Professional Documents

Culture Documents

Acc 2214 - Whistle Blowing

Uploaded by

Sunday OcheOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Acc 2214 - Whistle Blowing

Uploaded by

Sunday OcheCopyright:

Available Formats

ACC 2213- ACCOUNTING ETHICS

WHISTLE BLOWING AND ETHICAL THEORIES

1.0 WHISTLE BLOWING CONCEPT:

Whistle blowing simply means giving information (usually to the authorities) about illegal or

under hand practice (Chambers Dictionary) exposing to the press a wrong doing or cover up in

a business or government office.

Whistle blowing can also be seen as calling attention to wrong doing that is occurring within an

organization. Experts and analyst believe that whistle blowing; the act of exposing fraud, waste,

abuse or misbehavior in a company organization is on the rise globally.

2.0 Four ways to blow the whistle

The government accountability project list four ways to blow the whistle.

1. Report wrong doing or a violation of the law to the proper authorities such as supervisors, a

hotline, or an inspector general.

2. Leaking evidence of wrong doings to the media.

3. Testifying in legal proceedings.

4. Refusing to participate in wrong doing in work place.

Of course, whistle blowing goes on in the private sector involving some of the most famous

figures including ERNON vice president Sharon Watkins and Tobacco executive Jeffrey

Wigan. Because government by its very nature is supposed to open and transparent, full

disclosure of unethical or illegal behavior in the public sphere is particularly important, whistle

blowing today becomes the position of the government globally.

3.0 But is it wise to speak out? Consider the following examples:

On the 22nd July 2005, Charles de Menezes, having just entered a train, was shot seven times

by the London Police. The police claimed he was wearing a bulky coat and had jumped over the

ticket barrier and had run to the train. But Lana Vandenberg knew the police were lying. She

work for the independent police complaint commission and had access to evidence presented at

the commission’s enquiry into the shooting. She leaked the information to television journalists

and then was subject to reprisals by the police. In a dawn raid by 21st September 2005, ten

police officers broke down her door and arrested her, she was kept in a cell without access to

lawyer for 8 hours and threatened by a police that she could go to prison. She said “It never

crossed my mind that I would be treated as if I was a criminal for telling the truth. Unlike the

police, I hadn’t killed an innocent person”.

Whistle blowing definitely is a risky business. There examples are just sample of thousands of

similar cases, although each one is far more complicated than can be conveyed by a short

summary.

4.0 Who is a Whistle Blower?

A Whistle Blower is an employee, former employee, or member pf an organization, especially a

business or government agent who reports misconduct to people or entities that have power and

permitted to presumed willingness to take corrective measures. Generally, the misconduct is a

violation of law, rule, regulations and corruption. One of the publicized whistle blowing cases

WHISTLE BLOWING & ETHICAL THEORIES Page 1

ENFORCEMENT OF ACCOUNTING ETHICS

ACC 2213- ACCOUNTING ETHICS

involved Jeffrey Wigand, who exposed the Big Tobacco scandal, revealing that executive of the

companies knew the cigarette were addictive while approving the addition known as

Carcinogenic ingredients to the cigarettes. Wigand’s story was the basis for the 1999 movie

“The Insider”. Another famous whistle blower was Dr. Frederic Whiteburst, who exposed

irregularities at the federal bureau of investigations (FBI) crime lab

5.0 Types of Whistle Blowing

1. Internal Whistle Blowing: A person who reports misconduct to another employee or

supervisor within their company or agency. A disclosure made in good faith essentially

honestly to the employer (be it a manager or director) will be protected if the whistle blower

has a reasonable suspicion that the wrong doing has occurred, is occurring or likely to occur.

2. External Whistle Blowing: Reports misconduct to outside persons or entities. In these

cases, depending on its severity an nature, whistle blowers may report the misconduct to

lawyers, the media, law enforcement, state or federal agencies.

Wider disclosures (e.g. to the police, the media etc) are protected if in addition to the tests for

regulatory disclosure, they are reasonably in all circumstances and they are not made for

personal gain. A wider disclosure must however, meet one of four pre-conditions to trigger

protection. These are:

a) The whistle blower reasonably believed he would be victimized if he raised the matter

internally or with a prescribed regulation.

b) There was no prescribed regular and he reasonably believed the evidence was likely to be

concealed or destroyed.

c) The concern had already been raised with the employer or a prescribed regulation.

