Professional Documents

Culture Documents

Calculation of EMI With Prepayment Option

Uploaded by

Yokesh Ganesh0 ratings0% found this document useful (0 votes)

4 views12 pagesCopyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

4 views12 pagesCalculation of EMI With Prepayment Option

Uploaded by

Yokesh GaneshCopyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You are on page 1of 12

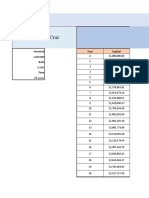

Calculation of EMI with Prepayment Option

Annual Interest Rate 8.00%

Years 1

Number of Payment Per Year 12

Original Balance $ 150,000.00

Prepayment $ 10,000.00

Month EMI Interest Principal Balance Paid Loan

0 $ 140,000.00 0.00%

1 ($12,178.38) ($933.33) ($11,245.05) $ 128,754.95 8.03%

2 ($12,178.38) ($858.37) ($11,320.01) $ 117,434.94 16.12%

3 ($12,178.38) ($782.90) ($11,395.48) $ 106,039.46 24.26%

4 ($12,178.38) ($706.93) ($11,471.45) $ 94,568.01 32.45%

5 ($12,178.38) ($630.45) ($11,547.93) $ 83,020.08 40.70%

6 ($12,178.38) ($553.47) ($11,624.91) $ 71,395.17 49.00%

7 ($12,178.38) ($475.97) ($11,702.41) $ 59,692.76 57.36%

8 ($12,178.38) ($397.95) ($11,780.43) $ 47,912.33 65.78%

9 ($12,178.38) ($319.42) ($11,858.96) $ 36,053.36 74.25%

10 ($12,178.38) ($240.36) ($11,938.02) $ 24,115.34 82.77%

11 ($12,178.38) ($160.77) ($12,017.61) $ 12,097.73 91.36%

12 ($12,178.38) ($80.65) ($12,097.73) 0.00 100.00%

#DIV/0!

Calculation of EMI

Annual Interest Rate 8.00%

Years 1

Number of Payment Per Year 12

Original Balance $ 150,000.00

Prepayment $ 10,000.00

Month EMI Interest Principal Balance Paid Loan

0 $ 140,000.00 0.00%

1 ($12,178.38)

2 ($12,178.38)

3 ($12,178.38)

4 ($12,178.38)

5 ($12,178.38)

6 ($12,178.38)

7 ($12,178.38)

8 ($12,178.38)

9 ($12,178.38)

10 ($12,178.38)

11 ($12,178.38)

12 ($12,178.38)

#DIV/0!

Use of IPMT Function

Annual Interest Rate 8.00%

Years 1

Number of Payment Per Year 12

Original Balance $ 150,000.00

Prepayment $ 10,000.00

Month EMI Interest Principal Balance Paid Loan

0 $ 140,000.00 0.00%

1 ($12,178.38) ($933.33)

2 ($12,178.38) ($858.37)

3 ($12,178.38) ($782.90)

4 ($12,178.38) ($706.93)

5 ($12,178.38) ($630.45)

6 ($12,178.38) ($553.47)

7 ($12,178.38) ($475.97)

8 ($12,178.38) ($397.95)

9 ($12,178.38) ($319.42)

10 ($12,178.38) ($240.36)

11 ($12,178.38) ($160.77)

12 ($12,178.38) ($80.65)

#DIV/0!

Calculation of Principal

Annual Interest Rate 8.00%

Years 1

Number of Payment Per Year 12

Original Balance $ 150,000.00

Prepayment $ 10,000.00

Month EMI Interest Principal Balance Paid Loan

0 $ 140,000.00 0.00%

1 ($12,178.38) ($933.33) ($11,245.05)

2 ($12,178.38) ($858.37) ($11,320.01)

3 ($12,178.38) ($782.90) ($11,395.48)

4 ($12,178.38) ($706.93) ($11,471.45)

5 ($12,178.38) ($630.45) ($11,547.93)

6 ($12,178.38) ($553.47) ($11,624.91)

7 ($12,178.38) ($475.97) ($11,702.41)

8 ($12,178.38) ($397.95) ($11,780.43)

9 ($12,178.38) ($319.42) ($11,858.96)

10 ($12,178.38) ($240.36) ($11,938.02)

11 ($12,178.38) ($160.77) ($12,017.61)

12 ($12,178.38) ($80.65) ($12,097.73)

#DIV/0!

