Professional Documents

Culture Documents

CI - Tax Free Fixed Deposit

Uploaded by

Bheki ShongweOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CI - Tax Free Fixed Deposit

Uploaded by

Bheki ShongweCopyright:

Available Formats

Investec Tax Free Fixed Deposit

Product Rules

Investec Specialist Bank

These product rules form part of and are deemed to be incorporated in the Terms and Conditions applicable to

Investec Cash Investments (“Terms and Conditions”). Words and expressions used in these product rules

which are not defined, shall have the meaning ascribed to them in the terms and conditions. If there is any

conflict between the terms and conditions and these product rules, these product rules apply.

Product description

An Investec Tax Free Fixed Deposit is a 12-month cash investment account, where you agree to invest an

amount, to a maximum of R36 000 for 12 months at a guaranteed, fixed interest rate. In terms of the provisions

of the Income Tax Act, 1962 interest earned is not subject to income tax, subject to the provisions of that act

and all other applicable legislation.

Definitions

• “account” means the Investec Tax Free Fixed Deposit

• “account balance” means the total capital invested in the account and constitutes the balance on which

interest is earned

• “fixed period” means the agreed/committed term of the investment

• “fixed interest rate” means the interest you earn on your account will not change if there are fluctuations in

market interest rates

• “maturity date” is the end of the fixed period and date at which funds become available

• “tax year” means the period commencing on 1 March each year and ending on the last day of February the

next year

General

Your account is subject to the parameters set out herein.

• You will only be allowed to make one deposit into the account, up to a maximum amount of R36 000 per

tax year

• Should you wish to open more than one Tax Free Fixed Deposit (or any other tax free investment account

with Investec or another institution), the aggregate maximum capital amount that can be invested per tax

year is R36 000

06/2017

Instant Access | Notice Accounts | Fixed Deposits

Investec Tax Free Fixed Deposit Product Rules Page 2 of 3

• Fixed period: 12 months

• The interest rate applicable to the account is a fixed interest rate, which will only be applicable until the

maturity date

Interest rates

• The interest rate is calculated on the account balance and is fixed for the fixed period

• The interest earned can be compounded monthly or transferred to a designated bank account

• If interest is transferred to a designated bank account, it is done so on the first business day of the month

Deposits

• The minimum deposit is R30 000

• The maximum capital contribution per tax year is R36 000 (or such other limit determined by legislation)

• Additional deposits cannot be made into an existing account

Withdrawals

• Funds may only be withdrawn from this account on the maturity date

• A withdrawal before the maturity date will attract penalty fees. These penalty fees are detailed below, and

may reduce your capital amount

• Withdrawals before the maturity date are permitted, but subject to a minimum withdrawal limit of R5 000

Maturity

• On or before the maturity date, you must advise Investec if you do not wish to reinvest in another Tax Free

Fixed Deposit for another fixed period

• In the event that we have not received an instruction by the maturity date, your funds will automatically be

reinvested in another Tax Free Fixed Deposit, at the prevailing market rate for another fixed period

Online banking functionality

You will be able to:

• View statements online

• View transactional history online

• View or print statements and IT3(s) Income tax certificates

Fees

• No monthly management or administration fees apply to the Investec Tax Free Fixed Deposit

Instant Access | Notice Accounts | Fixed Deposits

Investec Tax Free Fixed Deposit Product Rules Page 3 of 3

• Investec is entitled to charge and recover fees in respect of transactions. Refer to

www.investec.co.za/ci-fees for the applicable transaction fees.

Penalty fee

• Notwithstanding the higher penalty fee stipulated for other fixed investment products in the Terms and

Conditions, the early withdrawal of funds and/or the termination of this account will attract penalty fees in

an amount equal to a formula set out by National Treasury (set out below), subject to a minimum fee of

R300 (three hundred Rand) including VAT

• National Treasury stipulates the applicable penalty to be calculated as the capital balance of the

withdrawal multiplied, over the remaining time to maturity, by the difference of the interest rate1 applicable

to the investment period of the original fixed deposit and one which is entered into on the date of

withdrawal, with the same maturity date as the original fixed deposit

• These penalty fees will reduce your capital amount

Account closure

• You may close the account at any time with 32 business days’ written notice subject to the penalty fees set

out above

• Accrued interest will be capitalised on the maturity date and included in the amount transferred when the

closing instruction is executed

• Refer to the Terms and Conditions, available on www.investec.co.za, for further details regarding account

closure

Complaints

Should you have any complaints, contact your banker or the Global Client Support Centre on +27 11 286 9663.

