Professional Documents

Culture Documents

Naveen Interest Concession

Uploaded by

Manipal SinghOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Naveen Interest Concession

Uploaded by

Manipal SinghCopyright:

Available Formats

Customers Miscellaneous Approvals

(Miscellaneous Approvals LLMS ID: MA0000356502)

Chief General Manager (Circle)

General Manager (NETWORK)

Circle/ Branch/ Unit Name Part I

Circle/SBU: NBG Branch Name : CB TIRUPUR

Unit Name : NAVEEN COTTON MILLS Branch code: 4201

PVT LTD

a. Proposal for

* Financial : Interest rate concessions

* Non-Financial : Others

2. Other Approvals

Approval

Sr. No : 1

Competitive pricing of FBWC limits at 2.05 % above MCLR - 6 M, present effective

rate being 9.95% p.a. with monthly rests against applicable pricing of 5.40 % above

MCLR - 6 M i.e., 13.30 % p.a. for SB-8 rated borrower and existing pricing of 5.40 %

above MCLR - 6 M i.e., 13.30 % p.a. (For change in the existing pricing)

Confidential and Property of State Bank of India NEWFORMAT Page 1 / 14

Miscellaneous Approval Proposal No. MA0000356502 Generated by Manipal Singh (7674228), CB TIRUPUR (4201) On 25-10-

2022 6.44 PM

b. Borrowing Unit's Profile

Name of NAVEEN COTTON MILLS PVT CIF No. : 80289391054

the Unit : LTD

Constitution : Private Ltd Co Group, if any : Naveen

Industry TEXTILES

Activity MFG. OF THREAD

Segment C&I

Chairman / MD / Promoter / CEO/ CFO

Official Designation Official Name

Chairman & MD Anandh Ramasamy

Banking WC TL

Arrangement MBA Sole Banking

Current IRAC Status:

IRAC Status as

19-10-2022

on

IRAC Status of: Standard IRAC Status of: Standard

2. Investments 1.Advances

Date of last

08-09-2021

review / renewal

Confidential and Property of State Bank of India NEWFORMAT Page 2 / 14

Miscellaneous Approval Proposal No. MA0000356502 Generated by Manipal Singh (7674228), CB TIRUPUR (4201) On 25-10-

2022 6.44 PM

Credit Rating: Borrower

Current Previous

CRA Based on CRA Non Trading Non Trading

31-03- 31-03- Model Simplified Regular

Balance Sheet

2020(Audite 2017(Audite

as on

Validated on 04-09-2021 07-08-2017 Current Previous

CRA Rating CRA -

(without any SB-8 SB-9

Rating

upgrade on

NA NA

account of

Overall

Navratana / 67.92 53.78

Score

Maharatna)

CRA Rating Financial

18.42 26.90

(after upgrade Score

on account of NA NA

Navratana / Minimum

19.00 23.00

Maharatna) Score

External Rating: Present

Date of Agency Long Short Valid Long Short Valid Up to

External Term Term Up to Term Term

Rating Rating Rating Rating Rating

Amount Amount

None

External Rating: Previous

Date of Agency Long Short Valid Up to Long Term Short Term

External Term Term Rating Rating

Rating Rating Rating Amount Amount

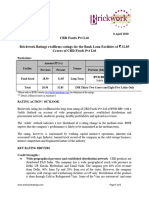

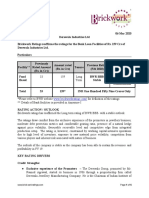

13-10- BRICKWO BBB- NA 12-01-2019 INR 32.18 INR 5.56

2017 RK Crore Crore

Rating Rationale :

BWR has essentially relied upon the audited financial results of FY 17 and

projections figures up to FY 19 and projections and publicly available information

and clarifications provided by the company.

Confidential and Property of State Bank of India NEWFORMAT Page 3 / 14

Miscellaneous Approval Proposal No. MA0000356502 Generated by Manipal Singh (7674228), CB TIRUPUR (4201) On 25-10-

2022 6.44 PM

The rating has factored extensive experience of the promoters in the textile Industry,

Increase in gross sales and long standing relationship with customers. However the

rating is constrained by increase in receivables and payables levels which results in

stressed liquidity position, stabilization of new product of new yarn product

introduced in the market and moderate Net worth.

FINANCIAL PERFORMANCE:

Total operating Income of the company has increased in the FY 17 to Rs.125.75 from

Rs.107.56 cr in FY 16. PAT of the Company has increased in FY 17 to Rs.1.30 cr.

Networth of the Company has increased in FY 17 to Rs.19.77 cr from Rs.18.54 cr in

FY 16.

