Professional Documents

Culture Documents

Statement of Accounts - 204117822

Uploaded by

ANAND PRAKASH OJHAOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Statement of Accounts - 204117822

Uploaded by

ANAND PRAKASH OJHACopyright:

Available Formats

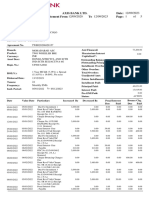

ACCOUNT STATEMENT HOME

Generated Electronically as on 06 October, 2023

ANAND PRAKASH OJHA

S.no 55 Cts No 1655/1, B Wing , Flat No 202, Leena,

Heritage, Khopoli,

Raigad - 410203

883-044-6292

anandojha0@gmail.com

Summary of Loan Account

A/C No Products EMI Amount Remaining EMI(s) Principal Outstanding EMI(s) Overdue Charges Overdue

103245007 Personal Loan 2,987 16 43,210 0 0

* To know principal outstanding for loan against property / home loans please get in touch with our customer service please call 1860-258-2000

Please note that a charge of Rs 400 will be levied against your account in case of EMI bouncing due to insufficient balance. Please maintain sufficient

balance in your account by 1st of every month to avoid EMI Bounce charges. A second attempt to recover EMI will be made 2-3 working days after the first

presentation of every month. If sufficient balance is not maintained by this second attempt, a further bounce charge of Rs 400 will be levied. Please also

note that non-payment of EMI within the calendar month will result in a penal charge of 2% of the unpaid EMI or Rs 300 whichever is higher. For any

clarifications of charges applicable to your account, consult our schedule of charges.

All charges mentioned in the statement are exclusive of GST. GST will be charged as per the applicable rules and regulations.

DISCLAIMER: This is a system generated Account Statement and does not require signature. In case of any discrepancy in this Account Statement, please

call 1860-258-2000 or visit nearest IDFC FIRST Bank branch within 10 (TEN) days from the date of last entry made in this statement, failing which, this

Account Statement will be deemed to be accepted by you (the borrower).

Visit us at Call us on Download our app

www.idfcfirstbank.com 1860-258-2000

PERSONAL LOAN HOME

LOAN EMI PAYMENTS & CHARGES

A/C No 103245007 EMI Amount ` 2,987.00 Last Payment Date 02 October 2023

Loan Amount ` 61,608.00 EMI Start Month March 2023 Last Payment Amount ` 2,987.00

Net Tenure 24 Months EMI End Month February 2025 Payment Mode Others

Gross Tenure 24 Months EMI Due On 02 of every month EMI Overdue ` 0.00

Status Active Remaining EMI(s) 16 Bounce Charges Overdue ` 0.00

Disbursed Date 20 Jan, 2023 Penalty Charges Overdue ` 0.00

Other charges ` 0.00

Unadjusted Payments ` 0.00

Pay

Transaction Details

March 2023

Date Particular Remark Debit Credit

02-03-2023 Due For Instalment 1 - 2,987.00 0.00

02-03-2023 Payment Received Cheque No.:0DG610ELJYNE Receipt No.---- CRED_PROD_3864758_37724608 0.00 2,987.00

April 2023

Date Particular Remark Debit Credit

02-04-2023 Due For Instalment 2 - 2,987.00 0.00

02-04-2023 Payment Received Cheque No.:DX6YNQ2L16W8 Receipt No.---- CRED_PROD_3864758_37724608 0.00 2,987.00

May 2023

Date Particular Remark Debit Credit

02-05-2023 Due For Instalment 3 - 2,987.00 0.00

02-05-2023 Payment Received Cheque No.:52Q8196D3918 Receipt No.---- CRED_PROD_3864758_37724608 0.00 2,987.00

June 2023

Date Particular Remark Debit Credit

02-06-2023 Due For Instalment 4 - 2,987.00 0.00

02-06-2023 Payment Received Cheque No.:Y9YP868D645N Receipt No.---- CRED_PROD_3864758_37724608 0.00 2,987.00

Visit us at Call us on Download our app

www.idfcfirstbank.com 1860-258-2000

PERSONAL LOAN HOME

Transaction Details

July 2023

Date Particular Remark Debit Credit

02-07-2023 Due For Instalment 5 - 2,987.00 0.00

02-07-2023 Payment Received Cheque No.:NJD8NPPYXX Receipt No.---- CRED_PROD_3864758_37724608 0.00 2,987.00