6.0 Whistle Blowing and Ethics

Whistle blowing has to do with ethics because it represents a person’s understanding at a deep

level that an action his/her organization is taken is harmful- that it interferes with peoples right

or unfair or detracts from the common good. Whistle blowing also calls upon the virtues,

especially of course, as standing up for principles can be a punishing experience.

Even though laws are supposed to protect whistle blowers from retaliation, people who feel

threatened by the revelations can ostracize the whistle blower, marginalize or even forcing him

or her out of public office.

On the hand, there have been occasions when the role of whistle blower has actually catapulted

people into a higher office and has carried the respect of constitutions. For example former

Director General of NAFDAC Prof. (Mrs) Dorah Akunyili.

7.0 Ethics Theories

In the study of moral development as conducted by psychologist Lawrence Kohlberg, he

discovered two types of moral theories namely, Ethical Subjectivism and Cultural

Relativism.

a) Ethical Subjectivism: This theory claims that morality is relative to individual and that it

differs among people depending on what they feel. It is believed that morality is a matter of

opinion. In the view of Boss (2005), “If morality was simply a matter of opinion, then there

WHISTLE BLOWING & ETHICAL THEORIES Page 2

ENFORCEMENT OF ACCOUNTING ETHICS

ACC 2213- ACCOUNTING ETHICS

was no point in trying to use rational arguments to convince the racist or the serial killer that

what he did was wrong”.

b) Cultural Relativism: This theory was developed from the studies of simple cultures. It

proposes that morality is a societal norm. It is believed that public opinion and not private

determines what is right and wrong. This theory holds that what is right in one society or

culture maybe regarded as wrong as wrong in another society or culture.

While the ethical subjectivism absolves people of ever hearing to deliberate before moving a

making a moral judgement. Culture relativism on the other hand, absolves people from

moral responsibility as long as they follow the good. In accountancy profession, whether the

member is working in the industry or in a professional practice, the member cannot just

follow the crowd without being in trouble.

This therefore, brings us to the universal moral principles such as the Utilitarian and

Deontology.

a) Utilitarian Theory: This theory was developed by Jeremy Bentham, proposes that the

morality of an action is determined solely by its consequences. Utilitarian’s maintain that

actions as rights, to the extent that they tend to promote overall happiness and vice versa.

According to this theory, when people or individual is faced with ethical dilemma, the

consequences of the action are usually first evaluated in terms of what produces the greatest

amount of good for the greatest number of people. Utilitarian Philosophers that individual

should evaluate behavior in terms of its social consequences.

b) Deontology: This theory regards duty as the basis for morality. According to Echekwube

(1991). The Greek word “Deon”(duty) emphasizes that it is not the result of an action that

make it right or wrong, rather it is the action itself in its original conception and intuition

which determines whether the action is right or wrong.

WHISTLE BLOWING & ETHICAL THEORIES Page 3

ENFORCEMENT OF ACCOUNTING ETHICS

ACC 2213- ACCOUNTING ETHICS

ENFORCEMENT OF ACCOUNING ETHICS

1.0 ENFORECEMENT OF ETHICS

To a large extent, the accounting profession is self-regulated rather than being regulated by the

government. For instance, the ICAN and ANAN have their internal means to enforce the code

of ethics. The power of ICAN, ANAN to enforce ethical standards is conferred on the

accountant disciplinary tribunal.

Violations of ethical standards can lead to expulsion or suspension. This is because of the

extreme importance of a professional accountant’s regulation, expulsion is a strong disciplinary

measures. However, ethical violation can lead to even more adverse consequences for

Accountant’s because of state and federal laws as contained in the company and allied matters

act 1990 as amended to date in the Nigerian constitution.

2.0 RESOLVING ETHICAL DELIMMA

By definition, an ethical dilemma is a situation that will often involve an apparent conflicts

between moral imperatives and one or a number of other issues.

Ethical dilemmas faced by mangers are often more real to life and highly complex- with no

clear Guidelines when one are actually faced with a significant conflict; some options may

exist;

(a) Significant Values conflicting among different interest

(b) Real alternatives that are equally justifiable, and

(c) Significant consequences on “stake holders” in the situation.