Any negative events / triggers after Balance-sheet date and Borrower rating under

watch: No

c. Existing Credit Limits (Amount INR in Crore)

Existing Proposed

Facility ID/Name Curren SBI % Total Cons / SBI % Total Cons /

Facility Name by user cy MBA/ MBA/

Syndication Syndication

FB WC

F00003565001 - Cash Credit

INR 0.00 0 28.70 0.00 0 28.70

( Cash Credit )

F00003565002 - SLC-FBWC

INR 0.00 0 7.74 0.00 0 7.74

( SLC-FBWC )

Total FB-WC (a) 0.00 36.44 0.00 36.44

FB TL

F00003565005 - TL

INR 0.00 0 0.39 0.00 0 0.39

( TL )

F00003565011 - GECL-WCTL-2

INR 0.00 0 1.95 0.00 0 1.95

( GECL )

F00003565004 - TL

INR 0.00 0 14.49 0.00 0 14.49

( TL )

F00003565012 - TL

INR 2.04 0 0.00 2.04 0 0.00

( WindMill )

Total FB-TL (b) 2.04 16.83 2.04 16.83

Total FB (a) + (b) = (c) 2.04 53.27 2.04 53.27

NFB WC

F00003565003 - LC

INR 0.00 0 3.66 0.00 0 3.66

( LC )

Total NFB-WC (d) 0.00 3.66 0.00 3.66

Confidential and Property of State Bank of India NEWFORMAT Page 4 / 14

Miscellaneous Approval Proposal No. MA0000356502 Generated by Manipal Singh (7674228), CB TIRUPUR (4201) On 25-10-

2022 6.44 PM

NFB Projects

None

Total NFB-Projects (e) 0.00 0.00 0.00 0.00

Derivatives (after applying CCF)

None

Total Derivatives (f) 0.00 0.00 0.00 0.00

Total NFB (d) + (e) + (f) = (g) 0.00 3.66 0.00 3.66

Total Indebtedness (c) + (g) = (h) 2.04 56.93 2.04 56.93

Investments (i)

None

Total Investments (i) 0.00 0.00

Leasing (j)

None

Total Leasing (j) 0.00 0.00 0.00 0.00

Total Exposure (h) + (i) + (j) = (k) 2.04 56.93 2.04 56.93

Sub limit

Existing Proposed

Facility ID/Name Sublimit name Curren SBI % Total Cons SBI % Total Cons

Facility Name by user cy / MBA/ / MBA/

Syndication Syndication

None

Confidential and Property of State Bank of India NEWFORMAT Page 5 / 14

Miscellaneous Approval Proposal No. MA0000356502 Generated by Manipal Singh (7674228), CB TIRUPUR (4201) On 25-10-

2022 6.44 PM

d. Performance and Financial Indicators Part II

A. Company as a whole Amount INR in Crore

2019-20 2020-21 2021-22 2022-23

Audited Estimated Audited Estimated Estimated Projected

Particulars 01-04- 01-04- 01-04- 01-04- 01-04- 01-04-

0 1 2 3 4 5

2019/31-03- 2019/31-03- 2020/31-03- 2020/31-03- 2021/31-03- 2022/31-03-

2020 2020 2021 2021 2022 2023

107.32 0.00 96.92 98.52 109.92 115.65

Gross Sales (Value)

Net Sales (Value) 107.32 0.00 96.92 98.52 109.92 115.65

Subsidy in Sales 0.00 0.00 0.00 0.00 0.00 0.00

Exports (value)

Net Sales

(Quantity) in

Exports (Quantity)

in

Capacity Utilization

80.14 0.00 66.38 69.64 73.58 78.59

Raw Materials

Power and Fuel 5.27 5.18 5.15 4.30 2.69

Direct Labour 6.07 6.80 6.10 7.18 7.72

2019-20 2020-21 2021-22 2022-23

Audited

0 Estimated

1 Audited

2 Estimated

3 Estimated

4 Projected

5

Particulars 01-04- 01-04- 01-04- 01-04- 01-04- 01-04-

2019/31- 2019/31- 2020/31- 2020/31- 2021/31- 2022/31-

03-2020 03-2020 03-2021 03-2021 03-2022 03-2023

SG & A Costs 1.75 2.09 2.55 3.02 3.47

Interest 3.72 0.00 3.42 3.64 4.14 4.29

Operating

3.22 0.00 5.06 5.36 5.24 5.95

Profit(OP) After

PBT 3.23 0.00 5.26 5.48 5.44 6.15

PAT 2.31 0.00 3.44 4.38 4.24 4.31

Cash Accruals 4.04 0.00 4.82 6.18 7.09 8.46

EBIDTA 8.68 0.00 10.06 10.92 12.43 14.59

EBIDTA Margin 8.09 0.00 10.38 11.08 11.31 12.62

TOL / Adj.TNW 2.17 0.00 2.03 1.89 2.15 1.82

Current Ratio 1.58 0.00 1.80 1.92 1.66 1.66

Confidential and Property of State Bank of India NEWFORMAT Page 6 / 14

Miscellaneous Approval Proposal No. MA0000356502 Generated by Manipal Singh (7674228), CB TIRUPUR (4201) On 25-10-

2022 6.44 PM

If the latest Audited B/S is not available, explanation as to why they are not

available, to be given.

