Professional Documents

Culture Documents

M.sc. in Actuarial Science and Quantitative Finance

Uploaded by

Sahil ShethOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

M.sc. in Actuarial Science and Quantitative Finance

Uploaded by

Sahil ShethCopyright:

Available Formats

Master's in

Actuarial Science

University of Mumbai Degree

M.Sc. (Actuarial Science) , 2 Years Full-time

Learn

Portfolio

Risk Management &

Modelling Business Valuation

Data Science using

Actuarial Pricing

R, Python, VBA and

and Reserving

more

+91 9372777615 | actuarialscience@patkarvardecollege.edu.in

What does an Actuary do?

In a Life/Non-Life/Reinsurance In a Consultancy Firm

Product Development Advise Clients

Pricing Valuation Design Pension plans and Compensation

Regulatory Reporting Risk and Cost Analysis

In Insurance Regulatory In a Financial Institution

Review Laws and Regulations Risk Consulting

Survillence Equity Research

Portfolio and Investment Management

Actuaries in Various Fields

+91 9372777615 | actuarialscience@patkarvardecollege.edu.in

IAQS

The 2-Year, Full Time, M.Sc. (Actuarial Science) degree program is offered by Patkar-Varde college

(accredited with A+ Level at NAAC) - the University of Mumbai in association with the Institute of

Actuarial and Quantitative Studies (IAQS). The course a unique blend of industry-academia tie-ups,

bringing real-life experiences to the lecture theatre, enabling students to get industry rich learning

experiences.

M.Sc. in Actuarial Science

Term - 2 Years (Full Time)

Degree - University of Mumbai

For whom? - Fresh graduates or working professionals interested in starting their career as an Actuary

8 Reasons to choose M.Sc. Actuarial Science

Power Your Knowledge

Equip yourself with vital knowledge and skills that navigates your career in the right direction. It will polish

certain universal skills like analytical and critical thinking along with technical skills required in your career

life.

Offers scope to Multi-diverse fields

The masters degree will open your gate to multiple fields where actuaries work. From weather forecasting ,

venture capitalist, data science, InsurTech firms to conventional Insurance companies and Banks.

Elevate your game

It will equip you with the right kind of competencies needed to perform in the professional space. It involves

research oriented projects and case studies which will keep you up-to-date with on goings in actuarial,

financial, banking and tech industry.

Be Job Ready

Be ready to learn beyond classroom and class material to form a deeper understanding of the subjects.

Apply theoretical knowledge on various softwares, case-studies/projects and Internships

Industry Academia Tie-ups

The course offers hands-on experience solving real-life, complex data-sets through a Project-Based

Internship provided by our Industry partners along with Internship and Job opportunities

Fast-Track your career

It covers the material syllabus of the Institute and Faculty of Actuaries (IFoA, UK) and the Institute of

Actuaries of India (IAI, India) such as CM1, CM2, CS1, CS2, CB1, CB2, CP1 and CP2

Learn from the Industry Experts

Faculty members include professionals who are Qualified Actuaries (FIA/ FIAI), Associates Actuaries (AIAI),

Chartered Accountants (CA), Chartered Financial Analyst's (CFA), Financial Risk Manager (FRM) and Others

Advisory Board - Backed By the Best

Thomas Mathew T Nilesh Shah

Board of Director (L&T group Managing Director, Kotak Mahindra

of companies, LIC of India, Canara, AMC Ltd,

HSBC OBC, L.I.C Ltd.) Chairman: Association of Mutual

• Former Chairman-in-charge & MD Funds in India,

of LIC of India. Member at Prime Minister’s Economic

• Ex member - Panel of experts Advisory Counsil

(Ministry of Finance, Govt. of India) • Ex MD CEO - Axis Capital Ltd.

• Ex member - Quality review board • Ex Chief Investment Officer -

(Institute of Actuaries of India) ICICI Prudential AMC Ltd.

& Franklin Templeton India.

JV Prasad Sauvik Banarjee

Director, Willis Towers Watson Digital Technology leader - Tata Group

• Ex VP Tata Industries, CTO TataCLiQ, SAP,

• Ex Appointed Actuary &

Accenture, Infosys, Netsuite Author, Tedx

Vice - President - ICICI Lombard GIC Ltd.