Disclaimers

• Investec is entitled to amend these product rules and/or to withdraw the product at any time, in accordance

with the Terms and Conditions. All amendments are published on www.investec.co.za

• These product rules (as amended from time to time) apply to any Investec Tax Free Fixed Deposit account

you may open with Investec. It is your responsibility to ensure that you have read and understood the

product rules and any amendments to the product rules

• Please refer to www.investec.co.za for additional information on the product or to review the Terms and

Conditions

1

Interest rate in this context is defined as that of the zero coupon nominal bond curve that is published by the JSE limited, daily

Instant Access | Notice Accounts | Fixed Deposits

Investec Specialist Bank, a division of Investec Bank Limited registration number 1969/004763/06. Investec Specialist Bank is committed

to the Code of Banking Practice as regulated by the Ombudsman for Banking Services. A registered credit provider registration number

NCRCP9.

You might also like

- Cut Your Clients Tax Bill: Individual Tax Planning Tips and StrategiesFrom EverandCut Your Clients Tax Bill: Individual Tax Planning Tips and StrategiesNo ratings yet

- Landbank AccountsDocument17 pagesLandbank AccountscammiecazzieNo ratings yet

- RCA Information Booklet1Document4 pagesRCA Information Booklet1jrladduNo ratings yet

- Procedures Undertaken Before Granting Bank Finance & Banking ServicesDocument24 pagesProcedures Undertaken Before Granting Bank Finance & Banking ServicesNikhil RanjanNo ratings yet

- Presentation - FINANCIAL INSTRUMENTSDocument12 pagesPresentation - FINANCIAL INSTRUMENTSnareshNo ratings yet

- Money Back Guarantee Terms and ConditionsDocument6 pagesMoney Back Guarantee Terms and Conditionsbujie ionNo ratings yet

- FD Terms-and-Conditions 0Document10 pagesFD Terms-and-Conditions 0iamtom101516No ratings yet

- Terms and Conditions For SavingsDocument10 pagesTerms and Conditions For Savingsdevpal78No ratings yet

- Tax On Mutual FundsDocument7 pagesTax On Mutual FundsPramod KumarNo ratings yet

- Terms and Conditions For Citibank Deposit VariantsDocument1 pageTerms and Conditions For Citibank Deposit VariantsAkshay MittalNo ratings yet

- Provisional Tax Saving Fixed Deposit Confirmation AdviceDocument3 pagesProvisional Tax Saving Fixed Deposit Confirmation AdviceKunda MalleshNo ratings yet

- Deductions Under Section 80C For Investments in The Indian It Act 1961Document20 pagesDeductions Under Section 80C For Investments in The Indian It Act 1961saurav-maitra-3114No ratings yet

- Axis Bank Product: Term DepositDocument35 pagesAxis Bank Product: Term DepositSaroj Kumar PandaNo ratings yet

- 1tax Planning For Retirees of IOB 1Document34 pages1tax Planning For Retirees of IOB 1mail2ncNo ratings yet

- Investment Management: Module-1Document28 pagesInvestment Management: Module-1Avin P RNo ratings yet

- What Is Secondary Market?Document25 pagesWhat Is Secondary Market?Gaurav GuptaNo ratings yet

- Session 2Document13 pagesSession 2Jahnvi DubeyNo ratings yet

- Advisorkhoj ICICI Prudential Mutual Fund ArticleDocument6 pagesAdvisorkhoj ICICI Prudential Mutual Fund ArticleBIJAY KRISHNA DASNo ratings yet

- Portfolio Management and Investment Alternatives: Shruti ChavarkarDocument17 pagesPortfolio Management and Investment Alternatives: Shruti ChavarkarShrikant SabatNo ratings yet

- Cumulative Deposit SchemeDocument16 pagesCumulative Deposit SchemearctickingNo ratings yet

- Rbs Business Terms PDFDocument20 pagesRbs Business Terms PDFJejomarie Tatoy0% (1)

- Citibank ChargesDocument11 pagesCitibank ChargesarmppNo ratings yet

- Rbs Business Terms 2021Document20 pagesRbs Business Terms 2021haitoecheNo ratings yet

- Fundior Investment LTD - Special Terms and Conditions 2013-07-25Document2 pagesFundior Investment LTD - Special Terms and Conditions 2013-07-25Anibal MachicaoNo ratings yet

- Stanbic IBTC Bank Product Knowledge Assessment Test Study PackDocument32 pagesStanbic IBTC Bank Product Knowledge Assessment Test Study PackMike TelkNo ratings yet

