Professional Documents

Culture Documents

Pakistan Cement Disptaches - Sep 2023

Pakistan Cement Disptaches - Sep 2023

Uploaded by

hammad.khan.4440kOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Pakistan Cement Disptaches - Sep 2023

Pakistan Cement Disptaches - Sep 2023

Uploaded by

hammad.khan.4440kCopyright:

Available Formats

PAKISTAN CEMENTS

September 21, 2023

, 22 2021

Sector Call

Cement Dispatches are expected to grow 22

Overweight by 25% YoY in 1QFY24

Chase Research Pakistan's total cement sales for September 2023 are expected to witness a

research@chasesecurities.com

+92-21-35293054-60 slightly drop of -0.1% YoY, reaching an estimated 4.27 million tons. While,

on a cumulative basis, total sales is anticipated to increase by 25% YoY in

1QFY24 to 12 million tons. The growth is driven by the expected recovery in

local demand following by low base effect due to floods and a pickup in

exports.

Local Dispatches

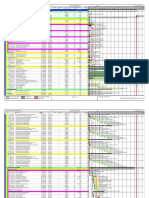

6.0 5.0 Sep Aug Sep 1QFY24 1QFY23 YoY

5.0 ('mn tons) MoM YoY

4.0

3.8 3.9 3.9 3.7 3.6 3.6

3.4 3.4 3.5

3.8 3.6 23E 23A 22A

Mn Tons

2.9 2.8

3.0

1.9

2.5 North Local 2.93 3.09 -5.2% 3.13 -6.5% 8.37 7.25 15.4%

2.0

North Export 0.16 0.16 -4.0% 0.13 24.6% 0.45 0.29 54.7%

1.0

0.0 North Total 3.09 3.25 -5.1% 3.26 -5.2% 8.81 7.54 16.9%

Feb-23

Mar-23

May-23

Jun-22

Jan-23

Jun-23

Jul-22

Aug-22

Sep-22

Oct-22

Nov-22

Dec-22

Apr-23

Jul-23

Aug-23

Sep-23

South Local 0.62 0.70 -11.3% 0.67 -6.3% 1.75 1.34 30.9%

South Export 0.56 0.56 -0.9% 0.35 60.7% 1.43 0.72 97.4%

South Total 1.18 1.27 -6.7% 1.01 16.6% 3.19 2.07 54.2%

Grand Total 4.27 4.52 -5.6% 4.27 -0.1% 12.00 9.61 24.9%

Export Sales

Lower coal prices than last year along with a gradual increase in cement prices

800 725 710

is expected to increase margins going forward and we remain overweight on

700

600 472

533

576 the sector due to its solid cash generation and cheap valuations. Cement

'000 Tons

500 418 450 438 421 436

400

387 362 companies are trading significantly below replacement value and we expect

300 205

200

154 148

valuations to revert to the mean once economic uncertainty reduces. Cement

100

- sector returns in the past have majorly been led by sector pricing discipline

Feb-23

Mar-23

May-23

Jan-23

Jun-23

Jul-22

Aug-22

Oct-22

Nov-22

Dec-22

Sep-22

Apr-23

Jul-23

Aug-23

Sep-23

rather than cement dispatches.

We indicate a promising outlook for the cement industry due to potential

economic recovery and political stability. We believe that cement export from

the south zone could show significant growth in FY24 as lower coal prices

have made companies competitive again.

+92 213 529 3054-60 www.chasesecurities.com research@chasesecurities.com Page 1 of 3