August 2023

Date Particular Remark Debit Credit

02-08-2023 Due For Instalment 6 - 2,987.00 0.00

02-08-2023 Payment Received Cheque No.:89WZVQ2R1L3 Receipt No.---- CRED_PROD_3864758_37724608 0.00 2,987.00

September 2023

Date Particular Remark Debit Credit

02-09-2023 Due For Instalment 7 - 2,987.00 0.00

02-09-2023 Payment Received Cheque No.:WEDW4DGE818 Receipt No.---- CRED_PROD_3864758_37724608 0.00 2,987.00

October 2023

Date Particular Remark Debit Credit

02-10-2023 Due For Instalment 8 - 2,987.00 0.00

02-10-2023 Payment Received Cheque No.:LYGDRZZPLLE Receipt No.---- CRED_PROD_3864758_37724608 0.00 2,987.00

Visit us at Call us on Download our app

www.idfcfirstbank.com 1860-258-2000

ACCOUNT STATEMENT HOME

Generated Electronically as on 06 October, 2023

Products/Type of charges Personal Loan

EMI Bounce charges per presentation* 400

Late payment/Penal charges/ Default interest/Overdue (per month) 2% of the unpaid EMI or Rs 300 whichever is higher

Cheque Swap charges (per swap)* 500

10000 within 30 days of disbursement or 1st EMI presentation whichever is

Cancellation & Rebooking charges earlier. Post 30 days or 1st EMI presentation request for cancellation will be

treated as foreclosure

Foreclosure / Prepayment charges* 5% of principle outstanding amount

Loan re scheduling charges (per re scheduling) NA

Duplicate No Objection Certificate Issuance Charges* 500

Physical Repayment Schedule * 500

Physical Statement of Account* 500

Document retrieval charges (per retrieval)* 500

Stamping Charges As per actuals

Processing fees Up to 3.5% of the total loan amount

List of Documents NA

Part Payment charges Part Payment is not allowed

Initial Money Deposit/ Application Fees (Non-refundable) NA

EBC Replacement Fee (if EBC Applicable)

Easy Buy Card Replacement Fee (If Easy Buy Card Applicable)

EBC & Push Card fee(if applicable)

EMI Pickup/ Collection Charges* 350

Admin Charges (If Applicable)

Pre EMI

* To know principal outstanding for loan against property / home loans please get in touch with our customer service please call 1860-258-2000

Please note that a charge of Rs 400 will be levied against your account in case of EMI bouncing due to insufficient balance. Please maintain sufficient

balance in your account by 1st of every month to avoid EMI Bounce charges. A second attempt to recover EMI will be made 2-3 working days after the first

presentation of every month. If sufficient balance is not maintained by this second attempt, a further bounce charge of Rs 400 will be levied. Please also

note that non-payment of EMI within the calendar month will result in a penal charge of 2% of the unpaid EMI or Rs 300 whichever is higher. For any

clarifications of charges applicable to your account, consult our schedule of charges.

All charges mentioned in the statement are exclusive of GST. GST will be charged as per the applicable rules and regulations.

DISCLAIMER: This is a system generated Account Statement and does not require signature. In case of any discrepancy in this Account Statement, please

call 1860-258-2000 or visit nearest IDFC FIRST Bank branch within 10 (TEN) days from the date of last entry made in this statement, failing which, this

Account Statement will be deemed to be accepted by you (the borrower).

Visit us at Call us on Download our app

www.idfcfirstbank.com 1860-258-2000

ACCOUNT STATEMENT HOME

Generated Electronically as on 06 October, 2023

Products/Type of charges Personal Loan

Security Post Dated Cheque Waiver

Legal/Collections/ Repossession & Incidental Charges

PDD charges

Valuation Charges (If applicable)

Admin Fee (if applicable)

Other Charges (if applicable)

Valuation Charges (Used Tractor)

*Charges above are exclusive of GST

* To know principal outstanding for loan against property / home loans please get in touch with our customer service please call 1860-258-2000

Please note that a charge of Rs 400 will be levied against your account in case of EMI bouncing due to insufficient balance. Please maintain sufficient

balance in your account by 1st of every month to avoid EMI Bounce charges. A second attempt to recover EMI will be made 2-3 working days after the first

presentation of every month. If sufficient balance is not maintained by this second attempt, a further bounce charge of Rs 400 will be levied. Please also

note that non-payment of EMI within the calendar month will result in a penal charge of 2% of the unpaid EMI or Rs 300 whichever is higher. For any

clarifications of charges applicable to your account, consult our schedule of charges.