3.0 Ethical Dilemma Document

In other for organization to resolve ethical dilemma they should develop a document a

procedure for dealing with dilemma as they arises. In an ideal situation, ethical dilemma ought

to be resolved by a group within the organization, of an ethics committee which may comprise

of top managers and/or members of the brand

Today’s workforce is composed of people who are more diverse than ever in nationality,

culture, religion, age, Education, and socioeconomic status. More people enter the workforce

with differing background, value, goals, and perceptions of acceptable behavior, many of them

have career expectations that will be difficult, if not impossible to realize in today’s society.

Ethical issues may project themselves as well.

The diverse, multicultural population of workers is being used to work together in a spirit of

corporation and aspect for the good of the organization band the public they serve. According to

Kirrane (1990) there’s move pressure on people in the organizations than there ever has been to

do more with less and adjust quickly to change. In response to pressure people may cut corners,

may engage in expedient but questionable behavior.

4.0 Involving stakeholders

The resolution of conflict cannot and should not rest in the hands of one or two persons. All

stakeholders in a situation must be involved. This is probably for legal and ethical reasons, this

knowledge, opinion, and expertise of all the stakeholders in a particular decision situation must

be considered. In line with this assertion, Sonvesyu (1990) opines, “potential clients should also

be recognized as stakeholders because their choice to do business with a firm may be based on

the firm’s reputation for ethical behavior”.

WHISTLE BLOWING & ETHICAL THEORIES Page 4

ENFORCEMENT OF ACCOUNTING ETHICS

ACC 2213- ACCOUNTING ETHICS

5.0 Requirements for successful Resolution of Ethical Dilemma Resolving Ethical Dilemmas

requires ;

Interpersonal and negotiation skills as well as the new application of Employability skills.

Honesty

Ability to move cooperatively

Respect for others

Pride in one’s work

Willingness to lean

Dependability

Responsibility for one’s action

Integrity

Loyalty

Over the years, employers have sought workers with their skills, today, businesses are training

their employees in ethical and critical thinking and conflict resolution skills required for ethical

decision making.

6.0. Consulting Services

Accountants also render consultations service, ethical standards must guide such service as

well, such ethical standards must be observed by American Institution of certified public

Accountant (AICPA) has shed some light in this aspect.

The AICPAs management consulting services executive committee is authorized to issue

statement bon the standards for consulting services to provide practitioner with authoritative

guidance on providing consulting services to their client , consulting services are broadly

defined by their standard to include virtually all services Accounting and review services and

tax services. To the general standard the following requirements are added to types of

engagements;

a. Client interest: the practitioner should strive to meet the objective of the client while

maintaining integrity and objectivity.

b. Understanding Client: the practitioner should establish a written or oral undertaking with the

client about the nation, scope and limitation of the consulting engagement.

c. Communication with client : the practitioner should inform the client of

1. Any conflict of interest that may occur with respect to the engagement.

2. Any significant reservation about the scope or benefit of the engagement.

3. All significant finding or event.

WHISTLE BLOWING & ETHICAL THEORIES Page 5

ENFORCEMENT OF ACCOUNTING ETHICS

You might also like

- Whistle BlowerDocument21 pagesWhistle BlowerVimal SinghNo ratings yet

- Whistleblowing and Death Penalty-Thelma R. VillanuevaDocument75 pagesWhistleblowing and Death Penalty-Thelma R. VillanuevaThelma R. VillanuevaNo ratings yet

- Whistle BlowingDocument24 pagesWhistle BlowingTati Mansur100% (4)

- Whistle Blowing Is of Two TypesDocument5 pagesWhistle Blowing Is of Two TypesmanisandhuNo ratings yet

- Doing the Right Thing Bible Study Participant's Guide: Making Moral Choices in a World Full of OptionsFrom EverandDoing the Right Thing Bible Study Participant's Guide: Making Moral Choices in a World Full of OptionsNo ratings yet

- Ethical FallaciesDocument5 pagesEthical Fallaciesst3792No ratings yet

- WhistleblowerDocument14 pagesWhistleblowerAvinash Kumar100% (2)