Latest Audited B/S available.

d1. Income Analysis / Value of account

Estimates Actuals Estimates

From

31-03-2022 31-03-2021 31-03-2023

WC Int

TL Int 0.04 0.04 0.25

LC

BG

Bills

Forex

Loan processing /

0.27 0.27 0.27

upfront fee

Commitment Charge

Income from others Viz

CMP, Cross-Selling etc

For other verticals in the

bank

For Non Banking

Subsidiaries

Total earnings from the

account for

SBG(excluding banking

subsidiaries)

Comments(Interest Income):

Comments(Other Income):

e. Conduct of Account

e1. Position With our Bank: None

CIF No.: 80289391054

Confidential and Property of State Bank of India NEWFORMAT Page 7 / 14

Miscellaneous Approval Proposal No. MA0000356502 Generated by Manipal Singh (7674228), CB TIRUPUR (4201) On 25-10-

2022 6.44 PM

e2. Position With Other Bank:

Applicable: Yes

(Amount INR in Crore)

Facility Id, Facility Currency Existing DP Outstand Irregul Irr.

Name, Name by User limits ing as on arity, Since(If

31-08- if any Irregular)

2021

F00003565003 - LC INR 2.00 2.00 2.00

( LC )

Remarks on the irregularity, if any:

F00003565001 - Cash INR 14.00 14.00 13.42 0.00

Credit

( Cash Credit )

Remarks on the irregularity, if any:

F00003565012 - TL INR 14.40 14.40 14.00

( WindMill )

Remarks on the irregularity, if any:

F00003565002 - SLC- INR 15.00 15.00 13.98 0.00

FBWC

( SLC-FBWC )

Remarks on the irregularity, if any:

F00003565004 - TL INR 5.10 5.10 3.95

( TL )

Remarks on the irregularity, if any:

F00003565011 - INR 6.70 6.70 6.70

GECL-WCTL-2

( GECL )

Remarks on the irregularity, if any:

f. Credit Audit / RFIA criticaL observations

1) Sworn, notarised affidavits of Assets & Liabilities have not been obtained in

eligible cases (For all loans rated SB-9 and worse and existing loans under

rehabilitation.

Branch Reply: Latest Assets and liabilites kept on record.

2) Checklist on identification and physical verification of the properties has not been

prepared on annexure - F and kept on record (Format revised since 12.12.2018).

Branch Reply: Annexure F kept on record.

3) Original Search Fee Receipt is not enclosed with the TIR.

Confidential and Property of State Bank of India NEWFORMAT Page 8 / 14

Miscellaneous Approval Proposal No. MA0000356502 Generated by Manipal Singh (7674228), CB TIRUPUR (4201) On 25-10-

2022 6.44 PM

Branch Reply: Original Search Fee receipt enclosed with TIR.

4) Letter of Engagement to advocate has not been issued in prescribed format either

manually or through LLMS (Applicable since 26.03.2019).

Branch Reply: Letter of engagement from advocate obtained.

5) Following clauses are not incorporated in arrangement letter: a.The Borrower

shall always be responsible to ensure that the insurance policy in respect of the

hypothecated assets remains valid till all the dues of the Bank are repaid and to

keep such Insurance Policy renewed each year. b. The Bank shall not be liable for

any consequence arising from non-renewal of insurance in any year even if the Bank

has in any previous year renewed the Insurance of the hypothecated assets by

debiting the Borrowers account for failure of the Borrower to renew such Insurance

Policy. (Applicable since 31.07.2019).

Branch Reply: New arrangement letter with the clauses obtained and kept on record

6) An undertaking / declaration from the mortgagor/Borrower that 'no dues to the IT

department, alongwith a copy of application for issue of NOC, duly acknowledged by

the IT authorities' not obtained. (In respect of loans of Rs.1.00 cr and above, other

than P-Segment loans).

Branch Reply: Latest IT report for FY 21-22 obtained and kept on record

7) Confirmation letter is incomplete.

Branch Reply: Complete conformation letter obtained

8) Memorandum of Deposit of Title Deeds (SME-5/7) is not on record.

Branch Reply: MOD of Title Deeds kept on record

9) Confirmation letter confirming the deposit of the title deeds has not been obtained

on a date subsequent to the deposit of title deeds.

Branch Reply: Confirmation letter confirming deposit of title deeds kept on record.

10) Memorandum of Deposit of Title Deeds (SME 5/7) is not signed by two officials of

the Branch (who had signed the EM Recital).

Branch Reply: MOD of Title Deeds signed by 2 officials kept on record.

11) Supplementary TIR is not obtained after the receipt of the original document.

(Applicable only when the title deeds are created/ received after disbursement of

loan).

Branch Reply: Supplementary TIR obtained.

