Professional Documents

Culture Documents

Minimum Salary in Romania (2023)

Minimum Salary in Romania (2023)

Uploaded by

CALLISTAR GROUP0 ratings0% found this document useful (0 votes)

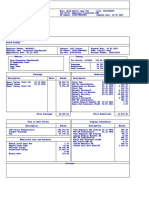

2 views1 pageThe document contains a minimum salary analysis for Romania effective January 1st, 2023. It shows the breakdown of an employee's gross salary of 3,000 Lei (518.99 Euro) into net salary, taxes, and contributions. The employee's net salary is 1,898 Lei (385.79 Euro) after paying 1,102 Lei (223.99 Euro) in taxes through social insurance, medical insurance, income tax, and personal discount deductions. The employer pays an additional 63 Lei (12.81 Euro) in employment insurance contributions.

Original Description:

Total calculation of minimum salary in Romania for the year 2023

Original Title

Minimum salary in Romania (2023)

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document contains a minimum salary analysis for Romania effective January 1st, 2023. It shows the breakdown of an employee's gross salary of 3,000 Lei (518.99 Euro) into net salary, taxes, and contributions. The employee's net salary is 1,898 Lei (385.79 Euro) after paying 1,102 Lei (223.99 Euro) in taxes through social insurance, medical insurance, income tax, and personal discount deductions. The employer pays an additional 63 Lei (12.81 Euro) in employment insurance contributions.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

2 views1 pageMinimum Salary in Romania (2023)

Minimum Salary in Romania (2023)

Uploaded by

CALLISTAR GROUPThe document contains a minimum salary analysis for Romania effective January 1st, 2023. It shows the breakdown of an employee's gross salary of 3,000 Lei (518.99 Euro) into net salary, taxes, and contributions. The employee's net salary is 1,898 Lei (385.79 Euro) after paying 1,102 Lei (223.99 Euro) in taxes through social insurance, medical insurance, income tax, and personal discount deductions. The employer pays an additional 63 Lei (12.81 Euro) in employment insurance contributions.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

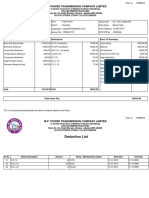

T(RO) +40 352 086060 T(GR) +30 210 4409900 E contact@callistar.

group

ROMANIA

Minimum salary analysis with effect since 1.1.2023

EMPLOYEE Lei Euro

Gross salary 3.000 518.99

Tax free 200 40,65

Social Insurance (CAS) 25% 700 142,28

Medical Insurance (CASS) 10% 280 56,91

Personal discount (DP) 600 121,96

Φόρος Εισοδήματος (IV) 10% 122 24,80

Net salary (in hand) 1.898 385,79

EMPLOYER Lei Euro

Employment Insurance Contribution (CAM) 2.25% 63 12,81

Total salary 3.063 622,59

TOTAL TAXES Lei Euro

Employee pays the state1 1.102 223,99

Employer pays the state 63 12,81

Total taxes to the state 1.165 236,80

To pay a net salary of 1.898 lei, the employer pays 1.165 lei in taxes / month

1 Employee taxes are withheld and paid by the employer.

SINCE 2003 IN ROMANIA

You might also like

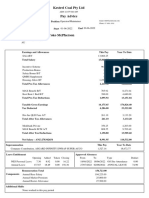

- Paystub 202303Document1 pagePaystub 202303carinaNo ratings yet

- IndividualPayslip wOldPayout PDFDocument1 pageIndividualPayslip wOldPayout PDFFawaz SayedNo ratings yet

- PDF&Rendition 1Document2 pagesPDF&Rendition 1vijaybhaskar damireddyNo ratings yet

- Payslip IndiaApproved On30 Nov 2023 - UnlockedDocument3 pagesPayslip IndiaApproved On30 Nov 2023 - UnlockedrithulblockchainNo ratings yet

- Salary SlipDocument1 pageSalary SlipAnkit SinghNo ratings yet

- Paywithtaxslip 102324 PDFDocument1 pagePaywithtaxslip 102324 PDFamitshrivastava154218No ratings yet

- Form PDFDocument2 pagesForm PDFSuresh DoosaNo ratings yet

- EPF Universal Account NumberDocument1 pageEPF Universal Account NumberetrshillongNo ratings yet

- 01-18-2020 Payslip PDFDocument1 page01-18-2020 Payslip PDFCarla ZanteNo ratings yet

- Payslip 46044522Document2 pagesPayslip 46044522Steve OrtonNo ratings yet

- SalarySlipwithTaxDetails 2021 MayDocument1 pageSalarySlipwithTaxDetails 2021 MaySameer KulkarniNo ratings yet

- UnknownDocument2 pagesUnknownSudip MondalNo ratings yet

- Amit JiDocument1 pageAmit JiRohit RajNo ratings yet

- M.P. Power Transmission Company LimitedDocument2 pagesM.P. Power Transmission Company LimitedKanhaiya SharmaNo ratings yet

- India JUN-2020 ...Document1 pageIndia JUN-2020 ...laxman luckyNo ratings yet

- NL Ec LS 400 6Document1 pageNL Ec LS 400 6Gladys CasarrubiasNo ratings yet

- Model-Place 01012014Document3 pagesModel-Place 01012014Mirza SharanNo ratings yet

- Prudential Life Assurance Page 1 of 2 (Date Printed: 16-Jul-2019)Document2 pagesPrudential Life Assurance Page 1 of 2 (Date Printed: 16-Jul-2019)KomalaNo ratings yet

- Prudential Life Assurance Page 1 of 2 (Date Printed: 09-Oct-2019)Document2 pagesPrudential Life Assurance Page 1 of 2 (Date Printed: 09-Oct-2019)KomalaNo ratings yet

