Professional Documents

Culture Documents

ACC 1100 Day 06&07 Columbia Example

Uploaded by

Mai Anh ĐàoOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ACC 1100 Day 06&07 Columbia Example

Uploaded by

Mai Anh ĐàoCopyright:

Available Formats

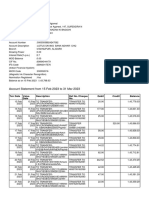

ACC 1100 Introductory Financial Accounting

Days 6&7 Adjusting Entry

Columbia Flying Service

Unadjusted Trial Balance

As at December 31, 2020

Debit Credit

Cash $61,500

Accounts receivable 45,000

Supplies inventory 2,000

Equipment 42,000

Equipment, accumulated depreciation $6,000

Planes 216,000

Planes, accumulated depreciation 71,000

Prepaid insurance 34,000

Accounts payable 8,000

Deferred revenue (lessons) 28,000

Notes payable 60,000

Common shares 10,000

Retained earnings 78,100

Revenues from lessons 895,000

Revenues from charters 156,000

Salaries expense 623,000

Fuel expense 189,000

Maintenance expense 51,000

Supplies expense 6,000

Insurance expense 15,000

Advertising expense 13,000

Rent expense 11,000

Interest expense 2,400

Licences and fees 1,200

$1,312,100 $1,312,100

The following information is also available:

1) Instructor salaries for the last week of December, 2020, have not yet been

recorded. They will be payable the first week of the New Year. Salaries for the

one week are $15,500.

2) In the course of the last two weeks of December, 2020, lessons were given that

had been paid for in advance (deferred revenue). The amount charged for the

lessons was $16,500. No accounting recognition has yet been given for the

service provided.

3) No depreciation has been recorded in 2020. The useful life of the planes is

estimated at 10 years (no salvage value) and that of the equipment at 7 years

(also no salvage value).

4) Rent for December, $1,000, has not yet been paid and recorded.

5) The company purchases a one-year insurance policy each year which takes

effect on July 1. The entire cost of the current year’s policy (July 1, 2020 to

June 30, 2021) has been charged (debited) to “Prepaid insurance”. No entries

to the “Insurance expense” have been made since July 1, 2020.

6) Interest on the $60,000 note payable outstanding is payable twice each year,

April 1 and October 1. The annual rate of interest is 8 percent. The note was

issued on April 1, 2020. The amount of interest expense represents the first

interest payment, which was made on October 1.

7) All purchases of supplies are charged (debited) to “Supplies expense”. The

balance in “Supplies inventory” represents supplies on hand at the beginning of

the year. A physical count on December 31, 2020, indicated supplies currently

on hand of $4,000.

8) On December 29, the company flew a charter for which it has not yet billed the

customer and which it has not yet recorded in the accounts. The customer will

be charged $6,800.

9) Based on preliminary computations, the firm estimates that income tax expense

for year 2020 will be $22,000.

Required

a. Prepare all journal entries that would be necessary to adjust and bring the

accounts up to date. (Add any additional account titles that you believe to be

necessary.)

b. Prepare all the financial statements except the statement of cash flows for

the year ending December 31, 2020.

You might also like

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Soal Mojakoe-UTS Akuntansi Keuangan 1 Ganjil 2020-2021Document9 pagesSoal Mojakoe-UTS Akuntansi Keuangan 1 Ganjil 2020-2021Vincenttio le CloudNo ratings yet

- SdsasacsacsacsacsacDocument4 pagesSdsasacsacsacsacsacIden PratamaNo ratings yet

- Arab Final 90% Fall2021 (YS)Document8 pagesArab Final 90% Fall2021 (YS)ahmed abuzedNo ratings yet

- Chapter 3 Practice QuestionsDocument3 pagesChapter 3 Practice QuestionsFamily PicturesNo ratings yet

- Principles of Accounting (A B E)Document3 pagesPrinciples of Accounting (A B E)r kNo ratings yet

- Module 2 - Financial StatementsDocument6 pagesModule 2 - Financial Statementskemifawole13No ratings yet

- A2.1 April2023Document7 pagesA2.1 April2023thuyhangg0209No ratings yet

- Mba ZC415 Ec-3r First Sem 2022-2023Document4 pagesMba ZC415 Ec-3r First Sem 2022-2023Ravi KaviNo ratings yet

- Accounting ExamDocument14 pagesAccounting ExamSally SalehNo ratings yet

- AC3202 WK2 Exercises (22:23A)Document9 pagesAC3202 WK2 Exercises (22:23A)Long LongNo ratings yet

- ĐỀ THI NLKT ĐỀ 8Document3 pagesĐỀ THI NLKT ĐỀ 8Khánh LêNo ratings yet

- PA T22WSB 3 Group Assignment 1Document4 pagesPA T22WSB 3 Group Assignment 1Pham Minh Thu NguyenNo ratings yet

