Professional Documents

Culture Documents

CDD Form Individual

Uploaded by

Arslan ButtOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CDD Form Individual

Uploaded by

Arslan ButtCopyright:

Available Formats

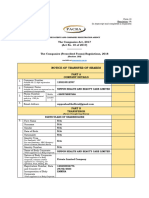

Customer Due Diligence Details for Individuals

As per the requirement of AML & CFT Regulations, 2018

Name Portfolio No.

CNIC Date of Birth

Nationality

Section 1

Source of Income Business/Self-owned Salary Pension Rent Profit / Dividend Other

Source of Wealth Inheritance Remittances Savings Stocks/Investments Other

Landlord Real Estate/Builder Accountant/Auditor Lawyer/Advocate Doctor/Pharmacist Agriculturist/Dairy Farmer

Occupation

Details Importer/Exporter Retailer/Wholesaler Consultant/Tax Advisor Jeweler/Precious Metal & Stone Other

Section 2

Is the customer a PEP or the persons (close aides, relatives etc.) acting on behalf of the person a PEP or its beneficial owner? Yes No

Does the customer originate from non-compliant FATF countries? Yes No

If answers to any of the above is YES, the customer shall be categorized as High Risk.

Section 3

Customer Risk Profiling

Risk Determinants Risk Variables Risk Assigned Weight

Amount of Investment (up to Rs. 2.5 mn--score 0, Rs. 2.5 to Rs. 5 mn -- 5, Rs. 5-Rs. 9.99 mn--10, 10mn and above--20)

There is a reason to believe that the customer has been refused by any financial institution

Customer’s source of wealth/income is high risk/cash intensive (real estate, retailer, jewelers or dealers of

Customers

precious metals, clearing & forwarding agents, real estate brokers, lawyer/notaries or self-employed without

registration with FBR where required)

Is the customer financially dependent or supported by another person (e.g. customer being housewife, student etc.)

Beneficial ownership of funds may not belong to customer

Products & Services Use of products and services which entail non face-to-face contact (e.g. online account opening)

Are investment being made through online channels

Channels

Element of anonymity in transaction (investment made through third party)

Customer’s link to offshore centers or tax havens

Locations

Customer is a non-resident.

Total

Please note that risk weight assigned as above have been selected according to assessment of risk i.e.

Never = 0

Scale

Low = 5

Moderate = 10

High = 20

Benchmarking Rating Customer Risk Profiling Check

Risk Score Range

1-2 Low Risk

Below 25 1

26-40 2

41-55 3 3-4 Medium Risk

56-70 4

71-85 5

5-6 High Risk

85 and above 6

Note: If answers to any of the questions in Section 2 is Yes then customer risk rating would be higher irrespective of the rating in Section 3. Please specify the reason for assigned low risk rating (mandatory)

Physical Address Verification Date (only if required)

Prepared by Reviewed by Approved by Senior Management (applicable for high risk customer)

Preparer and reviewer needs to ensure that all the documents as specified in the KYC Checklist are complete and obtained at the time of filling of this form.

PEPs (Politically Exposed Person) includes:

Foreign PEPs, individuals who are or have been entrusted with prominent public functions by a foreign country, for example Heads of State or of government, senior

politicians, senior government, judiciary or military officials, senior executives of state owned corporations, important political party officials;

Domestic PEPs, individuals who are or have been entrusted with prominent public function for example Heads of state or of government, senior politicians, senior government

judiciary or military officials, senior executives of state owned corporations, important political party officials;

Persons who are or have been entrusted with a prominent function by an International organization, means members of senior management and members of the board

or equivalent functions.

You might also like

- 1.3 Risk+Taking+A+Corporate+Governance+Perspective+风险承担:公司治理的角度+ (2015考纲本节删除,选修)Document25 pages1.3 Risk+Taking+A+Corporate+Governance+Perspective+风险承担:公司治理的角度+ (2015考纲本节删除,选修)James JiangNo ratings yet

- KYC AML CFT Procedure ManualDocument74 pagesKYC AML CFT Procedure ManualVipul Jain100% (7)

- Risk Management Worksheets Risk Assessment WorksheetDocument4 pagesRisk Management Worksheets Risk Assessment Worksheetkapil ajmaniNo ratings yet

