Professional Documents

Culture Documents

Problem 4.10 and 4.11 Solutions

Uploaded by

Apex RosettiOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Problem 4.10 and 4.11 Solutions

Uploaded by

Apex RosettiCopyright:

Available Formats

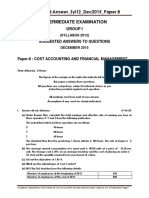

Depreciation Accounting Problems 4.10 and 4.

11

Problems 4.10 and 4.11 focus on depreciation accounting.

Problem 4.10

During its first year of operations, United Entertainment Co. (UEC) purchased a piece of equipment

for $96,000. It submitted and paid for the purchase via the seller’s online purchase order system on

January 1, so for purposes of this problem you can assume that UEC has owned the equipment for

a full year during year one of operations. UEC estimates that the equipment will have an expected

useful life of 12 years and a salvage value of $40,000. In addition, UEC estimates that the

equipment will produce 80,000 units over its useful life.

Determine the amount of depreciation expense that UEC should recognize for years one to five

using each of the following depreciation methods and assume that UEC produces 6,800, 6,400,

6,600, 6,100, and 5,900 units in years one to five, respectively:

Part A: Straight-Line Method

Formula: Cost - Salvage / Useful Life 96,000 - 40,000/ 12 = $4,666.67/year

Depreciation Expense: Years 1 - 5: $4,666.67 each year or $23,333.35 for first five years

Part B: Declining Balance Method (for both 150 percent and 200 percent)

Straight Line Rate = 1/12

Straight Line Rate = .083

Declining Balance Rate @150% = 150% X .083

Declining Balance Rate @150% = .1245

Asset would be fully depreciated in year 7 if problem was extended.

Declining Balance Rate @200% = 200% X .083

Declining Balance Rate @200% = .166

* Actual year 5 depreciation is $7,709.81, but year 5 depreciation expense is

capped at $6,444.62 so asset is not depreciated below its $40,000 salvage value.

Part C: Sum-of-the-Years’ Digits Method

SYD = [12(12+1)]/2

SYD = 78

Part D: Units of Production Method

Depreciation Rate = (96,000 - 40,000) / 80,000

Depreciation Rate = 0.70/unit

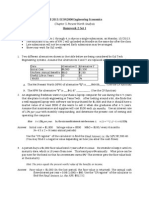

Problem 4.11

UEC also purchased office computers worth $112,000 during its first year of operations on June 1. In

addition to the cost of the computers, it cost UEC an additional $2,100 in delivery charges, which

included the delivery fee and cost of in-transit insurance. Lastly, UEC paid a third-party contractor

$900 to install the computers. UEC believes the computers will only last four years, at which point

UEC will sell them for parts for $12,400.

Determine the amount of depreciation expense that UEC should recognize for each year under the

following depreciation methods:

Part A: Straight-Line Method

Formula: Cost - Salvage / Useful Life = (115,000-12.400) / 4 = 25,650 per year

Depreciation Expense: Years 1 - 4: $25,650 each year

Total Depreciation Expense: $102,600

Part B: Declining Balance Method (for both 150 percent and 200 percent)

Straight Line Rate = 1/4

Straight Line Rate = .25

Declining Balance Rate @150% = 150% X .25

Declining Balance Rate @150% = .375

* Asset was not fully depreciated in 4 years so depreciation carries into year 5

to record the remaining $5,147.61 worth of depreciation to reach salvage of $12,400

Declining Balance Rate @200% = 200% X .25

Declining Balance Rate @200% = .50

* Actual year 4 depreciation is $7,187.50, but year 4 depreciation expense is

capped at $1,975.00 so asset is not depreciated below $12,400.00 salvage value.