Pakistan Cements

September 21, 2023

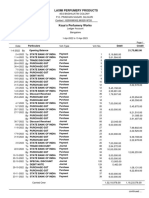

Company wise expected Cement Dispatches

Company Sep’23E Sep’22A YoY Aug’23A MoM 1QFY24 1QFY23 YoY

LUCK 820,670 747,663 9.8% 871,750 -6% 2,294,310 1,600,682 43%

Local 638,625 582,129 9.7% 680,039 -6% 1,810,715 1,278,294 42%

Exports 182,044 165,534 10.0% 191,711 -5% 483,594 322,388 50%

DGKC 453,265 470,946 -3.8% 456,590 -1% 1,204,810 1,099,971 10%

Local 343,413 414,949 -17.2% 361,631 -5% 952,079 906,334 5%

Exports 109,853 55,997 96.2% 94,959 16% 252,732 193,637 31%

MLCF 357,067 359,873 -0.8% 363,274 -2% 1,011,118 861,000 17%

Local 344,218 346,470 -0.6% 345,762 0% 969,803 834,377 16%

Exports 12,849 13,403 -4.1% 17,512 -27% 41,315 26,623 55%

BWCL 629,782 613,242 2.7% 662,555 -5% 1,777,855 1,444,607 23%

Local 622,545 608,541 2.3% 651,771 -4% 1,751,900 1,389,404 26%

Exports 7,237 4,701 53.9% 10,784 -33% 25,955 55,203 -53%

PIOC 215,354 285,741 -24.6% 230,914 -7% 604,922 632,948 -4%

Local 215,354 285,741 -24.6% 230,914 -7% 604,922 632,948 -4%

Exports

CHCC 227,117 291,047 -22.0% 244,929 -7% 687,967 705,826 -3%

Local 193,812 243,697 -20.5% 197,332 -2% 567,990 600,244 -5%

Exports 33,305 47,350 -29.7% 47,597 -30% 119,977 105,582 14%

ACPL 211,554 187,512 12.8% 221,246 -4% 541,577 345,000 57%

Local 113,387 125,945 -10.0% 128,428 -12% 327,040 265,005 23%

Exports 98,167 61,567 59.4% 92,818 6% 214,537 79,995 168%

KOHC 246,154 308,161 -20.1% 286,986 -14% 761,381 685,413 11%

Local 239,695 307,643 -22.1% 281,354 -15% 745,078 684,895 9%

Exports 6,459 518 1146.9% 5,632 15% 16,303 518 3047%

GWLC 101,194 124,339 -18.6% 113,251 -11% 297,070 283,752 5%

Local 101,194 124,339 -18.6% 113,251 -11% 297,070 283,752 5%

Exports -

+92 213 529 3054-60 www.chasesecurities.com research@chasesecurities.com Page 2 of 3

Pakistan Cements

September 21, 2023

Important Disclosures

Disclaimer:

This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under

no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has

been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase

Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time,

Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be

interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have

business relationships, including investment banking relationships with the companies referred to in this report This report is

provided only for the information of professional advisers who are expected to make their own investment decisions without undue

reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising

from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject

to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.

+92 213 529 3054-60 www.chasesecurities.com research@chasesecurities.com Page 3 of 3

You might also like

- 大众汽车2024年战略规划报告Document44 pages大众汽车2024年战略规划报告Gordon FreemanNo ratings yet

- Systematix Indian Cement Industry UpdateDocument255 pagesSystematix Indian Cement Industry UpdateShivam kesarwaniNo ratings yet

- Cement Industry - Galloping Towards GrowthDocument3 pagesCement Industry - Galloping Towards GrowthSandeep SinghNo ratings yet

- Pick of The Week - Steel Strip Wheels LTDDocument3 pagesPick of The Week - Steel Strip Wheels LTDshaubhikmondalNo ratings yet

- 15.05.2023Document38 pages15.05.2023jenniNo ratings yet

- SIG Report - EarningsCall-9M2022-31102022Document8 pagesSIG Report - EarningsCall-9M2022-31102022methaNo ratings yet

- Capt SUBRA ZIA Conference - Post Pandemic ChallengesDocument24 pagesCapt SUBRA ZIA Conference - Post Pandemic ChallengesJohn HoangNo ratings yet

- Turkcell Presentation Q422 ENG VfinalDocument24 pagesTurkcell Presentation Q422 ENG Vfinalmahmoud.te.strategyNo ratings yet

- Michelin-PPT Q3-2023Document71 pagesMichelin-PPT Q3-2023Vishal JoshiNo ratings yet