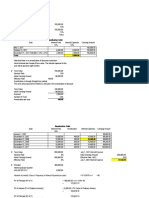

Application of Mathematical Summation Formula

Annual Interest Rate 8.00%

Years 1

Number of Payment Per Year 12

Original Balance $ 150,000.00

Prepayment $ 10,000.00

Month EMI Interest Principal Balance Paid Loan

0 $ 140,000.00

1 ($12,178.38) ($933.33) ($11,245.05) $ 128,754.95

2 ($12,178.38) ($858.37) ($11,320.01) $ 117,434.94

3 ($12,178.38) ($782.90) ($11,395.48) $ 106,039.46

4 ($12,178.38) ($706.93) ($11,471.45) $ 94,568.01

5 ($12,178.38) ($630.45) ($11,547.93) $ 83,020.08

6 ($12,178.38) ($553.47) ($11,624.91) $ 71,395.17

7 ($12,178.38) ($475.97) ($11,702.41) $ 59,692.76

8 ($12,178.38) ($397.95) ($11,780.43) $ 47,912.33

9 ($12,178.38) ($319.42) ($11,858.96) $ 36,053.36

10 ($12,178.38) ($240.36) ($11,938.02) $ 24,115.34

11 ($12,178.38) ($160.77) ($12,017.61) $ 12,097.73

12 ($12,178.38) ($80.65) ($12,097.73) 0.00

#DIV/0!

Calculation of Paid Loan in Percentage

Annual Interest Rate 8.00%

Years 1

Number of Payment Per Year 12

Original Balance $ 150,000.00

Prepayment $ 10,000.00

Month EMI Interest Principal Balance Paid Loan

0 $ 140,000.00 0.00%

1 ($12,178.38) ($933.33) ($11,245.05) $ 128,754.95 8.03%

2 ($12,178.38) ($858.37) ($11,320.01) $ 117,434.94 16.12%

3 ($12,178.38) ($782.90) ($11,395.48) $ 106,039.46 24.26%

4 ($12,178.38) ($706.93) ($11,471.45) $ 94,568.01 32.45%

5 ($12,178.38) ($630.45) ($11,547.93) $ 83,020.08 40.70%

6 ($12,178.38) ($553.47) ($11,624.91) $ 71,395.17 49.00%

7 ($12,178.38) ($475.97) ($11,702.41) $ 59,692.76 57.36%

8 ($12,178.38) ($397.95) ($11,780.43) $ 47,912.33 65.78%

9 ($12,178.38) ($319.42) ($11,858.96) $ 36,053.36 74.25%

10 ($12,178.38) ($240.36) ($11,938.02) $ 24,115.34 82.77%

11 ($12,178.38) ($160.77) ($12,017.61) $ 12,097.73 91.36%

12 ($12,178.38) ($80.65) ($12,097.73) 0.00 100.00%

#DIV/0!

You might also like

- Calculation of Simple Interest On Reducing BalanceDocument12 pagesCalculation of Simple Interest On Reducing BalanceIsabeau Jane Salvatore St-PierreNo ratings yet

- Effective Interest RateDocument8 pagesEffective Interest RateDoha anaNo ratings yet

- Case SolutionDocument12 pagesCase Solutionsoniasogreat100% (1)

- Chapter 16Document25 pagesChapter 16Semh ZavalaNo ratings yet

- Reducing Balance EMI CalculatorDocument1 pageReducing Balance EMI CalculatorIrfanNo ratings yet

