Professional Documents

Culture Documents

Ellipses Corp. December 2018 Payroll $6.08

Uploaded by

Jacquin MokayaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ellipses Corp. December 2018 Payroll $6.08

Uploaded by

Jacquin MokayaCopyright:

Available Formats

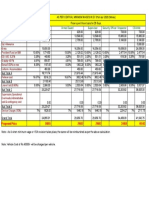

Social State Federal

Regular Overtime Regular Overtime Taxable Medicare Federal Income 401 (k) Charitable Total

Gross Pay Security Income W/H Net Pay

Pay Rate Pay Rate Hours Hours pay Tax Tax Deduction Contribution Deductions

Tax Tax Allowances

6.20% 1.45% 5.00%

Monthly SS Wage Base 10,600.0

Employee

Hunter Cranston 18 27 141 0 2,538.00 157.36 2,380.64 36.80 119.03 269.80 152.28 20.00 755.27 500.00 2,282.73

Allison Harrison 24 36 113 1 2,748.00 170.38 2,577.62 39.85 128.88 293.44 137.40 20.00 789.94 500.00 1,958.06

John Parker n/a n/a n/a n/a 17,033.33 1,056.07 15,977.27 246.98 798.86 3,714.49 - 100.00 5,916.40 333.33 11,116.93

Pierre Sternberg n/a n/a n/a n/a 9,316.67 577.63 8,739.03 135.09 436.95 1,621.50 931.67 - 3,702.85 333.33 5,613.82

Monthly Income tax brackets

4. John Parker Single Married

Bracket Tax rate Tax amount Bracket Tax rate Tax amount

793.75 10% 79.375 793.75 10% 79.375

2,431.17 12% 291.74 2,431.17 12% 291.74

3649.92 22% 802.9816667 3649.92 22% 802.98166667

6249.92 24% 1499.98 6249.92 24% 1499.98

3,251.29 32% 1040.4128 3541.58 32% 1133.3066667

16,376.04 3,714.49 3,807.38

1. Hunter Cranston Tax computation

793.75 79.375

NOTES 1586.89 190.42728

1 State Income Tax is 5% of the taxable pay 2,380.64 269.80

2 Social Security Tax is 6.2% of the gross income

3 Medicare Tax is 1.45% of the gross income

4 Weekly 401 (k) Deduction is 6% of the gross pay 2. Allison Harrison Tax computation

5 Charitable Contribution is $5 per week 793.75 79.375

6 SUTA tax: This is unemployement tax paid by employers only, except for the states of Alaska, New Jesry and Pennyslavania 1783.874 214.06488

where employees pay the unemployment tax as well. In this case, Ellispses Corp is in Virginia which does not require 2,577.62 293.44

employees to pay unmployment tax. Therefore Allison Harrison will not be charged SUTA tax in her December payroll

3. Pierre Sternberg Tax computation

793.75 79.375

2431.17 291.74

3649.92 802.98

1864.20 447.408

8,739.03 1,621.50

REFERENCES:

1.Taxable Income Brackets: https://www.cnbc.com/2019/02/07/how-to-find-out-what-tax-bracket-youre-in-under-the-new-tax-law.html

2. Withholding Allowances: https://www.irs.gov/pub/irs-pdf/fw4.pdf

You might also like

- Assignment of ContractDocument2 pagesAssignment of Contractapi-355836870No ratings yet

- Pay Stub 4022018-4152018Document1 pagePay Stub 4022018-4152018lilian hutsilNo ratings yet

- Sspusadv PDFDocument1 pageSspusadv PDFKIMNo ratings yet

- 02475792798Document1 page02475792798Edwin Zamora PastorNo ratings yet

- Payslip To Print 04 29 2017 PDFDocument1 pagePayslip To Print 04 29 2017 PDFDoraNo ratings yet

- Earnings Statement Only Non NegotiableDocument1 pageEarnings Statement Only Non NegotiableLiz MatzNo ratings yet

- Franklyn Solano Cruz: Earnings StatementDocument1 pageFranklyn Solano Cruz: Earnings StatementFranky CruzNo ratings yet

