Professional Documents

Culture Documents

Factsheet 202306 Eng

Uploaded by

Quỳnh PhanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Factsheet 202306 Eng

Uploaded by

Quỳnh PhanCopyright:

Available Formats

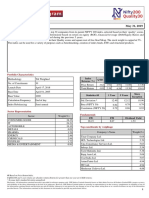

Fubon ETF Series OFC

Fubon ICE FactSet Taiwan Core Semiconductor Index ETF

Stock Code: 3076

As of 30/6/2023

Important Information

• Fubon ICE FactSet Taiwan Core Semiconductor Index ETF (the “Sub-Fund”) is a sub-fund of Fubon ETF Series OFC (the “Company”), which is a public

umbrella open-ended fund company established under Hong Kong law with variable capital with limited liability and segregated liability between sub-funds.

• Registration with and authorisation by the SFC do not represent a recommendation or endorsement of the Company or the Sub-Fund nor do they guarantee

the commercial merits of the Company, the Sub-Fund or their performance. They do not mean the Company or the Sub-Fund are suitable for all investors

nor do they represent an endorsement of their suitability for any particular investor or class of investors.

• The Sub-Fund is a passively managed index tracking exchange traded fund (“ETF”) It is denominated in USD and traded in HKD on The Stock Exchange of

Hong Kong Limited (the “SEHK”).

• The investment objective of the Sub-Fund is to provide investment results that, before deduction of fees and expenses, closely correspond to the

performance of the ICE® FactSet® Taiwan Core Semiconductor Index (“Index”) which tracks the performance of listed Taiwan companies involved in the

semiconductor industry. There is no assurance that the Sub-Fund will achieve its investment objective.

• The Sub-Fund’s investments are concentrated in Taiwan listed companies in the semiconductor industry. The value of the Sub-Fund is subject to risks

associated with Taiwan and emerging markets, as well as concentration risk. It may be more volatile than that of a fund investing in more developed

markets and / or having a more diverse investment portfolio.

• The Sub-Fund is subject to risks associated with the semiconductor industry, such as intense competition in the industry, rapid obsolescence of products,

substantial capital expenditures, government intervention and trade protectionism, etc. These may harm the business and operating results of

semiconductor companies.

• The Index is a new index and therefore the Sub-Fund may be riskier than other ETFs tracking more established indices with longer operating history.

• The Sub-Fund is subject to risk associated with small-capitalisation / mid-capitalisation companies. The prices of such companies are more volatile to

adverse economic developments than those of larger capitalisation companies in general.

• The Sub-Fund is passively managed and the Manager / Sub-Manager will not have the discretion to adapt to market changes nor take defensive positions

in declining markets. It may also be subject to tracking error risk.

• The Sub-Fund is subject to trading risks that its shares may trade at a substantial premium or discount to its net asset value. It is also subject to trading

time differences risk due to the different trading hours of SEHK and the Taiwan Stock Exchange. This may increase the level of premium/discount of the

Sub-Fund’s share price to its net asset value.

• The Sub-Fund is also subject to equity market risk, currency risk, early termination risk and reliance on market maker risks.

• Investment involves risks and your investment in the Sub-Fund may suffer losses. You should not make investment decision on the basis of this material

alone. Please read the prospectus and the product key facts statement of the Sub-Fund for further details including the risk factors.

Investment Objective Performance History (%)

The investment objective of the Sub-Fund is to Top 10 Holdings (%)

120 Taiwan Semiconductor Mfg 25.36

provide investment results that, before

100 ASE Industrial Holding Co., Ltd. 5.82

deduction of fees and expenses, closely

80

correspond to the performance of the ICE® eMemory Technology Inc. 5.71

60

FactSet® Taiwan Core Semiconductor Index Realtek Semiconductor Corp. 5.70

40

(“Index”) which tracks the performance of listed 20 MediaTek Inc. 5.59

Taiwan companies involved in the semiconductor 0 Novatek Microelectronics Corp. 5.28

industry. There is no assurance that the Sub- United Microelectronics Corp. 5.23

13/1/2022

13/2/2022

13/3/2022

13/4/2022

13/5/2022

13/6/2022

13/7/2022

13/8/2022

13/9/2022

13/1/2023

13/2/2023

13/3/2023

13/4/2023

13/5/2023

13/6/2023

13/10/2022

13/11/2022

13/12/2022

Fund will achieve its investment objective. Global Unichip Corp. 4.86

Silergy Corp. 4.34

The figure show as a NAV change of the Sub-Fund based on a 3.80

GlobalWafers Co., Ltd

hypothetical 100 investment in the Sub-Fund.