- Farage DossierDocument40 pagesFarage DossierCallum JonesNo ratings yet

- Course Agenda: Understanding Money LaunderingDocument56 pagesCourse Agenda: Understanding Money LaunderinglarissarovaneNo ratings yet

- KYC Onboarding Work FlowDocument15 pagesKYC Onboarding Work FlowVijay Challa0% (1)

- Kyc Aml PDFDocument25 pagesKyc Aml PDFshruti tyagiNo ratings yet

- Chapters 10 and 12 Credit Analysis and Distress Prediction3223Document45 pagesChapters 10 and 12 Credit Analysis and Distress Prediction3223alfiNo ratings yet

- Data Driven Approach To KYCDocument31 pagesData Driven Approach To KYCPankaj Kumar Baid100% (2)

- AML KYC Questionnaire For Financial InstitutionsDocument8 pagesAML KYC Questionnaire For Financial Institutionspaddy borhadeNo ratings yet

- Anti Money LaunderingDocument13 pagesAnti Money LaunderingphdmakerNo ratings yet

- Customer Due Diligence TemplatesDocument25 pagesCustomer Due Diligence TemplatesFreznel B. Sta. Ana100% (1)

- KycDocument51 pagesKycAli ShamsheerNo ratings yet

- Credit Risk: Categories ofDocument17 pagesCredit Risk: Categories ofaroojchNo ratings yet

- FinQuiz - Smart Summary - Study Session 16 - Reading 56Document7 pagesFinQuiz - Smart Summary - Study Session 16 - Reading 56Rafael100% (1)

- 2013 FRM Level 1 Practice ExamDocument93 pages2013 FRM Level 1 Practice ExamDũng Nguyễn TiếnNo ratings yet

- TF Firm Wide Risk Assessment 1022Document7 pagesTF Firm Wide Risk Assessment 1022Vu Nguyen AnhNo ratings yet

- (GFB) Risk Assessment Tool - Make ADocument100 pages(GFB) Risk Assessment Tool - Make Aeya dridiNo ratings yet

- Risk Management and ALMDocument93 pagesRisk Management and ALMThe Cultural CommitteeNo ratings yet

- Interview Question Answer For KYC AML Profile 1677153332Document13 pagesInterview Question Answer For KYC AML Profile 1677153332shivali guptaNo ratings yet

- Audit and Assurance: AnswersDocument20 pagesAudit and Assurance: AnswersLauren McMahonNo ratings yet

- AAI 2 Part 8 PSA 240 Fraud & Error Rev PDFDocument141 pagesAAI 2 Part 8 PSA 240 Fraud & Error Rev PDFDanielle May CequiñaNo ratings yet

- KYC Interview Questions PDFDocument6 pagesKYC Interview Questions PDFJd DodiaNo ratings yet

- BoK - BPI AO - Final Customer Risk Profiling (CRP) FormatDocument3 pagesBoK - BPI AO - Final Customer Risk Profiling (CRP) FormatMuhammad Yaseen LakhaNo ratings yet

- Fra Merged PDFDocument336 pagesFra Merged PDFSubhadip SinhaNo ratings yet

- AMLA Risk Assessment Methodology 28th February 2020Document26 pagesAMLA Risk Assessment Methodology 28th February 2020nishi nanavatiNo ratings yet

- Critical Thinking - RISK CLASS HandoutDocument75 pagesCritical Thinking - RISK CLASS Handoutirshad khanNo ratings yet

- Customer Declaration Form MFDocument3 pagesCustomer Declaration Form MFswiftcenterNo ratings yet

- XC20200139 Saagar Chitkara BundlingDocument4 pagesXC20200139 Saagar Chitkara BundlingSaagar ChitkaraNo ratings yet

- Bus 303 Final Assignment DoneDocument10 pagesBus 303 Final Assignment DonePorosh Uddin Ahmed TaposhNo ratings yet

- AAA Assignment 1 FinalDocument7 pagesAAA Assignment 1 FinaljasonnumahnalkelNo ratings yet

- CRISL Rating of Banks and FI SDocument2 pagesCRISL Rating of Banks and FI SFaisal Tanvir KhanNo ratings yet

- Risk Assesment by Program AreaDocument7 pagesRisk Assesment by Program AreaJoanne PerandoNo ratings yet