- Chapter 14Document49 pagesChapter 14Semh ZavalaNo ratings yet

- Mortgage Annuity TableDocument4 pagesMortgage Annuity TableLjubomir_Ivanc_875No ratings yet

- Project NPV Sensitivity AnalysisDocument54 pagesProject NPV Sensitivity AnalysisAsad Mehmood100% (3)

- Valuation of AppleDocument25 pagesValuation of AppleQuofi SeliNo ratings yet

- Value Drivers (Assumptions)Document6 pagesValue Drivers (Assumptions)Phuong ThaoNo ratings yet

- Tax LiabilityDocument133 pagesTax LiabilitySebastian Cruz RivasNo ratings yet

- Class 1Document27 pagesClass 1gatete samNo ratings yet

- Loan Data TablesDocument4 pagesLoan Data TablesDreamer_ShopnoNo ratings yet

- Plazo (Meses, Semanas, Días) Saldo InsolutoDocument2 pagesPlazo (Meses, Semanas, Días) Saldo InsolutoFanny Osorio TapiasNo ratings yet

- Effective Annual Interest Rate CalculatorDocument1 pageEffective Annual Interest Rate CalculatorGolamMostafaNo ratings yet

- Reducing Balance EMI CalculatorDocument2 pagesReducing Balance EMI CalculatorJamesNo ratings yet

- Ejercicio de Tablas de AmortizacionDocument2 pagesEjercicio de Tablas de AmortizacionAnlly AlvarezNo ratings yet

- Amazon ValuationDocument22 pagesAmazon ValuationDr Sakshi SharmaNo ratings yet

- Book 1Document8 pagesBook 1Alejandra LamasNo ratings yet

- Chapter 15Document39 pagesChapter 15Semh ZavalaNo ratings yet

- 5 Concrete ExampleDocument3 pages5 Concrete ExampleTobias ManunureNo ratings yet

- Asb CalculatorDocument2 pagesAsb Calculatorsyazwan_shukri_1No ratings yet

- Effective Interest Rate Method Excel TemplateDocument49 pagesEffective Interest Rate Method Excel TemplateAngeline DolosaNo ratings yet

- Applied Math Practice For Financial Advisors - Exercises (Solutions)Document62 pagesApplied Math Practice For Financial Advisors - Exercises (Solutions)Ali kamakuraNo ratings yet

- Ejercicios 6-7Document5 pagesEjercicios 6-7Ana GarcíaNo ratings yet

- Scenario Summary: Changing Cells: Result CellsDocument5 pagesScenario Summary: Changing Cells: Result CellsNitin JoyNo ratings yet

- Financial StatDocument11 pagesFinancial StatYaqin YusufNo ratings yet

- Financial StatDocument11 pagesFinancial StatYaqin YusufNo ratings yet

- Financial StatDocument11 pagesFinancial StatYaqin YusufNo ratings yet

- Institución Valor Cuota CAE Tasa de Interés MensualDocument32 pagesInstitución Valor Cuota CAE Tasa de Interés MensualJorge Andres Tapia AlburquenqueNo ratings yet

- Multiple IrrDocument4 pagesMultiple IrrDreamer_Shopno100% (1)

- Payment Number Payment Principal Interest BalanceDocument1 pagePayment Number Payment Principal Interest BalanceJohn Ray AbadNo ratings yet

- Asb Calculator v11Document2 pagesAsb Calculator v11Nd ANdy NdNo ratings yet

- Asb Calculator v11Document2 pagesAsb Calculator v11mmahaliNo ratings yet

- Asb Calculator v11Document2 pagesAsb Calculator v11Mohd HafizNo ratings yet

- Net Present Value and Other Investment RulesDocument38 pagesNet Present Value and Other Investment RulesBussines LearnNo ratings yet

- Assignment 1Document4 pagesAssignment 1LNo ratings yet

- Bond PriceDocument6 pagesBond Pricenrao123No ratings yet

- Compilation First Prelim Period SolutionDocument12 pagesCompilation First Prelim Period SolutionHarvyn Kuster AcedilloNo ratings yet