Fund Information Cumulative Performance (%) Sectors (%)

Listing Date 13 January 2022 Semiconductors & Semiconductor 95.17

Since

Exchange Listing SEHK – Main Board 3-month 6-month YTD 1-Year 3-Year 5-Year Equipment

Launch

Base Currency USD Other 2.40

2.03 26.55 26.55 15.86 N/A N/A -29.02

Trading Currency HKD Cash and Cash Equivalents 1.57

Index ICE® FactSet® Taiwan Core Calendar Year Performance (%)

Machinery, Equipment & Components 0.44

Semiconductor Index 2022 2021 2020 2019 2018 Electronic Equipment, Instruments & 0.43

Fund Size (Mil) USD 1.63 Components

N/A N/A N/A N/A N/A

NAV per Share USD 0.7079

Distribution Subject to the Manager’s Sub-Fund performance is calculated on a Net Asset Value (NAV)

basis, with income reinvested, net of fees. Performance is

Frequency discretion. Currently the calculated in the Sub-Fund currency. Source: Fubon. Past

Manager does not intend performance is not a guide to future performance and should not

to pay or make any be the sole factor of consideration when selecting a product.

Investors may not get back the full amount invested.

distributions or dividends.

Current Charge

Management fee 0.6% p.a.

Source: Fubon Fund Management (Hong Kong) Limited. The information contained in this document is for information purposes only and

Codes does not constitute any recommendation, offer or solicitation to buy, sell or subscribe to any securities or financial instruments in any

Stock Code 3076 jurisdiction.

ISIN HK0000817103 References to particular sectors, securities or companies are for general information and illustrative purposes only and are not

recommendations to buy or sell a security, or an indication of the issuer's holdings at any one time.

Bloomberg 3076.HK Investment involves risks. Past performance is not indicative of future performance. Please refer to the prospectus and the product key

facts statement of the Sub-Fund for further details including the risk factors. This document is issued by Fubon Fund Management (Hong

Kong) Limited and it has not been reviewed by the Securities and Futures Commission ("SFC").

For more information, please visit www.fubonetf.com.hk today. (This website has not been reviewed by the SFC)

You might also like

- KPIT Technologies - Initiating Coverage - Centrum 26022020Document32 pagesKPIT Technologies - Initiating Coverage - Centrum 26022020Adarsh ReddyNo ratings yet

- Investments Profitability, Time Value & Risk Analysis: Guidelines for Individuals and CorporationsFrom EverandInvestments Profitability, Time Value & Risk Analysis: Guidelines for Individuals and CorporationsNo ratings yet

- Fitch Malaysia Infrastructure Report - 2020-03-18Document54 pagesFitch Malaysia Infrastructure Report - 2020-03-18kik leeNo ratings yet

- Fm202 Exam Questions 2013Document12 pagesFm202 Exam Questions 2013Grace VersoniNo ratings yet

- Buckwold 21e - Ch10 Selected SolutionDocument15 pagesBuckwold 21e - Ch10 Selected SolutionLucyNo ratings yet

- V Vietnam Ietnam: T Telec Elecommunica Ommunications R Tions Report EportDocument53 pagesV Vietnam Ietnam: T Telec Elecommunica Ommunications R Tions Report EportK59 Tran Kha Vy100% (1)

- Project Report Bba 6TH SemDocument103 pagesProject Report Bba 6TH Sembharat sachdeva83% (107)

- Vatech 2022.3Q Earnings Release - EngDocument17 pagesVatech 2022.3Q Earnings Release - Engemremik1No ratings yet

- ATRAM Global Technology Feeder Fund Fact Sheet Jan 2020Document2 pagesATRAM Global Technology Feeder Fund Fact Sheet Jan 2020anton clementeNo ratings yet

- Fund Facts - HDFC Tax Saver - August 22.1422969Document3 pagesFund Facts - HDFC Tax Saver - August 22.1422969Jignesh Jagjivanbhai PatelNo ratings yet

- Infrastructure Is Driving India's Growth. Buckle Up.: Invest in L&T Infrastructure FundDocument2 pagesInfrastructure Is Driving India's Growth. Buckle Up.: Invest in L&T Infrastructure FundDeepak Singh PundirNo ratings yet