Part C: Sum-of-the-Years’ Digits Method

SYD = [4(4+1)]/2

SYD = 10

You might also like

- Advanced Cost Management MidtermDocument9 pagesAdvanced Cost Management MidtermAnkit BajajNo ratings yet

- ACCT 434 Midterm ExamDocument5 pagesACCT 434 Midterm ExamDeVryHelpNo ratings yet

- Life Cycle CostingDocument38 pagesLife Cycle CostingSapan Gupta100% (2)

- E) DepreciationDocument40 pagesE) DepreciationOtieno EdwineNo ratings yet

- ACCT 434 Midterm Exam (Updated)Document4 pagesACCT 434 Midterm Exam (Updated)DeVryHelpNo ratings yet

- Class: 9 Project Programs 2021-2022Document6 pagesClass: 9 Project Programs 2021-2022Deekshith mNo ratings yet

- Module Code: PMC Module Name: Performance Measurement & Control Programme: MSC FinanceDocument9 pagesModule Code: PMC Module Name: Performance Measurement & Control Programme: MSC FinanceRenato WilsonNo ratings yet

- Saage SG Fma RevisionDocument21 pagesSaage SG Fma RevisionNurul Shafina HassanNo ratings yet

- Ias 16 HW1Document3 pagesIas 16 HW1Raashida RiyasNo ratings yet

- (Drills - Ppe) Acc.107Document10 pages(Drills - Ppe) Acc.107Boys ShipperNo ratings yet

- Chapter 11 SolvedDocument20 pagesChapter 11 SolvedSaeed Ahmed (Father Name:Jamal Ud Din)No ratings yet

- Acc312 Platt Spr07 Exam1 Solution PostedDocument13 pagesAcc312 Platt Spr07 Exam1 Solution Posted03322080738No ratings yet

- Intermediate Examination: Suggested Answer - Syl12 - Dec2015 - Paper 8Document15 pagesIntermediate Examination: Suggested Answer - Syl12 - Dec2015 - Paper 8JOLLYNo ratings yet

- Cash Flow Estimation Models: Estimating Relationships and ProblemsDocument30 pagesCash Flow Estimation Models: Estimating Relationships and ProblemsSenthil RNo ratings yet

- Capital BudgetingDocument16 pagesCapital Budgetingjamn1979No ratings yet

- HW 2 Set 1 KeysDocument7 pagesHW 2 Set 1 KeysIan SdfuhNo ratings yet

- PART I (Short Answer) : 1 - Explain Plant Asset, Intangible Asset and Natural Resource With Your Own Term?Document6 pagesPART I (Short Answer) : 1 - Explain Plant Asset, Intangible Asset and Natural Resource With Your Own Term?CHALCHISA soboksaNo ratings yet

- Chapter 10Document3 pagesChapter 10Michaela Francess Abrasado AbalosNo ratings yet

- Final Review Questions SolutionsDocument5 pagesFinal Review Questions SolutionsNuray Aliyeva100% (1)

- Answer To PTP - Intermediate - Syllabus 2012 - Jun2014 - Set 2Document16 pagesAnswer To PTP - Intermediate - Syllabus 2012 - Jun2014 - Set 2ankitshah21No ratings yet

- Management Accounting 1 (Acc103) Assignment (15%) Sem 1, 2021 Due Date: 5 Apr 2021 General InstructionsDocument9 pagesManagement Accounting 1 (Acc103) Assignment (15%) Sem 1, 2021 Due Date: 5 Apr 2021 General InstructionsRan CastiloNo ratings yet

- Porter's Five Forces Analysis of Polyglue MarketDocument7 pagesPorter's Five Forces Analysis of Polyglue MarketchengNo ratings yet

- Module 10 ExercisesDocument5 pagesModule 10 Exercisesomsfadhl50% (2)

- Advanced Multiple Choice QuizDocument3 pagesAdvanced Multiple Choice Quizfgaushiya0% (1)

- 2016 AccountingDocument16 pages2016 AccountingAlison JcNo ratings yet

- Tutorial - 1 - 2 - (06.10.2022, 13.10.22) TOPIC: Basic Cost Terms and Concepts, Cost Classification Ex. 1Document3 pagesTutorial - 1 - 2 - (06.10.2022, 13.10.22) TOPIC: Basic Cost Terms and Concepts, Cost Classification Ex. 1Tomas SanzNo ratings yet

- Tugas Terstruktur 1Document2 pagesTugas Terstruktur 1patrick jeo100% (1)

- Acca QNSDocument10 pagesAcca QNSIshmael OneyaNo ratings yet

- Cases Data - Session 1 Revision of Cost AccountingDocument3 pagesCases Data - Session 1 Revision of Cost AccountingQian LiuNo ratings yet

- Chapter 01 Problems & Final AnswersDocument4 pagesChapter 01 Problems & Final AnswersEng. Mahmoud AlkhabitNo ratings yet