Confidential and Property of State Bank of India NEWFORMAT Page 9 / 14

Miscellaneous Approval Proposal No. MA0000356502 Generated by Manipal Singh (7674228), CB TIRUPUR (4201) On 25-10-

2022 6.44 PM

g(i). Present Proposal Part III

* Financial : Interest rate concessions

* Non-Financial : Others

2. Other Approvals

Approval

Sr. No : 1

Competitive pricing of FBWC limits at 2.05 % above MCLR - 6 M, present effective

rate being 9.95% p.a. with monthly rests against applicable pricing of 5.40 % above

MCLR - 6 M i.e., 13.30 % p.a. for SB-8 rated borrower and existing pricing of 5.40 %

above MCLR - 6 M i.e., 13.30 % p.a. (For change in the existing pricing)

g(ii). Present Proposal other than above

h. Justification

1. Industry: Textile

2. Internal Rating: SB-8 as per ABS as on 04.09.2021

3. Renewal / Sanction Date: 08.09.2021

5. Activity: Manufacturing of thread

6. Financial Arrangement: Private Limited Co

7. IRAC Status: Standard

8. Turnover: Rs.150 Cr/yr.

9. Brief Background & Conduct of the Account:

M/s. Naveen Cotton Mill Private Limited [NCMPL] was incorporated in 2005 by Shri.

Gandhimathi Anandh Promoter, one of the reputed export business houses in

Tirupur.

NCMPL is the leading producers of Fancy and Melange Yarns at the plant is located

Confidential and Property of State Bank of India NEWFORMAT Page 10 / 14

Miscellaneous Approval Proposal No. MA0000356502 Generated by Manipal Singh (7674228), CB TIRUPUR (4201) On 25-10-

2022 6.44 PM

at Pungampalli Village, Sathyamangalam Taluk, Erode Dist. The registered office of

the company is located at No. 8/1456, RS Puram, Ist Street, Near Pandiyan Nagar

Bus Stop, P.N. Road, Tirupur

Company has an installed capacity of 19,680 spindles, producing 3000 tons of Yarn

per annum. NCMPL produces a wide range of Melange and Fancy Yarns ranging

from Ne 16 to Ne 60 in ring-spun Yarns. The company also produces value added

yarns like Organic GOTS, OCS, BCI & OEKOTE certified yarns. Company also has

got dedicated feeder line from Tamil Nadu Electricity Board and unit continuously

running 24 hours without any power cuts and achieved projected capacity

utilization.

NCMPL has availed term loan limits with State Bank of India. The Company's limits

with our bank were sanctioned under SBI Solar Term Loan by RCCC on 08.09.2021

which is valid for 8 years.

BUSINESS RELATIONSHIP WITH OUR BANK

a) Credit Facilities:

(Amount in INR_ Crores)

Sr. Facility Limit Outstandin Average Interest Fee income

No. g Utilisation income * *

(past 12

months)

i. Solar Term 2.10 2.04 0.06 0.12 0.03

Loan

* Previous Year in case of Existing Unit, Annual estimation for new connection

Bankwise Outstanding as on 18.10.22 (Rs in Crores)

S.N Faciliti Federal On ICICI On SBI On Toal On

es Bank 18.10.2 Bank 18.10.2 18.10.2 18.10.2

2 2 2 2

Sanctio Outsta Sanctio Outsta Sanctio Outsta Sanctio Outsta

ned nding ned nding ned nding ned nding

1 WCTL 3.45 1.95 0.00 0.00 0.00 0.00 3.45 1.95

2 Term 0.60 0.39 0.00 0.00 0.00 0.00 0.60 0.39

Loan

3 ECGL 2.90 2.90 6.70 4.84 0.00 0.00 9.60 7.74

4 Term 7.29 7.29 7.20 7.20 0.00 0.00 14.49 14.49

Loan -

Solar

Confidential and Property of State Bank of India NEWFORMAT Page 11 / 14

Miscellaneous Approval Proposal No. MA0000356502 Generated by Manipal Singh (7674228), CB TIRUPUR (4201) On 25-10-

2022 6.44 PM

5 Working 14.00 13.81 15.00 14.89 0.00 0.00 29.00 28.70

Capital

- CC

6 Term 0.00 0.00 0.00 0.00 2.10 2.04 2.10 2.04

Loan -

Windmil

l

7 Working 5.00 0.49 2.00 1.13 2.10 2.04 9.10 3.66

Capital

- LC

Total 33.24 26.83 30.90 28.06 4.20 4.14 68.34 59.03

10. Value of Account

(Previous Year in case of Existing Unit, Annual estimation for new connection)

Interest Income

(Amount in INR_ Crores)

Facility Limit Interest Interest Cost of Net Interest Net Interest

(A) (B) Rate Rate % Funds Income income

%(C) after % (E) before after

concession concession concession

(D) (F) =B*(C-E) (G) =B*(D-E)

/100 / 100

TL 2.10 13.3 9.95 6.7 0.14 0.07

Other Income (existing):

Fee / Charges Card Annualized Concession (K) Annualized

Details (H) Rate Income at card Income after

(I) rate (J) passing

concession (L)