All charges mentioned in the statement are exclusive of GST. GST will be charged as per the applicable rules and regulations.

DISCLAIMER: This is a system generated Account Statement and does not require signature. In case of any discrepancy in this Account Statement, please

call 1860-258-2000 or visit nearest IDFC FIRST Bank branch within 10 (TEN) days from the date of last entry made in this statement, failing which, this

Account Statement will be deemed to be accepted by you (the borrower).

Visit us at Call us on Download our app

www.idfcfirstbank.com 1860-258-2000

You might also like

- Insurance Practice TestDocument12 pagesInsurance Practice TestkatchmeifyoucannotNo ratings yet

- How To Earn Money OnlineDocument4 pagesHow To Earn Money OnlineAamir IqbalNo ratings yet

- Your USABOX Address: Miami FL 33166-2626Document1 pageYour USABOX Address: Miami FL 33166-2626Maria Cecília PodestáNo ratings yet

- Sujata Dinesh Rathod: Account StatementDocument10 pagesSujata Dinesh Rathod: Account StatementVinitha RathodNo ratings yet

- EFU Life InsuranceDocument14 pagesEFU Life InsuranceAwais ImranNo ratings yet

- Screenshot 2024-03-12 at 5.28.33 PMDocument8 pagesScreenshot 2024-03-12 at 5.28.33 PMchiraggajjar242No ratings yet

- Statement of Accounts - 183307329Document6 pagesStatement of Accounts - 183307329Sathish KumarNo ratings yet

- Statement of Accounts - 144250953Document5 pagesStatement of Accounts - 144250953Sullapanchagrah Hiremath Panchagrah HiremethNo ratings yet

- Statement of Account - 075422904Document6 pagesStatement of Account - 075422904amitrdeshmukh98No ratings yet

- Statement of Account - 141927264Document5 pagesStatement of Account - 141927264Raghavendar JonnojuNo ratings yet

- Statement of Account - 95570252 - 121137539Document6 pagesStatement of Account - 95570252 - 121137539Lasterborn KhongsitNo ratings yet

- Statement of Accounts - 200212680Document6 pagesStatement of Accounts - 200212680DheerajNo ratings yet

- Statement of Accounts - 212555530Document7 pagesStatement of Accounts - 212555530meet12mrurNo ratings yet

- Statement of Account - 231248388Document3 pagesStatement of Account - 231248388Sandeepkumar SharmaNo ratings yet

- Statement of Accounts - 081410597Document4 pagesStatement of Accounts - 081410597swapna vijayNo ratings yet

- Statement of Accounts - 125847848Document7 pagesStatement of Accounts - 125847848hariyaharendraentertainmentNo ratings yet

- Statement of Accounts - 190259080Document3 pagesStatement of Accounts - 190259080swapna vijayNo ratings yet

- Statement of Account - 085515993Document3 pagesStatement of Account - 085515993mohammadzarifchouhanNo ratings yet

- Statement of Account - 125800090 - 72451411Document4 pagesStatement of Account - 125800090 - 72451411Mallepally ChakravardhanNo ratings yet

- Naaa Yokka SlokaDocument9 pagesNaaa Yokka SlokaSiddharthaNo ratings yet

- Pooja Jaiswal: Account StatementDocument10 pagesPooja Jaiswal: Account StatementnosNo ratings yet

- There Are No Active Loans Available For The Customer.: Suman KumarDocument7 pagesThere Are No Active Loans Available For The Customer.: Suman KumarRokoxNo ratings yet

- Statement of Accounts - 180201062Document5 pagesStatement of Accounts - 180201062Wesley RajaNo ratings yet

- Statement of Accounts - 175139622Document6 pagesStatement of Accounts - 175139622subbiahsubashaudiosNo ratings yet

- Statement of Accounts - 151903563Document5 pagesStatement of Accounts - 151903563Yuvraj Singh 2》No ratings yet