- Plagiarism Report 1Document2 pagesPlagiarism Report 1Siddharth AgarwalNo ratings yet

- Credit Risk GradingDocument27 pagesCredit Risk GradingShafkat HossainNo ratings yet

- 03 Structure of Interest Rates GRCDocument6 pages03 Structure of Interest Rates GRCJohanna Nina UyNo ratings yet

- Know Your Client Information: Client Number Client Name Consultant Number Consultant NameDocument1 pageKnow Your Client Information: Client Number Client Name Consultant Number Consultant NameAndrewNo ratings yet

- UITF Kit Individual ClientsDocument14 pagesUITF Kit Individual ClientsNoel MolitNo ratings yet

- XC20200139 Saagar Chitkara Bundling V1Document4 pagesXC20200139 Saagar Chitkara Bundling V1Saagar ChitkaraNo ratings yet

- Agency Handbook 2021Document57 pagesAgency Handbook 2021Kartheek ChandraNo ratings yet

- Credit Risk GradingDocument88 pagesCredit Risk GradingSirak AynalemNo ratings yet

- Tool Kit - CFH Fa-050 21m - TWPLDocument9 pagesTool Kit - CFH Fa-050 21m - TWPLAshish Ranjan JhaNo ratings yet

- Credit Rating in "Bank of India"Document20 pagesCredit Rating in "Bank of India"Utkarsh SethiNo ratings yet

- Financial Risk Management - IntroductionDocument32 pagesFinancial Risk Management - IntroductionAnanthasyam GopimanoharanNo ratings yet

- Knowledge Series : Typical Payoff Scenario Typical Payoff ScenarioDocument2 pagesKnowledge Series : Typical Payoff Scenario Typical Payoff ScenarioAvinash NairNo ratings yet

- Presentation On Credit: Prepared byDocument32 pagesPresentation On Credit: Prepared bymoidulmktduNo ratings yet

- Small Firms Tools SampleDocument12 pagesSmall Firms Tools SampledongetalertNo ratings yet

- BkriskmgtDocument39 pagesBkriskmgtAtul VikashNo ratings yet

- Axis Investor Deck v2.4Document20 pagesAxis Investor Deck v2.4Puneet GoelNo ratings yet

- Credit Rating AgenciesDocument40 pagesCredit Rating AgenciesSmriti DurehaNo ratings yet

- Credit Rating MatrixDocument12 pagesCredit Rating MatrixNaman SharmaNo ratings yet

- Tool Kit - TFM A-015 MF - TWPLDocument10 pagesTool Kit - TFM A-015 MF - TWPLAshish Ranjan JhaNo ratings yet

- CFA L1 - DerivativesDocument44 pagesCFA L1 - Derivativesnur syahirah bt ab.rahmanNo ratings yet

- Credit Risk Mangament of Commercial Bank.Document5 pagesCredit Risk Mangament of Commercial Bank.Sibiya Zaman AdibaNo ratings yet

- General Information: Indicative Terms & ConditionsDocument8 pagesGeneral Information: Indicative Terms & ConditionsRudy RodriguezNo ratings yet

- BPI Equity Value Fund - November 2023 v2Document3 pagesBPI Equity Value Fund - November 2023 v2Lexter Renzo RamosNo ratings yet

- What Is A Risk Profile FormDocument4 pagesWhat Is A Risk Profile FormMahmood 786No ratings yet

- Chapter 7 NotesDocument7 pagesChapter 7 NotesSavy DhillonNo ratings yet

- Invt FM 1 Chapter-2Document68 pagesInvt FM 1 Chapter-2Khalid MuhammadNo ratings yet

- Risk Management Systems in Banks Genesis, Significance and ImplementationDocument32 pagesRisk Management Systems in Banks Genesis, Significance and Implementationmahajan87No ratings yet

- Monthly Factsheet Lu1883841022 Eng Rou Retail AmundiDocument5 pagesMonthly Factsheet Lu1883841022 Eng Rou Retail Amundiiulian_macoveiciucNo ratings yet

- Chapter 1. Risk ManagmentDocument16 pagesChapter 1. Risk ManagmentNeha MunankarNo ratings yet

- Analyst Prep VRM 2024Document425 pagesAnalyst Prep VRM 2024Useless IdNo ratings yet