Processing 1.30% 0.03 0% 0.03

Charges

Facility Fee -- -- -- --

BG/LC -- -- -- --

Commission

Documentation, -- -- -- --

EM

Charges &

Interchangeabili

ty Fee

Interest rate 13.3% 0.13 9.95% 0.10

concession

Confidential and Property of State Bank of India NEWFORMAT Page 12 / 14

Miscellaneous Approval Proposal No. MA0000356502 Generated by Manipal Singh (7674228), CB TIRUPUR (4201) On 25-10-

2022 6.44 PM

TOTAL 0.16 0.13

Annualized income Annualized income after Total Concession % =(M-

without concession passing concession N)/M*100

(Net Interest + other (interest + other income)

income) N = Total of G & L

M = Total of F & J

0.30 0.20 33.33%

11. Proposed concessions in Interest Related Charges:

i. Concessions details:

Charges Card Rate Calculated Proposed Expected

details Income before Concessions Income after

passing (%) passing

concession concession

Interest Related 0.10% 0.14 25% 0.07

Charges

TOTAL 0.14 0.07

ii. a. RAROC before concessions: 22.7% b. RAROC after

concessions: 5.7%

12. Remarks & Recommendations for the proposed concession:

There are only a few Melange Yarn players in the Tirupur market such as

Sulochana Cotton Mills, Amarjothi Spinning Mills and Naveen Cotton Mills Pvt Ltd

(NCMPL). Due to consistent heavy orders domestically and internationally, company

has invested in latest art of technology plant and machineries. Their unit is one

among the leading manufacturers of Melange and Fancy yarn varieties in Tirupur.

1. Naveen Cotton Mill Private Limited had been banking with our Bank since

2005 with exposure of Rs 51.41 till 2018 but the same was taken over by Kotak

Mahindra Bank which offered better pricing

2. Presently the customer is enjoying credit facilities with Federal Bank, ICICI

Bank & SBI with exposure of 68.34 Cr. and SBI has only 2.1 Cr. exposure in total.

3. Company is in the same line of activity since 2005 clocking a turnover of Rs.

150 Crores /year.

4. Average gross DSCR is estimated at 1.70.

5. The unit has been timely servicing the borrowing obligations and the conduct

Confidential and Property of State Bank of India NEWFORMAT Page 13 / 14

Miscellaneous Approval Proposal No. MA0000356502 Generated by Manipal Singh (7674228), CB TIRUPUR (4201) On 25-10-

2022 6.44 PM

of the company's accounts is uniformly satisfactory with all the member Banks.

6. The unit is unhappy with the service rendered by Federal Bank but is hesitant

to move to SBI as the interest rates at both Federal Bank and ICICI are sub-10.

7. Promoters of the Company are educated, experienced and successful

entrepreneurs having a rich experience of two decades.

8. The proposed concessions will enable the branch in garnering more business

from the unit.

9. In light of the above, we herewith recommend for concession of 335 bps in

applicable interest rate on the term loan from 13.30% to 9.95%, which falls within

the discretionary powers of GM of the circle as per the Circular No. NBG/SMEBU-

INT RATE M/1/2022 -23 dated 01/04/2022.

i. Recommendation

Designation Name Signature Mobile Place Date

Appraised by:

Manager Manipal Singh 9779901880 Tirupur 20-10-2022

Assessed by:

Chief Manager Arumugam N 8838030110

Recommended by:

Confidential and Property of State Bank of India NEWFORMAT Page 14 / 14

Miscellaneous Approval Proposal No. MA0000356502 Generated by Manipal Singh (7674228), CB TIRUPUR (4201) On 25-10-

2022 6.44 PM

You might also like

- JP Infra Mumbai 23dec2021Document6 pagesJP Infra Mumbai 23dec2021Rishabh MehtaNo ratings yet

- Faridabad Steel Mongers Rating RationaleDocument4 pagesFaridabad Steel Mongers Rating RationaleShamNo ratings yet

- Pump DesignDocument4 pagesPump Designmarathasanatani6No ratings yet

- PR - Sri Anagha - Refineries - 23 - 09 - 2020Document6 pagesPR - Sri Anagha - Refineries - 23 - 09 - 2020Jayshreeben DobariyaNo ratings yet

- SPG Infraprojects BL 23sep2019 PDFDocument6 pagesSPG Infraprojects BL 23sep2019 PDFChander ShekharNo ratings yet

- Mahima Real Estate 10apr2019Document5 pagesMahima Real Estate 10apr2019Reena GahlotNo ratings yet

- Entertainment City Ratings ReaffirmedDocument6 pagesEntertainment City Ratings ReaffirmedPuneet367No ratings yet

- WorkingCapitalFinanceForNBFC AxisFinance C014 23 24 26 33 43 66Document18 pagesWorkingCapitalFinanceForNBFC AxisFinance C014 23 24 26 33 43 66Raunak BothraNo ratings yet

- Saya Homes ProjectDocument5 pagesSaya Homes ProjectSatish RAjNo ratings yet

- Micromax Biofuels PVT Ltd.Document6 pagesMicromax Biofuels PVT Ltd.Kamlakar AvhadNo ratings yet