Speaker, MIT starter hub mentor.

• Ex CRISIL - Structured finance Ratings.

Prathibha Jain Rajesh Khairajani

Founder & Managing Director, Partner - KNAV International,

Eduabroad Consultant. Partner - Inde Global Advisory

• Education Counsellor, Mumbai • Valuation expert, Speaker at

University affiliated colleges. Indo American Chamber of Commerce

& NASSCOM

• Candidate of the American Society of

Appraisers.

D Sivanandhan

Board of Directors on Various Companies, IPS Officer (Retd.), Ex Commissioner of Police

• Ex member - Central Security Cell (Reserve Bank Of India Panel)

• Ex member - Special task force, National Security Council (Prime Minister’s Office).

• Recipient of the President’s Distinguished Service Medal.

Follow us on our Social Media handles by clicking on the icons below:

Set Personalized Counselling Session by clicking on the following button:

Personalized

Counselling Session

+91 9372777615 | actuarialscience@patkarvardecollege.edu.in

Course Curriculum

Meeting Entry Requirement

Semester 1 Semester 2

Probability and Statistics Portfolio Theory and Security Analysis

Financial Mathematics Financial Engineering - 1

Insurance - Principles, Products and Practices Business Economics

Introduction to Derivatives and Financial Markets Statistical and Risk Modelling - 1

Business Finance Introduction and Modelling in R

Application of IT - Basic and Advance Excel Fixed Income Products

Semester 3 Semester 4

Statistical and Risk Modelling - 2 Statistical and Risk Modelling - 4

Statistical and Risk Modelling - 3 Pricing and Reserving for Life Insurance Products - 2

Pricing and Reserving for Life Insurance Products - 1 Actuarial Practice - 2

Actuarial Practice - 1 Predictive Analysis and Machine Learning

Professional Ethics Application on Actuarial Software

Model Documentation Analysis and Reporting Business Communication

Application of IT - Python Project Based Internship

Eligiblity Fees Structure Outcome

Bachelor’s degree in any The course fees are: This one of a kind degree aims at

discipline (Commerce / For the 1st year - Rs. 313,625 propelling into the profession by

Engineering / IT background / For the 2nd year - Rs. 346,875 offering strong fundamentals in:

Mathematics) with a minimum

of 70% in Semester 5 Fees includes tuition fee, library Actuarial Science

fee, exam fee, university charges, Insurance

If the Semester 5 marks are study material fee and industry Finance

<70% then students need to training fee. Investments

give an aptitude test – QAT and Risk Modelling

Clear a Personal Interview Data Analytics

Round Asset – Liability Management

+91 9372777615 | actuarialscience@patkarvardecollege.edu.in

You might also like

- Brochure Advanced Certification Programme in Business Analytics IIScDocument18 pagesBrochure Advanced Certification Programme in Business Analytics IIScYadhu NarayananNo ratings yet

- FE Presentation4Document29 pagesFE Presentation4qweNo ratings yet

- Risk Risk Analytics TeamDocument2 pagesRisk Risk Analytics TeamCOMPETITIVE GURU JINo ratings yet

- CV Prince GuptaDocument3 pagesCV Prince GuptaUtsav shahNo ratings yet

- Siddharth Sahoo: " Operating Norms in Debt Investment and Equity Research "Document2 pagesSiddharth Sahoo: " Operating Norms in Debt Investment and Equity Research "Manoj NanduriNo ratings yet

- Data Science Course - Batch 2Document10 pagesData Science Course - Batch 2Aayan TripathiNo ratings yet

- ACUITE RATINGS AND RESEARCH - PowerPoint PresentatonDocument28 pagesACUITE RATINGS AND RESEARCH - PowerPoint Presentatonmpk srihariNo ratings yet

- IISWBM - Final Brochure - 22-05-18Document16 pagesIISWBM - Final Brochure - 22-05-18Rina BiswasNo ratings yet

- Acuite Corporate Presentation 4-Mar-2020Document16 pagesAcuite Corporate Presentation 4-Mar-2020s cNo ratings yet

- Certificate Program in Financial Analysis, Valuation & Risk ManagementDocument16 pagesCertificate Program in Financial Analysis, Valuation & Risk ManagementCharvi SaxenaNo ratings yet

