may lead to not able to

renew the facility.

Risk rating (Based on Revised Internal Rating Tool vetted by CRISIL research)

Name of Client M/s. Aryadhan Financial Solutions Private Limited

External Rating CRISIL BBB- (Positive)

Industry and Asset Class Risk 99%

Market Positioning 42%

Earning Quality 63%

Aryadhan Financial Solutions Private Limited - CAM & Annexures Page 18 of 67

Asset Quality 64%

Capital Strength 78%

Liquidity 79%

Management & Others 60%

Overall Score 67%

Explanation Fair

Nature of Case Moderate Safety

Internal Rating USFB 4

RAROC:

Benchmark Rate Actual Rate Deviation if any

Interest Rate based on 11.25% 11.25% No

RAROC

Interest rate benchmark 10.39%

as per Rate Matrix

Conclusion:

Aryadhan Financial Solutions Private Limited (AFSPL) is an existing client of the Bank with

w.e.f. May 2022. AFSPL open Term Loans as on date has the current outstanding as on

February 28, 2023, is ~₹3.75cr. The repayment record as on date is good with no delay of

a single day in schedule repayment. Major strengths of AFSPL are: -

a) The management team reflects an adequate level of depth of experience and

capability in the business of collateral management and warehousing of

agricultural produce. Aryadhan gets synergistic benefit from its parent company,

Arya Warehousing, in financing against agricultural collateral business.

b) AFSPL Net worth stood at ₹233.93cr as on December 31, 2022. AFSPL is having a

CRAR of ~65% as of December 31, 2022, which is way above the regulatory

requirement. Overall gearing is at 1x.

c) AFSPL GNPA- 90+DPD (including w/o) as per December 31, 2022, number is 0.43%

of AUM which is at comfortable level.

d) AFSPL had a Cash & Cash Equivalents Balance of ~ ₹95 Crores as on December 31,

2022. The company generally keeps liquidity to meet 3-4 months Debt repayment

and Opex obligations. ALM statement as of December 31, 2022, reflects no

cumulative negative mismatch in any of the buckets.

AFSPL is externally rated by CRISIL BBB- with Positive outlook. The Internal Rating of

AFSPL is USFB 4.

The key risks as highlighted above and given the justified remarks on the same. Risk

management supports for Enhancement in Term Loan for ₹16.25cr to AFSPL with

door-to-door tenor of 12 months, subject to following covenants:

Based on RBI recent instruction of not reckoning External Rating of Rating

Agencies if it is not disclosed, we should also add a penal clause and charge

Aryadhan Financial Solutions Private Limited - CAM & Annexures Page 19 of 67

extra interest if the same is not complied by the Company through ECRAs

within an agreeable period.

The overall (WSL + Treasury) NBFC industry exposure at Bank level with this

disbursement should not cross ₹ 1250 cr.

18) Justification, Deviation, Delegation & Recommendation (From Credit Dept): -

Justification for the Proposal –

Experienced Promoters and Senior Mangement

Availability of effective liquidation mechanism

Comfortable liquidity position

Operational linkages, synergies and financial support from the parent. Arya

Warehousing also keeps track of commodity prices and ensures Aryadhan sends

margin call notices to the borrowers

Adequate capital position, supported by regular equity infusion

Delegation for the Proposal –

As per the Credit Approval Authorization Matrix (approved by the Board of the Bank in the

Board meeting held on Sep. 17, 2022 and vide circular no. USFB/CIR/CREDIT/2022-

23/07/115 dated Oct. 10, 2022), the delegation of powers vested with Senior Management

Credit Committee (SMCC) of the Bank for lending to Wholesale Corporates are upto ₹20.00

Crore to Borrowers with external rating below “A-“ or “Unrated” and upto ₹30.00 Crore

to Borrowers with external rating “A- & above“ and upto ₹40.00 Crore to Group with

external rating “A- & above”.

Given the proposed Exposure is of ₹20 Crores (existing + Proposed) and minimum external

rating of “BBB-” rated by CRISIL, present proposal falls under the purview of SMCC.

Accordingly, proposal is presented to SMCC for its approval.