- Rajratan Global Wire LimitedDocument6 pagesRajratan Global Wire Limitedpraveen kumarNo ratings yet

- Shree Radhekrushna Ginning - R-11092017Document6 pagesShree Radhekrushna Ginning - R-11092017SuMit PaTilNo ratings yet

- Rajesh Exports 20may2021Document6 pagesRajesh Exports 20may2021adhyan kashyapNo ratings yet

- BWR A4 Rating for Malar International's Rs.6 Cr Bank Loan FacilitiesDocument4 pagesBWR A4 Rating for Malar International's Rs.6 Cr Bank Loan FacilitiesNalla ThambiNo ratings yet

- Sanghi Jewellers PVT - R - 20102020Document7 pagesSanghi Jewellers PVT - R - 20102020DarshanNo ratings yet

- Credit Perspective GetRationaleFile 103495Document6 pagesCredit Perspective GetRationaleFile 103495anil1820No ratings yet

- Jainam Cables (India) Private Limited: Summary of Rated InstrumentsDocument6 pagesJainam Cables (India) Private Limited: Summary of Rated InstrumentspunamNo ratings yet

- ACCUFOX-ENTERPRISES - PC Jewellers Franchise - 1 StoreDocument5 pagesACCUFOX-ENTERPRISES - PC Jewellers Franchise - 1 StoreJai PhookanNo ratings yet

- CRD Foods 8apr2020Document6 pagesCRD Foods 8apr2020samudragupta05No ratings yet

- TVS Credit Services 15dec2022Document10 pagesTVS Credit Services 15dec2022brahmaputragoatfarmNo ratings yet

- Topline Infra Projects BL 96 78Cr Reaffirmation Rationale 18aug2017Document4 pagesTopline Infra Projects BL 96 78Cr Reaffirmation Rationale 18aug2017CAAkashSinghNo ratings yet

- Kogta Financial India LimitedDocument5 pagesKogta Financial India LimitedofficeloginpurposeNo ratings yet

- Project Report - UMW Dongshin MotechDocument22 pagesProject Report - UMW Dongshin MotechGAURAV NIGAM0% (1)

- Rating Rationale: TNPFIDC or "Corporation")Document5 pagesRating Rationale: TNPFIDC or "Corporation")venugopallNo ratings yet

- Aryadhan New CAM Format For NBFC Clean Version CAM & AnnexuresDocument67 pagesAryadhan New CAM Format For NBFC Clean Version CAM & AnnexuresSwarna SinghNo ratings yet

- Mehala Machines India LimitedDocument4 pagesMehala Machines India LimitedKarthikeyan RK SwamyNo ratings yet

- Rama Udyog Private Limited November 03, 2020: Rating Instrument / Facility Amount (Rs. Crore) Rating Rating ActionDocument4 pagesRama Udyog Private Limited November 03, 2020: Rating Instrument / Facility Amount (Rs. Crore) Rating Rating ActionRAMODSNo ratings yet

- A-1 Facility and Property Managers Private Limited: Rating RationaleDocument5 pagesA-1 Facility and Property Managers Private Limited: Rating RationaleDeepti JajooNo ratings yet

- The Government Tele Communication R 03102017Document7 pagesThe Government Tele Communication R 03102017SandeeploguNo ratings yet

- Final Process NoteDocument24 pagesFinal Process Notesaorabh13No ratings yet

- Ramnord Research Laboratories Pvt. LtdDocument6 pagesRamnord Research Laboratories Pvt. LtdraghavNo ratings yet

- Milkfood Ltd. Bank Loan Rating Downgraded to BBB- on Revenue DeclineDocument7 pagesMilkfood Ltd. Bank Loan Rating Downgraded to BBB- on Revenue DeclineUthay UthayNo ratings yet

- Ayushman Merchants Private Limited: Summary of Rated InstrumentsDocument6 pagesAyushman Merchants Private Limited: Summary of Rated InstrumentsJeffNo ratings yet

- 3B Binani GlassfibreDocument2 pages3B Binani GlassfibreData CentrumNo ratings yet

- Digvijay Construction 4may2021Document7 pagesDigvijay Construction 4may2021hesham zakiNo ratings yet

- Vinayak Steels Limited Financial ReportDocument7 pagesVinayak Steels Limited Financial Reportsaikiran reddyNo ratings yet

- RATING RATIONALE FOR DEREWALA INDUSTRIES LTDDocument6 pagesRATING RATIONALE FOR DEREWALA INDUSTRIES LTDMukul SoniNo ratings yet

- CRISIL Rating Metro July19Document3 pagesCRISIL Rating Metro July19pankaj_xaviersNo ratings yet

- Vasavi Infrastructure Projects 20jan2020Document4 pagesVasavi Infrastructure Projects 20jan2020Gaurav VaswaniNo ratings yet

- Globe Capacitors 14nov2019Document6 pagesGlobe Capacitors 14nov2019Puneet367No ratings yet