- Paystub 1Document1 pagePaystub 1PeterJamesNo ratings yet

- Paystub E56da99c 5958 40f5 9b2a 8069ae22b175 PDFDocument8 pagesPaystub E56da99c 5958 40f5 9b2a 8069ae22b175 PDFLuis MartinezNo ratings yet

- 87 FC 2402Document1 page87 FC 2402AmaryNo ratings yet

- Amended Tax Credit Certificate 2020 7243210862511Document2 pagesAmended Tax Credit Certificate 2020 7243210862511Aurimas AurisNo ratings yet

- Income Tax Calculator Calculate Income Tax For FY 2022-23Document1 pageIncome Tax Calculator Calculate Income Tax For FY 2022-23Vivek LakkakulaNo ratings yet

- Muhammad Nizamuddin Bin Nor Napis NO 5490 MUKIM 16 Jalan Gajah Mati Machang Bubuk 14020 Bukit Mertajam Pulau Pinang MalaysiaDocument7 pagesMuhammad Nizamuddin Bin Nor Napis NO 5490 MUKIM 16 Jalan Gajah Mati Machang Bubuk 14020 Bukit Mertajam Pulau Pinang MalaysiaZamNo ratings yet

- Epolicy - 1022684495Document61 pagesEpolicy - 1022684495Kurt MarfilNo ratings yet

- FIN 6060 Module 5 AssignmentDocument7 pagesFIN 6060 Module 5 Assignmentr.olanibi55100% (1)

- The Role of Capital Market Intermediaries in The Dot-Com Crash of 2000Document5 pagesThe Role of Capital Market Intermediaries in The Dot-Com Crash of 2000Prateek Jain100% (2)

- CompleteFreedom 0066 22oct2022Document5 pagesCompleteFreedom 0066 22oct2022bigman walthoNo ratings yet

- CF Murphy Stores CLC DraftDocument12 pagesCF Murphy Stores CLC DraftPavithra TamilNo ratings yet

- Davita Payslip To Print - Report Design 03-06-2024Document1 pageDavita Payslip To Print - Report Design 03-06-2024addae.fredrickNo ratings yet

- Annual Computation of Taxable Salary FY 2021-22Document1 pageAnnual Computation of Taxable Salary FY 2021-22Irfan RazaNo ratings yet

- Terracebudget 17Document3 pagesTerracebudget 17api-354468897No ratings yet

- FM AssignmentDocument10 pagesFM AssignmentKaleab TadesseNo ratings yet

- Commercial Confirmation JSW BarbilDocument1 pageCommercial Confirmation JSW BarbilSabuj SarkarNo ratings yet

- Vodafone Idea Limited: PrintDocument1 pageVodafone Idea Limited: PrintPrakhar KapoorNo ratings yet

- Paye Calculator-2Document11 pagesPaye Calculator-2MORRIS MURIGINo ratings yet

- Sync Tower S Sample Computation Project Completion: Q2 2024Document1 pageSync Tower S Sample Computation Project Completion: Q2 2024Isang PescasioNo ratings yet

- Payslip-03 10 2023Document1 pagePayslip-03 10 2023wireNo ratings yet

- Individual Medical Cover TemplateDocument7 pagesIndividual Medical Cover TemplatePeter Osundwa KitekiNo ratings yet

- PaymentDocument12 pagesPaymentshadenguerrero6No ratings yet

- February 2017 Tax ReceiptsDocument2 pagesFebruary 2017 Tax ReceiptsBrian DulleNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- BUSM365 CH7 Student Version .XLSX 1Document14 pagesBUSM365 CH7 Student Version .XLSX 1Kesarapu Venkata ApparaoNo ratings yet

- Tirecity - XLS092 XLS ENGDocument6 pagesTirecity - XLS092 XLS ENGpp ppNo ratings yet

- Sal Copy 5Document9 pagesSal Copy 5Prateek MohapatraNo ratings yet

- Advanced Financial ManagementDocument5 pagesAdvanced Financial ManagementAkshay KapoorNo ratings yet

- Credit Card Payment CalculatorDocument10 pagesCredit Card Payment CalculatorMay Ann PiangcoNo ratings yet