Recommendation

Aryadhan Financial Solutions Private Limited is engaged in providing warehousing receipt

financing for the commodities stored under the control of its parent company Arya

Collateral Warehousing Services Private Limited. Aryadhan was incorporated in 2017

however it has expertise of above 2 decades through its parent company under whose

flagship it is into lending business. Arya Collateral is engaged in providing warehousing

and management of stocks primarily agricultural products. The company offers

warehousing and collateral management, audits and surveillance, financial inclusion and

priority sector assistance, quality certification, and assaying services. ACWSPL works with

farmers, farmer organizations, financial institutions, agriculture corporations,

development actors, commodity exchanges, and international players. The company’s

clientele includes ADM, Britannia, ITC Limited, Axis Bank, HDFC Bank, ICICI Bank, Yes

Bank, and RBL Bank.

Aryadhan Financial Solutions Private Limited - CAM & Annexures Page 20 of 67

Based on operations in 14 states, existing clientele, comfortable capital profile, scope for

deepening WRF Funding, availability of effective liquidation mechanism and comfortable

liquidity position; Additional Term loan of ₹16.25 Crores is being recommended.

Meeting at Borrower’s Corporate office at Noida, Uttar Pradesh was held on Mar 03, 2023.

The meeting was physically attended by Mr. Arjitkumar Manbahadur Singh (Credit Analyst,

Wholesale Banking) and Mr. Chandrasekhar Mahto (Relationship Manager- Wholesale

Banking-NBFC).

SMCC’s approval is being sought for the sanction as per terms and conditions detailed in

the Appendix to this note and summarized as below:

Detailed in the Appendix.

Recommended by:

Kanak Baid

(Credit Analyst, WSL Credit)

Kamal Amarlal Kapoor Mohit Wahi

(Head, Credit – Wholesale Lending) (Business Head, WSL – NBFC)

Aryadhan Financial Solutions Private Limited - CAM & Annexures Page 21 of 67

Final Loan Term Sheet

Amount Rs. 16.25 Crore

Nature Term Loan

Tenor 12 Months

Repayment Monthly

Frequency

Principal 12 Monthly

Interest 1st working day on subsequent month

Interest Rate 11.25% Floating with Quarterly Reset (364 days T Bill Rate, 6.97%

+ 4.28% spread)

Processing Fee 0.25% plus applicable taxes (Upfront)

Documentation Rs 15,000 plus applicable taxes (Upfront)

Charges

Monitoring Rs 15,000 plus applicable taxes (Annually)

Charges

Primary Security Primary: 1.10 x of Receivables. First and exclusive charge on Book

Debts/Loan assets of the Company to the extent of 110% of the

exposure created out of Utkarsh Small Finance Bank Ltd funding.

Cash Collateral 5% of the Loan Amount sanctioned in the form of FDR duly marked

lien in favour of Utkarsh Small Finance Bank till the entire tenor

of the loan (to be obtained before disbursement of the loan).

Personal Nil

Guarantee

Corporate Arya Collateral Warehousing Services Private Limited

Guarantee

Facility Purpose Onward lending in normal course of business

Source of Clients Repayment

Repayment

Date:

Place: VARANASI

Aryadhan Financial Solutions Private Limited - CAM & Annexures Page 22 of 67

Contents

Appendix Terms and Conditions

Annexure -1 Dedupe Checks

Annexure -2 Shareholding of Promoter Group companies and its description

Annexure- 3 Management background

Annexure- 4 Borrowing Profile

Annexure- 5 Portfolio cuts and PAR analysis

Annexure-6 ALM and Cash Flow analysis

Annexure-7 Adherence done with regulatory checks

Annexure-8 Products and Processes

Annexure-9 External Rating

Annexure-10 TOP 20 Borrowers

Annexure-11 Details of Group Companies

Aryadhan Financial Solutions Private Limited - CAM & Annexures Page 23 of 67

Appendix

Terms and Conditions:

A) Facility Term Loan

1 Limit ₹16.25 Crore

2 Currency ₹

For onward lending in the normal course of business

3 Purpose The funds cannot be utilized for onward lending or Capital Infusion

into any subsidiary or associate Company / associate NBFC.

4 Tenor of the loan 12 months

Primary: 1.10 x of Receivables. First and exclusive charge on Book

5 Security Debts/Loan assets of the Company to the extent of 110% of the

exposure created out of Utkarsh Small Finance Bank Ltd funding.

5% of the Loan Amount sanctioned in the form of FDR duly marked lien

6 Cash Collateral in favour of Utkarsh Small Finance Bank till the entire tenor of the

loan (to be obtained before disbursement of the loan).