- Iiqf CPQFRMDocument30 pagesIiqf CPQFRM123 45No ratings yet

- CPFE Certificate Program in Financial Engeering Brochure IIQFDocument30 pagesCPFE Certificate Program in Financial Engeering Brochure IIQFPushpa BhatNo ratings yet

- Pro School BA BrochureDocument21 pagesPro School BA BrochureTarakanta PathyNo ratings yet

- Data Analytics v2 Brochure SkillovillaDocument40 pagesData Analytics v2 Brochure Skillovillarishabh vermaNo ratings yet

- Advanced Programme In: Fintech and Financial BlockchainDocument15 pagesAdvanced Programme In: Fintech and Financial BlockchainYogeshNo ratings yet

- JD - Privileged Access Management SMEDocument4 pagesJD - Privileged Access Management SMEShahbazNo ratings yet

- PWC Actuarial Services India - Vacancy DescriptionDocument14 pagesPWC Actuarial Services India - Vacancy DescriptionMohit Kohli100% (1)

- Acuite Corporate Presentation 05-May-2020Document16 pagesAcuite Corporate Presentation 05-May-2020s cNo ratings yet

- Harshal Narwani - CVDocument1 pageHarshal Narwani - CVRahul SetiyaNo ratings yet

- CBA Batch 5 Profile Book 25JAN18 PDFDocument62 pagesCBA Batch 5 Profile Book 25JAN18 PDFhappiness ElemNo ratings yet

- Financial Analytics, Valuation and Risk ManagementDocument16 pagesFinancial Analytics, Valuation and Risk ManagementMayank KhuranaNo ratings yet

- Business Analytics: With Certification From NSE AcademyDocument8 pagesBusiness Analytics: With Certification From NSE AcademyTanuj SinghNo ratings yet

- Business AnalyticsDocument8 pagesBusiness Analyticspongoh07No ratings yet

- Edu Individual Life AnnDocument2 pagesEdu Individual Life AnnpfvNo ratings yet

- Data Analytics: Get Certified! Get Hired!Document38 pagesData Analytics: Get Certified! Get Hired!DivyaNo ratings yet

- Introductory Property and Casualty PresentationDocument44 pagesIntroductory Property and Casualty PresentationAndrew NguyenNo ratings yet

- Sakshi Luthra CVDocument2 pagesSakshi Luthra CVSakshi GuptaNo ratings yet

- Jasa Raharja PuteraDocument10 pagesJasa Raharja PuteraFiqriNo ratings yet

- Satyaki Dey ResumeDocument2 pagesSatyaki Dey Resumesatyaki.d.deyNo ratings yet

- PGCM DSFM Placement Brochure 2022 23.Cdr PGCM DSFM Placement Brochure 2022-23-1Document17 pagesPGCM DSFM Placement Brochure 2022 23.Cdr PGCM DSFM Placement Brochure 2022-23-1OmkarNo ratings yet

- CM InfosysDocument18 pagesCM InfosysDaksh AnejaNo ratings yet

- NSE Academy Business Analytics Course 2017Document22 pagesNSE Academy Business Analytics Course 2017Lakshmi RaoNo ratings yet

- Business Analytics: For Future ManagersDocument3 pagesBusiness Analytics: For Future ManagersSumit KumarNo ratings yet

- Annual Placement Report 2020 2021Document12 pagesAnnual Placement Report 2020 2021shoba harikrishnaNo ratings yet

- Job Description ABCDocument3 pagesJob Description ABCMANAS OLINo ratings yet

- RSS ProfileDocument3 pagesRSS ProfileleonardoxvinciNo ratings yet

- Keshav Khandelwal - ResumeDocument1 pageKeshav Khandelwal - Resumedeepak.sharmaNo ratings yet

- Advanced Programme In: Fintech and Financial BlockchainDocument15 pagesAdvanced Programme In: Fintech and Financial BlockchainAJNo ratings yet

- Business Analytics Course 2016Document23 pagesBusiness Analytics Course 2016Ankit GautamNo ratings yet

- About N.C.E.TDocument22 pagesAbout N.C.E.Tpunitg0109No ratings yet

- Naukri VivekSharma (4y 0m)Document1 pageNaukri VivekSharma (4y 0m)gaplacement1No ratings yet

