Professional Documents

Culture Documents

DCF Template BofA - VF

DCF Template BofA - VF

Uploaded by

Ayesha RehmanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

DCF Template BofA - VF

DCF Template BofA - VF

Uploaded by

Ayesha RehmanCopyright:

Available Formats

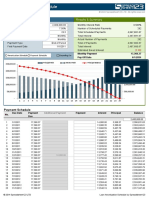

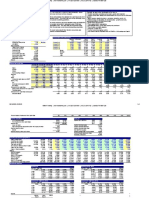

Simple Discounted Cash Flow Model

DCF Analysis

Year 1 2 3 4 5

2022E 2023E 2024E 2025E 2026E

Revenue $0.0

% Growth 0% 0% 0% 0%

EBITDA $0.0

% Margin 0% 11% 21% 32% 42%

Cash Taxes Calculation

EBITDA $0.0 $0.0 $0.0 $0.0 $0.0

Less: Depreciation and Amortization 0.0

EBIT $0.0 $0.0 $0.0 $0.0 $0.0

Cash Taxes 0.0% $0.0 $0.0 $0.0 $0.0 $0.0

Capital Expenditures

Net Working Capital $0.0

Change in NWC $0.0

EBITDA $0.0 $0.0 $0.0 $0.0 $0.0

Less: Cash Taxes

Less: Changes in W/C

Less: Capital Expenditures

Total Unlevered Free Cash Flow $0.0

Total Discounted Unlevered Free Cash Flow $0.0

PV of Unlevered FCF $0.0

Implied Enterprise / Equity Valuation from DCF Analysis

Forward (2026E) EBITDA $0.0

Terminal Multiple

Terminal Value $ -

Present Value of Terminal Value

PV of Unlevered FCF $0.0

Plus: PV of Terminal Value 0.0

Implied TEV / Present Value $0.0

Plus: Cash

Less: Debt

Implied Equity Value $0.0

Shares Outstanding

Implied Share Price Valuation #DIV/0!

Sensitivities

Enterprise Value ($M)

Terminal Multiple

-2.0x -1.0x 0.0x 1.0x 2.0x

###

###

WAC ###

###

###

Implied Share Price

Terminal Multiple

-2.0x -1.0x 0.0x 1.0x 2.0x

###

###

WAC ###

###

###

You might also like

- Barber Shop Business Plan ExampleDocument34 pagesBarber Shop Business Plan ExampleJoseph Quill100% (2)

- Loan Amortization Calculator BestDocument11 pagesLoan Amortization Calculator BestHenok mekuriaNo ratings yet

- Project Finance Training Model SampleDocument282 pagesProject Finance Training Model SampleKumar SinghNo ratings yet

- Company Name: Financial ModelDocument13 pagesCompany Name: Financial ModelGabriel AntonNo ratings yet

- Accretion Dilution ModelDocument10 pagesAccretion Dilution ModelQuýt BéNo ratings yet

- LBO Blank TemplateDocument15 pagesLBO Blank TemplateBrian DongNo ratings yet

- ChristophJanz SaaSCohortAnalysis21Document13 pagesChristophJanz SaaSCohortAnalysis21Diego SinayNo ratings yet

- Pres Bocconi2021PDFDocument25 pagesPres Bocconi2021PDFfabriNo ratings yet

- 2022 North American Private Equity Compensation Survey Heidrick StrugglesDocument25 pages2022 North American Private Equity Compensation Survey Heidrick StrugglesUbairNo ratings yet

- Revised ModelDocument27 pagesRevised ModelAnonymous 0CbF7xaNo ratings yet

- ModelDocument103 pagesModelMatheus Augusto Campos PiresNo ratings yet

- 2022.07.24 - DCF Tutorial Answer KeyDocument18 pages2022.07.24 - DCF Tutorial Answer KeySrikanth ReddyNo ratings yet

- Project Frozen - Valuation SummaryDocument20 pagesProject Frozen - Valuation SummaryReusNo ratings yet

- WST Circular ReferenceDocument1 pageWST Circular Referencecool_stuffsaleNo ratings yet