- 4 TXDocument1 page4 TXemartey62No ratings yet

- Prudential Life Assurance Page 1 of 2 (Date Printed: 09-Oct-2019)Document2 pagesPrudential Life Assurance Page 1 of 2 (Date Printed: 09-Oct-2019)KomalaNo ratings yet

- $valueDocument1 page$valueMuzi MyezaNo ratings yet

- Shravan Payslip Sept2018 Millinium FNBDocument1 pageShravan Payslip Sept2018 Millinium FNBbolloju VictoNo ratings yet

- PayslipDocument1 pagePayslipSuyash RaulNo ratings yet

- Payslip - Andrei Ungureanu - 08-12-2023Document1 pagePayslip - Andrei Ungureanu - 08-12-2023tubalcain3macbenac3No ratings yet

- Payslip PDFDocument1 pagePayslip PDFASHWINI KHANGARNo ratings yet

- UnknownDocument1 pageUnknownNISHCHAL AGARWALNo ratings yet

- Pay Slip of August 2023Document1 pagePay Slip of August 2023alim.siddiquiNo ratings yet

- Your Pay Advice For Pay Ending 30 06 2022Document2 pagesYour Pay Advice For Pay Ending 30 06 2022iqbal.shahid0374No ratings yet

- 45Document1 page45Nicola LendersNo ratings yet

- Gross Wage: Otto Id Sap IdDocument1 pageGross Wage: Otto Id Sap IdGheorghita CaloroNo ratings yet

- PaySlip - PDF 20231219 141142 0000Document1 pagePaySlip - PDF 20231219 141142 0000jzeb.gonzales18No ratings yet

- 7, House No:C61, Mohalla Station, Bhakkar, Bhakkar, Bhakkar Bhakkar Bushra AnwarDocument3 pages7, House No:C61, Mohalla Station, Bhakkar, Bhakkar, Bhakkar Bhakkar Bushra AnwarAdvocatesajidKambohNo ratings yet

- 2019 Declaration PDFDocument4 pages2019 Declaration PDFIkramNo ratings yet

- RPT Pay Slip YTDDocument1 pageRPT Pay Slip YTDTomola BlessingNo ratings yet

- Salary 11-2023Document1 pageSalary 11-2023Van DaoNo ratings yet

- 2021 12 December - 71000700Document2 pages2021 12 December - 71000700Pablo BarónNo ratings yet

- Asad Naseer Malik ITR 2022Document6 pagesAsad Naseer Malik ITR 2022Deen with AyaanNo ratings yet

- Oct 1st PayoutDocument1 pageOct 1st PayoutJohn HenryNo ratings yet

- Payslip-03 10 2023Document1 pagePayslip-03 10 2023wireNo ratings yet

- Pay StructureDocument1 pagePay StructurerotimiNo ratings yet

- ResignDocument1 pageResignBaBy GaMiNgNo ratings yet

- Draft Return For ReviewDocument4 pagesDraft Return For ReviewsajjadNo ratings yet

- Itr 1 FormatDocument3 pagesItr 1 FormatPawanNo ratings yet

- Sample Payroll CalculationDocument5 pagesSample Payroll CalculationArajrubanNo ratings yet

- Your Pay Advice For Pay Ending 30 09 2022Document2 pagesYour Pay Advice For Pay Ending 30 09 2022iqbal.shahid0374No ratings yet

- Alejandra Rodriguez Castaneda Payslip For Dec 2020Document1 pageAlejandra Rodriguez Castaneda Payslip For Dec 2020Andres CastañoNo ratings yet

- Kashana Hafiz Mir Colony Near Petrol PUMP LILYANI 0492450277 Khalil Ahmad ShakirDocument4 pagesKashana Hafiz Mir Colony Near Petrol PUMP LILYANI 0492450277 Khalil Ahmad ShakirKhalil ShakirNo ratings yet

- Declaration4220102804067 PDFDocument5 pagesDeclaration4220102804067 PDFIkramNo ratings yet

- Acknowledgement Slip: Name: Address: Noor Complex, Civil Lines, Jhang Registration No Tax YearDocument6 pagesAcknowledgement Slip: Name: Address: Noor Complex, Civil Lines, Jhang Registration No Tax YearFairTax SolutionsNo ratings yet

- Mahnia Wala Chak No 190 JB Post Office Khas Tehsil Chiniot Distt Muhammad Saleem Raza ShahDocument4 pagesMahnia Wala Chak No 190 JB Post Office Khas Tehsil Chiniot Distt Muhammad Saleem Raza ShahMUHAMMAD SALEEM RAZANo ratings yet

- Mobile Services: Your Account Summary This Month'S ChargesDocument5 pagesMobile Services: Your Account Summary This Month'S Chargesvipin agarwalNo ratings yet

- Fluturasi Lichidare Iul 20 DIVEICA CORNELIA PDFDocument1 pageFluturasi Lichidare Iul 20 DIVEICA CORNELIA PDFGeorgeSiCamiNeaguNo ratings yet

- 2021 IK Return WDocument6 pages2021 IK Return Wali razaNo ratings yet

- M/s.S.S.Rote FY 2019-20: 1-Apr-2019 To 31-Mar-2020 1-Apr-2019 To 31-Mar-2020Document1 pageM/s.S.S.Rote FY 2019-20: 1-Apr-2019 To 31-Mar-2020 1-Apr-2019 To 31-Mar-2020Abhijeet PatilNo ratings yet

- Maretlwa PayslipDocument1 pageMaretlwa Payslipmoonyung602No ratings yet

- MemberDocument2 pagesMemberjennifergutierrezevasanNo ratings yet

- Salary Slip Format For HCLDocument1 pageSalary Slip Format For HCLrajkannamdu100% (1)