- Rate 7% 15 40 75 Forever $ (5,500.00) PV $ 50,093.53 $ 73,324.40 $ 78,079.98 $ 78,571.43Document18 pagesRate 7% 15 40 75 Forever $ (5,500.00) PV $ 50,093.53 $ 73,324.40 $ 78,079.98 $ 78,571.43Arpi OrujyanNo ratings yet

- Mortgage Calculations 15Document40 pagesMortgage Calculations 15fouad.mlwbdNo ratings yet

- Chapter 19Document13 pagesChapter 19Semh ZavalaNo ratings yet

- 90 Day Trade SpreadsheetDocument24 pages90 Day Trade SpreadsheetMarian RagaNo ratings yet

- Felisha Burkeen Comp1 AccountingDocument2 pagesFelisha Burkeen Comp1 Accountingledmabaya23No ratings yet

- Solar Energy Cash Flow Canadian Solar Share XLS Stripped 01Document40 pagesSolar Energy Cash Flow Canadian Solar Share XLS Stripped 01Bhaskar Vijay SinghNo ratings yet

- Loan Calculator Practice FileDocument3 pagesLoan Calculator Practice FileDANE MATTHEW PILAPILNo ratings yet

- Calculate financial projections and equity value for companyDocument4 pagesCalculate financial projections and equity value for companySunil SharmaNo ratings yet

- Ejercicio Proyecto FinalDocument3 pagesEjercicio Proyecto FinalCortez Rodríguez Karen YanethNo ratings yet

- 08 ENMA302 InflationExamplesDocument8 pages08 ENMA302 InflationExamplesMotazNo ratings yet

- Scenario Summary: Changing CellsDocument3 pagesScenario Summary: Changing CellsCoco Luis Trinidad AlvaradoNo ratings yet

- NPV & IrrDocument58 pagesNPV & IrrAira DacilloNo ratings yet

- AmortDocument3 pagesAmortapi-3763644No ratings yet

- Ebook Cases in Finance 3Rd Edition Demello Solutions Manual Full Chapter PDFDocument17 pagesEbook Cases in Finance 3Rd Edition Demello Solutions Manual Full Chapter PDFfintanthamh4jtd100% (10)

- Cases in Finance 3rd Edition Demello Solutions ManualDocument8 pagesCases in Finance 3rd Edition Demello Solutions Manuallovellhebe2v0vn100% (21)

- Case Spreadsheet NewDocument6 pagesCase Spreadsheet NewUsman Ch0% (2)

- Lease Financing AssignmentDocument8 pagesLease Financing AssignmentAshraful IslamNo ratings yet

- Task 2Document1 pageTask 2killian.influNo ratings yet

- Part 1 (Weight: 50%) : Show Your Calculations and Results Similar To Table 6.1 and 6.2 (Book Example)Document7 pagesPart 1 (Weight: 50%) : Show Your Calculations and Results Similar To Table 6.1 and 6.2 (Book Example)Arpi OrujyanNo ratings yet

- HW Tut 5 - Dang Thuy Huong - 1704040049Document7 pagesHW Tut 5 - Dang Thuy Huong - 1704040049Đặng Thuỳ HươngNo ratings yet

- CFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)From EverandCFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)Rating: 5 out of 5 stars5/5 (1)

- Robert E. Wright Vincenzo QuadriniDocument38 pagesRobert E. Wright Vincenzo Quadriniwaqas illyasNo ratings yet

- Case Digest CreditDocument32 pagesCase Digest CreditEnzoNo ratings yet

- Best Strategic Management For Dhaka Bank (12!08!17)Document14 pagesBest Strategic Management For Dhaka Bank (12!08!17)tazreeNo ratings yet

- JUDGMENT REVERSED IN PART FOR HOMEOWNER - Robert Herrera V Deutsche, CRC Et Al - Court of Appeals CaliforniaDocument9 pagesJUDGMENT REVERSED IN PART FOR HOMEOWNER - Robert Herrera V Deutsche, CRC Et Al - Court of Appeals California83jjmackNo ratings yet