- Statement of Accounts - 203314731Document17 pagesStatement of Accounts - 203314731Realm PhangchoNo ratings yet

- Statement of Account - 090525792Document6 pagesStatement of Account - 090525792edupulapatisiri26No ratings yet

- Statement of Accounts - 190626766Document4 pagesStatement of Accounts - 190626766sanjeet.2707No ratings yet

- Statement of Accounts - 122439734Document5 pagesStatement of Accounts - 122439734Ashwin MNo ratings yet

- Maddi Abhilash: Account StatementDocument6 pagesMaddi Abhilash: Account StatementAbhi0% (1)

- Statement of Accounts - 185458139Document5 pagesStatement of Accounts - 185458139royalmailbox20No ratings yet

- Statement of Accounts - 150759369Document4 pagesStatement of Accounts - 150759369anandbasista018No ratings yet

- Statement of Account - 79072589 - 221211314Document6 pagesStatement of Account - 79072589 - 221211314ishitasharma1793No ratings yet

- Dinesh Kumar: Account StatementDocument5 pagesDinesh Kumar: Account Statementdineshjangir310No ratings yet

- Statement of Accounts - 102830437Document5 pagesStatement of Accounts - 102830437Tabe alamNo ratings yet

- Purnachandra Samal: Account StatementDocument6 pagesPurnachandra Samal: Account StatementManika JenaNo ratings yet

- IDFCDocument11 pagesIDFCÂkãśh Kűmăř ŠìńğhNo ratings yet

- Statement of Account - 155736387Document5 pagesStatement of Account - 155736387saquibhotkhanNo ratings yet

- Statement of Accounts - 183507327Document8 pagesStatement of Accounts - 183507327Diwakar SinghNo ratings yet

- Statement of Accounts - 201132679Document5 pagesStatement of Accounts - 201132679RAMSWROOP PRAJAPATNo ratings yet

- Sagar R: Account StatementDocument6 pagesSagar R: Account Statementsagar R RaoNo ratings yet

- Idfc Loan StatmentDocument13 pagesIdfc Loan StatmentAarti ParmarNo ratings yet

- Geeta Rakesh: Account StatementDocument7 pagesGeeta Rakesh: Account StatementHarsh KardamNo ratings yet

- Statement of Accounts - 184545858Document5 pagesStatement of Accounts - 184545858DEEPAK KUMAR NANDANo ratings yet

- Geeta Rakesh: Account StatementDocument7 pagesGeeta Rakesh: Account StatementHarsh KardamNo ratings yet

- There Are No Active Loans Available For The Customer.: Pss KiranDocument6 pagesThere Are No Active Loans Available For The Customer.: Pss KiranPss KiranNo ratings yet

- Geeta Rakesh: Account StatementDocument7 pagesGeeta Rakesh: Account StatementHarsh KardamNo ratings yet

- Geeta Rakesh: Account StatementDocument6 pagesGeeta Rakesh: Account StatementHarsh KardamNo ratings yet

- Statement of Accounts - 205239502Document8 pagesStatement of Accounts - 205239502karthick mNo ratings yet

- Geeta Rakesh: Account StatementDocument6 pagesGeeta Rakesh: Account StatementHarsh KardamNo ratings yet

- Parthasarathy K: Account StatementDocument4 pagesParthasarathy K: Account Statementsarathy psNo ratings yet

- Dharmendra Singh: Account StatementDocument8 pagesDharmendra Singh: Account StatementAnand RajNo ratings yet

- MD Azhar Badruddin: Account StatementDocument6 pagesMD Azhar Badruddin: Account StatementMD AZHARNo ratings yet

- Statement of Account - 124227634Document5 pagesStatement of Account - 124227634devendra4200.dkNo ratings yet

- Statement of Account - 42137507 - 046191Document9 pagesStatement of Account - 42137507 - 046191menuprasath09No ratings yet

- Chithra Baskar: Account StatementDocument8 pagesChithra Baskar: Account StatementSarath KumarNo ratings yet

- Statement of Accounts - 200547220Document7 pagesStatement of Accounts - 200547220Karan JangidNo ratings yet

- TWR028206828157 - Soa MDocument5 pagesTWR028206828157 - Soa Madimaygupta1123No ratings yet

