Professional Documents

Culture Documents

Revision QP 2

Uploaded by

Nikitha0 ratings0% found this document useful (0 votes)

14 views4 pagesThe document contains a set of 12 revision questions related to forms of business organizations under the topic "CH-2: FORMS OF BUSINESS ORGANISATIONS". The questions cover topics like different forms of business such as company, partnership, cooperative society etc. and their key features including liability of partners, governance structure etc.

Original Description:

BUSINESS STUDIES IMP QUESTIONS CLASS 11

Original Title

REVISION QP 2 (1)

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document contains a set of 12 revision questions related to forms of business organizations under the topic "CH-2: FORMS OF BUSINESS ORGANISATIONS". The questions cover topics like different forms of business such as company, partnership, cooperative society etc. and their key features including liability of partners, governance structure etc.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

14 views4 pagesRevision QP 2

Uploaded by

NikithaThe document contains a set of 12 revision questions related to forms of business organizations under the topic "CH-2: FORMS OF BUSINESS ORGANISATIONS". The questions cover topics like different forms of business such as company, partnership, cooperative society etc. and their key features including liability of partners, governance structure etc.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 4

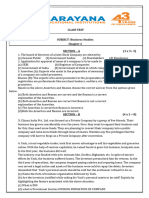

REVISION QUESTIONS

CH-2: FORMS OF BUSINESS ORGANISATIONS

1. The structure in which there is separation of ownership and

management as per law

a) Company

b) All business organisation

c) Partnership

d) Sole proprietorship

2. In which form of business organisation, a minor can also be a

member?

a) Co-operative society

b) Joint stock company

c) Joint Hindu family

d) Partnership

3. Sudhir contributes to the capital and shares the profits and

losses of the firm. But he does not take part in the day to-day

activities of the firm. Identify the type of partner in the above

situation.

a) Active partner

b) Dormant partner

c) Secret partner

d) Partner by holding out

4. The liability of all the co-parceners except the...........is

limited to their share in the business, and consequently their

risk is well-defined and precise.

a) Karta

b) Partners

c) Members

d) Shareholders

5. The members comprise of consumers desirous of obtaining

good quality products at reasonable prices.

a) Consumer’s cooperative societies

b) Producer’s cooperative societies

c) Marketing cooperative societies

d) Farmer’s cooperative societies

6. The company form of organisation is governed by The

Companies Act, ..............

a) 1912 b) 2013 c)1966 d) 1965

7. The members of these societies consist of people who are

desirous of procuring residential accommodation at lower

costs.

(a) Consumer’s cooperative societies

(b) Producer’s cooperative societies

(c) Marketing cooperative societies

(d) Cooperative housing societies

8. It can continue as long as the partners want and is terminated

when any partner gives a notice of withdrawal from

partnership to the firm.

(a) Partnership at will

(b) Particular partnership

(c) General Partnership

(d) Limited Partnership

9. The principle of ‘one man one vote’ governs the cooperative

society.

(a) True (b) False (c) Partly True (d) None of these

10. A company is a creation of law and exists independent of

its members.

(a) Formation

(b) Separate legal entity

(c) Perpetual succession

(d) Artificial person

11. Mr. Sharma was unable to assume the responsibility of all

managerial tasks such as purchasing, selling, financing etc.

Good workers started leaving the organisation. The goodwill

of the business in the market went on declining. In no time,

the liabilities of the business became many times more than

the assets. On account of the pressure exerted on him by the

creditors, Mr. Sharma had to repay the debts of the business

by disposing off his personal properties.

a. Identify the form of business organisation discussed in the

above para.

b. Quoting the relevant lines from the para, explain any two

limitations of the form of business organisation identified in part

(a) of the question.

12. Ramesh’s father gifted him a cricket bat on his birthday.

The cost of the bat was Rs. 800. Few months later, Ramesh

sold it to his friend, Kartik for Rs.850. He was very happy to

earn a profit of Rs. 50. He was boosted by this transaction

and after completing his studies, he formed a partnership

business with his friend Kartik trading in bats and other

sports material under the name M/s Ramesh Traders. Ramesh

and Kartik both act like an agent as well as principal of each

other. Firm soon started earning good profits. Ramesh’s

father suggested that they need to spend some money on

social responsibilities. They then decided to donate free

sports goods to schools which were financially weak.

a. Can the transaction between Ramesh and Kartik be termed as a

business transaction?

b. Can the transactions between M/s Ramesh Traders and other

persons be termed as business transactions? Give reason.

c. State and explain the feature of partnership form of business

mentioned above?

d. Identify the objective of business fulfilled by M/s Rakesh

Traders by donating sports goods.