- Presented By: Jasmeeta Setpal Shagufta Khan George D'lima Nilofar Momin Sumit ManwarDocument44 pagesPresented By: Jasmeeta Setpal Shagufta Khan George D'lima Nilofar Momin Sumit ManwarGeorgeNo ratings yet

- Credit Rating: Submitted By: Group 5 TH Roll No. 6144, 6145, 6136,6141,6104Document26 pagesCredit Rating: Submitted By: Group 5 TH Roll No. 6144, 6145, 6136,6141,6104sukhjeetkaur35No ratings yet

- Class IV-FinanceDocument19 pagesClass IV-FinanceVinayak RaoNo ratings yet

- Credit & Liquidity Risk of A Financial Institution: Perspective of Dhaka Bank LTDDocument46 pagesCredit & Liquidity Risk of A Financial Institution: Perspective of Dhaka Bank LTDzaman asadNo ratings yet

- Investor Risk Profile - Report: (Applicable For Unit Linked Insurance Plans)Document2 pagesInvestor Risk Profile - Report: (Applicable For Unit Linked Insurance Plans)miteshNo ratings yet

- RisksDocument7 pagesRisksJaden EuNo ratings yet

- International Asset RecoveryDocument8 pagesInternational Asset Recoveryred lilyNo ratings yet

- Fiduserve Management Ltd-Economic Profile Questionnaire-2021Document10 pagesFiduserve Management Ltd-Economic Profile Questionnaire-2021skyanikinNo ratings yet

- Annual KYC Updation Form - IndividualDocument2 pagesAnnual KYC Updation Form - IndividualJoy T100% (1)

- PEPDocument5 pagesPEPCPMMNo ratings yet

- Politically Exposed Person-Declaration: Nieuwezijds Voorburgwal 162, 1012 SJ Amsterdam, Netherlands - WWW - Rewire.toDocument1 pagePolitically Exposed Person-Declaration: Nieuwezijds Voorburgwal 162, 1012 SJ Amsterdam, Netherlands - WWW - Rewire.toAndrey GolosenkoNo ratings yet

- PGIM Common Application With SIPDocument6 pagesPGIM Common Application With SIPRakesh LahoriNo ratings yet

- HDFC Bank Resident Account To NRO Account Conversion FormDocument4 pagesHDFC Bank Resident Account To NRO Account Conversion FormHaroon MansooriNo ratings yet

- Updated M1 To M5 PRDocument7 pagesUpdated M1 To M5 PRRehan0% (1)

- KYC Manual GMBF - PDFDocument38 pagesKYC Manual GMBF - PDFkamal lamaNo ratings yet

- RBI Revised KYC Norms (27 (1) .11.09)Document108 pagesRBI Revised KYC Norms (27 (1) .11.09)Badri NathNo ratings yet

- Effects of Corruption in The Public Procurement Process On The Economy of The Country ZambiaDocument61 pagesEffects of Corruption in The Public Procurement Process On The Economy of The Country ZambiaMunya RadziNo ratings yet

- Politically Exposed Persons (PEPs) - Risks... (PDF Download Available)Document22 pagesPolitically Exposed Persons (PEPs) - Risks... (PDF Download Available)FrankNo ratings yet

- Account Opening Form - IndividualDocument5 pagesAccount Opening Form - IndividualoyindaNo ratings yet

- Naidoo Termination 2019Document37 pagesNaidoo Termination 2019M KashifNo ratings yet

- Kyc FormDocument6 pagesKyc FormSohel RanaNo ratings yet

- Blocked Account Contract DetailsDocument13 pagesBlocked Account Contract Detailsbeo hieuNo ratings yet

- Change in Designated Managing Partners & Partners (For Partnership Firms)Document25 pagesChange in Designated Managing Partners & Partners (For Partnership Firms)Sãmpãth Kûmãř kNo ratings yet

- GIABA Mutual Evaluation Senegal 2018Document216 pagesGIABA Mutual Evaluation Senegal 2018AnitEeuh ThiamNo ratings yet

- Anti-Money Laundering / Counter-Terrorism Financing Policy (AML/CTF-Policy)Document4 pagesAnti-Money Laundering / Counter-Terrorism Financing Policy (AML/CTF-Policy)Georgio RomaniNo ratings yet

- Companies Form 18Document8 pagesCompanies Form 18Sianga SiangaNo ratings yet