- Servlet ControllerDocument1 pageServlet ControllerRohit SolomonNo ratings yet

- Eastwest 1St Mastercard Sample Interest Computation: A. Retail TransactionDocument1 pageEastwest 1St Mastercard Sample Interest Computation: A. Retail TransactionNathan A. Campo IINo ratings yet

- 2010 June Finance Profit Loss Budget ActualDocument2 pages2010 June Finance Profit Loss Budget ActualblueriverdocNo ratings yet

- DMIC Homes Staggered DP Computation 762009Document1 pageDMIC Homes Staggered DP Computation 762009jsleellacerNo ratings yet

- 31 Jan 2024Document2 pages31 Jan 2024vikzNo ratings yet

- Caso Analisis V y H TBCTDGDocument1 pageCaso Analisis V y H TBCTDGAnali Bedriñana EspinoNo ratings yet

- DGW Residential Plots Price List (W.e.f 28-04-2022)Document1 pageDGW Residential Plots Price List (W.e.f 28-04-2022)abduNo ratings yet

- Check Stub 1Document1 pageCheck Stub 1raheemtimo1No ratings yet

- Workday 1Document1 pageWorkday 1raheemtimo1No ratings yet

- Goodweek TiresDocument2 pagesGoodweek TiresadriNo ratings yet

- Panther Tyre Company Balance Sheet 43,100.00 2,018.00 2,019.00 2,020.00 Assets Current Assets Increase or (Decrease)Document7 pagesPanther Tyre Company Balance Sheet 43,100.00 2,018.00 2,019.00 2,020.00 Assets Current Assets Increase or (Decrease)HussainNo ratings yet

- Sip FinalDocument39 pagesSip Finalbabu raoNo ratings yet

- BSBFIM601 Assessment 1: Sales and Profit BudgetsDocument8 pagesBSBFIM601 Assessment 1: Sales and Profit Budgetsprasannareddy9989100% (1)

- Bureau of Local Government Finance Department of FinanceDocument2 pagesBureau of Local Government Finance Department of FinancetutoymolaNo ratings yet

- Williamstown Five-Year Revenue Projection 2010Document1 pageWilliamstown Five-Year Revenue Projection 2010iBerkshires.comNo ratings yet

- Claim Balai Harta (Perhitungan) 3Document14 pagesClaim Balai Harta (Perhitungan) 3hari natoNo ratings yet

- Prudential Life Assurance Page 1 of 2 (Date Printed: 09-Oct-2019)Document2 pagesPrudential Life Assurance Page 1 of 2 (Date Printed: 09-Oct-2019)KomalaNo ratings yet

- Sip FinalDocument65 pagesSip Finalbabu raoNo ratings yet

- Part 3Document1 pagePart 3sanjay mouryaNo ratings yet

- Sinopec - Individual AssignmentDocument6 pagesSinopec - Individual AssignmentShaarang BeganiNo ratings yet

- Britannia Industries: PrintDocument2 pagesBritannia Industries: PrintTanmoy BhuniaNo ratings yet

- DownloadDocument2 pagesDownloadSowbhagya VaderaNo ratings yet

- Tire City IncDocument18 pagesTire City IncSoumyajitNo ratings yet

- Company Info - Print Financials - P&LDocument1 pageCompany Info - Print Financials - P&LUtkarshNo ratings yet

- Profitability RatioDocument11 pagesProfitability RatioNicole Kate PorrasNo ratings yet

- 630 Aspen Heights Subdivision Sample Price ComputationDocument1 page630 Aspen Heights Subdivision Sample Price ComputationMichaelNo ratings yet

- Underwriting Report-Week Ending 03 September 2020Document12 pagesUnderwriting Report-Week Ending 03 September 2020Emmanuel MonzeNo ratings yet

- Your Pay Advice For Pay Ending 30 09 2022Document2 pagesYour Pay Advice For Pay Ending 30 09 2022iqbal.shahid0374No ratings yet

- Hi-Tech Appliance Voucher RegisterDocument3 pagesHi-Tech Appliance Voucher RegistersppNo ratings yet

- Childhood - Obesity - Order - 4 Pages - $18Document6 pagesChildhood - Obesity - Order - 4 Pages - $18Jacquin MokayaNo ratings yet

- Financial Ratio Analysis With References-$12Document3 pagesFinancial Ratio Analysis With References-$12Jacquin MokayaNo ratings yet