- Class Problems CH 4Document9 pagesClass Problems CH 4Eduardo Negrete100% (2)

- Asm 2 AcDocument19 pagesAsm 2 AcNguyen Duc Quang (BTEC HN)No ratings yet

- MOJAKOE AK1 UTS 2012 GasalDocument15 pagesMOJAKOE AK1 UTS 2012 GasalVincenttio le CloudNo ratings yet

- Chapter 4 - Complete The Accounting Cycle Practice Set A: Exercise 4.1A - Prepare Correcting EntriesDocument8 pagesChapter 4 - Complete The Accounting Cycle Practice Set A: Exercise 4.1A - Prepare Correcting EntriesBảo GiangNo ratings yet

- (Adjusting Entries) The Ledger of Chopin Rental Agency On March 31 of The Current YearDocument3 pages(Adjusting Entries) The Ledger of Chopin Rental Agency On March 31 of The Current YearFlorencia IrenaNo ratings yet

- AkuntansuDocument36 pagesAkuntansusuryati hungNo ratings yet

- ĐỀ THI NLKT - ĐỀ 4Document4 pagesĐỀ THI NLKT - ĐỀ 4Hợp BáchNo ratings yet

- ACC 221 - Intermediate Accounting 3 Exit Competency Exam: Additional InformationDocument2 pagesACC 221 - Intermediate Accounting 3 Exit Competency Exam: Additional InformationRyan PedroNo ratings yet

- Practice Questions For Closing EntriesDocument2 pagesPractice Questions For Closing EntriesZainullah KhanNo ratings yet

- Prepare Financial Report AssignmentDocument7 pagesPrepare Financial Report AssignmentBiruk HabtamuNo ratings yet

- Group Assignment On Fundamentals of Accounting IDocument6 pagesGroup Assignment On Fundamentals of Accounting IKaleab ShimelsNo ratings yet

- ACW1120-Week 5 Practice Q-Topic 5-Prepare FSDocument8 pagesACW1120-Week 5 Practice Q-Topic 5-Prepare FSGan ZhengweiNo ratings yet

- Asm 2 Ac Tiếng Anh FullDocument23 pagesAsm 2 Ac Tiếng Anh FullNguyen Duc Quang (BTEC HN)No ratings yet

- E5-11 (Statement of Financial Position Preparation) Presented Below Is TheDocument7 pagesE5-11 (Statement of Financial Position Preparation) Presented Below Is Thedebora yosika100% (1)

- ACCT 2500 Test 2 Format, Instructions and ReviewDocument17 pagesACCT 2500 Test 2 Format, Instructions and Reviewyahye ahmedNo ratings yet

- Jawaban Mojakoe-UTS Akuntansi Keuangan 1 Ganjil 2020-2021Document22 pagesJawaban Mojakoe-UTS Akuntansi Keuangan 1 Ganjil 2020-2021Vincenttio le CloudNo ratings yet

- Revision - Additional ExercisesDocument2 pagesRevision - Additional ExercisesĐào Huyền Trang 4KT-20ACNNo ratings yet

- Solution - B124 - FTHE - V2 Summer 2020-2021 2 - V1Document13 pagesSolution - B124 - FTHE - V2 Summer 2020-2021 2 - V1AhmEd GhayasNo ratings yet

- BUS 285 F23 Practice Questions in WordDocument6 pagesBUS 285 F23 Practice Questions in WordLê AnhNo ratings yet

- Ap A2.1 - FinalDocument7 pagesAp A2.1 - FinalLuna LeeNo ratings yet

- QUICKDocument8 pagesQUICKnissaNo ratings yet

- Akuntansi Keuangan 1Document15 pagesAkuntansi Keuangan 1Vincenttio le CloudNo ratings yet

- Tutorials Topic 7Document9 pagesTutorials Topic 7haniNo ratings yet

- Adjusting EntriesDocument5 pagesAdjusting EntriesM Hassan BrohiNo ratings yet

- ACT301 (Final), Spring-21Document4 pagesACT301 (Final), Spring-21Papon SarkerNo ratings yet

- AE 22 Activity 8Document2 pagesAE 22 Activity 8Venus PalmencoNo ratings yet

- Bali Company Worksheet For The Year Ended December 31, 2020: InstructionsDocument4 pagesBali Company Worksheet For The Year Ended December 31, 2020: Instructionsshera haniNo ratings yet

- Homework 4題目Document2 pagesHomework 4題目劉百祥No ratings yet

- Exercise 1: On December 31, Bryniuk's Company, The Accounting Records Showed The Following InformationDocument10 pagesExercise 1: On December 31, Bryniuk's Company, The Accounting Records Showed The Following InformationJohn Kenneth Bohol50% (2)