You might also like

- BST SQPDocument4 pagesBST SQPNidhi TanikellaNo ratings yet

- Chapter 2 Forms of Business OrganizationsDocument2 pagesChapter 2 Forms of Business OrganizationstmoNo ratings yet

- 11 BST CH-2 Forms of B.O.Document3 pages11 BST CH-2 Forms of B.O.Saurabh JainNo ratings yet

- Class XL Business StudiesDocument2 pagesClass XL Business StudiesParv KukrejaNo ratings yet

- Worksheet - Unit 2 - Forms of Business OrganizationsDocument3 pagesWorksheet - Unit 2 - Forms of Business Organizationsfredrick russelNo ratings yet

- BS CTDocument6 pagesBS CTkartik deshwalNo ratings yet

- Delhi Public School, Siliguri.: Periodic Assessment / Unit Tests - I Session: 2021 - 22Document2 pagesDelhi Public School, Siliguri.: Periodic Assessment / Unit Tests - I Session: 2021 - 22UNNATI KUMARINo ratings yet

- Company Law 2017Document3 pagesCompany Law 2017Aarthi SnehaNo ratings yet

- Case Studies Chapter 2 BST 11Document2 pagesCase Studies Chapter 2 BST 11Sachpreet Kaur100% (1)

- GR-11 Summer Break WSDocument4 pagesGR-11 Summer Break WSMay HarukaNo ratings yet

- g11 SLW CH 2 Forms of Business OrgDocument5 pagesg11 SLW CH 2 Forms of Business OrgShreya KhannaNo ratings yet

- Law BCR Q MTP CAF Mar 2021Document7 pagesLaw BCR Q MTP CAF Mar 2021Antrew B2No ratings yet

- Class 11 Business StudiesDocument5 pagesClass 11 Business StudiesPriyank TiwariNo ratings yet

- Indian Partnership Act - Paper 50 MarksDocument2 pagesIndian Partnership Act - Paper 50 Markstherealbeetch99No ratings yet

- CA Foundation Law BCR Q MTP 2 June 2023Document7 pagesCA Foundation Law BCR Q MTP 2 June 2023Nirav MurarkaNo ratings yet

- SBILLDocument5 pagesSBILLSrishti 2k22No ratings yet

- Business StudiesDocument6 pagesBusiness StudiesdebangeesahooNo ratings yet

- Xi BSTDocument15 pagesXi BSTShubham Gupta100% (1)

- Important Questions For BST Class 11Document16 pagesImportant Questions For BST Class 11Yash DawaniNo ratings yet

- Joint Stock CompanyDocument22 pagesJoint Stock CompanyPratyush MishraNo ratings yet

- BST Worksheet Class 11Document26 pagesBST Worksheet Class 11btsqueen62No ratings yet

- 11 BST Formsofbusinessorganisation tp01Document6 pages11 BST Formsofbusinessorganisation tp01RajatNo ratings yet

- I'd Rather Be Honest Than Impressive.": Bala Vidya Mandir SR - Sec.SchoolDocument3 pagesI'd Rather Be Honest Than Impressive.": Bala Vidya Mandir SR - Sec.Schooladiti suryanarayananNo ratings yet

- 11 Business Studies23 24sp01Document6 pages11 Business Studies23 24sp01niteshnotessinghNo ratings yet

- Case Laws On Company LawDocument5 pagesCase Laws On Company LawPriyanka Dargad0% (1)

- Chapter - 2 Forms of Business Organisation: One Line QuestionsDocument2 pagesChapter - 2 Forms of Business Organisation: One Line QuestionstanishaNo ratings yet

- Assignment 1573Document41 pagesAssignment 1573black horseNo ratings yet

- Test Series: March 2021 Mock Test Paper 1 Foundation Course Paper 2: Business Laws and Business Correspondence and Reporting Section A: Business LawsDocument7 pagesTest Series: March 2021 Mock Test Paper 1 Foundation Course Paper 2: Business Laws and Business Correspondence and Reporting Section A: Business LawsSanjai RNo ratings yet

- Test Series: October, 2019 Mock Test Paper 1 Paper 2A: Business LawsDocument7 pagesTest Series: October, 2019 Mock Test Paper 1 Paper 2A: Business Lawspavan kumarNo ratings yet

- Test 5 Full Test Law BCRDocument11 pagesTest 5 Full Test Law BCRPuru GuptaNo ratings yet