- Lecture11 - Mar15 Long-Term Assets, Depreciation (Deferred Taxes) PDFDocument6 pagesLecture11 - Mar15 Long-Term Assets, Depreciation (Deferred Taxes) PDFjasminetsoNo ratings yet

- Seem 2440A/B - Engineering Economics First Term (2011 - 2012)Document3 pagesSeem 2440A/B - Engineering Economics First Term (2011 - 2012)Sun KelvinNo ratings yet

- Mas Drill 2Document5 pagesMas Drill 2Hermz ComzNo ratings yet

- CA IPCC Costing Nov 14 Guideline Answers PDFDocument13 pagesCA IPCC Costing Nov 14 Guideline Answers PDFmohanraokp2279No ratings yet

- 2009-Management Accounting Main EQP and CommentariesDocument53 pages2009-Management Accounting Main EQP and CommentariesBryan Sing100% (1)

- Managerial Accounting ExamenDocument4 pagesManagerial Accounting Examenabalasa54100% (1)

- MTP - Intermediate - Syllabus 2012 - Jun2015 - Set 1: Paper - 8: Cost Accounting & Financial ManagementDocument8 pagesMTP - Intermediate - Syllabus 2012 - Jun2015 - Set 1: Paper - 8: Cost Accounting & Financial ManagementRAj BardHanNo ratings yet

- Plant, Assets, Natural Resources and Intangible AssetsDocument31 pagesPlant, Assets, Natural Resources and Intangible AssetsNatya Nindyagitaya100% (1)

- Numb Er of MH Maintena Nce Costs Numb Er of MH Maintena Nce CostsDocument3 pagesNumb Er of MH Maintena Nce Costs Numb Er of MH Maintena Nce CostssuperultimateamazingNo ratings yet

- Waterway Continuous Problem WCPDocument17 pagesWaterway Continuous Problem WCPAboi Boboi50% (4)

- 202E02Document20 pages202E02plaestineNo ratings yet

- Today Agenda: What Is A Project?Document9 pagesToday Agenda: What Is A Project?Nouman SheikhNo ratings yet

- Tutorial Chapter 10-11 Part ADocument47 pagesTutorial Chapter 10-11 Part AKate BNo ratings yet

- ACCT 1002 BBC Session Depreciation Methods & Merchandising ConceptsDocument29 pagesACCT 1002 BBC Session Depreciation Methods & Merchandising ConceptsMingxNo ratings yet

- ITP4107 Technical Support Fund 1617 Test2 AnsDocument2 pagesITP4107 Technical Support Fund 1617 Test2 AnsdieloNo ratings yet

- Cash Flow EstimationDocument9 pagesCash Flow EstimationCassandra ChewNo ratings yet

- Cocomo II With ExampleDocument7 pagesCocomo II With ExampleInsta GramNo ratings yet

- Acct1 8 (1Document9 pagesAcct1 8 (1Thu V A NguyenNo ratings yet

- Plates in Econ Direction: Copy and Solve The Following Problems in A Short/long/a4 Bond of Paper. Final Answer Must Be inDocument1 pagePlates in Econ Direction: Copy and Solve The Following Problems in A Short/long/a4 Bond of Paper. Final Answer Must Be inJamie MedallaNo ratings yet

- Cash Flow Estimation in Capital Budgeting A Case StudyDocument4 pagesCash Flow Estimation in Capital Budgeting A Case Studyahmadmujtaba005No ratings yet

- TRADITIONAL VS ABC COSTING FOR TWO PRODUCTSDocument16 pagesTRADITIONAL VS ABC COSTING FOR TWO PRODUCTSrsalicsicNo ratings yet

- 97 ZaDocument7 pages97 ZaMeow Meow HuiNo ratings yet

- Question 1 (14 Points)Document18 pagesQuestion 1 (14 Points)Spam SpamNo ratings yet

- Cama PDFDocument15 pagesCama PDFChandrikaprasdNo ratings yet

- How to Estimate with RSMeans Data: Basic Skills for Building ConstructionFrom EverandHow to Estimate with RSMeans Data: Basic Skills for Building ConstructionRating: 4.5 out of 5 stars4.5/5 (2)

- Chassis Dynamometer Testing: Addressing the Challenges of New Global LegislationFrom EverandChassis Dynamometer Testing: Addressing the Challenges of New Global LegislationNo ratings yet