- 107 10 DCF Sanity Check AfterDocument6 pages107 10 DCF Sanity Check AfterDavid ChikhladzeNo ratings yet

- Cours 2 Essec 2018 Lbo PDFDocument81 pagesCours 2 Essec 2018 Lbo PDFmerag76668No ratings yet

- 1634 - MLA M - A Quick Reference GuideDocument157 pages1634 - MLA M - A Quick Reference Guideshinil_b100% (1)

- Gas Business Opportunity - South East AsiaDocument18 pagesGas Business Opportunity - South East AsiaMuhammad Syaiful ArifinNo ratings yet

- Free Cash Flow To Firm DCF Valuation Model Base DataDocument3 pagesFree Cash Flow To Firm DCF Valuation Model Base DataTran Anh VanNo ratings yet

- Ascots Ascots Ascots Ascots: UnderstandingDocument24 pagesAscots Ascots Ascots Ascots: UnderstandingPratik GiteNo ratings yet

- Relative Valuation Model CompleteDocument3 pagesRelative Valuation Model Completeosama alnatshehNo ratings yet

- L&T 4Q Fy 2013Document15 pagesL&T 4Q Fy 2013Angel BrokingNo ratings yet

- LBO BMC Course Manual - 639b9f6484ec3Document151 pagesLBO BMC Course Manual - 639b9f6484ec3Marc ONo ratings yet

- 20.06.26 Nano II Model - SentDocument309 pages20.06.26 Nano II Model - SentAdrian KurniaNo ratings yet

- Valuation - DCF+LBO - Master - VS - 09-01-2012 EB CommentsDocument89 pagesValuation - DCF+LBO - Master - VS - 09-01-2012 EB CommentsJames MitchellNo ratings yet

- DCF Model - Power Generation: Strictly ConfidentialDocument5 pagesDCF Model - Power Generation: Strictly ConfidentialAbhishekNo ratings yet

- 3 Cash Flow Model 0Document14 pages3 Cash Flow Model 0kumarmayurNo ratings yet

- WACC AnalysisDocument9 pagesWACC AnalysisFadhilNo ratings yet

- DCF Model - Blank: Strictly ConfidentialDocument5 pagesDCF Model - Blank: Strictly ConfidentialaeqlehczeNo ratings yet

- 50 AAPL Buyside PitchbookDocument22 pages50 AAPL Buyside PitchbookkamranNo ratings yet

- LBO Model Algeco - MagistralDocument3 pagesLBO Model Algeco - MagistralZexi WUNo ratings yet

- Fitch Special Report US Private Equity Overview October 2010Document19 pagesFitch Special Report US Private Equity Overview October 2010izi25No ratings yet

- Investor-Owned Utility (IOU) : of The State's Electric Customers)Document1 pageInvestor-Owned Utility (IOU) : of The State's Electric Customers)brett.willitt1628No ratings yet

- Aswath DamodaranDocument437 pagesAswath DamodaranheliocuaiaNo ratings yet

- Sensitivity Analysis Excel TemplateDocument5 pagesSensitivity Analysis Excel TemplateCele MthokoNo ratings yet

- Vault Fund Venture Studio Structure AnalysisDocument6 pagesVault Fund Venture Studio Structure AnalysisKleber Bastos Gomes JuniorNo ratings yet

- Empowerment, Advocacy and Participatory DevelopmentDocument20 pagesEmpowerment, Advocacy and Participatory DevelopmentRiah Yuzon100% (2)

- Variance Analysis: Assignment Line ItemDocument18 pagesVariance Analysis: Assignment Line Itemfatima khurramNo ratings yet

- Advance Corporate FinanceDocument53 pagesAdvance Corporate FinanceIdham Idham IdhamNo ratings yet

- 1.kaizen Cross Over GCPDocument1 page1.kaizen Cross Over GCPPRANAV KUMAR GAUTAMNo ratings yet

- 50 AAPL Buyside PitchbookDocument22 pages50 AAPL Buyside PitchbookAkshay ShaikhNo ratings yet