- Motilal Oswal PMS PortfolioDocument25 pagesMotilal Oswal PMS PortfolioHetanshNo ratings yet

- Broadcom Company Overview IR 202006 FINAL PDFDocument18 pagesBroadcom Company Overview IR 202006 FINAL PDFReddaiah C MachineniNo ratings yet

- Opportunity Day: 28 February 2023Document40 pagesOpportunity Day: 28 February 2023sozodaaaNo ratings yet

- Edelteq 2023 05 09 Factsheet VfinalDocument2 pagesEdelteq 2023 05 09 Factsheet VfinalTee Nick VannNo ratings yet

- SyngeneDocument12 pagesSyngeneIndraneel MahantiNo ratings yet

- Happiest Minds TechnologiesLtd IPO NOTE07092020Document7 pagesHappiest Minds TechnologiesLtd IPO NOTE07092020subham mohantyNo ratings yet

- Press Release Saksoft Limited: Details of Instruments/facilities in Annexure-1Document5 pagesPress Release Saksoft Limited: Details of Instruments/facilities in Annexure-1Sandy SanNo ratings yet

- Quant Tax Plan - Fact SheetDocument1 pageQuant Tax Plan - Fact Sheetsaransh saranshNo ratings yet

- Tech Talk - 6-7Document1 pageTech Talk - 6-7John EerlNo ratings yet

- JP Morgan Greater China FundDocument13 pagesJP Morgan Greater China FundArmstrong CapitalNo ratings yet

- HDFC BlueChip FundDocument1 pageHDFC BlueChip FundKaran ShambharkarNo ratings yet

- Value Product Note October-20Document2 pagesValue Product Note October-20Swades DNo ratings yet

- Kontr 2q23 Investor Presentation 11102023Document56 pagesKontr 2q23 Investor Presentation 11102023Coyo TitoNo ratings yet

- PMSGDSEP2022Document292 pagesPMSGDSEP2022Rohan ShahNo ratings yet

- 2008 09 18 Wachovia Capital Markets Equity Research Semiconductor IndustryDocument80 pages2008 09 18 Wachovia Capital Markets Equity Research Semiconductor IndustryJohnnyPageNo ratings yet

- 國巨Document22 pages國巨9487豪No ratings yet

- Infineon Mobile - Robots ApplicationPresentation v01 - 00 ENDocument19 pagesInfineon Mobile - Robots ApplicationPresentation v01 - 00 ENjonj72351No ratings yet

- SPDR S&P Midcap 400 ETF Trust: Fund Inception Date Cusip Key Features About This BenchmarkDocument2 pagesSPDR S&P Midcap 400 ETF Trust: Fund Inception Date Cusip Key Features About This BenchmarkmuaadhNo ratings yet

- EBUY Lyxor MSCI Digital Economy ESG Filtered DR UCITS ETF Acc USDDocument4 pagesEBUY Lyxor MSCI Digital Economy ESG Filtered DR UCITS ETF Acc USDpee-jayNo ratings yet

- TT Vision - Berhad - IPODocument11 pagesTT Vision - Berhad - IPO健德No ratings yet

- HDFC Opportunities FundDocument1 pageHDFC Opportunities FundManjunath BolashettiNo ratings yet

- Ar2005e PDFDocument80 pagesAr2005e PDFJan LerNo ratings yet

- Fund Facts - HDFC TaxSaver - February 2022Document2 pagesFund Facts - HDFC TaxSaver - February 2022Tarun TiwariNo ratings yet

- Portfolio Characteristics: 1 Year YTD QTD 5 Years Since Inception Index Returns (%)Document2 pagesPortfolio Characteristics: 1 Year YTD QTD 5 Years Since Inception Index Returns (%)Praise and worshipNo ratings yet

- Broadcom Company Overview IR 20231206 FINALDocument20 pagesBroadcom Company Overview IR 20231206 FINALRockyBloomNo ratings yet

- Best of TataDocument4 pagesBest of TatamaheshNo ratings yet

- Kotak Technology Fund FAQsDocument4 pagesKotak Technology Fund FAQsjayalekshmicvNo ratings yet

- IPO Factsheet Cosmos Technology International BerhadDocument2 pagesIPO Factsheet Cosmos Technology International Berhadsj7953No ratings yet

