Professional Documents

Culture Documents

Assignment - Current Liabilities - Notes Payable

Uploaded by

BEA CATANEO0 ratings0% found this document useful (0 votes)

9 views24 pages Based on the information provided:

The carrying amount of the loan increased by ₱88,820 during the year ended December 31, 20x1.

Original Description:

Original Title

Assignment_ Current Liabilities_Notes Payable

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document Based on the information provided:

The carrying amount of the loan increased by ₱88,820 during the year ended December 31, 20x1.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

9 views24 pagesAssignment - Current Liabilities - Notes Payable

Uploaded by

BEA CATANEO Based on the information provided:

The carrying amount of the loan increased by ₱88,820 during the year ended December 31, 20x1.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 24

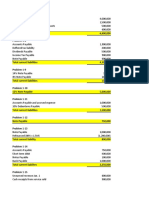

Accounts payable 750,000

Short term borrowings 400,000

Current portion of Mortgage payable 100,000

Bank loan payable 1,000,000

Total current liabilities 2,250,000

Answer C. 750,000

Cost of glass 200

Remittance from customer (50)

Net premium cost 150

Box tops to be redeemed ( 50% x 100000) 50,000

Box tops redeemed 40,000

Outstanding 10,000

Premium expense (50000/2 = 25000x150) 3,750,000

Estimated liability at year end

(10000/2=5000x150) 750,000

Number of premiums distributed in 2022 20,000

Number of premiums to be distributed in 2023 5,000

Total premiums in 2022 25,000

Premium expense for 2022 (25000x40) 1,000,000

Estimated liability - 12/31/2022 (5000x40) 200,000

Premiums distributed in 2023 50,000

Premiums to be distributed in 2024 3,000

Total 53,000

Premiums arising from 2022 sals distributed in 2023 (5,000)

Premiums applicable to 2023 48,000

Premium expense for 2023 (48000x40) 1,920,000

Estimated liability - 12/31/2023 (3000x40) 120,000

Answer: 8100000 Answer: b. 8,100,000

Answer: c. 1,500,000

Answer: a. 750,000

Answer: b. 475,000

Answer: b. 2,300,000

Answer: a. 2,025,000

Amount allocated to the points (1M/8Mx7M) 875,000

Points to be redeemed in 2022 (80%x50000) 40,000

Revenue from points for 2022 (15000/40000x875000) 328,125

Points to be redeemed in 2023 (85%x50000) 42,500

Total points redeemed to 12/31/2023 (15000+7950) 22,950

Cumulative revenue - 12/31/2023 (22950/425000x875000) 472,500

Revenue from points for 2022 (328,125)

Revenue from points for 20223 144,375

Points to be redeemed in 2024 (85%x50000) 42,500

Total points redeemed to 12/31/2024 (15000+7950+2550) 25,500

Cumulative revenue - 12/31/2024 (25500/42500x875000) 525,000

Cumulative revenue recognized in 2023 (472,500)

Revenue from points for 2024 52,500

Points to be redeemed in 2025 (90%x50000) 45,000

Total points redeemed to 12/31/2025 (15000+7950+2550+15000) 40,000

Cumulative revenue - 12/31/2025 (40500/45000x875000) 787,500

Cumulative revenue recognized in 2024 (525,000)

Revenue from points for 2025 262,500

Answer: a. 1,250,000

Warranty expense 1,900,000

Warranty liabilty (200,000)

Warranty expenditure 1,700,000

Warranty expense 2,400,000

Warranty liabilty (100,000)

Warranty expenditure 2,500,000

Estimated warranty liability (800,000 - 100,000) 700,000

Answer: c. 177,000

PV of N/P (600000x3.60) 2160000

PV of N/P(200000X5.712) 1,142,400

First payment - 12/31/2022 (200,000)

PV on N/P - 12/312022 942,400

Answer: b. 1,100,000

Accrued interest - March 1, 2021 to Feb 28, 2021 120,000

Accrued Interest - March 1, 2021 to Dec 31, 2022 112,000

Accrued interest payable 232,000

Contest prize expense 418,250

Discount on N/P 531,750

N/P - noncurrent 950,000

Contest prize expense 50,000

N/P - current 50,000

PV of 1, 8% 4 periods 3,675,000

PV of Ordinary Annuity of 1, 8% 4 periods 1,656,000

Total 5,331,000

Notes payable (5,000,000)

331,000 gain

PV of 1, 12% 3 periods 3,560,000

PV of Ordinary Annuity of 1, 12% 3 periods 1,201,000

Total 4,761,000

Notes payable (5,000,000)