11.25% Floating with Quarterly Reset (364 days T Bill Rate, 6.97% +

7 Rate of Interest

4.28% spread)

8 Processing fees 0.25% plus applicable taxes (Upfront)

Documentation

9 ₹ 15000 plus applicable taxes

Charges

Annual Monitoring

10 ₹ 15000 plus applicable taxes

Visit Charges

Personal Nil

11

Guarantee

Corporate Arya Collateral Warehousing Services Private Limited

12

Guarantee

Subsequent to each disbursement, the borrower shall submit list of

beneficiaries, amount of loan and purpose of loan utilization, signed

by a Chartered Accountant, within 60 days from the loan disbursement

date.

13 Draw down / Disbursement of loan is subject to:

(a) Tranche

Utkarsh Small Finance Bank Ltd being satisfied regarding the

financial performance, portfolio quality, recovery rate, utilization

of loan etc.

The borrower fulfilling all the obligations, as stipulated by RBI

applicable to NBFCs

13

Utilisation Period 30 days

(b)

The Loan shall be repaid in 12 Monthly Principal & Interest

instalments.

The repayments made shall be appropriated in the following order

a) Firstly, towards interest including additional interest payable

Tenor/Repayment under the loan agreement.

14

schedule b) Secondly, towards further interest and liquidated damages on

defaulted amounts

c) Thirdly, towards penalty on prepayment

d) Fourthly, towards repayment of instalment of principal due and

payable under this agreement

Aryadhan Financial Solutions Private Limited - CAM & Annexures Page 24 of 67

The borrower shall remit the repayment amount as per repayment

schedule of this agreement in the designated account of Utkarsh Small

Mode of Finance Bank Limited or shall provide a Debit Mandate/NACH from

15

Repayment their CC/OD accounts maintained with the Bank that has 10 per cent

or more of the exposure of the banking system of the borrower as per

guidelines Reverse Bank of India.

Interest payment Interest would be payable monthly, on the first working day of

16

frequency subsequent month, starting from the month of draw down.

Interest

17 Interest will be calculated on 365 days basis

calculation

If the Borrower wishes to prepay the facility amount, it may do so with

payment of Prepayment Premium of 2.0% on principal amount of the

loan prepaid The borrower will have to give advance written notice of

18 Prepayment 60 days, disclosing intention for foreclosure/ prepayment and the

source for the money for such foreclosure/ prepayment. The Lender

shall be entitled to reject any notice which is not given in advance of

60 days

Pre-commitment

19 Not Applicable

Conditions

i) The Company shall not invest / lend/extend advances to group or

subsidiary companies without written approval of the Bank.

ii) The borrower undertakes that the proposed term loan will be

covered under the rating with existing credit rating agency (CRISIL)

and same will be provided within period of 90 days from date of

disbursement to Utkarsh Small Finance Bank Ltd (USFBL).

iii) The borrower shall not issue corporate guarantee on behalf of its

group/sister concerns without prior written approval of Utkarsh

Small Finance Bank Ltd.

iv) Subsequent to each disbursement, the borrower shall submit list of

beneficiaries, amount of loan and purpose of loan utilization, duly

certified by a Chartered Accountant, within 60 days from the loan

20 Special Conditions

disbursement date

v) If the Bank finds that the profitability, the cash flow, and other

circumstances so warrant, the Bank may, on prior intimation to the

borrower, advise the borrower to prepay the loan on dates earlier

than the dates set out in the repayment schedule and also to

increase the repayment instalment amount.

vi) Utkarsh Small Finance Bank Ltd shall have the right to recall the

entire loan if it is not satisfied with the proper end use of funds or

the borrower commits default in payment of instalment towards

principal and/or interest on due date(s) or in the event of breach

or violation of any terms and conditions of the loan agreement

vii) The borrower shall agree to carry out the lending operations with

due diligence and efficiency, sound business practices and in

Aryadhan Financial Solutions Private Limited - CAM & Annexures Page 25 of 67

accordance with the code of conduct stipulated by Reserve Bank

of India (RBI) for Non-Banking Finance Companies (NBFC)

viii) All case of frauds/defalcation shall be reported forthwith to

Utkarsh Small Finance Bank Ltd with action taken/proposed report

ix) The company shall not invest/lend/extend advances to group or

subsidiaries companies without prior written approval of Utkarsh

Small Finance Bank Ltd.

x) The borrower shall not issue corporate guarantee on behalf of its

group/sister concerns without prior written approval of Utkarsh

Small Finance Bank Ltd.

