Professional Documents

Culture Documents

HF Assignment 3-1 Pt. 1

Uploaded by

RippleOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

HF Assignment 3-1 Pt. 1

Uploaded by

RippleCopyright:

Available Formats

Healthcare Finance

Assignment 3-1

M. Isaac Ripple

Breakeven Analysis of Better Care Clinic

Based on the provided information regarding the Better Care Clinic

associated with the Fairbanks Memorial Hospital, I have arrived at the following

conclusions, in tandem with the assigned questions:

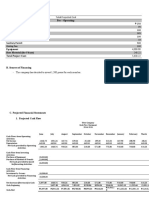

1. By taking the data provided in table 1 of the case study, and factoring

the numbers to reflect data points over the course of a calendar year, it

became evident that, at the current rate of 45 patient visits per day, the

clinic would see a net profit loss of $24,750 in 2018. I arrived at this

number by taking each provided data point from table 1 and multiplying

it by 250 (number of working days in 2018, with 12 months in the year).

Number of Visits 11,250

Net Revenue $ 461,250.00

Salaries and wages $ 112,750.00

Physician fees 150,000.00

Malpractice insurance 26,750.00

Travel and education -

General insurance 7,000.00

Utilities 9,000.00

Equipment leases 1,250.00

Building lease 104,250.00

Other operating 75,000.00

expenses

Total operating $ 486,000.00

expenses

Net profit (loss) $ (24,750.00)

2. In order to break even, the clinic would either need to increase daily

visits by 3-10, or 12-15. Based on the information provided in the case

study, however, my recommendation would be to attempt to increase the

number of visits by 3-10, as this would not require the hiring of

additional clinical staff and therefore would not incur additional semifixed

costs.

Visits Net Base Semifixed Variable Total

Added Total Revenue Costs Costs Costs Costs Profit

3 48 $ $ 19.00

1,968.0 1,944.00 - 5.00 1,949.00

0

4 49 $ $ 60.00

2,009.0 1,944.00 - 5.00 1,949.00

0

5 50 $ $ 101.00

2,050.0 1,944.00 - 5.00 1,949.00

0

6 51 $ $ 142.00

2,091.0 1,944.00 - 5.00 1,949.00

0

7 52 $ $ 183.00

2,132.0 1,944.00 - 5.00 1,949.00

0

8 53 $ $ 224.00

2,173.0 1,944.00 - 5.00 1,949.00

0

9 54 $ $ 265.00

2,214.0 1,944.00 - 5.00 1,949.00

0

10 55 $ $ 306.00

2,255.0 1,944.00 - 5.00 1,949.00

0

3. Without any change to visit volume (number of visits per day to the

clinic), and using the data provided for 2018, factored by the appropriate

inflation rates to predict costs in 2023, the clinic would still not be able

to generate a profit on a day-to-day basis.

2018 Inflation 2023

Average Factor Average Day

Day

Number of Visits 45

45

Net $ 1.04 $ 1,918.80

Revenue 1,845.00

Salaries and wages $ 1.04 $ 469.04

451.00

Physician 1.04 624.00

fees 600.00

Malpractice 1.04 111.28

insurance 107.00

Travel and education 1.02 -

-

General insurance 1.02 28.56

28.00

Utilities 1.02 36.72

36.00

Equipment leases 1.02 5.10

5.00

Building 1.02 425.34

lease 417.00

Other operating 1.02 306.00

expenses 300.00

Total operating $ $ 2,006.04

expenses 1,944.00

Net profit (loss) $ $ (87.24)

(99.00)

4. Given the information regarding how the amount of malpractice insurance

is determined for the Fairbanks Memorial Hospital and its affiliated sites,

the impact that the allocation scheme has a very minor impact on the

clinic’s true cash profitability, as the cost incurred per visit is roughly

$3.42. In the event that the clinic was to add between 4-10 additional

visits per day, the clinic would still see a net profit, and would not be

losing money.

5. As a walk-in, urgent-care style facility, the Better Care Clinic does have

value to the hospital aside from financial and numerical analysis by

enabling members of the community to receive first-rate medical care

when they need it, without making an appointment in advance. While the

actions of the competitor, Baptist Hospital, might seem alarming to the

leadership of Fairbanks Memorial, they must realize that their clinic still

serves an important role in the community.