- Whistle Blowing Case in InfosysDocument7 pagesWhistle Blowing Case in InfosysMahendhar Reddy PagadalaNo ratings yet

- Whistle BlowingDocument16 pagesWhistle BlowingSakshi Bansal83% (6)

- Secret Service: National Security in an Age of Open InformationFrom EverandSecret Service: National Security in an Age of Open InformationNo ratings yet

- Term Paper On Whistle BlowingDocument14 pagesTerm Paper On Whistle Blowingaayushijain1990100% (1)

- Week 4 Whistle BlowingDocument24 pagesWeek 4 Whistle BlowingPankaj GautamNo ratings yet

- 003 F - MR Alis Bin Puteh Full PaperDocument11 pages003 F - MR Alis Bin Puteh Full PaperastroneNo ratings yet

- Lecture 6Document13 pagesLecture 6Modest DarteyNo ratings yet

- Study On Whistle Blowing: For Ethics & Corporate Governance Assignment SubmissionDocument12 pagesStudy On Whistle Blowing: For Ethics & Corporate Governance Assignment SubmissionNikhil PachNo ratings yet

- Whistle Blowing PDFDocument21 pagesWhistle Blowing PDFAbdul MuqeetNo ratings yet

- A Business Ethic Theory of WhistleblowingDocument14 pagesA Business Ethic Theory of WhistleblowingIlham NurhidayatNo ratings yet

- CASTILLO - Part 02Document2 pagesCASTILLO - Part 02MARIELLE CASTILLONo ratings yet

- Seminar Report ON "Whistle Blowing"Document21 pagesSeminar Report ON "Whistle Blowing"Malika Malhotra100% (2)

- IJRHS_2014_vol02_issue-1Document5 pagesIJRHS_2014_vol02_issue-1lovesuvikashNo ratings yet

- Ulitarian or or Consequentialist Ethics Utilitarianism (Also Called Consequentialism) Is A Moral Theory Developed and Refined in TheDocument2 pagesUlitarian or or Consequentialist Ethics Utilitarianism (Also Called Consequentialism) Is A Moral Theory Developed and Refined in TheAnonymous sQPULpNo ratings yet

- Project ReportDocument49 pagesProject ReportShivani Bansal50% (4)

- Whistle BlowingDocument26 pagesWhistle Blowingsairaali_45No ratings yet

- A Project On Whistle Blowing (Business Ethics)Document14 pagesA Project On Whistle Blowing (Business Ethics)Kiran moreNo ratings yet

- White Collar Crime ExamDocument4 pagesWhite Collar Crime Examjinisha sharmaNo ratings yet

- Ethics at Workplace TheoriesDocument8 pagesEthics at Workplace TheoriesGaurav DevraNo ratings yet

- Descriptive EthicsDocument2 pagesDescriptive EthicsJhazreel BiasuraNo ratings yet

- Whistleblowing Group AssgDocument3 pagesWhistleblowing Group AssgEmellda MANo ratings yet

- Whistleblow IndiaDocument16 pagesWhistleblow IndiaSomashish NaskarNo ratings yet

- Paper Delivered To The National Conference of Whistleblowers Australia "Whistleblowing: Making It Work" September 11 2005, AdelaideDocument20 pagesPaper Delivered To The National Conference of Whistleblowers Australia "Whistleblowing: Making It Work" September 11 2005, AdelaidepurtflintNo ratings yet

- F024 Ishaan Shetty Research PaperDocument10 pagesF024 Ishaan Shetty Research PaperISHAAN SHETTYNo ratings yet

- Torque: Clarity On The US Waterboarding Policy Is Necessary To Combat ImpunityFrom EverandTorque: Clarity On The US Waterboarding Policy Is Necessary To Combat ImpunityNo ratings yet

- Whistleblowing: Presented by Ebad Khan Muhammad Uzair Hassan Asif SahibaDocument12 pagesWhistleblowing: Presented by Ebad Khan Muhammad Uzair Hassan Asif SahibaSahiba FaisalNo ratings yet