xi) In the event of default committed by the company in complying

with the provisions of the Loan Agreement to be entered into by

the company for availing the present facility, the same shall be

deemed to be a default committed by the company under any Loan

Agreement / Facility Agreement entered into by the company for

availing any other facility / facilities.

xii) In the event of default committed by the company under any Loan

Agreement / Facility Agreement entered into by the company for

availing any other facility / facilities, the same shall be deemed to

be a default committed by the company under the provisions of

the Loan Agreement to be entered into by the company for availing

the present facility.

xiii) The facility either in part or full will not be used for investment

in Capital market, land acquisition, acquiring equity shares of

Indian company/ies, buyback of shares of Indian company or any

other purpose, which is prohibited or any illegal activity.

xiv) Utkarsh Small Finance Bank Ltd reserves the right to stipulate

such additional conditions at its sole discretion prior to the

disbursement of its above-mentioned committed amount.

xv) Utkarsh Small Finance Bank Ltd shall have right to sell, assign,

transfer or otherwise dispose of or any part of the rupee term loan

at any time.

xvi) The company shall furnish a certificate from a Chartered

Accountant regarding the utilization of fund / book debts within

60 days from the date of disbursement of each tranche of the Term

loan.

xvii) The loan sanction letter would be valid for 30 days from the

date of issue, within which the Company would be required to send

their acceptance of the sanction letter, as a token of their

acceptance of the stipulated terms/conditions with the duly

completed documentation.

Aryadhan Financial Solutions Private Limited - CAM & Annexures Page 26 of 67

xviii) M/s Aryadhan Financial Solutions Private Limited shall submit

quarterly reports on book debts duly certified by the practicing

Chartered Accountant/Chartered Accountant Firm. Any loan with

overdue of 90 days plus would be replaced by the customer with

fresh pool of 0 DPD. The borrower will share this certificate in

totality mentioning name and respective margin of the all other

lenders.

xix) Irrevocable Power of attorney in favour of Utkarsh Small

Finance Bank Ltd. to recover Book Debts directly from the

borrower and to create mortgage in favour of Utkarsh Small

Finance Bank Ltd. in the event of default by the Company

xx) At the time of sanction, the borrower shall provide a declaration

regarding their Unhedged Foreign Currency Exposure (UFCE). The

borrower shall subsequently provide such exposure certificates at

quarterly intervals within 45 days from the close of each quarter,

on self-certification basis. However, at least on an annual basis,

the borrower shall provide the certificate regarding UFCE, duly

certified by their statutory auditors prior to October 31st of every

year for the preceding financial year or declaration on UFCE has to

be mentioned in Audited Financial Statement.

xxi) The borrower would obtain Legal Entity Identifier (LEI)

registration within the stipulated timeline, as prescribed by the

Reserve Bank of India.

xxii) The Bank shall recover principal and interest, as and when due

from the borrower in the designated account of Utkarsh Small

Finance Bank Limited or shall provide a Debit Mandate/ NACH from

their CC/OD accounts maintained with the Bank that has 10

percent or more of the exposure of the banking system of the

borrower as per guidelines of Reserve Bank of India.

xxiii) The Borrower shall provide required approval to USBFL to

access its data from any Credit Information Company (CIC) in order

to ascertain the performance of its portfolio.

xxiv) Compliance with specific environmental & social management

conditions: Borrower confirms that:

Borrower shall not utilize funds borrowed from USFBL in providing

loans, funding or other support to Clients engaged in any of the

activities mentioned in the below activities

- Production or trade in any product or activity deemed illegal under

host country laws or regulations or international conventions and

agreements, or subject to international bans such as

pharmaceuticals, pesticides / herbicides, ozone depleting

substances, PCB’s, wildlife or product regulated under CITES.

- Production or trade in weapons and munitions.

Aryadhan Financial Solutions Private Limited - CAM & Annexures Page 27 of 67

- Production or trade in alcoholic beverages (excluding beer and

wine) This does not apply to project sponsors who are not

substantially involved in these activities. “Not substantially

involved” means that the activity concerned is ancillary to a

project sponsor’s primary operations.

- Production or trade in tobacco.

- Gambling, casinos and equivalent enterprises.

- Pornography

- Production or trade in radioactive materials. This does not apply

to the purchase of medical equipment quality control

Measurement) equipment and any equipment which the company

considers the radioactive source to be trivial and/ or adequately

shielded.