- Bonds Duration NoteDocument3 pagesBonds Duration NoteRhea ZenuNo ratings yet

- Introduction To Financial ManagementDocument61 pagesIntroduction To Financial ManagementPrimoNo ratings yet

- Accepted For Value RulesDocument6 pagesAccepted For Value RulesChad Lange96% (28)

- BUSINESS FINANCE Module 2Document4 pagesBUSINESS FINANCE Module 2Jes M. MoñezaNo ratings yet

- FM 42: Investment and Portfolio ManagementDocument39 pagesFM 42: Investment and Portfolio ManagementSarah Jane OrillosaNo ratings yet

- Case 4 - Final Report Nupetco Case (Pastel Group)Document23 pagesCase 4 - Final Report Nupetco Case (Pastel Group)Nurul Farah Mohd FauziNo ratings yet

- EBCL Distinguish BetweenDocument39 pagesEBCL Distinguish BetweenNilam GhadgeNo ratings yet

- Foreclosure - Metrobank Vs MirandaDocument3 pagesForeclosure - Metrobank Vs MirandaElijah B BersabalNo ratings yet

- Sample TestDocument14 pagesSample TestShara Lyn50% (2)

- What Is The PV FunctionDocument6 pagesWhat Is The PV FunctionJealousy MarumisaNo ratings yet

- Titman PPT CH18Document79 pagesTitman PPT CH18IKA RAHMAWATINo ratings yet

- 19ago2019 WeeklyMarketOutlookDocument24 pages19ago2019 WeeklyMarketOutlookparlacheNo ratings yet

- AF205 Assignment 2 - Navneet Nischal Chand - S11157889Document3 pagesAF205 Assignment 2 - Navneet Nischal Chand - S11157889Shayal ChandNo ratings yet

- RTC Jurisdiction Over Consignation Case Involving Property Purchase DisputeDocument1 pageRTC Jurisdiction Over Consignation Case Involving Property Purchase DisputeDaphne EnriquezNo ratings yet

- Presentation IFMDocument11 pagesPresentation IFMSrikara SimhaNo ratings yet

- NJ Tax Guide for Home Buyers & SellersDocument9 pagesNJ Tax Guide for Home Buyers & Sellersnour abdallaNo ratings yet

- Taxes TransferDocument52 pagesTaxes TransferGrayl TalaidNo ratings yet

- ECO432 Explains Financial SystemsDocument7 pagesECO432 Explains Financial SystemsNuzhat TasnumNo ratings yet

- Regions Bank StatementDocument2 pagesRegions Bank StatementGalarraga H AbrahamNo ratings yet

- Mortgage vs Antichresis RulingDocument2 pagesMortgage vs Antichresis RulingBibi JumpolNo ratings yet

- EQUITY PRINCIPLES: CLEAN HANDS AND DOING EQUITYDocument6 pagesEQUITY PRINCIPLES: CLEAN HANDS AND DOING EQUITYMuhammad Imran Ahmad Kamboh75% (8)

- Module 1 - Introduction To Credit and CollectionDocument23 pagesModule 1 - Introduction To Credit and CollectionAllan Cris RicafortNo ratings yet

- Ong v. CA (G.R. No. 75884, September 24, 1987)Document2 pagesOng v. CA (G.R. No. 75884, September 24, 1987)Lorie Jean UdarbeNo ratings yet

- How the Big Short exposed flaws in the US mortgage marketDocument2 pagesHow the Big Short exposed flaws in the US mortgage marketPedro HacheNo ratings yet

- TAXATION REVIEW: KEY CONCEPTS AND SITUATIONSDocument113 pagesTAXATION REVIEW: KEY CONCEPTS AND SITUATIONSDaryl Mae Mansay100% (1)

- The Principles of Lending and Lending BasicsDocument38 pagesThe Principles of Lending and Lending BasicsenkeltvrelseNo ratings yet