- Bpmtoolbox 6.0-Historical & Forecast Business Planning Model Example (Basic)Document94 pagesBpmtoolbox 6.0-Historical & Forecast Business Planning Model Example (Basic)januarNo ratings yet

- Insights From Endeavor Strategies: What Drives Saas ValuationsDocument8 pagesInsights From Endeavor Strategies: What Drives Saas Valuationsgaurav004usNo ratings yet

- VC and IPO NumericalDocument16 pagesVC and IPO Numericaluse lnctNo ratings yet

- Group 6 Report HandoutsDocument13 pagesGroup 6 Report HandoutsAlia Arnz-DragonNo ratings yet

- Fin 600 - Radio One-Team 3 - Final SlidesDocument20 pagesFin 600 - Radio One-Team 3 - Final SlidesCarlosNo ratings yet

- LBO Model Algeco - For StudentsDocument5 pagesLBO Model Algeco - For StudentsZexi WUNo ratings yet

- Powerpoint Embedded Layouts: Look & Feel 2010Document30 pagesPowerpoint Embedded Layouts: Look & Feel 2010Chandan_RicharyaaNo ratings yet

- 2014-7 Equity Yield Curve FinalDocument16 pages2014-7 Equity Yield Curve FinalLuke ConstableNo ratings yet

- BM410-16 Equity Valuation 2 - Intrinsic Value 19oct05Document35 pagesBM410-16 Equity Valuation 2 - Intrinsic Value 19oct05muhammadanasmustafaNo ratings yet

- Synopsis of Many LandsDocument6 pagesSynopsis of Many Landsraj shekarNo ratings yet

- PNRA Panera Bread 2016 Annual Shareholder PresentationDocument46 pagesPNRA Panera Bread 2016 Annual Shareholder PresentationAla BasterNo ratings yet

- DCF ModellDocument7 pagesDCF ModellziuziNo ratings yet

- TVS Motor DCF ModelDocument35 pagesTVS Motor DCF ModelPrabhdeep DadyalNo ratings yet

- Lbo ModelDocument4 pagesLbo Modelharshalp1212No ratings yet

- One Page M&A Simple Model Improved BlankDocument21 pagesOne Page M&A Simple Model Improved BlankAllen FengNo ratings yet

- Overview of Investment Banking in IndiaDocument8 pagesOverview of Investment Banking in Indiasumit pamechaNo ratings yet

- Case 1 SwanDavisDocument4 pagesCase 1 SwanDavissilly_rabbit0% (1)

- Merger Model PP Allocation BeforeDocument100 pagesMerger Model PP Allocation BeforePaulo NascimentoNo ratings yet

- Model #14 M - A Model (Mergers and Acquisitions)Document11 pagesModel #14 M - A Model (Mergers and Acquisitions)Rahul GopanNo ratings yet

- Company ValuationDocument68 pagesCompany ValuationXinyi SunNo ratings yet

- Finance Simulation - Capital BudgetingDocument1 pageFinance Simulation - Capital BudgetingKarthi KeyanNo ratings yet

- 72Ho-Singer Model V3Document28 pages72Ho-Singer Model V3aqwaNo ratings yet

- DCF Model Answer - VFDocument1 pageDCF Model Answer - VFhimanshushrma.9112No ratings yet

- API NY - GDP.PCAP - CD DS2 en Excel v2 5454823Document44 pagesAPI NY - GDP.PCAP - CD DS2 en Excel v2 5454823Hunter Hearst LevesqueNo ratings yet

- DCF Model Answer - VFDocument1 pageDCF Model Answer - VFHunter Hearst LevesqueNo ratings yet

- Morocco Crystals - Catalog 23Document13 pagesMorocco Crystals - Catalog 23Hunter Hearst LevesqueNo ratings yet

- Webflix Financial Summary TemplateDocument1 pageWebflix Financial Summary TemplateHunter Hearst LevesqueNo ratings yet

- Task 2 - Initial Set of Questions TemplateDocument1 pageTask 2 - Initial Set of Questions TemplateHunter Hearst LevesqueNo ratings yet