- Statement of Account - 42061647 - 101023336Document6 pagesStatement of Account - 42061647 - 101023336RksksNo ratings yet

- Akshay Sanjay Shinde: Account StatementDocument7 pagesAkshay Sanjay Shinde: Account Statementrajprajapati467No ratings yet

- Fayyaz Yaqubali Nathani: Account StatementDocument6 pagesFayyaz Yaqubali Nathani: Account StatementVishal SheteNo ratings yet

- Statement of Accounts - 145944925Document9 pagesStatement of Accounts - 145944925Rmillionsque FinserveNo ratings yet

- Chithra Baskar: Account StatementDocument6 pagesChithra Baskar: Account StatementSarath KumarNo ratings yet

- Fee ChallanDocument1 pageFee ChallanM abubakar AbubakarNo ratings yet

- Trade Certification Level I ALLDocument8 pagesTrade Certification Level I ALLRAHUL BISHWAS100% (1)

- Digital SignatureDocument31 pagesDigital SignatureVipin KumarNo ratings yet

- Electronic Banking Is An Umbrella Term For The Process by Which A CustomerDocument7 pagesElectronic Banking Is An Umbrella Term For The Process by Which A CustomerBhagwati ChaudharyNo ratings yet

- Flipkart - Graplling With Product ReturnsDocument13 pagesFlipkart - Graplling With Product ReturnsAbhilash C VNo ratings yet

- Just-In-time Manufacturing - Wikipedia, The Free EncyclopediaDocument6 pagesJust-In-time Manufacturing - Wikipedia, The Free Encyclopediasyafiq badrishahNo ratings yet

- Cygnus 850: 2-Wire G.SHDSL Modem FamilyDocument2 pagesCygnus 850: 2-Wire G.SHDSL Modem FamilyPradeep Kumar YadavNo ratings yet

- How To Start Telecommunication Business in Nigeria (Updated)Document6 pagesHow To Start Telecommunication Business in Nigeria (Updated)Digital AmeerNo ratings yet

- Customer Churn DataDocument1,006 pagesCustomer Churn DataIshitaNo ratings yet

- Chapter# 5 Distribution ChannelsDocument28 pagesChapter# 5 Distribution Channelssayed mujeeb HashimiNo ratings yet

- Expense StatementDocument3 pagesExpense StatementSwapnil SatheNo ratings yet

- Api H2HDocument5 pagesApi H2HShree GuptaNo ratings yet

- Vikas 2016Document259 pagesVikas 2016chetankumarmrbt01No ratings yet

- Presentation On "Insurance Sector": Submitted By: Faraz Shaikh Roll No: 9 Mba MarketingDocument16 pagesPresentation On "Insurance Sector": Submitted By: Faraz Shaikh Roll No: 9 Mba MarketingFakhruddin DholkawalaNo ratings yet

- Unit 4 Personal AccountsDocument12 pagesUnit 4 Personal Accountsprisca pebriyaniNo ratings yet

- MLLNDocument10 pagesMLLNdharanmurali3881No ratings yet

- Visa-Payment-Method DERIVDocument1 pageVisa-Payment-Method DERIVKennedy Kenzo Ken ObochelengNo ratings yet

- Po LSS004813Document2 pagesPo LSS004813Rossmary SalasNo ratings yet

- Latisha Kelly Resume AssignmentDocument3 pagesLatisha Kelly Resume Assignmentapi-324927307No ratings yet

- Flowchart RevenueDocument45 pagesFlowchart RevenueRezki PerdanaNo ratings yet

- Can 1334Document2 pagesCan 1334hamzaNo ratings yet

- Pledging of ReceivablesDocument2 pagesPledging of ReceivablesPrince Alexis GarciaNo ratings yet

- Ajeevan Sampatti Benefit IllustrationDocument5 pagesAjeevan Sampatti Benefit IllustrationSurya GudipatiNo ratings yet

- PatientList 201 226Document26 pagesPatientList 201 226numair481No ratings yet

- Microsoft Dynamics 365 Business Central ERP Partner VancouverDocument7 pagesMicrosoft Dynamics 365 Business Central ERP Partner VancouverLiam ThomasNo ratings yet

- 5th Semester Fee Challan 1Document1 page5th Semester Fee Challan 1Ali HassanNo ratings yet