- 1 - Risk Starter Kit Introduction and Getting StartedDocument6 pages1 - Risk Starter Kit Introduction and Getting StartedSuleyman S. Gulcan100% (1)

- CV Archil JainDocument3 pagesCV Archil JainArchil JainNo ratings yet

- WWW - Livecareer - Com - Resume Search - R - Third Party Risk Management Compliance AnalystDocument5 pagesWWW - Livecareer - Com - Resume Search - R - Third Party Risk Management Compliance AnalystmissowusuNo ratings yet

- Bhavik Gandhi ResumeDocument1 pageBhavik Gandhi ResumeBhavik GandhiNo ratings yet

- SCM Can Give Your Organisation A Competitive Edge. Learn How It Can Give Your Career One As WellDocument6 pagesSCM Can Give Your Organisation A Competitive Edge. Learn How It Can Give Your Career One As WellPramod ShawNo ratings yet

- Global Markets - Prime Services - FO Risk JDDocument3 pagesGlobal Markets - Prime Services - FO Risk JDKushagroDharNo ratings yet

- Consulting CaseBook IITMDocument59 pagesConsulting CaseBook IITMajaibhatnagar100% (1)

- Bonanza Human Resource Solutions - Corporate DeckDocument18 pagesBonanza Human Resource Solutions - Corporate DeckEnoch lsNo ratings yet

- Day 2 Pembentukan CSIRTDocument35 pagesDay 2 Pembentukan CSIRTsetia wulandariNo ratings yet

- Equity Research MumbaiDocument5 pagesEquity Research MumbaiAyushi ChauhanNo ratings yet

- 10 Days Research and Valuation Programme' - : Training The Capital Markets andDocument20 pages10 Days Research and Valuation Programme' - : Training The Capital Markets andAKSHAY SINGHNo ratings yet

- Agile and Business Analysis: Practical guidance for IT professionalsFrom EverandAgile and Business Analysis: Practical guidance for IT professionalsNo ratings yet

- E-SUMMIT 2021: A Pragmatic AdventDocument11 pagesE-SUMMIT 2021: A Pragmatic AdventSAUMYA MUNDRANo ratings yet

- Certified Credit Research Analyst (CCRA)Document4 pagesCertified Credit Research Analyst (CCRA)Suksham SoodNo ratings yet

- Fintech Organisation StructureDocument17 pagesFintech Organisation StructureBIKRAMJIT BANERJEE33% (3)

- Ameya Abhyankar, CFA, CQFProfileDocument4 pagesAmeya Abhyankar, CFA, CQFProfileyezdiarwNo ratings yet

- Data Analytics-PythonDocument41 pagesData Analytics-Pythonparas1.sosyohajooriNo ratings yet

- JD Deloitte Analyst Trainee Risk&FinancialAdvisoryDocument3 pagesJD Deloitte Analyst Trainee Risk&FinancialAdvisoryganduharami702No ratings yet

- Presentation Strategic Opportunities PortfolioDocument28 pagesPresentation Strategic Opportunities PortfolioAditya UdaniNo ratings yet

- Unit-II-Chapter-I - Indian Agriculture - Agricultural ReformsDocument15 pagesUnit-II-Chapter-I - Indian Agriculture - Agricultural ReformsSahil ShethNo ratings yet

- 5 - Commerce-V (Marketing) (T.Y.B.COM Sem-V)Document251 pages5 - Commerce-V (Marketing) (T.Y.B.COM Sem-V)Sahil ShethNo ratings yet

- Commerce NotesDocument10 pagesCommerce NotesSahil ShethNo ratings yet

- Psychology of Human Behaviour at WorkDocument5 pagesPsychology of Human Behaviour at WorkSahil ShethNo ratings yet

- Axis BankDocument16 pagesAxis Bankalokascribd60% (5)

- Aud Prob Part 1Document106 pagesAud Prob Part 1Ma. Hazel Donita DiazNo ratings yet

- Summary Sheet - Helpful For Retention For Cash Flow StatementsDocument5 pagesSummary Sheet - Helpful For Retention For Cash Flow StatementsJJ KNo ratings yet

- Sneha Foundation PlusDocument17 pagesSneha Foundation PlusBikash KumarNo ratings yet