- Task 2 - Email To Kim (Senior Associate) TemplateDocument1 pageTask 2 - Email To Kim (Senior Associate) TemplateHunter Hearst LevesqueNo ratings yet

- Task 4 - Process Flow TemplateDocument1 pageTask 4 - Process Flow TemplateHunter Hearst LevesqueNo ratings yet

- Chapter - General Journal 4Document32 pagesChapter - General Journal 4Israr AhmedNo ratings yet

- Strategic Management Final Exam ReviewerDocument10 pagesStrategic Management Final Exam ReviewerMergierose DalgoNo ratings yet

- Intercompany Profit Transactions - BondsDocument50 pagesIntercompany Profit Transactions - BondsJeremy JansenNo ratings yet

- Jimmy Makhija: MarketingDocument3 pagesJimmy Makhija: MarketingDrNitin SippyNo ratings yet

- VAT CodalDocument20 pagesVAT Codaldaryl canozaNo ratings yet

- Fabm2 Lesson10 Accounting Practice SetDocument9 pagesFabm2 Lesson10 Accounting Practice SetTrisha TorresNo ratings yet

- 10 Steps To Conduct A PFMEADocument8 pages10 Steps To Conduct A PFMEASudhagarNo ratings yet

- WiRED 7.0 Product Case StudyDocument4 pagesWiRED 7.0 Product Case StudyPalak AroraNo ratings yet

- Merchandising Lecture MRFDDocument59 pagesMerchandising Lecture MRFDMaria Louella MagadaNo ratings yet

- Business Law Unit IIDocument8 pagesBusiness Law Unit IIKaran Veer SinghNo ratings yet

- Turnover Ratio: Inventory Turnover Net Sales / Average Inventory 92922.3/ (3097+2729.3) /2 31.8Document5 pagesTurnover Ratio: Inventory Turnover Net Sales / Average Inventory 92922.3/ (3097+2729.3) /2 31.8rimanjoharNo ratings yet

- Emerging Challenges As Facilitator of CSR: JHARCRAFT A New HopeDocument1 pageEmerging Challenges As Facilitator of CSR: JHARCRAFT A New HopeETCASESNo ratings yet

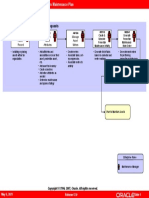

- Asset Purchase To Maintenance Plan Flow ModelDocument1 pageAsset Purchase To Maintenance Plan Flow ModelJavier ScribNo ratings yet

- Presentation CRMDocument10 pagesPresentation CRMdchaudharayNo ratings yet

- CV Writing Lalazar English Academy GujranwalaDocument2 pagesCV Writing Lalazar English Academy GujranwalaDissertation, report and Essay writing for studentNo ratings yet

- Foreign Currency ConversionDocument39 pagesForeign Currency ConversionRutuja KulkarniNo ratings yet

- CV of Sonakshi For ConclaveDocument4 pagesCV of Sonakshi For ConclavedhruvNo ratings yet

- Employment Contract For China SampleDocument9 pagesEmployment Contract For China SampleQureshi Amir AliNo ratings yet

- Contract Law II Kslu Notes FinalDocument84 pagesContract Law II Kslu Notes FinalInchara KashyapNo ratings yet

- 25 PDFDocument1 page25 PDFEdin PasalicNo ratings yet

- 15 Hackett Recommended Metrics To Benchmark Your O2C ProcessesDocument14 pages15 Hackett Recommended Metrics To Benchmark Your O2C ProcesseskhatmalNo ratings yet

- Disha Khosla: Curriculum VitaeDocument5 pagesDisha Khosla: Curriculum VitaeRuby SethiNo ratings yet

- Ent 407 Entrepreneurship DevelopmentDocument356 pagesEnt 407 Entrepreneurship Developmentjohn peterNo ratings yet

- Business Value ManagementDocument2 pagesBusiness Value ManagementFrancisNo ratings yet

- Exterior Inc - C (CCUBES)Document2 pagesExterior Inc - C (CCUBES)Anurag JainNo ratings yet