- PR JyotiCNC 26apr23Document7 pagesPR JyotiCNC 26apr23Virag ShahNo ratings yet

- Satya Deeptha Pharmaceuticals LimitedDocument6 pagesSatya Deeptha Pharmaceuticals LimitedsriramraneNo ratings yet

- Sitaram Maharaj Sakhar - R - 22042019 PDFDocument6 pagesSitaram Maharaj Sakhar - R - 22042019 PDFJagadamba RealtorNo ratings yet

- D&H Secheron Electrodes Private Limited: Summary of Rated InstrumentsDocument6 pagesD&H Secheron Electrodes Private Limited: Summary of Rated InstrumentsMahee MahemaaNo ratings yet

- Indotech Transformers LimitedDocument6 pagesIndotech Transformers LimitedMonika GNo ratings yet

- Stove Kraft Limited-3Document5 pagesStove Kraft Limited-3venkyniyerNo ratings yet

- CM BSMLDocument27 pagesCM BSMLRihanNo ratings yet

- Della Adventure R 17112017Document7 pagesDella Adventure R 17112017Anil KanojiaNo ratings yet

- Modern Construction Company R 18062020Document7 pagesModern Construction Company R 18062020Ali KayaNo ratings yet

- Pondy Oxides and Chemicals 22apr2019Document6 pagesPondy Oxides and Chemicals 22apr2019DarshanNo ratings yet

- DR Datson Labs 22mar2021Document5 pagesDR Datson Labs 22mar2021office88kolNo ratings yet

- Microlite Indsutries 30may2020Document3 pagesMicrolite Indsutries 30may2020utkarsh kumarNo ratings yet

- LGB Forge Limited: Summary of Rating ActionDocument7 pagesLGB Forge Limited: Summary of Rating ActionPuneet367No ratings yet

- Devi 6nov2020Document4 pagesDevi 6nov2020jagadeeshNo ratings yet

- Bansal Pathways Habibganj Private LimitedDocument5 pagesBansal Pathways Habibganj Private LimitedKapil PadlakNo ratings yet

- PMEGPDocument26 pagesPMEGPadhyan kashyapNo ratings yet

- InvestorDocument69 pagesInvestorsam solankiNo ratings yet

- Truck Proposal TLDocument10 pagesTruck Proposal TLwamiqhasanNo ratings yet

- PJS Credit Rating by Brickwork On On 26th Aug 2019Document4 pagesPJS Credit Rating by Brickwork On On 26th Aug 2019PJS OverseasNo ratings yet

- Asia Small and Medium-Sized Enterprise Monitor 2021 Volume III: Digitalizing Microfinance in Bangladesh: Findings from the Baseline SurveyFrom EverandAsia Small and Medium-Sized Enterprise Monitor 2021 Volume III: Digitalizing Microfinance in Bangladesh: Findings from the Baseline SurveyNo ratings yet

- Analyzing Financial Performance and Credit Risk FactorsDocument86 pagesAnalyzing Financial Performance and Credit Risk FactorsManipal SinghNo ratings yet

- 1161 Research Pick of The Week JMFS 080833 b7049Document8 pages1161 Research Pick of The Week JMFS 080833 b7049Manipal SinghNo ratings yet

- Macquarie Banking & Insurance CoverageDocument19 pagesMacquarie Banking & Insurance CoverageManipal SinghNo ratings yet

- Admit Letter For Online Anti-Money Laundering and Know Your Customer Examination - Dec 2022 Candidate DetailsDocument2 pagesAdmit Letter For Online Anti-Money Laundering and Know Your Customer Examination - Dec 2022 Candidate DetailsManipal SinghNo ratings yet

- Elearning Productcard CertificateincommercialcreditDocument1 pageElearning Productcard CertificateincommercialcreditManipal SinghNo ratings yet

- Mandtory Learning CircularDocument25 pagesMandtory Learning CircularManipal SinghNo ratings yet

- Tax Invoice Provides Details of Sold Duffel BagDocument1 pageTax Invoice Provides Details of Sold Duffel BagManipal SinghNo ratings yet

- Inv PresDocument16 pagesInv PresManipal SinghNo ratings yet

- Borosil RenewablesDocument8 pagesBorosil RenewablesManipal SinghNo ratings yet

- ALiterature Study of Consumer Perception Towards Digital Payment Mode in IndiaDocument17 pagesALiterature Study of Consumer Perception Towards Digital Payment Mode in IndiaManipal SinghNo ratings yet

- Erkende referenten Recognised sponsorsDocument169 pagesErkende referenten Recognised sponsorsManipal SinghNo ratings yet

- Kaynes Technology India LTD - IPO Note - 11!11!2022Document8 pagesKaynes Technology India LTD - IPO Note - 11!11!2022Manipal SinghNo ratings yet

- Investment Management: Banking BookDocument50 pagesInvestment Management: Banking BookManipal SinghNo ratings yet