- Corporate LawDocument2 pagesCorporate LawJay PatelNo ratings yet

- CH 2 AssignmentDocument1 pageCH 2 AssignmentSachpreet KaurNo ratings yet

- 2019 Batch 2021m CompanyDocument1 page2019 Batch 2021m Companyuday kumarNo ratings yet

- Paper - Timing - Important:-: CA Foundation Business Law - FCA Slot - 60 MARK'S 1.5 Hour'sDocument3 pagesPaper - Timing - Important:-: CA Foundation Business Law - FCA Slot - 60 MARK'S 1.5 Hour'sSohan AgrawalNo ratings yet

- Grade 11 Business Practice PaperDocument16 pagesGrade 11 Business Practice PaperPurva JaniNo ratings yet

- 1.Ch 2. Company LawDocument5 pages1.Ch 2. Company LawDiana CiobanuNo ratings yet

- 11 Business Studies23 24sp01Document12 pages11 Business Studies23 24sp01Tech with Tesu100% (1)

- ET 2021 Answers To LAB End TermDocument46 pagesET 2021 Answers To LAB End Termnikhil chaudharyNo ratings yet

- Business - Studies CH 2Document2 pagesBusiness - Studies CH 2Aashi GuptaNo ratings yet

- Chap 2 BST RevisionDocument1 pageChap 2 BST RevisionAbhradeep GhoshNo ratings yet

- Business Studies Monday Test 2021-22Document4 pagesBusiness Studies Monday Test 2021-22Parth AroraNo ratings yet

- Half Yearly Xi BSTDocument4 pagesHalf Yearly Xi BSTJahnavi GoelNo ratings yet

- Test Series: May, 2023 Mock Test Paper 2 Foundation Course Paper 2: Business Laws and Business Correspondence and Reporting Section A: Business LawsDocument7 pagesTest Series: May, 2023 Mock Test Paper 2 Foundation Course Paper 2: Business Laws and Business Correspondence and Reporting Section A: Business LawssaranshNo ratings yet

- Silence Is The Best Answer of All Stupid Questions: Smile Is The Best Reaction in All Critical SituationDocument1 pageSilence Is The Best Answer of All Stupid Questions: Smile Is The Best Reaction in All Critical SituationNaseem AkhtarNo ratings yet

- Business and Company Law Question 2017 MarchDocument5 pagesBusiness and Company Law Question 2017 MarchSukhdeep KaurNo ratings yet

- Mid Term 2022 Company LawDocument4 pagesMid Term 2022 Company Lawpradeep ranaNo ratings yet

- 11 BSTDocument4 pages11 BSTMayank KumarNo ratings yet

- Presentation SimonDocument19 pagesPresentation Simonchakisimon5No ratings yet

- Aa 1Document14 pagesAa 1Rajalakshmi PugazhendhiNo ratings yet

- Manava Bharati International School, Patna - Final Exam Question Paper LeakedDocument8 pagesManava Bharati International School, Patna - Final Exam Question Paper Leakedsomyasinha246No ratings yet

- GM Test Series: Top 50 QuestionsDocument46 pagesGM Test Series: Top 50 QuestionsShruti JhaNo ratings yet

- TCS InterviewDocument122 pagesTCS InterviewJay rayNo ratings yet

- Business Studies PaperDocument3 pagesBusiness Studies PaperRajat GandhiNo ratings yet

- BLaw Quiz#1 FinalsDocument3 pagesBLaw Quiz#1 FinalsCmNo ratings yet

- (2)Document8 pages(2)Shubham PadolNo ratings yet

- Class 11 Business Studies - Chapter 2Document9 pagesClass 11 Business Studies - Chapter 2Srk LegendNo ratings yet

- Multiple Choice QuestionsDocument12 pagesMultiple Choice QuestionsParthNo ratings yet

- Law - T9 PartnershipDocument3 pagesLaw - T9 Partnership包子No ratings yet

- Business StudiesDocument8 pagesBusiness StudiesSonali Chaudhuri 17100% (1)

- LLC: A Complete Guide To Limited Liability Companies And Setting Up Your Own LLCFrom EverandLLC: A Complete Guide To Limited Liability Companies And Setting Up Your Own LLCNo ratings yet

- Hiperfet Power Mosfets Isoplus247 Ixfr 70N15: (Electrically Isolated Backside)Document3 pagesHiperfet Power Mosfets Isoplus247 Ixfr 70N15: (Electrically Isolated Backside)William moreNo ratings yet

- E Commerce WikipediaDocument20 pagesE Commerce WikipediaUmer AhmedNo ratings yet

