Professional Documents

Culture Documents

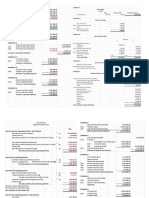

FM 18 (1st Sem)

Uploaded by

James ForondaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FM 18 (1st Sem)

Uploaded by

James ForondaCopyright:

Available Formats

What Is the Buy-Side?

The financial institutions of a free-market economy include a segment called the buy-side: firms that

purchase investment securities. These include insurance firms, mutual funds, hedge funds, and pension

funds, that buy securities for their own accounts or for investors with the goal of generating a return.

Opposite of the buy-side professional is the sell-side. Unlike the buy-side, sell-side efforts do not include

making a direct investment. Instead, they assist the investing market with all activities related to the sale

of securities to the buy-side, such as underwriting for initial public offerings (IPOs), providing clearing

services, and generating research material and analysis

Jointly, these two sides (buy and sell) make up the main activities of financial markets.

Understanding the Buy-Side.

A buy-side firm will buy stocks, bonds, and other financial products based on the needs and strategy of

their company's or client's portfolio. The buy-side activity occurs in a variety of settings, not just the

financial institutions mentioned above. Trusts, equity funds, and high-net-worth individuals are also

included.

The goal of buy-side investing is to add value to a firm's clients. They accomplish this by locating and

purchasing underpriced assets that they believe will appreciate in value over time. Because the buy-side

involves purchasing large blocks of market securities, the most prestigious companies frequently have

significant market power. Investors and the media are also keeping a close eye on these market titans.

8.68 trillion dollars

-BlackRock's assets under management (AUM) as of December 31, 2020. In terms of assets, BlackRock is

the world's largest investment manager.

Firms such as BlackRock and Vanguard can significantly influence market prices by making large-scale

investments in single stocks. These investments, however, are typically not disclosed in real time and can

appear ghostly to market traders. The Securities and Exchange Commission's (SEC) 13F filing requires

buy-side managers to publicly disclose all holdings bought and sold each quarter.

Benefits of the Buy-Side

Buy-side investors have many advantages over other traders. They can place large-lot transactions that

minimize trading costs. They also have access to a very broad array of internal trading resources that

helps them to analyze, identify, and act on investment opportunities in real-time.

https://www.investopedia.com/terms/b/buyside.asp

You might also like

- AirSial TICKET 1P547CDocument2 pagesAirSial TICKET 1P547CBASIT100% (2)

- MODULE 1 Lecture Notes (Jeff Madura)Document4 pagesMODULE 1 Lecture Notes (Jeff Madura)Romen CenizaNo ratings yet

- Stock Market Investing for Beginners: The Best Book on Stock Investments To Help You Make Money In Less Than 1 Hour a DayFrom EverandStock Market Investing for Beginners: The Best Book on Stock Investments To Help You Make Money In Less Than 1 Hour a DayNo ratings yet

- A simple approach to bond trading: The introductory guide to bond investments and their portfolio managementFrom EverandA simple approach to bond trading: The introductory guide to bond investments and their portfolio managementRating: 5 out of 5 stars5/5 (1)

- Financial SecurityDocument3 pagesFinancial SecurityJackie BallaranNo ratings yet

- Security Market: 2.1 Concept of Primary MarketDocument10 pagesSecurity Market: 2.1 Concept of Primary MarketTawsif BracNo ratings yet

- Module 2Document5 pagesModule 2Marivica DagunaNo ratings yet

- Blcok-3 MCO-7 Unit-1Document23 pagesBlcok-3 MCO-7 Unit-1Tushar SharmaNo ratings yet

- Finance My NotesDocument19 pagesFinance My NotespappuNo ratings yet

- Assignment - Financial Institutions and MarketsDocument6 pagesAssignment - Financial Institutions and MarketsShivam GoelNo ratings yet

- Banking StylesDocument14 pagesBanking StylesRen Algarate0% (1)

- Capital Market InstrumentsDocument4 pagesCapital Market InstrumentsJanhavi SrivastavaNo ratings yet

- 01 - Introduction To Securities IndustryDocument45 pages01 - Introduction To Securities IndustryDhanraj ShettyNo ratings yet

- Investment BaInvestment Nking12Document53 pagesInvestment BaInvestment Nking12Jared AllenNo ratings yet

- Chapter I: Financial MarketsDocument25 pagesChapter I: Financial MarketsApril ManjaresNo ratings yet

- INTRODUCTIONDocument26 pagesINTRODUCTION9022756315yashpatel2003No ratings yet

- Merchant Banking Cha-3 by Saidul AlamDocument11 pagesMerchant Banking Cha-3 by Saidul AlamSaidul AlamNo ratings yet

- Financial Markets and InstitutionsDocument32 pagesFinancial Markets and Institutionsalex_obregon_6No ratings yet