- SiTime - 회사소개서 Investor Presentation - 2021Document27 pagesSiTime - 회사소개서 Investor Presentation - 2021천일계전No ratings yet

- Gronic MaybankDocument9 pagesGronic MaybankNicholas ChehNo ratings yet

- FMDS0900Document39 pagesFMDS0900tricedenceNo ratings yet

- Ind Niftysmallcap 50Document2 pagesInd Niftysmallcap 50Santosh TandaleNo ratings yet

- ValueResearchFundcard HDFCRetirementSavingsFund HybridEquityPlan RegularPlan 2019mar04Document4 pagesValueResearchFundcard HDFCRetirementSavingsFund HybridEquityPlan RegularPlan 2019mar04ChittaNo ratings yet

- Vanguard Global Stock Index FundDocument4 pagesVanguard Global Stock Index FundjorgeperezsidecarshotmailomNo ratings yet

- ValueResearchFundcard L&TInfrastructureFund DirectPlan 2017nov23Document4 pagesValueResearchFundcard L&TInfrastructureFund DirectPlan 2017nov23ShamaNo ratings yet

- Majesco HDFC Sec PDFDocument25 pagesMajesco HDFC Sec PDFJatin SoniNo ratings yet

- Posicionamiento de Switching CiscoDocument43 pagesPosicionamiento de Switching CiscoDavid EspinozaNo ratings yet

- Nifty IndicesDocument19 pagesNifty Indicesjitender8No ratings yet

- HDFC Diversified Equity FundDocument1 pageHDFC Diversified Equity FundMayank RajNo ratings yet

- Portfolio Characteristics: Since Inception 5 Years 1 Year QTD Ytd Index Returns (%)Document2 pagesPortfolio Characteristics: Since Inception 5 Years 1 Year QTD Ytd Index Returns (%)Atul KaulNo ratings yet

- Factsheet Nifty Consumer DurablesDocument2 pagesFactsheet Nifty Consumer DurablesUMANG KHUNTNo ratings yet

- 9 Factsheet - Nifty - Consumer - DurablesDocument2 pages9 Factsheet - Nifty - Consumer - DurablesKapilSahuNo ratings yet

- FY2022InvPresFY2022InvPresL&T Q4FY22 Investor PresentationDocument59 pagesFY2022InvPresFY2022InvPresL&T Q4FY22 Investor PresentationS MD SAMEERNo ratings yet

- JT Express - Highlights of Draft IPO Prospectus - MW - June - 2023 c8jnqgDocument18 pagesJT Express - Highlights of Draft IPO Prospectus - MW - June - 2023 c8jnqgfkyqn9kp75No ratings yet

- Rating Rationale-CRISILDocument6 pagesRating Rationale-CRISILSagar KansalNo ratings yet

- Cisco Switching Positioning Claro - Abril 2012 - (Consultores)Document39 pagesCisco Switching Positioning Claro - Abril 2012 - (Consultores)David EspinozaNo ratings yet

- ValueResearchFundcard AxisDynamicEquityFund RegularPlan 2019oct11Document4 pagesValueResearchFundcard AxisDynamicEquityFund RegularPlan 2019oct11ChittaNo ratings yet

- India Automotive Component Post Covid 19Document27 pagesIndia Automotive Component Post Covid 19Anurag MishraNo ratings yet

- Ind Nifty 500Document2 pagesInd Nifty 500VIGNESH RKNo ratings yet

- NTDOP Product Note 31st October 2020Document2 pagesNTDOP Product Note 31st October 2020Swades DNo ratings yet

- Blue Chip JulyDocument1 pageBlue Chip JulyPiyushNo ratings yet

- Braced for Impact: Reforming Kazakhstan's National Financial Holding for Development Effectiveness and Market CreationFrom EverandBraced for Impact: Reforming Kazakhstan's National Financial Holding for Development Effectiveness and Market CreationNo ratings yet

- Listening - Creating Balance Sheet - Sinh ViênDocument2 pagesListening - Creating Balance Sheet - Sinh ViênQuỳnh PhanNo ratings yet

- Listening - Ratios For Evaluating Financial Progress - Sinh ViênDocument2 pagesListening - Ratios For Evaluating Financial Progress - Sinh ViênQuỳnh PhanNo ratings yet