- Production or trade in unbonded asbestos fibers. This does not

apply to purchase and use of bonded asbestos cement sheeting

where the asbestos contend is less than twenty percent. (20%)

- Drift net fishing in the marine environment using nets in excess of

2.5 KM in length.

- Production or activities involving harmful or exploitative forms of

forced labour/harmful child labour. Forced labour means all work

or service, not voluntarily performed, that is extracted from an

individual under threat of force or penalty. Harmful child labour

means the employment of children that is economically exploitive,

or is likely to be hazardous to, to interfere with, the child’s

education, or to be harmful to the child’s health, or physical,

mental, spiritual, moral or social development.

- Production, trade, storage, or transport of significant volumes of

hazardous chemicals, or commercial scale usage of hazardous

chemicals. Hazardous chemicals include gasoline, kerosene, and

other petroleum products.

- Production or activities that impinge on the lands owned, or

claimed under adjudication, by indigenous peoples, without full

documented consent of such peoples.

- Prostitution.

xxv) The borrower undertakes that the proposed loan is not

extended for any activities undertaken by borrower which are not

eligible for bank credit as below:

a) Bills discounted / rediscounted by NBFCs, except for rediscounting

of bills discounted by NBFCs arising from sale of –

- commercial vehicles (including light commercial vehicles), and

- two-wheeler and three wheeler vehicles, subject to the following

conditions:

- the bills should have been drawn by the manufacturer on dealers

only;

- the bills should represent genuine sale transactions as may be

ascertained from the chassis / engine number; and

- before rediscounting the bills, banks should satisfy themselves

about the bona fides and track record of NBFCs which have

discounted the bills.

Aryadhan Financial Solutions Private Limited - CAM & Annexures Page 28 of 67

b) Investments of NBFCs both of current and long-term nature, in any

company / entity by way of shares, debentures, etc. However,

Stock Broking Companies may be provided need-based credit

against shares and debentures held by them as stock-in-trade.

c) Unsecured loans / inter-corporate deposits by NBFCs to / in any

company.

d) All types of loans and advances by NBFCs to their subsidiaries,

group companies / entities.

e) Finance to NBFCs for further lending to individuals for subscribing

to Initial Public Offerings (IPOs) and for purchase of shares from

secondary market.

Operational terms and conditions

The term loan facility are available for a period of 12 months

subject to review at periodical intervals wherein the facility may

Period of sanction

be continued/cancelled/reduced depending upon the conduct and

utilization of the facilities.

Inspection will be conducted at half yearly intervals by the Bank’s

functionaries. Inspections, if required will also be conducted by

Inspection

the Bank’s concurrent auditors or statutory auditors or officials of

RBI or any other re-financing agency

Provisional: within three months from the close of the accounting

Audited/unaudited year and within period of 60 days from end of each quarter.

financial Audited: within six months from the close of the accounting year

statements or within 15 days from filing with the regulator whichever is

earlier.

The Company shall create security stipulated by the Bank in a

Creation of form and manner satisfactory to the Bank prior to disbursement

charges and shall file particulars of charges with the Registrar of

Companies as prescribed by law.

i) Interest payable to unsecured lenders will be subservient to the

interest payable to Utkarsh Small Finance Bank Ltd.

ii) Company shall ensure that a minimum CRAR as per regulations

is maintained during currency of the loan.

iii) The company shall pay penal interest Default Interest Rate at

2% over the Documented Rate, which shall be levied from the

date of default of any of the covenants noted as under till the

date of compliance

Special Conditions

iv) The Bank reserves the unconditional right to cancel the

outstanding un-drawn commitments advanced/ to be advanced

under the CAL and/ or transaction documents (either fully or

partially) without giving any prior notice to the Borrower, on

the occurrence of any one or more of the following:

i. In case the overall limits/part of the overall limits are not

utilized by the borrower; or

ii. In case of deterioration in the creditworthiness of the

borrower in any manner whatsoever; or

Aryadhan Financial Solutions Private Limited - CAM & Annexures Page 29 of 67

iii. In case of non-compliance of the terms and conditions of

the transaction documents and/or CAL.

v) For the purpose of this clause, ‘deterioration in the

creditworthiness’ shall mean and include without limitation,

the following events:

a) downgrade of the rating of the borrower by a credit rating

agency;

b) inclusion of the borrower and/or any of its directors in the

Reserve Bank of India’s wilful defaulters list;

c) closure of a significant portion of the borrower’s operating

capacity;

d) any adverse comment from the auditor; and

e) any other reason/ event in the opinion of the Bank

constituting or which may constitute deterioration in the

creditworthiness

vi) The Borrower shall provide all information as may be

required by the Bank/ Lender from time to time in relation

to its foreign currency exposures and hedging details in

relation thereto.