- Fundamentals of Investment - Unit 1Document55 pagesFundamentals of Investment - Unit 1Abhishek MukherjeeNo ratings yet

- General BankingDocument24 pagesGeneral BankingMD. JAHIDNo ratings yet

- Clubcard Pay Plus Summary BoxDocument1 pageClubcard Pay Plus Summary BoxramiroNo ratings yet

- DTC ProvisionsDocument3 pagesDTC ProvisionsrajdeeppawarNo ratings yet

- NW Business Reserve Info Sheet 190521Document2 pagesNW Business Reserve Info Sheet 190521true.exeNo ratings yet

- Digital Assignment - 3: Submitted To: Submitted byDocument11 pagesDigital Assignment - 3: Submitted To: Submitted byMonashreeNo ratings yet

- About The ExpertDocument7 pagesAbout The ExpertAnurag RanbhorNo ratings yet

- Taxation 12Document13 pagesTaxation 12surajspammsNo ratings yet

- Investment Avenues:: Chapter No.2Document12 pagesInvestment Avenues:: Chapter No.2rajaniNo ratings yet

- OMWealth OldMutualWealthInvestmentVehiclesOverviewDocument5 pagesOMWealth OldMutualWealthInvestmentVehiclesOverviewJohn SmithNo ratings yet

- Help To Buy Isa Key Features PDFDocument4 pagesHelp To Buy Isa Key Features PDFfsdesdsNo ratings yet

- Features of Fixed DepositsDocument4 pagesFeatures of Fixed DepositsBeula Heidy19 071No ratings yet

- (B3) 16. Investing & FinancingDocument21 pages(B3) 16. Investing & FinancingNabiha ChoudaryNo ratings yet

- Financial Services 1Document21 pagesFinancial Services 1JEFFERSON OPSIMANo ratings yet

- RD - Terms and ConditionsDocument9 pagesRD - Terms and ConditionsDhiraj NemadeNo ratings yet

- Signed Terms of AgreementDocument5 pagesSigned Terms of Agreementbro100% (1)

- Deposit Schemes: Savings Plus AccountDocument17 pagesDeposit Schemes: Savings Plus AccountMAnmit SIngh DadraNo ratings yet

- SHCIL Processes The Entire Paperwork Required 1Document22 pagesSHCIL Processes The Entire Paperwork Required 1Pankaj KumarNo ratings yet

- Taxation in Mutual FundsDocument16 pagesTaxation in Mutual Fundsvineetb553No ratings yet

- Taxation in Mutual FundsDocument18 pagesTaxation in Mutual Fundsvineetb553No ratings yet

- Investment Management Unit - Ii Investement AlternativesDocument57 pagesInvestment Management Unit - Ii Investement AlternativesmalavikaNo ratings yet

- Vantage Key FeaturesDocument6 pagesVantage Key FeaturesAlviNo ratings yet

- SAPMDocument45 pagesSAPMswamyNo ratings yet

- Stocks: Tax Free Government BondsDocument4 pagesStocks: Tax Free Government BondsRavi SinghNo ratings yet

- Deposit Confirmation/Renewal AdviceDocument1 pageDeposit Confirmation/Renewal AdviceSudheer KumarNo ratings yet

- Customers' Deposit Accounts: Unit IVDocument26 pagesCustomers' Deposit Accounts: Unit IVShaifaliChauhanNo ratings yet

- Taxation Regulations IndiaDocument6 pagesTaxation Regulations IndiaSiddhant WaliaNo ratings yet

- 12 DTC PresentationDocument19 pages12 DTC PresentationPunit BhandariNo ratings yet

- Topic 7: Traditional Banking ProductsDocument26 pagesTopic 7: Traditional Banking ProductsPremah BalasundramNo ratings yet

- Opening and Operation of Accounts-SBDocument41 pagesOpening and Operation of Accounts-SBnurul000No ratings yet

- Terms and ConditionsDocument4 pagesTerms and ConditionsGmanNo ratings yet

- Credit Card Agreement For Consumer Cards in Capital One Bank (USA), N.ADocument8 pagesCredit Card Agreement For Consumer Cards in Capital One Bank (USA), N.Ajeremywright100% (1)

- Cumulative Deposit SchemeDocument9 pagesCumulative Deposit Schemehisri6350No ratings yet