- WikipediaDocument8 pagesWikipediaAnurag ShekhawatNo ratings yet

- Debt and Equity MarketDocument2 pagesDebt and Equity MarketprahladtripathiNo ratings yet

- Reading Material - InvestmDocument71 pagesReading Material - InvestmPiyush AseejaNo ratings yet

- (NR) Financial Markets and InstitutionDocument8 pages(NR) Financial Markets and InstitutionMichael MendozaNo ratings yet

- Capital Market and Its InstrumentsDocument26 pagesCapital Market and Its InstrumentsHariniNo ratings yet

- 5 6206307345643864568Document58 pages5 6206307345643864568SURYANo ratings yet

- Financial MarketsDocument18 pagesFinancial MarketsMuhammad YamanNo ratings yet

- Equity and Debt SecuritiesDocument16 pagesEquity and Debt Securitieskaran pawarNo ratings yet

- Financial EnvironmentDocument20 pagesFinancial EnvironmentZahidul Islam SoykotNo ratings yet

- Module 5 - Understanding The Role of Financial Markets and InstitutionsDocument7 pagesModule 5 - Understanding The Role of Financial Markets and InstitutionsMarjon Dimafilis100% (1)

- Investment BanksDocument9 pagesInvestment BanksmarufNo ratings yet

- Case 2Document10 pagesCase 2Kim BihagNo ratings yet

- Unit 3Document27 pagesUnit 3RAJNo ratings yet

- Regulation of Capital MarketDocument5 pagesRegulation of Capital MarketKritika KesriNo ratings yet

- Functions:: Financial InstitutionsDocument3 pagesFunctions:: Financial InstitutionskimNo ratings yet

- STOCKDocument7 pagesSTOCKElizabeth OlaNo ratings yet

- Types of Financial InstitutionsDocument9 pagesTypes of Financial InstitutionsfathimabindmohdNo ratings yet

- Stock MarketDocument16 pagesStock MarketHades RiegoNo ratings yet

- Neha Siddique 02-111201-222 BBA-4B Fundamentals of Finance: Integrated Case StudyDocument8 pagesNeha Siddique 02-111201-222 BBA-4B Fundamentals of Finance: Integrated Case StudyArishfa khanNo ratings yet

- Industry Profile of Financial Service IndustryDocument7 pagesIndustry Profile of Financial Service IndustryMedha SinghNo ratings yet

- Money MarketDocument25 pagesMoney Marketvicky_n007No ratings yet

- Investment BankDocument8 pagesInvestment BankArun KumarNo ratings yet

- Public Offering Stock Securities Exchange Private Company Public Company MonetizeDocument8 pagesPublic Offering Stock Securities Exchange Private Company Public Company MonetizeDivya KhandelwalNo ratings yet

- Investment Banks: Main Activities and UnitsDocument8 pagesInvestment Banks: Main Activities and UnitsatifqadriNo ratings yet

- Business and The Financial Markets Chapter 03Document50 pagesBusiness and The Financial Markets Chapter 03James KuruvalakaNo ratings yet

- Investment Banking: Organizational Structure of An Investment BankDocument9 pagesInvestment Banking: Organizational Structure of An Investment Banksun2samNo ratings yet

- Role of Primary MarketDocument24 pagesRole of Primary Marketprashantgorule100% (4)

- Chapter # 5 The Structure & Performance of Sec MarketsDocument29 pagesChapter # 5 The Structure & Performance of Sec MarketsBappyNo ratings yet

- 2 - Overview of Capital MarketDocument15 pages2 - Overview of Capital MarketJeffrey RiveraNo ratings yet

- Financial Institution and Marketing Cha 4Document23 pagesFinancial Institution and Marketing Cha 4Gadisa TarikuNo ratings yet

- Investment BankingDocument8 pagesInvestment Bankinghs playsNo ratings yet

- Introductory To FinanceDocument4 pagesIntroductory To Financeinnies duncanNo ratings yet

- Stock MarketDocument9 pagesStock MarketFrank KenyanNo ratings yet

- Full Project PDFDocument54 pagesFull Project PDFPraveen Kumar VMNo ratings yet

- The Basic Structure of Financial MarketsDocument10 pagesThe Basic Structure of Financial Markets202220012No ratings yet

- Equity Research: Q.1 Top Down and Bottom Up ApproachDocument10 pagesEquity Research: Q.1 Top Down and Bottom Up Approachpuja bhatNo ratings yet

- FNM 106 M-TERM lECTURE 3,4Document10 pagesFNM 106 M-TERM lECTURE 3,4haron franciscoNo ratings yet

- Markets. in Primary Markets, Securities Are Bought by Way of Public Issue DirectlyDocument40 pagesMarkets. in Primary Markets, Securities Are Bought by Way of Public Issue DirectlyramchandrakumbharNo ratings yet