(239,000) loss

a. ₱500,000

Answer: a. 2,250,780

Answer: c. 468,250

Carrying amount of loan on January 1, 20x1 4,563,000

Carrying amount of loan on December 31, 20x1 4,651,820

You might also like

- Jesus Loves You: Law Notes, Past Questions and Answers atDocument51 pagesJesus Loves You: Law Notes, Past Questions and Answers atVite ResearchersNo ratings yet

- Investment and Portfolio Chapter 1Document24 pagesInvestment and Portfolio Chapter 1MarjonNo ratings yet

- Sales - Breach of Contract, Extinguishment of SaleDocument26 pagesSales - Breach of Contract, Extinguishment of SaleErika WijangcoNo ratings yet

- Allonges and FraudDocument4 pagesAllonges and FraudAva StamperNo ratings yet

- Let's Practise: Maths Workbook Coursebook 7From EverandLet's Practise: Maths Workbook Coursebook 7No ratings yet

- Chapter 2 The Financial Market EnvironmentDocument35 pagesChapter 2 The Financial Market EnvironmentJames Kok67% (3)

- Bautista v. Sps. BalolongDocument2 pagesBautista v. Sps. BalolongJay jogs100% (1)

- Real Estate Finance and Economics - Quiz - 22jan2023Document4 pagesReal Estate Finance and Economics - Quiz - 22jan2023harriet daleNo ratings yet

- SUMMARYDocument44 pagesSUMMARYGenelle Mae MadrigalNo ratings yet

- CONTRACTS - ObliConDocument84 pagesCONTRACTS - ObliConNicole SantoallaNo ratings yet

- Sol. Man. - Chapter 4 Provisions, Cont. Liabs. & Cont. AssetsDocument9 pagesSol. Man. - Chapter 4 Provisions, Cont. Liabs. & Cont. AssetsEinez B. CarilloNo ratings yet

- Chapter 12 Dealings in PropertiesDocument6 pagesChapter 12 Dealings in PropertiesAlyssa BerangberangNo ratings yet

- Activity - Consolidated Financial Statement Part 1Document10 pagesActivity - Consolidated Financial Statement Part 1PaupauNo ratings yet

- Digital Electronics For Engineering and Diploma CoursesFrom EverandDigital Electronics For Engineering and Diploma CoursesNo ratings yet

- Solutions Manual to accompany Introduction to Linear Regression AnalysisFrom EverandSolutions Manual to accompany Introduction to Linear Regression AnalysisRating: 1 out of 5 stars1/5 (1)

- Irrevocable Special Power of AttorneyDocument3 pagesIrrevocable Special Power of Attorneyplaysomegames100% (1)

- Problem 6-8 Answer A Savage CompanyDocument6 pagesProblem 6-8 Answer A Savage CompanyJurie BalandacaNo ratings yet

- A Study On Customer Perception On HDFC BankDocument88 pagesA Study On Customer Perception On HDFC BankShahzad SaifNo ratings yet

- Chap2 ProblemsDocument31 pagesChap2 Problemskyle GNo ratings yet

- 93 - Final Preaboard AFAR SolutionsDocument11 pages93 - Final Preaboard AFAR SolutionsLeiNo ratings yet

- Midterms Quiz 2 Answers PDFDocument7 pagesMidterms Quiz 2 Answers PDFFranz Campued100% (1)

- Group 1Document11 pagesGroup 1Cherie Soriano AnanayoNo ratings yet

- AssignmentDocument40 pagesAssignmentnoeljrpajaresNo ratings yet

- IA 1 - Chapter 6 Notes Receivable Problems Part 2Document11 pagesIA 1 - Chapter 6 Notes Receivable Problems Part 2John CentinoNo ratings yet

- Cpa Review School of The Philippines Mani LaDocument6 pagesCpa Review School of The Philippines Mani LaSophia PerezNo ratings yet

- Corrections: Suggested SolutionDocument5 pagesCorrections: Suggested SolutionZairah FranciscoNo ratings yet

- 2Document4 pages2Dan Shadrach DapegNo ratings yet

- Problem 6-8 Answer A Savage CompanyDocument6 pagesProblem 6-8 Answer A Savage CompanyJurie BalandacaNo ratings yet

- Investments: SolutionDocument8 pagesInvestments: SolutionAce LimpinNo ratings yet

- In Acc April Lyn Limsan BsaDocument6 pagesIn Acc April Lyn Limsan BsaJurie BalandacaNo ratings yet