6. My final recommendation regarding the future of the Better Care Clinic

can be summarized as follows:

- Attempt to increase the visibility and awareness of the services offered

by the clinic through increased marketing of the clinic throughout the

community. As this is a walk-in style facility, it is difficult to increase

the average number of daily visits because each visit is for an acute

issue and more visits cannot simply be scheduled. With an increased

community awareness, the is a chance for greater profitability as more

visits might arise.

- If the clinic does not increase visits and profit margins in 5 years, the

total amount of money lost would be $109,050. The data file shared

that in order to cancel the lease on the property, $37,500 must be

paid. Therefore, after 2 years, the performance and financial metrics

need to be closely reviewed to determine the trend of the clinic. If

there are no changes or increases in profitability after 2 years, then

executive leadership needs to reassess the situation and seriously

consider paying out the lease and closing the clinic so as not to lose

more money.

You might also like

- BiziMobile Inc.-2021 PDFDocument5 pagesBiziMobile Inc.-2021 PDFtahjinNo ratings yet

- C1 - Rosemont MANAC SolutionDocument13 pagesC1 - Rosemont MANAC Solutionkaushal dhapare100% (1)

- Don MastersDocument2 pagesDon MastersMigs CruzNo ratings yet

- Addendum 121922 BOEDocument3 pagesAddendum 121922 BOEAlexis TarraziNo ratings yet

- Financial AspectDocument56 pagesFinancial AspectAngela LaurillaNo ratings yet

- WPF Profit and Loss 2023-04-18-07 - 44Document2 pagesWPF Profit and Loss 2023-04-18-07 - 44Win Lwin OoNo ratings yet

- Mighty Digits - 3 Statement Model TemplateDocument31 pagesMighty Digits - 3 Statement Model TemplateHilyah AuliaNo ratings yet

- Ap8 Ev4 InglesDocument5 pagesAp8 Ev4 InglesPaula ForeroNo ratings yet

- Campussaver FinancialsDocument5 pagesCampussaver Financialsapi-707643099No ratings yet

- Habesha Unique Digital Health Solution Enterprise Financial Reporting Summary Sheet Debre MarkosDocument6 pagesHabesha Unique Digital Health Solution Enterprise Financial Reporting Summary Sheet Debre Markosbinaym tarikuNo ratings yet

- Surigao Del Sur State University: - Financial AspectDocument13 pagesSurigao Del Sur State University: - Financial AspectGian CarloNo ratings yet

- M3 Shifa 2021-23 PracticeDocument5 pagesM3 Shifa 2021-23 PracticeSetul ShethNo ratings yet

- Hindustanprofit LossDocument2 pagesHindustanprofit LossPradeep WaghNo ratings yet

- Guillermo UpdateddataDocument6 pagesGuillermo UpdateddataGabiNo ratings yet

- Plan-Do-Check-Adjust (PDCA) Cycle: W. Edwards Deming Toyota Production System Lean ManufacturingDocument29 pagesPlan-Do-Check-Adjust (PDCA) Cycle: W. Edwards Deming Toyota Production System Lean ManufacturingnozediNo ratings yet

- Financial PlanDocument9 pagesFinancial PlanFrancisco T. Del CastilloNo ratings yet

- Annual Food Service Department Budget Report FOR FISCAL YEAR 2020-2021Document9 pagesAnnual Food Service Department Budget Report FOR FISCAL YEAR 2020-2021api-536652711No ratings yet

- Profit and Loss Statement SampleDocument6 pagesProfit and Loss Statement SampleHeatman RobertNo ratings yet

- Budget Variance ReportDocument2 pagesBudget Variance ReportaryanneNo ratings yet

- Salary Variance Report: Psno Employee NameDocument1 pageSalary Variance Report: Psno Employee NameAkhil MohammadNo ratings yet

- COVID-19 OT Hours Pay Run Through 04.11.2020 04.22.2020Document119 pagesCOVID-19 OT Hours Pay Run Through 04.11.2020 04.22.2020Gwen FilosaNo ratings yet