- Chapter-1 Homework Basic Concepts Part 1Document4 pagesChapter-1 Homework Basic Concepts Part 1Kenneth Christian WilburNo ratings yet

- Chapter 13 Homework Assignment #2 QuestionsDocument8 pagesChapter 13 Homework Assignment #2 QuestionsCole Doty0% (1)

- Cases Chapter 5Document2 pagesCases Chapter 5Rifqi FarhanNo ratings yet

- Problems: Final Review Intermediate 1Document33 pagesProblems: Final Review Intermediate 1Nguyên NguyễnNo ratings yet

- Closing EntriesDocument10 pagesClosing EntriesFranco DexterNo ratings yet

- Sample Midterm Exam With SolutionDocument17 pagesSample Midterm Exam With Solutionq mNo ratings yet

- DocxDocument17 pagesDocxVy Pham Nguyen KhanhNo ratings yet

- (EN) Problem Mojakoe AK1Document11 pages(EN) Problem Mojakoe AK1gebbyNo ratings yet

- Financial Accounting-Assignment-4Document4 pagesFinancial Accounting-Assignment-4Margaux JohannaNo ratings yet

- Final Exam QuestionDocument4 pagesFinal Exam QuestionHồng XuânNo ratings yet

- HI5020 Tutorial Question Assignment T3 2020 FinalDocument7 pagesHI5020 Tutorial Question Assignment T3 2020 FinalAamirNo ratings yet

- Chapter 4 Review Principles of Accounting AnswersDocument3 pagesChapter 4 Review Principles of Accounting AnswersChien Phuong ThanhNo ratings yet

- FABM 210 Fundamentals of Accounting Part 2: Lyceum-Northwestern UniversityDocument10 pagesFABM 210 Fundamentals of Accounting Part 2: Lyceum-Northwestern UniversityAmie Jane MirandaNo ratings yet

- Acc 1 QuizDocument7 pagesAcc 1 QuizAyat MukahalNo ratings yet

- Managerial: July 16 Aug 16 Sept 16 Oct 16 Nov 16 Dec 16Document5 pagesManagerial: July 16 Aug 16 Sept 16 Oct 16 Nov 16 Dec 16Miral AqelNo ratings yet

- ACCT 490 Assignment 1Document7 pagesACCT 490 Assignment 1Saad FahadNo ratings yet

- Preparation of Financial StatementsDocument13 pagesPreparation of Financial StatementsSharina Mhyca SamonteNo ratings yet

- ACC601 Xero Assignment S1 2020 v1 PDFDocument9 pagesACC601 Xero Assignment S1 2020 v1 PDFbhavikaNo ratings yet

- Practice Operations Simulation - Reflection TemplateDocument1 pagePractice Operations Simulation - Reflection TemplateMai Anh ĐàoNo ratings yet

- ACC 1100 Day 08&09 Ratio and Comparative AnalysisDocument32 pagesACC 1100 Day 08&09 Ratio and Comparative AnalysisMai Anh ĐàoNo ratings yet

- ACC 1100 Day 12&13 InventoryDocument36 pagesACC 1100 Day 12&13 InventoryMai Anh ĐàoNo ratings yet

- ACC 1100 Day 10 Cash and Bank AccountDocument17 pagesACC 1100 Day 10 Cash and Bank AccountMai Anh ĐàoNo ratings yet

- Bombardier 2022 Financial Report enDocument176 pagesBombardier 2022 Financial Report enMai Anh ĐàoNo ratings yet

- ACC 1100 Day 08&09 Ratio DefinitionsDocument1 pageACC 1100 Day 08&09 Ratio DefinitionsMai Anh ĐàoNo ratings yet

- SM 10Document62 pagesSM 10Mai Anh ĐàoNo ratings yet

- SM 11Document75 pagesSM 11Mai Anh ĐàoNo ratings yet

- SM 06Document73 pagesSM 06Mai Anh ĐàoNo ratings yet

- SM 13Document71 pagesSM 13Mai Anh ĐàoNo ratings yet

- SM 07Document40 pagesSM 07Mai Anh ĐàoNo ratings yet

- SM 05Document92 pagesSM 05Mai Anh ĐàoNo ratings yet

- SM 14Document67 pagesSM 14Mai Anh ĐàoNo ratings yet

- Research Shows That Business Meetings, Discussions and Training Are Happening Online Nowadays. Do The Advantages Outweigh The Disadvantages?Document3 pagesResearch Shows That Business Meetings, Discussions and Training Are Happening Online Nowadays. Do The Advantages Outweigh The Disadvantages?Mai Anh ĐàoNo ratings yet

- More Employment Opportunities For People With High Income in Many CountriesDocument1 pageMore Employment Opportunities For People With High Income in Many CountriesMai Anh ĐàoNo ratings yet

- Profood International CorporationDocument26 pagesProfood International CorporationYew MercadoNo ratings yet