- SSRN Id2258296 PDFDocument10 pagesSSRN Id2258296 PDFVed VyasNo ratings yet

- SSRN Id2258296 PDFDocument10 pagesSSRN Id2258296 PDFVed VyasNo ratings yet

- Whistle BlowingDocument18 pagesWhistle BlowingabeerNo ratings yet

- The Bureaucratic Production of Difference: Ethos and Ethics in Migration AdministrationsFrom EverandThe Bureaucratic Production of Difference: Ethos and Ethics in Migration AdministrationsJulia M. EckertNo ratings yet

- Whistle BlowingDocument65 pagesWhistle Blowingtri utariNo ratings yet

- Criminological Theory (Labelling Theory) : Registered Criminologist, Napolcom Passer, Security Staff II, PAGCORDocument6 pagesCriminological Theory (Labelling Theory) : Registered Criminologist, Napolcom Passer, Security Staff II, PAGCORJee AlmanzorNo ratings yet

- Evasive Entrepreneurs and the Future of Governance: How Innovation Improves Economies and GovernmentsFrom EverandEvasive Entrepreneurs and the Future of Governance: How Innovation Improves Economies and GovernmentsNo ratings yet

- What Price the Moral High Ground?: How to Succeed without Selling Your SoulFrom EverandWhat Price the Moral High Ground?: How to Succeed without Selling Your SoulNo ratings yet

- Whistle Blowi NG: Evidence of Illegal Immoral ConductDocument18 pagesWhistle Blowi NG: Evidence of Illegal Immoral Conductdrbrijmohan100% (1)

- Lecture 3Document33 pagesLecture 3Florian Ananias ByarugabaNo ratings yet

- Whistle BlowingDocument34 pagesWhistle BlowingMuskaan ChaudharyNo ratings yet

- Human Rights as Human Independence: A Philosophical and Legal InterpretationFrom EverandHuman Rights as Human Independence: A Philosophical and Legal InterpretationNo ratings yet

- Title of Assignment:: Submitted To: Management Development Institute of Singapore - University of SunderlandDocument9 pagesTitle of Assignment:: Submitted To: Management Development Institute of Singapore - University of SunderlandandiniNo ratings yet

- FRA NotesDocument3 pagesFRA NotesAmit RayNo ratings yet

- Lokpal and Lokayukta: Administrative LawDocument10 pagesLokpal and Lokayukta: Administrative LawZainul AbedeenNo ratings yet

- TermPaper - Whistle BlowingDocument6 pagesTermPaper - Whistle BlowingAnshul GoyalNo ratings yet

- MEH - Combined (1) - 4Document9 pagesMEH - Combined (1) - 4Gandhi Jenny Rakeshkumar BD20029No ratings yet

- TheoriesDocument8 pagesTheoriesAmjad IrshadNo ratings yet

- Share Queenalyssayapbsedmath1bfinalexamDocument12 pagesShare Queenalyssayapbsedmath1bfinalexamCONDADA, FHILIP O.No ratings yet

- Gale Researcher Guide for: The Sociological Study of DevianceFrom EverandGale Researcher Guide for: The Sociological Study of DevianceNo ratings yet

- Name - Riaz Mehadi ID - 1931746042 Section - 8: 1. Explain and Evaluate The Four Critical Principles of EthicsDocument5 pagesName - Riaz Mehadi ID - 1931746042 Section - 8: 1. Explain and Evaluate The Four Critical Principles of EthicsRiaz Mehadi 1931746042No ratings yet

- UtilitarianismDocument6 pagesUtilitarianismRanz GieoNo ratings yet

- Daily InspirationDocument11 pagesDaily InspirationSunday OcheNo ratings yet

- Fund Raising Letter DniDocument2 pagesFund Raising Letter DniSunday OcheNo ratings yet

- Unfair CompetitionDocument9 pagesUnfair CompetitionSunday OcheNo ratings yet

- Unfair CompetitionDocument9 pagesUnfair CompetitionSunday OcheNo ratings yet

- Effects of Leadership Style On Organizational PerfDocument13 pagesEffects of Leadership Style On Organizational PerfEira Del RosarioNo ratings yet

- Fukuhmss19acc0183 Oche Acc 3210Document15 pagesFukuhmss19acc0183 Oche Acc 3210Sunday OcheNo ratings yet

- Bean Game ActivityDocument4 pagesBean Game Activityapi-314402585No ratings yet

- Handbook of Quality Procedures Before EPO enDocument73 pagesHandbook of Quality Procedures Before EPO enaffashNo ratings yet