- HC P & L - Feb 2022 To March 2023Document9 pagesHC P & L - Feb 2022 To March 2023MaiNo ratings yet

- Separation by Mutual Agreement: Barbara MyrickDocument7 pagesSeparation by Mutual Agreement: Barbara MyrickAmanda RojasNo ratings yet

- Elijah Jayie: Rate Hours Amount Amount YTD Hours YTD Amount YTD AmountDocument1 pageElijah Jayie: Rate Hours Amount Amount YTD Hours YTD Amount YTD Amountmdyafi8084No ratings yet

- Module 6 SolutionsDocument6 pagesModule 6 SolutionsNeha Wadhwani AhujaNo ratings yet

- Business BudgetDocument5 pagesBusiness BudgetCarolNo ratings yet

- Cash Breakeven Analysis: Awus $10,000 100%Document13 pagesCash Breakeven Analysis: Awus $10,000 100%iPakistanNo ratings yet

- Multifamily Real EstateDocument17 pagesMultifamily Real EstaterohitranjansindriNo ratings yet

- Menahga School District Executive Audit Summary 2023Document22 pagesMenahga School District Executive Audit Summary 2023Shannon GeisenNo ratings yet

- Total Compensation Benefit Summary STMTDocument3 pagesTotal Compensation Benefit Summary STMTlorigross3No ratings yet

- Mubadala/DTC Financial Number - Nestride YumgaDocument1 pageMubadala/DTC Financial Number - Nestride YumgaCapitolIntelNo ratings yet

- Task 7Document14 pagesTask 7Damaris MoralesNo ratings yet

- Chapter 6 7 Financial-study-AnalysisDocument15 pagesChapter 6 7 Financial-study-AnalysisNorwin RoxasNo ratings yet

- RVU Distribution - New ChangesDocument5 pagesRVU Distribution - New Changesmy indiaNo ratings yet

- Payrollactivity 1Document6 pagesPayrollactivity 1Chrizel NiloNo ratings yet

- Salinan Dari Monthly Expense Report TemplateDocument170 pagesSalinan Dari Monthly Expense Report TemplateAgus Putra AdnyanaNo ratings yet

- COL 1st Sem Assessment 2023 2024Document4 pagesCOL 1st Sem Assessment 2023 2024Janzel Bueno ChumaceraNo ratings yet

- Business Plan TemplateDocument10 pagesBusiness Plan Templateakinade busayoNo ratings yet

- Cocopatch ProformaDocument9 pagesCocopatch ProformaRod OrtanezNo ratings yet

- SCOPE TO BE CONTINUEDCurrentttttDocument14 pagesSCOPE TO BE CONTINUEDCurrentttttAlexis John CaayohanNo ratings yet

- Instruksi: Baca Cara Penggunaan Software Secara SeksamaDocument24 pagesInstruksi: Baca Cara Penggunaan Software Secara SeksamaditaNo ratings yet

- Mount Moreland Hospital: Perform Financial CalculationsDocument9 pagesMount Moreland Hospital: Perform Financial CalculationsJacob Sheridan0% (1)

- BL SheetDocument3 pagesBL Sheetroselle oronganNo ratings yet

- Payslip 10 10Document2 pagesPayslip 10 10John Paul SandovalNo ratings yet

- Diokno 12.15.21Document1 pageDiokno 12.15.21MACN ASSROBNo ratings yet

- Assignment Part-2 Solution F18Document3 pagesAssignment Part-2 Solution F18Pablo AlarconNo ratings yet

- AML FinancialsDocument9 pagesAML FinancialsMichelle MorganNo ratings yet

- Agritopia Master - 6 - 2021 Operating Budget BOD Resolution - 11-24-20Document6 pagesAgritopia Master - 6 - 2021 Operating Budget BOD Resolution - 11-24-20Faaria ZainabNo ratings yet

- Ps 3Document1 pagePs 3Destiny SmithNo ratings yet

- Robert Reid Lady M Confections SubmissionDocument13 pagesRobert Reid Lady M Confections SubmissionSam Nderitu100% (1)

- 5.financial ViabilityDocument2 pages5.financial Viabilityrobelyn veranoNo ratings yet