- Art of Not Caring, StocismDocument2 pagesArt of Not Caring, Stocismbhargavi mishraNo ratings yet

- Case No. 128 Dacasin vs. DacasinDocument1 pageCase No. 128 Dacasin vs. DacasinCA CarilloNo ratings yet

- 1 LCCB Student Senate Virtual Meeting: Minutes of The MeetingDocument7 pages1 LCCB Student Senate Virtual Meeting: Minutes of The MeetingLak YaNo ratings yet

- QnA Cause and EffectDocument8 pagesQnA Cause and EffectWinda Kurnia FitrianiNo ratings yet

- Providing Post Advice and Post Services To Hilot ClientsDocument15 pagesProviding Post Advice and Post Services To Hilot Clientsjazzy mallariNo ratings yet

- IMBR 25 May 2011 Cost Benefit Analysis of Procurement Systems1Document13 pagesIMBR 25 May 2011 Cost Benefit Analysis of Procurement Systems1Prashanth ShettyNo ratings yet

- MTRCB V. Abs-Cbn G.R. No. 155282 January 17, 2005: Pictures As Herein Defined "Document1 pageMTRCB V. Abs-Cbn G.R. No. 155282 January 17, 2005: Pictures As Herein Defined "Anonymous bOncqbp8yiNo ratings yet

- 4100.05.A. Overview of Partnership RulesDocument11 pages4100.05.A. Overview of Partnership Rulesgerarde moretNo ratings yet

- Chapter3 - 2Document54 pagesChapter3 - 2Hafzal Gani67% (3)

- Research Approach: Deductive Research Approach Inductive Research Approach Abductive Research ApproachDocument10 pagesResearch Approach: Deductive Research Approach Inductive Research Approach Abductive Research ApproachupenderNo ratings yet

- Spear 4Document4 pagesSpear 4Sweet Joanne Morilla CapiloyanNo ratings yet

- MS Word 2016 Using Find and ReplaceDocument5 pagesMS Word 2016 Using Find and ReplaceMerlita TuralbaNo ratings yet

- Aurobindo Pharma Receives USFDA Approval For Celecoxib Capsules (Company Update)Document1 pageAurobindo Pharma Receives USFDA Approval For Celecoxib Capsules (Company Update)Shyam SunderNo ratings yet

- Leverage Analysis: (Jindal Steel & Power LTD) (SAIL)Document15 pagesLeverage Analysis: (Jindal Steel & Power LTD) (SAIL)Shaurya SingruNo ratings yet

- Control Structures in PythonDocument24 pagesControl Structures in PythonBkNo ratings yet

- Leadership 1ADocument20 pagesLeadership 1ASony GuptaNo ratings yet

- "Non Omnis Moriar" Is Improper, Unsuitable, and UnbefittingDocument12 pages"Non Omnis Moriar" Is Improper, Unsuitable, and UnbefittingEdwin BaelNo ratings yet

- Perdev - Module 9Document9 pagesPerdev - Module 9April Rose CortesNo ratings yet

- Chapter 5CALCDocument17 pagesChapter 5CALCMj ReyesNo ratings yet

- Comp ReDocument8 pagesComp RervanguardiaNo ratings yet

- Eap 5 Assignment Cover Sheet: ClassDocument8 pagesEap 5 Assignment Cover Sheet: ClassThu MinhNo ratings yet

- SAC Review: Omic' Technologies: Genomics, Transcriptomics, Proteomics and MetabolomicsDocument7 pagesSAC Review: Omic' Technologies: Genomics, Transcriptomics, Proteomics and MetabolomicsandreaNo ratings yet

- Assessing The Impact of Occupational Health and Safety Practice On The Lives of Construction Workers.A Case Study of Consa LimitedDocument8 pagesAssessing The Impact of Occupational Health and Safety Practice On The Lives of Construction Workers.A Case Study of Consa LimitedrookieNo ratings yet

- Buku Saku Icd 9, RSGM Unair-1Document21 pagesBuku Saku Icd 9, RSGM Unair-1riris roselinaNo ratings yet

- Lingering at The Threshold Between Word and Image - TateDocument17 pagesLingering at The Threshold Between Word and Image - TateElizaveta NoskovaNo ratings yet

- Hydraulic Design of Stepped SpillwaysDocument12 pagesHydraulic Design of Stepped SpillwaysCristian Hadad100% (1)

- Sansad Adarsh Gram YojanaDocument40 pagesSansad Adarsh Gram YojanaJagan RathodNo ratings yet

- Klocek v. GatewayDocument5 pagesKlocek v. GatewayAres Victor S. AguilarNo ratings yet