- In Acc Chris Jean Paden BsaDocument6 pagesIn Acc Chris Jean Paden BsaJurie BalandacaNo ratings yet

- Chapter 29Document19 pagesChapter 29Darlianne Klyne BayerNo ratings yet

- Group 1Document9 pagesGroup 1Cherie Soriano AnanayoNo ratings yet

- Solution Set - Costing & O.R.-4th EditionDocument417 pagesSolution Set - Costing & O.R.-4th EditionRonny Roy50% (4)

- Management Accounting: Page 1 of 6Document70 pagesManagement Accounting: Page 1 of 6Ahmed Raza MirNo ratings yet

- Far AnswersDocument2 pagesFar AnswersMikhail Ayman MasturaNo ratings yet

- Group G Answer KeyDocument5 pagesGroup G Answer KeyMaichaNo ratings yet

- Mid Semester Assignment: Course Code: FIN - 254 Section: 08Document8 pagesMid Semester Assignment: Course Code: FIN - 254 Section: 08Fahim Faisal 1620560630No ratings yet

- ReSA SLU AFAR Midterm Exam ANSWER KEYDocument10 pagesReSA SLU AFAR Midterm Exam ANSWER KEYAira Mugal OwarNo ratings yet

- Advacc 6.1Document17 pagesAdvacc 6.1Lorifel Antonette Laoreno TejeroNo ratings yet

- Total Increase in PPE 9,700,000Document22 pagesTotal Increase in PPE 9,700,000Stephanie gasparNo ratings yet

- Interim Financial ReportingDocument7 pagesInterim Financial ReportingRey Joyce AbuelNo ratings yet

- Interim Financial Reporting: Problem 45-1: True or FalseDocument7 pagesInterim Financial Reporting: Problem 45-1: True or FalseXyverbel Ocampo RegNo ratings yet

- Interim Financial Reporting: Problem 45-1: True or FalseDocument7 pagesInterim Financial Reporting: Problem 45-1: True or FalseMarjorieNo ratings yet

- Sol. Man. - Chapter 6 - Teacher's Manual - Ia Part 1aDocument7 pagesSol. Man. - Chapter 6 - Teacher's Manual - Ia Part 1aYamateNo ratings yet

- Diagnostic Level 3 AccountingDocument17 pagesDiagnostic Level 3 AccountingRobert CastilloNo ratings yet

- Advanced Accounting - Answers and Solutions: Problem 1. DDocument4 pagesAdvanced Accounting - Answers and Solutions: Problem 1. DDaniel HunksNo ratings yet

- Sol. Man. - Chapter 6 - Receivables Addtl Concept - Ia Part 1aDocument7 pagesSol. Man. - Chapter 6 - Receivables Addtl Concept - Ia Part 1aJenny Joy Alcantara0% (1)

- Angelica S. Rubios: Problem 10-19Document4 pagesAngelica S. Rubios: Problem 10-19Angel RubiosNo ratings yet

- Finalchapter 17Document4 pagesFinalchapter 17Jud Rossette ArcebesNo ratings yet

- Business Combi CH 6 de JesusDocument9 pagesBusiness Combi CH 6 de JesusMerel Rose FloresNo ratings yet

- Auditing Problem 2 To 6Document5 pagesAuditing Problem 2 To 6April Rose CercadoNo ratings yet

- PROBLEM 12-10 ANSWER: C. 1,800,000 SolutionDocument2 pagesPROBLEM 12-10 ANSWER: C. 1,800,000 SolutionJessica Cabanting OngNo ratings yet

- Chapter 29Document6 pagesChapter 29Shane Ivory ClaudioNo ratings yet

- CPA Review School of The Philippines ManilaDocument4 pagesCPA Review School of The Philippines ManilaSophia PerezNo ratings yet

- Problem 2-4Document6 pagesProblem 2-4Dan Shadrach DapegNo ratings yet

- Chapter 28Document6 pagesChapter 28Shane Ivory ClaudioNo ratings yet

- Solution Far450 UITM - Jan 2013Document8 pagesSolution Far450 UITM - Jan 2013Rosaidy SudinNo ratings yet

- Bank A and B - Bank XDocument4 pagesBank A and B - Bank XSoleil SierraNo ratings yet

- Module 8 - Answer KeyDocument3 pagesModule 8 - Answer KeyFiona MiralpesNo ratings yet

- Far Situational Solution-1Document6 pagesFar Situational Solution-1Baby BearNo ratings yet

- Solution Far450 - Jan 2013Document9 pagesSolution Far450 - Jan 2013aielNo ratings yet