- Monitoring Mhs Magang - Angkatan 2016Document28 pagesMonitoring Mhs Magang - Angkatan 2016Ihda WahyuNo ratings yet

- Zee InvoiceDocument1 pageZee InvoiceRajkumar WadhwaniNo ratings yet

- Wcms 756877Document136 pagesWcms 756877alnaturamilkaNo ratings yet

- Anticipated Final AccountDocument1 pageAnticipated Final AccountJelson RumuarNo ratings yet

- 2018 Symposium Speaker SpotlightDocument3 pages2018 Symposium Speaker SpotlightJomz De La RosaNo ratings yet

- G Ym 6 F 8 HEtoev 4 GEbDocument6 pagesG Ym 6 F 8 HEtoev 4 GEbPrakhar AgarwalNo ratings yet

- Operational Data StoreDocument0 pagesOperational Data StorerajsalgyanNo ratings yet

- JNE Hybrid - PACKING LIST BANG DEDE 13-OKTOBERDocument2 pagesJNE Hybrid - PACKING LIST BANG DEDE 13-OKTOBERFarhan SawieNo ratings yet

- Engineering Economy ProblemsDocument2 pagesEngineering Economy ProblemsBenj Paulo AndresNo ratings yet

- Bitcoin Case Analysis Bingaman SkylarDocument5 pagesBitcoin Case Analysis Bingaman Skylarapi-546422400No ratings yet

- Intellectual Property Law-REPORTING SCHEDULE: Reportin G Date Topic Case NO. Case Title Reporter RemarksDocument2 pagesIntellectual Property Law-REPORTING SCHEDULE: Reportin G Date Topic Case NO. Case Title Reporter RemarksArrianne ObiasNo ratings yet

- PART 1 An Overview of Strategic Retail Management 21: Chapter 1 An Introduction To Retailing 22Document1 pagePART 1 An Overview of Strategic Retail Management 21: Chapter 1 An Introduction To Retailing 22AlesmanNo ratings yet

- Thai Am RegulationDocument10 pagesThai Am Regulationdessi purnamasariNo ratings yet

- Invoice 22111 From Ride The Wind EbikesDocument1 pageInvoice 22111 From Ride The Wind EbikesChris PringleNo ratings yet

- What Is Cybersecurity Insurance and Why Is It ImportantDocument3 pagesWhat Is Cybersecurity Insurance and Why Is It ImportantJaveed A. KhanNo ratings yet

- Guidelines On PD and LGD Estimation (EBA-GL-2017-16) - Chapters 1,2,3 (Only PD Estimation Part) PDFDocument200 pagesGuidelines On PD and LGD Estimation (EBA-GL-2017-16) - Chapters 1,2,3 (Only PD Estimation Part) PDFShankar RavichandranNo ratings yet

- Supplying The Fashion Product-Assessment 1-Range Plan ReportDocument31 pagesSupplying The Fashion Product-Assessment 1-Range Plan Reportapi-292074531No ratings yet

- Transaction June'2017Document1,795 pagesTransaction June'2017IndranilGhoshNo ratings yet

- ETH-1217 2021 ESL ShipmentDocument7 pagesETH-1217 2021 ESL ShipmentAnteneh ShumeteNo ratings yet

- Michael Howlett The Criteria For Effective Policy Design Character and Context in Policy Instrument Choices.Document36 pagesMichael Howlett The Criteria For Effective Policy Design Character and Context in Policy Instrument Choices.Antonin DolohovNo ratings yet

- Hacof Company Profile 2021 Revised 8Document12 pagesHacof Company Profile 2021 Revised 8Ahmed HanadNo ratings yet

- Chapter 13 Intermediate AccountingDocument18 pagesChapter 13 Intermediate AccountingDanica Mae GenaviaNo ratings yet

- DR1 - Preliminary Design Review GuidelinesDocument8 pagesDR1 - Preliminary Design Review Guidelineswalterbircher100% (1)

- Harris Center Unionization ResolutionDocument2 pagesHarris Center Unionization ResolutionRob LauciusNo ratings yet

- Data File Barang BajuDocument12 pagesData File Barang BajuRian YongNo ratings yet

- Going Above and Beyond: To Deliver Value To The WorldDocument11 pagesGoing Above and Beyond: To Deliver Value To The WorldenzoNo ratings yet

- StashFin IntroDocument12 pagesStashFin IntroMohit Garg100% (1)

- Digital Transformation of Local Government: A Case Study From GreeceDocument10 pagesDigital Transformation of Local Government: A Case Study From GreeceDaniela Gabriela CazanNo ratings yet

- Q1 Module 2 Characteristics of Solids According To ColorDocument20 pagesQ1 Module 2 Characteristics of Solids According To ColorJaneth ArizalaNo ratings yet