- Radex Electric Co. Forecasting and InvestmentDocument3 pagesRadex Electric Co. Forecasting and InvestmentJacquin MokayaNo ratings yet

- The Quest For HappinessDocument4 pagesThe Quest For HappinessJacquin MokayaNo ratings yet

- Excel Project PV Saving AccountDocument5 pagesExcel Project PV Saving AccountJacquin MokayaNo ratings yet

- XXXXXXXXXXX0788-01-01-2022to31-07-2023 ASHUDocument3 pagesXXXXXXXXXXX0788-01-01-2022to31-07-2023 ASHUashokchaturvedi1990No ratings yet

- The Weekly Peak: Peak Theories Research LLCDocument6 pagesThe Weekly Peak: Peak Theories Research LLCfcamargoeNo ratings yet

- Investments An Introduction 12th Edition Mayo Solutions Manual DownloadDocument13 pagesInvestments An Introduction 12th Edition Mayo Solutions Manual DownloadArnold Evans100% (23)

- Boughton James. Porqué White y No Keynes. 25 Páginas InglésDocument25 pagesBoughton James. Porqué White y No Keynes. 25 Páginas InglésKaro GutierrezNo ratings yet

- Economics of Money Banking and Financial Markets The Business School Edition 3rd Edition Mishkin Test Bank 1Document19 pagesEconomics of Money Banking and Financial Markets The Business School Edition 3rd Edition Mishkin Test Bank 1paulhansenkifydcpaqr100% (24)

- Treasury ManagementDocument10 pagesTreasury ManagementSankar RajagopalNo ratings yet

- Answers To Textbook Problems: Chapter 16 (5) Price Levels and The Exchange Rate in The Long Run 93Document4 pagesAnswers To Textbook Problems: Chapter 16 (5) Price Levels and The Exchange Rate in The Long Run 93anaNo ratings yet

- BD5 SM12Document10 pagesBD5 SM12didiajaNo ratings yet

- Anubhavkumar DeskDocument33 pagesAnubhavkumar DeskAnubhav RanjanNo ratings yet

- Shopping Vocabulary, Expressions and PhrasesDocument2 pagesShopping Vocabulary, Expressions and PhrasesicghtnNo ratings yet

- Final Pyramid of Ratios: Strictly ConfidentialDocument3 pagesFinal Pyramid of Ratios: Strictly ConfidentialaeqlehczeNo ratings yet

- Tax Saving (ELSS) Statement: Bijoy DuttaDocument1 pageTax Saving (ELSS) Statement: Bijoy DuttaBijoy DuttaNo ratings yet

- NSDL Case StudyDocument3 pagesNSDL Case StudyDeepshikha Goel100% (1)

- Chapter 2 RRLDocument21 pagesChapter 2 RRLBrent Roger De la CruzNo ratings yet

- Module 5 Answer KeysDocument5 pagesModule 5 Answer KeysJaspreetNo ratings yet

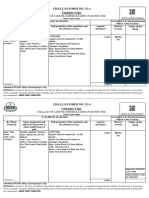

- Challan Form No. 32-A Treasury Copy: Challan of Cash/Transfer/Clearing Paid Into TheDocument1 pageChallan Form No. 32-A Treasury Copy: Challan of Cash/Transfer/Clearing Paid Into TheZahoorNabiNo ratings yet

- Fundamentals of Financial PlanningDocument20 pagesFundamentals of Financial PlanningCE On LineNo ratings yet

- Bank Marketing 1Document69 pagesBank Marketing 1nirosha_398272247No ratings yet

- Gayla Poole PaystubDocument1 pageGayla Poole Paystubwadewilliamsperling1992No ratings yet

- Issue of Shares Question Part 1Document2 pagesIssue of Shares Question Part 1Madhvi Gaur.No ratings yet

- Mutual Fund Report Jun-19Document45 pagesMutual Fund Report Jun-19muddasir1980No ratings yet

- Theory of InvestmentDocument17 pagesTheory of InvestmentLarissa NunesNo ratings yet

- 144084533r33 PDFDocument10 pages144084533r33 PDFRAJ TUWARNo ratings yet