- Non - Negotiable: Notification of DepositDocument1 pageNon - Negotiable: Notification of Depositေျပာမယ္ လက္တို႔ၿပီးေတာ့No ratings yet

- Chapter 6 Fs SingsonDocument9 pagesChapter 6 Fs SingsonDonna Mae SingsonNo ratings yet

- 2010 MercyAnnual ReportDocument3 pages2010 MercyAnnual ReportKristen Clark WelchNo ratings yet

- PNL Aug 2019 Az CalivaDocument1 pagePNL Aug 2019 Az CalivaJeffrey MacaraegNo ratings yet

- Hindustan Unilever: PrintDocument2 pagesHindustan Unilever: PrintUTSAVNo ratings yet

- Fire Employee CompensationDocument1 pageFire Employee CompensationAnn Arbor Government DocumentsNo ratings yet

- Financial Statements For China CNR Corp LTD - Google Finance CFDocument1 pageFinancial Statements For China CNR Corp LTD - Google Finance CFethandanfordNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Textbook of Urgent Care Management: Chapter 12, Pro Forma Financial StatementsFrom EverandTextbook of Urgent Care Management: Chapter 12, Pro Forma Financial StatementsNo ratings yet

- 12.26.2021 XMAS SEASON CHOIR VERSION Cycle CDocument1 page12.26.2021 XMAS SEASON CHOIR VERSION Cycle CRippleNo ratings yet

- Workout Week 2Document2 pagesWorkout Week 2RippleNo ratings yet

- 10-24-20 Coaches MeetingDocument1 page10-24-20 Coaches MeetingRippleNo ratings yet

- Blue Dolphins Workout 11.21.2020Document2 pagesBlue Dolphins Workout 11.21.2020RippleNo ratings yet

- Beginners' Swim Workout 1Document1 pageBeginners' Swim Workout 1RippleNo ratings yet

- Brochure 2024 100Document30 pagesBrochure 2024 100RippleNo ratings yet

- Blue Dolphins Workout 11.14.2020Document1 pageBlue Dolphins Workout 11.14.2020RippleNo ratings yet

- Dryland Circuit - 30 Min Leg Burner: Quad/glute Activation WorkDocument1 pageDryland Circuit - 30 Min Leg Burner: Quad/glute Activation WorkRippleNo ratings yet

- MUGN 398 Project Verification FormDocument1 pageMUGN 398 Project Verification FormRippleNo ratings yet

- MUGN 398 Project Verification FormDocument1 pageMUGN 398 Project Verification FormRippleNo ratings yet

- Copland 3 Score ExcerptsDocument18 pagesCopland 3 Score ExcerptsRippleNo ratings yet

- BM Oboe CIM Course ChecklistDocument1 pageBM Oboe CIM Course ChecklistRippleNo ratings yet

- Tombeau ScoreDocument26 pagesTombeau ScoreRippleNo ratings yet

- BM Oboe CIM Course ChecklistDocument1 pageBM Oboe CIM Course ChecklistRippleNo ratings yet

- Student Practice SheetDocument1 pageStudent Practice SheetRippleNo ratings yet

- NotesDocument3 pagesNotesRippleNo ratings yet

- Caroline Hove English Horn Reed Outline PDFDocument2 pagesCaroline Hove English Horn Reed Outline PDFRippleNo ratings yet

- Cloning Human BeingsDocument23 pagesCloning Human BeingsRippleNo ratings yet

- Bill Evans-Everything I LoveDocument3 pagesBill Evans-Everything I LoveThomasNo ratings yet

- Caroline Hove English Horn Reed OutlineDocument2 pagesCaroline Hove English Horn Reed OutlineRipple100% (1)

- Danzi in e Minor Oboe PDFDocument6 pagesDanzi in e Minor Oboe PDFRippleNo ratings yet

- 1882 Stravinsky 1909 FirebirdDocument172 pages1882 Stravinsky 1909 FirebirdMark AlburgerNo ratings yet

- 02 Rossini - Guillaume TellDocument1 page02 Rossini - Guillaume TellRippleNo ratings yet

- BUTI Audition MaterialsDocument4 pagesBUTI Audition MaterialsRippleNo ratings yet