vii) In the event of any change in applicable laws/ regulations

(including regulatory/statutory requirements pertaining to

provisioning norms and/or risk weightage), the Bank/

Lender shall have the right to recover the cost, in any

manner that it deems fit, including by way of revision in

spread/applicable rate.

viii) The Borrower will keep the Bank advised of any

circumstances adversely affecting their financial position

including any action taken by any creditor, Government

authority against them.

ix) The borrower will furnish information/documents including

quarterly/annual financial accounts as may be required by

the Bank for review of credit facility now sanctioned.

x) The borrower shall pay the charges to the Bank as per the

Banks standard schedule of charges for various services

rendered by the Bank.

xi) The Bank may at its sole discretion disclose such information

to such institution(s) / bank in connection with the credit

facilities granted to the borrower if requested by them.

xii) Loans to directors/ associates and other related entities

shall be made only with our prior consent in writing.

xiii) The borrower shall adhere to any other covenants stipulated

by the Bank from time to time.

Aryadhan Financial Solutions Private Limited - CAM & Annexures Page 30 of 67

xiv) The Bank will have the right to examine at all times, the

borrower’s books of accounts and to have the its offices/

sites inspected from time to time by officer(s) of the bank

and / or qualified auditors and / or technical experts and /

or management consultants of the Bank’s choice. Cost of

such inspection shall be borne by the borrower.

xv) The borrower shall not make any drastic change in its

management set up without the permission of the Bank.

xvi) Any other terms and conditions, which are not specifically

covered herein but stipulated in the sanction, should be

strictly complied with, including those stipulated by

other banks, if any, under multiple banking

arrangements.

xvii) The Bank will be free to suitably modify the terms and

conditions detailed above whenever considered necessary.

This will be done in consultation with the borrower.

xviii) The Bank reserves the right to discontinue the facility and

to withhold/stop any disbursement without giving any notice

in case of non-compliance/breach of any terms and

conditions stipulated herein and from time to time as also

in the relevant documents or any information/particulars

furnished to us is found to be incorrect or in case of any

development or situations in the opinion of the bank, its

interest will be/is likely to be prejudicially affected by such

continuation or disbursement.

xix) The borrower not to pay any consideration by way of

commission, brokerage, fees or any other form to guarantors

directly or indirectly.

xx) The Borrower and Guarantor(s) shall be deemed to have

given their express consent to the Bank to disclose the

information and data furnished by them to the Bank and also

those regarding the credit facility/ies to the Credit

Information Bureau (India) Ltd. (“CIBIL”), upon signing the

copy of the sanction letter. The Borrower and Guarantor(s)

further agree that they shall further execute such additional

documents as may be necessary for this purpose.

xxi) In the event of the borrower committing default in the

repayment of term loan instalments or payment of interest

on due dates, Utkarsh Small Finance Bank Ltd. shall have an

unqualified right to disclose the names of the Borrower and

its directors to the Reserve Bank of India (RBI). The borrower

Aryadhan Financial Solutions Private Limited - CAM & Annexures Page 31 of 67

shall give its consent to Utkarsh Small Finance Bank Ltd. and

/ or to RBI to publish its name and the names of its directors

as defaulters in such manner and through such medium as

Utkarsh Small Finance Bank Ltd. in their absolute discretion

may think fit. The aforesaid right shall be available to

Utkarsh Small Finance Bank Ltd. in addition to and not in

derogation of any other rights available under the Loan

Agreement or the General Conditions, as the case may be.

xxii) The Credit facilities granted will be subject to RBI guidelines

/ Bank’s policies from time to time.

xxiii) Company should not induct a person who is a director on the

Board of a Firm/Company, which has been identified as a

wilful defaulter. In case such a person is found to be on the

board of the Company, it would take expeditious and

effective steps for removal of the person from its Board.

xxiv) This sanction does not vest with the Borrower any right to

claim any damages against the Bank for any reason

whatsoever.

xxv) Confirmation to be submitted by the Borrower that the

amount of drawdown to be availed from USFB from time to

time (multiple tranche drawdown) will remain

unencumbered till the loan is fully deployed by us within

stipulated timeline and appropriate charge on the

underlying receivables pool in created in favour of USFB (30-

60 days) as per sanction terms.