- 27.THPT Thái Phiên - Hải Phòng - Lần 1 - Năm 2019 (Có Lời Giải Chi Tiết)Document24 pages27.THPT Thái Phiên - Hải Phòng - Lần 1 - Năm 2019 (Có Lời Giải Chi Tiết)Quỳnh PhanNo ratings yet

- De Thi Chon HSG Anh 6 - THSDocument7 pagesDe Thi Chon HSG Anh 6 - THSQuỳnh PhanNo ratings yet

- Kilimo Kwanza Resolution - FinalDocument2 pagesKilimo Kwanza Resolution - FinalVincs KongNo ratings yet

- KSA Education Sector Report - AljaziraDocument16 pagesKSA Education Sector Report - Aljaziraaliahmed.iba95No ratings yet

- BFC5935 - Tutorial 4 SolutionsDocument6 pagesBFC5935 - Tutorial 4 SolutionsXue XuNo ratings yet

- One Dollar VentureDocument2 pagesOne Dollar VentureAjanta KNo ratings yet

- North America - GCT Report 2023 (Digital)Document20 pagesNorth America - GCT Report 2023 (Digital)Ali AlharbiNo ratings yet

- A029 Vishal Goyal SSDocument46 pagesA029 Vishal Goyal SSvishalgoyal0043No ratings yet

- Punjab National Bank Financial Inclusion: Experience SharingDocument18 pagesPunjab National Bank Financial Inclusion: Experience SharingShreya DubeyNo ratings yet

- Chapter 4Document6 pagesChapter 4Fatemah MohamedaliNo ratings yet

- Banking and Insurance Law - Abstract and Synopsis!Document4 pagesBanking and Insurance Law - Abstract and Synopsis!Anonymous 6oIohENx0% (1)

- Kim C Pangilinan Profile-1Document4 pagesKim C Pangilinan Profile-1JenniferNo ratings yet

- Information System Used by Hindustan Unilever LimitedDocument3 pagesInformation System Used by Hindustan Unilever LimitedSaanjana G PNo ratings yet

- Digest RR 5-2015Document1 pageDigest RR 5-2015Cristine100% (1)

- Study On Financial Report of Emami and Calculation of RatiosDocument30 pagesStudy On Financial Report of Emami and Calculation of RatiosanupsharmahrmNo ratings yet

- 0 Keep in Order: This Chapter Has 122 QuestionsDocument21 pages0 Keep in Order: This Chapter Has 122 QuestionsDinesh DhalNo ratings yet

- Chanda D. Kochhar: Executive ProfileDocument5 pagesChanda D. Kochhar: Executive ProfileRahul PandeyNo ratings yet

- BizLaunch Account PricingDocument3 pagesBizLaunch Account PricingfairwellmdNo ratings yet

- 1995 - Stern and Stewart - EVADocument17 pages1995 - Stern and Stewart - EVAAbdulAzeemNo ratings yet

- WSP Indonesia WSS Turning Finance Into Service For The FutureDocument88 pagesWSP Indonesia WSS Turning Finance Into Service For The FutureLutfi LailaNo ratings yet

- Chapter 2 Completing The Audit Process Isa 560Document52 pagesChapter 2 Completing The Audit Process Isa 560黄勇添No ratings yet

- Comprehensive Problem Excel SpreadsheetDocument23 pagesComprehensive Problem Excel Spreadsheetapi-237864722100% (3)

- 09-29-2010 Term Sheet - Wednesday, Sept. 2919Document5 pages09-29-2010 Term Sheet - Wednesday, Sept. 2919Sri ReddyNo ratings yet

- BrochureDocument5 pagesBrochureSumay Kumar FNo ratings yet

- Case Assignment MNGMNT BirhaassasaDocument9 pagesCase Assignment MNGMNT BirhaassasaBirhanu BerihunNo ratings yet

- Week 7 - PPL Ganjil 2023-2024Document35 pagesWeek 7 - PPL Ganjil 2023-2024riqqi rahardi jrNo ratings yet

- Role of Law and Legal Institutions in Cambodia Economic DevelopmentDocument410 pagesRole of Law and Legal Institutions in Cambodia Economic DevelopmentThach Bunroeun100% (1)

- Syed Zaveer Naqvi Internship Viva ReportDocument42 pagesSyed Zaveer Naqvi Internship Viva ReportMuhammad HasnatNo ratings yet

- What Is The Link Between Organisation Strateg1Document12 pagesWhat Is The Link Between Organisation Strateg1Pardeep KumarNo ratings yet