- Schedule & S-Curve - Rev.01 - Submitted To JKR (Financial S Curve March 2021)Document1 pageSchedule & S-Curve - Rev.01 - Submitted To JKR (Financial S Curve March 2021)Tony JamesNo ratings yet

- Grade A: India Warehousing ReportDocument9 pagesGrade A: India Warehousing ReportParin MaruNo ratings yet

- Investor Presentation: April 2021Document47 pagesInvestor Presentation: April 2021PARAS KAUSHIKKUMAR DAVENo ratings yet

- Daily 01-05-2023Document1 pageDaily 01-05-2023Andi RiyantoNo ratings yet

- Press Release: S, R S, F C U, I DDocument4 pagesPress Release: S, R S, F C U, I DElectra EVNo ratings yet

- File 20240213105413Document1 pageFile 20240213105413xyue53893No ratings yet

- 2 Earningscall 1h2022 06092022 FinalDocument9 pages2 Earningscall 1h2022 06092022 FinalHendy PNo ratings yet

- Sbots Wel-15-March-2024Document8 pagesSbots Wel-15-March-2024shakeelahmedNo ratings yet

- Cash Flow Position As at January 2023Document44 pagesCash Flow Position As at January 2023alNo ratings yet

- DuPont AnalysingDocument2 pagesDuPont AnalysingNiharika GuptaNo ratings yet

- 2021 04 22 Q1 Production EngDocument13 pages2021 04 22 Q1 Production EngChristian RamaculaNo ratings yet

- Cement - 3QFY24 Earnings To Decline by 25%QoQDocument4 pagesCement - 3QFY24 Earnings To Decline by 25%QoQmuhammadghufran1No ratings yet

- O&G Modeling - One Field - v2Document7 pagesO&G Modeling - One Field - v2PabloDasNevesNo ratings yet

- TASCODocument13 pagesTASCOsozodaaaNo ratings yet

- PWC - Pre Budget Briefing Mining June 2023Document15 pagesPWC - Pre Budget Briefing Mining June 2023ivan vivanoNo ratings yet

- 165-Sotrafer Depot Project (51) - 21-09-2021Document1 page165-Sotrafer Depot Project (51) - 21-09-2021Mitendra Kumar ChauhanNo ratings yet

- External Sector Performance - January 2023Document13 pagesExternal Sector Performance - January 2023Adaderana OnlineNo ratings yet

- Building Materials Cost Index Dec'23Document1 pageBuilding Materials Cost Index Dec'23Wafiuddin AdhaNo ratings yet

- Q3 Meeting SMCL HR.Document5 pagesQ3 Meeting SMCL HR.Santosh KumarNo ratings yet

- Laporan FGTM Up3 Bogor 11 Juli 2023Document7 pagesLaporan FGTM Up3 Bogor 11 Juli 2023aditya kevinNo ratings yet

- CCN 1014402Document11 pagesCCN 1014402richard87bNo ratings yet

- Saudi Cement Sector - Cementing The Future - 2023 ReportDocument39 pagesSaudi Cement Sector - Cementing The Future - 2023 Reportkhizar.zubairiNo ratings yet

- Plasticsthefastfacts2023 1Document1 pagePlasticsthefastfacts2023 1manoj pandeyNo ratings yet

- G R InfraprojectDocument1 pageG R Infraprojectyiyefom319No ratings yet

- FGTM 04 Apr 2024Document46 pagesFGTM 04 Apr 2024Reddy PamungkasNo ratings yet

- Rajrappa PPT 16.04.2023Document40 pagesRajrappa PPT 16.04.2023jenniNo ratings yet

- Brazil Industry Report - Civil Construction January - 2024Document19 pagesBrazil Industry Report - Civil Construction January - 2024José Jair Campos ReisNo ratings yet

- Laporan FGTM Up3 Bogor 26 November 2023Document8 pagesLaporan FGTM Up3 Bogor 26 November 2023aditya kevinNo ratings yet