- AC13.1.2 Module 1 Answer KeyDocument6 pagesAC13.1.2 Module 1 Answer KeyDianaNo ratings yet

- 1 2021 FAR FinalsDocument6 pages1 2021 FAR FinalsZatsumono YamamotoNo ratings yet

- Intermediate Accounting 3Document18 pagesIntermediate Accounting 3Cristine MayNo ratings yet

- Unit 2: Accounting For Current Liabilities TOPIC 1: Premium Liability Problem #1Document3 pagesUnit 2: Accounting For Current Liabilities TOPIC 1: Premium Liability Problem #1Jonas FranciscoNo ratings yet

- 1.) Answer: 1 050 000: Prelim Bring Home ExamDocument12 pages1.) Answer: 1 050 000: Prelim Bring Home ExamMary Joy CabilNo ratings yet

- ASE 3902 - IAS - Revised Syllabus - Answers To Specimen Paper 2008 16307Document8 pagesASE 3902 - IAS - Revised Syllabus - Answers To Specimen Paper 2008 16307WinnieOngNo ratings yet

- CMPC 131 Finals Quiz 1 Short Term AY 2018 2019 SolutionDocument4 pagesCMPC 131 Finals Quiz 1 Short Term AY 2018 2019 SolutionAlinah AquinoNo ratings yet

- Perry - SolutionsDocument4 pagesPerry - SolutionsCharles TuazonNo ratings yet

- Ffa ADocument5 pagesFfa Aaccounts officerNo ratings yet

- The Financial Education Fallacy (Lauren Willis 2011)Document7 pagesThe Financial Education Fallacy (Lauren Willis 2011)MarcoKreNo ratings yet

- Parties & Their Role in Project FinanceDocument15 pagesParties & Their Role in Project FinanceBlesson PerumalNo ratings yet

- Holders of Nonvoting Shares Shall Nevertheless Be Entitled To Vote On The Following Matters (A) Amendment of The Articles of IncorporationDocument5 pagesHolders of Nonvoting Shares Shall Nevertheless Be Entitled To Vote On The Following Matters (A) Amendment of The Articles of IncorporationIraNo ratings yet

- (Credit Hours 3) Corporate Financing Decisions: Text BooksDocument1 page(Credit Hours 3) Corporate Financing Decisions: Text Booksshraddha amatyaNo ratings yet

- Module 2 Special Topics in Financial ManagementDocument16 pagesModule 2 Special Topics in Financial Managementkimjoshuadiaz12No ratings yet

- Competency, Incidents of Transfer and Conditions Restraining AlienationDocument17 pagesCompetency, Incidents of Transfer and Conditions Restraining AlienationHarshini BakarajuNo ratings yet

- UBS Strategy Outlook 4Q2023Document16 pagesUBS Strategy Outlook 4Q2023Khang ĐặngNo ratings yet

- FAC1502 - Study Unit 12 - 2021Document9 pagesFAC1502 - Study Unit 12 - 2021Ndila mangalisoNo ratings yet

- Financial Accounting: Assignment#3Document2 pagesFinancial Accounting: Assignment#3RameenNo ratings yet

- G Holdings V National GR No. 160236Document20 pagesG Holdings V National GR No. 160236Jacqui GierNo ratings yet

- Money Market in BangladeshDocument34 pagesMoney Market in Bangladeshjubaida khanamNo ratings yet

- Households - Chapter 17 - DraftDocument12 pagesHouseholds - Chapter 17 - DraftFazra FarookNo ratings yet

- Bret Broaddus Tips To Avoid Mistakes That Home Buyers MakeDocument3 pagesBret Broaddus Tips To Avoid Mistakes That Home Buyers MakeBret broaddusNo ratings yet

- Quiz Chapter+2 Notes+payable+-+Document2 pagesQuiz Chapter+2 Notes+payable+-+Rena Jocelle NalzaroNo ratings yet

- Current LiabilitiesDocument9 pagesCurrent LiabilitiesErine ContranoNo ratings yet

- Stock Market Crash EssayDocument5 pagesStock Market Crash Essayapi-531397083No ratings yet

- Essential Housing - Grubb PropertiesDocument7 pagesEssential Housing - Grubb PropertiesGrubb PropertiesNo ratings yet

- Loan Agreement and Promissory Note: Maria Christina E. Gaviola Legforms 3B Atty. CallejaDocument5 pagesLoan Agreement and Promissory Note: Maria Christina E. Gaviola Legforms 3B Atty. CallejaKIARA DANIELLE NAZARIONo ratings yet