xxvi) Confirmation to be submitted by the Borrower that the loan

to be availed from USFB by borrower will not be

released/provided to any Associate / Subsidiary company

(Equity / Investment / Unsecured loan / Fixed Asset creation

or any other form) during the tenor of loan.

xxvii) Confirmation to be submitted by the Borrower that without

prior written approval from USFB, borrower will not

establish/ form any new associate / subsidiary company

during the tenor of loan.

xxviii) The undertaking from the Borrower Company M/s

Aryadhan Financial Solutions Private Limited stating that

the end utilization of the funds from the loan proceeds

shall be used for the onward lending in the normal course

of business. The Borrower Company shall not utilize the

funds for onward lending to the subsidiary / associate

company in any form or manner and submit the written

undertaking to this confirmation prior to disbursement.

Aryadhan Financial Solutions Private Limited - CAM & Annexures Page 32 of 67

xxix) Declaration from M/s Aryadhan Financial Solutions Private

Limited on Multiple Banking Arrangement and Credit

Facilities being availed as per Annexure-1 of RBI Circular-

RBI/2008-2009/354 UBD.PCBNo. 36/13.05.000/2008-09

dated January 21, 2009

Default Rates-Penal Interest

Facility

Sl. / Nature Proposed default interest rate

Reckoning of default interest

No of (p. a.) payable monthly

Default

Penal In case of any default / delay in the Penal Interest @ 2% P.A. shall be

Interest repayment of principal instalments or charged on the outstanding

1. payment of interest, charges or both amount for the defaulted /

or other monies due on the facility. delayed period (calculated from

due date till the date of payment).

Penal Non-Submission or Delayed Penal Interest @ 2% P.A. shall be

interest submission of Book Debts / charged on the outstanding

Receivables Hypothecated to USFB amount for the defaulted /

2.

within 45 days from end of the delayed period (calculated from

quarter starting post the date of LUC due date till the date of

submission submission).

Penal Delay in submission of audited Penal Interest @ 2% P.A. shall be

interest financials as on 31st March of every charged on the outstanding

year amount post 30 days from the due

date allowed as per regulatory

3.

timelines for audited financials for

the defaulted / delayed period

(calculated from due date till the

date of submission).

Penal GNPA > 3% in any quarter (Half yearly Penal Interest @ 2% over and above

4.

interest testing ~ Mar & Sep) the documented rate shall be

Penal Capital Adequacy Ratio < 20% (to be charged on the outstanding

5. interest tested based on half yearly numbers – amount from the date of default of

March & Sep) any of these covenants till the

Penal Leverage of the Company (Total date of compliance.

interest Outside Liabilities/TNW, including

CCPS) > 3x shall be reckoned after

6. adjustment for contingent liabilities

and investment in subsidiaries. (to be

tested based half yearly numbers –

March & Sep).

7. Increase External Rating falls by one notch Rate of Interest shall be increased

in Rate from existing rating “BBB-“ from by 2% p.a. over and above the

of CRISIL Ratings. documented rate on the

Interest outstanding amount in case of

breach in rating covenant.

Covenant mentioned in clause 1 will be tested as and when repayments due. Covenant

mentioned in clause 2 and clause 4 will be tested on quarterly basis. Covenant mentioned

in clause 3, 5 & 6 will be tested on yearly basis and covenant mentioned in clause 7 will

be tested as and when next rating done.

Aryadhan Financial Solutions Private Limited - CAM & Annexures Page 33 of 67

Annexure-1 Dedupe Checks

CIBIL Checks

CIBIL CIBIL Report Delinquencies, if

Name of Company/Directors Remarks

Score Date any

ARYADHAN FINANCIAL SOLUTIONS Nil

NA 10.03.2023 -

PRIVATE LIMITED

ARYA COLLATERAL WAREHOUSING CMR- 10.03.2023 Nil -

SERVICES PRIVATE LIMITED 1

ARYADHAN FOUNDATION FOR 10.03.2023 Nil

NA -

EQUITABLE AGRICULTURE

ARYATECH PLATFORMS PRIVATE 10.03.2023 Nil

NA

LIMITED

ANAND CHANDRA 796 10.03.2023 Nil -

DEVARAJAN CHATTANATHAN 805 10.03.2023 Nil -

MARGAPURI PRASANNA RAO 790 10.03.2023 Nil -

NA- Not Available

Other Due Diligence:

Due Diligence Date of Remarks

Check

CRILC ARYADHAN FINANCIAL SOLUTIONS 10.03.2023 Reported Standard by lending banks. No

PRIVATE LIMITED adverse observation.