- 通膨是什麼?通膨升息有關係?該怎麼進行通膨投資?|天下雜誌Document1 page通膨是什麼?通膨升息有關係?該怎麼進行通膨投資?|天下雜誌賴峻德No ratings yet

- Mining: Production and Sales (Preliminary) April 2023Document14 pagesMining: Production and Sales (Preliminary) April 2023anastasi mankese mokgobuNo ratings yet

- JK Tyre One Page ProfileDocument1 pageJK Tyre One Page Profilep9688822No ratings yet

- KPMG 2023-24 Bermuda Budget SnapshotDocument1 pageKPMG 2023-24 Bermuda Budget SnapshotAnonymous UpWci5No ratings yet

- BASF Charts Analyst Conference Call Q3-2023Document15 pagesBASF Charts Analyst Conference Call Q3-2023Torres LondonNo ratings yet

- Tamki Revised Ppow (With Agreed Upon Timeline and Mitigations)Document3 pagesTamki Revised Ppow (With Agreed Upon Timeline and Mitigations)oseni momoduNo ratings yet

- Wel 15 April 2024Document8 pagesWel 15 April 2024zurehmanNo ratings yet

- Oil and Gas: NEUTRAL (Maintain)Document12 pagesOil and Gas: NEUTRAL (Maintain)umyatika92No ratings yet

- Makkah Reservoir Progress Report 23-12-2021Document13 pagesMakkah Reservoir Progress Report 23-12-2021Mohammed ShabanNo ratings yet

- Cement: Down But Is It OutDocument7 pagesCement: Down But Is It OutbradburywillsNo ratings yet

- Tgmo Poc t2 - 6202023 Rev1Document1 pageTgmo Poc t2 - 6202023 Rev1TGMO SUT01No ratings yet

- Performance Analysis Performance Analysis: Q3 FY 2020 Q2 FY 2021Document37 pagesPerformance Analysis Performance Analysis: Q3 FY 2020 Q2 FY 2021Mahesh DhalNo ratings yet

- Statistical AppendixDocument6 pagesStatistical AppendixVenus PlanetNo ratings yet

- Wel 16 February 2024Document8 pagesWel 16 February 2024Maryam ShahNo ratings yet

- MEI 202311 eDocument22 pagesMEI 202311 eChathura WickramaNo ratings yet

- 2022-03-DHL ReeferDocument21 pages2022-03-DHL ReeferernieyNo ratings yet

- SBI Securities Pick of The Week Escorts Kubota LTD With 15% UPSIDEDocument3 pagesSBI Securities Pick of The Week Escorts Kubota LTD With 15% UPSIDEmanitjainm21No ratings yet

- Touchpoints Budget2020Document38 pagesTouchpoints Budget2020Elaine YeapNo ratings yet

- CPI Infographics For All Income Households 2018100 February 2023Document1 pageCPI Infographics For All Income Households 2018100 February 2023Theresa Faye De GuzmanNo ratings yet

- Laporan FGTM Up3 Bogor 22 November 2023Document8 pagesLaporan FGTM Up3 Bogor 22 November 2023aditya kevinNo ratings yet

- India Mumbai Office Q1 2023Document2 pagesIndia Mumbai Office Q1 2023jaiat22No ratings yet

- Laporan FGTM Up3 Bogor 20 November 2023Document8 pagesLaporan FGTM Up3 Bogor 20 November 2023aditya kevinNo ratings yet

- MCTF Asset Depreciation 2012Document16 pagesMCTF Asset Depreciation 2012adelNo ratings yet

- Supply Chain Management of KFCDocument29 pagesSupply Chain Management of KFC0825727131340% (5)

- FIN348 - Introduction To Technical Analysis L6Document10 pagesFIN348 - Introduction To Technical Analysis L6saraaqilNo ratings yet

- Contoh Penelitian Akta Grosse Pengakuan HutangDocument26 pagesContoh Penelitian Akta Grosse Pengakuan Hutangjasa biro kitaNo ratings yet