- KYC, AML & CFT Virtual ProgrammeDocument6 pagesKYC, AML & CFT Virtual ProgrammeManipal SinghNo ratings yet

- An Overview: Treasury Operations in BanksDocument61 pagesAn Overview: Treasury Operations in BanksManipal SinghNo ratings yet

- Fedai RulesDocument36 pagesFedai RulesManipal SinghNo ratings yet

- Technical Analysis Tools and IndicatorsDocument23 pagesTechnical Analysis Tools and IndicatorsManipal SinghNo ratings yet

- RBI liquidity tools CRR SLR money market instrumentsDocument2 pagesRBI liquidity tools CRR SLR money market instrumentsManipal SinghNo ratings yet

- South Carolina Property Tax GuideDocument98 pagesSouth Carolina Property Tax GuidecameronNo ratings yet

- What's The Best Core Banking Platform For Your Business?: AvaloqDocument2 pagesWhat's The Best Core Banking Platform For Your Business?: AvaloqAditiNo ratings yet

- Consolidated ReportDocument86 pagesConsolidated ReportBalasubramanian M.BNo ratings yet

- Chapter 7-١Document27 pagesChapter 7-١zkNo ratings yet

- Metals Industry Research & Development Center Citizen's CharterDocument88 pagesMetals Industry Research & Development Center Citizen's CharterMabelle GaytanoNo ratings yet

- Marxist Theories of Imperialism001Document33 pagesMarxist Theories of Imperialism001ChristopherGundersonNo ratings yet

- Ambit Speciality ChemicalDocument16 pagesAmbit Speciality ChemicaldcoolsamNo ratings yet

- Return of InvestmentDocument5 pagesReturn of InvestmentPakar Kuda LautNo ratings yet

- Mankiw (1990) Refresher Course in Macroeconomics PDFDocument17 pagesMankiw (1990) Refresher Course in Macroeconomics PDFAngie PérezNo ratings yet

- Appraisal Committee ManualDocument17 pagesAppraisal Committee ManualWorstWitch TalaNo ratings yet

- BUS685 - Trade TheoriesDocument35 pagesBUS685 - Trade TheoriesMd Wasiq DayemNo ratings yet

- PUP Lesson on Scanning Industry Opportunities and ThreatsDocument8 pagesPUP Lesson on Scanning Industry Opportunities and ThreatsMika MolinaNo ratings yet

- Rev 1Document1 pageRev 1Jessa BeloyNo ratings yet

- Hubungan Perundingan Dengan Penyelesaian Masalah Di Kalangan Peniaga-Peniaga Kecil Di MalaysiaDocument16 pagesHubungan Perundingan Dengan Penyelesaian Masalah Di Kalangan Peniaga-Peniaga Kecil Di Malaysiashaan7821No ratings yet

- Nifty 50 ratiosDocument6 pagesNifty 50 ratiosDeepak RahejaNo ratings yet

- KDS Master and Transactional DataDocument104 pagesKDS Master and Transactional DatayoginderNo ratings yet

- Mobil UsmrDocument2 pagesMobil UsmrSiddharth SrivastavaNo ratings yet

- Financing Urban Development in China Through Urban Development Investment CompaniesDocument4 pagesFinancing Urban Development in China Through Urban Development Investment CompaniesRaviAgarwalNo ratings yet

- Operations ManagementDocument14 pagesOperations ManagementSaurabh Agarwal0% (2)

- Financial Accounting Module Investment AnalysisDocument6 pagesFinancial Accounting Module Investment AnalysisDanny ToligiNo ratings yet

- تحليل سلسلة القيمة مقالةDocument16 pagesتحليل سلسلة القيمة مقالةMohanned MaithamNo ratings yet

- Radhakrishna Foodland Private LimitedDocument4 pagesRadhakrishna Foodland Private LimitedSneha GodseNo ratings yet

- 2652 Theory of Day TradingDocument7 pages2652 Theory of Day Tradinglppandey100% (1)

- Module 1 L2Document69 pagesModule 1 L2Joan SagaNo ratings yet

- Sharjah Indian School - Br. JuwaizaDocument3 pagesSharjah Indian School - Br. Juwaizathana076690No ratings yet

- M. Kabir Hassan, Rasem N. Kayed, and Umar A. Oseni: Introduction To Islamic Banking and Finance: Principles and PracticeDocument40 pagesM. Kabir Hassan, Rasem N. Kayed, and Umar A. Oseni: Introduction To Islamic Banking and Finance: Principles and PracticeAhmed MousaNo ratings yet

- Mid-Sem Answers and SolutionsDocument26 pagesMid-Sem Answers and SolutionsAmeer Zahar50% (2)

- R. ChiripalDocument42 pagesR. ChiripalRahul PambharNo ratings yet

- Ryanair's Cost-Leadership Strategy Driving SuccessDocument2 pagesRyanair's Cost-Leadership Strategy Driving SuccessBruna Aldegheri67% (3)

- Sample Business ProposalDocument8 pagesSample Business ProposalKathleen DamianNo ratings yet