ARYA COLLATERAL 10.03.2023 Reported Standard by lending banks. No

WAREHOUSING SERVICES PRIVATE adverse observation.

LIMITED

ARYADHAN FOUNDATION FOR 10.03.2023 No match found

EQUITABLE AGRICULTURE

ARYATECH PLATFORMS PRIVATE 10.03.2023 Reported Standard by lending banks. No

LIMITED adverse observation.

ANAND CHANDRA 10.03.2023 No match found

DEVARAJAN CHATTANATHAN 10.03.2023 Reported Standard by lending bank (ICICI).

No adverse findings.

MARGAPURI PRASANNA RAO 10.03.2023 No match found

KUSHAL AGRAWAL 10.03.2023 No match found

CFR ARYADHAN FINANCIAL SOLUTIONS 10.03.2023 No match found

PRIVATE LIMITED

ARYA COLLATERAL 10.03.2023 No match found

WAREHOUSING SERVICES PRIVATE

LIMITED

ARYADHAN FOUNDATION FOR 10.03.2023 No match found

EQUITABLE AGRICULTURE

Aryadhan Financial Solutions Private Limited - CAM & Annexures Page 34 of 67

ARYATECH PLATFORMS PRIVATE 10.03.2023 No match found

LIMITED

ANAND CHANDRA 10.03.2023 No match found

DEVARAJAN CHATTANATHAN 10.03.2023 No match found

MARGAPURI PRASANNA RAO 10.03.2023 No match found

KUSHAL AGRAWAL 10.03.2023 No match found

MCA Site Verification of Directors & 11.03.2023 No adverse observation

Company

Save Risk 11.03.2023 No adverse observations.

Strike Off companies 11.03.2023 Active

RBI Defaulter’s List (CIC Suit Filed & Non 10.03.2023 No match found in the name of the

Suit Filed Accounts- Wilful Defaulters ₹ 25 company and its directors.

Lacs & above on CIBIL site)

Change of Statutory Auditor 11.03.2023 There is a change in auditors in

compliance with RBI Circular dated April

27, 2021 on appointment/ re-appointment

of Auditor.

M/s. BSR & Co LLP was Statutory Auditor

from 2019 to 2021. They resigned on Nov

25, 2021 to comply with RBI Circular.

M/s Dass Gupta & Associates were

appointed as Statutory Auditors of the

Company for the Financial Year 2021-2026

and to hold the office of Statutory

Auditors from the conclusion of this (5th)

Annual General Meeting till conclusion of

10th Annual General Meeting of the

Company..

Holding & Subsidiary Companies 11.03.2023 Arya Collateral Warehousing Services

Private Limited is holding company of

Aryadhan Financial Solutions Private

Limited.

Aryadhan Foundation For Equitable

Agriculture is subsidiary company to

Aryadhan Financial Solutions Private

Limited.

Aryadhan Financial Solutions Private Limited - CAM & Annexures Page 35 of 67

Annexure-2 Detailed List of shareholders and its description

Shareholding Pattern as on Dec 31, 2022

Aryadhan Financial Solutions Private Limited is 100% subsidiary of Arya Collateral

Warehousing Private Limited. Shareholding pattern of Arya Collateral Warehousing

Private Limited is given below:

Class

Name of Promoter/ % of Holding

of No. of No. of Shares on

Shareholde Non (On Fully

Share Shares Fully Diluted Basis

r Promoter Diluted Basis)

s

Mr.

Prasanna Promoter Equity 9.43%

50,917 50,917

Rao

Mr. Anand

Promoter Equity 5.30%

Chandra 28,617 28,617

Mr.

Devarajan

Promoter Equity 2.84%

Chattanath 15,342 15,342

an

Mr. Krishna Non

Equity 8.82%

B Kotak Promoter 47,653 47,653

Mr. Dhruv K Non

Equity 2.94%

Kotak Promoter 15,885 15,885

Mr. Vir K Non

Equity 2.94%

Kotak Promoter 15,885 15,885

Mr.

Non

Gurpreet Equity 6.98%

Promoter 37,684 37,684

Dhaliwal

Non

ESOP Equity 5.00%

Promoter 27,000 27,000

Non

Aspada Equity 0.02%