- BBC Dividends from Unrealized Asset AppreciationDocument1 pageBBC Dividends from Unrealized Asset Appreciationvmanalo16No ratings yet

- LT Tax Advantage FundDocument2 pagesLT Tax Advantage FundDhanashri WarekarNo ratings yet

- Teacher performance certification Titay ZamboangaDocument3 pagesTeacher performance certification Titay ZamboangaJul Abs Salip100% (6)

- Invoice With Finance ChargeDocument1 pageInvoice With Finance ChargeD ¡ a R yNo ratings yet

- CIA Vs Parker Heaxd FinalDocument3 pagesCIA Vs Parker Heaxd Finalإسراء النبريصي50% (2)

- Introduction to Financial Institutions: An OverviewDocument16 pagesIntroduction to Financial Institutions: An OverviewsleshiNo ratings yet

- Earn 5 Unlocks For Every 10 Resources You UploadDocument1 pageEarn 5 Unlocks For Every 10 Resources You UploadHuber Emiro Riascos GomezNo ratings yet

- Baybay Elementary School Monthly Accomplishment Report on Anti-Drug ProgramsDocument1 pageBaybay Elementary School Monthly Accomplishment Report on Anti-Drug ProgramsCarinaJoy Ballesteros Mendez DeGuzman100% (1)

- Reliable Exports Lease DeedDocument27 pagesReliable Exports Lease DeedOkkishoreNo ratings yet

- Lista AuspiciadoresDocument2 pagesLista AuspiciadoresWanda MendezNo ratings yet

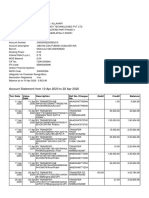

- Account activity and balance from 10 Apr to 22 AprDocument2 pagesAccount activity and balance from 10 Apr to 22 AprSRIDHAR allhari0% (1)

- Pineal Opening - Jigsaw Puzzle - Teal Swan ShopDocument1 pagePineal Opening - Jigsaw Puzzle - Teal Swan ShopBranx VisiNo ratings yet

- Biodesign - The Process of Innovating Medical Technologies - Section 4.1 NotesDocument5 pagesBiodesign - The Process of Innovating Medical Technologies - Section 4.1 NotesMaria JLNo ratings yet

- CRIME SCENE INVESTIGATIONDocument10 pagesCRIME SCENE INVESTIGATIONMel DonNo ratings yet

- Strategic AlliancesDocument20 pagesStrategic Alliancessatyabrat sahoo100% (1)

- Republic Vs de GuzmanDocument2 pagesRepublic Vs de GuzmanAxel Gonzalez100% (1)

- Tbtu MSDS (Tci-B1658) PDFDocument3 pagesTbtu MSDS (Tci-B1658) PDFBigbearBigbearNo ratings yet

- 2019 Os Parent Handbook Final 2Document44 pages2019 Os Parent Handbook Final 2api-573823749No ratings yet

- Accounting for Dividends and Preference SharesDocument16 pagesAccounting for Dividends and Preference Sharesruth san joseNo ratings yet

- SabioDocument2 pagesSabioPrecious TancincoNo ratings yet

- 论公民不服从(小姜老师整理)Document24 pages论公民不服从(小姜老师整理)James JiangNo ratings yet

- Fusion TaskListDocument20 pagesFusion TaskListObulareddy BiyyamNo ratings yet

- SN54273, SN54LS273, SN74273, SN74LS273 Octal D-Type Flip-Flop With ClearDocument8 pagesSN54273, SN54LS273, SN74273, SN74LS273 Octal D-Type Flip-Flop With Clearsas999333No ratings yet

- Tangan Vs CADocument1 pageTangan Vs CAjoyNo ratings yet

- NPA Recruitment Strategy EDITEDDocument55 pagesNPA Recruitment Strategy EDITEDLisha Binong100% (1)

- Indian Stock Market MechanismDocument2 pagesIndian Stock Market Mechanismneo0157No ratings yet

- Human Rights Sarmiento Chap 1Document11 pagesHuman Rights Sarmiento Chap 1nesteamackNo ratings yet

- Bar GlassesDocument31 pagesBar GlassesLyka GazminNo ratings yet