- Case Study - Financial MarketsDocument9 pagesCase Study - Financial Marketsbtsvt1307 phNo ratings yet

- Instruments of The Capital MarketDocument3 pagesInstruments of The Capital MarketHarsh ThakurNo ratings yet

- Mastering the Markets: Advanced Trading Strategies for Success and Ethical Trading PracticesFrom EverandMastering the Markets: Advanced Trading Strategies for Success and Ethical Trading PracticesNo ratings yet

- How to Make Money Trading Stocks & Shares: A comprehensive manual for achieving financial success in the marketFrom EverandHow to Make Money Trading Stocks & Shares: A comprehensive manual for achieving financial success in the marketNo ratings yet

- Topic 12 Evaluating HRM Towards The Future BX2051Document33 pagesTopic 12 Evaluating HRM Towards The Future BX2051JunNo ratings yet

- Final Chapter 6 Financial PlanDocument26 pagesFinal Chapter 6 Financial Planangelo felizardoNo ratings yet

- BSC Investment and Financial Risk ManagementDocument13 pagesBSC Investment and Financial Risk ManagementchimaegbukoleNo ratings yet

- CopelandDocument49 pagesCopelandRUMA AKTERNo ratings yet

- MwigaDocument89 pagesMwigamichael richardNo ratings yet

- Aakanksha C.VDocument2 pagesAakanksha C.VAakanksha GulatiNo ratings yet

- Cases Unit 1 ServopsDocument5 pagesCases Unit 1 ServopsViswanath NihanNo ratings yet

- 18300038,14th, MGT 331, AssignmentDocument8 pages18300038,14th, MGT 331, AssignmentMd RifatNo ratings yet

- IFI - World BankDocument9 pagesIFI - World BankSagar AryalNo ratings yet

- D - Data Processing Agreement For SAP ServicesDocument10 pagesD - Data Processing Agreement For SAP ServicesUlysse TpnNo ratings yet

- Axe Effect PresentationDocument17 pagesAxe Effect PresentationAmey SankheNo ratings yet

- Mgt400 Group Assignment 1 FinalDocument19 pagesMgt400 Group Assignment 1 FinalJoshua NicholsonNo ratings yet

- Flinn (ISA 315 + ISA 240 + ISA 570)Document2 pagesFlinn (ISA 315 + ISA 240 + ISA 570)Zareen AbbasNo ratings yet

- Attachment J.1 Statement of Objectives (Soo) Usaid Udhyam Nepal ActivityDocument31 pagesAttachment J.1 Statement of Objectives (Soo) Usaid Udhyam Nepal ActivityManoj MaharjanNo ratings yet

- Lansing (MI) City Council Meeting Info Packet For June 28 MeetingDocument213 pagesLansing (MI) City Council Meeting Info Packet For June 28 MeetingwesthorpNo ratings yet

- Simulation 9 - Bookkeeping TemplateDocument3 pagesSimulation 9 - Bookkeeping Templateapi-520325493No ratings yet

- Kaizen Sheet - Tamil & EngDocument6 pagesKaizen Sheet - Tamil & EngkrixotNo ratings yet

- AIDS, Condoms and Carnival Durex in BrazilDocument39 pagesAIDS, Condoms and Carnival Durex in BrazilJordana Le GallNo ratings yet

- GTC Construction Co. ProfileDocument11 pagesGTC Construction Co. Profilemustafurade1No ratings yet

- APG-Audit Planning PDFDocument4 pagesAPG-Audit Planning PDFdio39saiNo ratings yet

- Essex College: Operation Management (British Aerospace)Document25 pagesEssex College: Operation Management (British Aerospace)Ahmed BilalNo ratings yet

- 1.2.3 PED and The Total Revenue Test Practice ActivityDocument2 pages1.2.3 PED and The Total Revenue Test Practice ActivityRafael TristanNo ratings yet

- Resume CyrineDocument2 pagesResume CyrineCyrine DridiNo ratings yet

- Product Concept: Apple Co. Is A Well-Known Company For Its Gadgets andDocument4 pagesProduct Concept: Apple Co. Is A Well-Known Company For Its Gadgets andcarloNo ratings yet

- Abbot Photocopier & Net Cafe: (Business Plan) History and BackgroundDocument9 pagesAbbot Photocopier & Net Cafe: (Business Plan) History and Backgroundirfan99651No ratings yet

- Planning Information SystemDocument12 pagesPlanning Information SystemedelitaNo ratings yet

- Mgt3 GovernanceDocument2 pagesMgt3 GovernanceZeah Viendell CruzatNo ratings yet

- Cash BudgetDocument8 pagesCash BudgetKei CambaNo ratings yet

- Strategic Alliance Proposal - AFFIN ISLAMIC BANKDocument13 pagesStrategic Alliance Proposal - AFFIN ISLAMIC BANKHighdeal Andwar100% (1)