- Interest IncomeDocument4 pagesInterest Incomenikhil khajuriaNo ratings yet

- Application - Loan Overdraft Against DepositDocument5 pagesApplication - Loan Overdraft Against DepositUday Kiran0% (1)

- Asian University of Bangladesh: Assignment OnDocument17 pagesAsian University of Bangladesh: Assignment OnMahfuzur RahmanNo ratings yet

- The Accounting Cycle and The Double Entry SystemDocument7 pagesThe Accounting Cycle and The Double Entry SystemJhanna Vee DamaleNo ratings yet

- Modigliani, F. and Miller, M.H. (1958) The Cost of Capital, Corporation Finance and The Theory of Investment.Document16 pagesModigliani, F. and Miller, M.H. (1958) The Cost of Capital, Corporation Finance and The Theory of Investment.TrangNo ratings yet

- PDIC LawDocument27 pagesPDIC LawSuzette VillalinoNo ratings yet

- WWW - Edutap.co - In: Forex Markets - Video 1Document51 pagesWWW - Edutap.co - In: Forex Markets - Video 1SaumyaNo ratings yet

- What Is Without Recourse?Document1 pageWhat Is Without Recourse?johngaultNo ratings yet

- Final Exam f02Document13 pagesFinal Exam f02Omar Ahmed ElkhalilNo ratings yet

- Philippine Banking SystemDocument2 pagesPhilippine Banking SystemXytusNo ratings yet

- Interview QuestionsDocument5 pagesInterview QuestionsHappy RanaNo ratings yet

- Department AdminDocument13 pagesDepartment AdminPradeep AdsareNo ratings yet

- Sample-Loan Commitment LetterDocument3 pagesSample-Loan Commitment LetterJustice Williams100% (1)

- The Most Important Determinant of Consumption and Saving Is TheDocument2 pagesThe Most Important Determinant of Consumption and Saving Is Thenirvana123456No ratings yet

- Chapter 6 - Principles Products Services of IFDocument54 pagesChapter 6 - Principles Products Services of IFYaaga DharsiniNo ratings yet

- Partnership FinalDocument4 pagesPartnership FinalJessa Mae Caballero JagnaNo ratings yet

- FDNACCT - Mock Exam - Answer Key - 3 - Fill in The Blank Problems PDFDocument5 pagesFDNACCT - Mock Exam - Answer Key - 3 - Fill in The Blank Problems PDFJames de LeonNo ratings yet

- Capital Markets ProjectDocument54 pagesCapital Markets Projectjaggis1313100% (4)

- Lesson 4 10 Tips For Managing Your Money As A College StudentDocument9 pagesLesson 4 10 Tips For Managing Your Money As A College StudentAndrew BantiloNo ratings yet

- History of EurobondsDocument2 pagesHistory of Eurobondsterigand50% (2)

- Szabo, Nick - Shelling Out The Origins of Money PDFDocument20 pagesSzabo, Nick - Shelling Out The Origins of Money PDFCody MillerNo ratings yet

- Laporan Transaksi Pinjaman: Juwar Niningsih JL Lobak Kel Malawele Kec AimasDocument2 pagesLaporan Transaksi Pinjaman: Juwar Niningsih JL Lobak Kel Malawele Kec AimasARD SORONGNo ratings yet

- SolutionDocument57 pagesSolutionJeremiah NcubeNo ratings yet

- Secretary Certificate TemplateDocument2 pagesSecretary Certificate TemplateChristian John Tomas100% (1)

- Financial Reporting 1St Edition Loftus Test Bank Full Chapter PDFDocument31 pagesFinancial Reporting 1St Edition Loftus Test Bank Full Chapter PDFalicebellamyq3yj100% (12)

- Ch.16 - 14ed Supply Chain Work Cap MGMT - StudentDocument59 pagesCh.16 - 14ed Supply Chain Work Cap MGMT - StudentLinh Ha Nguyen KhanhNo ratings yet

- Ifm - 5Document17 pagesIfm - 5Tường LinhNo ratings yet

- IrrDocument11 pagesIrrnitishNo ratings yet

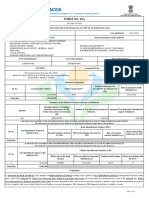

- Form No. 16A: From ToDocument2 pagesForm No. 16A: From ToRichardNoelFernandesNo ratings yet

- 1 Haw Pia V China Banking Corp (Ferrer) PDFDocument4 pages1 Haw Pia V China Banking Corp (Ferrer) PDFMatt LedesmaNo ratings yet

- Credit RiskDocument11 pagesCredit RiskElaine LatonioNo ratings yet