- Chapter# 5 Accounting Transaction CycleDocument16 pagesChapter# 5 Accounting Transaction CycleMuhammad IrshadNo ratings yet

- Bar 2015 QuestionsDocument27 pagesBar 2015 QuestionsBrent DagbayNo ratings yet

- Call Center Business Plan ExampleDocument33 pagesCall Center Business Plan ExamplemeozenemyNo ratings yet

- Bagul Salma Case DigestDocument11 pagesBagul Salma Case DigestJake Pipania BaruadoNo ratings yet

- M.Mukundhante AbhimukhamDocument7 pagesM.Mukundhante AbhimukhamkanakambariNo ratings yet

- The Original Version of James Tansey's Growing Pains ReportDocument19 pagesThe Original Version of James Tansey's Growing Pains ReportIan Young100% (1)

- WTO Trade Policy Review - PhilippinesDocument9 pagesWTO Trade Policy Review - PhilippinesBela VillamilNo ratings yet

- Loan Sanction Letter C33EFFTDocument10 pagesLoan Sanction Letter C33EFFTNAKSH CREATIONNo ratings yet

- Black-Scholes Option PricingDocument11 pagesBlack-Scholes Option PricingtraderescortNo ratings yet

- Accounting Thesis Topics For UndergraduateDocument4 pagesAccounting Thesis Topics For Undergraduatebshpab74100% (2)

- Bhel (Bhel In) : Q4FY19 Result UpdateDocument6 pagesBhel (Bhel In) : Q4FY19 Result Updatesaran21No ratings yet

- 2013-14 Wabash College Academic BulletinDocument294 pages2013-14 Wabash College Academic BulletinYoung-ho ParkNo ratings yet

- Rice Bistro Business PlanDocument69 pagesRice Bistro Business PlanChienny HocosolNo ratings yet

- Inside The Black Box - Revealing The Alternative Beta in Hedge Fund Returns - (J.P. Morgan Asset Management)Document10 pagesInside The Black Box - Revealing The Alternative Beta in Hedge Fund Returns - (J.P. Morgan Asset Management)QuantDev-MNo ratings yet

- Customers' perception of insuranceDocument48 pagesCustomers' perception of insuranceYogendraNo ratings yet

- Non-Current Assets Held For SaleDocument20 pagesNon-Current Assets Held For Salerj batiyegNo ratings yet

- Trading With The 200 and 50 EMADocument3 pagesTrading With The 200 and 50 EMAChrisLaw123100% (2)

- Management Consultancy Finals ReviewDocument20 pagesManagement Consultancy Finals ReviewGerlie89% (9)

- Master in Economics of Banking and Finance ProgramDocument2 pagesMaster in Economics of Banking and Finance ProgramtranglomangoNo ratings yet

- Haresham BaharumDocument38 pagesHaresham Baharumjaharuddin.hannoverNo ratings yet

- Ba PDFDocument269 pagesBa PDFTaskin Reza KhalidNo ratings yet

- BloombergDocument100 pagesBloombergMentor RexhepiNo ratings yet

- Partnership EssentialsDocument48 pagesPartnership EssentialsMary Pascua Abella100% (1)

- FIC77LIFE - Bene ChangeDocument6 pagesFIC77LIFE - Bene ChangeMary GeorgeNo ratings yet

- Klarna DealsDatabseExportDataDocument18 pagesKlarna DealsDatabseExportDataGreg AdamsNo ratings yet

- Royal Monetary Authority Act of Bhutan, 2010eng5thDocument95 pagesRoyal Monetary Authority Act of Bhutan, 2010eng5thsha ve3No ratings yet

- Risk and Insurance: Biyani's Think TankDocument122 pagesRisk and Insurance: Biyani's Think TankFaiz Ur RehmanNo ratings yet

- Harry Markowitz TranscriptDocument31 pagesHarry Markowitz TranscriptGanesh DhoulakhandiNo ratings yet

- Audit Case StudiesDocument18 pagesAudit Case StudiesAanand ALNo ratings yet

- CH 18 Audit of The Acquisition and Payment Cycle PDFDocument13 pagesCH 18 Audit of The Acquisition and Payment Cycle PDFFred The Fish100% (1)