- CHAPTER 1: Resource Utilization & Economics Part I: Identification Directions: Fill in The BlanksDocument28 pagesCHAPTER 1: Resource Utilization & Economics Part I: Identification Directions: Fill in The BlanksAngelo Montelibano Patron100% (4)

- Projected Income Statement of Ayala Land IncorporationDocument2 pagesProjected Income Statement of Ayala Land IncorporationErika May RamirezNo ratings yet

- Press 12may23Document5 pagesPress 12may23Arun SinghNo ratings yet

- CDC Annual ESG Report TemplateDocument6 pagesCDC Annual ESG Report TemplateJean OlemouNo ratings yet

- Anshul PCDocument2 pagesAnshul PCNamit DumreNo ratings yet

- 0452 s19 QP 13 PDFDocument24 pages0452 s19 QP 13 PDFmarryNo ratings yet

- Solutions Chapter 8Document29 pagesSolutions Chapter 8Brenda WijayaNo ratings yet

- SPM Unit2 2marksDocument2 pagesSPM Unit2 2marksjormnNo ratings yet

- Chiropractic Marketing BlueprintDocument23 pagesChiropractic Marketing BlueprintDashboardMarketingSolutions100% (1)

- WebSim - Price Volume PDFDocument10 pagesWebSim - Price Volume PDFNeelesh KumarNo ratings yet

- BDM of 12.10.2015 - Buyback Program, Sell Up and PayoutDocument5 pagesBDM of 12.10.2015 - Buyback Program, Sell Up and PayoutBVMF_RINo ratings yet

- Test Bank Financial Accounting and Reporting TheoryDocument58 pagesTest Bank Financial Accounting and Reporting TheoryAngelie De LeonNo ratings yet

- Lupin, 4th February, 2013Document11 pagesLupin, 4th February, 2013Angel BrokingNo ratings yet

- Furry Tales FinalDocument46 pagesFurry Tales FinalRitu Makkar100% (1)

- Operating CostingDocument22 pagesOperating CostingNeelabh Kumar50% (2)

- Accounting 2 - Chapter 14 - Notes - MiuDocument4 pagesAccounting 2 - Chapter 14 - Notes - MiuAhmad Osama MashalyNo ratings yet

- Financial Management Assignment NotesDocument3 pagesFinancial Management Assignment NotesDaniyal AliNo ratings yet

- GDBA505 Formula Sheet For ExamDocument3 pagesGDBA505 Formula Sheet For ExamFLOREAROMEONo ratings yet

- Multi Airport System 4Document19 pagesMulti Airport System 4irbasukirahardjocesNo ratings yet

- Income-Taxation 5-7 ValenciaDocument56 pagesIncome-Taxation 5-7 ValenciaDevonNo ratings yet

- Required: Indicate Each Account's Classification and Normal Balance by Placing (/) Marks. TheDocument1 pageRequired: Indicate Each Account's Classification and Normal Balance by Placing (/) Marks. TheBebie Joy UrbanoNo ratings yet

- Book Value Per Share: RequiredDocument19 pagesBook Value Per Share: RequiredLouise73% (11)

- Dividend PolicyDocument8 pagesDividend PolicySumit PandeyNo ratings yet

- Assignment On Capacity PlanningDocument3 pagesAssignment On Capacity Planningnot youNo ratings yet

- RCMP Investment Presentation: NAP NDocument27 pagesRCMP Investment Presentation: NAP NInter 4DMNo ratings yet

- Fabm2 Module 4Document8 pagesFabm2 Module 4Rea Mariz Jordan67% (3)

- Initial Measurement: by Default: FVPLDocument7 pagesInitial Measurement: by Default: FVPLRemNo ratings yet

- RER Appendix 46 1 SampleDocument1 pageRER Appendix 46 1 SampleMary Grace Lagdamen PerochoNo ratings yet

- Techna-X Berhad: Incorporated in MalaysiaDocument17 pagesTechna-X Berhad: Incorporated in MalaysiaChoon Wei WongNo ratings yet

- M6 - Deductions P2 Students'Document53 pagesM6 - Deductions P2 Students'micaella pasionNo ratings yet