- ANJT - Report ANJT Q2 2021Document134 pagesANJT - Report ANJT Q2 2021pipinfitriadiNo ratings yet

- Information Sheet 1Document11 pagesInformation Sheet 1Nosaj HermosillaNo ratings yet

- Aber Report 2020 - en - 4Document92 pagesAber Report 2020 - en - 4ForkLogNo ratings yet

- PDF Abm 11 Famb1 q1 w4 Mod5 DDDocument18 pagesPDF Abm 11 Famb1 q1 w4 Mod5 DDMargie Sorquiano Abad QuitonNo ratings yet

- 4 Administer, Monitor and Control General and Subsidiary LedgersDocument86 pages4 Administer, Monitor and Control General and Subsidiary LedgersSurafel HNo ratings yet

- Grade 7 EMS QP and Answer Sheets - Midyear 2022Document8 pagesGrade 7 EMS QP and Answer Sheets - Midyear 2022Life MakhubelaNo ratings yet

- Acctg 2 Quiz Lecture Notes 1 2Document5 pagesAcctg 2 Quiz Lecture Notes 1 2Mika MolinaNo ratings yet

- ACCO 40013 IM - Lesson 3.1 Income-Based ValuationDocument15 pagesACCO 40013 IM - Lesson 3.1 Income-Based ValuationrylNo ratings yet

- แบบฝึกหัดบทที่1Document3 pagesแบบฝึกหัดบทที่1Rasatja YongskulroteNo ratings yet

- CreditCard Companies-Case Study PDFDocument3 pagesCreditCard Companies-Case Study PDFHamza EjazNo ratings yet

- MS Yukos Enterprises (EA) LTD Another Vs MS Maxinsure (T) LTD Another (Commercial Case 30 of 2021) 2022 TZHCComD 93 (8 April 2022)Document72 pagesMS Yukos Enterprises (EA) LTD Another Vs MS Maxinsure (T) LTD Another (Commercial Case 30 of 2021) 2022 TZHCComD 93 (8 April 2022)hamisNo ratings yet

- Corporate Reporting-1Document69 pagesCorporate Reporting-1Najmul IslamNo ratings yet

- Fabm2 q1 Mod1 Statement of Financial Position v3 RDocument33 pagesFabm2 q1 Mod1 Statement of Financial Position v3 RJilli ChilliNo ratings yet

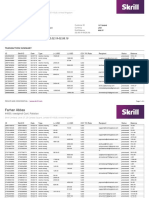

- Transaction Report: Farhan AbbasDocument4 pagesTransaction Report: Farhan AbbasSaqib TaimoorNo ratings yet

- 4 FinalsDocument59 pages4 FinalsXerez SingsonNo ratings yet

- Suggested SolutionsDocument7 pagesSuggested SolutionsManda simzNo ratings yet

- ACBP5122wA1 PDFDocument9 pagesACBP5122wA1 PDFAmmarah Ramnarain0% (1)

- Morgan MoneyDocument4 pagesMorgan MoneyIgnacio KristofNo ratings yet

- Banking Notes (With Digests From Kriz P) - Cha MendozaDocument570 pagesBanking Notes (With Digests From Kriz P) - Cha Mendozacmv mendozaNo ratings yet

- Pag IBIG Housing Loan Application Form PDFDocument2 pagesPag IBIG Housing Loan Application Form PDFBon Vincent Chua100% (1)

- Carding Vocabulary and Understanding TermsDocument4 pagesCarding Vocabulary and Understanding TermsTrex InfernoNo ratings yet

- Sec 1 - 23 Self Made ReviewerDocument21 pagesSec 1 - 23 Self Made ReviewerJyasmine Aura V. AgustinNo ratings yet

- Marlon Dave Quindipan Calva: Statement of AccountDocument4 pagesMarlon Dave Quindipan Calva: Statement of AccountMerlyCalvaNo ratings yet

- A Commercial General LiabilityDocument2 pagesA Commercial General LiabilityTarannum khatri100% (1)

- Financial Accounting Version 2 0 2nd Hoyle Solution ManualDocument13 pagesFinancial Accounting Version 2 0 2nd Hoyle Solution ManualTimothy Moultrie100% (34)