- OOSR000385740Document2 pagesOOSR000385740AL MAYASINo ratings yet

- CHAPTER 1 - Overview of Financial Statement Analysis-1Document14 pagesCHAPTER 1 - Overview of Financial Statement Analysis-1Mohammed HassanNo ratings yet

- Interest Rate SwapsDocument19 pagesInterest Rate SwapsSubodh MayekarNo ratings yet

- FIN 331 2010 Spring Test 2 A Updated 5-14-2010Document8 pagesFIN 331 2010 Spring Test 2 A Updated 5-14-2010lthomas09No ratings yet

- Answer: B: Towson University Department of Finance Fin331 Dr. M. Rhee 2010 Spring Name: ID#Document8 pagesAnswer: B: Towson University Department of Finance Fin331 Dr. M. Rhee 2010 Spring Name: ID#Sheikh Sahil MobinNo ratings yet

- Application Form - Annexure A PDFDocument2 pagesApplication Form - Annexure A PDFSunil KumarNo ratings yet

- Magic Mix Illustration For Mr. Tushar N Patel (Age 27) : Proposed InsuranceDocument7 pagesMagic Mix Illustration For Mr. Tushar N Patel (Age 27) : Proposed Insurancejdchandrapal4980No ratings yet

- Bill DiscountingDocument69 pagesBill DiscountingDhanesh BabarNo ratings yet

- PLDT - Com Fy 2018 Financial StatementsDocument170 pagesPLDT - Com Fy 2018 Financial StatementseveNo ratings yet

- LA County Peoples GuideDocument68 pagesLA County Peoples GuidegreggerlbcaNo ratings yet

- Socio-Economic and Government Impact On BusinessDocument42 pagesSocio-Economic and Government Impact On BusinessaguNo ratings yet

- In Compliance December 2011Document32 pagesIn Compliance December 2011Ian BrumptonNo ratings yet

- Asset SecuritizationDocument2 pagesAsset SecuritizationZameer AbbasiNo ratings yet

- Celisse Cobos Trs ResumeDocument2 pagesCelisse Cobos Trs Resumeapi-301798205No ratings yet

- Ksfe Organisation StudyDocument74 pagesKsfe Organisation Studyrajagopal100% (1)

- An Assessment of The Impact of Covid-19 On Small ADocument9 pagesAn Assessment of The Impact of Covid-19 On Small ACHIZELUNo ratings yet

- Franchise AccountingDocument25 pagesFranchise AccountingKaren Sing Balibalos100% (2)

- Striking OffDocument8 pagesStriking OffNur Amalina MuhamadNo ratings yet

- Case QuestionsDocument9 pagesCase QuestionsFami FamzNo ratings yet

- Attraction of Foreign Investment To Ukraine: Problems and SolutionsDocument8 pagesAttraction of Foreign Investment To Ukraine: Problems and SolutionsHaval A.MamarNo ratings yet

- Superscope, Inc. v. Brookline Corp., Etc., Robert E. Lockwood, 715 F.2d 701, 1st Cir. (1983)Document3 pagesSuperscope, Inc. v. Brookline Corp., Etc., Robert E. Lockwood, 715 F.2d 701, 1st Cir. (1983)Scribd Government DocsNo ratings yet

- Securities and Exchange Board of India (Issue of Capital and Disclosure Requirements) Regulations, 2009Document241 pagesSecurities and Exchange Board of India (Issue of Capital and Disclosure Requirements) Regulations, 2009samlobo31No ratings yet

- Narendra Ochani Final Order 26.04.2022Document10 pagesNarendra Ochani Final Order 26.04.2022SR LegalNo ratings yet

- Koyas PerfumeryDocument2 pagesKoyas PerfumeryTANUJ CHAKRABORTYNo ratings yet

- Islamic Finance Book - 2nd Edition PDFDocument140 pagesIslamic Finance Book - 2nd Edition PDFMhmdNo ratings yet

- PKF - TRU Budget Highlights 2080-81 - FinalDocument11 pagesPKF - TRU Budget Highlights 2080-81 - Finalprojects.shangrilaNo ratings yet